SPIE - Press release - 2024 Half-Year results

Cergy, July 26th, 2024

Strong half-year results reflecting the

strengths of SPIE’s business model and quality of

execution

- Revenue: €4,704.5 million, up +14.4% vs. H1 2023 (of which

+8.3% from contribution from bolt-on acquisitions and +5.8% organic

growth)

- Revenue growth in Q2 was up +16.9% vs. Q2 2023 (of which +11.3%

from contribution of bolt-on acquisitions and +5.4% organic

growth)

- EBITA: €265.6 million, up +20.7% vs. H1 2023

- EBITA margin: 5.6% of revenue, up +30 bps vs. H1 2023

- Adjusted net income1, up +28.9% vs. H1 2023, at

€157.6 million

Significant EBITA margin increase, +30 bps

at Group level with all segments improving

- Enhanced pricing power, highly selective approach in a context

of strong demand for our services and solutions, unabated focus on

operational excellence and discipline across the board

- Accretive impact of recent bolt-on acquisitions

Intense

bolt-on

acquisitions activity, at

the core of SPIE’s model of value creation

- 3 bolt-on acquisitions signed to date in Germany totalling c.

€320 million of full-year revenue acquired (ICG Group, MBG energy

GmbH, OTTO LSE); on top of ROBUR (c.€ 380 million) announced in

2023, closed in 2024

- 1 bolt-on acquisition in the nuclear domain (HORUS) in France

signed in July 2024

- Very rich pipeline of bolt-on opportunities across our existing

geographies

Leverage ratio: a sound financial

structure

- Leverage ratio: end of June 2024 at 2.4x compared to 2.3x at

end of June 2023 (excluding IFRS 16)

- Self-financed M&A translated into a limited increase of the

leverage ratio thanks to a lower working capital seasonality effect

in H1 2024

Sustainability: upgrade of our MSCI rating

and update on our progress on Scope 1, 2 & 3

emissions

- MSCI upgraded SPIE to 'A' rating, highlighting the Group’s

governance and transparency policies

- Substantial progress in reducing Scopes 1, 2, and 3 emissions,

underscoring SPIE’s commitment to decarbonation targets

2024 outlook firmed-up with EBITA margin

reaching at least 7% of revenue

- Further organic growth, at a slower pace than in 2023

(unchanged)

- EBITA margin: at least 7% of revenue (a minimum of +30 bps

increase compared to 2023)

(Previously: “Further EBITA margin

increase”)

- Continuation of a dynamic bolt-on M&A strategy, remaining

at the core of SPIE’s business model (unchanged)

- The proposed dividend pay-out ratio will remain at c.40% of

Adjusted Net Income1 attributable to the Group

(unchanged)

The Group’s EBITA margin mid-term guidance

(2025) is now expected to be reached one year in advance. The Group

plans to organize a Capital Market Day by mid-2025.

Gauthier Louette, Chairman & CEO,

said: “In H1 2024 SPIE delivered another very strong

performance after a record year in 2023. It illustrates the

strengths of its business model and SPIE’s unique positioning in

highly valuable multi-technical services supporting the

accelerating energy transition and digital transformation markets.

SPIE has forged a well-balanced business profile with predominant

positioning in asset support, offering visibility and recurring

revenue. Our long-lasting relationships with customers along with

the mission critical nature of our services serve as key

cornerstones. This obviously reinforces our confidence to weather

the current French context.

Our geographical footprint is increasingly well-diversified

with the strengthening of our presence in the energy transition

markets in Germany and the Netherlands. Germany is this year the

first contributing country of the Group.

H1 2024, has been very active on the M&A front with notably

the closing of ROBUR and Correll Group as well as the announcement

of 4 new acquisitions to date, of which 3 in Germany. Bolt-on

M&A remains at the core of our strategy and the integration of

the recent acquisitions is well on track.

These very strong H1 2024 results enable us to firm-up our

guidance for the year 2024 with an EBITA margin of at

least 7% of revenue, achieving the 2025 margin target one year in

advance”.

