Bitfarms Ltd. (NASDAQ: BITF // TSXV: BITF), a global Bitcoin

self-mining company, secured a $100 million credit facility with

Galaxy Digital LLC backed by Bitcoin (BTC).

“Bitcoin mining is a highly capital-intensive

industry. We seek to strike a balance between maximizing financing

flexibility and minimizing our overall cost of capital,” said Jeff

Lucas, CFO of Bitfarms. “Our new $100 million BTC credit facility

adds another component to our diversified financing strategy and

contributes significant non-dilutive capital to fund our global

growth initiatives, which include four farms with 298 Megawatts

mining capacity under construction.”

“With over 3,300 BTC presently held in treasury,

we are leveraging the value of our BTC holdings while increasing

working capital flexibility. We plan to utilize these funds for

general corporate purposes in support of our goals of achieving

hash rates of 3 Exahash per second (EH/s) by March 31, 2022 and 8

EH/s by December 31, 2022, as well as future miner purchases,”

added Lucas.

$100 Million Bitcoin-backed Credit

Facility

On December 30, 2021, Bitfarms secured a $100

million BTC-backed credit facility with Galaxy Digital LLC, an

affiliate of Galaxy Digital Holdings Ltd, a provider of blockchain

and cryptocurrency financial services for institutions. This is a

revolving, multi-draw credit facility that automatically renews

annually. Bitfarms has made an initial $60 million draw with a

six-month term at an interest rate of 10.75% per annum. Anticipated

additional draws over the next few months, which would bring the

total borrowings to $100 million, are subject to customary TSX

Venture Exchange approval and would be expected to bear the same

interest rate and to be due on the same date as the initial

draw.

About Bitfarms Ltd.

Founded in 2017, Bitfarms is a global Bitcoin

self-mining company, running vertically integrated mining

operations with onsite technical repair, proprietary data analytics

and Company-owned electrical engineering and installation services

to deliver high operational performance and uptime.

Having demonstrated rapid growth and stellar

operations, Bitfarms became the first Bitcoin mining company to

complete its long form prospectus with the Ontario Securities

Commission and started trading on the TSX-V in July 2019. On

February 24, 2021, Bitfarms was honoured to be announced as a

Rising Star by the TSX-V. On June 21, 2021, Bitfarms started

trading on the Nasdaq Stock Market.

Bitfarms has a diversified production platform

with five industrial scale facilities located in Québec and one in

Washington state. Each facility is over 99% powered with

environmentally friendly hydro power and secured with long-term

power contracts. Bitfarms is currently the only publicly traded

pure-play mining company audited by a Big Four accounting firm.

To learn more about Bitfarms’ events,

developments, and online communities:

Website: www.bitfarms.com

https://www.facebook.com/bitfarms/https://twitter.com/Bitfarms_iohttps://www.instagram.com/bitfarms/https://www.linkedin.com/company/bitfarms/

Cautionary Statement

Trading in the securities of the Company should

be considered highly speculative. No stock exchange, securities

commission or other regulatory authority has approved or

disapproved the information contained herein. Neither the TSX

Venture Exchange nor its Regulation Services Provider (as that term

is defined in the policies of the TSX Venture Exchange), Nasdaq, or

any other securities exchange or regulatory authority accepts

responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release contains certain

“forward-looking information” and “forward-looking statements”

(collectively, “forward-looking information”) that are based on

expectations, estimates and projections as at the date of this news

release. The information in this release regarding expectations in

respect of the Company’s anticipated future borrowings under the

new credit facility and use of debt to enhance its capital

structure, its expansion plans, anticipated mining capacity and

about other future plans and objectives of the Company are

forward-looking information. Other forward-looking information

includes, but is not limited to, information concerning: the

intentions, plans and future actions of the Company, as well as

Bitfarms’ ability to successfully mine digital currency, revenue

increasing as currently anticipated, the ability to profitably

liquidate current and future digital currency inventory, volatility

of network difficulty and digital currency prices and the potential

resulting significant negative impact on the Company’s operations,

the construction and operation of expanded blockchain

infrastructure as currently planned, and the regulatory environment

for cryptocurrency in the applicable jurisdictions.

