Appoints Ken Seipel as Chief Executive

Officer

Reports Preliminary Third Quarter Results

above prior outlook

Q3 2024 Preliminary Total Sales of $179.1

million, comparable store sales increase of 5.7%

Citi Trends Inc. (NASDAQ: CTRN) today announced the Board of

Directors has appointed Kenneth (Ken) Seipel as Chief Executive

Officer, effective November 18, 2024. Mr. Seipel has been serving

as the Interim CEO of Citi Trends since June 1, 2024, and on the

Board of Directors since 2019. Concurrently, the Board appointed

Peter Sachse, the current Executive Chairman of the Board, as

Chairman of the Board.

In addition, the Company is announcing preliminary Q3 2024

results with sales of $179.1 million and comparable store sales

growth of 5.7% vs. Q3 2023. Q3 sales results are expected to be

above the Company’s previous outlook of second half comparable

store sales results flat to up low single digits compared to prior

year. Gross margin for Q3 2024 is expected to be 39.8%, an increase

of 160 basis points compared to Q3 2023. Sales and gross margin

results are due to improved product, better allocation methods and

increased customer traffic. Q3 2024 Adjusted EBITDA* is expected to

be a loss of $3.3 million, which includes strategic costs for

in-depth customer and market research and costs to improve

operational processes. More details will be provided with the

Company’s Q3 earnings release on December 3, 2024.

The Company’s Chairman of the Board, Peter Sachse, commented,

“We are pleased with our sales and gross margin performance in Q3

2024 and are excited to appoint Ken to the permanent role of CEO.

In a short period of time, Ken has improved the Company’s business

performance and is laying the groundwork for long term shareholder

value creation. Ken’s deep retail experience and his strong track

record of leading significant value creation as CEO in past

companies gives us confidence that he will develop and execute Citi

Trends’ long term strategic plan to more than triple our company

value.”

Ken Seipel commented, “Citi Trends is an exciting growth

opportunity. The Company is uniquely positioned with nearly 600

stores serving our core African American customers in their

neighborhoods, creating a defensible moat against competition. We

are fortunate to have a loyal and frequent base of shoppers who

have quickly responded to our improved product strategies,

including exceptional prices on branded product. Working with our

talented, highly engaged employees, I am confident we will

significantly improve business performance and shareholder

value”.

Seipel continued: “I am pleased to continue working with Peter

and the entire Board of Directors on the future of Citi Trends.

Further, as a shareholder, I would like to acknowledge the Board of

Directors for creating a progressive compensation package that is

aligned with shareholder interests with an incentive for

significant share price appreciation”.

About Kenneth (Ken)

Seipel

Ken is a Senior Retail Executive with experience in public and

private equity backed ownership companies along with Fortune 500

retail company background. A seasoned, multi-functional general

manager / leader, with experience in large scale growth, concept

development, expansion and business turn-around, Ken most recently

served as Interim CEO of Citi Trends and as a member of the Board

of Directors of Citi Trends since 2019 serving as the Chairman of

the Nominating and Corporate Governance Committee, and member of

the Audit and Finance Committee.

From 2018 to 2021, Ken served as CEO and co-owner of West

Marine, the world’s largest retailer of boating supplies. Ken led a

highly successful business turn around leading to a successful

transaction, and an over six times return on investment for

shareholders. From 2013 through March 2017, Ken served as CEO of

Gabriel Brothers Inc. AKA "Gabe's". Under Ken's leadership, the

company’s business strategies resulted in a private transaction

valued at three times investment. In 2011 and 2012, Ken served as

President and COO of Wet Seal Inc. where he stabilized the volatile

business, restored cash to the balance sheet, optimized real estate

and reduced working capital needs. In late 2009 and 2010, Ken

served as Chief Restructuring Officer and Interim CEO at Pamida

Stores. Following his business turn around strategies to restore

profit and the balance sheet, Pamida was merged as a growth

strategy for another retail holding.

Prior to 2009, Ken served as the EVP of Operations for North

America, at the Old Navy division of Gap, Inc., leading the concept

through a time of explosive growth to $7B and over 1,000 stores

when the brand developed into the value specialty brand known

today. Ken began his career with JCPenney in operations and

merchandise buying, in the mid 90's with Target as a leader on the

Supercenter development team and later was head of stores and

acquisitions for Shopko.

