Noventiq Holdings plc and Corner Growth Acquisition Corp. Mutually Terminate Transaction

July 04 2024 - 7:30AM

Business Wire

Noventiq Holdings plc (“Noventiq”), a global digital

transformation and cybersecurity solutions and services provider,

and Corner Growth Acquisition Corp. (Nasdaq: COOL) (“Corner

Growth”), a special purpose acquisition company led by veteran

technology investors (“Sponsors”), announced today a mutual

agreement to terminate their merger agreement, originally entered

into on May 4, 2023, and amended and restated on December 29, 2023,

effective immediately. Noventiq and Corner Growth made this

decision as a result of current unfavourable SPAC market conditions

and other factors.

Hervé Tessler, CEO of Noventiq, said: “Due to current

SPAC and equity market conditions, it was mutually agreed that the

best option for all parties at this time is to terminate the

transaction. We have determined that the right decision for

Noventiq is to remain private at this time. We are confident about

our operational outlook, and we look forward to continuing to drive

significant growth in our business.”

Marvin Tien, Co-Chairman & CEO of Corner Growth,

said: “After considering the current market environment, the Corner

Growth and Noventiq teams have mutually agreed to terminate the

transaction. This decision aligns with our shared commitment to

maximizing value for all of our stakeholders. We believe that

Noventiq is well positioned to thrive as a private company at this

time, and the Corner Growth team will continue to be vigilant in

our pursuit of value-creating opportunities for our shareholders

and are confident in our ability to identify alternative pathways

to a successful transaction.”

About Noventiq Noventiq (Noventiq Holdings PLC) is a

leading global solutions and services provider in digital

transformation and cybersecurity, headquartered in London. The

company enables, facilitates, and accelerates digital

transformation for its customers’ businesses, connecting

organizations across a comprehensive range of industries with

best-in-class IT vendors, alongside its own services and

proprietary solutions. The company’s rapid growth is underpinned by

its three-dimensional strategy to expand its market penetration,

product portfolio, and sales channels. This is supported by an

active approach to M&A, positioning Noventiq to capitalize on

the industry’s ongoing consolidation. With around 6,400 employees

globally, Noventiq operates in approximately 60 countries with

significant growth potential in multiple regions including Latin

America, EMEA, and APAC – with a notable presence in India.

About Corner Growth Corner Growth Acquisition Corp.

(Nasdaq: COOL) is a special purpose acquisition company (SPAC)

focused on partnering with a high growth technology company. Corner

Growth’s mission is to deliver value to its investors by providing

a compelling alternative to a traditional public offering. Corner

Growth is uniquely positioned to deliver on its value-add approach

given its management team’s history, experience, relationships,

leadership and track record in identifying and investing in

disruptive technology companies across all technology

verticals.

Corner Growth also brings a group of highly respected investment

professionals, with strong track records and deep individual

experience in SPAC and de-SPAC processes, a rolodex of premier

public market investors, and a team of advisors who offer

experience and access to networks across a broad functional and

physical geography.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240703682277/en/

Noventiq Investors: Steven Salter Global VP of Corporate Affairs

IR@noventiq.com Media: Rocio Herraiz Global Head of Communications

pr@noventiq.com Corner Growth David Katz

katz@cornercapitalgroup.com

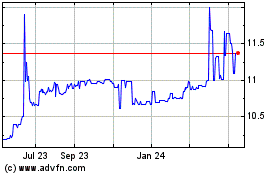

Corner Growth Acquisition (NASDAQ:COOL)

Historical Stock Chart

From Dec 2024 to Jan 2025

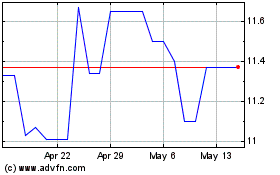

Corner Growth Acquisition (NASDAQ:COOL)

Historical Stock Chart

From Jan 2024 to Jan 2025