H1 2024 results

|

In millions of euros |

H1 2024 |

H1 2023 |

Change |

|

|

Revenue |

4,704.5 |

4,114.0 |

+14.4% |

|

|

EBITA |

265.6 |

220.0 |

+20.7% |

|

|

EBITA margin |

5.6% |

5.3% |

+30 bps |

|

| Net

income (Group share) |

56.8 |

73.2 |

-22.4% |

|

|

Adjusted net income2 (Group share) |

157.6 |

122.3 |

+28.9% |

|

| Net

debt (excl. IFRS 16) |

(1,834.7) |

(1,346.8) |

-488.0 |

|

|

Leverage ratio3 (excl. IFRS 16) |

2.4x |

2.3x |

+0.1x |

|

Group revenue stood at €4,704.5

million in H1 2024, up +14.4% compared to H1 2023. Revenue organic

growth was up +5.8%, confirming the strong demand on our markets.

Changes in perimeter accounted for +8.3%, related to the

contribution effect of acquisitions. Currency movements impacts

were +0.3%.

Group EBITA rose by +20.7%

compared to H1 2023, to €265.6 million. EBITA

margin was at 5.6% of revenue, up +30 bps compared to H1

2023, thanks to our enhanced pricing power, highly selective

approach in a context of strong demand for our services and

solutions, unabated focus on operational excellence and discipline

across the board, as well as an accretive impact of recent bolt-on

acquisitions.

Net income (Group share) was at

€56.8 million (compared to €73.2 million in H1 2023), down

-22.4%, mainly due to the negative €(53.8) million non-cash impact

related to the split accounting method of the ORNANE in accordance

with IFRS.

Adjusted net income4

(Group share) was €157.6 million, up +28.9%

year-on-year, mainly supported by the EBITA increase of +20.7% and

well-contained financial costs.

Operating cash flow and

net debt (excluding IFRS 16)

SPIE’s structurally negative working

capital stood at €(456.9) million at end of June 2024,

corresponding to (17) days of revenue (compared to €(366.7) million

at end of June 2023, corresponding to (16) days of revenue).

Excluding the impact of the 2024 consolidated acquisitions, the

working capital would represent (21) days at end of June 2024. This

is an excellent performance, in line with the historical

seasonality pattern and reflecting the strong discipline regarding

invoicing and cash collection process across the board.

As induced by SPIE’s usual working capital

seasonal pattern (which translates into a cash outflow in H1 and a

cash inflow in H2) the operating cash flow is

negative in H1. It has improved to

€(79.9) million in H1 2024 (compared to €(203.9) million in H1

2023) in accordance with the EBITA performance and thanks to a

lower seasonality of the working capital in H1 2024. The

free cash flow was accordingly improved to

€(211.1) million (compared to €(313.1) million in H1 2023).

Net debt excluding IFRS 16 was

€1,834.7 million at end of June 2024, compared to €1,346.8 million

at end of June 2023. Leverage ratio5

excluding IFRS 16 reached 2.4x at end of June 2024 compared to at

2.3x at end of June 2023. Self-financed M&A (corresponding to

€721.7 million cash-out in H1 2024) translated into a limited

increase of the leverage ratio thanks to a lower working capital

seasonality effect in H1 2024.

Financing and liquidity

The Group’s liquidity stands at

€1,045.6 million at end of June 2024, including €345.6 million of

cash and €700 million of undrawn Revolving Credit Facility

(compared to €1,171.7 million at end of June 2023).

In June 2024, SPIE extended and increased the

revolving credit facility to €1,000m6

until 2029 (compared to €600m until 2027 before) under the same

financing conditions as in October 2022 (refer to the appendix of

the present press release for further details). The revolving

credit facility is primarily dedicated to maintaining a high level

of liquidity and to finance the external growth of the Group.

As of June 30th, 2024, the revolving

credit facility has been drawn down for €300 million, following an

initial 3-month drawdown of €200 million in April 2024, and a

3-month drawdown of €100 million in June 2024.