About Citi

Trends

Citi Trends, Inc. is a value-priced retailer of urban fashion

apparel, accessories and home goods for the entire family. The

Company operates 592 stores located in 33 states. Citi Trends’

website address is www.cititrends.com.

Fiscal 2024 Third Quarter Earnings

Release

Management will provide further details on its third quarter

conference call on December 3, 2024 at 9:00 a.m. ET. The number to

call for the live interactive teleconference is 877-407-0779. The

live broadcast of Citi Trends' conference call will be available

online at the Company's website, www.cititrends.com, under the

Investor Relations section.

* Non-GAAP

Financial Measure – Adjusted EBITDA

Adjusted EBITDA is calculated as earnings before interest,

income taxes and depreciation and amortization and excludes the

impact of CEO transition, shareholder defense and store impairment

expenses.

Forward-Looking

Statements

All statements other than historical facts contained in this

news release, including statements regarding the Company’s future

financial results and position, business plans and the objectives

and expectations of management, are forward-looking statements that

are subject to material risks and uncertainties. The words

“believe,” “may,” “could,” “plans,” “estimate,” “expects,”

“continue,” “anticipate,” “intend,” “expect,” “upcoming,” “trend”

and similar expressions, as they relate to the Company, are

intended to identify forward-looking statements, although not all

forward-looking statements contain such language. Statements with

respect to earnings or sales are forward-looking statements.

Investors are cautioned that any such forward-looking statements

are subject to the finalization of the Company’s quarter-end

financial and accounting procedures, are not guarantees of future

performance and are inherently subject to risks and uncertainties,

some of which cannot be predicted or quantified. Actual results or

developments may differ materially from those included in the

forward-looking statements as a result of various factors, which

are discussed in our Annual Reports and Quarterly Reports on Forms

10-K and 10-Q, respectively, and any amendments thereto, filed with

the SEC. These risks and uncertainties include, but are not limited

to, uncertainties relating to general economic conditions,

including inflation, energy and fuel costs, unemployment levels,

and any deterioration whether caused by acts of war, terrorism,

political or social unrest (including any resulting store closures,

damage or loss of inventory) or other factors; changes in market

interest rates and market levels of wages; natural disasters such

as hurricanes; uncertainty and economic impact of pandemics,

epidemics or other public health emergencies such as the ongoing

COVID-19 pandemic; transportation and distribution delays or

interruptions; changes in freight rates; the Company’s ability to

attract and retain workers; the Company’s ability to negotiate

effectively the cost and purchase of merchandise inventory risks

due to shifts in market demand; the Company’s ability to gauge

fashion trends and changing consumer preferences; changes in

consumer confidence and consumer spending patterns; competition

within the industry; competition in our markets; the duration and

extent of any economic stimulus programs; changes in product mix;

interruptions in suppliers’ businesses; the ongoing assessment and

impact of the cyber disruption we identified on January 14, 2023,

including legal, reputational, financial and contractual risks

resulting from the disruption, and other risks related to

cybersecurity, data privacy and intellectual property; temporary

changes in demand due to weather patterns; seasonality of the

Company’s business; changes in market interest rates and market

levels of wages; the results of pending or threatened litigation;

delays associated with building, remodeling, opening and operating

new stores; and delays associated with building and opening or

expanding new or existing distribution centers. Any forward-looking

statements by the Company are intended to speak only as of the date

such statements are made. Except as required by applicable law,

including the securities laws of the United States and the rules

and regulations of the SEC, the Company does not undertake to

publicly update any forward-looking statements in this news release

or with respect to matters described herein, whether as a result of

any new information, future events or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241119220147/en/

Tom Filandro ICR, Inc. CitiTrendsIR@icrinc.com

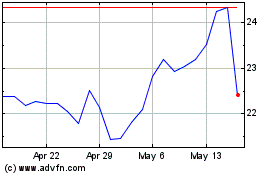

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Nov 2024 to Dec 2024

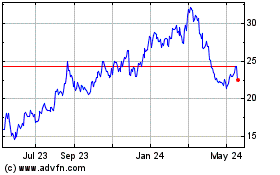

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Dec 2023 to Dec 2024