Top 5 Coins To Watch In The First Week Of April 2023

April 03 2023 - 6:18AM

NEWSBTC

After experiencing gains last week, the current market structure is

now posing a challenge to the progress made by the bulls. According

to CoinGecko, the total market cap of cryptocurrencies has

decreased by 2% in the past 24 hours, indicating a significant

shift in sentiment as major cryptocurrencies’ momentum has slowed.

As the new month begins, these top 5 coins show promise amidst the

current downturn. Investors and traders may find value in these

cryptocurrencies as the market looks to regain ground in the coming

days. Related Reading: These Top 5 Meme Coins Are Bleeding As March

2023 Ends – Here’s Why Top 5 Coins To Watch This Week UNI

Uniswap is one of the household names in the world of decentralized

finance. With its native token sitting at the price of $5.9, the

token holds a potential upside in the medium to long term. Despite

this, investors and traders will experience pain in the short term

with UNI slipping 3% in the daily timeframe. 1/ Introducing

the Uniswap mobile wallet 🦄✨ A completely self-custodial,

open-sourced mobile app from the most trusted name in DeFi. Now

available as a limited early release – through Apple TestFlight.

pic.twitter.com/NmO8c0bXMs — Uniswap Labs 🦄 (@Uniswap) March 3,

2023 On-chain development should drive the demand for UNI. After

the release of its mobile wallet last month, the token’s rebound

from $5.8 is inevitable. Investors should also watch the charts of

UNI as it moves to a narrower trading range. If the token

manages to regain $6.2, UNI should have enough momentum for a

bigger upside. Bored Ape Yacht Club. Image: TheStreet APE Despite

showing weakness after the January market rally, APE has recently

shown promise for investors due to strong on-chain developments

from Yuga Labs, the creator of the Bored Ape Yacht Club NFT

collection. At the time of writing, the token has risen nearly 5%

within the weekly timeframe, going against the current crypto

market momentum. APE is currently trading above $4, which is

expected to support the bulls in the coming days. Furthermore, the

narrow trading range in which the token finds itself adds to the

bullishness. If the token breaks through $4.5, the potential upside

for investors will grow significantly. TRX Despite the recent

controversy about Justin Sun surrounding Huobi Global, the Tron

ecosystem continues to thrive. TRX, the native token of the

ecosystem, is up nearly 2% in the weekly timeframe. The token’s

price movement follows the crypto market’s broader movement in the

past few days. TRX is seen below the $0.065 resistance as it

follows the current market slippage. If the bears capitalize on

this downward pressure, TRX can drop toward $0.062 support. If the

bulls can defend the drop to this support, the token can rebound

toward $0.071. Ethereum Classic. Image: Getty ETC Ethereum

Classic is Ethereum’s fork that retains ETH’s old characteristics.

The altcoin certainly has a place in the portfolios of investors

and traders. However, ETC has been struggling in the past few days.

CoinGecko reveals that the altcoin is down more than 4% in the

daily timeframe. For ETC, the altcoin’s price movement has

stagnated above $20. Ethereum Classic is also trading at a narrow

trading range which may lead to an explosive upside toward $23. If

ETC bulls strengthen the current support, a retest or a possible

breakthrough above this level is inevitable. Crypto total

market cap currently at $1.14 trillion on the daily chart at

TradingView.com Related Reading: Bitcoin Loses $28,000 Handle – Is

A Retreat In The Offing For BTC? We’re ready to fund multiple

efforts focused on unlocking #Bitcoin‘s full potential with @Stacks

sBTC & more! ⭐ Decentralized Staking Pool ⭐ EVM compatible

subnet ⭐ sBTC Birgde ⭐ Much more! View the Critical Bounties 👇 1/2

— stacksfoundation.btc (@StacksOrg) March 31, 2023 STX Stacks,

which rounds up our top 5 coins roster, have been going bullish

after a few weeks of pain. According to CoinGecko, STX, the

ecosystem’s native token is up more than 2% in the daily timeframe

with the biggest gains being made in the monthly at nearly 6%. The

organization’s recent announcement that they will fund projects

that would benefit the ecosystem’s Bitcoin layer is expected to

affect investor sentiment. STX is currently trying to rebound

above the $0.868 support level. If successful, investors and

traders could see gains in the coming days. STX bulls can

comfortably target $1.1 in the short to medium term depending on

the crypto market’s sentiment. -Featured image from GAAP Dynamics

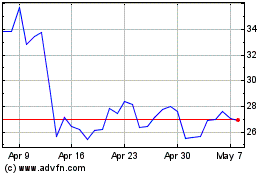

Ethereum Classic (COIN:ETCUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ethereum Classic (COIN:ETCUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024