Any statements that involve discussions with

respect to predictions, expectations, beliefs, plans, projections,

objectives, assumptions, future events or performance (often but

not always using phrases such as “expects”, or “does not expect”,

“is expected”, “anticipates” or “does not anticipate”, “plans”,

“budget”, “scheduled”, “forecasts”, “estimates”, “believes” or

“intends” or variations of such words and phrases or stating that

certain actions, events or results “may” or “could”, “would”,

“might” or “will” be taken to occur or be achieved) are not

statements of historical fact and may be forward-looking

information and are intended to identify forward-looking

information.

This forward-looking information is based on

assumptions and estimates of management of the Company at the time

they were made, and involves known and unknown risks, uncertainties

and other factors which may cause the actual results, performance

or achievements of the Company to be materially different from any

future results, performance or achievements expressed or implied by

such forward-looking information. Such factors include, among

others, risks relating to: discretion of Galaxy Digital LLC in

respect of future borrowings under the new credit facility

(including as to the terms of such borrowings); the global economic

climate; dilution; the Company’s limited operating history; future

capital needs and uncertainty of additional financing including the

Company’s ability to utilize the Company’s at-the-market offering

(the “ATM Program”) and the prices at which the Company may sell

Common Shares in the ATM Program as well as capital market

conditions in general; the competitive nature of the industry;

currency exchange risks; the need for the Company to manage its

planned growth and expansion; the effects of product development

and need for continued technology change; protection of proprietary

rights; the effect of government regulation and compliance on the

Company and the industry; network security risks; the ability of

the Company to maintain properly working systems; reliance on key

personnel; global economic and financial market deterioration

impeding access to capital or increasing the cost of capital;

dilution in relation to the ATM Program and from other equity

issuances; and volatile securities markets impacting security

pricing unrelated to operating performance. In addition, particular

factors that could impact future results of the business of

Bitfarms include, but are not limited to: the construction and

operation of blockchain infrastructure may not occur as currently

planned, or at all; expansion may not materialize as currently

anticipated, or at all; the digital currency market; the ability to

successfully mine digital currency; revenue may not increase as

currently anticipated, or at all; it may not be possible to

profitably liquidate the current digital currency inventory, or at

all; a decline in digital currency prices may have a significant

negative impact on operations; an increase in network difficulty

may have a significant negative impact on operations; the

volatility of digital currency prices; the anticipated growth and

sustainability of hydroelectricity for the purposes of

cryptocurrency mining in the applicable jurisdictions, the ability

to complete current and future financings, any regulations or laws

that will prevent Bitfarms from operating its business; historical

prices of digital currencies and the ability to mine digital

currencies that will be consistent with historical prices; an

inability to predict and counteract the effects of COVID-19 on the

business of the Company, including but not limited to the effects

of COVID-19 on the price of digital currencies, capital market

conditions, restriction on labour and international travel and

supply chains; and, the adoption or expansion of any regulation or

law that will prevent Bitfarms from operating its business, or make

it more costly to do so. For further information concerning these

and other risks and uncertainties, refer to the Company’s filings

on www.SEDAR.com including the annual information form for the year

ended December 31, 2020, filed on April 7, 2021. The Company has

also assumed that no significant events occur outside of Bitfarms’

normal course of business. Although the Company has attempted to

identify important factors that could cause actual results to

differ materially from those expressed in forward-looking

statements, there may be other factors that cause results not to be

as anticipated, estimated or intended. There can be no assurance

that such statements will prove to be accurate as actual results

and future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on any forward-looking information. The Company undertakes

no obligation to revise or update any forward-looking information

other than as required by law.

Contacts

Investor Relations:

LHA Investor RelationsDavid Barnard+1 415 433

3777Investors@bitfarms.com

US Media:

YAP GlobalMia Grodsky, Account

Managermia@yapglobal.com

Québec Media:

Ryan Affaires publiques Valérie Pomerleau,

Public Affairs and Communicationsvalerie@ryanap.com

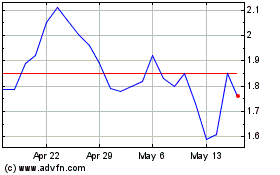

Bitfarms (NASDAQ:BITF)

Historical Stock Chart

From Oct 2024 to Nov 2024

Bitfarms (NASDAQ:BITF)

Historical Stock Chart

From Nov 2023 to Nov 2024