true

0001859199

0001859199

2024-11-19

2024-11-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K/A

(Amendment

No. 1)

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (date of earliest event reported): November 19, 2024

reAlpha Tech Corp.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-41839 |

|

86-3425507 |

(State

or other jurisdiction of

incorporation or organization) |

|

(Commission File

Number) |

|

(I.R.S.

Employer

Identification Number) |

6515 Longshore Loop, Suite 100, Dublin, OH 43017

(Address

of principal executive offices and zip code)

(707)

732-5742

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

symbol(s) |

|

Name

of each exchange on which registered |

| Common Stock, par value $0.001 per share |

|

AIRE |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Explanatory Note

This Amendment No. 1 on Form 8-K/A (“Amendment No. 1”) amends the Current Report on Form 8-K of reAlpha Tech Corp. (the “Company”)

filed with the Securities and Exchange Commission on November 21, 2024 (the “Original Filing”) to disclose certain information

with respect to the Company’s commitment to purchase an aggregate of $600,000 of convertible promissory notes to be issued by Unreal

Estate Inc., which was inadvertently omitted under Item 1.01 of Form 8-K in the Original Filing. Except as expressly stated herein and

below, including under the heading “Unreal Estate Inc. Convertible Promissory Notes,” this Amendment No. 1 does not

amend or update any other information contained in the Original Filing, which remains unchanged. Accordingly, this Amendment No. 1 should

be read in conjunction with the Original Filing.

Item 1.01 Entry into a Material Definitive Agreement.

Acquisition of USRealty

Brokerage Solutions, LLC and Investment in Unreal Estate Inc.

On

November 19, 2024, reAlpha Tech Corp. (the “Company”) entered into a Membership Interest Purchase Agreement (the “Purchase

Agreement”), with Unreal Estate LLC, a Delaware limited liability company (the “Seller”), USRealty Brokerage Solutions,

LLC, a Delaware limited liability company and wholly-owned subsidiary of the Seller (“US Realty”), and Unreal Estate Inc.,

a Delaware corporation (the “Parent”), pursuant to which, on November 20, 2024 (the “Closing Date”), the Company

acquired from the Seller 100% of the membership interests of US Realty that were outstanding immediately prior to the execution of the

Purchase Agreement (the “Acquisition”). Prior to the Acquisition, US Realty had no operations except for a Multiple Listing

Service registration.

Pursuant

to the terms and subject to the conditions of the Purchase Agreement, in exchange for all of the membership interests of US Realty outstanding

immediately prior to the execution of the Purchase Agreement, the Company agreed to pay the Seller an aggregate purchase price of $250,000

in the form of in-kind services to be provided by the Company, including software usage by the Seller or the Parent, beginning on the

Closing Date and continuing for a period of one year thereafter (the “In-Kind Services”). The terms of the In-Kind Services

will be further described in a services agreement to be entered into among the Company, the Seller and the Parent within 30 days of the

Closing Date.

The

Purchase Agreement provides that, following the Closing Date, the Seller will indemnify the Company and its affiliates for any liability,

damages, losses, costs and/or expenses arising out of breaches by the Seller of its covenants and representations, and for certain other

matters as specified in the Purchase Agreement, subject to certain limitations and exclusions as identified therein. The Company is also

required, following the Closing Date, to indemnify the Seller, the Parent and their respective affiliates for any liability, damages,

losses, costs and/or expenses arising out of any breaches by the Company of its covenants and representations set forth in the Purchase

Agreement, as well as fees incident to the Company’s indemnification obligations. The Company also has the right to set-off any

amounts it owes to the Seller in connection with the Purchase Agreement, against the obligations and liabilities of the Seller to the

Company under the Purchase Agreement. The Purchase Agreement also contains representations and warranties, other covenants and conditions,

in each case, customary for transactions of this type.

On

November 19, 2024, US Realty entered into a separate independent contractor agreement (the “Broker Services Agreement”), with

one of the Seller’s real estate brokers (the “Broker”), pursuant to which the Broker agreed to provide certain services

to US Realty. Specifically, under the terms of the Broker Services Agreement, the Broker’s services will include: (i) acting on

behalf of US Realty as its designated broker or broker of record with respect to the real estate commission requirements of the 33 U.S.

states in which the Broker is licensed, and (ii) providing certain managerial and administrative services to US Realty with respect to

its real estate licensing and compliance requirements in those U.S. states. US Realty will pay the Broker at a rate of $150 per hour in

exchange for such services.

