0001705110FALSE00017051102025-02-112025-02-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 11, 2025

Angi Inc.

(Exact name of registrant as specified in charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-38220 | | 82-1204801 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | | | | |

3601 Walnut Street, | Suite 700 | | |

Denver, | CO | | 80205 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (303) 963-7200

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A Common Stock, par value $0.001 | ANGI | The Nasdaq Stock Market LLC |

| | (Nasdaq Global Select Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

Item 7.01 Regulation FD Disclosure

On February 11, 2025 the Registrant announced that it had released its results for the quarter ended December 31, 2024. The full text of the related press release, which is posted on the "Investor Relations" section of the Registrant's website at https://ir.angi.com/quarterly-earnings and appears in Exhibit 99.1 hereto, is incorporated herein by reference.

Exhibit 99.1 is being furnished under both Item 2.02 "Results of Operations and Financial Condition" and Item 7.01 "Regulation FD Disclosure."

Item 9.01. Financial Statements and Exhibits

| | | | | |

Exhibit

Number | Description |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| ANGI INC. |

| |

| By: | /s/ Shannon M. Shaw |

| Name: | Shannon M. Shaw |

| Title: | Chief Legal Officer |

Date: February 11, 2025 | | |

ANGI REPORTS Q4 2024

IAC Board of Directors approved plan to spin off Angi

Q4 operating income of $2 million

Q4 Adjusted EBITDA of $32 million

DENVER — February 11, 2025 — Angi Inc. (NASDAQ: ANGI) released its fourth quarter results today and separately posted a letter to shareholders from Jeffrey Kip, the Chief Executive Officer of Angi Inc., on the Investor Relations section of Angi Inc.’s website at ir.angi.com. A letter to IAC shareholders from Joey Levin, the Chairman of Angi Inc. and Chief Executive Officer of IAC, was also posted on the Investor Relations section of IAC's website at ir.iac.com.

| | | | | | | | | | | | | | | | | | | | |

| ANGI INC. SUMMARY RESULTS |

| ($ in millions except per share amounts) |

| | Q4 2024 | | Q4 2023 | | Growth |

| Revenue | $ | 267.9 | | | $ | 300.4 | | | -11 | % |

| | | | | | |

| | | | | | |

| Operating income | 2.2 | | | 7.6 | | | -72 | % |

| Net loss | (1.3) | | | (5.6) | | | 77 | % |

| Diluted loss per share | $ | (0.00) | | | $ | (0.01) | | | NM |

| Adjusted EBITDA | 31.8 | | | 41.4 | | | -23 | % |

See reconciliations of GAAP to non-GAAP measures beginning on page 10. |

Q4 2024 HIGHLIGHTS

•On January 13, 2025, IAC announced its Board of Directors approved a plan to spin off IAC's full stake in Angi Inc. to IAC shareholders. The transaction is expected to close in the first half of 2025 but no sooner than March 31, 2025.

•On January 13, 2025, Angi Inc. announced the appointment of Joey Levin as Executive Chairman. Upon the earlier of the completion of the Angi Inc. spin-off or May 31, 2025, Joey Levin will step down from his role as IAC CEO.

•Operating income decreased $5 million to $2 million and Adjusted EBITDA decreased 23% to $32 million driven primarily by the recovery in Q4 2023 of $11 million of previously incurred legal fees.

◦Full year 2024 operating income increased $48 million to $22 million and Adjusted EBITDA increased 23% to $145 million.

•International revenue grew 5%.

•For the twelve months ended December 31, 2024, net cash provided by operating activities attributable to continuing operations increased $62 million to $156 million and Free Cash Flow increased $59 million to $105 million.

•Full year 2025 outlook

◦For Q1 2025, Angi Inc. expects breakeven operating income and over $20 million of Adjusted EBITDA.

◦For the full year 2025, Angi Inc. expects $25-$60 million of operating income and $135-$150 million of Adjusted EBITDA.

Revenue

| | | | | | | | | | | | | | | | | | | | |

| | Q4 2024 | | Q4 2023 | | Growth |

| ($ in millions; rounding differences may occur) | | | | | | |

| Ads and Leads | | $ | 214.5 | | | $ | 246.9 | | | -13 | % |

| Services | | 24.8 | | | 26.1 | | | -5 | % |

| Total Domestic | | $ | 239.2 | | | $ | 273.1 | | | -12 | % |

| International | | 28.6 | | | 27.4 | | | 5 | % |

| Total | | $ | 267.9 | | | $ | 300.4 | | | -11 | % |

•Revenue was $267.9 million, down 11% year-over-year driven by:

◦Ads and Leads revenue decreased 13% driven by ongoing user-experience enhancements as well as lower consumer marketing and professional acquisition expense, resulting in both lower Service Requests and lower acquisition of new professionals

