Achilles Therapeutics Reports Fourth Quarter and Year-End 2023 Financial Results and Recent Business Highlights

April 04 2024 - 5:45AM

Achilles Therapeutics plc (NASDAQ: ACHL), a clinical-stage

biopharmaceutical company developing AI-powered precision T cell

therapies targeting clonal neoantigens to treat solid tumors, today

announced its financial results for the fourth quarter and

year-ended December 31, 2023, and recent business highlights.

“In 2023, we made important progress on the

optimization of our VELOS™ manufacturing process with a

significant improvement in cNeT doses delivered and are developing

our understanding of the relationship between host conditioning and

the engraftment of infused cNeT. We recently shared updated safety,

tolerability and translational science data from checkpoint

refractory patients that continue to be encouraging and reveal

important mechanistic learnings about the factors driving durable T

cell engraftment and the impact of immune evasion mechanisms at an

antigen level. These learnings will inform the development of cNeT

and related neoantigen vaccine and TCR-T therapies,” said

Dr Iraj Ali, Chief Executive Officer of Achilles

Therapeutics. “Looking ahead to 2024, we will evaluate

cNeT persistence and clinical activity in patients with enhanced

host conditioning, and we plan to report a meaningful data update

in the second half of 2024. Our financial position remains strong

with more than $131 million in cash, which supports operations

through 2025, including the completion of the ongoing Phase I/IIa

trials.”

2023 and Year-to-Date 2024 Clinical

Highlights

- Provided an interim Phase I/IIa update on clonal neoantigen

reactive T cells in advanced NSCLC and melanoma from 18 new

patients, highlighting improved doses from the VELOS™ manufacturing

process and a favorable tolerability profile

- The VELOS™ manufacturing process delivered ~10-fold improvement

in the median cNeT dose (172 million) across the 18 patients in the

update, with 10 products over 100 million cNeT and five over one

billion cNeT

- First patients dosed in CHIRON and THETIS with enhanced host

conditioning to evaluate the benefit of increased lymphodepletion

intensity and Il-2 dosing aligned to standard TIL therapy, with

additional meaningful data expected in the fourth quarter of

2024

- Continued

development and improvements of the PELEUS™ clonal neoantigen

prediction platform

2023 and Year-to-Date 2024 Corporate

Highlights

- Publication in Nature Cancer from researchers affiliated with

Achilles and the DECOD-Ag consortium outlined the vast potential of

neoantigen immunogenicity prediction

- neoRanker™, a new AI-enabled neoantigen immunogenicity ranking

module of PELEUS™, outperformed current AI and non-AI

state-of-the-art methods for neoantigen immunogenicity

prediction

- U.S. patent 11,634,773 granted

covering treatment with an immunotherapy that targets a neoantigen

predicted to be presented by a human leukocyte antigen (HLA) allele

that has not been lost in a tumor, where loss of HLA alleles is

determined using a proprietary sequence-based method

- Regained

compliance with the minimum bid price requirement of Nasdaq Listing

Rule 5450(a)(1) on March 1, 2024, as confirmed by a written notice

received from the Listing Qualifications Department of

The Nasdaq Stock Market on March 4, 2024

Financial Highlights

- Cash and cash

equivalents: Cash and cash equivalents were $131.5 million

as of December 31, 2023, as compared to $173.3 million as of

December 31, 2022. The Company anticipates that its cash and cash

equivalents are sufficient to fund its planned operations through

2025.

- Research and development

(R&D) expenses: R&D expenses were $15.9 million

for the fourth quarter ended December 31, 2023, a decrease of $3.0

million compared to $18.9 million for the fourth quarter ended

December 31, 2022. R&D expenses were $58.2 million for the year

ended December 31, 2023, an increase of $0.9 million compared to

$57.3 million for the year ended December 31, 2022. The increase

was primarily driven by an increased focus on the ongoing clinical

trials.

- General and administrative

(G&A) expenses: G&A expenses were $3.6 million for

the fourth quarter ended December 31, 2023, a decrease of $0.4

million compared to $4.0 million for December 31, 2022. G&A

expenses were $17.1 million for the year ended December 31, 2023, a

decrease of $4.0 million compared to the $21.1 million for the year

ended December 31, 2022. This decrease was primarily driven by

lower personnel costs and lower legal and professional fees.

- Net loss: Net loss

for the fourth quarter ended December 31, 2023 was $18.6 million or

$0.46 per share compared to $24.1 million or $0.61 per share for

the fourth quarter ended December 31, 2022. Net loss for the year

ended December 31, 2023 was $69.7 million or $1.74 per share

compared to $71.2 million or $1.82 per share for the year ended

December 31, 2022.