The

foregoing description of the Purchase Agreement does not purport to be a complete description of the rights and obligations of the parties

thereunder and is qualified in its entirety by reference to the full text of the Purchase Agreement, a copy of which is filed hereto as

Exhibit 2.1, and incorporated herein by reference.

Unreal Estate Inc.

Convertible Promissory Notes

The Company entered into a

letter agreement, dated as of November 19, 2024 (the “Letter Agreement”), with the Parent and Seller, pursuant to which the

Company agreed to purchase an aggregate amount of $600,000 of convertible promissory notes (each, a “Note,” and collectively

the “Notes”) from the Parent in a series of six installments in the amounts set forth in the Letter Agreement (each such installment,

an “Installment Payment”), beginning on the date of the Closing Date and continuing on the first of the month every month

thereafter until the $600,000 amount is fully paid. Additionally, pursuant to the Letter Agreement and as a further inducement to the

Company to purchase the Notes, the Parent and Seller waived the non-compete of the Broker in order to allow such Broker to provide the

services described herein to US Realty for as long as the Broker Services Agreement remains in effect.

On

the same date, in connection with the Letter Agreement, the Parent issued and sold to the Company a Note in the original principal amount

of $60,000, which Note constituted full payment and satisfaction by the Company of the first Installment Payment due on the Closing Date.

The Notes are convertible into shares of preferred stock or common stock of the Parent, as applicable, as follows: (i) if the Parent effects

a transaction or series of transactions of its preferred stock for capital raising purposes, then the amount of the outstanding principal

balance of the Notes (plus all unpaid accrued interest thereon) as of the conversion date (the “Convertible Amount”) will

automatically convert into shares of the Parent’s preferred stock; (ii) if the Parent effects (a) a transaction or series of transactions

in which it sells more than 50% of its outstanding voting securities, (b) a reorganization, merger or consolidation or (c) a direct listing

or initial public offering of its securities, then, in each case, the Company will be eligible to receive the Convertible Amount or shares

of the Parent’s common stock upon conversion of the Notes and the Convertible Amount thereof, whichever is greater; and (iii) at

any time after the Notes reaches its maturity date, and at the election of the Company, the Notes and Convertible Amount thereof may be

converted into shares of the Parent’s common stock. The Notes issued to the Company is one of a series of convertible promissory

notes issued by the Parent (collectively, the “Offering Notes”). Interest under the Notes will accrue at a rate of 9% per

annum. The entire outstanding principal balance of the Notes (plus all unpaid accrued interest thereon) will be due and payable in 4 years

following the date of its issuance, unless earlier converted based on the terms of the Notes, or extended by the holders of a majority-in-interest

of the aggregate principal amount of the Offering Notes.

Pursuant

to the terms of the Letter Agreement, if the Company fails to purchase a Note within 10 business days of each of the Installment Payment

dates (each, an “Event of Default”), then the full remaining aggregate Installment Payment that has not yet been paid by the

Company shall immediately become due and payable without any action by the Parent, and the Parent may provide notice to the Company to

declare that such remaining aggregate Installment Payment be immediately due and payable. Upon the occurrence of an Event of Default,

the Company shall pay on demand all expenses of the Parent in connection with its exercise, preservation or enforcement of any of its

rights, remedies or options provided under the Letter Agreement.

Subsequent to the Original

Filing, and since the first Installment Payment was made by the Company, the Company has not made any further Installment Payments pursuant

to the Letter Agreement and the Company and the Parent have since engaged in preliminary discussions regarding a potential restructuring,

or termination, of the Letter Agreement and obligations thereunder. As of the date of this Amendment No. 1, the discussions with the Parent

are continuing and no agreement has been reached at this time. There can be no assurance that any agreement will be entered into, and

the Company cannot guarantee a successful outcome from the current discussions with the Parent.

Moreover,

the Letter Agreement also provided that the Parent and the Company, following the Closing Date, would use their good faith efforts to

negotiate a mutually acceptable agreement whereby the Parent would designate the Company as the exclusive mortgage provider for any properties

listed with or through the Parent and its affiliates. As of the date of this Amendment No. 1, no such agreement has been entered into.

The

foregoing descriptions of the Letter Agreement and the Notes in this Amendment No. 1 do not purport to be complete descriptions of the

rights and obligations of the parties thereunder and are qualified in their entirety by reference to the full text of the Letter Agreement

and the Notes, copies of which are filed hereto as Exhibits 10.1 and 99.1, respectively, and incorporated herein by reference.

