City Holding Company (“Company” or “City”) (NASDAQ:CHCO), a $3.6

billion bank holding company headquartered in Charleston, today

announced record quarterly diluted earnings of $1.17 per share and

record quarterly net income of $18.0 million. Effective January 1,

2015, the Company sold its insurance operations, “CityInsurance”,

and recognized a one-time after tax gain of $5.8 million, or $0.37

per diluted share, in the first quarter of 2015.

Net Interest Income

The Company’s tax equivalent net interest income increased $0.1

million, or 0.4%, from $29.4 million during the fourth quarter of

2014 to $29.5 million during the first quarter of 2015. This

increase is due to additional accretion from fair value adjustments

related to the acquisitions of Virginia Savings Bank and Community

Bank ($2.5 million for the quarter ended March 31, 2015 compared to

$1.3 million for the quarter ended December 31, 2014). This

increase was partially offset by a decrease in interest income from

commercial loans of $0.6 million due to lower yields as a result of

a continued competitive commercial lending environment. The

Company’s reported net interest margin increased from 3.89% for the

fourth quarter of 2014 to 3.99% for the first quarter of 2015.

Excluding the favorable impact of the accretion from the fair value

adjustments, the net interest margin would have been 3.66% for the

quarter ended March 31, 2015 and 3.71% for the quarter ended

December 31, 2014.

Credit Quality

The Company’s ratio of nonperforming assets to total loans and

other real estate owned increased slightly from 0.90% at December

31, 2014 to 0.96% at March 31, 2015. Excluded from this ratio are

purchased credit-impaired loans in which the Company estimated cash

flows and estimated a credit mark. Such loans would be considered

nonperforming loans if the loan’s performance deteriorates below

the initial expectations. Total past due loans decreased modestly

from $10.7 million, or 0.40% of total loans outstanding, at

December 31, 2014 to $10.2 million, or 0.39% of total loans

outstanding, at March 31, 2015. Acquired past due loans represent

approximately 45% of total past due loans and have declined $11.9

million, or 72%, since March 31, 2013.

As a result of the Company’s quarterly analysis of the adequacy

of the ALLL, the Company recorded a provision for loan losses of

$0.9 million in the first quarter of 2015, compared to $1.4 for the

comparable period in 2014 and $0.4 million for the fourth quarter

of 2014. The provision for loan losses recorded in the first

quarter of 2015 reflects difficulties of certain commercial

borrowers of the Company during the quarter, the downgrade of their

related credits and management’s assessment of the impact of these

difficulties on the ultimate collectability of the loans.

Additionally, the first quarter of 2015 includes $0.25 million of

provision expense related to purchased credit impaired loans.

Changes in the amount of the provision and related allowance are

based on the Company’s detailed systematic methodology and are

directionally consistent with changes in the composition and

quality of the Company’s loan portfolio. The Company believes its

methodology for determining the adequacy of its ALLL adequately

provides for probable losses inherent in the loan portfolio and

produces a provision and allowance for loan losses that is

directionally consistent with changes in asset quality and loss

experience.

Non-interest Income

Effective January 1, 2015, the Company sold its insurance

operations, CityInsurance, which resulted in a pre-tax gain of

$11.1 million. Exclusive of this gain, non-interest income declined

from $14.2 million for the first quarter of 2014 to $12.9 million

for the first quarter of 2015. The primary reason for this decline

was the sale of CityInsurance which had insurance commission

revenues of $2.0 million in the first quarter of 2014. In addition,

service charges decreased $0.2 million, or 3.8%, from the first

quarter of 2014 to $5.9 million. These decreases were partially

offset by increases in bankcard revenues of $0.4 million (10.6%),

other income of $0.4 million, and trust and investment management

fee income of $0.2 million (15.7%).

Non-interest Expenses

Non-interest expenses decreased $0.2 million, from $23.4 million

in the first quarter of 2014 to $23.2 million in the first quarter

of 2015. This drop was largely due to a decline in salaries and

employee benefit expense of $1.0 million, or 7.3%, to $12.2

million. This decrease was due to a reduction in the Company’s

salary expense as a result of the sale of CityInsurance. This

decrease was partially offset by an increase in other expenses of

$0.8 million to $2.7 million. During the first quarter of 2014, the

Company’s non-income based taxes decreased due to the recognition

of a previously unrecognized tax position due to the close of the

statute of limitations for a previous tax year and was discrete to

the first quarter of 2014.

Balance Sheet Trends

Loans decreased $19.6 million (0.7%) from December 31, 2014 to

$2.63 billion at March 31, 2015. Commercial real estate loans

decreased $17.2 million (1.7%), commercial and industrial

(“C&I”) loans decreased $8.3 million (6.3%), home equity junior

lien loans fell $1.9 million (1.3%), and consumer loans declined

$1.3 million (3.2%). These decreases were partially offset by an

increase in residential real estate loans of $8.7 million

(0.7%).

