Ethereum: 108,000 ETH Sent To Crypto Exchanges, Will Price Revisit $2,200?

October 05 2024 - 6:30AM

NEWSBTC

Ethereum (ETH) has seen a 10.3% drop from last week’s highs

following the recent market downturn. Its performance has worried

many analysts and investors, considering ETH could be near another

correction. Related Reading: Analysts Unfazed By Bitcoin (BTC)

Drop, But Should We Fear October 5? Ethereum Whales Send Millions

To Exchanges Ethereum has struggled to reclaim some key resistance

levels since the October 1 correction. On Tuesday, the

cryptocurrency saw its price nosedive from the $2,600 zone to the

$2,300 mark, hovering between the lower and higher range of that

support level for the past few days. Since then, news of multiple

investors moving their tokens has hit the industry, alarming the

community. On-chain analytics firm Lookonchain revealed that an

Ethereum Initial Coin Offering (ICO) participant sold their tokens

as the market bleed. Per the report, the whale deposited 12,010

ETH, worth $31.6 million, to Kraken a week ago after being inactive

for two years. The same address sold another 19,000 ETH two days

ago, around $47.54 million. Today, crypto analyst Ali Martinez

highlighted that on October 3, roughly $259.2 million worth of ETH

had been sent to crypto exchanges. According to the CryptoQuant

data shared by Martinez, 108,000 ETH were sent to exchanges in the

last 24 hours, significantly increasing from the day before. The

news continued to fuel the bearish sentiment among many community

members, who are disappointed about Ethereum’s performance and fear

ETH’s price could soon face significant selling pressure. Will ETH

Revisit Lower Levels Soon? Crypto investor Ted Pillows noted that

ETH has been “one of the most underperforming cryptos in 2024.”

Despite the approval of Ethereum spot ETFs (exchange-traded funds),

the crypto has “underperformed almost every large cap.” He also

pointed out that ETH surged alongside Bitcoin whenever the market

was up but dropped significantly harder when the market struggled.

“Whenever BTC has pumped 5%, ETH has pumped 3%, but whenever BTC

has dumped 5%, ETH has dumped 12%-15%,” he remarked. However, Ted

explained that every time Ethereum was considered “dead,” like in

2020-2021, it has eventually outperformed BTC. Based on this, the

investor believes that ‘the king of Altcoins’ could face “one last

flush” to $2,200 before the reversal. Similarly, trader Crypto

General suggested that the cryptocurrency could retest the $4,000

by next month as he expects ETH to bounce from the current levels.

However, he asserted that if the price breaks the trendline, “we

can easily see the price touching the $2100 level.” Related

Reading: Aptos (APT) Jumps 11% Following Acquisition Of Japanese

Blockchain Developer HashPallette Other market watchers pointed out

that Ethereum must reclaim the $2,400 resistance level to see a

potential bounce toward $2,800. Previously, Daan Crypto Trades set

the $2,850 resistance level as one of the key levels to watch. The

analyst considers that reclaiming this level would signal a trend

reversal for the cryptocurrency. This zone corresponds with the

horizontal level that started the February-March run to ETH’s

yearly high of $4,090. As of this writing, ETH has seen a positive

price jump, currently trading at $2,431. This performance

represents a 4.3% surge in the daily timeframe. Featured Image from

Unsplash.com, Chart from TradingView.com

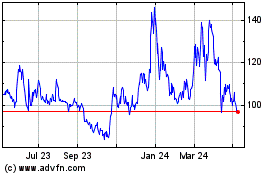

Quant (COIN:QNTUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

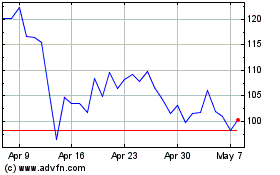

Quant (COIN:QNTUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024