BE Semiconductor Industries N.V. (the “Company" or "Besi")

(Euronext Amsterdam: BESI; OTC markets: BESIY, Nasdaq International

Designation), a leading manufacturer of assembly equipment for the

semiconductor industry, today announced its results for the third

quarter and nine months ended September 30, 2021.

Key Highlights Q3-21

- Revenue of € 208.3 million declined

7.9% vs. Q2-21 and was in line with prior guidance. Decrease

primarily due to lower shipments for mobile applications post H1-21

capacity build and supply chain constraints. Up 92.3% vs. Q3-20 due

to increased demand for mobile and automotive applications and

higher shipments to Asian subcontractors

- Orders of € 209.2 million grew 4.5%

vs. Q2-21 and 120.4% vs. Q3-20 primarily as a result of increased

bookings for hybrid bonding, high performance computing and

automotive applications

- Gross margin of 60.4% declined by

1.7 points vs. Q2-21 principally due to a less favorable product

mix. Down 0.4 points vs. Q3-20 primarily due to adverse forex

influences

- Net income of € 84.2 million

decreased € 9.3 million (-9.9%) vs. Q2-21 principally as a result

of lower revenue and gross margin levels realized. Up € 50.2

million, or 147.6%, vs. Q3-20

- Net margin of 40.4% declined

slightly vs. the 41.3% achieved in Q2-21 but increased by 9.1

points vs. Q3-20 highlighting the significant operating leverage in

Besi’s business model

Key Highlights YTD-21

- Revenue of € 577.6 million rose

78.3% vs. YTD-20 reflecting strong demand across Besi’s end-user

markets, geographies and customers with particular strength in

mobile applications

- Orders of € 736.5 million grew €

421.7 million, or 134.0%, primarily due to significant growth in

each of Besi’s principal end-user markets

- Gross margin reached 60.5%, up 0.4

points vs. YTD-20 principally related to a more favorable product

mix and increased labor efficiencies despite adverse forex

influences and additional costs to scale Besi’s production

capacity

- Net income of € 215.3 million grew

€ 127.7 million, or 145.8%, vs. YTD-20. Net margin expanded to

37.3% vs. 27.1% in YTD-20

- Net cash of € 287.8 million at end

of Q3-21 increased by € 129.1 million (+81.3%) vs. Q3-20

Outlook

- Q4-21 revenue to decrease

approximately 5-15% vs. Q3-21 as new products are introduced,

capacity added in 2021 is deployed and typical H2 seasonal trends.

Revenue expected to rise 60-80% vs. Q4-20 highlighting ongoing

market strength. Gross margin of 59-61% at similar levels as

reported in Q3-21.

| (€

millions, except EPS) |

Q3-2021 |

Q2-2021 |

Δ |

Q3-2020 |

Δ |

YTD-2021 |

YTD-2020 |

Δ |

|

Revenue |

208.3 |

226.1 |

-7.9 |

% |

108.3 |

+92.3 |

% |

577.6 |

323.9 |

+78.3 |

% |

| Orders |

209.2 |

200.2 |

+4.5 |

% |

94.9 |

+120.4 |

% |

736.5 |

314.8 |

+134.0 |

% |

| Operating

Income |

95.4 |

106.7 |

-10.6 |

% |

42.0 |

+127.1 |

% |

250.4 |

109.2 |

+129.3 |

% |

| EBITDA |

99.7 |

110.9 |

-10.1 |

% |

46.5 |

+114.4 |

% |

263.1 |

123.5 |

+113.0 |

% |

| Net

Income |

84.2 |

93.5 |

-9.9 |

% |

34.0 |

+147.6 |

% |

215.3 |

87.6 |

+145.8 |

% |

| EPS

(basic) |

1.08 |

1.23 |

-12.2 |

% |

0.47 |

+129.8 |

% |

2.84 |

1.21 |

+134.7 |

% |

| EPS

(diluted) |

1.00 |

1.12 |

-10.7 |

% |

0.43 |

+132.6 |

% |

2.58 |

1.12 |

+130.4 |

% |

| Net Cash &

Deposits |

287.8 |

206.7 |

+39.2 |

% |

158.7 |

+81.3 |

% |

287.8 |

158.7 |

+81.3 |

% |

Richard W. Blickman, President and Chief

Executive Officer of Besi, commented: "Besi reported

strong results for both the third quarter and first nine months of

2021 as we leveraged our leadership position in advanced packaging

to expand revenue growth, executed strategic initiatives to drive

profitability and refined our business model to take advantage of

emerging opportunities in wafer level assembly.

For the quarter, revenue of € 208.3 million and

net income of € 84.2 million increased by 92.3% and 147.6% versus

Q3-20. Results were slightly ahead of the midpoint of guidance

despite ongoing supply chain disruptions which constrained the

potential number of customer shipments. In addition, we maintained

gross margins above 60% and limited operating expense development

that aided profitability and resulted in a net margin above 40% for

the second consecutive quarter.

