Kaufman & Broad SA : DIVIDEND FOR THE FISCAL YEAR ENDED AT 2018, NOVEMBER 30TH - OPTION FOR THE PAYMENT OF THE DIVIDEND IN SH...

May 02 2019 - 11:28AM

Press release

DIVIDEND FOR THE FISCAL YEAR ENDED AT 2018, NOVEMBER 30TH - OPTION

FOR THE PAYMENT OF THE DIVIDEND IN SHARES

Paris, 2 May

2019- At the Annual General Meeting held today, Kaufman &

Broad's shareholders approved the proposed €2.50 per share dividend

for the financial year ended 30 November 2018 and decided to offer

shareholders an option between (i) the payment of all of the

dividend in cash, (ii) the payment of the whole of the dividend in

new shares of the Company or (iii) the payment of the portion

corresponding to one half of the dividend (equal to 1.25 euro per

share) in new shares, the other half being paid in cash, it being

understood that the shareholder will only be entitled to one of the

choices proposed.

The issue price of these new

shares to be issued in consideration for the dividend has been set

at €32.23 per share. This issue price represents in accordance with

the provisions of Article L. 232-19 of the French Commercial Code

95% of the average prices quoted of the Kaufman & Broad share

on the regulated market of Euronext Paris during the 20 trading

days preceding the date of the Annual General Meeting, less the

amount of the dividend, and rounded upward to the nearest euro

cent.

The dividend ex-date is set on May

15, 2019. The shareholders may opt for one of the three options

from May 17, 2019 to June 6, 2019 included, by sending their

request to their financial intermediaries. For the shareholders who

have not exercised their dividend payment option by June 6, 2019,

the dividend shall exclusively be paid in cash.

For the shareholders who have not

opted for a payment of all or part of the dividend in shares, the

dividend shall be paid fully in cash on June 14, 2019. For the

shareholders who have opted to receive all or part of the dividend

in shares, settlement and delivery of the shares will be as from

June 14, 2019; the corresponding part, if any, of the payment in

cash will be paid on June 14, 2019.

If the amount of dividends for which the option is exercised does

not correspond to a whole number of shares, shareholders may choose

to either receive the rounded-up whole number of shares by paying

the difference in cash on the day they exercise the option or

receive the rounded-down whole number of shares and the balance in

cash.

The shares issued as dividend

payment will carry dividend rights as from December 1st, 2018. An

application to list these new shares on Euronext Paris will be

made. The new shares will rank pari passu with existing shares and

will be fully fungible with existing shares already listed.

The maximum total number of new

shares which may be issued for the purpose of the dividend payment

in shares is 1,661,691 shares (excluding additional shares issued

for rounding purposes), representing approximately 7.67% of the

share capital and 6.75% of the voting rights of Kaufman & Broad

which can be exercised in General Meetings, based on the total

number of shares and voting rights published on April 11, 2019 and

after taking into account the share capital reduction by way of

cancellation of 210,732 treasury shares decided today by the Board

of directors.

| Calendar : |

|

| 15 May

2019 |

Ex-date

for the payment of the dividend and opening of the option period

for the payment of all or part of the dividend in shares

|

| 16 May

2019 |

Record

date for the payment of the dividend |

6 June 2019 |

Closing

of the option period for the payment of all or part of the dividend

in shares

|

| 11 June

2019 |

Announcement of the option's result |

14 June 2019 |

Dividend payment in cash, settlement of the dividend in shares |

Disclaimer

This press

release constitutes the information document required pursuant to

Article 212-4 4° and 212-5 5° of the French Financial Market

Authority (AMF) General Regulation and Article 18 of the AMF

Instruction n° 2016-04 of 21 October 2016, as amended on January

15, 2018.

This press

release does not constitute an offer to purchase securities. This

press release and any other document relating to the payment of

dividend in shares may only be distributed or disseminated outside

of France in conformity with applicable local laws and regulations

and shall not constitute an offer for securities in any

jurisdiction where such an offer would infringe applicable laws and

regulations.

The option to

receive the dividend for the financial year ended 30 November 2018

payment in shares, as described herein, is not available to

shareholders residing in any country where such option would

require registration or approval by local securities regulators.

Shareholders residing outside of France must inform themselves

about, and comply with, any restrictions which may apply under

their local laws.

For tax purposes

in relation to the dividend payment in shares, the shareholders are

invited to review their personal situation with their own tax

advisor.

In making the

election to receive all or part of the dividend payment in shares,

shareholders should take into consideration the risks associated

with an investment in shares, including those described in chapter

1.2 of the registration document filed with the AMF under number

D.19-0228 dated March 29, 2019.

This press release

is available at www.kaufmanbroad.fr

Contacts

Chief Financial

Officer

Bruno Coche

01 41 43 44 73

infos-invest@ketb.com

|

Press Relations |

Media relations: Hopscotch Capital: Valerie Sicard

01 58 65 00 77 / k&b@hopscotchcapital.fr

Kaufman & Broad: Emmeline Cacitti

06 72 42 66 24 / ecacitti@ketb.com |

About Kaufman

& Broad - Kaufman & Broad has been designing,

developing, building, and selling single-family homes in

communities, apartments, and offices on behalf of third parties for

more than 50 years. Kaufman & Broad is one of the leading

French developers-builders due to the combination of its size and

profitability, and the strength of its brand.

The Kaufman &

Broad Registration Document was filed with the French Financial

Markets Authority ("AMF") under No. D.19-0228 on March 29,

2019. It is available on the AMF

(www.amf-france.org) and Kaufman & Broad

(www.kaufmanbroad.fr) websites. It contains a

detailed description of Kaufman & Broad's business activities,

results, and outlook, as well as the associated risk factors.

Kaufman & Broad specifically draws attention to the risk

factors set out in Chapter 1.2 of the Registration Document. The

occurrence of one or more of these risks might have a material

adverse impact on the Kaufman & Broad group's business

activities, net assets, financial position, results, and outlook,

as well as on the price of Kaufman & Broad's

shares.

This press release does not amount to, and cannot

be construed as amounting to a public offering, a sale offer or a

subscript ion offer, or as intended to seek a purchase or

subscription order in any country.

K&B: Dividend and payment

option for the year 2018

This

announcement is distributed by West Corporation on behalf of West

Corporation clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Kaufman & Broad SA via Globenewswire

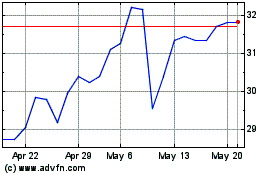

Kaufman and Broad (EU:KOF)

Historical Stock Chart

From Oct 2024 to Nov 2024

Kaufman and Broad (EU:KOF)

Historical Stock Chart

From Nov 2023 to Nov 2024