The Group has no upcoming maturity before June

2026 and benefits from optimised financing conditions in a context

of higher interest rates.

SPIE’s long term corporate credit

rating granted by Standard & Poor’s and Fitch are at

BB+ both with stable outlook. This rewards our strong performance

and the Group’s sound financial structure.

Analysis by segment

Half-Year 2024 revenue

|

In millions of euros |

H1 2024 |

H1 2023 |

|

Change |

o/w

organic growth |

o/w

external growth |

o/w

disposal |

o/w foreign exchange |

|

France |

1,649.5 |

1,585.9 |

|

+4.0% |

+2.1% |

+1.9% |

- |

- |

|

Germany |

1,459.2 |

1,117.7* |

|

+30.6% |

+6.0% |

+24.6% |

- |

- |

|

North-Western Europe |

954.0 |

869.8 |

|

+9.7% |

+8.3% |

+1.4% |

- |

- |

|

Central Europe |

379.8 |

353.8* |

|

+7.3% |

+3.2% |

+0.7% |

- |

+3.4% |

|

Global Services Energy |

262.0 |

186.8 |

|

+40.2% |

+29.3% |

+11.5% |

- |

-0.6% |

|

Group revenue |

4,704.5 |

4,114.0 |

|

+14.4% |

+5.8% |

+8.3% |

- |

+0.3% |

* Reclassification of Traffic

System revenue from Germany to Austria (for €3.0 million in H1

2023) compared to the segmentation provided in the FY2023 results

press release. The table presenting the new segmentation with 2023

figures is in the appendix of the present press release.

Quarterly organic growth by segment

|

|

Q1 2024 |

Q2 2024 |

|

H1 2024 |

|

France |

+2.2% |

+2.1% |

|

+2.1% |

|

Germany |

+4.1% |

+7.8% |

|

+6.0% |

|

North-Western Europe |

+10.0% |

+6.8% |

|

+8.3% |

|

Central Europe |

+3.2% |

+3.3% |

|

+3.2% |

|

Global Services Energy |

+43.7% |

+15.8% |

|

+29.3% |

|

Group |

+6.2% |

+5.4% |

|

+5.8% |

EBITA

|

In millions of euros |

H1 2024 |

H1 2023 |

Change |

|

|

France |

98.7 |

94.1 |

+4.9% |

|

| In

% of revenue |

6.0% |

5.9% |

+10 bps |

|

|

Germany |

75.3 |

53.0* |

+41.9% |

|

| In

% of revenue |

5.2% |

4.7%* |

+50 bps |

|

|

North-Western Europe |

56.0 |

46.7 |

+19.9% |

|

| In %

of revenue |

5.9% |

5.4% |

+50

bps |

|

|

Central Europe |

11.3 |

8.6* |

+31.1% |

|

| In

% of revenue |

3.0% |

2.4%* |

+60 bps |

|

| Global

Services Energy |

22.0 |

15.2 |

+45.4% |

|

| In

% of revenue |

8.4% |

8.1% |

+30 bps |

|

|

Holding |

2.3 |

2.4 |

- |

|

|

Group EBITA |

265.6 |

220.0 |

+20.7% |

|

|

In % of revenue |

5.6% |

5.3% |

+30 bps |

|

* Reclassification of Traffic

System EBITA from Germany to Austria (for €0.2 million in H1 2023)

compared to the segmentation provided in the FY2023 results press

release. The table presenting the new segmentation with 2023

figures is in the appendix of the present press release.

France

The France segment’s revenue grew by +4.0% in H1

2024, including a +2.1% organic growth and +1.9% linked to bolt-on

acquisitions contribution.