Q3-21 orders of € 209.2 million trended

favorably relative to typical seasonal patterns, increasing by 4.5%

sequentially versus Q2-21 and by 120.4% versus Q3-20. In general,

order growth reflected continued strong customer demand for

advanced packaging applications as customers increased their

investment in AI, 5G, data center, vehicle electrification and

cloud infrastructure applications. Versus Q2-21, growth was

primarily due to follow-on orders for hybrid bonding systems as

well as increased demand for high performance computing and

automotive applications, continuing trends we saw in Q2-21. Growth

for such end-user markets helped offset reduced demand by Asian

subcontractors for mobile applications as incremental capacity

ordered in the first half year was installed for new product

introductions in H2-21.

Results for the first nine months were also very

strong with revenue and orders reaching € 577.6 million and € 736.5

million, respectively, increases of € 253.7 million (78.3%) and €

421.7 million (134.0%), versus the prior year period. Year to date

revenue and order growth resulted from significantly increased

demand across all Besi’s end-user markets, geographies and

customers with a particular focus in the first quarter on high-end

mobile applications followed by strength in the second and third

quarters for automotive and high performance computing

applications. Net income also rose strongly, increasing by € 127.7

million, or 145.8%, versus YTD-20 to reach € 215.3 million due to

substantial revenue growth combined with tight controls of overhead

and personnel costs. As a result, Besi’s net margins expanded to

37.3% in YTD-21 versus 27.1% in YTD-20 highlighting the significant

operating leverage in our business model.

Our liquidity position continued to grow with

cash and deposits and net cash increasing by 15.5% and 39.2%,

respectively, versus Q2-21 due to strong cash flow generated from

operations post the significant working capital investment required

in H1-21. In addition, our capital allocation policy continues to

reward investors with total distributions of € 163.7 million in

dividends and share repurchases year to date, highlighting our

commitment to long-term value creation for shareholders.

At present, we are completing a strategic review

2021-2025 with refinements to our organization and management

planned for the next phase of Besi’s development. As such, we hope

to realize the potential of a new generation of <7 nanometer

chip to wafer assembly applications while maintaining the exciting

growth opportunities of our existing advanced packaging portfolio.

Toward this end, we will have increased development and service

personnel by approximately 20% and 40%, respectively, by year end

and increased our presence in the US and Taiwan to help support new

fabs planned by customers. In addition, we are in the process of

significantly ramping Besi’s hybrid bonding production capacity in

alignment with customer roadmaps for 2022-2025. Over the past year,

the Besi and Applied Materials’ teams have made excellent progress

working together to process customer materials and accelerate

development of advanced heterogeneous integration technologies.

Looking forward, we believe that the market

drivers supporting the growth of the assembly equipment market in

this upcycle remain intact based on updated industry research

forecasts and increased capex spending plans recently announced by

our principal customers for mobile, automotive and computing

end-user markets. We also see near-term incremental growth

opportunities represented by hybrid bonding and other chip to wafer

process technologies consistent with favorable order trends over

the past two quarters.

For Q4-21, we estimate that revenue will decline

by 5-15% versus Q3-21 as new products are introduced by customers,

capacity added in 2021 is deployed and typical H2 seasonal trends.

However, revenue is anticipated to increase by 60-80% versus Q4-20

highlighting ongoing assembly market strength. In addition, we

forecast gross margins between 59-61%, roughly equivalent to Q3-21

and for operating expenses to be flat, plus or minus 5%, versus the

€ 30.4 million realized in Q3-21."

Third Quarter Results of

Operations

|

|

Q3-2021 |

Q2-2021 |

Δ |

Q3-2020 |

Δ |

|

Revenue |

208.3 |

226.1 |

-7.9 |

% |

108.3 |

+92.3 |

% |

|

Orders |

209.2 |

200.2 |

+4.5 |

% |

94.9 |

+120.4 |

% |

|

Book to Bill Ratio |

1.0 |

0.9 |

+0.1 |

|

0.9 |

+0.1 |

|

Q3-21 revenue of € 208.3 million decreased by €

17.8 million versus Q2-21 as shipments for high-end mobile

applications declined after a strong H1-21 capacity build,

partially offset by increased shipments for automotive, high

performance computing and mainstream electronics applications. The

sequential quarterly revenue decrease (-7.9%) was at the favorable

end of prior guidance (down 5-15% versus Q2-21). Besi’s 92.3%

revenue growth versus Q3-20 primarily reflected increased demand

for mobile and automotive end-user markets, significantly increased

shipments to Asian subcontractors for mainstream mobile and

electronics applications and more favorable market conditions

generally.

