Corsair Gaming, Inc. (Nasdaq: CRSR) (“Corsair” or the

“Company”), a leading global provider and innovator of

high-performance gear for gamers, streamers, content-creators, and

gaming PC builders, today announced financial results for the third

quarter ended September 30, 2024.

Third Quarter 2024 Select Financial Metrics

- Net revenue was $304.2 million compared to $363.2 million in

the third quarter of 2023, a decrease of 16.2%. Gaming Components

and Systems segment net revenue was $202.2 million compared to

$272.8 million in the third quarter of 2023, while Gamer and

Creator Peripherals segment net revenue was $102.0 million compared

to $90.4 million in the third quarter of 2023.

- Net loss attributable to common shareholders was $58.4 million,

or a net loss of $0.56 per diluted share, compared to a net loss of

$3.1 million, or a net loss of $0.03 per diluted share, in the

third quarter of 2023.

- Adjusted net loss was $30.3 million, or an adjusted net loss of

$0.29 per diluted share, compared to adjusted net income of $13.4

million, or an adjusted net income of $0.13 per diluted share, in

the third quarter of 2023. Loss per share in the current quarter

includes a $32.5 million non-cash charge for valuation allowance on

deferred tax assets.

- Adjusted EBITDA was $4.8 million, compared to adjusted EBITDA

of $23.0 million in the third quarter of 2023.

- Cash and restricted cash were $61.6 million as of September 30,

2024.

First Nine Months 2024 Select Financial Metrics

- Net revenue was $902.8 million compared to $1,042.6 million in

the first nine months of 2023, a decrease of 13.4%. Gaming

Components and Systems segment net revenue was $599.6 million

compared to $784.5 million in the first nine months of 2023, while

Gamer and Creator Peripherals segment net revenue was $303.2

million compared to $258.1 million in the first nine months of

2023.

- Net loss attributable to common shareholders was $100.5

million, or a net loss of $0.97 per diluted share, compared to a

net loss of $3.0 million, or a net loss of $0.03 per diluted share,

in the first nine months of 2023.

- Adjusted net loss was $27.6 million, or an adjusted net loss of

$0.27 per diluted share, compared to adjusted net income of $35.1

million, or an adjusted net income of $0.33 per diluted share, in

the first nine months of 2023. Loss per share in the first nine

months of 2024 includes the above mentioned $32.5 million non-cash

charge for valuation allowance on deferred tax assets.

- Adjusted EBITDA was $21.6 million compared to $61.3 million in

the first nine months of 2023.

Andy Paul, Chief Executive Officer of Corsair, stated, “Our

Gaming Components and Systems business segment continues to show

challenging results, as we near the end of the latest technology

cycle of GPU cards. We believe the industry is gearing up for a

strong 2025, with new Nvidia GPU cards expected to be launched in

Q1, and we believe that we will see the beginning of a significant

refresh cycle from the COVID lockdown surge of system builds. In

the meantime, we remain a market leader in gaming components and

systems, and are focused on improving efficiencies where we can

across the business and working to increase profitability in our

newer products. PC gaming as an activity continues to grow, and we

can see that from the industry reports of headset sales, which are

substantially higher than pre-pandemic levels, and are now showing

growth from last year. We continue to gain positive momentum in our

Gamer and Creator Peripherals segment, with 13% revenue growth on a

year over year basis in the third quarter of 2024 and continued

strong margins reaching 38.3% in Q3 2024. This is where most of our

M&A activity is focused and we were pleased to recently

announce that we completed our acquisition of the Fanatec business

from Endor AG. We believe this will greatly accelerate our recent

entry into the large and rapidly growing Sim Racing market. In

addition, with our new Chassis, Gaming PCs, Monitors and Fanatec

steering wheels, wheel bases and pedals, we have a full end-to-end

solution. We are working hard on the integration of Fanatec, which

we expect to have substantially completed by Q2 2025. We expect

revenue in Q4 2024 will be EBITDA neutral, but are confident that

business will be profitable in 2025, with Fanatec having the

potential to drive meaningful revenue growth over the coming years.

