Chainlink Creator Expects Mass Crypto Adoption To Send Market Cap To $10 Trillion

October 04 2023 - 11:00AM

NEWSBTC

In a recent interview, Chainlink’s co-founder, Sergey Nazarov, said

the collapse of the banking industry will drive crypto mass

adoption. Chainlink’s Co-Founder Predicts Crypto And Blockchain

Prospects Over The Next Decade Sergey Nazarov believes that the

collapse of the banking industry will favor crypto adoption and

growth in the next decade. Related Reading: Crypto Is On The Brink

Of Explosion As 9-Year DXY Formation Returns Nazarov believes the

crypto industry and its technological innovations might maintain

the same slow growth pace. However, the industry player cited two

possible crypto and blockchain adoption scenarios in the next ten

years. First, the Chainlink co-founder proposed a fast-case

scenario where the collapse of the traditional finance system puts

individuals in pain. This pain will force individuals to

“acknowledge the relevance” of cryptographic financial

systems. Further, Nazarov noted that the continued collapse

of banks like Silicon Valley Bank could fast-track crypto

adoption. Secondly, based on the first theory, the collapse

of traditional finance systems will lead to political tension and

international problems. Nazarov believes investors will favor

crypto for financial operations if the pain of suffering losses

becomes unbearable. Therefore, Nazarov insists that even in

the slow case, the crypto market is likely on its way to a $10

trillion market cap. Chainlink’s Adoption By ANZ Banking

Group Supports Nazarov’s Growth Theory According to a new industry

report, ANZ Bank has adopted Chainlink’s CCIP for cross-chain

tokenized asset settlement. CCIP solution helps to transfer data

and tokenized assets across blockchains in a decentralized and

secure way, according to the crypto founder. Notably, ANZ

Bank is one of the world’s largest banks, with over $1 trillion in

total assets managed. Sergey Nazarov noted that Chainlink’s

adoption by ANZ shows how large companies are now adopting

Chainlink’s CCIP. Also, the co-founder stated that building

on a global internet needs secure connectivity between private bank

chains and public chains. The CCIP is an upgrade on the

Chainlink Network that functions as a global Internet of Contracts.

This upgrade aims to create the world’s largest liquidity layer

across various regions and markets. Remarkably, Nazarov

stated that CCIP can create a higher level of cross-chain security.

It achieves this extra security with multiple layers of

decentralization and advanced risk management techniques.

Moreover, most cryptocurrencies offer users fast and secure

cross-border transactions cheaply. However, some critics still

insist that cryptocurrencies are unreliable based on their

volatility and crisis in the sector. Related Reading: Will

XRP Price Defy A 50% Stock Market Crash? Analysts Share Predictions

With innovations like the CCIP of Chainlink, more banks may

integrate crypto and blockchain-based solutions. This drives crypto

to mainstream adoption, increasing the market cap to $10 trillion,

as Nazarov predicts. Meanwhile, the collapse of banks such as

Silicon Valley Bank (SVB) in 2023 has strained the global finance

economy. If another banking crisis occurs, cryptocurrencies might

become the preferred option for most investors based on their

rising utility. Featured image from Shutterstock and chart from

TradingView.com

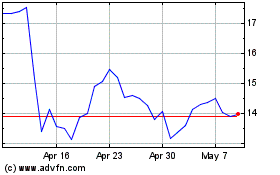

ChainLink Token (COIN:LINKUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

ChainLink Token (COIN:LINKUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024