Orders of € 209.2 million increased 4.5% versus

Q2-21 and 120.4% versus Q3-20 due primarily to increased bookings

for hybrid bonding, high performance computing and automotive

applications. On a sequential basis, Q3-21 order growth was

partially offset by reduced demand by Asian subcontractors for

high-end mobile applications. Per customer type, IDM orders

increased € 22.4 million, or 20.1%, versus Q2-21 and represented

64% of total orders for the period. Subcontractor orders decreased

by € 13.4 million, or 15.1%, versus Q2-21 and represented 36% of

total orders.

|

|

Q3-2021 |

Q2-2021 |

Δ |

Q3-2020 |

Δ |

|

Gross Margin |

60.4 |

% |

62.1 |

% |

-1.7 |

|

60.8 |

% |

-0.4 |

|

|

Operating Expenses |

30.4 |

|

33.6 |

|

-9.5 |

% |

23.9 |

|

+27.2 |

% |

|

Financial Expense/(Income), net |

3.4 |

|

2.8 |

|

+21.4 |

% |

3.2 |

|

+6.3 |

% |

|

EBITDA |

99.7 |

|

110.9 |

|

-10.1 |

% |

46.5 |

|

+114.4 |

% |

Besi’s gross margin in Q3-21 was 60.4%, a

decrease of 1.7 points versus Q2-21 primarily due to a less

favorable product mix of systems shipped during the quarter. Versus

Q3-20, Besi’s gross margin decreased by 0.4 points due to adverse

forex movements of the euro relative to the USD and Chinese Yuan

which could not be offset by increased labor efficiencies realized

from significantly higher revenue levels.

Q3-21 operating expenses declined by € 3.2

million, or 9.5%, as compared to Q2-21 principally as a result of a

€ 2.2 million reduction in share-based compensation expense.

Operating expenses increased by € 6.5 million, or 27.2%,

versus Q3-20 primarily due to increased variable sales related

expenses associated with higher revenue levels, increased R&D

spending for the development of next generation wafer level

assembly systems and higher consulting expenses. As a percentage of

revenue, operating expenses declined to 14.6% in Q3-21 versus 14.9%

in Q2-21 and 22.1% in Q3-20.

|

|

Q3-2021 |

Q2-2021 |

Δ |

Q3-2020 |

Δ |

|

Net Income |

84.2 |

|

93.5 |

|

-9.9 |

% |

34.0 |

|

+147.6 |

% |

|

Net Margin |

40.4 |

% |

41.3 |

% |

-0.9 |

|

31.3 |

% |

+9.1 |

|

|

Tax Rate* |

8.4 |

% |

10.0 |

% |

-1.6 |

|

12.4 |

% |

-4.0 |

|

* Effective tax rate reflects € 3.7 million and

€ 2.4 million of tax benefits recognized in Q3-21 and Q2-21,

respectively.

Besi’s net income reached € 84.2 million in

Q3-21, a decrease of € 9.3 million, or 9.9%, versus Q2-21 primarily

due to a 7.9% revenue decrease and lower gross margin realized.

Such decreases were partially offset by a 9.5% reduction in

operating expenses and a lower effective tax rate due to a € 3.7

million tax benefit recognized at Besi Switzerland. Versus Q3-20,

net income increased by € 50.2 million, or 147.6%, principally as a

result of a 92.3% revenue increase combined with ongoing cost

controls of fixed personnel and overhead which limited operating

expense development. As a result, Besi’s net margin of 40.4% in

Q3-21 rose by 9.1 points versus the 31.3% realized in Q3-20.

Nine Months Results of

Operations

|

|

YTD-2021 |

YTD-2020 |

Δ |

|

Revenue |

577.6 |

|

323.9 |

|

+78.3 |

% |

|

Orders |

736.5 |

|

314.8 |

|

+134.0 |

% |

|

Gross Margin |

60.5 |

% |

60.1 |

% |

+0.4 |

|

|

Operating Income |

250.4 |

|

109.2 |

|

+129.3 |

% |

|

Net Income |

215.3 |

|

87.6 |

|

+145.8 |

% |

|

Net Margin |

37.3 |

% |

27.1 |

% |

+10.2 |

|

|

Tax Rate* |

10.2 |

% |

13.0 |

% |

-2.8 |

|

* Effective tax rate reflects € 6.1 million of tax benefits

recognized in YTD-21.

YTD-21 revenue reached € 577.6 million, up 78.3%

versus YTD-20 reflecting strong demand across Besi’s end-user

markets, geographies and customers. In particular, revenue growth

reflected a large capacity build by customers in H1-21 for high-end

smart phones in anticipation of new product introductions in the

second half year. It also reflected increased demand by Asian

subcontractors for mainstream mobile and electronics

applications.

Similarly, orders of € 736.5 million grew by €

421.7 million, or +134.0%, versus YTD-20 primarily due to

significant growth in each of Besi’s principal end-user markets and

more favorable industry conditions generally. IDM and subcontractor

orders represented 51% and 49%, respectively, of YTD-21 orders

versus 43% and 57%, respectively, in YTD-20.

Besi’s net income rose strongly as well,

increasing by € 127.7 million, or 145.8%, versus YTD-20 to reach €

215.3 million. Similarly, Besi’s net margin of 37.3% increased by

10.2 points versus YTD-20 as increased revenue and gross margin

more than offset a 15.8% increase in operating expenses primarily

associated with increased share-based compensation expense and

variable, sales related expenses due to significantly higher

revenue levels.