Overall, we expect 2025 to be a strong year with expected continued

growth from Gaming and Sim Racing and a strong rebound from our

components product lines.”

Michael G. Potter, Chief Financial Officer of Corsair, stated,

“We were able to use our strong balance sheet to complete the

Fanatec business acquisition, which we expect will be a significant

long-term growth driver similar to what we have achieved with other

highly successful segment leading acquisitions we have previously

integrated and grown. We also increased our investment in our

majority owned, key supplier for our industry leading Stream Deck

family of products, which has helped us to achieve higher margins

in one of our fastest growing product areas. We believe that Q2

through Q3 2024 was the trough for revenue and margins for our

Gaming Components and Systems segment and we are seeing progress

towards a recovery in Q4 2024. We exited the quarter with a healthy

cash position and our revolver fully available. This is a result of

our focus on ensuring we could invest in growth opportunities,

while also reducing debt in a steady manner. In reaction to this

year’s slower than expected recovery industrywide, we have taken

additional cost saving actions, including a targeted workforce

reduction to better align our resources with the current business

environment. With these cost saving actions, we made deliberate

decisions to not impact product development or revenue generating

areas so that we can meet higher anticipated demand when the new

GPUs are released to the market. We expect our cost saving measures

to result in several millions of dollars of savings per quarter,

which will start to ramp in Q4 2024. We also expect to steadily

improve EBITDA margins as we return to a path to hit high single

digits there.”

Updated 2024 Financial Outlook

Corsair updated its financial outlook for the full year 2024.

The Company continues to expect revenue to improve through 2024,

with a further improvement in adjusted EBITDA led by an additional

improvement in margin, stabilized shipping costs and continued

tight operating expense controls.

- The Company reiterated its expectation for revenue for the full

year 2024 to be in the range of $1.25 billion to $1.35 billion,

including approximately $20 million of EBITDA-neutral revenue in Q4

2024 from its recent Fanatec acquisition.

- Adjusted operating income is now expected to be in the range of

$28 million to $43 million, compared to $48 million to $63 million

previously.

- Adjusted EBITDA is now expected to be in the range of $40

million to $55 million, compared to $60 million to $75 million

previously.

Certain non-GAAP measures included in our financial outlook were

not reconciled to the comparable GAAP financial measures because

the GAAP measures are not accessible on a forward-looking basis. We

are unable to reconcile these forward-looking non-GAAP financial

measures to the most directly comparable GAAP measures without

unreasonable efforts because we are currently unable to predict

with a reasonable degree of certainty the type and extent of

certain items that would be expected to impact GAAP measures for

these periods but would not impact the non-GAAP measures. Such

items may include stock-based compensation charges, amortization,

and other items. The unavailable information could have a

significant impact on our GAAP financial results.

The foregoing forward-looking statements reflect our

expectations as of today’s date. Given the number of risk factors,

uncertainties and assumptions discussed below, actual results may

differ materially. We do not intend to update our financial outlook

until our next quarterly results announcement.

Recent Product Developments

- Acquisition Moves Corsair into Sim Racing’s Pole

Position: Closed the acquisition of the Fanatec Sim Racing

brand and all associated personnel, in an asset purchase from Endor

AG, creating a leading end-to-end premium Sim Racing product line.

The Fanatec Sim Racing product line is known for setting the gold

standard for excellence in force feedback steering wheels and

wheelbases, pedals, shifters and other accessories for PlayStation,

Xbox, and PC-based racing simulators, which fully complements

Corsair’s Sim Racing chassis, Gaming PCs, Gaming and Streaming

Peripherals, and Monitors.

- Multi-Year Collaboration with Activision: Corsair

released the first products in its multi-year, full cross-brand

collaboration with the critically acclaimed Call of Duty franchise.

This powerful new integration sees two of the world’s best-known

gaming brands come together for the first time with the

collaboration extending across multiple product categories at

Corsair including Drop, Elgato, ORIGIN PC and SCUF Gaming.

- Apple Partnership: Apple will be making a custom-made

Corsair gaming keyboard and mouse available in its stores for the

upcoming 2024 holiday season and continuing into 2025.