Item 8.01 Other Events.

On

November 21, 2024, the Company issued a press release announcing the transactions described in Item 1.01. A copy of the press release

is furnished hereto as Exhibit 99.2 and is incorporated herein by reference.

The

information set forth and incorporated by reference into this Item 8.01 of this Amendment No. 1, including Exhibit 99.2, is being furnished

pursuant to Item 8.01 of Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act

of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed

incorporated by reference into any of the Company’s filings under the Securities Act of 1933, as amended, or the Exchange Act, whether

made before or after the date hereof and regardless of any general incorporation language in such filings, except to the extent expressly

set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Exhibit

Number |

|

Description |

| |

|

| 2.1+ |

|

Membership Interest Purchase Agreement, dated November 19, 2024, among reAlpha Tech Corp., USRealty Brokerage Solutions, LLC, Unreal Estate LLC and Unreal Estate Inc. (previously filed as Exhibit 2.1 of Form 8-K filed with the SEC on November 21, 2024). |

| 10.1* |

|

Letter Agreement, dated November 19, 2024, among reAlpha Tech Corp., Unreal Estate Inc. and Unreal Estate LLC. |

| 99.1 |

|

Convertible Promissory Note, dated November 19, 2024 (previously filed as Exhibit 99.1 of Form 8-K filed with the SEC on November 21, 2024). |

| 99.2 |

|

Press Release, dated November 21, 2024 (previously furnished as Exhibit 99.2 of Form 8-K filed with the SEC on November 21, 2024). |

| 104* |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

| + | The

schedules and exhibits to this agreement have been omitted pursuant to Item 601(a)(5) of Regulation S-K. A copy of

any omitted schedule and/or exhibit will be furnished to the U.S. Securities and Exchange Commission upon request. |

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| Date: January 29, 2025 |

reAlpha Tech Corp. |

| |

|

|

| |

By: |

/s/ Giri Devanur |

| |

|

Giri Devanur |

| |

|

Chief Executive Officer |

Exhibit 10.1

UNREAL

ESTATE INC.

332

SOUTH MICHIGAN AVENUE, SUITE 121-A19

CHICAGO,

ILLINOIS 60604

November

19, 2024

reAlpha

Tech Corp.

6515

Longshore Loop

Dublin,

Ohio 43017

| Re: | Investment

in Unreal Estate Inc., a Delaware corporation (the “Company”) |

Ladies

and Gentlemen:

This

letter (“Letter Agreement”) is written in connection with the purchase by reAlpha Tech Corp., a Delaware corporation

(the “Holder”), of an aggregate amount of $600,000 of convertible promissory notes of the Company, in the form attached

hereto as Exhibit A (the “Notes”), to be purchased by the Holder pursuant to the terms of this Letter Agreement.

Capitalized terms that are not defined herein will be defined as set forth in the Notes.

The

Company, Unreal Estate LLC, a Delaware limited liability company (the “Seller”), and the Holder have entered into

that certain Membership Interests Purchase Agreement, dated as of the date hereof (the “Purchase Agreement”), whereby

the Seller desires to sell and transfer to the Holder, and the Holder desires to purchase from the Seller, all of the membership interests

of USRealty Brokerage Solutions, LLC, a Delaware limited liability company (“USRealty”), all as more specifically

provided in the Purchase Agreement.

Immediately

after the closing of the Purchase Agreement (the “Closing Date”), USRealty and Ryan Gehris shall have entered into

that certain Independent Contractor Agreement, dated as of the date hereof (the “Gehris Agreement”), whereby the Company

and Seller shall waive Mr. Gehris’ non-competition obligations to the Seller, in order to allow Mr. Gehris to provide broker services

to the USRealty as set forth in the Gehris Agreement.

The

Company and the Seller have entered into the Purchase Agreement and waived Mr. Gehris non-competition obligations as an inducement to

the Holder to purchase an aggregate of $600,000 of the Company’s Notes in such amounts and upon such dates set forth on Schedule

A hereto (the “Note Purchase”).

Upon

execution by all parties hereto, in consideration of the mutual covenants, terms, and conditions set forth herein, and for other good

and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, this Agreement will constitute a binding agreement

among the parties hereto that may not be amended without such parties' mutual written consent as follows:

1. Note

Purchase. The Holder agrees to purchase an aggregate of $600,000 of the Company’s Notes by making a payment in cash by wire

transfer of immediately available funds to an account specified in writing by the Seller on the dates and in such amounts (each such

date, the “Purchase Date”, and each such amount, the “Purchase Amount”) as set forth on Schedule

A hereto. Upon receipt of each of Holder’s payment of the Purchase Amount, the Company shall issue to the Holder a Note in

the form attached hereto as Exhibit A evidencing the purchase of such Notes with the Principal Amount of such Note equal to the

actual amount of such Purchase Amount and the Date of Issuance of such Note being the date the Company actually received the funds in

its account.