Financial Condition

|

|

Q32021 |

Q22021 |

Δ |

Q32020 |

Δ |

YTD-2021 |

YTD-2020 |

Δ |

|

Total Cash and Deposits |

590.5 |

511.4 |

+15.5 |

% |

564.5 |

+4.6 |

% |

590.5 |

564.5 |

+4.6 |

% |

|

Net Cash and Deposits |

287.8 |

206.7 |

+39.2 |

% |

158.7 |

+81.3 |

% |

287.8 |

158.7 |

+81.3 |

% |

|

Cash flow from Ops. |

98.6 |

51.2 |

+92.6 |

% |

60.9 |

+61.9 |

% |

176.0 |

110.3 |

+59.6 |

% |

At the end of Q3-21, Besi had a strong liquidity

position with total cash and deposits aggregating € 590.5 million.

Total cash and deposits increased by € 79.1 million versus

Q2-21 primarily due to € 98.6 million of cash flow generated from

operations which was used to fund (i) € 14.2 million of share

repurchases and (ii) € 5.5 million of capitalized development

spending. Similarly, net cash of € 287.8 million at quarter

end increased by € 81.1 million, or 39.2% versus Q2-21 and by €

129.1 million, or 81.3%, versus Q3-20 primarily due to strong cash

flow generated from operations and ongoing conversions of Besi’s

Convertible Notes due to its upward share price appreciation.

Share Repurchase Activity

/ Convertible NotesDuring the quarter, Besi

repurchased 189,838 of its ordinary shares at an average price of €

74.52 per share for a total of € 14.2 million. Cumulatively, as of

September 30, 2021, 4.0 million shares have been purchased under

the current € 185 million share repurchase program at an average

price of € 29.54 per share for a total of € 119.1

million. As of such date, Besi held approximately 0.5 million

shares in treasury, equal to 0.6% of its shares outstanding.

During the quarter, € 1.0 million and € 2.6

million principal amount of the 2.5% Convertible Notes due 2023 and

the 0.5% Convertible Notes due 2024, respectively, were converted

into 105,452 ordinary shares. As a result, the principal amount

outstanding of the 2.5% Convertible Notes due 2023 and the 0.5%

Convertible Notes due 2024 declined to € 4.7 million and €

172.4 million, respectively.

Outlook

Based on its September 30, 2021 order backlog

and feedback from customers, Besi forecasts for Q4-21 that:

- Revenue will decrease by

approximately 5-15% vs. the € 208.3 million reported in Q3-21

- Gross margin will range between

59-61% vs. the 60.4% realized in Q3-21

- Operating expenses will be flat,

plus or minus 5%, vs. the € 30.3 million reported in Q3-21

Investor and

media conference callA conference call and webcast for

investors and media will be held today at 4:00 pm CET (10:00 am

EDT). The dial-in for the conference call is (31) 20 531 5851. To

access the audio webcast and webinar slides, please visit

www.besi.com.

Basis of Presentation

The accompanying condensed Consolidated

Financial Statements have been prepared in accordance with

International Financial Reporting Standards (“IFRS”) as adopted by

the European Union. Reference is made to the Summary of Significant

Accounting Policies to the Notes to the Consolidated Financial

Statements as included in our 2020 Annual Report, which is

available on www.besi.com.

About Besi

Besi is a leading supplier of semiconductor

assembly equipment for the global semiconductor and electronics

industries offering high levels of accuracy, productivity and

reliability at a low cost of ownership. The Company develops

leading edge assembly processes and equipment for leadframe,

substrate and wafer level packaging applications in a wide range of

end-user markets including electronics, mobile internet, cloud

server, computing, automotive, industrial, LED and solar energy.

Customers are primarily leading semiconductor manufacturers,

assembly subcontractors and electronics and industrial companies.

Besi’s ordinary shares are listed on Euronext Amsterdam (symbol:

BESI). Its Level 1 ADRs are listed on the OTC markets (symbol:

BESIY Nasdaq International Designation) and its headquarters are

located in Duiven, the Netherlands. For more information, please

visit our website at www.besi.com.

Contacts:Richard W. Blickman,

President &

CEO Hetwig van

Kerkhof, SVP FinanceLeon Verweijen, VP FinanceClaudia Vissers,

Executive Secretary/IR coordinatorEdmond Franco, VP Corporate

Development/US IR coordinatorTel. (31) 26 319

4500 investor.relations@besi.com

Caution Concerning Forward Looking Statements

This press release contains statements about

management's future expectations, plans and prospects of our

business that constitute forward-looking statements, which are

found in various places throughout the press release, including,

but not limited to, statements relating to expectations of orders,

net sales, product shipments, expenses, timing of purchases of

assembly equipment by customers, gross margins, operating results

and capital expenditures. The use of words such as “anticipate”,

“estimate”, “expect”, “can”, “intend”, “believes”, “may”, “plan”,

“predict”, “project”, “forecast”, “will”, “would”, and similar

expressions are intended to identify forward looking statements,

although not all forward looking statements contain these

identifying words. The financial guidance set forth under the

heading “Outlook” contains such forward looking statements. While

these forward looking statements represent our judgments and

expectations concerning the development of our business, a number

of risks, uncertainties and other important factors could cause

actual developments and results to differ materially from those

contained in forward looking statements, including any inability to

maintain continued demand for our products; failure of anticipated

orders to materialize or postponement or cancellation of orders,

generally without charges; the volatility in the demand for

semiconductors and our products and services; the extent and

duration of the COVID-19 pandemic and measures taken to contain the

outbreak, and the associated adverse impacts on the global economy,

financial markets, and our operations as well as those of our

customers and suppliers; failure to develop new and enhanced

products and introduce them at competitive price

levels; failure to adequately decrease costs and expenses as

revenues decline; loss of significant customers, including through

industry consolidation or the emergence of industry alliances;