- Launches Stream Deck for Professional Broadcasters:

Developed in collaboration with Bitfocus, pioneers in professional

broadcast software, Corsair’s new, professional-grade Stream Deck

Studio is positioned to redefine how professional broadcasters

interact with their tools. The hyper customizable Stream Deck

Studio was designed with a sleek 19-inch console with 32

customizable LCD keys and two customizable rotary dials, and slots

seamlessly into universal studio racks.

- Expands Award-Winning VIRTUOSO Gaming Headset Family:

Corsair launched the new VIRTUOSO MAX Headset with cutting-edge

audio technology for spectacularly clear, precise audio and

ultra-immersive gaming. Available in both PC and Xbox versions,

with active noise cancellation and Dolby Atmos®.

Conference Call and Webcast Information

Corsair will host a conference call to discuss the third quarter

2024 financial results today at 2:00 p.m. Pacific Time. The

conference call will be accessible on Corsair’s Investor Relations

website at https://ir.corsair.com, or by dialing 1-844-481-2518

(USA) or 1-412-317-0546 (International) with conference ID

10193635. A replay will be available approximately 3 hours after

the live call ends on Corsair's Investor Relations website, or

through November 13, 2024 by dialing 1-844-512-2921 (USA) or

1-412-317-6671 (International), with passcode 10193635.

About Corsair Gaming

Corsair (Nasdaq: CRSR) is a leading global developer and

manufacturer of high-performance products and technology for

gamers, content creators, and PC enthusiasts. From award-winning PC

components and peripherals, to premium streaming equipment and

smart ambient lighting, Corsair delivers a full ecosystem of

products that work together to enable everyone, from casual gamers

to committed professionals, to perform at their very best. Corsair

also sells products under its Fanatec brand, the leading end-to-end

premium Sim Racing product line; Elgato brand, which provides

premium studio equipment and accessories for content creators; SCUF

Gaming brand, which builds custom-designed controllers for

competitive gamers; Drop, the leading community-driven mechanical

keyboard brand; and ORIGIN PC brand, a builder of custom gaming and

workstation desktop PCs.

Forward Looking Statements

Except for the historical information contained herein, the

matters set forth in this press release are forward-looking

statements within the meaning of the “safe harbor” provisions of

the Private Securities Litigation Reform Act of 1995, including,

but not limited to, Corsair’s expectations regarding our

anticipated full year 2024 financial results; market headwinds and

tailwinds, including its expectations regarding the gaming market’s

continued growth such as its potential for strong growth in 2025;

statements regarding new product launches, the entry into new

product categories and demand for new products; its ability to

successfully close and integrate acquisitions and expectations

regarding the growth of these acquisitions as well as their

estimated impact on the Company’s financial results in future

periods; statements regarding the size of this markets and segments

in the future; the impact of the Company’s cost-saving measures and

the timing and benefits, if any, the Company may realize as a

result of these measures; and statements regarding the Company’s

future EBITDA margins. Forward-looking statements are based on our

management’s beliefs, as well as assumptions made by, and

information currently available to them. Because such statements

are based on expectations as to future financial and operating

results and are not statements of fact, actual results may differ

materially from those projected. Factors which may cause actual

results to differ materially from current expectations include, but

are not limited to: current macroeconomic conditions, including the

impacts of high inflation and risk of recession, on demand for our

products, consumer confidence and financial markets generally; the

lingering impacts and future outbreaks of the COVID-19 pandemic and

its impacts on our operations and the operations of our

manufacturers, retailers and other partners, as well as its impacts

on the economy overall, including capital markets; our ability to

build and maintain the strength of our brand among gaming and

streaming enthusiasts and our ability to continuously develop and

successfully market new products and improvements to existing

products; the introduction and success of new third-party

high-performance computer hardware, particularly graphics

processing units and central processing units as well as

sophisticated new video games; fluctuations in operating results;

the risk that we are not able to compete with competitors and/or

that the gaming industry, including streaming and esports, does not

grow as expected or declines; the loss or inability to attract and

retain key management; the impacts from geopolitical events and

unrest; delays or disruptions at our or third-parties’

manufacturing and distribution facilities; the risk that we are not

able to successfully identify and close acquisitions, as well as

integrate any companies or assets we have acquired or may acquire;

