- A cash position of 15.2 million euros on December 31, 2021,

strengthened to 28 million euros on March 28, 2022

- Major technical advances in 2021: - The approval to enter Phase

3 in China for BioChaperone® (BC) Lispro, granted by the Chinese

regulatory authorities (CDE) to our partner Tonghua Dongbao - The

start of two clinical studies on M1Pram and BC LisPram - 3 patents

on two new platforms: an immunoprotective hydrogel matrix for cell

therapy (AdoShell®) and an oral peptide delivery technology

(AdOral®)

- Promising perspectives for 2022: - Start of BC Lispro Phase 3

in China - Completion of clinical studies to support BC Combo's

Phase 3 dossier in China - Publication of M1Pram (Phase 2) and BC

LisPram (Phase 1) clinical studies results - Phase 1 studies

preparation on our new projects

Regulatory News:

Adocia (Euronext Paris: FR0011184241 – ADOC) (Paris:ADOC), a

clinical-stage biopharmaceutical company focused on the research

and development of innovative therapeutic solutions for the

treatment of diabetes and other metabolic diseases, announced today

its full year 2021 financial results as of December 31, 2021. The

financial statements were approved by the Board of Directors set on

April 14, 2022 and will be submitted for shareholder approval at

the next General Shareholders’ Meeting on June 28, 2022.

"We are very pleased with the advancement of our two projects,

BC Lispro and BC Combo, in Asia by our partner Tonghua Dongbao with

the enhanced prospect of receiving up to $85 million in milestone

payments over the coming years", said Gérard Soula, Chairman and

CEO of Adocia. "The preclinical results obtained in cell therapy

and oral delivery of peptides provide us with new partnership

opportunities in addition to those underway for BC Lispro, BC Combo

and multi-hormonal combinations.”

Financial highlights

The following table summarizes the financial statements under

IFRS for the years ended December 31, 2021 and December 31,

2020:

In (€) thousands, Consolidated

financial statements, IAS/IFRS

FY2021 (12 months)

FY 2020 (12 months)

Revenue

1 444

841

Grants, Research tax credit,

others

4 611

5 992

Operating revenue

6 055

6833

Research and development

expenses

(20 016)

(22 547)

General and administrative

expenses

(5 404)

(5 434)

Operating expenses

(25 421)

(27 981)

OPERATING INCOME

(LOSS)

(19 366)

(21 148)

FINANCIAL INCOME

(LOSS)

(3 388)

(2 147)

Tax

-

(29)

NET INCOME (LOSS)

(22 754)

(23 324)

Company's results for the year 2021 are characterized:

- Net loss of € 22.8 million in 2021, compared to a loss of €23.3

million in 2020, mainly consisted of:

- Revenue of €1.4 million in 2021 (compared to €0.8 million in

2020) coming essentially from the two-licensing contract signed

with Tonghua Dongbao. In 2021, additional services have been

performed by Adocia for a total amount of €1 million income at the

request of our Chinese partner for the preparation of 3 clinical

trials conducted in Europe on BC Combo;

- Other operating income of €4.6 million, resulting mainly from

the research tax credit (CIR) generated on 2021 expenses;

- Total operating expenses of €25.4 million, a €2.5 million

decrease compared to last year;

- Financial loss of €3.4 million reflecting the financial

interests paid on the €15 million IPF partner loan contracted in

2019. The increase of €1.1 million 2021 is mainly explained by the

IFRS impact (non-cash) of the revaluation at fair value through

income of the convertible bond contracted in October 2021.

- A cash position of €15.2 million as of December 31, 2021

(compared to €28.1 million as of December 31, 2020).

The cash consumption over the full year 2021 was €19.9 million,

in a decrease compared to 2020 (which was €22.5 million), on a

comparable basis (excluding financing operations).

Net financial debts (excluding the impact of derivative

instruments) amounted to €33.3 million the end of December 2021,

compared to €27.3 million twelve months earlier. The increase of €6

million is mainly due to the convertible bond financing completed

in October 2021, which resulted in a net cash in-flow of €6

million. A portion of the bonds was converted at the end of

December, the balance being recorded as debt under IFRS 9 and IAS

32.

In addition, in March 2022 the company has sold its headquarter

offices for a net amount of €19 million. Taking this into account

and the consumption of cash during the first quarter of 2022, the

company's cash position amounted to €28 million on March 28, 2022,

the day of the sale signature.

"We are pleased to have been able to complete the sale of our

building, which has significantly strengthened our cash position

without dilution for our shareholders and no impact on operations.

Our cash position at the end of March provides us with sufficient

financial resources to execute the announced news flow," said

Valérie Danaguezian, Chief Financial Officer of Adocia.

Key events in 2021

2021 was marked by major advances in our insulin portfolio and

by the achievement of important proofs of concept on new

technological platforms in cell therapy and oral delivery of

peptides. In addition, the financial operation carried out in the

last quarter strengthened the financial resources available to

support the Company's growth.