lengthening of the sales cycle; acts of terrorism and

violence; disruption or failure of our information technology

systems; inability to forecast demand and inventory levels for

our products; the integrity of product pricing and protection of

our intellectual property in foreign jurisdictions; risks, such as

changes in trade regulations, currency fluctuations, political

instability and war, associated with substantial foreign customers,

suppliers and foreign manufacturing operations, particularly to the

extent occurring in the Asia Pacific region; potential instability

in foreign capital markets; the risk of failure to successfully

manage our diverse operations; any inability to attract and retain

skilled personnel, including as a result of restrictions on

immigration, travel or the availability of visas for skilled

technology workers as a result of the COVID-19 pandemic; those

additional risk factors set forth in Besi's annual report for the

year ended December 31, 2020 and other key factors that

could adversely affect our businesses and financial performance

contained in our filings and reports, including our statutory

consolidated statements. We expressly disclaim any obligation to

update or alter our forward-looking statements whether as a result

of new information, future events or

otherwise.

Consolidated Statements of

Operations

|

(euro in thousands, except share and per share data) |

Three Months EndedSeptember

30,(unaudited) |

Nine Months EndedSeptember

30,(unaudited) |

|

|

2021 |

2020 |

2021 |

2020 |

|

|

|

|

|

|

| Revenue |

208,306 |

108,343 |

577,565 |

323,949 |

| Cost of sales |

82,514 |

42,466 |

228,188 |

129,339 |

| |

|

|

|

|

| Gross profit |

125,792 |

65,877 |

349,377 |

194,610 |

| |

|

|

|

|

| Selling, general and

administrative expenses |

21,581 |

16,312 |

72,472 |

59,970 |

| Research and development

expenses |

8,806 |

7,598 |

26,474 |

25,457 |

| |

|

|

|

|

| Total operating expenses |

30,387 |

23,910 |

98,946 |

85,427 |

| |

|

|

|

|

| Operating income |

95,405 |

41,967 |

250,431 |

109,183 |

| |

|

|

|

|

| Financial expense, net |

3,401 |

3,197 |

10,720 |

8,500 |

| |

|

|

|

|

| Income before taxes |

92,004 |

38,770 |

239,711 |

100,683 |

| |

|

|

|

|

| Income tax expense |

7,761 |

4,814 |

24,401 |

13,054 |

| |

|

|

|

|

| Net

income |

84,243 |

33,956 |

215,310 |

87,629 |

|

|

|

|

|

|

| Net income per share – basic |

1.08 |

0.47 |

2.84 |

1.21 |

| Net income per share –

diluted |

1.00 |

0.43 |

2.58 |

1.12 |

|

Number of shares used in computing per share amounts:- basic-

diluted 1 |

78,121,83685,347,997 |

72,705,06284,386,221 |

75,747,52585,422,234 |

72,471,11783,217,565 |

Consolidated Balance Sheets

|

(euro in thousands) |

September 30, 2021 (unaudited) |

June 30, 2021(unaudited) |

March 31, 2021(unaudited) |

December 31, 2020(audited) |

|

ASSETS |

|

|

|

|

| |

|

|

|

|

| Cash and cash

equivalents |

455,267 |

298,802 |

347,979 |

375,406 |

| Deposits |

135,204 |

212,575 |

257,847 |

223,299 |

| Trade

receivables |

213,641 |

217,725 |

147,737 |

93,218 |

| Inventories |

85,172 |

78,100 |

61,709 |

51,645 |

| Other current

assets |

14,630 |

17,165 |

17,655 |

11,964 |

| |

|

|

|

|

| Total current

assets |

903,914 |

824,367 |

832,927 |

755,532 |

| |

|

|

|

|

| |

|

|

|

|

| Property, plant and

equipment |

27,838 |

27,344 |

27,739 |

27,840 |

| Right of use

assets |

10,560 |

10,280 |

8,958 |

9,873 |

| Goodwill |

44,966 |

44,732 |

44,851 |

44,484 |

| Other intangible

assets |

61,747 |

57,450 |

54,078 |

50,660 |

| Deferred tax

assets |

19,947 |

20,086 |

21,177 |

21,924 |

| Other non-current

assets |

1,034 |

1,084 |

1,078 |

1,043 |

| |

|

|

|

|

| Total

non-current assets |

166,092 |

160,976 |

157,881 |

155,824 |

| |

|

|

|

|

|

Total assets |

1,070,006 |

