Total sales of $179.1 million; Comparable

store sales growth of 5.7%

Gross margin of 39.8%, expansion of 160

basis points from Q3 2023

Strong financial position with liquidity of

approximately $114 million and no debt

Strong start to Holiday Season

Company raises Outlook for second half of

Fiscal 2024

Citi Trends, Inc. (NASDAQ: CTRN), a leading specialty value

retailer of apparel, accessories and home trends for way less spend

primarily for African American and multicultural families in the

United States, today reported results for the third quarter ended

November 2, 2024.

Financial Highlights – Third Quarter

2024

- Total sales of $179.1 million decreased 0.3% vs. Q3 2023;

comparable store sales, calculated on a shifted 13-week to 13-week

basis, increased 5.7% compared to Q3 2023 driven by increases in

traffic, basket and conversion, reflecting improved product and

better allocation methods

- Gross margin of 39.8% vs. 38.2% in Q3 2023, an increase of 160

basis points due to markup expansion and a 40 basis point

improvement in shrink results from the impact of mitigation

efforts

- SG&A of $74.7 million, $74.6 million as adjusted* vs. $69.7

million, or $70.8 million as adjusted* in Q3 2023; approximately

$1.6 million of the increase was due to one-time strategic costs in

support of turnaround efforts, including a customer and market

insight study and consulting to accelerate improved shrink and to

support operational process improvements across the

organization

- Net loss of $(7.2) million, or adjusted net loss* of $(6.5)

million, vs. net loss of $(3.9) million, or $(4.6) million as

adjusted* in Q3 2023

- Adjusted EBITDA* loss of ($3.3) million compared to adjusted

EBITDA* loss of ($2.3) million in Q3 2023

- Closed 4 stores to end the quarter with 593 locations; 23% of

the fleet in CTx remodeled format

- Cash of $38.9 million at quarter-end, with no debt and no

borrowings under a $75 million credit facility

- Quarter-end total dollar inventory decreased 1.7% compared to

Q3 2023

Chief Executive Officer

Comments

Ken Seipel, Chief Executive Officer, commented, "Our third

quarter performance of mid-single digit comparable store sales

growth and a 160 basis point improvement in gross margin are early

indicators that our customers are responding to our strategy

adjustments. Comparable store sales increases grew sequentially

each month in the quarter driven by increased transaction counts,

with continuing momentum Q4 to-date. These results reflect the

early impact of our initiatives to strengthen Citi Trends’ good,

better, best product offering, adding extreme value branded deals

to the treasure hunt and to improve operational disciplines,

including product allocation to ensure the right product is in the

right stores.

During the quarter, we incurred strategic costs, which I

consider as one-time in nature, to drive long-term growth including

an extensive customer and market research study which will help us

refine our product assortment and serve as a basis for the

Company’s long range plan, costs to research and accelerate

improved shrink results and the development of best practices to

improve operational efficiency across the organization. These work

streams and their related expenses are expected to be completed in

the fourth quarter and are instrumental in our goal to

significantly increase shareholder value.”

“I am excited to be appointed to the role of permanent CEO.

Since assuming the interim CEO role six months ago, my confidence

in the Company’s potential has only deepened. Citi Trends is a

unique and exciting growth opportunity. We have nearly 600

locations serving a largely underserved core African American

customer in their neighborhoods. Our brand familiarity, customer

loyalty and neighborhood locations are difficult to duplicate,

giving us a defensible moat against competition. The challenges we

face are largely within our control, and we are taking decisive

action to address them. A strong balance sheet with ample liquidity

and no debt will allow us to execute the foundational work

necessary for future growth and profit acceleration. While we are

still early in our transformation journey, I am energized by our

team's swift pivot to execute upon our new initiatives and the

encouraging results of Q3 along with the strong early results of

the holiday period. This momentum reinforces my belief in the

Company’s potential to deliver much improved near-term and

long-term results," Seipel concluded.

Capital Return Program

Update

In the third quarter of fiscal 2024, the Company did not

repurchase any shares of its common stock. At the end of Q3 2024,

$50.0 million remained available under the Company’s share

repurchase program.

The Company expects to resume share repurchase activity in the

fourth quarter of fiscal 2024.

