Regulatory News:

Carmila (Paris:CARM):

Acquisition of Galimmo completed on 1 July 2024

- Total investment of €300 million at a 38% discount to EPRA

NDV

- Immediately accretive (5% annual contribution to recurring

earnings and EPRA NDV)

Excellent financial and operating performance

- Recurring earnings per share at €1.67, up 4.5% versus

2023

- Net rental income of €370.7 million, with sustained growth

of 8.3% compared with 2023 (4.2% on an organic basis)

- Very good leasing momentum with 942 leases signed and

positive reversion of 3.0%

- Financial occupancy at a record high 96.7%1, up 0.1

percentage points

- Specialty Leasing and Pop-up Store revenue at €18.2 million

(up 6.9% like for like)

- Record high collection rate of 97.0%

- Retailer sales up 1.8% versus 2023

- Attributable net income (IFRS) of €313.8 million

Positive trend in portfolio value

- Portfolio value of €6.7 billion, up 13.0% on 2023 (up 0.9%

on a like-for-like basis)

- Net Initial Yield of 6.57% (around 336 basis points above

10-year French government bond yield)

- Sharp rise in EPRA NTA per share to €26.12 at end-2024 (up

8.1%), in connection with the integration of Galimmo

Solid financial structure

- Net-debt-to-EBITDA ratio of 7.4x

- EPRA LTV ratio including transfer taxes2 of 38.9% at

end-2024

- Inaugural Green Bond launched at attractive terms in

September 2024 (€300 million maturing in 2032 with a fixed coupon

of 3.875%)

- No maturities to be refinanced before May 2027

- S&P rating maintained at BBB with a stable

outlook

Robust non-financial performance

- 54% reduction in Scopes 1 & 2 carbon emissions compared

with 2019 (in line with the net zero target for 2030)

- Strong improvement in GRESB rating3 (Green Star:

91/100)

2024 dividend and 2025 outlook

- Proposed dividend of €1.25 per share (up 4.2% on 2023)

4

- Recurring earnings per share expected in 2025: €1.75 (up

4.8%)

- Launch of a further €10 million share buyback programme in

2025

Marie Cheval, Chair and Chief Executive Officer of Carmila

commented:

"The successful implementation of the Building Sustainable

Growth plan and the outstanding commitment of our employees confirm

Carmila’s ability to achieve sustained growth in recurring

earnings, supported by strong results in 2024.

Carmila posted a remarkable operating performance, with strong

momentum in retailer sales and record-high occupancy. Carmila's

shopping centres are go-to destinations when it comes to capturing

and transforming the latest retail trends.

The acquisition of Galimmo has consolidated Carmila's position

as Europe's third-largest listed operator of shopping centres.

Backed by a solid balance sheet and dynamic capital allocation

policy, Carmila is well positioned to seize future

opportunities.”

Key financial highlights

2024

2023

Change

LfL change

Gross rental income (€m)

404.1

368.6

+9.6%

Net rental income (€m)

370.7

342.4

+8.3%

+4.2%

EBITDA (€m)

313.8

292.4

+7.3%

Recurring earnings (€m)

236.9

228.2

+3.8%

Recurring earnings per share (€)

1.67

1.60

+4.5%

2024

2023

Change

LfL change

Property portfolio valuation including

transfer taxes (€m)

6,652.1

5,884.5

+13.0%

+0.9%

Net Initial Yield

6.57%

6.42%

+15 bps

EPRA LTV ratio (including RETTs1)

38.9%

36.6%

+230 bps

EPRA NTA2 per share (in euros)

26.12

24.17

+8.1%

1. 2024 activity

Excellent leasing momentum: 942 leases signed in 2024

Carmila saw strong leasing momentum in 2024, with 942 leases

signed for total minimum guaranteed rent of €54.3 million (up 23.0%

year on year), or 15% of the rental base. Reversion was a positive

3.0% on average over the year, on top of indexation. This includes

new leases on vacant premises and renewals.