◦Services revenue decreased 5% due to margin-optimization initiatives and lower Service Requests, partially offset by favorable true-ups related to retail partners

◦International revenue increased 5% driven primarily by a larger professional network and higher revenue per professional

Operating income (loss) and Adjusted EBITDA

| | | | | | | | | | | | | | | | | | | | |

| | Q4 2024 | | Q4 2023 | | Growth |

| ($ in millions; rounding differences may occur) | | | | | | |

| Operating income (loss): | | | | | | |

| Ads and Leads | | $ | 28.7 | | | $ | 23.7 | | | 21 | % |

| Services | | (7.1) | | | (1.9) | | | -268 | % |

| Other | | (18.8) | | | (15.0) | | | -25 | % |

| Total Domestic | | 2.7 | | | 6.7 | | | -59 | % |

| International | | (0.6) | | | 0.9 | | | NM |

| Total | | $ | 2.2 | | | $ | 7.6 | | | -72 | % |

| Adjusted EBITDA: | | | | | | |

| Ads and Leads | | $ | 47.9 | | | $ | 47.2 | | | 2 | % |

| Services | | (1.4) | | | 5.1 | | | NM |

| Other | | (15.2) | | | (12.7) | | | -20 | % |

| Total Domestic | | 31.3 | | | 39.5 | | | -20 | % |

| International | | 0.5 | | | 1.8 | | | -73 | % |

| Total | | $ | 31.8 | | | $ | 41.4 | | | -23 | % |

•Operating income decreased 72% to $2.2 million and Adjusted EBITDA decreased 23% to $31.8 million driven by:

◦Ads and Leads operating income increased 21% to $28.7 million reflecting:

▪Adjusted EBITDA increasing 2% to $47.9 million reflecting:

•Lower consumer marketing expense and professional acquisition expense driven by improved efficiency and lower sales-related expenses

•Partially offset by 13% lower revenue and a $10.9 million benefit from insurance coverage for previously incurred legal fees in Q4 2023

◦Services operating loss increased $5.2 million to $7.1 million reflecting:

▪Adjusted EBITDA loss of $1.4 million compared to a profit of $5.1 million in Q4 2023 due primarily to 5% lower revenue and higher legal expenses including a $3.0 million legal settlement

▪$2.6 million higher amortization of intangibles related to an impairment of certain indefinite-lived intangible assets

▪$3.4 million lower depreciation related to capitalized software assets fully depreciated in current and previous periods

◦International operating loss of $0.6 million compared to a profit of $0.9 million in Q4 2023 due primarily to Adjusted EBITDA declining 73% driven by higher provision for credit losses and restructuring costs related to Homestars, partially offset by a 5% increase in revenue

Income Taxes

The Company recorded an income tax provision of $1.7 million in Q4 2024 for an effective tax rate of 387% due primarily to unbenefited realized losses and the impact of stock-based awards. In Q4 2023, the Company recorded an income tax provision of $5.7 million for an effective tax rate of 69%, which was higher than the statutory rate due primarily to unbenefited losses, reduced research credits and state taxes.

Operating Metrics

| | | | | | | | | | | | | | | | | | | | |

| | Q4 2024 | | Q4 2023 | | Growth |

| | | | | | |

| Service Requests (in thousands) | | 3,629 | | | 4,324 | | | -16 | % |

| Monetized Transactions (in thousands) | | 5,255 | | | 5,500 | | | -4 | % |

Monetized Transactions per Service Request | | 1.45 | | | 1.27 | | | 14 | % |

| Transacting Professionals (in thousands) | | 168 | | | 196 | | | -14 | % |

Free Cash Flow

For the twelve months ended December 31, 2024, net cash provided by operating activities attributable to continuing operations was $155.9 million, an increase of $61.8 million year-over-year. Free Cash Flow increased $59.0 million to $105.4 million due primarily to favorable working capital and higher Adjusted EBITDA, partially offset by $2.7 million higher capital expenditures.

| | | | | | | | | | | | | | |

| | Year Ended December 31, |

| ($ in millions; rounding differences may occur) | | 2024 | | 2023 |

| Net cash provided by operating activities attributable to continuing operations | | $ | 155.9 | | | $ | 94.2 | |

| Capital expenditures | | (50.5) | | | (47.8) | |

| Free Cash Flow | | $ | 105.4 | | | $ | 46.4 | |

LIQUIDITY AND CAPITAL RESOURCES

As of December 31, 2024:

•Angi Inc. had 497.8 million shares of Class A and Class B common stock outstanding.

•IAC’s economic interest in Angi Inc. was 85.3% and IAC’s voting interest in Angi Inc. was 98.3%.

