Polygon On-Chain Activity Lights Up: MATIC Reversal Incoming?

August 29 2024 - 1:30PM

NEWSBTC

On-chain data shows that some activity metrics related to Polygon

have surged recently, which could be positive for the asset’s

price. Polygon Active Addresses & Age Consumed Have Spiked

Recently In a new post on X, the on-chain analytics firm

Santiment discussed the latest trend in two MATIC indicators.

The first is the “Daily Active Addresses,” which

tracks the total number of addresses participating in some

kind of transaction activity on the network every day. The unique

number of active addresses can be considered the same as the unique

number of users participating in network activities, so the value

of this metric tells us about the amount of traffic that the

blockchain is observing right now. Related Reading: Bitcoin

Plummets To $59,000, On-Chain Data Reveals Why When the indicator’s

value rises, more users are becoming active on the network. Such a

trend implies that cryptocurrency is attractive to investors. On

the other hand, the metric registering a decline suggests investor

interest in the asset could be declining as fewer users make

transfers on the blockchain. Now, here is a chart that shows the

trend in the Daily Active Addresses for Polygon over the past few

months: The above graph shows that the Polygon Daily Active

Addresses has recently experienced a surge. At the peak of the

latest spike, 3,369 MATIC addresses made transactions on the

network, the second-highest value for the year. Thus, investors

appear to have been actively engaged on the network recently. It

can generally be hard to say what the consequences of such activity

may be for the asset, as both selling and buying activity would be

flagged up in the indicator. One thing that can generally be said

is that high user activity may lead to cryptocurrency

volatility. In the current case, though, there may be one other

hint: the surrounding price action. Interestingly, the largest

spike in the indicator only came just after MATIC’s latest price

decline, which could imply that investors may be rushing to buy the

dip. If this is the case, then Polygon could benefit from a

turnaround in the activity. The second indicator in the chart is

the “Age Consumed,” which tells us whether dormant coins are on the

move. From the chart, it’s visible that a large number of old

tokens appear to have moved on the network during the latest

activity rush. This can be a mixed signal, as it could

suggest that the asset’s diamond hands are selling. It’s

also possible that these investors have only shifted the coins for

some other activity, as the last Age Consumed spike of a similar

scale proved bullish for Polygon. Related Reading: Litecoin Sees

Sudden Exodus Of Retail Investors: Why This Can Be Bullish Given

the spikes these on-chain indicators have witnessed, how the coin

develops from here remains to be seen. MATIC Price Polygon’s price

has plunged almost 17% over the past week to $0.43. Featured image

from iStock.com, Santiment.net, chart from TradingView.com

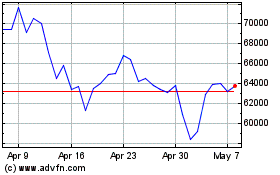

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024