2024 Focus and Upcoming Events

- Clinical Data: Report clinical activity and

translational science data from patients in CHIRON and THETIS

Cohort C, evaluating the benefit of enhanced host conditioning,

with a meaningful data update expected in 2H 2024

- Translational Science: Leverage the Company’s

world-class translational science platform to define the features

associated with clinical response and to pursue rational design of

the final cNeT product

- Clinical Activity:

Drive additional confirmed responses in CHIRON and THETIS patients

on cNeT therapy by delivering higher cNeT doses with enhanced host

conditioning

- Manufacturing

Development: Continue VELOS™ and PELEUS™ development to

optimize cNeT dose and functionality

Achilles will participate in the following

upcoming conferences. Additional details will be available in

the Events & Presentations section of the Company’s

website:

- Immuno-Oncology Summit Europe,

April 23 - 24, 2024, London

- LSX World Congress, April 29 - 30, 2024, London

- Chardan’s 8th Annual Cell Therapy Manufacturing Summit, April

29, 2024, Virtual

About Achilles Therapeutics

Achilles is a clinical-stage biopharmaceutical

company developing AI-powered precision T cell therapies targeting

clonal neoantigens: protein markers unique to the individual that

are expressed on the surface of every cancer cell. The Company has

two ongoing Phase I/IIa trials, the CHIRON trial in patients with

advanced non-small cell lung cancer (NSCLC) and the THETIS trial in

patients with recurrent or metastatic melanoma. Achilles uses DNA

sequencing data from each patient, together with its proprietary

PELEUS™ bioinformatics platform, to identify clonal neoantigens

specific to that patient, and then develop precision T cell-based

product candidates specifically targeting those clonal

neoantigens.

Forward Looking Statements

This press release contains express or implied

forward-looking statements that are based on our management's

belief and assumptions and on information currently available to

our management. Forward-looking statements in this press release

include, but are not limited to, statements regarding the timing of

the Company’s clinical and translational data updates and the

Company’s beliefs about recent data updates, and expectations

related to the Company’s operating expenses and capital expense

requirements. Although we believe that the expectations reflected

in these forward-looking statements are reasonable, these

statements relate to future events or our future operational or

financial performance, and involve known and unknown risks,

uncertainties and other factors that may cause our actual results,

performance, or achievements to be materially different from any

future results, performance or achievements expressed or implied by

these forward-looking statements. The forward-looking statements in

this press release represent our views as of the date of this press

release. We anticipate that subsequent events and developments will

cause our views to change. However, while we may elect to update

these forward-looking statements at some point in the future, we

have no current intention of doing so except to the extent required

by applicable law. You should therefore not rely on these

forward-looking statements as representing our views as of any date

subsequent to the date of this press release.

For further information, please contact:

Investors:Meru AdvisorsLee M.

Sternlstern@meruadvisors.com

Media:ICR ConsiliumSukaina Virji, Tracy Cheung,

Emmalee Hoppe+44 (0) 203 709 5000achillestx@consilium-comms.com

|

ACHILLES THERAPEUTICS PLCConsolidated

Balance Sheets(in thousands, except share and per share

amounts)(expressed in U.S. Dollars, unless otherwise stated) |

|

|

|

|

December 31, |

|

December 31, |

|

|

|

2023 |

|

|

|

2022 |

|

| ASSETS |

|

|

|

| CURRENT ASSETS: |

|

|

|

| Cash and cash equivalents |

$ |

131,539 |

|

|

$ |

173,338 |

|

| Prepaid expenses and other

current assets |

|

14,094 |

|

|

|

23,242 |

|

|

Total current assets |

|

145,633 |

|

|

|

196,580 |

|

| Property and equipment, net |

|

9,171 |

|

|

|

12,399 |

|

| Operating lease right of use

assets |

|

4,372 |

|

|

|

8,081 |

|

| Deferred tax assets |

|

41 |

|

|

|

251 |

|

| Restricted cash |

|

33 |

|

|

|

33 |

|

| Other assets |

|

2,206 |

|

|

|

3,014 |

|

|

Total non-current assets |

|

15,823 |

|

|

|

23,778 |

|

|

Total assets |

$ |

161,456 |

|

|

$ |

220,358 |

|

| LIABILITIES AND SHAREHOLDERS’

