Yen Declines To Multi-decade Low

April 23 2024 - 11:32PM

RTTF2

The Japanese yen weakened against their major currencies in the

Asian session on Wednesday, as markets expect currency intervention

by Japanese authorities to prop up the currency ahead of this

week's Bank of Japan policy meeting.

Traders await the BOJ's two-day policy meeting starts on

Thursday for cues on when the central bank will raise interest

rates again.

The foreign exchange market intervention decisions are highly

political in Japan. Japan lastly intervened in currency markets in

September and October of 2022.

Finance Minister Shunichi Suzuki said on Tuesday, "We are

watching market moves with a high sense of urgency,".

Easing geopolitical tensions in the Middle East, also led to the

slide of the currency.

The Asian stock markets traded higher, as data showing a

slowdown in U.S. manufacturing activity in the month of April

raised hopes the U.S. Fed will start thinking of cutting interest

rates soon. Traders also continue to pick up stocks at relatively

reduced levels after the recent sell-off.

Traders now await more economic data later in the week,

including the release of first-quarter U.S. GDP data as well as the

core personal-consumption expenditures (PCE) price index, which is

the Fed's preferred measure of inflation. This ahead of the next

Federal Open Market Committee meeting on April 30-May 1.

In economic news, data from the Bank of Japan showed that the

producer prices in Japan were up 2.3 percent on year in March. That

exceeded expectations for an increase of 2.1 percent and was up

from the upwardly revised 2.2 percent gain in February.

On a monthly basis, producer prices climbed 0.8 percent -

accelerating from 0.3 percent in the previous month.

In the Asian trading today, the yen declined to a 34-year low of

154.95 against the U.S. dollar and nearly a 17-year low of 113.38

against the Canadian dollar, from yesterday's closing quotes of

154.82 and 113.30, respectively. If the yen extends its downtrend,

it is likely to find support around 156.00 against the greenback

and 115.00 against the loonie.

Against the euro and the pound, the yen slid to a 16-year low of

165.85 and a 2-week low of 192.96 from Tuesday's closing quotes of

165.65 and 192.73, respectively. The yen is likely to find support

around 167.00 against the euro and 194.00 against the pound.

The yen edged down to 169.88 against the Swiss franc, from

yesterday's closing value of 169.77, respectively. On the downside,

171.00 is seen as the next support level for the yen.

Looking ahead, Germany Ifo business climate index for April and

U.K. Confederation of British Industry's industrial trends survey

results for April are due to be released in the European

session.

In the New York session, U.S. MBA mortgage approvals data,

Canada retail sales data for February, manufacturing sales data for

March, U.S. durable goods orders for March and U.S. EIA crude oil

data are slated for release.

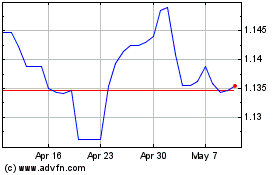

Sterling vs CHF (FX:GBPCHF)

Forex Chart

From Apr 2024 to May 2024

Sterling vs CHF (FX:GBPCHF)

Forex Chart

From May 2023 to May 2024