The organic growth remained solid in H1 2024 at

+2.1% considering the challenging comparison basis. Technical

Facility Management activities were very dynamic marked by a high

rate of contract renewals, notably with blue chip customers

requiring a national footprint, as well as the deployment of energy

performance contracts. Building Solutions was well-oriented,

notably with projects in buildings renovation and the deployment of

our energy efficiency solutions. City Networks was supported by the

contracts in smart city segment (notably smart public lighting

solutions) and public transport, while revenue decrease from our

fibre activities remained well-contained. Industry Services, driven

by decarbonation and electrification projects, remained resilient

with the diversity of the sectors we address. Nuclear services

revenue growth remained constrained. We will see our first

contribution of the new nuclear program with the new order received

from EDF for the main diesel backup generators for the six

EPR2-type nuclear reactors.

EBITA margin was up +10 bps (at 6.0% of revenue

in H1 2024 compared to 5.9% in H1 2023) thanks to our permanent

focus on quality of execution, discipline and our added-value

innovative solutions.

We remain confident to weather the current

French context and in our ability to deliver solid activity and

performance levels going forward, thanks to the well-proven

resilience of our business.

Germany

Revenue in Germany increased by +30.6% in H1

2024, including a +6.0% organic growth and a +24.6% growth

contribution from bolt-on acquisitions (ECS, Bridging IT, ROBUR,

ICG Group and MBG energy GmbH).

In H1 2024, organic growth was very strong in

Germany thanks to our unique positioning in High Voltage and City

Networks and Grids activities where the backlog further increased

from an all-time high. The growth was mainly driven by projects for

connecting renewable energy sources to the grids (high voltage

lines and substations), expanding the capacity of the grids and

deploying smart monitoring systems. Technical Facility Management

activities did ramp up in Q2 2024 and will continue to do so in H2

2024.

ROBUR, setting up our Industry Services activity

in Germany, was consolidated as from March 1st, 2024 (4

months contribution) and did deliver a good performance. ICG Group

(not yet consolidated) included in City Networks and Grids

activities did contribute for 3 months. Their integration plans are

progressing as contemplated.

All in all, with the full year contribution of

these acquisitions compounded by the superior organic growth,

Germany becomes this year the largest reporting segment for

SPIE.

EBITA margin in Germany increased by +50 bps in

H1 2024 (at 5.2% of revenue compared to 4.7%7 in H1

2023) with a positive mix effect from our T&D (Transmission

& Distribution) activities, the accretive impact of recent

bolt-on acquisitions and a permanent focus on quality of execution

across the board.

North-Western Europe

Revenue in the North-Western Europe segment

increased by +9.7% in H1 2024, including a +8.3% organic growth.

Growth from bolt-on acquisitions contribution was +1.4%.

The Netherlands recorded an exceptional organic

growth in H1 2024. This performance was driven by High Voltage

activities (overhead lines and substations) as well as a dynamic

bridges and locks market benefitting from significant spending for

renovations and upgrades across the country. Industry Services was

at a high level of organic growth with transformation projects in

electrification and digitalisation. Building Solutions activities

remained dynamic and supported by remarkable contracts, mainly

related to renovation and decarbonation, with blue chip

customers.

In Belgium, organic growth was supported by High

Voltage projects nurtured by massive investments made by the main

Belgian TSO (Transmission System Operator), while Building

Solutions was fuelled by renovation contracts for existing

facilities.

EBITA margin of North-Western Europe increased

by +50 bps in H1 2024 (at 5.9% of revenue compared to 5.4% in H1

2023), with a favourable mix effect and a proven pricing power in

the Netherlands, and Belgium constantly improving.

Central Europe

In H1 2024 revenue in Central Europe was up

+7.3%, including a +3.2% organic growth and +0.7% related to growth

from bolt-on acquisitions contribution. The foreign exchange

amounted to +3.4%, mainly linked to the Zloty, the Czech Crown and

the Swiss Franc.

But for Switzerland, the momentum was very

strong in Central Europe, particularly in Austria driven by tunnels

and transportation infrastructures projects. Poland was very

dynamic in High Voltage with a strong activity in the construction

of substations for TSOs (Transmission System Operators) and in the

connection of renewables to the grid (wind and photovoltaic) while

the modernization of public lighting is expanding in the

country.