Total average depository balances increased $74.7 million, or

2.6%, from the quarter ended December 31, 2014 to the quarter ended

March 31, 2015. Increases in savings deposits ($51.8 million),

interest-bearing deposits ($17.1 million), and noninterest-bearing

demand deposits ($14.4 million) were partially offset by a decrease

in time deposits ($8.5 million).

Income Tax Expense

The Company’s effective income tax rate for the first quarter of

2015 was 38.7% compared to 31.4% for the year ended December 31,

2014, and 29.6% for the quarter ended March 31, 2014. As noted

previously, the Company sold CityInsurance in the first quarter of

2015. As a result of differences between the book and tax basis of

the assets that were sold, the Company’s income tax expense

increased by $1.1 million. During the first quarter of 2014, the

Company reduced income tax expense by $0.8 million due to the

recognition of previously unrecognized tax position resulting from

the close of the statute of limitations for a previous tax year.

Exclusive of the sale of CityInsurance in the first quarter of 2015

and the discrete item recognized in the first quarter of 2014, the

Company’s tax rate from operations was 33.3% and 33.6%, for the

quarters ended March 31, 2015 and March 31, 2014, respectively.

Capitalization and Liquidity

The Company’s loan to deposit ratio was 89.5% and the loan to

asset ratio was 74.1% at March 31, 2015. The Company maintained

investment securities totaling 10.4% of assets as of this date.

Further, the Company’s deposit mix is weighted heavily toward

checking and saving accounts that fund 54.3% of assets at March 31,

2015. Time deposits fund 28.5% of assets at March 31, 2015, but

very few of these deposits are in accounts that have balances of

more than $250,000, reflecting the core retail orientation of the

Company.

The Company is also strongly capitalized. The Company’s tangible

equity ratio increased from 9.4% at December 31, 2014 to 9.6% at

March 31, 2015. At March 31, 2015, City National Bank’s Leverage

Ratio is 9.07%, its Common Equity Tier I ratio is 11.87%, its Tier

I Capital ratio is 13.04%, and its Total Risk-Based Capital ratio

is 13.89%. These regulatory capital ratios are significantly above

levels required to be considered “well capitalized,” which is the

highest possible regulatory designation.

On March 26, 2015, the Board approved a quarterly cash dividend

of $0.42 cents per share payable April 30, 2015, to shareholders of

record as of April 15, 2015.

City Holding Company is the parent company of City National Bank

of West Virginia. City National operates 82 branches across West

Virginia, Virginia, Kentucky and Ohio.

Forward-Looking Information

This news release contains certain forward-looking statements

that are included pursuant to the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995. Such information

involves risks and uncertainties that could result in the Company's

actual results differing materially from those projected in the

forward-looking statements. Important factors that could cause

actual results to differ materially from those discussed in such

forward-looking statements include, but are not limited to, (1) the

Company may incur additional loan loss provision due to negative

credit quality trends in the future that may lead to a

deterioration of asset quality; (2) the Company may incur increased

charge-offs in the future; (3) the Company could have adverse legal

actions of a material nature; (4) the Company may face competitive

loss of customers; (5) the Company may be unable to manage its

expense levels; (6) the Company may have difficulty retaining key

employees; (7) changes in the interest rate environment may have

results on the Company’s operations materially different from those

anticipated by the Company’s market risk management functions; (8)

changes in general economic conditions and increased competition

could adversely affect the Company’s operating results; (9) changes

in other regulations and government policies affecting bank holding

companies and their subsidiaries, including changes in monetary

policies, could negatively impact the Company’s operating results;

(10) the Company may experience difficulties growing loan and

deposit balances; (11) the current economic environment poses

significant challenges for us and could adversely affect our

financial condition and results of operations; (12) deterioration

in the financial condition of the U.S. banking system may impact

the valuations of investments the Company has made in the

securities of other financial institutions resulting in either

actual losses or other than temporary impairments on such

investments; (13) the effects of the Wall Street Reform and

Consumer Protection Act (the “Dodd-Frank Act”) and the regulations

promulgated and to be promulgated thereunder, which may subject the

Company and its subsidiaries to a variety of new and more stringent

legal and regulatory requirements which adversely affect their

respective businesses; (14) the impact of new minimum capital

thresholds established as a part of the implementation of Basel

III; and (15) other risk factors relating to the banking industry

or the Company as detailed from time to time in the Company’s

reports filed with the Securities and Exchange Commission,

including those risk factors included in the disclosures under the

heading “ITEM 1A Risk Factors” of the Company’s Annual Report on

Form 10-K for the fiscal year ended December 31, 2014.

Forward-looking statements made herein reflect management's

expectations as of the date such statements are made. Such

information is provided to assist stockholders and potential

investors in understanding current and anticipated financial

operations of the Company and is included pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. The Company undertakes no obligation to update any

forward-looking statement to reflect events or circumstances that

arise after the date such statements are made. Further, the Company

is required to evaluate subsequent events through the filing of its

March 31, 2015 Form 10-Q. The Company will continue to evaluate the

impact of any subsequent events on the preliminary March 31, 2015

results and will adjust the amounts if necessary.