EQUITY |

|

|

|

| CURRENT LIABILITIES: |

|

|

|

| Accounts payable |

$ |

5,629 |

|

|

$ |

5,187 |

|

| Income taxes payable |

|

- |

|

|

|

326 |

|

| Accrued expenses and other

liabilities |

|

7,828 |

|

|

|

8,292 |

|

| Operating lease liabilities -

current |

|

3,539 |

|

|

|

4,188 |

|

|

Total current liabilities |

|

16,996 |

|

|

|

17,993 |

|

| NON-CURRENT LIABILITIES: |

|

|

|

| Operating lease liabilities -

non-current |

|

1,076 |

|

|

|

4,388 |

|

| Other long-term liability |

|

1,015 |

|

|

|

933 |

|

|

Total non-current liabilities |

|

2,091 |

|

|

|

5,321 |

|

|

Total liabilities |

|

19,087 |

|

|

|

23,314 |

|

|

|

|

|

|

| Commitments and

contingencies |

|

|

|

| SHAREHOLDERS’ EQUITY: |

|

|

|

| Ordinary shares, £0.001 par

value; 41,082,948 and 40,932,727 shares authorized,issued and

outstanding at December 31, 2023 and December 31, 2022,

respectively |

|

54 |

|

|

|

54 |

|

| Deferred shares, £92,452.00 par

value, one share authorized, issued and outstandingat December 31,

2023 and December 31, 2022, respectively |

|

128 |

|

|

|

128 |

|

| Additional paid in capital |

|

415,210 |

|

|

|

408,844 |

|

| Accumulated other comprehensive

income |

|

(13,071 |

) |

|

|

(21,695 |

) |

| Accumulated deficit |

|

(259,952 |

) |

|

|

(190,287 |

) |

|

Total shareholders’ equity |

|

142,369 |

|

|

|

197,044 |

|

|

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY |

$ |

161,456 |

|

|

$ |

220,358 |

|

|

ACHILLES THERAPEUTICS PLCConsolidated

Statements of Operations and Comprehensive Loss(in

thousands, except share and per share amounts)(expressed in U.S.

Dollars, unless otherwise stated) |

|

|

|

|

|

|

|

Three Months Ended |

|

Twelve Months Ended |

|

|

December 31, |

December 31, |

|

December 31, |

December 31, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| OPERATING EXPENSES: |

|

|

|

|

|

|

|

|

Research and development |

$ |

15,892 |

|

|

$ |

18,876 |

|

|

$ |

58,246 |

|

|

$ |

57,263 |

|

|

General and administrative |

|

3,622 |

|

|

|

3,958 |

|

|

|

17,009 |

|

|

|

21,120 |

|

|

Total operating expenses |

|

19,914 |

|

|

|

22,834 |

|

|

|

75,255 |

|

|

|

78,383 |

|

| LOSS FROM OPERATIONS: |

|

(19,914 |

) |

|

|

(22,834 |

) |

|

|

(75,255 |

) |

|

|

(78,383 |

) |

| OTHER INCOME (EXPENSE), NET: |

|

|

|

|

|

|

|

|

Other income (expense) |

|

1,389 |

|

|

|

(1,181 |

) |

|

|

6,081 |

|

|

|

7,318 |

|

|

Total other income (expense), net |

|

1,389 |

|

|

|

(1,181 |

) |

|

|

6,081 |

|

|

|

7,318 |

|

| Loss before income taxes |

|

(18,125 |

) |

|

|

(24,015 |

) |

|

|

(69,174 |

) |

|

|

(71,065 |

) |

|

Provision for income taxes |

|

(505 |

) |

|

|

(41 |

) |

|

|

(491 |

) |

|

|

(111 |

) |

|

Net loss |

|

(18,630 |

) |

|

|

(24,056 |

) |

|

|

(69,665 |

) |

|

|

(71,176 |

) |

| Other comprehensive (loss)

income: |

|

|

|

|

|

|

|

|

Foreign exchange translation adjustment |

|

6,119 |

|

|

|

16,795 |

|

|

|

8,624 |

|

|

|

(28,331 |

) |

| Comprehensive loss |

$ |

(12,511 |

) |

|

$ |

(7,261 |

) |

|

$ |

(61,041 |

) |

|

$ |

(99,507 |

) |

| Net loss per share attributable

to ordinary shareholders—basic and diluted |

$ |

(0.46 |

) |

|

$ |

(0.61 |

) |

|

$ |

(1.74 |

) |

|

$ |

(1.82 |

) |

| Weighted average ordinary shares

outstanding—basic and diluted |

|

40,187,152 |

|

|

|

39,518,910 |

|

|

|

39,973,059 |

|

|

|

39,139,693 |

|

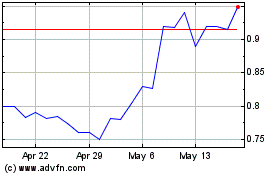

Achilles Therapeutics (NASDAQ:ACHL)

Historical Stock Chart

From Oct 2024 to Nov 2024

Achilles Therapeutics (NASDAQ:ACHL)

Historical Stock Chart

From Nov 2023 to Nov 2024