Lagardere Shares Surge After Vivendi Paves Way for Full Takeover

September 16 2021 - 3:43AM

Dow Jones News

By Mauro Orru

Shares in French media group Lagardere SA surged Thursday after

Vivendi SE struck a deal to increase its stake in the company, a

move that opens the door to a full takeover.

At 0800 GMT, Lagardere shares traded 21% higher at EUR23.60.

Vivendi, the conglomerate steered by the family of French

billionaire Vincent Bollore, agreed to buy a 17.93% stake in

Lagardere held by activist investor Amber Capital for about 609.86

million euros ($720.6 million).

The deal would take Vivendi's stake in the company to 45.1%,

effectively forcing it to pursue a takeover of Lagardere.

France's markets regulator obliges companies exceeding a 30%

threshold in another listed company to submit a tender offer for

all remaining shares, although exemptions are possible.

A potential takeover, if approved by French and European

regulators, would represent a sizeable investment for Vivendi after

the spinoff of Universal Music Group, for years its crown jewel

that accounted for the lion's share of revenue growth.

Lagardere, which owns book publisher Hachette, radio stations

and a travel retail business, is one of France's most prominent

media companies. Its share price climbed roughly 15% this year, a

sign of investors' confidence as coronavirus restrictions that

crippled air passenger traffic--key to Lagardere's travel retail

business--disappear.

Lagardere welcomed Vivendi's investment, saying it underscored

Vivendi's confidence in a deal that would complement its own

activities.

Vivendi's operations span television through its pay-TV business

Canal+ Group, videogame production and marketing. It also owns book

publisher Editis, which competes with Lagardere's Hachette.

"We believe Vivendi is primarily interested in Lagardere's

international publishing business which would bring scale,

synergies and savings to Editis," analysts at J.P. Morgan Cazenove

said, with Vivendi likely to sell the travel retail business.

Vivendi should ramp up its stake by Dec. 15 next year, marking

the exit of Amber Capital from Lagardere.

Lagardere and Amber Capital have been at loggerheads since the

investor sought to oust Arnaud Lagardere as chief executive and

overhaul the company's former legal structure, which gave Mr.

Lagardere veto powers on most decisions made by shareholders,

effectively handing him control of the company well beyond the size

of his stake.

Lagardere has since abandoned the "societe en commandite par

actions" structure in favor of the more common "societe anonyme"

status, which grants more rights depending on stake sizes.

Write to Mauro Orru at mauro.orru@wsj.com; @MauroOrru94

(END) Dow Jones Newswires

September 16, 2021 04:28 ET (08:28 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

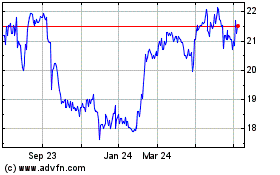

Lagardere (EU:MMB)

Historical Stock Chart

From Oct 2024 to Nov 2024

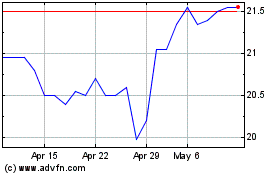

Lagardere (EU:MMB)

Historical Stock Chart

From Nov 2023 to Nov 2024