EUROPE MARKETS: European Stocks Nudge Higher Despite Fresh U.S.-China Tariffs Coming Into Force

September 02 2019 - 5:04AM

Dow Jones News

By Callum Keown

European stocks nudged higher on Monday despite fresh U.S.

tariffs on Chinese goods coming into force, as investors latched on

to hopes of a resolution.

The Stoxx 600 climbed 0.3%, while the DAX rose just 0.1% as

German Chancellor Angela Merkel and her coalition partners lost

support in regional elections.

The FTSE MIB surged 0.8% as Italian Prime Minister Giuseppe

Conte said he expected to complete a new government by

Wednesday.

U.S. markets are closed on Monday for the Labor Day

(http://www.marketwatch.com/story/us-stock-futures-weaken-as-tariffs-go-into-effect-2019-09-02)holiday.

What's moving the markets?

The latest round of U.S. tariff hikes on Chinese goods came into

force on Sunday

(http://www.marketwatch.com/story/asian-markets-mixed-as-latest-us-china-tariffs-take-effect-2019-09-01),

with duties raised from 10% to 15% on $112 billion of imports.

China retaliated with fresh tariffs of its own and plans further

hikes next month and in December.

However, the prospect of face-to-face talks between trade

negotiators later this month and positive sentiments from both

sides lifted markets.

Mark Haefele, global chief investment officer at UBS Wealth

Management, said: "Despite the market's sanguine take, we believe

the ultimate outlook for the trade dispute has become harder to

predict with confidence.

"Since trade tensions have become the major driving force for

stocks, even greater than monetary policy, we advise against adding

significantly to equity exposure."

In Germany, Merkel's Christian Democrats and her Social Democrat

coalition partners lost support to the far-right Alternative for

Germany (AfD) in two regional elections on Sunday but held on to

first place.

Which stocks are active?

AstraZeneca (AZN.LN) shares jumped 2.8% to all-time highs as the

pharmaceutical company said Farxiga, its type-2 diabetes drug,

reduced the chances of cardiovascular death or worsening heart

failure by 26% in a recent trial.

Zurich-based recruitment firm Adecco (ADEN.EB) rose 1.4% after

Credit Suisse upgraded the company from neutral to outperform,

citing improved macro conditions as an upside risk. The Swiss bank

also upgraded Dutch recruiter Randstad (RAND.AE), which climbed

1.1%.

(END) Dow Jones Newswires

September 02, 2019 05:49 ET (09:49 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

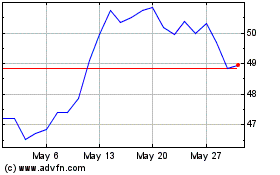

Randstad NV (EU:RAND)

Historical Stock Chart

From Oct 2024 to Nov 2024

Randstad NV (EU:RAND)

Historical Stock Chart

From Nov 2023 to Nov 2024