CITY HOLDING COMPANY AND

SUBSIDIARIES

Financial Highlights

(Unaudited)

Three Months Ended March 31,

Percent 2015

2014

Change Earnings ($000s, except per share

data): Net Interest Income (FTE) $ 29,533 $ 30,193 (2.19)% Net

Income available to common shareholders 17,992 13,803 30.35%

Earnings per Basic Share 1.18 0.87 35.04% Earnings per Diluted

Share 1.17 0.86 35.72%

Key Ratios (percent): Return on Average Assets 2.04% 1.63% 25.18%

Return on Average Tangible Equity 21.58% 17.32% 24.60% Net Interest

Margin 3.99% 4.15% (3.75)% Efficiency Ratio (a) 54.24% 52.28% 3.75%

Average Shareholders' Equity to Average Assets 11.48% 11.64%

(1.34)% Consolidated Risk Based Capital Ratios (b): CET I

14.04% * N/A Tier I 14.70% 13.58% 8.25% Total 15.57% 14.47% 7.60%

Tangible Equity to Tangible Assets 9.60% 9.60% (0.01)%

Common Stock Data: Cash

Dividends Declared per Share $ 0.42 $ 0.40 5.00% Book Value per

Share 26.63 25.05 6.30% Tangible Book Value per Share 21.96 20.28

8.28% Market Value per Share: High 48.09 46.69 3.00% Low 41.76

42.15 (0.93)% End of Period 47.03 44.86 4.84% Price/Earnings

Ratio (c) 9.96 12.83 (22.36)%

(a) The March 31, 2015 efficiency ratio

calculation excludes the gain on sale of insurance division.

(b) March 31, 2015 risk-based capital

ratios are estimated.

(c) March 31, 2015 price/earnings ratio

computed based on annualized first quarter 2015 earnings.

(*) Basel III CET 1 ratio requirements are

effective beginning January 1, 2015 and are not required for prior

periods.

CITY HOLDING COMPANY AND

SUBSIDIARIES

Financial Highlights

(Unaudited)

Book Value and Market Price Range per

Share Market Price Book Value per Share Range

per Share March 31 June 30

September 30 December 31

Low High 2011 20.39 20.58 20.86

21.05 26.06 37.22 2012 21.46 21.63 22.14 22.47 30.96 37.16 2013

23.36 23.52 24.03 24.61 36.07 49.21 2014 25.05 25.45 25.52 25.85

41.20 46.95 2015 26.63 41.76 48.09

Earnings per Basic Share Quarter

Ended March 31 June 30 September

30 December 31 Year-to-Date

2011 0.62 0.65 0.77 0.65 2.68 2012 0.68 0.50 0.71 0.73 2.63

2013 0.51 0.83 0.89 0.84 3.07 2014 0.87 0.81 0.76 0.95 3.40 2015

1.18 1.18

Earnings per

Diluted Share Quarter Ended March 31

June 30 September 30 December

31 Year-to-Date 2011 0.62 0.64 0.76

0.65 2.67 2012 0.67 0.50 0.71 0.73 2.61 2013 0.51 0.82 0.88 0.83

3.04 2014 0.86 0.80 0.76 0.95 3.38 2015 1.17 1.17

CITY HOLDING COMPANY AND

SUBSIDIARIES

Consolidated Statements of

Income

(Unaudited) ($ in 000s, except per

share data)

Three Months Ended March 31, 2015

2014 Interest Income Interest and fees

on loans $ 29,388 $ 29,734 Interest on investment securities:

