U.S. Dollar Advances Ahead Of Trump's Press Conference

January 11 2017 - 12:09AM

RTTF2

The U.S. dollar drifted higher against its major counterparts in

the early European session on Wednesday ahead of the U.S.

President-elect Donald Trump's press conference later in the day,

with investors awaiting more specifics about his stimulus measures,

mainly relating to tax cuts and infrastructure spending.

With Trump addressing the media for the first time since his

shocking victory on November 8 elections, market participants are

betting that he is likely to give details on his economic

policies.

According to incoming White House Press Secretary Sean Spicer,

Trump will address how he is handling the transfer of his business

to focus on the office.

Trump's proposed tax cuts and spending plans could boost U.S.

and global growth, while uncertainty about his trade policies adds

to the risks, the World Bank said in its latest outlook on the

global economy.

Growth in the United States was expected to pick up to 2.2

percent, as manufacturing and investment growth gain traction after

a weak 2016. The outlook for this year was left unchanged.

Meanwhile, European stocks recovered from early losses, as base

metal prices remained strong, the euro weakened against the dollar

and British grocer Sainsbury reported record Christmas sales,

defying concerns of a slowdown in consumer spending.

Oil prices also edged up after steep overnight losses in the

wake of reports that Saudi Arabia has started to comply with slight

supply cuts from contracted volumes in February, including to India

and Malaysia.

The greenback has been trading modestly higher against its major

rivals in the Asian session.

The greenback climbed to 1.2110 against the pound, off its early

2-day low of 1.2198. On the upside, 1.19 is possibly seen as the

next resistance level for the greenback.

Data from the Office for National Statistics showed that the

U.K. visible trade deficit widened more-than-expected in

November.

The trade in goods showed a deficit of GBP 12.2 billion versus a

shortfall of GBP 9.9 billion in October. Economists had expected

the deficit to rise to GBP 11.5 billion.

The greenback, having fallen to 115.67 against the yen at 7:00

pm ET, reversed direction and climbed to a 2-day high of 116.46.

The greenback is seen finding resistance around the 118.00

mark.

The greenback strengthened to 2-day highs of 1.0530 against the

euro and 1.0196 versus the Swiss franc, from Tuesday's closing

values of 1.0554 and 1.0168, respectively. If the greenback extends

rise, it may find resistance around 1.03 against the franc and 1.04

against the euro.

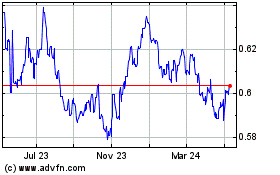

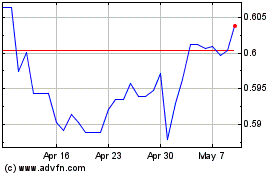

The greenback bounced off to 0.6990 against the kiwi and 0.7372

against the aussie, from its early low of 0.7022 and a multi-week

low of 0.7396, respectively. The next possible resistance levels

for the greenback may be seen around 0.67 against the kiwi and 0.70

against the aussie.

Looking ahead, the Bank of England governor Mark Carney will

testify before the Parliament's Treasury Select Committee in London

at 9:15 am ET.

The Energy Information Administration releases official crude

inventory data in the New York session.

New York Fed President William Dudley speaks about banking

culture from a regulatory perspective at the Banking Symposium in

New York at 1:20 pm ET.

NZD vs US Dollar (FX:NZDUSD)

Forex Chart

From Apr 2024 to May 2024

NZD vs US Dollar (FX:NZDUSD)

Forex Chart

From May 2023 to May 2024