985,343 |

990,808 |

911,356 |

| |

|

|

|

|

| |

|

| |

|

|

|

|

| Trade payables |

84,342 |

91,472 |

65,351 |

44,017 |

| Other current

liabilities |

102,349 |

87,337 |

83,155 |

57,469 |

| |

|

|

|

|

| Total current

liabilities |

186,691 |

178,809 |

148,506 |

101,486 |

| |

|

|

|

|

| Long-term debt |

302,637 |

304,647 |

389,614 |

399,956 |

| Lease

liabilities |

7,307 |

6,963 |

6,348 |

6,952 |

| Deferred tax

liabilities |

11,312 |

11,448 |

12,905 |

12,840 |

| Other non-current

liabilities |

16,251 |

15,947 |

18,887 |

18,895 |

| |

|

|

|

|

| Total

non-current liabilities |

337,507 |

339,005 |

427,754 |

438,643 |

| |

|

|

|

|

| Total

equity |

545,808 |

467,529 |

414,548 |

371,227 |

| |

|

|

|

|

|

Total liabilities and equity |

1,070,006 |

985,343 |

990,808 |

911,356 |

Consolidated Cash Flow

Statements

|

(euro in thousands) |

Three Months Ended September

30,(unaudited) |

Nine Months Ended September

30,(unaudited) |

|

|

2021 |

|

2020 |

|

2021 |

|

2020 |

|

|

|

|

|

|

|

| Cash flows from operating

activities: |

|

|

|

|

| Income before income tax |

92,004 |

|

38,770 |

|

239,711 |

|

100,683 |

|

| |

|

|

|

|

| Depreciation and

amortization |

4,285 |

|

4,495 |

|

12,717 |

|

14,343 |

|

| Share-based payment expense |

1,395 |

|

981 |

|

14,792 |

|

9,014 |

|

| Financial expense, net |

3,401 |

|

3,197 |

|

10,720 |

|

8,500 |

|

| |

|

|

|

|

| Changes in working capital |

226 |

|

14,546 |

|

(86,671 |

) |

(10,197 |

) |

| Income tax paid |

(1,659 |

) |

(221 |

) |

(12,080 |

) |

(8,974 |

) |

| Interest paid |

(1,064 |

) |

(865 |

) |

(3,170 |

) |

(3,045 |

) |

| |

|

|

|

|

|

Net cash provided by operating activities |

98,588 |

|

60,903 |

|

176,019 |

|

110,324 |

|

| |

|

|

|

|

| Cash flows from investing

activities: |

|

|

|

|

| Capital expenditures |

(1,206 |

) |

(1,250 |

) |

(4,071 |

) |

(2,600 |

) |

| Proceeds from sale of

property |

- |

|

- |

|

54 |

|

- |

|

| Capitalized development

expenses |

(5,497 |

) |

(4,286 |

) |

(16,277 |

) |

(12,268 |

) |

| Repayments of (investments in)

deposits |

79,291 |

|

(110,127 |

) |

89,244 |

|

(95,127 |

) |

| |

|

|

|

|

|

Net cash provided by (used in) investing activities |

72,588 |

|

(115,663 |

) |

68,950 |

|

(109,995 |

) |

| |

|

|

|

|

| Cash flows from financing

activities: |

|

|

|

|

|

Payments of bank lines of credit |

- |

|

- |

|

- |

|

(434 |

) |

|

Proceeds from (payments of) debt |

- |

|

- |

|

1,021 |

|

(416 |

) |

|

Proceeds from convertible notes |

- |

|

147,757 |

|

- |

|

147,757 |

|

| Payments on lease

liabilities |

(889 |

) |

(853 |

) |

(2,739 |

) |

(2,622 |

) |

| Dividends paid to

shareholders |

- |

|

- |

|

(129,357 |

) |

(73,486 |

) |

| Purchase of treasury shares |

(14,175 |

) |

(3,259 |

) |

(34,372 |

) |

(9,457 |

) |

| |

|

|

|

|

|

Net cash provided by (used in) financing activities |

(15,064 |

) |

143,645 |

|

(165,447 |

) |

61,342 |

|

| |

|

|

|

|

|

Net increase in cash and cash equivalents |

156,112 |

|

88,885 |

|

79,522 |

|

61,671 |

|

| Effect of changes in exchange

rates on cash and cash equivalents |

353 |

|

(1,047 |

) |

339 |

|

(610 |

) |

| Cash and cash equivalents at

beginning of the period |

298,802 |

|

251,621 |

|

375,406 |

|

278,398 |

|

| |

|

|

|

|

|

Cash and cash equivalents at end of the period |

455,267 |

|

339,459 |

|

455,267 |

|

339,459 |

|

Supplemental Information

(unaudited) (euro in millions, unless stated

otherwise)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

REVENUE |

Q1-2020 |

Q2-2020 |

Q3-2020 |

Q4-2020 |

Q1-2021 |

Q2-2021 |

Q3-2021 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Per geography: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Asia Pacific |