Taxable 2,712 3,003 Tax-exempt 264 281

Total Interest Income

32,364 33,018

Interest Expense Interest on deposits

2,741 2,753 Interest on short-term borrowings 82 75 Interest on

long-term debt 150 150

Total Interest Expense

2,973 2,978

Net Interest Income 29,391 30,040

Provision for loan losses 888 1,363

Net Interest

Income After Provision for Loan Losses 28,503 28,677

Non-Interest Income Gains on sale of investment securities

14 83 Service charges 5,927 6,160 Bankcard revenue 4,074 3,685

Insurance commissions - 2,025 Trust and investment management fee

income 1,200 1,037 Bank owned life insurance 764 756 Gain on sale

of insurance division 11,084 - Other income 958 559

Total Non-Interest Income 24,021 14,305

Non-Interest Expense Salaries and employee benefits 12,179

13,139 Occupancy and equipment 2,590 2,615 Depreciation 1,511 1,478

FDIC insurance expense 450 410 Advertising 704 824 Bankcard

expenses 818 806 Postage, delivery, and statement mailings 561 575

Office supplies 346 410 Legal and professional fees 567 409

Telecommunications 475 338 Repossessed asset losses, net of

expenses 220 379 Other expenses 2,744 1,993

Total

Non-Interest Expense 23,165 23,376

Income

Before Income Taxes 29,359 19,606 Income tax expense

11,367 5,803

Net Income Available to Common

Shareholders $ 17,992 $ 13,803 Distributed earnings

allocated to common shareholders $ 6,315 $ 6,224 Undistributed

earnings allocated to common shareholders 11,468

7,438 Net earnings allocated to common shareholders $ 17,783 $

13,662 Average common shares outstanding 15,067 15,631

Effect of dilutive securities: Employee stock options and warrants

82 165 Shares for diluted earnings per share

15,149 15,796 Basic earnings per common share $ 1.18

$ 0.87 Diluted earnings per common share $ 1.17 $ 0.86 Dividends

declared per common share $ 0.42 $ 0.40 Comprehensive Income

$ 18,898 $ 14,579

CITY HOLDING COMPANY AND

SUBSIDIARIES

Consolidated Statements of Changes in

Stockholders' Equity

(Unaudited) ($ in 000s)

Three Months Ended March 31, 2015

March 31, 2014 Balance at January 1 $ 390,853

$ 387,623 Net income 17,992 13,803 Other comprehensive

income: Change in unrealized (loss) gainon securities

available-for-sale 906 776 Cash dividends declared ($0.42/share)

and ($0.40/share), respectively (6,389 ) (6,287 ) Issuance of stock

award shares, net 740 572 Exercise of 28,500 stock options 973 -

Exercise of 7,000 stock options - 199 Purchase of 68,145 common

shares of treasury - (2,936 )

Balance at March

31 $ 405,075 $ 393,750

CITY HOLDING COMPANY AND

SUBSIDIARIES

Condensed Consolidated Quarterly

Statements of Income

(Unaudited) ($ in 000s, except per

share data)

Quarter Ended March

31 December 31 September 30 June 30

March 31

2015 2014 2014

2014 2014

Interest income $ 32,364 $ 32,282 $ 32,438 $ 31,828 $ 33,018

Taxable equivalent adjustment 142 164

152 151 153 Interest income

(FTE) 32,506 32,446 32,590 31,979 33,171 Interest expense

2,973 3,041 2,968 2,973

2,978 Net interest income 29,533 29,405 29,622 29,006

30,193 Provision for loan losses 888 384

1,872 435 1,363 Net

interest income after provision for loan losses 28,645 29,021

27,750 28,571 28,830 Noninterest income 24,021 14,669 14,609

15,139 14,305 Noninterest expense 23,165

23,035 24,325 24,305

23,376 Income before income taxes 29,501 20,655 18,034 19,405

19,759 Income tax expense 11,367 5,961 6,010 6,497 5,803 Taxable

equivalent adjustment 142 164

152 151 153 Net income $ 17,992

$ 14,530 $ 11,872 $ 12,757 $ 13,803

Distributed earnings allocated to common

shareholders $ 6,315 $ 5,996 $ 6,073 $ 6,178 $ 6,224 Undistributed

earnings allocated to common shareholders 11,468

8,378 5,673 6,448

7,439 Net earnings allocated to common shareholders $ 17,783

$ 14,374 $ 11,746 $ 12,626 $ 13,663

Average common shares outstanding 15,067 15,096 15,363 15,556

15,631 Effect of dilutive securities: Employee stock options

and warrants 82 86 82

150 165 Shares for diluted earnings per

share 15,149 15,182 15,445

15,706 15,796 Basic earnings per

common share $ 1.18 $ 0.95 $ 0.76 $ 0.81 $ 0.87 Diluted earnings

per common share 1.17 0.95 0.76 0.80 0.86 Cash dividends

declared per share 0.42 0.40 0.40 0.40 0.40

Net

Interest Margin 3.99% 3.89% 3.95% 3.95% 4.15% Interest

Income from Accretion Related to Fair Value Adjustments Recorded as

a Result of Acquisition $ 2,450 $ 1,307 $ 1,836 $ 1,494 $ 2,151

Net Interest Margin (excluding accretion) 3.66% 3.71% 3.71%

3.75% 3.85%

CITY HOLDING COMPANY AND

SUBSIDIARIES

Non-Interest Income and Non-Interest

Expense

(Unaudited) ($ in 000s)