In Switzerland, the organic growth was in

negative territory due to the very challenging comparison basis

observed in 2023 which benefitted from the catch up of the supply

chain delays in Information and Communication Services.

The EBITA margin of Central Europe increased by

+60 bps in H1 2024 (at 3.0% of revenue compared to 2.4% in H1 2023)

thanks to the quality of execution and a strong pricing power in

some markets.

Global Services Energy

In H1 2024, the Global Services Energy segment’s

revenue was up +40.2% year-on-year with an exceptionally strong

organic growth of +29.3%. Growth from bolt-on acquisitions

contribution had a +11.5% impact (Correll Group); the currency

movements had a -0.6% impact, primarily related to the USD/EUR

parity.

Global Services Energy experienced an

exceptional level of organic growth in H1 2024 explained by the

ramp-up of several pluriannual contracts (operations and

maintenance) as well as the contribution of a shutdown operation

for a customer offshore Sub-Saharan Africa.

In June 2024, Global Services Energy launched

its new Wind Power business unit which followed the acquisition of

Correll Group; the integration process is well on track as per our

action plan. The creation of Wind Power business unit highlights

SPIE Global Services Energy’s ambition to become an offshore wind

services international champion.

EBITA margin rose by +30 bps (at 8.4% of

revenue, compared to 8.1% in H1 2023) thanks to the proven pricing

power and an unabated focus on operational excellence.

Acquisitions &

perimeter

Bolt-on M&A

SPIE dedicates part of its free cash flow to

fund a regular stream of small and mid-size bolt-on acquisitions.

This bolt-on strategy is at the core of SPIE’s growth model and

contributes to the expansion of the Group’s service offering and

footprint density. SPIE operates in highly fragmented markets and

therefore enjoys a rich pipeline of future M&A

opportunities.

On March

11th, 2024,

SPIE signed an agreement for the acquisition of ICG

Group, a German leading turnkey service provider for

telecommunication infrastructure (for both fibre and 5G Mobile

telecommunications networks). ICG Group covers the entire value

chain and operates across the whole country through a customer

portfolio which comprises network operators, infrastructure

providers and municipalities. ICG Group generated a revenue of c.

230 million euros in 2023 with margins north of 10% in line with

the sector; the company employs approximately 720 highly skilled

employees.

With this acquisition SPIE enters the market for

5G mobile telecommunications infrastructure and significantly

strengthens its position in the fibre networks, a crucial move as

Germany is still in the early stages for the roll-out of fibre

across the country and is lagging behind the other European

countries in that field.

The transaction multiple was 9.1x EBITA 2023 and

7.5x EBITA 2024E. The transaction will result in a mid-single digit

EPS accretion for the Group as soon as the first year of

consolidation. The acquisition was financed with the existing

financial resources of the Group while maintaining its sound

financial policy regarding leverage ratio. SPIE acquired c.92% of

the share capital at closing, while the remaining 8% shareholding

were retained by the current management team who remains in place

and contributes to pursue the business development. The agreement

includes put and call mechanisms related to the 8%. The transaction

was closed on April 18th, 2024.

On March

27th, 2024,

SPIE announced the acquisition of c.75% of MBG energy

GmbH, a provider of engineering, procurement and

construction (EPC) services for the photovoltaic roll-out mainly

for rooftop installation on buildings in North-Eastern Germany. The

company, headquartered in Berlin, was founded in 2018 and employs

47 employees. The company generated a revenue of approximately 15

million euros in 2023. With this acquisition, SPIE strengthens its

position in the fast-growing photovoltaic roll-out market and gains

competences in that field in a context of the adoption by the

European legislators of the EU Solar Standard within the European

Performance of Buildings Directive. This legislation is set to

require solar installations on buildings across the European Union.

The acquisition of MBG energy GmbH will also provide with potential

commercial synergies with the existing Technical Facility

Management segment of SPIE in Germany.