•Angi Inc. had $416 million in cash and cash equivalents and $500 million of 3.875% Senior Notes due August 15, 2028 held at ANGI Group, LLC (a subsidiary of Angi Inc.).

Angi Inc. had 23.1 million shares remaining of its 25 million stock repurchase authorization, which was approved by the Angi Inc. Board of Directors on August 2, 2024. Share repurchases may be made over an indefinite period of time in the open market and in privately negotiated transactions, depending on those factors management deems relevant at any particular time, including, without limitation, market conditions, share price and future outlook.

CONFERENCE CALL

Angi Inc. and IAC will host a conference call to answer questions regarding their fourth quarter results on Wednesday, February 12, 2025, at 8:30 a.m. Eastern Time. This conference call will include the disclosure of certain information, including forward-looking information, which may be material to an investor’s understanding of Angi Inc.'s and IAC’s businesses. The conference call will be open to the public at ir.angi.com and ir.iac.com.

DILUTIVE SECURITIES

Angi Inc. has various dilutive securities. The table below details these securities as well as potential dilution at various stock prices (shares in millions; rounding differences may occur).

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Avg. Exercise | | As of | | | | | | | | |

| | Shares | | Price | | 2/7/25 | | Dilution At: |

| | | | | | | | | | | | | | |

| Share Price | | | | | | $ | 1.76 | | | $ | 2.00 | | | $ | 3.00 | | | $ | 4.00 | | | $ | 5.00 | |

| | | | | | | | | | | | | | |

Absolute Shares as of 2/7/25 | | 498.5 | | | | | 498.5 | | | 498.5 | | | 498.5 | | | 498.5 | | | 498.5 | |

| | | | | | | | | | | | | | |

| SARs | | 0.1 | | | $ | 2.66 | | | — | | | — | | | — | | | — | | | — | |

| Options | | 0.3 | | | $ | 12.32 | | | — | | | — | | | — | | | — | | | — | |

| RSUs and subsidiary denominated equity awards | | 27.3 | | | | | 6.8 | | | 6.8 | | | 6.6 | | | 6.5 | | | 6.4 | |

| | | | | | | | | | | | | | |

| Total Dilution | | | | | | 6.8 | | | 6.8 | | | 6.6 | | | 6.5 | | | 6.4 | |

| % Dilution | | | | | | 1.3 | % | | 1.3 | % | | 1.3 | % | | 1.3 | % | | 1.3 | % |

| Total Diluted Shares Outstanding | | | | | | 505.3 | | | 505.2 | | | 505.0 | | | 505.0 | | | 504.9 | |

The dilutive securities presentation is calculated using the method and assumptions described below, which are different from those used for GAAP dilution, which is calculated based on the treasury stock method.

The Company currently settles all equity awards on a net basis; therefore, the dilutive effect is presented as the net number of shares expected to be issued upon exercise or vesting, and in the case of options, assuming no proceeds are received by the Company. Any required withholding taxes are paid in cash by the Company on behalf of the employees. In addition, the estimated income tax benefit from the tax deduction received upon the exercise or vesting of these awards is assumed to be used to repurchase Angi Inc. shares. Assuming all awards were exercised or vested on February 7, 2025, withholding taxes paid by the Company on behalf of the employees upon net settlement would have been $22.0 million, assuming a stock price of $1.76 and a 50% withholding rate. The table above assumes no change in the fair value estimate of the non-publicly traded subsidiary denominated equity awards from the values used at December 31, 2024. The number of shares ultimately needed to settle these awards and the cash withholding tax obligation may vary significantly as a result of the determination of the fair value of this subsidiary. In addition, the number of shares required to settle these awards will be impacted by movement in the stock price of Angi Inc.

ANGI INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF OPERATIONS (UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Years Ended December 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| | (In thousands, except per share data) |

Revenue | | $ | 267,869 | | | $ | 300,433 | | | $ | 1,185,112 | | | $ | 1,358,748 | |

Cost of revenue (exclusive of depreciation shown separately below) | | 16,179 | | | 17,239 | | | 57,578 | | | 62,547 | |

| Gross profit | | 251,690 | | | 283,194 | | | 1,127,534 | | | 1,296,201 | |

Operating costs and expenses: | | | | | | | | |

Selling and marketing expense | | 130,821 | | | 156,613 | | | 601,638 | | | 765,205 | |

General and administrative expense | | 73,282 | | | 70,852 | | | 319,999 | | | 359,389 | |

Product development expense | | 22,511 | | | 24,185 | | | 95,360 | | | 96,543 | |