Quarter Ended March

31 December 31 September 30 June 30

March 31 2015 2014 2014

2014 2014 Non-Interest

Income: Service charges $ 5,927 $ 6,750 $ 6,934 $ 6,739 $ 6,160

Bankcard revenue 4,074 3,744 3,796 3,838 3,685 Insurance

commissions - 1,238 1,396 1,319 2,025 Trust and investment

management fee income 1,200 1,363 1,103 1,111 1,037 Bank owned life

insurance 764 778 771 765 756 Gain on sale of insurance division

11,084 - - - - Other income 958 612

538 549 559

Subtotal

24,007 14,485 14,538 14,321 14,222 Gain (loss) on sale of

investment securities 14 184 71

818 83

Total Non-Interest Income

$ 24,021 $ 14,669 $ 14,609 $ 15,139 $

14,305

Non-Interest Expense: Salaries and employee

benefits $ 12,179 $ 12,489 $ 13,144 $ 12,977 $ 13,139 Occupancy and

equipment 2,590 2,449 2,531 2,395 2,615 Depreciation 1,511 1,534

1,542 1,533 1,478 FDIC insurance expense 450 448 432 357 410

Advertising 704 726 799 925 824 Bankcard expenses 818 891 843 833

806 Postage, delivery and statement mailings 561 549 557 530 575

Office supplies 346 360 405 420 410 Legal and professional fees 567

552 476 612 409 Telecommunications 475 522 510 506 338 Repossessed

asset (gains) losses, net of expenses 220 27 31 142 379 Other

expenses 2,744 2,488 3,055

3,075 1,993

Total Non-Interest

Expense $ 23,165 $ 23,035 $ 24,325 $

24,305 $ 23,376

Employees

(Full Time Equivalent) 845 889 908 912 925 Branch Locations 82 82

82 82 82

CITY HOLDING COMPANY AND

SUBSIDIARIES

Consolidated Balance Sheets

($ in 000s)

March 31, 2015 December 31, 2014

(Unaudited) Assets Cash and due from banks $ 235,004

$ 138,503 Interest-bearing deposits in depository institutions

10,106 9,725 Federal funds sold - -

Cash and cash equivalents 245,110 148,228

Investment securities available-for-sale, at fair value 273,856

254,043 Investment securities held-to-maturity, at amortized cost

87,455 90,786 Other securities 9,857

9,857

Total investment securities 371,168 354,686

Gross loans 2,632,471 2,652,066 Allowance for loan losses

(20,179 ) (20,150 )

Net loans 2,612,292

2,631,916 Bank owned life insurance 95,880 95,116 Premises

and equipment, net 76,910 77,988 Accrued interest receivable 7,752

6,826 Net deferred tax assets 35,335 36,766 Intangible assets

70,964 74,198 Other assets 37,674

35,909

Total Assets $ 3,553,085 $

3,461,633

Liabilities Deposits:

Noninterest-bearing $ 551,596 $ 545,465 Interest-bearing: Demand

deposits 654,832 639,932 Savings deposits 722,324 660,727 Time

deposits 1,013,630 1,026,663

Total deposits 2,942,382 2,872,787 Short-term borrowings

Customer repurchase agreements 132,588 134,931 Long-term debt

16,495 16,495 Other liabilities 56,545

46,567

Total Liabilities 3,148,010 3,070,780

Stockholders' Equity Preferred stock, par value $25 per

share: 500,000 shares authorized; none issued - - Common stock, par

value $2.50 per share: 50,000,000 shares authorized; 18,499,282

shares issued at March 31, 2015 and December 31, 2014 less

3,285,958 and 3,345,590 shares in treasury, respectively 46,249

46,249 Capital surplus 106,397 107,370 Retained earnings 373,812

362,211 Cost of common stock in treasury (118,130 ) (120,818 )

Accumulated other comprehensive loss: Unrealized gain on securities

available-for-sale 2,096 1,190 Underfunded pension liability

(5,349 ) (5,349 )

Total Accumulated Other

Comprehensive Loss (3,253 ) (4,159 )

Total Stockholders' Equity 405,075

390,853

Total Liabilities and Stockholders'

Equity $ 3,553,085 $ 3,461,633

CITY HOLDING COMPANY AND

SUBSIDIARIES

Investment Portfolio

(Unaudited) ($ in 000s)

Original Cost

Credit-RelatedNet

InvestmentImpairmentLosses through March 31,

2015

Unrealized Gains(Losses)

Carrying Value US Government Agencies $ 1,713 $ - $ 2

$ 1,715 Mortgage Backed Securities 292,831 - 2,463 295,294

Municipal Bonds 38,147 - 767 38,914 Pooled Bank Trust Preferreds

20,664 (20,171 ) 1,167 1,660 Single Issuer Bank Trust Preferreds,

Subdebt of Financial Institutions, and Bank Holding Company

Preferred Stocks 22,040 (1,015 ) (2,350 ) 18,675 Money Markets and

Mutual Funds 1,525 - 10 1,535 Federal Reserve Bank and FHLB stock

9,857 - - 9,857 Community Bank Equity Positions 3,715

(1,584 ) 1,387 3,518

Total Investments

$ 390,492 $ (22,770 ) $ 3,446 $ 371,168

CITY HOLDING COMPANY AND

SUBSIDIARIES

Loan Portfolio

(Unaudited) ($ in 000s)

March 31 December

31 September 30 June 30 March 31

2015 2014 2014

2014 2014

Residential real estate (1) $ 1,303,258 $ 1,294,576 $ 1,274,062 $

1,242,972 $ 1,212,232 Home equity - junior liens

143,670 145,604 146,965 145,452 144,482 Commercial and industrial

124,342 132,641 130,462 131,627 126,569 Commercial real estate (2)