77.6 |

|

85 |

% |

105.7 |

|

85 |

% |

86.6 |

|

80 |

% |

91.1 |

|

83 |

% |

113.4 |

|

79 |

% |

175.7 |

|

78 |

% |

164.3 |

|

79 |

% |

|

| |

EU / USA |

13.7 |

|

15 |

% |

18.6 |

|

15 |

% |

21.7 |

|

20 |

% |

18.6 |

|

17 |

% |

29.8 |

|

21 |

% |

50.4 |

|

22 |

% |

44.0 |

|

21 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total |

91.3 |

|

100 |

% |

124.3 |

|

100 |

% |

108.3 |

|

100 |

% |

109.7 |

|

100 |

% |

143.2 |

|

100 |

% |

226.1 |

|

100 |

% |

208.3 |

|

100 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

ORDERS |

Q1-2020 |

Q2-2020 |

Q3-2020 |

Q4-2020 |

Q1-2021 |

Q2-2021 |

Q3-2021 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Per geography: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Asia Pacific |

102.0 |

|

86 |

% |

88.1 |

|

87 |

% |

75.9 |

|

80 |

% |

122.7 |

|

78 |

% |

253.2 |

|

77 |

% |

155.0 |

|

77 |

% |

170.5 |

|

82 |

% |

|

| |

EU / USA |

16.6 |

|

14 |

% |

13.2 |

|

13 |

% |

19.0 |

|

20 |

% |

34.6 |

|

22 |

% |

73.9 |

|

23 |

% |

45.2 |

|

23 |

% |

38.7 |

|

18 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total |

118.6 |

|

100 |

% |

101.3 |

|

100 |

% |

94.9 |

|

100 |

% |

157.3 |

|

100 |

% |

327.1 |

|

100 |

% |

200.2 |

|

100 |

% |

209.2 |

|

100 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Per customer type: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

IDM |

47.4 |

|

40 |

% |

44.6 |

|

44 |

% |

43.7 |

|

46 |

% |

77.6 |

|

49 |

% |

130.8 |

|

40 |

% |

111.3 |

|

56 |

% |

133.7 |

|

64 |

% |

|

| |

Subcontractors |

71.2 |

|

60 |

% |

56.7 |

|

56 |

% |

51.2 |

|

54 |

% |

79.7 |

|

51 |

% |

196.3 |

|

60 |

% |

88.9 |

|

44 |

% |

75.5 |

|

36 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total |

118.6 |

|

100 |

% |

101.3 |

|

100 |

% |

94.9 |

|

100 |

% |

157.3 |

|

100 |

% |

327.1 |

|

100 |

% |

200.2 |

|

100 |

% |

209.2 |

|

100 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

HEADCOUNT |

Mar 31, 2020 |

Jun 30, 2020 |

Sep 30, 2020 |

Dec 31, 2020 |

Mar 31, 2021 |

Jun 30, 2021 |

Sep 30, 2021 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Fixed staff (FTE) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Asia Pacific |

1,071 |

|

70 |

% |

1,067 |

|

70 |

% |

1,054 |

|

70 |

% |

1,060 |

|

70 |

% |

1,070 |

|

70 |

% |

1,096 |

|

70 |

% |

1,132 |

|

70 |

% |

|

| |

EU / USA |

458 |

|

30 |

% |

455 |

|

30 |

% |

459 |

|

30 |

% |

463 |

|

30 |

% |

468 |

|

30 |

% |

473 |

|

30 |

% |

483 |

|

30 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total |

1,529 |

|

100 |

% |

1,522 |

|

100 |

% |

1,513 |

|

100 |

% |

1,523 |

|

100 |

% |

1,538 |

|

100 |

% |

1,569 |

|

100 |

% |

1,615 |

|

100 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Temporary staff (FTE) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Asia Pacific |

42 |

|

46 |

% |

121 |

|

72 |

% |

95 |

|

63 |

% |

35 |

|

37 |

% |

299 |

|

82 |

% |

581 |

|

90 |

% |

559 |

|

87 |

% |

|

| |

EU / USA |

50 |

|

54 |

% |

48 |

|

28 |

% |

57 |

|

37 |

% |

60 |

|

63 |

% |

64 |

|

18 |

% |

68 |

|

10 |

% |

80 |

|

13 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total |

92 |

|

100 |

% |

169 |

|

100 |

% |

152 |

|

100 |

% |

95 |

|

100 |

% |

363 |

|

100 |

% |

649 |

|

100 |

% |

639 |

|

100 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total fixed and temporary staff (FTE) |

1,621 |

|

|

1,691 |

|

|

1,665 |

|

|

1,618 |

|

|

1,901 |

|

|

2,218 |

|

|

2,254 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

OTHER FINANCIAL DATA |

Q1-2020 |

Q2-2020 |

Q3-2020 |

Q4-2020 |

Q1-2021 |

Q2-2021 |

Q3-2021 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Gross profit |

51.7 |

|

56.7 |

% |

77.0 |

|

62.0 |

% |

65.9 |

|

60.8 |

% |

64.0 |

|

58.3 |

% |

83.3 |

|

58.2 |

% |

140.3 |

|

62.1 |

% |

125.8 |

|

60.4 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Selling, general and admin expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