Depreciation | | 20,311 | | | 23,917 | | | 86,052 | | | 93,604 | |

Amortization of intangibles | | 2,600 | | | — | | | 2,600 | | | 7,958 | |

| Total operating costs and expenses | | 249,525 | | | 275,567 | | | 1,105,649 | | | 1,322,699 | |

| Operating income (loss) | | 2,165 | | | 7,627 | | | 21,885 | | | (26,498) | |

| Interest expense | | (5,045) | | | (5,037) | | | (20,169) | | | (20,137) | |

| Other income, net | | 3,328 | | | 5,547 | | | 18,361 | | | 18,427 | |

| Earnings (loss) from continuing operations before income taxes | | 448 | | | 8,137 | | | 20,077 | | | (28,208) | |

| Income tax (provision) benefit | | (1,734) | | | (5,651) | | | 16,771 | | | (1,839) | |

| Net (loss) earnings from continuing operations | | (1,286) | | | 2,486 | | | 36,848 | | | (30,047) | |

| Loss from discontinued operations, net of tax | | — | | | (8,028) | | | — | | | (10,264) | |

| Net (loss) earnings | | (1,286) | | | (5,542) | | | 36,848 | | | (40,311) | |

| Net earnings attributable to noncontrolling interests | | — | | | (15) | | | (844) | | | (629) | |

| Net (loss) earnings attributable to Angi Inc. shareholders | | $ | (1,286) | | | $ | (5,557) | | | $ | 36,004 | | | $ | (40,940) | |

| | | | | | | | |

| Per share information from continuing operations: | | | | | | | | |

| Basic (loss) earnings per share | | $ | (0.00) | | | $ | 0.01 | | | $ | 0.07 | | | $ | (0.06) | |

| Diluted (loss) earnings per share | | $ | (0.00) | | | $ | 0.01 | | | $ | 0.07 | | | $ | (0.06) | |

| | | | | | | | |

| Per share information attributable to Angi Inc. shareholders: | | | | | | | | |

| Basic (loss) earnings per share | | $ | (0.00) | | | $ | (0.01) | | | $ | 0.07 | | | $ | (0.08) | |

| Diluted (loss) earnings per share | | $ | (0.00) | | | $ | (0.01) | | | $ | 0.07 | | | $ | (0.08) | |

| | | | | | | | |

| Stock-based compensation expense by function: | | | | | | | | |

| | | | | | | | |

| Selling and marketing expense | | $ | 1,077 | | | $ | 1,734 | | | $ | 4,605 | | | $ | 6,264 | |

| General and administrative expense | | 4,224 | | | 6,449 | | | 24,533 | | | 28,386 | |

| Product development expense | | 1,384 | | | 1,641 | | | 5,640 | | | 8,764 | |

| Total stock-based compensation expense | | $ | 6,685 | | | $ | 9,824 | | | $ | 34,778 | | | $ | 43,414 | |

| | | | | | | | | | | | | | |

| ANGI INC. CONSOLIDATED BALANCE SHEET (UNAUDITED) |

| ($ in thousands) |

| | December 31, |

| | 2024 | | 2023 |

| ASSETS | | | | |

| Cash and cash equivalents | | $ | 416,434 | | | $ | 364,044 | |

| | | | |

| Accounts receivable, net | | 36,670 | | | 51,100 | |

| Other current assets | | 41,981 | | | 72,075 | |

| | | | |

| Total current assets | | 495,085 | | | 487,219 | |

| | | | |

| Capitalized software, leasehold improvements and equipment, net | | 79,564 | | | 109,527 | |

| Goodwill | | 883,440 | | | 886,047 | |

| Intangible assets, net | | 167,662 | | | 170,773 | |

| Deferred income taxes | | 169,073 | | | 148,183 | |

| Other non-current assets, net | | 35,911 | | | 54,466 | |

| | | | |

| TOTAL ASSETS | | $ | 1,830,735 | | | $ | 1,856,215 | |

| | | | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | |

| LIABILITIES: | | | | |

| | | | |

| Accounts payable | | $ | 18,319 | | | $ | 29,467 | |

| Deferred revenue | | 42,008 | | | 49,859 | |

| Accrued expenses and other current liabilities | | 171,351 | | | 179,329 | |

| | | | |

| Total current liabilities | | 231,678 | | | 258,655 | |

| | | | |

| Long-term debt, net | | 496,840 | | | 496,047 | |

| | | | |

| Deferred income taxes | | 1,500 | | | 2,739 | |

| Other long-term liabilities | | 37,916 | | | 54,266 | |

| | | | |

| | | | |

| | | | |

| | | | |

| Commitments and contingencies | | | | |

| | | | |

| SHAREHOLDERS’ EQUITY: | | | | |

| Class A common stock | | 113 | | | 107 | |

| Class B convertible common stock | | 422 | | | 422 | |

| Class C common stock | | — | | | — | |

| Additional paid-in capital | | 1,465,640 | | | 1,447,353 | |

| Accumulated deficit | | (195,015) | | | (231,019) | |

| Accumulated other comprehensive (loss) income | | (2,495) | | | 1,187 | |

| Treasury stock | | (205,864) | | | (177,283) | |

| Total Angi Inc. shareholders’ equity | | 1,062,801 | | | 1,040,767 | |

| Noncontrolling interests | | — | | | 3,741 | |

| Total shareholders’ equity | | 1,062,801 | | | 1,044,508 | |

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | | $ | 1,830,735 | | | $ | 1,856,215 | |