Second Half 2024 Outlook

The Company is updating its outlook for the second half of

fiscal 2024 as follows:

- Expecting second half comparable store sales to be up low to

mid-single digits compared to the second half of fiscal 2023 vs.

prior outlook of flat to up low single digits; total sales expected

to be flat to down low-single digits due to the 53rd week last year

and store closures

- Second half gross margin is expected to be approximately 39%,

consistent with prior outlook

- Second half EBITDA* is expected to be in the range of $1.5

million to $4 million, above our prior outlook of $0.5 million to

$2.5 million

- The Company expects to end fiscal 2024 with approximately 590

stores, consistent with prior outlook

- Year-end cash balance is expected to be in the range of $60

million to $65 million, within prior outlook

- Capital expenditures for the full year are expected to be in

the range of $14 million to $18 million on pull-forward of certain

investments to drive performance improvement

While the Company does not provide quarterly guidance, given the

significant changes in the Company’s business model along with the

dynamic nature of its growth and where it is in its fiscal year, it

is offering the following comments about the fourth quarter of

fiscal 2024:

- Q4 comparable store sales are expected to be up low to

mid-single digits with total sales down mid-single digits due to

the 53rd week last year and store closures

- Q4 gross margin is expected to be in the range of 39% to

40%

- SG&A is expected to be approximately $76 million including

the finalization of strategic expenses plus store payroll to

support holiday sales

- Q4 EBITDA* is expected to be in the range of $5 million to $7

million

Financial Highlights – 39 weeks ended

November 2, 2024

- Total sales of $541.9 million increased 1.7% vs. 2023;

comparable store sales, calculated on a shifted 39-week to 39-week

basis, increased 2.3% compared to 2023

- Gross margin of 36.6% vs. 37.7%, or 37.8% as adjusted* in

2023

- Net loss of $(29.0) million, or adjusted net loss* of $(25.2)

million, vs. net loss of $(15.5) million, or $(15.0) million as

adjusted* in 2023

- Adjusted EBITDA* loss of ($21.3) million vs. adjusted EBITDA*

loss of ($8.5) million in 2023

Investor Conference Call and

Webcast

Citi Trends will host a conference call today at 9:00 a.m. ET.

The live broadcast of Citi Trends' conference call will be

available online at the Company's website, cititrends.com, under

the Investor Relations section, beginning today at 9:00 a.m. ET.

The online replay will follow shortly after the call and will be

available for replay for one year.

The live conference call can also be accessed by dialing (877)

407-0779. A replay of the conference call will be available until

December 10,2024, by dialing (844) 512-2921 and entering the

passcode, 13748381.

During the conference call, the Company may discuss and answer

questions concerning business and financial developments and trends

that have occurred after quarter-end. The Company’s responses to

questions, as well as other matters discussed during the call, may

contain or constitute information that has not been disclosed

previously.

*Non-GAAP Financial

Measures

The historical non-GAAP financial measures discussed herein are

reconciled to their corresponding GAAP measures at the end of this

press release. The Company is unable to provide a full

reconciliation of the forward-looking non-GAAP financial measure

used in 2024 guidance without unreasonable effort because it is not

possible to predict certain of its adjustment items with a

reasonable degree of certainty. This information is dependent upon

future events and may be outside of the Company’ control and its

unavailability could have a significant impact on its financial

results.

About Citi Trends

Citi Trends, Inc. is a leading specialty value retailer of

apparel, accessories and home trends for way less spend primarily

for African American and multicultural families in the United

States. The Company operates 592 stores located in 33 states. For

more information, visit cititrends.com or your local store.

Forward-Looking

Statements

All statements other than historical facts contained in this

news release, including statements regarding the Company’s future

financial results and position, business policy and plans,

objectives and expectations of management for future operations and

capital allocation expectations, are forward-looking statements

that are subject to material risks and uncertainties. The words

"believe," "may," "could," "plans," "estimate," “expects,”

"continue," "anticipate," "intend," "expect," “upcoming,” “trend”