Robust leasing activity reflects Carmila's proactive strategy in

terms of the merchandise mix, in particular:

- 90 new retailers have chosen to set up in a Carmila centre for

the first time (LEGO, Rossmann, Signorizza, etc.);

- leases signed with ready-to-wear flagship stores (Zara, Mango,

Kiabi);

- consolidation of our Healthcare offering with new pharmacies

and pharmacy extensions as well as a wide range of opticians

(GrandOptical, Optic 2000, Krys and Alain Afflelou);

- a dynamic beauty sector (Adopt', Rituals);

- continued expansion of discount chains (Action, Normal,

Tedi);

- renewal of the Food and Restaurants offering, with new concepts

such as Krispy Kreme in France and Liao Pastel in Spain, along with

a mix of international brands (KFC, Pitaya, O’Tacos) and regional

concepts;

- development of the Sports segment with Decathlon, Intersport,

JD Sport, Courir and fitness centres.

Financial occupancy came out at an all-time high of 96.7%7 at

end-2024, serving to illustrate the appeal of Carmila shopping

centres and their ability to seize the latest retail trends.

Temporary retail activity is following the same trend, with

revenues from Specialty Leasing at €18.2 million, up 15.9% on a

reported basis (up 6.9% like for like). Carmila has developed

expertise in rapidly deploying pop-up concepts that deliver

innovation and an enhanced customer experience.

Retailer sales up 1.8% versus 2023

Retailer sales in Carmila shopping centres for 2024 were up 1.8%

year on year, with footfall up slightly by 0.6%, underpinned by the

strength of Carrefour hypermarkets.

Business in Spain was particularly buoyant, with sales up 3.2%,

reaffirming the geographical positioning and category of Carmila's

centres, which are benefiting from the positive trend in

tourism.

In 2024, the average occupancy cost ratio of Carmila's tenants

was 10.5%, remaining stable versus 2023.

2. Completion of the Galimmo acquisition

Acquisition of Galimmo

On 1 July 2024, Carmila finalised the closing of the acquisition

of 93% of Galimmo SCA's share capital.

On 25 July 2024, Carmila acquired all shares held by Primonial

Capimmo, increasing its stake in Galimmo SCA to 99.8%.

On 31 October 2024, Carmila completed a simplified public tender

offer with a squeeze-out, increasing its stake in the company to

100%.

Carmila's total investment amounts to €300 million, at an

average acquisition price of €9.22 per share, and a 38% discount to

EPRA NDV.

Galimmo's 51 assets, mostly located in north-east France, were

valued at €724 million at end-December 2024. The geographic

complementarity of Carmila and Galimmo’s portfolios provides an

opportunity to roll out the powerful Carmila ecosystem across this

new scope.

The transaction offers a compelling value proposition to

Carmila's shareholders, with an implied acquisition yield of 9.8%

on Galimmo's portfolio and accretion of both net asset value per

share (up 5% pro forma) as well as recurring EPRA earnings per

share (up 3% before synergies and 5% pro forma after

synergies).

Assessments of the fair value of the assets acquired and

liabilities assumed led to the recognition of negative goodwill of

€155 million in 2024, reflecting the discount between the purchase

price and the fair value of the net assets acquired.

Integration of Galimmo

In the second half of the year, the integration of the Galimmo

teams was successfully completed, with the effective deployment of

Carmila's IT and management systems across the new scope. Galimmo's

integration will generate €5 million in run-rate cost synergies,

fully effective from 2025.

The deployment of Carmila’s value creation strategy for the

assets acquired from Galimmo is under way, and will generate

additional revenue in addition to the cost synergies implemented in

2025. Galimmo's 2024 collection rate has already begun to rise

(96.6% in 2024). From 2025, Carmila will be rolling out its first

agile projects and applying its leasing expertise, which will help

improve Galimmo’s financial occupancy (92.7% in 2024).