1,019,562 1,036,738 1,034,593 1,011,367 1,027,431 Consumer

38,436 39,705 41,042 42,858 42,320 DDA overdrafts

3,203 2,802 3,618 3,501

4,001

Gross Loans $ 2,632,471 $

2,652,066 $ 2,630,742 $ 2,577,777 $ 2,557,035

Construction loans included in: (1) - Residential real

estate loans $ 17,459 $ 22,992 $ 22,426 $ 20,078 $ 17,697 (2) -

Commercial real estate loans $ 30,554 $ 28,652 $ 24,875 $ 24,608 $

28,894

CITY HOLDING COMPANY AND

SUBSIDIARIES

Acquisition Activity -

Accretion

(Unaudited) ($ in 000s)

The following table presents the actual and forecasted

accretion related to the fair value adjustments on net interest

income recorded as a result of the Virginia Savings Bancorp

("Virginia Savings") and Community Financial Corporation

("Community") acquisitions.

Virginia

Savings Community Loan

Certificates of Loan Certificates of

Year Ended: Accretion(a)

Deposit(a) Accretion(a)

Deposit(a) Total 1Q 2015 $ 123 $ 129 $

2,158 $ 40 $ 2,450 Remainder 2015 336 388 1,734 120 2,578 2016 276

497 1,480 48 2,301 2017 154 - 1,070 - 1,224 a - 1Q 2015 amounts are

based on actual results. Remainder 2015, 2016 and 2017 amounts are

based on estimated amounts. Note: The amounts

reflected in the table above require management to make significant

assumptions based on estimated future default, prepayment, and

discount rates. Actual performance could be significantly different

from that assumed, which could result in the actual results being

materially different from the amounts estimated above.

CITY HOLDING COMPANY AND

SUBSIDIARIES

Consolidated Average Balance Sheets,

Yields, and Rates

(Unaudited) ($ in 000s)

Three Months Ended March 31,

2015 2014 Average Yield/

Average Yield/ Balance Interest

Rate Balance Interest

Rate Assets: Loan portfolio (1):

Residential real estate (2) $ 1,436,720 $ 14,201 4.01 % $ 1,350,556

$ 13,746 4.13 % Commercial, financial, and agriculture (2)

1,149,798 13,586 4.79 % 1,167,606 14,236 4.94 % Installment loans

to individuals (2), (3) 49,882 1,150 9.35 % 52,557 1,179 9.10 %

Previously securitized loans (4) *** 451 ***

*** 574 *** Total loans 2,636,400 29,388 4.52 %

2,570,719 29,735 4.69 % Securities: Taxable 327,185 2,712 3.36 %

345,982 3,003 3.52 % Tax-exempt (5) 28,477 406

5.78 % 27,506 433 6.38 %

Total securities

355,662 3,118 3.56 % 373,488 3,436 3.73 % Deposits in depository

institutions 8,968 - - 8,831 - - Federal funds sold -

- - - - 0.00 %

Total

interest-earning assets 3,001,030 32,506 4.39 % 2,953,038

33,171 4.56 % Cash and due from banks 222,409 125,221 Bank premises

and equipment 77,638 82,214 Other assets 244,686 246,091 Less:

Allowance for loan losses (20,658 )

(21,221 )

Total assets $

3,525,105 $ 3,385,343

Liabilities:

Interest-bearing demand deposits 636,810 132 0.08 % 611,797 176

0.12 % Savings deposits 694,700 181 0.11 % 618,412 207 0.14 % Time

deposits (2) 1,021,474 2,428 0.96 % 1,070,065 2,370 0.90 %

Short-term borrowings 129,647 82 0.26 % 118,771 75 0.26 % Long-term

debt 16,495 150 3.69 % 16,495

150 3.69 %

Total interest-bearing liabilities

2,499,126 2,973 0.48 % 2,435,540 2,978 0.50 % Noninterest-bearing

demand deposits 571,340 517,207 Other liabilities 49,996 38,705

Stockholders' equity 404,643

393,891

Total

liabilities and stockholders' equity $ 3,525,105

$ 3,385,343

Net interest income $ 29,533

$ 30,193

Net

yield on earning assets 3.99 %

4.15 % (1) For purposes of this

table, non-accruing loans have been included in average balances

and loan fees, which are immaterial, have been included in interest

income. (2) Included in the above table are the following amounts

(in thousands) for the accretion of the fair value adjustments

related to the acquisitions of Virginia Savings Bancorp ("Virginia

Savings") and Community Financial Corporation ("Community"):

Three Months Ended March 31, 2015

Three Months Ended March 31, 2014 Virginia

Savings Community Total

Virginia Savings Community Total Residential real

estate $ 64 $ 133 $ 197 $ 151 $ 115 $

266 Commercial, financial, and agriculture 29 1,959 1,988 114 1,324

1,438 Installment loans to individuals 30 66 96 34 189 223 Time

deposits 129 40 169

131 93 224

$ 252 $ 2,198 $ 2,450 $

430 $ 1,721 $ 2,151 (3) Includes the Company’s

consumer and DDA overdrafts loan categories. (4) Effective January

1, 2012, the carrying value of the Company's previously securitized

loans was reduced to $0. (5) Computed on a fully federal

tax-equivalent basis assuming a tax rate of approximately 35%.