and similar expressions, as they relate to the Company, are

intended to identify forward-looking statements, although not all

forward-looking statements contain such language. Statements with

respect to earnings, sales or new store guidance are

forward-looking statements. Investors are cautioned that any such

forward-looking statements are subject to the finalization of the

Company’s quarter-end financial and accounting procedures, are not

guarantees of future performance or results, and are inherently

subject to risks and uncertainties, some of which cannot be

predicted or quantified. Actual results or developments may differ

materially from those included in the forward-looking statements as

a result of various factors which are discussed in our Annual

Reports and Quarterly Reports on Forms 10-K and 10-Q, respectively,

and any amendments thereto, filed with the Securities and Exchange

Commission. These risks and uncertainties include, but are not

limited to, uncertainties relating to general economic conditions,

including inflation, energy and fuel costs, unemployment levels,

and any deterioration whether caused by acts of war, terrorism,

political or social unrest (including any resulting store closures,

damage or loss of inventory); or other factors; changes in market

interest rates and market levels of wages; impacts of natural

disasters such as hurricanes; uncertainty and economic impact of

pandemics, epidemics or other public health emergencies such as the

ongoing COVID-19 pandemic; transportation and distribution delays

or interruptions; changes in freight rates; the Company’s ability

to attract and retain workers; the Company’s ability to negotiate

effectively the cost and purchase of merchandise inventory risks

due to shifts in market demand; the Company’s ability to gauge

fashion trends and changing consumer preferences; consumer

confidence and changes in consumer spending patterns; competition

within the industry; competition in our markets; the duration and

extent of any economic stimulus programs; changes in product mix;

interruptions in suppliers’ businesses; the impact of the cyber

disruption we identified on January 14, 2023, including legal,

reputational, financial and contractual risks resulting from the

disruption, and other risks related to cybersecurity, data privacy

and intellectual property; temporary changes in demand due to

weather patterns; seasonality of the Company’s business; changes in

market interest rates and market level wages; the results of

pending or threatened litigation; delays associated with building,

remodeling, opening and operating new stores; and delays associated

with building, and opening or expanding new or existing

distribution centers. Any forward-looking statements by the

Company, with respect to guidance, the repurchase of shares

pursuant to a share repurchase program, or otherwise, are intended

to speak only as of the date such statements are made. Except as

required by applicable law, including the securities laws of the

United States and the rules and regulations of the Securities and

Exchange Commission, the Company does not undertake to publicly

update any forward-looking statements in this news release or with

respect to matters described herein, whether as a result of any new

information, future events or otherwise.

CITI TRENDS, INC. CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (unaudited) (in thousands, except

per share data) Third Quarter

2024

2023

2022

Net sales

$

179,066

$

179,520

$

192,323

Cost of sales (exclusive of depreciation shown separately

below)

(107,833

)

(110,942

)

(115,741

)

Selling, general and administrative expenses

(74,730

)

(69,654

)

(69,092

)

Depreciation

(4,755

)

(4,749

)

(5,076

)

Asset impairment

(574

)

(178

)

—

Gain on sale-leaseback

-

-

29,168

(Loss) Income from operations

(8,826

)

(6,003

)

31,582

Interest income

482

894

202

Interest expense

(79

)

(76

)

(76

)

(Loss) income before income taxes

(8,423

)

(5,185

)

31,708

Income tax benefit (expense)

1,271

1,322

(7,120

)

Net (loss) income

$

(7,152

)

$

(3,863

)

$

24,588

Basic net (loss) income per common share

$

(0.86

)

$

(0.47

)

$

3.02

Diluted net (loss) income per common share

$

(0.86

)

$

(0.47

)

$

3.02

Weighted average number of shares outstanding Basic

8,356

8,238

8,145

Diluted

8,356

8,238

8,145

Thirty-Nine Weeks Ended November 2,

2024 October 28, 2023 October 29, 2022 Net sales

$

541,907

$

532,762

$

585,550

Cost of sales (exclusive of depreciation shown separately

below)

(343,710

)

(331,827

)

(357,341

)

Selling, general and administrative expenses

(222,721

)

(210,004

)

(208,599

)

Depreciation

(14,331

)

(14,138

)

(15,793

)

Asset impairment

(1,835

)

(178

)

—

Gain on sale-leasebacks

—

—

64,088

(Loss) income from operations

(40,690

)

(23,385

)

67,905

Interest income

1,942

2,804

204

Interest expense

(238

)

(228

)

(230

)

(Loss) income before income taxes

(38,986

)

(20,809

)

67,879

Income tax benefit (expense)

9,995

5,279

(15,624

)

Net (loss) income

$

(28,991

)

$

(15,530

)

$

52,255

Basic net (loss) income per common share

$

(3.49

)

$

(1.89

)

$

6.34

Diluted net (loss) income per common share

$

(3.49

)

$

(1.89

)