3. Financial results

Net rental income on a reported basis: up 8.3% versus

2023

In 2024, net rental income on a reported basis rose by a

sustained 8.3% year on year to €370.7 million.

Organic net rental income growth of 4.2%, included a 3.4%

positive indexation effect.

Changes in the scope of consolidation include the contribution

of Galimmo over six months (+6.7%), the effect of asset disposals

in 2023 (-1.4%), and other miscellaneous effects (-1.2%), including

the effect of non-recurring items in 2023 net rental income

(collection of Covid receivables).

The collection rate stood at an all-time high of 97.0% in 2024,

up 50 basis points compared to 2023.

Recurring earnings per share came out at €1.67, up 4.5% on a

reported basis, compared to 2023

Recurring earnings per share for 2024 came out at €1.67, up

4.5%.

In 2024, Galimmo contributed 1.5% to growth in recurring

earnings per share.

This growth confirms the Building Sustainable Growth strategy

and demonstrates Carmila's ability to grow cash flow in a

predictable and sustainable way.

4. A robust balance sheet ready to seize

opportunities

Portfolio valuation on a reported basis up 13.0%

As of end-December 2024, the gross asset value of Carmila’s

portfolio, including transfer taxes and Galimmo’s assets, came out

at €6.7 billion (an increase of 13.0%).

On a like-for-like basis, the value of the portfolio increased

by 0.9%.

The portfolio capitalisation rate (Net Initial Yield) was up 15

basis points year on year, to 6.57%, and stable in the second

half.

Since 2017, the capitalisation rate has increased by 120 basis

points. The impact of this increase was entirely offset by organic

growth in the rental base. The yield on the portfolio also

represents a substantial premium of around 330 basis points over

the yield on 10-year French government bonds8.

Sharp rise in EPRA NTA per share to €26.12

Carmila’s EPRA NTA per share was €26.12 at end-2024, up

8.1%.

The improvement is attributable to the impact of higher

like-for-like appraisal values restated for investments (-€0.25

per-share impact), recurring earnings for the period (+€1.67),

dividend payments (-€1.20), share buybacks (+€0.06), other changes

(-€0.31) and the acquisition of Galimmo (+€1.98).

Robust balance sheet

Carmila’s financial position is solid, with an LTV ratio

including transfer taxes of 38.9%. The net debt to EBITDA ratio was

7.4x and the interest coverage ratio, 4.5x. Carmila has no

maturities to be refinanced before May 2027. The average debt

maturity was 4.5 years at end-2024.

Inaugural Green bond issue

On 17 September 2024, Carmila issued its inaugural Green Bond

for an amount of €300 million. The bonds have a maturity of just

over seven years and pay an annual coupon of 3.875%. The financing

was raised at a spread of 160 basis points above the benchmark rate

and with no issue premium.

Almost seven times oversubscribed, the issue met with great

success among ESG investors in France and abroad.

The transaction was carried out under Carmila's “Green Bond

Framework” published in October 2022. The funds raised from the

issue will be used to finance assets that meet stringent,

transparent eligibility criteria and have obtained BREEAM "Very

Good" or "Excellent" certification.

On 29 October, Carmila carried out a €100 million tap issue with

the same characteristics as the Green Bond.

S&P rating maintained at BBB with a stable

outlook

On 24 October 2024, S&P confirmed Carmila’s BBB rating with

a “stable” outlook.

Carmila has considerable headroom as regards the rating

thresholds (net debt/EBITDA of 7.4x, i.e., comfortably below the

9.5x threshold for a BBB rating).

5. Implementation of the 2022-2026 strategic plan, Building

Sustainable Growth

Third successful year of the strategic plan

In December 2021, Carmila launched its 2022-2026 strategic plan,

reflecting Carmila's ambition to build sustainable growth, invest

in new business lines and transform its assets. The plan is based

on three pillars:

- Recognised asset transformation expertise, pivot in the

merchandising mix, Carmila’s omnichannel platform and agile

restructuring projects;

- Optimised capital allocation backed by asset disposals to

favour reinvestment in targeted, value-creating acquisitions;

- A vision of long-term value creation reflected in mixed-use

property development projects, partnership with Carrefour,

non-financial strategy focused on carbon neutrality, and new

initiatives to create more value.