The management team of MBG energy GmbH comprises

the founders who joined SPIE’s team to further develop the business

and they stay as minority shareholders. Thus, SPIE acquired c.75%

of the share capital, while the remaining c.25% shareholding is

retained by the current management team. The agreement includes put

and call mechanisms related to the c.25%.

On July

17th, 2024,

SPIE announced the acquisition of c.87% of Otto Life

Science Engineering GmbH (OTTO LSE) in Germany.

Headquartered in Nuremberg in Bavaria, OTTO LSE was founded in 2017

and operates from 6 offices across Germany. The company is a

specialised provider of EPC services (Engineering, Procurement and

Construction) for pharmaceutical and biotech production facilities

and laboratories. OTTO LSE has a unique selling proposition with

its turnkey solutions and has a solid project track record in the

sector. The company covers the entire value chain (from planning,

designing, delivering to re-qualifying) with outstanding skills and

unique know-how providing for high added value solutions in process

design, pure media, clean room, building technology management,

dedicated to a first-class client base. Active in a very dynamic

market and focusing on high added value solutions, OTTO LSE

delivers a very high and recurring level of profitability (above

20% EBITA margin). The revenue generated by the company in 2023 was

close to €75 million with c.140 highly skilled employees.

With this acquisition SPIE will reinforce its

presence in the attractive and dynamic pharmaceutical and biotech

sectors.

The transaction multiple is below 8x the

forecasted EBITA 2024. The transaction will result in an EPS

accretion for the Group from the first year of consolidation. The

acquisition will be financed with the existing financial resources

of the Group while maintaining its sound financial policy regarding

leverage ratio. SPIE will hold c.87% of the share capital, while

the remaining c.13% shareholding will be retained by the current

management team who will remain in place and will contribute to

pursue the business development. The agreement includes put and

call mechanisms related to the c.13%. The closing of the

transaction is expected for Q3 2024.

On July

24th, 2024,

SPIE announced the acquisition of 100% of ABC, ETC, and

SIRAC, leaders in non-destructive testing and inspections

in the nuclear industry. Grouped under the

GIE8 HORUS, the three

companies ABC, ETC, and SIRAC are leaders in the market for

non-destructive testing and inspections in the nuclear industry

(radiographic, ultrasonic and penetrant testing, as well as

magnetic particle inspection) and operate throughout France with

over 300 qualified employees. Altogether, the three companies

generated nearly 35 million euros of revenue in 2023. With this

acquisition, SPIE expands its expertise in nuclear site

maintenance. The anticipated development of new nuclear reactors

(EPR2) and the extension of the lifespan of existing plants will

result in sustained growth in inspection and maintenance activities

over the coming decades.

Sustainability: update on progress made

on Scopes 1, 2 and Scope 3 and upgrade of MSCI rating

SPIE is fully mobilised to deliver on its

Sustainability 2025 roadmap, with significant progress made towards

its decarbonisation targets for Scope 1, 2, and 3 emissions.

For Scopes 1 and 2 direct emissions, the Group

is on track, driven by a significant increase of the share of

battery electric vehicle orders that reached 74% at end of June

2024, up from 54% at the end of 2023. As a reminder, machinery and

vehicle fuel consumption account for c.90% of SPIE's total direct

emissions.

Regarding scope 3, the proportion of emissions

related to our procurement made with suppliers who have set

ambitious targets to reduce their carbon footprint has increased

from 47% at end of December 2023 to 52% at end of June 2024 (67%

targeted for 2025), highlighting the continuous efforts made by the

Group with its major suppliers and subcontractors. In addition to

all measures implemented to train and engage, SPIE collaborates

with service providers to help small suppliers establish a first

carbon footprint assessment and develop an emissions reduction

plan.

SPIE's rating was upgraded by MSCI to 'A' in

June 2024 (compared to BBB in 2023). This upgrade highlights SPIE's

strong governance practices and transparency, strengthening its

leadership among peers. MSCI has particularly underscored SPIE's

well-structured Board, tailored to provide effective strategic

oversight for company management, along with an independent audit

committee with strong financial expertise.

