Chainlink Signal That Preceded Crashes Of 34% Is Back

October 02 2023 - 10:00AM

NEWSBTC

An on-chain signal that preceded crashes of at least 34% for

Chainlink in the past has once again formed for the cryptocurrency.

Chainlink 30-Day MVRV Ratio Recently Hit The 20% Mark As explained

by an analyst in a post on X, the last two times the 30-day MVRV

ratio broke above the 19% level, the price of LINK registered a

sharp decline. The “Market Value to Realized Value (MVRV) ratio” is

an indicator that measures the ratio between the Chainlink market

cap and the realized cap. The “realized cap” here refers to the

total amount of capital that holders of the cryptocurrency have

invested into it. As the MVRV ratio compares the spot valuation

(the market cap) with the amount that the investors bought the

asset with, its value can provide hints about whether the holders

as a whole are in profits or not. When the metric has a value

greater than 1, it means that the market cap is more than the

realized cap, and hence, the average investor is in profit right

now. The more the holders get into profit, however, the more likely

they become to sell, so high values of the MVRV ratio can suggest

the asset is becoming overpriced and a correction may be due.

Related Reading: This Bullish Combination Has Finally Formed For

Bitcoin, Rally Ahead? On the other hand, values under the threshold

suggest the cryptocurrency may be undervalued currently as the

overall market is holding some net unrealized losses. Now, here is

a chart that shows the trend in the 30-day version of the Chainlink

MVRV ratio, which looks at the profitability of only the investors

who bought within the past month: The value of the metric seems to

have sharply surged in recent days | Source: @ali_charts on X In

the above graph, the value of the 30-day MVRV ratio is represented

as a percentage relative to the break-even level. As is visible,

this indicator has observed some sharp uptrend recently as

Chainlink has enjoyed its rally. During this latest rapid growth,

the metric had managed to hit a peak of 20%, which means that the

market cap had become 20% more than the realized cap of the 30-day

investors. The analyst has pointed out an interesting trend that

LINK has followed during the past couple of years. It would appear

that whenever the 30-day MVRV ratio has broken above the 19% mark,

the cryptocurrency has followed up with a steep drawdown. This has

happened two times in the period of the chart and coincidentally,

Chainlink’s decline was about 34.5% in both of these instances

(although the time the drawdown was spread out over was different

in the two cases). Related Reading: Bitcoin Eyes Turnaround: Could

A New All-Time High Be On The Horizon? Analyst Predicts Since the

30-day MVRV has once again surged above this apparently significant

level, it’s possible that LINK may also register a similar drop in

the coming days or weeks. LINK Price Chainlink has observed some

sharp uptrend over the past month, as its price is currently

trading just under the $8 level, having gone up almost 34% in the

period. If the MVRV ratio is anything to go by, though, this

impressive run may finally be coming to an end. Looks like LINK has

sharply surged recently | Source: LINKUSD on TradingView Featured

image from Shutterstock.com, charts from TradingView.com,

Santiment.net

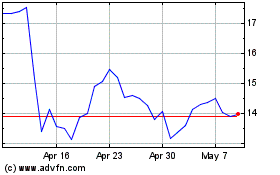

ChainLink Token (COIN:LINKUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

ChainLink Token (COIN:LINKUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024