IMPLANET Reports its 2024 First-Quarter Revenue

April 09 2024 - 11:00AM

Business Wire

- +10% growth in the French market vs. 2023 Q1

- Continued expansion of the SMTP surgical equipment distribution

activity

Regulatory News:

IMPLANET (Euronext Growth: ALIMP, FR0013470168, eligible for

PEA-PME equity savings plans), a medical technology company

specializing in vertebral implants for orthopedic surgery and the

distribution of technological medical equipment, today announces

its revenue for the first quarter of 2024.

Ludovic Lastennet, IMPLANET’s Chief Executive Officer,

stated: “The first quarter of 2024 was in line with previous

quarters, with good sales momentum in our domestic market, a

ramp-up in our medical equipment distribution activity, and the

gradual reinvigoration of our international activities.

Strengthening our presence through the deployment of our innovative

solutions remains one of our priorities for the months ahead, and

has already seen major progress with the ongoing reorganization of

our US subsidiary. With this in mind, 2024 should see the

finalization of the registration of our existing products under the

European MDR regulation, the commercial launch of our proprietary

JAZZ® range in China, and the launch of a novel range of hybrid

posterior fixation for the European market, co-developed by Sanyou

Medical and IMPLANET R&D teams.”

2024 First quarter

Revenue (in € thousands –

IFRS1)

2024 Q1

2023 Q1

Change %

France

1,032

942

+10%

United States

314

459

-32%

Rest of the world

618

674

-8%

Spine revenue

1,964

2,075

-5%

Medical equipment (SMTP)

247

124

+100%

Services (MADISONTM)

12

9

+41%

Total revenue 1st quarter

2,223

2,208

+1%

Spine activity generated revenue of €1.96 million in the first

quarter of 2024, down 5% compared with revenue of €2.8 million in

the first quarter of 2023.

Activity in France continues to show good momentum, with growth

of +10%, giving revenue of €1.03 million for the first quarter

versus €0.94 million for the same period in 2023. In the United

States, following the reorganisation of the sales department in the

fourth quarter of 2023 in response to the poor performance recorded

in this region, revenue reached €0.31 million in the first quarter

of 2024, versus €0.46 million for the same period in 2023. Export

activity in the rest of the world recorded revenue of €0.62 million

in the first quarter of 2024, versus €0.67 million for the same

period the previous year.

The Company is also continuing the rollout of its medical

equipment distribution activity with Sanyou Medical subsidiary

SMTP’s ultrasound surgical scalpel. The revenue generated by this

activity in the first quarter of 2024 was €0.24 million, double the

€0.12 million recorded in the same period of the previous year.

Cash position

As of March 31, 2024, the Company’s cash position stood at €2.24

million.

As a reminder, the Company announced on February 2, 2024, the

completion of a €5.5 million capital increase. The net proceeds of

this capital increase amounted to €5.3 million. As mentioned in its

press releases of October 11, and December 11, 2023, the Company

redeemed the bond loan contracted in October 2023 for a total

amount of €1.3 million.

The Company also concluded an agreement with some of its lenders

(Banque Populaire Méditerranée, Bpifrance, Région Nouvelle

Aquitaine and Société Générale) to reschedule part of its financial

debt over the remaining term of each of the loans concerned, whose

maturity has been extended by nine months. This agreement took

effect on March 4, 2024.

In view of these elements, and the cash consumption forecasts

based on current activity assumptions and anticipated business

developments with Sanyou Medical over the 2024 and 2025 financial

years, the Company considers that it will be able to cover the

financing requirements of its operations for the next twelve

months.

Key 2024 Q1 events

- Completion of the capital increase announced on January 4,

2024, raising €5.5 million through the issue of 83,924,897 new

shares;

- Appointment of Max W. Painter as Vice President and General

Manager of IMPLANET's US subsidiary.

2024 strategy and

outlook

- Finalize the registration of existing products within the

framework of the European Medical Device Regulation (MDR).

- Reinvigorate the Company’s presence in the United States:

- strengthen the resources and commercial means made available to

the historical team;

- strengthen the Company’s direct approach by expanding the

scientific team of opinion leaders;

- Strengthen market momentum and the product offering:

- deploy the commercial and technological partnership with Sanyou

Medical to jointly develop an innovative new European range of

hybrid posterior fixation;

- initiate the distribution of the JAZZ® platform in China (the

world’s largest spine market by volume) with Sanyou Medical.

Upcoming financial event

- 2024 First-Half Revenue, July 9, 2024, after market

About IMPLANET Founded in 2007, IMPLANET is a medical

technology company that manufactures high-quality implants for

orthopedic surgery and distributing medical technology equipment.

Its activity revolves around a comprehensive innovative solution

for improving the treatment of spinal pathologies (JAZZ®)

complemented by the product range offered by Orthopaedic &

Spine Development (OSD), acquired in May 2021 (thoraco-lumbar

screws, cages and cervical plates). Implanet’s tried-and-tested

orthopedic platform is based on the traceability of its products.

Protected by four families of international patents, JAZZ® has

obtained 510(k) regulatory clearance from the Food and Drug

Administration (FDA) in the United States, the CE mark in Europe

and ANVISA approval in Brazil. In 2022, IMPLANET entered into a

commercial, technological and financial partnership with SANYOU

MEDICAL, China's second largest medical device manufacturer.

IMPLANET employs 43 staff and recorded a consolidated revenue of

€7.4 million in 2023. Based near Bordeaux in France, IMPLANET

opened a US subsidiary in Boston in 2013. IMPLANET is listed on the

Euronext Growth market in Paris.

For further information, please visit www.Implanet.com.

1 Unaudited

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240409733252/en/

IMPLANET Ludovic Lastennet, CEO David Dieumegard, CFO

Tél. : +33 (0)5 57 99 55 55 investors@Implanet.com

NewCap Investor Relations Nicolas Fossiez Tél.: +33 (0)1

44 71 94 94 Implanet@newcap.eu

NewCap Media Relations Arthur Rouillé Tél.: +33 (0)1 44

71 94 94 Implanet@newcap.eu

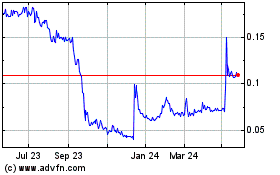

Implanet (EU:ALIMP)

Historical Stock Chart

From Oct 2024 to Nov 2024

Implanet (EU:ALIMP)

Historical Stock Chart

From Nov 2023 to Nov 2024