Asset transformation

In 2024, 46 agile restructuring projects were completed, with

total Capex of €40 million. In 2025, taking into account the

integration of Galimmo, Carmila plans to expand the budget by €10

million to €50 million, covering around fifty agile projects.

The pivot in the merchandising mix is well under way, with

exposure to the Ready-to-wear segment down to 28% from 34% in 2019,

and an acceleration in the Health and Beauty, Food and Restaurants

and Sports segments.

Optimised capital allocation

Since the start of 2022, Carmila has sold 14 assets for some

€300 million including transfer taxes, representing around 5% of

the portfolio's value. All disposals were conducted at prices in

line with appraisal values.

In 2024, Carmila sold an asset in Beaurains (France) for €5.6

million.

The capital generated by these disposals was reinvested in the

acquisition of Galimmo at a yield of more than 9%.

Carmila will continue this optimised capital allocation strategy

in 2025 and beyond.

A vision of long-term value creation

Mixed-use projects

Evolving regulations and the increasing urbanisation of towns

and cities are driving opportunities for Carmila shopping centres

to be adapted for other purposes (mainly residential).

In 2024, 15 mixed-use development projects adjoining Carmila

shopping centres were under way in collaboration with Carrefour.

Carmila holds a minority stake in the development companies of two

of these projects (Nantes and Sartrouville, in partnership with

Carrefour and Altarea), while the other 13 sites are being

developed jointly by Carrefour and Nexity.

Major projects

Carmila is working on five major retail-led expansion projects

at Orléans, Montesson, Toulouse Labège, Antibes and Terrassa, for a

total Capex estimated at €200 million. Work is scheduled to start

in 2026, representing annual Capex of €50 million from 2026.

Growth initiatives

Carmila is deploying the three growth initiatives included in

its strategic plan: Next Tower, the omnichannel incubator, and

Carmila Retail Development, which aims to contribute €30 million a

year to recurring earnings.

In 2024, Next Tower will operate 213 towers across France and

Spain, representing locked-in rental income of €2.7 million.

Carmila confirms the development potential of €10 million in annual

rental income from 2028.

In 2024, Carmila is stepping up efforts to roll out its

omnichannel platform and incubator for retailers, contributing €7.5

million to recurring earnings (franchise development, online

services, pop-up and flash pop-up sales, DNVB incubators, targeted

marketing and in-centre AI and connectivity).

Carmila Retail Development has entered into 13 partnerships

covering a total of 305 stores, 134 of which are in Carmila

shopping centres, representing €1.8 million in recurring

earnings.

Consolidating Carmila's position as Europe's third-largest

listed operator of shopping centres

Carmila is Europe’s third-largest listed operator of shopping

centres, with a portfolio of 251 sites anchored by Carrefour

hypermarkets.

Carmila has operations in France (168 centres, 74% of the

portfolio), Spain (75 centres, 21% of the portfolio) and Italy. The

integration of Galimmo has consolidated Carmila's position as

Europe's third-largest listed operator of shopping centres, with

the gross value of its assets up to €6.7 billion at end-2024.

86% of Carmila shopping centres are leaders or joint leaders in

their catchment areas, with a reasonable average rent of €276 per

square metre (stable and balanced occupancy cost ratio of 10.5%).

In 2024, Carmila's shopping centres welcomed more than 600 million

visitors.

The Building Sustainable Growth strategic plan reaffirms

Carmila’s potential for cash flow growth

Since the plan was announced, Carmila has achieved all of its

financial targets including recurring earnings growth and dividend

payouts, as well as maintaining a robust financial structure and

delivering sustainable growth in recurring earnings year after

year.