CITY HOLDING COMPANY AND

SUBSIDIARIES

Analysis of Risk-Based Capital

(Unaudited) ($ in 000s)

March 31

December 31 September 30 June 30 March

31 2015 (a) 2014 2014

2014 2014

Tier I Capital: Stockholders' equity $ 405,075 $ 390,853 $ 391,673

$ 397,231 $ 393,750 Goodwill and other intangibles (69,227 )

(74,011 ) (74,247 ) (74,483 ) (74,719 ) Accumulated other

comprehensive loss 3,253 4,159 2,921 2,509 4,214 Qualifying trust

preferred stock 16,000 16,000 16,000 16,000 16,000 Excess deferred

tax assets (1,564 ) (3,838 )

(3,131 ) (4,019 ) (6,508 ) Total tier I

capital $ 353,537 $ 333,163 $ 333,216 $ 337,238 $ 332,737

Qualifying trust preferred stock

(16,000 ) * * * * Total CET I capital $

337,537 * * * *

Total Risk-Based Capital: Tier I capital $ 353,537 $

333,163 $ 333,216 $ 337,238 $ 332,737 Qualifying allowance for loan

losses 20,179 20,150 20,487 20,536 21,044 Unrealized gain on

securities 704 560

630 605 786 Total

risk-based capital $ 374,420 $ 353,873

$ 354,333 $ 358,379 $ 354,567

Net risk-weighted assets $ 2,404,331 $ 2,493,078 $ 2,493,938

$ 2,464,081 $ 2,450,949

Ratios:

Average stockholders' equity to average assets 11.48 % 11.40 %

11.78 % 11.71 % 11.64 % Tangible capital ratio 9.60 % 9.35 % 9.58 %

9.80 % 9.60 % Risk-based capital ratios: CET 1 capital 14.04 % * *

* * Tier I capital 14.70 % 13.36 % 13.36 % 13.69 % 13.58 % Total

risk-based capital 15.57 % 14.19 % 14.21 % 14.54 % 14.47 % Leverage

capital 10.23 % 9.89 % 10.07 % 10.15 % 10.07 %

(a) March 31, 2015 risk-based capital

ratios are estimated.

(*) Basel III CET 1 ratio requirements are effective beginning

January 1, 2015 and are not required for prior periods.

CITY HOLDING COMPANY AND

SUBSIDIARIES

Intangibles

(Unaudited) ($ in 000s)

As of and for the Quarter Ended

March 31 December 31 September

30 June 30 March 31 2015

2014 2014 2014

2014 Intangibles, net $ 70,964 $ 74,198 $ 74,434 $

74,670 $ 74,906 Intangibles amortization expense 214 236 236 236

236

CITY HOLDING COMPANY AND

SUBSIDIARIES

Summary of Loan Loss Experience

(Unaudited) ($ in 000s)

Quarter Ended March

31 December 31 September 30 June 30

March 31 2015 2014

2014 2014 2014

Balance at beginning of period $ 20,150 $ 20,487 $

20,536 $ 21,044 $ 20,575

Charge-offs: Commercial and

industrial 94 (7 ) 325 1 4 Commercial real estate 337 260 696 587

382 Residential real estate 257 414 605 316 427 Home equity 91 21

142 38 108 Consumer 74 17 49 38 84 DDA overdrafts 311

363 390 321

341

Total charge-offs

1,164 1,068 2,207 1,301 1,346

Recoveries: Commercial

and industrial 18 4 4 18 63 Commercial real estate 8 19 11 53 30

Residential real estate 10 96 28 39 24 Home equity - - - - -

Consumer 28 32 43 53 76 DDA overdrafts 241

196 200 195

259

Total recoveries 305 347 286 358

452

Net charge-offs 859 721 1,921 943 894 Provision for

(recovery of) acquired loans 246 148 (3 ) 150 (12 ) Provision for

loan losses 642 236

1,875 285 1,375

Balance at end of period $ 20,179 $

20,150 $ 20,487 $ 20,536

$ 21,044 Loans outstanding $ 2,632,471

$ 2,652,066 $ 2,630,742 $ 2,577,777

$ 2,557,035 Average loans outstanding

2,636,400 2,639,106

2,600,142 2,563,601

2,570,719 Allowance as a percent of loans outstanding

0.77 % 0.76 % 0.78 % 0.80

% 0.82 % Allowance as a percent of non-performing

loans 121.81 % 128.10 % 112.61 %

106.86 % 100.09 % Net charge-offs

(annualized) as a percent of average loans outstanding 0.13

% 0.11 % 0.30 % 0.15 %

0.14 % Net charge-offs, excluding overdraft deposit

accounts, (annualized) as a percent of average loans outstanding

0.12 % 0.08 % 0.27 %

0.13 % 0.13 %

CITY HOLDING COMPANY AND

SUBSIDIARIES

Summary of Non-Performing

Assets

(Unaudited) ($ in 000s)