| | | | | | | | | | | | | | |

| ANGI INC. CONSOLIDATED STATEMENT OF CASH FLOWS (UNAUDITED) |

| ($ in thousands) |

| | Years Ended December 31, |

| | 2024 | | 2023 |

| | |

| Cash flows from operating activities attributable to continuing operations: | | | | |

| Net earnings (loss) | | $ | 36,848 | | | $ | (40,311) | |

| Loss from discontinued operations, net of tax | | — | | | (10,264) | |

| Net earnings (loss) attributable to continuing operations | | 36,848 | | | (30,047) | |

| Adjustments to reconcile net earnings (loss) to net cash provided by operating activities attributable to continuing operations: | | | | |

| Depreciation | | 86,052 | | | 93,604 | |

| Provision for credit losses | | 57,261 | | | 79,385 | |

| Stock-based compensation expense | | 34,778 | | | 43,414 | |

| Non-cash lease expense (including impairment of right-of-use assets) | | 16,010 | | | 11,878 | |

| Amortization of intangibles | | 2,600 | | | 7,958 | |

| Deferred income taxes | | (23,951) | | | (10,009) | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Other adjustments, net | | (433) | | | (1,059) | |

| Changes in assets and liabilities, net of effects of dispositions: | | | | |

| Accounts receivable | | (45,385) | | | (58,168) | |

| Other assets | | 28,932 | | | (13,852) | |

| Accounts payable and other liabilities | | (601) | | | (8,045) | |

| Operating lease liabilities | | (19,376) | | | (20,678) | |

| Income taxes payable and receivable | | (9,070) | | | 158 | |

| Deferred revenue | | (7,724) | | | (355) | |

| Net cash provided by operating activities attributable to continuing operations | | 155,941 | | | 94,184 | |

| | | | |

| Cash flows from investing activities attributable to continuing operations: | | | | |

| | | | |

| Capital expenditures | | (50,492) | | | (47,780) | |

| Purchases of marketable debt securities | | — | | | (12,362) | |

| Proceeds from maturities of marketable debt securities | | — | | | 12,500 | |

| Net proceeds from the sale of a business | | — | | | 1,000 | |

| Proceeds from sales of fixed assets | | 81 | | | 85 | |

| | | | |

| Net cash used in investing activities attributable to continuing operations | | (50,411) | | | (46,557) | |

| | | | |

| Cash flows from financing activities attributable to continuing operations: | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Purchases of treasury stock | | (28,605) | | | (10,932) | |

| | | | |

| Purchase of noncontrolling interests | | (16,019) | | | — | |

| Withholding taxes paid on behalf of employees on net settled stock-based awards | | (7,578) | | | (5,994) | |

| Distribution to IAC pursuant to the tax sharing agreement | | (1,548) | | | — | |

| Other, net | | (9) | | | (57) | |

| Net cash used in financing activities attributable to continuing operations | | (53,759) | | | (16,983) | |

| | | | |

| Total cash provided by continuing operations | | 51,771 | | | 30,644 | |

| Net cash provided by operating activities attributable to discontinued operations | | — | | | 10,661 | |

| Net cash provided by investing activities attributable to discontinued operations | | — | | | 325 | |

| | | | |

| Total cash provided by discontinued operations | | — | | | 10,986 | |

| Effect of exchange rate changes on cash and cash equivalents and restricted cash | | 473 | | | 535 | |

| Net increase in cash and cash equivalents and restricted cash | | 52,244 | | | 42,165 | |

| Cash and cash equivalents and restricted cash at beginning of period | | 364,301 | | | 322,136 | |

| Cash and cash equivalents and restricted cash at end of period | | $ | 416,545 | | | $ | 364,301 | |

RECONCILIATIONS OF GAAP TO NON-GAAP MEASURES

($ in millions; rounding differences may occur)