6. A clear roadmap for sustainable growth

Commitment to reduce carbon emissions (“net zero” Scopes 1

& 2 emissions by 2030)

Carmila is targeting “net zero” Scopes 1 & 2 carbon

emissions by end-2030, by which time it will have cut emissions by

90% versus 2019, notably by reducing energy consumption and

transitioning to renewable energy at its centres. The remaining 10%

of emissions will be offset, in keeping with the recommendations of

the Science Based Targets initiative (SBTi).

This will take the form of partnerships with Agoterra on

agro-ecological transition projects, and with Carbonapp on

reforestation projects in France for around 6,000 tCO2e.

Carmila is also continuing to reduce Scope 3 emissions, with the

aim of becoming fully carbon-neutral on all emissions sources by

2040.

At end-2024, Carmila’s Scopes 1 & 2 greenhouse gas emissions

were 54% lower than in 2019, due notably to a 59% reduction in

energy consumption.

Annual €10 million green capex investment plan

In addition to efforts to reduce energy consumption, an

ambitious annual €10 million green capex investment plan has been

drawn up to retrofit the most energy-intensive assets. This energy

efficiency plan combines technological innovation (installation of

centralised technical building management systems at more than 95%

of sites), artificial intelligence (installation of Flex Eco Watt

meters at 29 sites and 53 sites equipped with sub-meters),

investment in and careful management of facilities (105 adiabatic

rooftops installed at 18 centres).

In 2024, Carmila completed the first phase of the rollout of

photovoltaic panels to six centres in Spain. This upfront

investment will enable the centres to consume self-produced “green

power”. Carmila’s annual green power production target is 3,044

MWh, which will reduce the carbon footprint by 16,538 tonnes of

carbon equivalent.

Transparency on the non-financial characteristics of the

portfolio

In 2024, all significant shopping centres9 are certified, and

43% of the portfolio has obtained at least "Very Good"

BREEAM-In-Use certification.

Carmila received an EPRA sBPR Gold award for the fourth time in

recognition of its alignment with the highest sustainability

reporting standards. Carmila also received an EPRA BPR Gold award

for the quality of its financial disclosures.

The CDP included Carmila in its 2024 A-List (346 companies) of

the Climate Change questionnaire, remaining in the Top 5% of the

23,000 respondents.

GRESB, which assesses the Environmental, Social and Governance

(ESG) practices of real estate companies worldwide, has again

singled out Carmila. After achieving a score of 80/100 in 2023,

Carmila scored 91/100 this year – higher than its peers and the

average score for GRESB respondents in 2024, which stands at

76/100. Carmila has been awarded "Green Star" designation, the

highest category in the benchmark.

Carmila has again obtained a score of 95/100 on the Professional

Equality Index (IEG), in recognition of its diversity policy.

7. Outlook

Proposed cash dividend of €1.25 per share for 2024

The Ordinary and Extraordinary Shareholders’ Meeting to be held

on 14 May 2025 will be asked to approve a per-share cash dividend

of €1.25 in respect of 2024 (a 4.2% increase year on year).

This corresponds to a payout of 75% of recurring earnings, in

line with Carmila’s dividend policy.

Recurring earnings per share expected in 2025: €1.75

In 2025, Carmila expects recurring earnings per share of €1.75,

a 4.8% increase compared with 2024.

Forecasts for growth in recurring earnings assume organic growth

in rental income, supported by indexation as well as the additional

contribution of Galimmo on a full year.

Launch of a €10 million share buyback programme in

2025

In 2024, Carmila carried out two €10 million share buyback

programmes.

The first programme was launched on 29 April and completed on 31

July 2024.

The second programme was launched on 29 July and completed on 19

December.

The 1,189,746 shares bought back have been earmarked for

cancellation (i.e., 0.8% of the share capital).

A third buyback programme will be launched on 13 February 2025.

The shares purchased under the programme will also be earmarked for

cancellation. This transaction forms part of the share buyback

programme authorised by the Annual General Meeting of 24 April

2024.