2. Event

of Default. If the Holder fails to purchase a Company Note for the Purchase Amount within ten (10) business days of each of the scheduled

Payment Dates pursuant to the terms of Section 1 (an “Event of Default”), then the parties agree that the full remaining

aggregate Purchase Amount of Notes listed on Schedule A that has not yet been purchased by the Holder shall immediately become

due and payable without any action on the part of the Company, and the Company may by notice to the Holder declare that such remaining

aggregate Purchase Amount immediately due and payable, whereupon the same shall become immediately due and payable. Nothing contained

in this Letter Agreement shall be deemed to limit the ability of the Company to demand payment of the amounts owing hereunder at any

time after an Event of Default has occurred. Upon the occurrence of an Event of Default and at any time thereafter during the continuance

of any such event, the Company may at its option exercise any or all of its rights, powers or remedies under this Letter Agreement or

applicable law. Upon an Event of Default, the Holder shall pay on demand all expenses of the Company in connection with the Company’s

exercise, preservation or enforcement of any of its rights, remedies or options hereunder and/or thereunder, including, without limitation,

fees of legal counsel, accounting, consulting, brokerage or other similar professional fees or expenses, and any fees or expenses associated

with travel, and the amount of all such expenses shall, until paid, bear interest at the rate applicable to the Note.

3. Waiver

of Non-Competition. The parties hereto acknowledge and agree that Mr. Gehris is under certain non-competition contractual obligations

owed to the Seller (the “Non-Competition Agreement”). For the reasons and pursuant to the terms and conditions set

forth herein, the Seller consents to Mr. Gehris’ provision of broker services to USRealty as set forth in the Gehris Agreement

and agrees to waive its right to enforce the Non-Competition Agreement with respect to the Gehris Agreement and release Mr. Gehris from

those obligations for so long as the Gehris Agreement remains in effect.

4. Exclusive

Mortgage Agreement. After the Closing Date the parties hereto further agree to use their good faith efforts to negotiate a mutually

acceptable agreement whereby the Company shall designate the Holder as the exclusive mortgage provider for any properties listed with

or through the Company or its affiliates. Under this agreement, the Holder, either directly or through its affiliates, will facilitate

competitive, streamlined mortgage solutions for buyers of the Company’s properties, ensuring a seamless financing experience.

5. Governing

Law. This Letter Agreement shall be governed by and construed under the laws of the State of New York, without giving effect to conflicts

of law principles but including Section 5-1401 of the New York General Obligations Law. Each party hereby irrevocably and unconditionally

(i) agrees that any legal action, suit or proceeding arising out of or relating to this Letter Agreement may be brought in the courts

of the State of New York or of the United States of America for the Southern District of New York and (ii) submits to the exclusive jurisdiction

of any such court in any such action, suit or proceeding. Final judgment against either party in any action, suit or proceeding shall

be conclusive and may be enforced in any other jurisdiction by suit on the judgment. Nothing in this Letter Agreement shall affect the

right of the either party to (i) commence legal proceedings or otherwise sue the other party in any other court having jurisdiction over

such other party or (ii) serve process upon the other party in any manner authorized by the laws of any such jurisdiction. Each party

irrevocably and unconditionally waives, to the fullest extent permitted by applicable law, any objection that it may now or hereafter

have to the laying of venue of any action or proceeding arising out of or relating to this Letter Agreement in any court referred to

in this paragraph and the defense of an inconvenient forum to the maintenance of such action or proceeding in any such court. EACH PARTY

HEREBY IRREVOCABLY WAIVES, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY RIGHT IT MAY HAVE TO A TRIAL BY JURY IN ANY LEGAL PROCEEDING

DIRECTLY OR INDIRECTLY RELATING TO THIS LETTER AGREEMENT OR THE TRANSACTIONS CONTEMPLATED HEREBY OR THEREBY WHETHER BASED ON CONTRACT,

TORT OR ANY OTHER THEORY.

6. Counterparts.

This Letter Agreement may be executed in counterparts, each of which shall be deemed to be an original hereof, but all such counterparts

together shall constitute one and the same instrument. Signatures on this Letter Agreement may be delivered by facsimile or electronic

transmission and shall be binding upon the parties so transmitting their signatures.