Significant progress made on mature

projects in our pipeline:

- BioChaperone® Lispro: approved to enter Phase 3 in China

In October 2021, Tonghua Dongbao received approval from the CDE

(Center for Drug Evaluation) to start the Phase 3 program of BC

Lispro ultra-rapid insulin for the treatment of type 1 and type 2

diabetes in China. The operational start of Phase 3 in China should

trigger a milestone payment to Adocia, expected in the second

quarter of 2022. In parallel, the preparatory work for the Phase 3

studies in the United States and Europe has successfully been

completed. Our commercial activities are aimed at finding a partner

capable of financing the pivotal program until marketing

authorization is obtained in these regions.

- M1Pram and BioChaperone® LisPram: intensified clinical

development efforts

Adocia has intensified the clinical development of its two

product candidates, M1Pram and BC LisPram, positioned respectively

for the auto-injector pen and pump markets. These fixed

combinations of insulin and amylin analogs are expected to provide

improved medical benefits through weight loss in obese or

overweight people with diabetes, as compared to rapid insulins

administered alone. Rapid insulins are essential to the survival of

many patients. They generate more than $9 billion in revenue each

year. In the United States, 65% of type 1 diabetic patients and 85%

of type 2 diabetic patients are overweight or obese1,2.

A Phase 2 study (CT041) was initiated in March 2021 with M1Pram

in an auto-injector pen. This comes after the establishment of

proof of concept in humans in a study from 2020 that demonstrated

improved glycemic control and very significant weight loss, as

compared to the reference rapid insulin aspart, in only 3 weeks of

treatment. The CT041 study, which aims to confirm these results

over a 4-month period in people with type 1 diabetes, has been

designed to define all the parameters of a future Phase 3 program.

The results will be communicated in the second quarter of 2022.

Concurrently, a proof-of-concept study in humans has been

initiated with BC LisPram. This combination has been specifically

designed for automated pump administration using an algorithm. This

study is being conducted in collaboration with Dr. Ahmad Haidar of

McGill University (Canada) and results are expected in Q3 2022.

New proprietary technology platforms

in new growth markets

- Revolutionizing islet transplantation (AdoShell®

technology)

In January 2021, Adocia announced the filing of patents on a

hydrogel matrix designed to improve islet transplantation cell

therapy treatments. The function of this matrix is to maintain

transplanted cells’ secretory activity, while protecting them from

the immune system. Adocia's objective is to create an organoid

capable of secreting insulin in response to glycemic variations,

thus avoiding the use of immunosuppressive drugs. An academic

collaboration has been established with several teams, including

Inserm with Professor François Pattou, a world specialist in islet

transplantation. Animal trials are underway, prior to human

implantation trials.

- Combining hormones to treat obesity

In 2021, Adocia also initiated new projects in the field of

obesity. Patient management is undergoing major changes, due, on

the one hand, to gradual recognition of obesity as a pandemic

requiring drug treatment, and, on the other hand, to the discovery

of the efficacy of certain hormones - which are also involved in

diabetes - in controlling weight. These treatments make it possible

to avoid recourse to bariatric surgery. These products are intended

to be administered in pump so that the patient can set up, with the

support of a doctor, a personalized treatment adapted to lifestyle.

Patents have been filed by Adocia on these pump-administered

hormone combinations. The objective is to prepare a

proof-of-concept study in humans by 2022/2023. These hormonal

combinations could also be developed in other medical indications

such as NASH (Non-Alcoholic Steatohepatitis) and type 2

diabetes.

- Delivering peptides in oral form that were previously

administered by injection (AdOral® technology)

Adocia has developed a technology that can enable oral delivery

of peptides by limiting their natural degradation in the digestive

tract before reaching the bloodstream. Initial results obtained in

preclinical studies have shown an increase in the absorption

efficiency of peptides by the gastrointestinal tract, which would

allow for a switch from injectable to oral forms.

This new technological platform opens up numerous applications

for oral forms of therapeutic peptides used in metabolic

disorders.

"Promising results obtained on our two platforms, AdoShell® for

cell therapy and AdOral® for the delivery of oral peptides,

position us well amongst competition on these subjects which

represent major therapeutic challenges", commented Olivier Soula,

Adocia's Deputy CEO and Director of R&D.

The company's cash position was strengthened in October 2021 by

a financing operation and in March 2022 by a real estate

transaction:

- The financing operation achieved in October was for €7

million

In October 2021, the Company carried out a financing transaction

through (i) the issue of 6,568,422 bonds convertible into shares

with a par value of one euro each for a total amount of €6 million

net subscribed by Vester Finance and two other European investors

and (ii) a capital increase of €1 million, the subscription of

which was reserved for the benefit of Gérard Soula, the Company's

Chairman and CEO and a shareholder, by way of the issue of new

ordinary shares.