2024 outlook firmed-up with EBITA margin

reaching at least 7% of revenue

- Further organic growth, at a slower pace

than in 2023

(unchanged)

- EBITA margin: at least 7% of revenue (a minimum of +30 bps

increase compared to 2023)

(Previously: “Further EBITA margin increase”)

- Continuation of a dynamic bolt-on M&A strategy, remaining

at the core of SPIE’s business model (unchanged)

- The proposed dividend pay-out ratio will remain at c.40% of

Adjusted Net Income9 attributable to the Group

(unchanged)

The Group’s EBITA margin mid-term guidance

(2025) is now expected to be reached one year in advance.

Interim dividend

SPIE will pay an interim cash dividend of €0.25

per share on September 20th, 2024 (ex-date: September

18th, 2024), i.e. 30% of the approved dividend for

2023.

Consolidated financial

statements

The consolidated financial statements of the

SPIE Group as of and for the six months ended

June 30th, 2024 were authorised for issue by the Board

of Directors on July 25th, 2024. Auditors’ limited

review of the consolidated financial statements is complete and the

statutory auditors’ report on the 2024 half year financial

information has been issued. The audited consolidated financial

statements (full financial statements and notes) and the slide

presentation of the 2024 half-year results are available on our

website www.spie.com, in the “Investors” section.

Subsequent events

The subsidiaries SPIE Oil & Gas Services and

SPIE Operations have been informed that the Parquet National

Financier (French Financial Prosecutor) considers that proceedings

should be brought against them and certain employees before the

Tribunal Correctionnel (Criminal Court) of Paris in connection with

allegations of bribery of a public official in Indonesia in the

context of a dispute with a former Oil & Gas employee whose

dismissal occurred approximately ten years ago. SPIE vigorously

denies these allegations and fully cooperates with the

procedure.

Conference call details for investors

and analysts

Date: Friday, July

26th, 2024

9.00 am Paris time - 8.00 am London time

Speakers:

Gauthier Louette, Chairman & CEO

Jérôme Vanhove, Group CFO

Dial-in details:

- France: +33 (0) 1 70 37 71 66

- UK-Wide: +44 (0) 33 0551 0200

- US: +1 786 697 3501

- Password: SPIE

Webcast link:

-

https://channel.royalcast.com/landingpage/spie/20240726_1/

Next events

September 2nd and 3rd, 2024:

London Roadshow (Morgan Stanley)

September 3rd, 2024 (afternoon): UBS

Business Services, Leisure and Transport Conference (London)

September 4th, 2024: Frankfurt Roadshow

(BofA)

September 5th and 6th, 2024:

Nordics Roadshow (Oddo)

September 9th and 10th,

2024: Paris Roadshow (Bernstein SG)

September 11th, 2024: Kepler Autumn

Conference (Paris)

September 20th, 2024: Interim dividend

payment (ex-date: September 18th, 2024)

October 31st, 2024: Quarterly

information at September 30th, 2024

Financial definitions

Organic growth represents the

production completed during the six months of year N by all the

companies consolidated by the Group for the financial year ended

December 31st of year N-1 (excluding any contribution

from any companies acquired during year N) compared with the

production performed during the 6 months of year N-1 by the same

companies, independently of the date on which they were first

consolidated within the Group.

EBITA represents operating

income mainly before amortization of allocated goodwill, IFRS2

non-cash charges and IFRS3 M&A costs. Detailed bridge from

EBITA to Operating income is set forth in appendix.

Pro-forma EBITDA corresponds to

income generated by the Group’s permanent operations over 12 months

before tax and financial income, including the impacts over 12

months of acquisitions. It is calculated before depreciation of

tangible assets and amortisation of goodwill. It excludes the

impact of IFRS 16.

Adjusted net income: correspond

to net income adjusted for i) operating income items restated from

the Group’s EBITA, ii) the change in fair value and amortisation

costs of derivative related to the ORNANE, and iii) the

corresponding normative tax income adjustment.