currency exchange rate fluctuations or international trade disputes

resulting in our products becoming relatively more expensive to our

overseas customers or resulting in an increase in our manufacturing

costs; and the other factors described under the heading “Risk

Factors” in our Annual Report on Form 10-K for the year ended

December 31, 2023 filed with the Securities and Exchange Commission

(“SEC”) and our subsequent filings with the SEC. Copies of each

filing may be obtained from us or the SEC. All forward-looking

statements reflect our beliefs and assumptions only as of the date

of this press release. We undertake no obligation to update

forward-looking statements to reflect future events or

circumstances. Our results for the quarter ended September 30, 2024

are also not necessarily indicative of our operating results for

any future periods.

Use and Reconciliation of Non-GAAP Financial Measures

To supplement the financial results presented in accordance with

GAAP, this earnings release presents certain non-GAAP financial

information, including adjusted operating income (loss), adjusted

net income (loss), adjusted net income (loss) per diluted share and

adjusted EBITDA. These are important financial performance measures

for us, but are not financial measures as defined by GAAP. The

presentation of this non-GAAP financial information is not intended

to be considered in isolation of or as a substitute for, or

superior to, the financial information prepared and presented in

accordance with GAAP.

We use adjusted operating income (loss), adjusted net income

(loss), adjusted net income (loss) per share and adjusted EBITDA to

evaluate our operating performance and trends and make planning

decisions. We believe that these non-GAAP financial measures help

identify underlying trends in our business that could otherwise be

masked by the effect of the expenses and other items that we

exclude in such non-GAAP measures. Accordingly, we believe that

these non-GAAP financial measures provide useful information to

investors and others in understanding and evaluating our operating

results, enhancing the overall understanding of our past

performance and future prospects, and allowing for greater

transparency with respect to the key financial metrics used by our

management in our financial and operational decision-making. We

also present these non-GAAP financial measures because we believe

investors, analysts and rating agencies consider it useful in

measuring our ability to meet our debt service obligations.

Our use of these terms may vary from that of others in our

industry. These non-GAAP financial measures should not be

considered as an alternative to net revenue, operating income

(loss), net income (loss), cash provided by operating activities,

or any other measures derived in accordance with GAAP as measures

of operating performance or liquidity. Reconciliations of these

measures to the most directly comparable GAAP financial measures

are presented in the attached schedules.

We calculate these non-GAAP financial measures as follows:

- Adjusted operating income (loss), non-GAAP, is determined by

adding back to GAAP operating income (loss), the impact from

amortization, stock-based compensation, one-time costs related to

legal and other matters, acquisition and related integration costs,

restructuring and other charges, and acquisition accounting impact

related to recognizing acquired inventory at fair value.

- Adjusted net income (loss), non-GAAP, is determined by adding

back to GAAP net income (loss), the impact from amortization,

stock-based compensation, one-time costs related to legal and other

matters, acquisition and related integration costs, restructuring

and other charges, acquisition accounting impact related to

recognizing acquired inventory at fair value, and the related tax

effects of each of these adjustments.

- Adjusted net income (loss) per diluted share, non-GAAP, is

determined by dividing adjusted net income (loss), non-GAAP by the

respective weighted average shares outstanding, inclusive of the

impact of other dilutive securities.

- Adjusted EBITDA is determined by adding back to GAAP net income

(loss), the impact from amortization, stock-based compensation,

one-time costs related to legal and other matters, depreciation,

interest expense, net, acquisition and related integration costs,

restructuring and other charges, acquisition accounting impact

related to recognizing acquired inventory at fair value, and tax

expense (benefit).

We encourage investors and others to review our financial

information in its entirety, not to rely on any single financial

measure and to view these non-GAAP financial measures in

conjunction with the related GAAP financial measures.

Corsair Gaming, Inc.