RECONCILIATION OF OPERATING INCOME (LOSS) TO ADJUSTED EBITDA

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the three months ended December 31, 2024 |

| | Operating Income (Loss) | | Stock-based Compensation Expense | | Depreciation | | Amortization of Intangibles | | Adjusted EBITDA |

| Ads and Leads | | $ | 28.7 | | | $ | 2.1 | | | $ | 17.1 | | | $ | — | | | $ | 47.9 | |

| Services | | (7.1) | | | 0.6 | | | 2.5 | | | 2.6 | | | (1.4) | |

| Other | | (18.8) | | | 3.6 | | | – | | | – | | | (15.2) | |

| Total Domestic | | 2.7 | | | 6.4 | | | 19.6 | | | 2.6 | | | 31.3 | |

| International | | (0.6) | | | 0.3 | | | 0.8 | | | – | | | 0.5 | |

| Total | | $ | 2.2 | | | $ | 6.7 | | | $ | 20.3 | | | $ | 2.6 | | | $ | 31.8 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the three months ended December 31, 2023 |

| | Operating Income (Loss) | | Stock-based Compensation Expense | | Depreciation | | Amortization of Intangibles | | Adjusted EBITDA |

| Ads and Leads | | $ | 23.7 | | | $ | 6.3 | | | $ | 17.2 | | | $ | – | | | $ | 47.2 | |

| Services | | (1.9) | | | 1.1 | | | 5.9 | | | – | | | 5.1 | |

| Other | | (15.0) | | | 2.3 | | | – | | | – | | | (12.7) | |

| Total Domestic | | 6.7 | | | 9.7 | | | 23.1 | | | – | | | 39.5 | |

| International | | 0.9 | | | 0.1 | | | 0.8 | | | – | | | 1.8 | |

| Total | | $ | 7.6 | | | $ | 9.8 | | | $ | 23.9 | | | $ | – | | | $ | 41.4 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the twelve months ended December 31, 2024 |

| | Operating Income (Loss) | | Stock-based Compensation Expense | | Depreciation | | | Amortization of Intangibles | | Adjusted EBITDA |

| Ads and Leads | | $ | 94.4 | | | $ | 20.4 | | | $ | 65.5 | | | | $ | — | | | $ | 180.3 | |

| Services | | (19.4) | | | 3.8 | | | 17.5 | | | | 2.6 | | | 4.5 | |

| Other | | (64.8) | | | 9.4 | | | — | | | | — | | | (55.4) | |

| Total Domestic | | 10.1 | | | 33.7 | | | 83.0 | | | | 2.6 | | | 129.4 | |

| International | | 11.7 | | | 1.1 | | | 3.1 | | | | — | | | 16.0 | |

| Total | | $ | 21.9 | | | $ | 34.8 | | | $ | 86.1 | | | | $ | 2.6 | | | $ | 145.3 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the twelve months ended December 31, 2023 |

| | Operating Income (Loss) | | | Stock-based Compensation Expense | | | Depreciation | | Amortization of Intangibles | | Adjusted EBITDA |

| Ads and Leads | | $ | 50.0 | | | | $ | 23.1 | | | | $ | 66.2 | | | $ | 8.0 | | | $ | 147.4 | |

| Services | | (23.4) | | | | 7.6 | | | | 24.0 | | | — | | | 8.1 | |

| Other | | (61.4) | | | | 11.3 | | | | — | | | — | | | (50.1) | |

| Total Domestic | | (34.8) | | | | 42.0 | | | | 90.2 | | | 8.0 | | | 105.4 | |

| International | | 8.3 | | | | 1.4 | | | | 3.4 | | | — | | | 13.1 | |

| Total | | $ | (26.5) | | | | $ | 43.4 | | | | $ | 93.6 | | | $ | 8.0 | | | $ | 118.5 | |

RECONCILIATION OF Q1 AND FY 2025 OPERATING INCOME TO ADJUSTED EBITDA OUTLOOK

| | | | | | | | | | | |

| | 2025 Outlook |

| ($ in millions) | | Q1 2025 | FY 2025 |

| Operating income | | $0 | $25-$60 |

| Depreciation | | 25-20 | 90-80 |

| Stock-based compensation expense (a) | | (5)-0 | 20-10 |

| Adjusted EBITDA | | Over $20 | $135-$150 |

(a) Stock-based compensation expense reflects the reversal in Q1 2025 of approximately $10 million of previously recognized stock-based compensation expense in connection with the Employment Transition Agreement, entered into on January 13, 2025 between IAC and Mr. Levin. The expense was previously recognized from October 10, 2022 through April 8, 2024 when Mr. Levin served as CEO of the Company.

ANGI INC. PRINCIPLES OF FINANCIAL REPORTING

Angi Inc. reports Adjusted EBITDA and Free Cash Flow, which are supplemental measures to U.S. generally accepted accounting principles (“GAAP”). Adjusted EBITDA is considered our primary segment measure of profitability and is one of the metrics, along with Free Cash Flow, by which we evaluate the performance of our businesses and our internal budgets are based and may also impact management compensation. We believe that investors should have access to, and we are obligated to provide, the same set of tools that we use in analyzing our results. These non-GAAP measures should be considered in addition to results prepared in accordance with GAAP but should not be considered a substitute for or superior to GAAP results. Angi Inc. endeavors to compensate for the limitations of the non-GAAP measures presented by providing the comparable GAAP measures with equal or greater prominence and descriptions of the reconciling items, including quantifying such items, to derive the non-GAAP measures. We encourage investors to examine the reconciling adjustments between the GAAP and non-GAAP measures, which are included in this release. Interim results are not necessarily indicative of the results that may be expected for a full year.

