Bone Biologics Announces Pricing of $2.0 Million Public Offering

March 04 2024 - 8:15AM

Business Wire

Bone Biologics Corporation (“Bone Biologics” or the “Company”)

(Nasdaq: BBLG, BBLGW), a developer of orthobiologic products for

spine fusion markets, today announced the pricing of its public

offering of an aggregate of 781,251 shares of its common stock (or

common stock equivalents in lieu thereof) and warrants to purchase

up to 781,251 shares of common stock, at a public offering price of

$2.56 per share (or common stock equivalent in lieu thereof) and

accompanying warrant. The warrants will have an exercise price of

$2.43 per share, will be exercisable immediately upon issuance and

will expire five years after the date of issuance. The closing of

the offering is expected to occur on or about March 6, 2024,

subject to the satisfaction of customary closing conditions.

H.C. Wainwright & Co. is acting as the exclusive placement

agent for the offering.

Total gross proceeds to the Company from the offering, before

deducting the placement agent’s fees and other offering expenses,

are expected to be approximately $2.0 million. The Company intends

to use the net proceeds from this offering to fund clinical trials,

maintain and extend its patent portfolio, and for working capital

and other general corporate purposes.

The securities described above are being offered pursuant to a

registration statement on Form S-1 (File No. 333-276771), which was

declared effective by the Securities and Exchange Commission (the

“SEC”) on March 4, 2024. The offering is being made only by means

of a prospectus forming part of the effective registration

statement relating to the offering. A preliminary prospectus

relating to the offering has been filed with the SEC and is

available on the SEC’s website at http://www.sec.gov. Electronic

copies of the final prospectus, when available, may be obtained on

the SEC’s website at http://www.sec.gov and may also be obtained,

when available, by contacting H.C. Wainwright & Co., LLC at 430

Park Avenue, 3rd Floor, New York, NY 10022, by phone at (212)

856-5711 or e-mail at placements@hcwco.com.

This press release shall not constitute an offer to sell or a

solicitation of an offer to buy any of the securities described

herein, nor shall there be any sale of these securities in any

state or other jurisdiction in which such offer, solicitation or

sale would be unlawful prior to the registration or qualification

under the securities laws of any such state or other

jurisdiction.

About Bone Biologics

Bone Biologics was founded to pursue regenerative medicine for

bone. The Company is undertaking work with select strategic

partners that builds on the preclinical research of the Nell-1

protein. Bone Biologics is focusing development efforts for its

bone graft substitute product on bone regeneration in spinal fusion

procedures, while additionally having rights to trauma and

osteoporosis applications.

Forward-Looking Statements:

This press release contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. These forward-looking statements include all statements,

other than statements of historical fact, regarding the Company’s

current views and assumptions with respect to future events

regarding its business, including statements with respect to its

plans, assumptions, expectations, beliefs and objectives with

respect to the completion of the offering, the satisfaction of

customary closing conditions related to the offering, the intended

use of proceeds from the offering, product development, clinical

studies, clinical and regulatory timelines, market opportunity,

competitive position, business strategies, potential growth

opportunities, market and other conditions and other statements

that are predictive in nature.

These statements are generally identified by the use of such

words as “may,” “would,” “expect,” “intend,” “plan,” “will,”

“potential” and similar statements of a future or forward-looking

nature. Readers are cautioned that any forward-looking information

provided by the Company or on its behalf is not a guarantee of

future performance. Actual results may differ materially from those

contained in these forward-looking statements as a result of

various factors disclosed in filings with the SEC, including the

“Risk Factors” section of the Company’s Annual Report on Form 10-K

filed with the SEC on February 21, 2024 and the preliminary

prospectus filed with the SEC in connection with the public

offering. All forward-looking statements speak only as of the date

on which they are made, and the Company undertakes no duty to

update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise, except to

the extent required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240304119263/en/

LHA Investor Relations Kim Sutton Golodetz 212-838-3777

kgolodetz@lhai.com

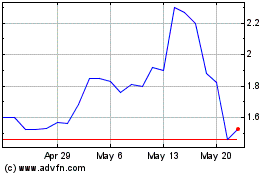

Bone Biologics (NASDAQ:BBLG)

Historical Stock Chart

From Oct 2024 to Nov 2024

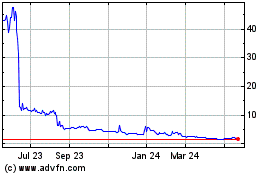

Bone Biologics (NASDAQ:BBLG)

Historical Stock Chart

From Nov 2023 to Nov 2024