As reported |

23.5 |

|

25.7 |

% |

20.1 |

|

16.2 |

% |

16.3 |

|

15.1 |

% |

15.8 |

|

14.4 |

% |

26.7 |

|

18.6 |

% |

24.2 |

|

10.7 |

% |

21.6 |

|

10.4 |

% |

|

| |

Share-based compensation expense |

(5.8 |

) |

-6.3 |

% |

(2.2 |

) |

-1.8 |

% |

(1.0 |

) |

-1.0 |

% |

(1.5 |

) |

-1.4 |

% |

(9.8 |

) |

-6.8 |

% |

(3.6 |

) |

-1.6 |

% |

(1.4 |

) |

-0.7 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

SG&A expenses as adjusted |

17.7 |

|

19.4 |

% |

17.9 |

|

14.4 |

% |

15.3 |

|

14.1 |

% |

14.3 |

|

13.0 |

% |

16.9 |

|

11.8 |

% |

20.6 |

|

9.1 |

% |

20.2 |

|

9.7 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Research and development expenses:: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

As reported |

9.4 |

|

10.3 |

% |

8.4 |

|

6.8 |

% |

7.6 |

|

7.0 |

% |

7.4 |

|

6.8 |

% |

8.3 |

|

5.8 |

% |

9.4 |

|

4.2 |

% |

8.8 |

|

4.2 |

% |

|

| |

Capitalization of R&D charges |

3.7 |

|

4.1 |

% |

4.3 |

|

3.5 |

% |

4.3 |

|

4.0 |

% |

5.4 |

|

4.9 |

% |

5.9 |

|

4.1 |

% |

4.9 |

|

2.2 |

% |

5.5 |

|

2.6 |

% |

|

| |

Amortization of intangibles |

(2.6 |

) |

-2.8 |

% |

(2.1 |

) |

-1.7 |

% |

(2.1 |

) |

-2.0 |

% |

(2.2 |

) |

-2.0 |

% |

(1.7 |

) |

-1.2 |

% |

(1.7 |

) |

-0.8 |

% |

(1.8 |

) |

-0.8 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

R&D expenses as adjusted |

10.5 |

|

11.5 |

% |

10.6 |

|

8.5 |

% |

9.8 |

|

9.0 |

% |

10.6 |

|

9.7 |

% |

12.5 |

|

8.7 |

% |

12.6 |

|

5.6 |

% |

12.5 |

|

6.00 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Financial expense (income), net: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Interest expense (income), net |

2.6 |

|

|

2.5 |

|

|

3.1 |

|

|

3.6 |

|

|

3.4 |

|

|

2.3 |

|

|

2.4 |

|

|

|

| |

Hedging results |

0.7 |

|

|

0.5 |

|

|

0.3 |

|

|

0.3 |

|

|

0.7 |

|

|

0.7 |

|

|

0.7 |

|

|

|

| |

Foreign exchange effects, net |

(0.7 |

) |

|

(0.3 |

) |

|

(0.2 |

) |

|

(0.1 |

) |

|

0.4 |

|

|

(0.2 |

) |

|

0.3 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total |

2.6 |

|

|

2.7 |

|

|

3.2 |

|

|

3.8 |

|

|

4.5 |

|

|

2.8 |

|

|

3.4 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Operating income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

as % of net sales |

18.8 |

|

20.6 |

% |

48.4 |

|

39.0 |

% |

42.0 |

|

38.8 |

% |

40.7 |

|

37.1 |

% |

48.4 |

|

33.8 |

% |

106.7 |

|

47.2 |

% |

95.4 |

|

45.8 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

EBITDA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

as % of net sales |

24.0 |

|

26.3 |

% |

53.1 |

|

42.7 |

% |

46.5 |

|

42.9 |

% |

45.5 |

|

41.5 |

% |

52.6 |

|

36.7 |

% |

110.9 |

|

49.0 |

% |

99.7 |

|

47.9 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

as % of net sales |

13.9 |

|

15.2 |

% |

39.8 |

|

32.0 |

% |

34.0 |

|

31.3 |

% |

44.6 |

|

40.7 |

% |

37.6 |

|

26.3 |

% |

93.5 |

|

41.3 |

% |

84.2 |

|

40.4 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Income per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Basic |

0.19 |

|

|

0.55 |

|

|

0.47 |

|

|

0.62 |

|

|

0.51 |

|

|

1.23 |

|

|

1.08 |

|

|

|

| |

Diluted |

0.19 |

|

|

0.50 |

|

|

0.43 |

|

|

0.55 |

|

|

0.47 |

|

|

1.12 |

|

|

1.00 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

__________________________________________________1) The

calculation of diluted income per share assumes the exercise of

equity-settled share-based payments and the conversion of all

Convertible Notes outstanding

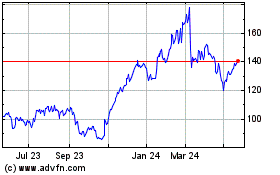

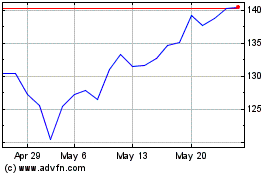

Be Semiconductor Industr... (EU:BESI)

Historical Stock Chart

From Oct 2024 to Nov 2024

Be Semiconductor Industr... (EU:BESI)

Historical Stock Chart

From Nov 2023 to Nov 2024