Condensed Consolidated

Statements of Operations

(Unaudited, in thousands, except

per share amounts)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Net revenue

$

304,199

$

363,193

$

902,756

$

1,042,589

Cost of revenue

234,538

273,840

683,371

785,000

Gross profit

69,661

89,353

219,385

257,589

Operating expenses:

Sales, general and administrative

74,072

74,000

224,677

211,482

Product development

16,533

16,111

50,585

48,542

Total operating expenses

90,605

90,111

275,262

260,024

Operating loss

(20,944

)

(758

)

(55,877

)

(2,435

)

Other (expense) income:

Interest expense

(3,011

)

(4,271

)

(10,138

)

(13,069

)

Interest income

297

1,742

3,020

5,194

Other income (expense), net

(910

)

304

(1,887

)

(1,326

)

Total other expense, net

(3,624

)

(2,225

)

(9,005

)

(9,201

)

Loss before income taxes

(24,568

)

(2,983

)

(64,882

)

(11,636

)

Income tax benefit (expense)

(27,018

)

97

(21,240

)

3,023

Net loss

(51,586

)

(2,886

)

(86,122

)

(8,613

)

Less: Net income attributable to

noncontrolling interest

122

193

1,345

958

Net loss attributable to Corsair Gaming,

Inc.

$

(51,708

)

$

(3,079

)

$

(87,467

)

$

(9,571

)

Calculation of net loss per share

attributable to common stockholders of Corsair Gaming, Inc.:

Net loss attributable to Corsair Gaming,

Inc.

$

(51,708

)

$

(3,079

)

$

(87,467

)

$

(9,571

)

Change in redemption value of redeemable

noncontrolling interest

(6,684

)

—

(13,044

)

6,535

Net loss attributable to common

stockholders of Corsair Gaming, Inc.

$

(58,392

)

$

(3,079

)

$

(100,511

)

$

(3,036

)

Net loss per share attributable to common

stockholders of Corsair Gaming, Inc.:

Basic

$

(0.56

)

$

(0.03

)

$

(0.97

)

$

(0.03

)

Diluted

$

(0.56

)

$

(0.03

)

$

(0.97

)

$

(0.03

)

Weighted-average common shares

outstanding:

Basic

104,397

102,863

103,974

102,288

Diluted

104,397

102,863

103,974

102,288

Corsair Gaming, Inc.

Segment Information

(Unaudited, in thousands, except

percentages)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Net revenue:

Gamer and Creator Peripherals

$

101,966

$

90,356

$

303,168

$

258,053

Gaming Components and Systems

202,233

272,837

599,588

784,536

Total Net revenue

$

304,199

$

363,193

$

902,756

$

1,042,589

Gross Profit:

Gamer and Creator Peripherals

$

39,032

$

29,928

$

118,374

$

82,085

Gaming Components and Systems

30,629

59,425

101,011

175,504

Total Gross Profit

$

69,661

$

89,353

$

219,385

$

257,589

Gross Margin:

Gamer and Creator Peripherals

38.3

%

33.1

%

39.0

%

31.8

%

Gaming Components and Systems

15.1

%

21.8

%

16.8

%

22.4

%

Total Gross Margin

22.9

%

24.6

%

24.3

%

24.7

%

Corsair Gaming, Inc.

Condensed Consolidated Balance

Sheets

(Unaudited, in thousands)

September 30, 2024

December 31, 2023

Assets

Current assets:

Cash and restricted cash

$

61,361

$

178,325

Accounts receivable, net

178,102

253,268

Inventories

293,005

240,172

Prepaid expenses and other current

assets

39,085

39,824

Total current assets

571,553

711,589

Restricted cash, noncurrent

245

239

Property and equipment, net

32,125

32,212

Goodwill

357,520

354,705

Intangible assets, net

175,387

188,009

Other assets

65,836

70,709

Total assets

$

1,202,666

$

1,357,463

Liabilities

Current liabilities:

Debt maturing within one year, net

$

12,223

$

12,190

Accounts payable

190,600

239,957

Other liabilities and accrued expenses

158,301

166,340

Total current liabilities

361,124

418,487

Long-term debt, net

164,993

186,006

Deferred tax liabilities

8,388

17,395

Other liabilities, noncurrent

55,290

41,595

Total liabilities

589,795

663,483

Temporary equity

Redeemable noncontrolling interest

14,387

15,937

Permanent equity

Corsair Gaming, Inc. stockholders’

equity:

Common stock and additional paid-in

capital

659,905

630,652

(Accumulated deficit) retained

earnings

(60,101

)

40,410

Accumulated other comprehensive loss

(1,320

)

(3,487

)

Total Corsair Gaming, Inc. stockholders'

equity

598,484

667,575

Nonredeemable noncontrolling interest

—

10,468

Total permanent equity

598,484

678,043

Total liabilities, temporary equity and

permanent equity

$

1,202,666

$

1,357,463

Corsair Gaming, Inc.