In June 2021, Adocia strengthened its Board of Directors with

the appointment of three new independent members: Dr. Claudia

Mitchell, Senior Vice President in charge of Portfolio Strategy at

Astellas Pharma; Dr. Katherine Bowdish, President and CEO of PIC

Therapeutics; and Stéphane Boissel, CEO of SparingVision.

Post-period events

In March 2022, the Company completed a sale and leaseback

transaction resulting in the sale of its building, acquired in

2016, and the signature of a 12-year renewable lease. This

transaction resulted in a net cash inflow of €19 million. As of

March 28, 2022, the Company's cash position thus amounted to €28

million.

In April 2022, the Company announced the start of the BC Combo

clinical program in Europe following the approval of the Chinese

and German health authorities. BC Combo has been licensed to

Tonghua Dongbao, which has given the conduct of these clinical

studies to Adocia due to its expertise and the experience in

clinical studies management. These studies, financed by Tonghua

Dongbao, aim at qualifying the formulation necessary for the Phase

3 dossier.

Outlook for 2022

- With the enrollment of the first patients in Phase 3 of BC

Lispro in China, Adocia will be eligible for a milestone payment

under the agreement with Tonghua Dongbao (agreement providing up to

$35 million in development milestone payments until the product

registration). The commercialization of BC Lispro in China and

other Asian countries (excluding Japan) will result in the payment

of royalties on sales.

- Phase 2 clinical data for M1Pram, a rapid-acting insulin for

auto-injector pen for type 1 diabetes patients, will be reported in

the second quarter of 2022.

- Phase 1 clinical results for BC LisPram, for automated pump

administration, are expected in the third quarter of 2022.

- Pre-clinical results for multi-hormone obesity therapies

(PramExe and BC GluExe), the hydrogel matrix for cell therapy and

the oral delivery technology are expected to enable first-in-man

studies in 2022-2023.

About Adocia

Adocia is a biotechnology company specializing in the discovery

and development of therapeutic solutions in the field of metabolic

diseases, primarily diabetes and obesity. The company has a broad

portfolio of drug candidates based on three proprietary technology

platforms:

1) The BioChaperone® technology for the development of new

generation insulins and products combining insulins with other

classes of hormones; 2) AdOral®, an oral peptide delivery

technology; 3) AdoShell®, an immunoprotective biomaterial for cell

transplantation with a first application in pancreatic cells

transplantation for patients with "brittle" diabetes.

Adocia holds more than 25 patent families and was ranked 4th and

7th in the French National Institute of Industrial Property (INPI)

ranking of SMEs on the number of patents filed, in 2019 and 2020

respectively.

Based in Lyon, the company has approximately 115 employees.

Adocia is listed on the EuronextTM Paris market (Euronext: ADOC;

ISIN: FR0011184241).

Disclaimer

This press release contains certain forward-looking statements

concerning Adocia and its business. Such forward-looking statements

are based on assumptions that Adocia considers as being reasonable.

However, there can be no guarantee that the estimates contained in

such forward-looking statements will be achieved, as such estimates

are subject to numerous risks including those which are set forth

in the “Risk Factors” section of the universal registration

document that was filed with the French Autorité des marchés

financiers on April 20, 2021 (a copy of which is available at

www.adocia.com), in particular uncertainties that are linked to

research and development, future clinical data, analyses, and the

evolution of the economic context, the financial markets and the

markets in which Adocia operates.

The forward-looking statements contained in this press release

are also subject to risks not yet known to Adocia or not considered

as material by Adocia as of this day. The occurrence of all or part

of such risks could cause that actual results, financial

conditions, performances, or achievements of Adocia be materially

different from those mentioned in the forward-looking

statements.

This press release and the information contained herein do not

constitute an offer to sell or the solicitation of an offer to buy

Adocia’s shares in any jurisdiction.

1 Conway et al, Diabetes Med 2010 April; 27(4):398-404.

BMI>25, Data for 2004-2007 period 2 Epidemiology of

Obesity and Diabetes and Their Cardiovascular Complications

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220419005778/en/

Adocia Gérard Soula CEO

contactinvestisseurs@adocia.com Tel : +33 4 72 610 610

www.adocia.com

Ulysse Communication Adocia Press and Investors Relations

Pierre-Louis Germain plgermain@ulysse-communication.com / +

33 (0)6 64 79 97 51

Margaux Puech Pays d’Alissac

mpuech@ulysse-communication.com / +33 (0)7 86 16 01 09

Bruno Arabian barabian@ulysse-communication.com / +33

(0)6 87 88 47 26

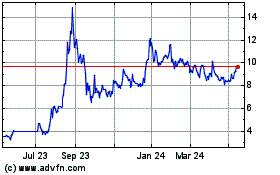

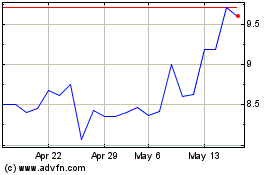

Adocia (EU:ADOC)

Historical Stock Chart

From Nov 2024 to Dec 2024

Adocia (EU:ADOC)

Historical Stock Chart

From Dec 2023 to Dec 2024