Definitions of Non-GAAP Measures

Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (Adjusted EBITDA) is defined as operating income excluding: (1) stock-based compensation expense; (2) depreciation; and (3) acquisition-related items consisting of amortization of intangible assets and impairments of goodwill and intangible assets, if applicable. We believe this measure is useful for analysts and investors as this measure allows a more meaningful comparison between our performance and that of our competitors. Adjusted EBITDA has certain limitations because it excludes the impact of these expenses.

Free Cash Flow is defined as net cash provided by operating activities attributable to continuing operations, less capital expenditures. We believe Free Cash Flow is useful to analysts and investors because it represents the cash that our operating businesses generate, before taking into account non-operational cash movements. Free Cash Flow has certain limitations in that it does not represent the total increase or decrease in the cash balance for the period, nor does it represent the residual cash flow for discretionary expenditures. For example, it does not take into account mandatory debt service requirements. Therefore, we think it is important to evaluate Free Cash Flow along with our consolidated statement of cash flows.

Non-Cash Expenses That Are Excluded from Adjusted EBITDA

Stock-based compensation expense consists of expense associated restricted stock units ("RSUs"), stock appreciation rights ("SARs"), stock options and performance-based RSUs and market-based awards. These expenses are not paid in cash, and we view the economic costs of stock-based awards to be the dilution to our share base; we also include the related shares in our fully diluted shares outstanding for GAAP earnings per share using the treasury stock method. Performance-based RSUs and market-based awards are included only to the extent the applicable performance or market condition(s) have been met (assuming the end of the reporting period is the end of the contingency period). The Company is currently settling all stock-based awards on a net basis and remits the required tax-withholding amounts from its current funds.

Please see page 6 for a summary of our dilutive securities as of February 7, 2025, and a description of the calculation methodology.

Depreciation is a non-cash expense relating to our capitalized software, leasehold improvements and equipment and is computed using the straight-line method to allocate the cost of depreciable assets to operations over their estimated useful lives, or, in the case of leasehold improvements, the lease term, if shorter.

Amortization of intangible assets and impairments of goodwill and intangible assets are non-cash expenses related primarily to acquisitions. At the time of an acquisition, the identifiable definite-lived intangible assets of the acquired company, such as professional relationships, technology and trade names, are valued and amortized over their estimated lives. Value is also assigned to acquired indefinite-lived intangible assets, which comprise trade names and trademarks, and goodwill that are not subject to amortization. An impairment is recorded when the carrying value of an intangible asset or goodwill exceeds its fair value. We believe that intangible assets represent costs incurred by the acquired company to build value prior to acquisition and the related amortization and impairments of intangible assets or goodwill, if applicable, are not ongoing costs of doing business.

Metric Definitions

Ads and Leads Revenue - Primarily comprises domestic revenue from consumer connection revenue for consumer matches, revenue from professionals under contract for advertising and membership subscription revenue from professionals and consumers.

Services Revenue – Primarily comprises domestic revenue from pre-priced offerings by which the consumer requests services through a Company platform and the Company connects them with a professional to perform the service.

International Revenue – Primarily comprises revenue generated within the International segment (consisting of businesses in Europe and Canada), including consumer connection revenue for consumer matches and membership subscription revenue from professionals.

Other – Reflects costs for corporate initiatives, shared costs, such as executive and public company costs, and other expenses not allocated to the operating segments.

Service Requests - Reflects (i) fully completed and submitted domestic service requests for connections with Ads and Leads professionals, (ii) contacts to Ads and Leads professionals generated via the professional directory from unique users in unique categories (such that multiple contacts from the same user in the same category in the same day are counted as one Service Request) and (iii) requests to book Services jobs in the period.

Monetized Transactions – Reflects (i) Service Requests that are matched to a paying Ads and Leads professional in the period and (ii) completed and in-process Services jobs in the period; a single Service Request can result in multiple monetized transactions.

Monetized Transactions per Service Request – Monetized Transactions divided by Service Requests.

Transacting Professionals (formerly known as Transacting Service Professionals) – The number of (i) Ads and Leads professionals that paid for consumer matches or advertising and (ii) Services professionals that performed a Services job, during the most recent quarter.