Additional information

The presentation of Carmila’s 2024 annual results will be

broadcast live on 12 February 2025 at 09:00 a.m. (CET) on Carmila’s

website (www.carmila.com).

The presentation in English is available on Carmila’s website on

the following page:

https://www.carmila.com/en/publications (financial

presentations)

A replay of the webcast will then be available online during the

day on 12 February 2025.

A document entitled "Consolidated financial statements and

commentary on 2024 business activity" is available on Carmila's

website at the following page:

https://www.carmila.com/en/publications (financial releases)

The audit procedures on the consolidated financial statements

have been completed. The audit report will be issued following the

final verification of the presentation of information in the format

stipulated by ESEF regulation relating to accounts that will be

included in the annual financial report.

INVESTOR AGENDA

12 February 2025 (09:00 a.m. Paris time): 2024 annual

results presentation 17 April 2025 (after market close):

First-quarter 2025 financial information 14 May 2025:

Ordinary and Extraordinary Shareholders’ Meeting 23 July 2025

(after market close): First-half 2025 results 24 July

2025: First-half 2025 results presentation 23 October 2025

(after market close): Third-quarter 2025 financial

information

ABOUT CARMILA

As the third-largest listed owner of commercial property in

Europe, Carmila was founded by Carrefour and large institutional

investors in order to enhance the value of shopping centres

adjoining Carrefour hypermarkets in France, Spain and Italy. At 31

December 2024, its portfolio was valued at €6.7 billion, and is

made up of 251 shopping centres with leading positions in their

catchment areas.

Carmila is listed on Euronext-Paris Compartment A under the

symbol CARM. It benefits from the tax regime for French real estate

investment trusts (“SIIC”). Carmila has been a member of the SBF

120 since 20 June 2022.

Important notice

Some of the statements contained in this document are not

historical facts but rather statements of future expectations,

estimates and other forward-looking statements based on

management’s beliefs. These statements reflect such views and

assumptions prevailing as of the date of the statements and involve

known and unknown risks and uncertainties that could cause future

results, performance or events to differ materially from those

expressed or implied in such statements. Please refer to the most

recent Universal Registration Document filed in French by Carmila

with the Autorité des marchés financiers for additional information

in relation to such factors, risks and uncertainties. Carmila has

no intention and is under no obligation to update or review the

forward-looking statements referred to above. Consequently, Carmila

accepts no liability for any consequences arising from the use of

any of the above statements.

This press release is available in the

“Financial Press Releases” section of Carmila’s Finance webpage:

https://www.carmila.com/en/publications (financial

releases)

Visit our website at

https://www.carmila.com/en/

_________________________________ 1 Excluding Galimmo (including

Galimmo: 96.2%). 2 EPRA LTV Ratio (including RETTS [Real Estate

Transfer Taxes]). 3 GRESB: Global Real Estate Sustainability

Benchmark. 4 Proposed to shareholders at the Ordinary and

Extraordinary Shareholders’ Meeting on 14 May 2025. 5 Including

real estate transfer taxes. 6 Net Tangible Assets. 7 With Galimmo:

96.2% 8 Balance at 31 December 2024 (source: Banque de France). 9

Centres with 30 or more stores.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250211495936/en/

INVESTOR AND ANALYST CONTACT Pierre-Yves Thirion - CFO

pierre_yves_thirion@carmila.com +33 6 47 21 60 49

PRESS CONTACT Elodie Arcayna – Corporate Communications Director

elodie_arcayna@carmila.com +33 7 86 54 40 10

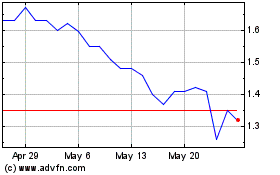

Carisma Therapeutics (NASDAQ:CARM)

Historical Stock Chart

From Jan 2025 to Feb 2025

Carisma Therapeutics (NASDAQ:CARM)

Historical Stock Chart

From Feb 2024 to Feb 2025