Prosus Launches GBP4.9 Billion Bid for Just Eat, Interrupting Takeaway.com Deal -- Update

October 22 2019 - 4:55AM

Dow Jones News

By Adria Calatayud and Oliver Griffin

Prosus NV (PRX.AE) on Tuesday offered to buy online

food-delivery service Just Eat PLC (JE.LN) in a 4.9 billion pound

($6.3 billion) cash deal that challenges an agreed all-share merger

between the U.K. company and Dutch peer Takeaway.com NV

(TKWY.AE).

London-based Just Eat promptly rejected Prosus's bid and said

the offer significantly undervalues the company and its proposed

combination with Takeaway.com.

Prosus said its wholly owned subsidiary, MIH Food Delivery

Holdings BV, has offered to buy Just Eat for 710 pence a share, a

20% premium to the U.K. company's closing price on Monday

FTSE 100 constituent Just Eat's shares soared on the news.

Shares at 0911 GMT were up 24% at 731 pence a share.

Prosus said it hasn't managed to reach an agreement with Just

Eat despite approaching its board with a number of indicative

proposals.

Just Eat said it engaged fully with Prosus throughout this

process. The U.K company said its board unanimously rejected

Prosus's initial proposal of 670 pence a share and subsequent

proposals of 700 pence and 710 pence a share.

Amsterdam-listed Prosus was formed from the international

internet assets of Naspers Ltd. (NPN.JO) and started trading in

September this year. Naspers continues to hold a 74% stake in

Prosus, according to FactSet.

Just Eat agreed in August to combine with Dutch rival

Takeaway.com in an all-share merger. The deal valued Just Eat at

731 pence a share at the time based on Takeaway.com's closing share

price of 83.55 euros ($93.21) on July 26, the last trading day

before the companies disclosed they were in talks.

Following a decline in Takeaway.com's share price since then,

Prosus said its bid represents a 20% premium to the value of

Takeaway.com's implied offer price of 594 pence as of Monday.

Some major Just Eat shareholders like Eminence Capital LP have

raised concerns over the terms of the Takeaway.com deal saying that

its terms undervalue the U.K. company's assets.

Prosus said an all-cash offer provides Just Eat shareholders

with certainty. Moreover, the Dutch company--which has investments

in food-delivery companies like Germany's Delivery Hero AG

(DHER.FF), India's Swiggy and Brazil's iFood--said it intends to

invest in Just Eat to drive the U.K. company to its next phase of

growth.

Prosus shares at 0913 GMT were up 0.4% at EUR66.38. Takeaway.com

shares traded 4.4% higher at EUR74.10.

Write to Adria Calatayud at adria.calatayudvaello@owjones.com

and to Oliver Griffin at oliver.griffin@dowjones.com;

@OliGGriffin

(END) Dow Jones Newswires

October 22, 2019 05:40 ET (09:40 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

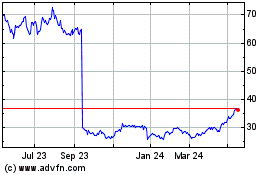

Prosus NV (EU:PRX)

Historical Stock Chart

From Apr 2024 to May 2024

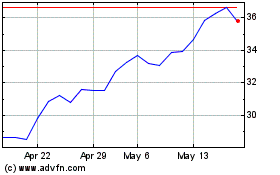

Prosus NV (EU:PRX)

Historical Stock Chart

From May 2023 to May 2024