Condensed Consolidated

Statements of Cash Flows

(Unaudited, in thousands)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Cash flows from operating

activities:

Net loss

$

(51,586

)

$

(2,886

)

$

(86,122

)

$

(8,613

)

Adjustments to reconcile net loss to net

cash (used in) provided by operating activities:

Stock-based compensation

7,424

7,825

23,125

23,245

Depreciation

3,314

3,083

9,494

9,016

Amortization

9,566

9,507

28,582

29,005

Deferred income taxes, net of valuation

allowance

28,031

(2,025

)

12,766

(7,724

)

Other

1,408

211

2,789

2,493

Changes in operating assets and

liabilities:

Accounts receivable

(1,561

)

(31,996

)

74,258

(18,070

)

Inventories

16,301

(16,110

)

(9,569

)

(35,452

)

Prepaid expenses and other assets

(7,118

)

1,036

216

(4,551

)

Accounts payable

10,702

12,727

(61,316

)

38,287

Other liabilities and accrued expenses

8,620

6,716

(13,901

)

4,424

Net cash (used in) provided by operating

activities

25,101

(11,912

)

(19,678

)

32,060

Cash flows from investing

activities:

Acquisition of business, net of cash

acquired

(43,131

)

(14,220

)

(43,131

)

(14,220

)

Purchase of property and equipment

(3,322

)

(3,327

)

(8,351

)

(10,784

)

Purchase of intangible asset

—

—

(100

)

—

Purchase price adjustment related to

business acquisition

—

—

1,041

—

Settlement of bridge Loan receivable

12,310

—

—

—

Net cash used in investing activities

(34,143

)

(17,547

)

(50,541

)

(25,004

)

Cash flows from financing

activities:

Repayment of debt

(3,125

)

(5,000

)

(21,250

)

(16,250

)

Borrowings from line of credit

21,500

—

21,500

—

Repayment of line of credit

(21,500

)

—

(21,500

)

—

Purchase of additional ownership

interest

(19,750

)

—

(19,750

)

—

Payment of deferred and contingent

consideration

—

—

(4,942

)

(950

)

Proceeds from issuance of shares through

employee equity incentive plans

1,810

411

5,110

6,790

Payment of taxes related to net share

settlement of equity awards

(147

)

(531

)

(562

)

(1,318

)

Dividend paid to noncontrolling

interest

(3,262

)

(980

)

(5,222

)

(980

)

Payment of other offering costs

—

—

—

(497

)

Net cash used in financing activities

(24,474

)

(6,100

)

(46,616

)

(13,205

)

Effect of exchange rate changes on

cash

535

(683

)

(123

)

(141

)

Net decrease in cash and restricted

cash

(32,981

)

(36,242

)

(116,958

)

(6,290

)

Cash and restricted cash at the beginning

of the period

94,587

184,012

178,564

154,060

Cash and restricted cash at the end of the

period

$

61,606

$

147,770

$

61,606

$

147,770

Corsair Gaming, Inc.

GAAP to Non-GAAP

Reconciliations

Non-GAAP Operating Income

Reconciliations

(Unaudited, in thousands, except

percentages)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Operating Loss - GAAP

$

(20,944

)

$

(758

)

$

(55,877

)

$

(2,435

)

Amortization

9,567

9,507

28,583

29,005

Stock-based compensation

7,424

7,825

23,125

23,245

One-time costs related to legal and other

matters

29

—

7,499

—

Acquisition and related integration

costs

2,281

1,386

4,660

2,160

Restructuring and other charges

3,369

709

4,935

709

Acquisition accounting impact related to

recognizing acquired inventory at fair value

695

960

1,073

960

Adjusted Operating Income -

Non-GAAP

$

2,421

$

19,629

$

13,998

$

53,644

As a % of net revenue - GAAP

-6.9

%

-0.2

%

-6.2

%

-0.2

%

As a % of net revenue - Non-GAAP

0.8

%

5.4

%

1.6

%

5.1

%

Corsair Gaming, Inc.