March 31

December 31 September 30 June 30 March

31 2015 2014 2014

2014 2014 Nonaccrual loans $ 16,182 $

15,307 $ 17,384 $ 18,423 $ 20,593 Accruing loans past due 90 days

or more 384 423 809

794 432

Total non-performing loans

16,566 15,730 18,193 19,217 21,025

Other real estate owned

8,771 8,180 9,162

9,129 9,538

Total non-performing assets $

25,337 $ 23,910 $ 27,355 $ 28,346 $

30,563 Non-performing assets as a percent of loans and other

real estate owned 0.96% 0.90% 1.04% 1.10% 1.19%

CITY HOLDING COMPANY AND

SUBSIDIARIES

Summary of Total Past Due Loans

(Unaudited) ($ in 000s)

Originated March 31 December

31 September 30 June 30

March 31 2015 2014 2014

2014 2014 Residential real

estate $ 4,326 $ 5,164 $ 5,276 $ 5,794 $ 4,118 Home equity - junior

liens 543 746 751 926 638 Commercial and industrial 113 310 188 25

77 Commercial real estate 299 479 938 443 789 Consumer 122 197 58

80 63 DDA overdrafts 215 318 592

281 196

Total past due loans $

5,618 $ 7,214 $ 7,803 $ 7,549 $ 5,881

Acquired March 31 December 31

September 30 June 30 March 31 2015

2014 2014 2014

2014 Residential real estate $ 1,792 $ 714 $ 500 $

873 $ 813 Home equity - junior liens 86 2 16 3 21 Commercial and

industrial 490 143 96 58 127 Commercial real estate 2,018 2,372

2,972 2,110 3,789 Consumer 150 221 162 374 397 DDA overdrafts

- - - -

-

Total past due loans $ 4,536 $ 3,452

$ 3,746 $ 3,418 $ 5,147

Total March

31 December 31 September 30 June 30

March 31 2015 2014 2014

2014 2014 Residential real

estate $ 6,118 $ 5,878 $ 5,776 $ 6,667 $ 4,931 Home equity - junior

liens 629 748 767 929 659 Commercial and industrial 603 453 284 83

204 Commercial real estate 2,317 2,851 3,910 2,553 4,578 Consumer

272 418 220 454 460 DDA overdrafts 215 318

592 281 196

Total past

due loans $ 10,154 $ 10,666 $ 11,549 $

10,967 $ 11,028 Total past due loans as a percent of

loans outstanding 0.39% 0.40% 0.44% 0.43% 0.43%

CITY HOLDING COMPANY AND

SUBSIDIARIES

Summary of Troubled Debt

Restructurings

(Unaudited) ($ in 000s)

March 31

December 31 September 30 June 30 March

31 2015 2014 2014 2014 2014

Residential real estate $ 19,067 $ 18,492 $ 18,040 $ 19,212

$ 18,940 Home equity - junior liens 2,741 2,688 2,821 2,858 2,866

Commercial and industrial 70 73 77 86 84 Commercial real estate

1,894 2,263 2,270 2,281 1,854 Consumer - - -

- -

Total $ 23,772 $ 23,516 $ 23,208 $ 24,437

$ 23,744

CITY HOLDING COMPANY AND

SUBSIDIARIES

Summary of Purchased Credit Impaired

Loans

(Unaudited) ($ in 000s)

Virginia Savings

Acquisition March 31 December 31

September 30 June 30 March 31 2015

2014 2014 2014

2014 Contractual required principal and interest

2,419 2,407 3,481 3,735 3,821 Carrying value 1,979 1,964 2,987

3,098 3,102

Community Acquisition March 31

December 31 September 30 June 30 March

31 2015 2014 2014

2014 2014 Contractual required

principal and interest 20,189 23,277 24,147 27,394 30,476 Carrying

value 14,627 15,365 15,518 17,902 19,986

City Holding CompanyCharles R. Hageboeck, Chief Executive

Officer and President304-769-1102

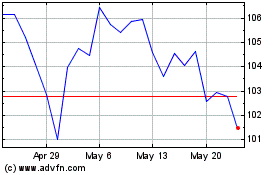

City (NASDAQ:CHCO)

Historical Stock Chart

From Jun 2024 to Jul 2024

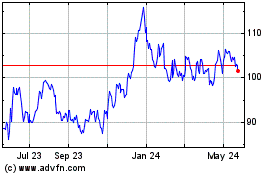

City (NASDAQ:CHCO)

Historical Stock Chart

From Jul 2023 to Jul 2024