Operating Cash-flow is the sum

of EBITA, amortisation expenses, change in working capital

requirement, and provisions related to income and expenses included

in EBITA, minus net investment flows (excluding acquisitions) for

the period. It excludes the impact of IFRS 16.

Cash-conversion is the ratio of

operating cash-flow of the year to EBITA excluding IFRS 16 of the

same year.

Free cash-flow is defined as

operating cash-flow minus taxes, net interest paid, restructuring

and discontinuation items and before acquisitions and disposals

proceeds and charges. It excludes the impact of IFRS 16.

Leverage is the ratio of net

debt excluding impact of IFRS 16 at end of June to pro forma EBITDA

(including full-year impact of acquisitions and disposals) on a

trailing twelve-month basis.

Segment Central Europe includes

Poland, Switzerland, Austria, Czech Republic, Hungary and

Slovakia.

Segment North-Western Europe

includes The Netherlands and Belgium.

About SPIE

SPIE is the independent European leader in

multi-technical services in the areas of energy and communications.

Our 50,000 employees are committed to achieving the energy

transition and responsible digital transformation alongside our

customers.

SPIE achieved in 2023 consolidated revenue of €8.7 billion and

consolidated EBITA of €584 million.

Contacts

SPIE

Pascal Omnès

Group Communications Director

Tel. + 33 (0)1 34 41 81 11

pascal.omnes@spie.com |

SPIE

Audrey Bourgeois

Investor Relations Director

Tel. + 33 (0)1 34 41 80 72

audrey.bourgeois@spie.com

|

IMAGE 7

Laurent Poinsot & Claire Doligez

Tel. + 33 (0)1 53 70 74 70

spie@image7.fr |

www.spie.com

https://www.facebook.com/SPIEgroup

http://twitter.com/spiegroup

Disclaimer

Certain information included in this press

release are not historical facts but are forward-looking

statements. These forward-looking statements are based on current

beliefs, expectations and assumptions, including, without

limitation, assumptions regarding present and future business

strategies and the environment in which SPIE operates, and involve

known and unknown risks, uncertainties and other factors, which may

cause actual results, performance or achievements, or industry

results or other events, to be materially different from those

expressed or implied by these forward-looking statements.

Forward-looking statements speak only as of the date of this press

release and SPIE expressly disclaims any obligation or undertaking

to release any update or revisions to any forward-looking

statements included in this press release to reflect any change in

expectations or any change in events, conditions or circumstances

on which these forward-looking statements are based. Such forward-

looking statements are for illustrative purposes only.

Forward-looking information and statements are not guarantees of

future performances and are subject to various risks and

uncertainties, many of which are difficult to predict and generally

beyond the control of SPIE. Actual results could differ materially

from those expressed in, or implied or projected by,

forward-looking information and statements. These risks and

uncertainties include those discussed or identified under Chapter 2

“Risk factors and internal control” of SPIE’s 2023 Universal

Registration Document, filed with the French Financial Markets

Authority (AMF) on April 5th, 2024

under number D.24-0245, which is available on the website of SPIE

(www.spie.com) and of the AMF

(www.amf-france.org). This press release includes

only summary information and does not purport to be comprehensive.

No reliance should be placed on the accuracy or completeness of the

information or opinions contained in this press release. This press

release does not contain or constitute an offer of securities for

sale or an invitation or inducement to invest in securities in

France, the United States or any other jurisdiction.

- SPIE - Press release - 2024 Half-Year results

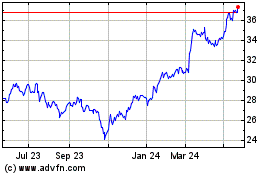

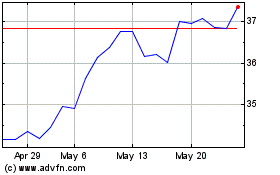

Spie (EU:SPIE)

Historical Stock Chart

From Oct 2024 to Nov 2024

Spie (EU:SPIE)

Historical Stock Chart

From Nov 2023 to Nov 2024