2 Reasons Why An Ethereum Mega Bull Run Is Inevitable

December 08 2023 - 4:00PM

NEWSBTC

While the recent Bitcoin and crypto momentum is cooling off,

Ethereum (ETH) rejects lower lows, especially against Bitcoin

(BTC). Taking to X on December 8, decentralized finance (DeFi)

researcher DefiIgnas shared insights that suggest ETH could be on

the verge of a rally that would potentially see the second most

valuable coin usurp BTC’s current position as the best-performing

asset. Reasons That Might Drive Ethereum Bulls The researcher

observed that ETH is down 24% versus BTC in 2023. However, multiple

fundamental indicators show that this is about to change. First,

DefiIgnas noted that crypto investors are increasingly drawn to

discounted Grayscale Ethereum Trust (GETH), which has been rallying

over the past few months, outperforming Ethereum spot prices.

Related Reading: Bitcoin Price Remains Strong and Eyes Fresh Surge

Above $44K GETH surged by 298% in the past few months, while ETH

only rose by around 100% in the same period. As GETH share prices

increased, its discount with spot ETH decreased. This means more

capital indirectly flowed into ETH, leading to higher demand.

Besides GETH rising, the researcher remains bullish on Ethereum

because of the recent developments surrounding the approval of the

first spot Bitcoin ETF. The crypto community expects the Securities

and Exchange Commission (SEC) to authorize multiple products,

including those proposed by Fidelity and BlackRock. In DefiIgnas’

assessment, once the spot Bitcoin ETF goes live, likely in early

2024, all “attention, narrative, and speculation” will shift toward

the agency approving the first spot Ethereum ETF. BlackRock, the

world’s largest asset manager, has already applied with the SEC to

issue the first spot Ethereum ETF. The expected activation of the

Cancun upgrade in H1 2024 will also likely support Ethereum prices.

Over the years, Ethereum has integrated multiple upgrades. This

includes shifting to proof-of-stake (PoS) from proof-of-work (PoW)

and overhauling their fee auction mechanism, introducing ETH

burning. Related Reading: Liquidation Quandary: Litecoin Wallets

Draining Fast – What’s Next For LTC Prices? However, with Cancun,

the goal is to directly enhance the main net’s capabilities by

activating several proposals, including EIP-4844 proto-dank

sharding, which aims to reduce gas fees associated with rollups.

This update will further cement Ethereum’s quest to significantly

increase on-chain scalability and reduce gas fees over the years.

ETH Looks Firm, Resistance At November Highs At spot rates, ETH is

firm versus BTC, looking at the candlestick arrangement in the

daily chart. How prices react in the days ahead remains to be seen.

Even so, if there is confirmation of the December 7 gains, ETH

might extend gains. In that case, it can break above the current

consolidation as bulls aim to break above November 2023 highs of

around 0.058 BTC. Feature image from Canva, chart from TradingView

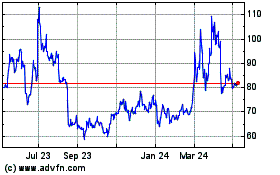

Litecoin (COIN:LTCUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Litecoin (COIN:LTCUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024