GAAP to Non-GAAP

Reconciliations

Non-GAAP Net Income (Loss) and

Net Income (Loss) Per Share Reconciliations

(Unaudited, in thousands, except

per share amounts)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Net loss attributable to common

stockholders of Corsair Gaming, Inc. (1)

$

(58,392

)

$

(3,079

)

$

(100,511

)

$

(3,036

)

Less: Change in redemption value of

redeemable noncontrolling interest

(6,684

)

—

(13,044

)

6,535

Net loss attributable to Corsair Gaming,

Inc.

(51,708

)

(3,079

)

(87,467

)

(9,571

)

Add: Net income attributable to

noncontrolling interest

122

193

1,345

958

Net Loss - GAAP

(51,586

)

(2,886

)

(86,122

)

(8,613

)

Adjustments:

Amortization

9,567

9,507

28,583

29,005

Stock-based compensation

7,424

7,825

23,125

23,245

One-time costs related to legal and other

matters

29

—

7,499

—

Acquisition and related integration

costs

2,281

1,386

4,660

2,160

Restructuring and other charges

3,369

709

4,935

709

Acquisition accounting impact related to

recognizing acquired inventory at fair value

695

960

1,073

960

Non-GAAP income tax adjustment

(2,031

)

(4,137

)

(11,317

)

(12,352

)

Adjusted Net Income (Loss) -

Non-GAAP

$

(30,252

)

$

13,364

$

(27,564

)

$

35,114

Diluted net income (loss) per

share:

GAAP

$

(0.56

)

$

(0.03

)

$

(0.97

)

$

(0.03

)

Adjusted, Non-GAAP

$

(0.29

)

$

0.13

$

(0.27

)

$

0.33

Weighted-average common shares

outstanding - Diluted:

GAAP

104,397

102,863

103,974

102,288

Adjusted, Non-GAAP

104,397

106,532

103,974

106,293

(1) Numerator for calculating net income

(loss) per share-GAAP

Corsair Gaming, Inc.

GAAP to Non-GAAP

Reconciliations

Adjusted EBITDA

Reconciliations

(Unaudited, in thousands, except

percentages)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Net Loss - GAAP

$

(51,586

)

$

(2,886

)

$

(86,122

)

$

(8,613

)

Amortization

9,567

9,507

28,583

29,005

Stock-based compensation

7,424

7,825

23,125

23,245

One-time costs related to legal and other

matters

29

—

7,499

—

Depreciation

3,314

3,083

9,494

9,016

Interest expense, net of interest

income

2,714

2,529

7,118

7,875

Acquisition and related integration

costs

2,281

1,386

4,660

2,160

Restructuring and other charges

3,369

709

4,935

709

Acquisition accounting impact related to

recognizing acquired inventory at fair value

695

960

1,073

960

Income tax (benefit) expense

27,018

(97

)

21,240

(3,023

)

Adjusted EBITDA - Non-GAAP

$

4,825

$

23,016

$

21,605

$

61,334

Adjusted EBITDA margin - Non-GAAP

1.6

%

6.3

%

2.4

%

5.9

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241106011577/en/

Investor Relations Contact: Ronald van Veen

ir@corsair.com 510-578-1407

Media Contact: David Ross david.ross@corsair.com +4411

8208 0542

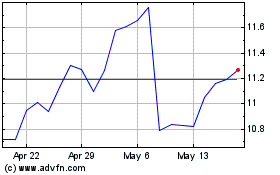

Corsair Gaming (NASDAQ:CRSR)

Historical Stock Chart

From Dec 2024 to Jan 2025

Corsair Gaming (NASDAQ:CRSR)

Historical Stock Chart

From Jan 2024 to Jan 2025