7. Assignment.

No party to this Letter Agreement may assign any of its rights or obligations hereunder without the prior written consent of the other

parties hereto.

8. Amendment;

Modification; Waiver. No amendment or modification of the terms hereof shall be valid and binding unless set forth in a written instrument

signed by all parties hereto. No waiver shall be deemed to have been granted or created by any course of conduct or acquiescence, and

no waiver shall be enforceable against any party hereto unless in writing and signed by each party against which such waiver is claimed.

9. Headings.

The section headings in this Letter Agreement are for convenient reference only and shall not affect the meaning or interpretation of

this Letter Agreement.

10. Entire

Agreement. This Letter Agreement constitutes the entire agreement of the parties with respect to the subject matter of this Letter

Agreement, and supersedes all prior understandings and agreements of the parties, written or oral, with respect thereto.

[Remainder

of Page Intentionally Left Blank]

If

the foregoing is acceptable to you, please signify your agreement by executing on the space indicated below.

| |

Very truly yours, |

| |

|

| |

UNREAL ESTATE INC. |

| |

|

|

| |

By: |

/s/ Kyle Stoner |

| |

Name: |

Kyle Stoner |

| |

Title: |

Chief Executive Officer |

| |

|

|

| |

UNREAL ESTATE LLC |

| |

|

|

| |

By: |

/s/ Kyle Stoner |

| |

Name: |

Kyle Stoner |

| |

Title: |

Chief Executive Officer |

Acknowledged

and agreed

as of the date first set forth above:

| REALPHA TECH CORP. |

|

| |

|

|

| By: |

/s/ Giri Devanur |

|

| Name: |

Giri Devanur |

|

| Title: |

Chief Executive Officer |

|

SCHEDULE

A

NOTE

PURCHASE SCHEDULE

| Payment Date | |

Payment Amount | |

| Closing Date of the Purchase Agreement | |

$ | 60,000.00 | |

| December 1, 2024 | |

$ | 120,000.00 | |

| January 1, 2025 | |

$ | 120,000.00 | |

| February 1, 2025 | |

$ | 120,000.00 | |

| March 1, 2025 | |

$ | 120,000.00 | |

| April 1, 2025 | |

$ | 60,000.00 | |

EXHIBIT

A

FORM

OF CONVERTIBLE PROMISSORY NOTE

(see

attached)

v3.24.4

Cover

|

Nov. 19, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K/A

|

| Amendment Flag |

true

|

| Amendment Description |

This Amendment No. 1 on Form 8-K/A (“Amendment No. 1”) amends the Current Report on Form 8-K of reAlpha Tech Corp. (the “Company”)

filed with the Securities and Exchange Commission on November 21, 2024 (the “Original Filing”) to disclose certain information

with respect to the Company’s commitment to purchase an aggregate of $600,000 of convertible promissory notes to be issued by Unreal

Estate Inc., which was inadvertently omitted under Item 1.01 of Form 8-K in the Original Filing. Except as expressly stated herein and

below, including under the heading “Unreal Estate Inc. Convertible Promissory Notes,” this Amendment No. 1 does not

amend or update any other information contained in the Original Filing, which remains unchanged. Accordingly, this Amendment No. 1 should

be read in conjunction with the Original Filing.

|

| Document Period End Date |

Nov. 19, 2024

|

| Entity File Number |

001-41839

|

| Entity Registrant Name |

reAlpha Tech Corp.

|

| Entity Central Index Key |

0001859199

|

| Entity Tax Identification Number |

86-3425507

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

6515 Longshore Loop

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

Dublin

|

| Entity Address, State or Province |

OH

|

| Entity Address, Postal Zip Code |

43017

|

| City Area Code |

707

|

| Local Phone Number |

732-5742

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

AIRE

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

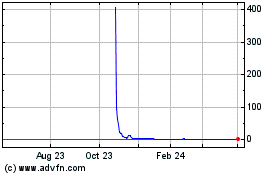

reAlpha Tech (NASDAQ:AIRE)

Historical Stock Chart

From Jan 2025 to Feb 2025

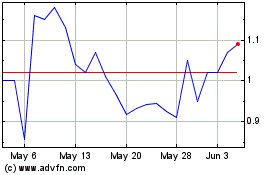

reAlpha Tech (NASDAQ:AIRE)

Historical Stock Chart

From Feb 2024 to Feb 2025