OTHER INFORMATION

Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995

This press release and our conference call, which will be held at 8:30 a.m. Eastern Time on Wednesday, February 12, 2025, may contain "forward‑looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. The use of words such as "anticipates," "estimates," "expects," "plans" and "believes," among others, generally identify forward-looking statements. These forward-looking statements include, among others, statements relating to: the future financial performance of the Company and its businesses, business prospects and strategy, the contemplated spin-off of IAC's ownership in the Company and anticipated benefits, anticipated trends and prospects in the home services industry and other similar matters. Actual results could differ materially from those contained in these forward-looking statements for a variety of reasons, including, among others: (i) the continued migration of the home services market online, (ii) our ability to market our various products and services in a successful and cost-effective manner, (iii) the continued prominence of the display of links to websites offering our products and services in search results, (iv) our ability to expand our pre-priced offerings, while balancing the overall mix of service requests and directory services on Angi platforms, (v) our ability to establish and maintain relationships with quality and trustworthy professionals, (vi) our continued ability to develop and monetize versions of our products and services for mobile and other digital devices, (vii) our ability to access, share, use and protect the personal data of consumers, (viii) our continued ability to communicate with consumers and professionals via e-mail (or other sufficient means), (ix) our ability to continue to generate leads for professionals given changing requirements applicable to certain communications with consumers, (x) any challenge to the contractor classification or employment status of our professionals, (xi) our ability to compete, (xii) unstable market and economic conditions (particularly those that adversely impact advertising spending levels and consumer confidence and spending behavior), either generally and/or in any of the markets in which our businesses operate, as well as geopolitical conflicts, (xiii) our ability to maintain and/or enhance our various brands, (xiv) our ability to protect our systems, technology and infrastructure from cyberattacks (including cyberattacks experienced by third parties who whom we do business), (xv) the occurrence of data security breaches and/or fraud, (xvi) increased liabilities and costs related to the processing, storage, use and disclosure of personal and confidential user information, (xvii) the integrity, quality, efficiency and scalability of our systems, technology and infrastructures (and those of third parties with whom we do business), (xviii) changes in key personnel, (xix) various risks related to our relationship with IAC, (xx) our ability to generate sufficient cash to service our indebtedness, (xxi) certain risks related to ownership of our Class A common stock and (xxii) risks related to the proposed spin-off of IAC's ownership in Angi Inc. Certain of these and other risks and uncertainties are discussed in Angi Inc.’s filings with the Securities and Exchange Commission (the "SEC"), including the most recent Annual Report on Form 10-K filed with the SEC on February 29, 2024, and subsequent reports that Angi Inc. files with the SEC. Other unknown or unpredictable factors that could also adversely affect Angi Inc.’s business, financial condition and results of operations may arise from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those expressed in any forward-looking statements we may make. Except as required by law, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of such statements. You should, therefore, not rely on these forward-looking statements as representing our views as of any date subsequent to the date of this press release.

About Angi Inc.

Angi (NASDAQ: ANGI) helps homeowners get home projects done well and helps home professionals grow their business. We started in 1995 with a simple goal to help people find skilled home pros in their area. Now more than 25 years later, we've evolved to help people with everything from finding, booking and hiring a skilled pro, to researching costs, finding inspiration and discovering project possibilities. With an extensive nationwide network of skilled home pros, Angi has helped more than 150 million people maintain, repair, renovate and improve their homes and has helped hundreds of thousands of small local businesses grow.

Contact Us

IAC/Angi Inc. Investor Relations

Mark Schneider

(212) 314-7400

Angi Inc. Corporate Communications

Emily Do

(303) 963-8352

IAC Corporate Communications

Valerie Combs

(212) 314-7251

Angi Inc.

3601 Walnut Street, Denver, CO 80205 (303) 963-7200 http://www.angi.com

v3.25.0.1

Cover

|

Feb. 11, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 11, 2025

|

| Entity Registrant Name |

Angi Inc.

|

| Entity File Number |

001-38220

|

| Entity Tax Identification Number |

82-1204801

|

| Entity Address, Address Line One |

3601 Walnut Street,

|

| Entity Address, Address Line Two |

Suite 700

|

| Entity Address, Postal Zip Code |

80205

|

| Entity Address, State or Province |

CO

|

| Entity Address, City or Town |

Denver,

|

| City Area Code |

303

|

| Local Phone Number |

963-7200

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A Common Stock, par value $0.001

|

| Trading Symbol |

ANGI

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001705110

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

DE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

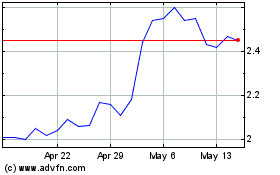

Angi (NASDAQ:ANGI)

Historical Stock Chart

From Jan 2025 to Feb 2025

Angi (NASDAQ:ANGI)

Historical Stock Chart

From Feb 2024 to Feb 2025