Crypto’s Silver Lining: Market Dips Are Stepping Stones To Soaring Heights – Analyst

December 13 2023 - 7:00PM

NEWSBTC

Crypto Rand, a renowned crypto trader, has shared insights on the

current market corrections, emphasizing the necessity of these

corrections for sustainable market ‘growth.’ The trader, who

disseminates his views on X, stresses that despite the evident

pullbacks, the crypto market’s macrostructure remains “intact.”

This perspective comes at a time when most crypto assets, including

Bitcoin, have experienced significant price drops over the past

couple of days. Related Reading: Bitcoin’s Unshakable Bottom:

Analyst Reveals The Price BTC Won’t Drop Below Navigating

Resistance Levels: The Path To Growth Crypto Rand’s leveraged the

price action index of various cryptocurrencies, such as Cosmos

(ATOM), Chainlink (LINK), NEAR Protocol (NEAR), Algorand (ALGO),

and MultiversX (EGLD), among others to highlight his point. Rand

identifies multiple resistance levels in these assets’

trajectories, suggesting these as potential points for market

turnaround. These resistance levels are categorized as major or

minor, depending on the frequency and intensity of price actions

historically observed at these points. Despite the temporary

pullbacks that these resistance levels might introduce, Crypto Rand

views them as necessary pauses that allow the market to gather

strength for future upward movements. This perspective is

particularly relevant in light of Bitcoin’s recent price behavior.

The flagship cryptocurrency has seen a notable dip from its recent

high of $44,000, currently trading just below $42,000. This

downward trend has echoed across the crypto market, impacting other

major assets like Ethereum including altcoins Rand mentioned like

Chainlink, and Algorand. Over the past 7 days, BTC and ETH have

experienced declines of 4.4% and 2%, respectively. Meanwhile,

Chainlink has seen a 6.9% drop during the same period, and Algorand

has fallen by 4.1% in just the past 24 hours. Always be ready for

more shakeouts, but remember, these corrections are needed for

healthy growth. The Mid Caps for example got rejected on the main

resistance, but overall macrostructure remains in tact. ⚡️ INDEXED:

$ATOM, $LINK, $NEAR, $ALGO, $EGLD and more.

pic.twitter.com/YKUhwyRM9C — Crypto Rand (@crypto_rand) December

13, 2023 The Broader Perspective On Crypto Market Corrections The

sentiment that market corrections are a healthy and necessary

aspect of growth is not exclusive to Crypto Rand. William Clemente,

the co-founder of Reflexivity Research, echoes this viewpoint.

Clemente posits that the current market retraction, which could

potentially bring Bitcoin’s price closer to $40,000, should “not be

a cause for alarm.” Clemente argues that this process is crucial

for eliminating weaker market participants and reducing excess

leverage, ultimately establishing a firmer foundation for future

upward trends. Related Reading: Crypto Expert Explains Why The

Bitcoin Price Crash To $40,000 Is Not A Bad Thing Clemente further

articulates that the inherent volatility of Bitcoin should be

perceived as “a feature, not a bug”. It is worth noting that this

stance reinforces the notion that the crypto market is still

evolving and that such fluctuations are part and parcel of its

journey towards maturity. BTC just ~doubled in 2 months with no

pull backs, a correction is not that surprising. Corrections shake

out “weak hands” and leverage, allowing for a stronger foundation

for eventual moves higher. Bitcoin’s volatility is a feature, not a

bug. Chill with the leverage 🫡 https://t.co/BdvvS8KDZU — Will

(@WClementeIII) December 11, 2023 Featured image from iStock, Chart

from TradingView

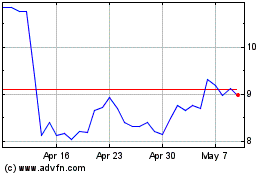

Cosmos Atom (COIN:ATOMUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cosmos Atom (COIN:ATOMUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024