Yen Climbs Amid Risk Aversion

January 16 2017 - 11:09PM

RTTF2

The Japanese yen strengthened against its most major rivals in

the early European session on Tuesday amid risk aversion, as

investors adopted a cautious stance ahead of the U.K. Prime

Minister Theresa May's speech, which is expected to outline a

"hard" exit from the European Union.

Investors became wary over reports that the U.K. PM is likely to

prefer a clean break from the EU, quitting from its single market

for goods and services and forge a completely new trading

relationship with the bloc.

"Not partial membership of the European Union, associate

membership of the European Union, or anything that leaves us

half-in, half-out," May is set to say, according to excerpts

released by her office.

Further dampening investor mood was growing uncertainty over

U.S. policy ahead of President-elect Donald Trump's inauguration

later this week.

Final figures from the Ministry of Economy, Trade and Industry

showed that Japan's industrial production increased as initially

estimated in November.

Industrial production rose a seasonally adjusted 1.5 percent

month-over-month in November, after remaining flat in the previous

month. That was in line with the flash data published on December

27.

The currency has been trading in a positive territory in the

previous session.

The yen climbed to 113.26 against the greenback, its strongest

since December 8, while approaching nearly 3-month high of 86.40

against the loonie. The yen is likely to challenge resistance

around 110.00 against the greenback and 84.00 against the

loonie.

The yen strengthened to a 1-1/2-month high of 120.67 against the

euro and near a 6-week high of 112.47 against the Swiss franc,

compared to Monday's closing values of 121.01 and 112.77,

respectively. If the yen extends rise, it may find resistance

around 118.00 against the euro and 111.00 against the franc.

On the flip side, the yen dropped to 137.83 against the pound,

from a high of 137.06 hit at 4:00 am ET. The next possible support

for the yen may be found around the 138.00 mark.

Looking ahead, European Central Bank Governing Council Member

Ewald Nowotny takes part in a panel discussion on "euro reforms in

turbulent times" in Vienna at 6:00 am ET.

In the New York session, U.S. Empire State manufacturing index

for January is slated for release.

At 8:45 am ET, Federal Reserve Bank of New York President

William Dudley is expected to speak about consumer behavior at the

National Retail Federation Convention and Expo, in New York.

At 10:00 am ET, Federal Reserve Board Governor Lael Brainard is

expected to speak on monetary and fiscal policy before the

Brookings Institution, in Washington, U.S.

Subsequently, Federal Reserve Bank of San Francisco President

John Williams is expected to speak before the Sacramento Business

Review Economic Forecast event, in Sacramento, U.S.

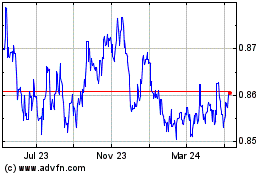

Euro vs Sterling (FX:EURGBP)

Forex Chart

From Apr 2024 to May 2024

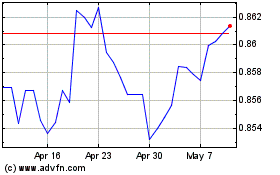

Euro vs Sterling (FX:EURGBP)

Forex Chart

From May 2023 to May 2024