$

6.34

Weighted average number of shares outstanding Basic

8,315

8,215

8,237

Diluted

8,315

8,215

8,237

CITI TRENDS, INC. CONDENSED CONSOLIDATED BALANCE

SHEETS (unaudited) (in thousands) November 2,

2024 October 28, 2023 (unaudited) (unaudited) Assets:

Cash and cash equivalents

$

38,872

$

59,726

Inventory

127,514

129,727

Prepaid and other current assets

13,145

11,266

Income Tax Receivable

3,581

3,306

Property and equipment, net

48,878

56,658

Operating lease right of use assets

218,899

239,282

Deferred tax assets

15,301

7,197

Other noncurrent assets

886

1,050

Total assets

$

467,076

$

508,212

Liabilities and Stockholders' Equity: Accounts payable

$

82,791

$

83,393

Accrued liabilities

25,837

24,985

Current operating lease liabilities

49,390

46,511

Other current liabilities

1,548

1,269

Noncurrent operating lease liabilities

175,767

196,856

Other noncurrent liabilities

1,473

2,132

Total liabilities

336,806

355,146

Total stockholders' equity

130,270

153,066

Total liabilities and stockholders' equity

$

467,076

$

508,212

CITI TRENDS, INC. RECONCILIATION OF

NON-GAAP FINANCIAL MEASURES (unaudited) (in thousands,

except per share data)

The Company makes reference in this release to adjusted

operating (loss) income, adjusted gross margin, adjusted net (loss)

income, adjusted EBITDA and adjusted SG&A. The Company believes

these supplemental measures reflect operating results that are more

indicative of the Company's ongoing operating performance while

improving comparability to prior and future periods, and as such,

may provide investors with an enhanced understanding of the

Company's past financial performance and prospects for the future.

This information is not intended to be considered in isolation or

as a substitute for the financial information prepared and

presented in accordance with generally accepted accounting

principles (GAAP).

Third Quarter November 2, 2024 October 28,

2023 Reconciliation of Adjusted Operating (Loss) Income

Operating loss

$

(8,826

)

$

(6,003

)

Gain on insurance

—

(1,188

)

Asset impairment

574

178

CEO transition expenses

121

—

Other non-recurring expenses

44

—

Adjusted operating loss

$

(8,087

)

$

(7,013

)

Third Quarter November 2, 2024 October 28,

2023 Reconciliation of Adjusted Net (Loss) Income Net

loss

$

(7,152

)

$

(3,863

)

Gain on insurance

—

(1,188

)

Asset impairment

574

178

CEO transition expenses

121

Other non-recurring expenses

44

—

Tax effect

(111

)

258

Adjusted net loss

$

(6,524

)

$

(4,615

)

Third Quarter November 2, 2024 October 28,

2023 Reconciliation of Adjusted EBITDA Net loss

$

(7,152

)

$

(3,863

)

Interest income

(482

)

(894

)

Interest expense

79

76

Income tax benefit

(1,271

)

(1,322

)

Depreciation

4,755

4,749

Gain on insurance

—

(1,188

)

Asset impairment

574

178

CEO transition expenses

121

—

Other non-recurring expenses

44

—

Adjusted EBITDA

$

(3,332

)

$

(2,264

)

Third Quarter November 2, 2024 October 28,

2023 Reconciliation of Adjusted Gross Margin Net sales

$

179,066

$

179,520

Cost of sales

(107,833

)

(110,942

)

Gross profit

$

71,233

$

68,578

Gross margin

39.8

%

38.2

%

Non-recurring expenses

$

-

$

-

Adjusted gross profit

$

71,233

$

68,578

Adjusted gross margin

39.8

%

38.2

%

Third Quarter November 2, 2024 October 28,

2023 Reconciliation of SG&A to Adjusted SG&A

SG&A

$

(74,730

)

$

(69,654

)

Gain on insurance

—

(1,188

)

CEO transition expenses

121

—

Other non-recurring expenses

44

—

Adjusted SG&A

$

(74,565

)

$

(70,842

)

Thirty-Nine Weeks Ended November 2, 2024

October 28, 2023 Reconciliation of Adjusted Operating

(Loss) Income Operating (loss) income

$

(40,690

)

$

(23,385

)

Gain on insurance

—

(1,188

)

Asset impairment

1,835

178

Cyber incident expenses

36

1,723

CEO transition expenses

1,479

—

Other non-recurring expenses

1,695

—

Adjusted operating (loss) income

$

(35,645

)

$

(22,672

)

Thirty-Nine Weeks Ended November 2, 2024

October 28, 2023 Reconciliation of Adjusted Gross

Margin Net sales

$

541,907

$

532,762

Cost of sales

(343,710

)

(331,827

)

Gross profit

$

198,197

$

200,935

Gross margin

36.6

%

37.7

%

Non-recurring expenses

$

-

$

513

Adjusted gross profit

$

198,197

$

201,448

Adjusted gross margin

36.6

%

37.8

%

Thirty-Nine Weeks Ended November 2, 2024

October 28, 2023 Reconciliation of Adjusted Net (Loss)

Income Net (loss) income

$

(28,991

)

$

(15,530

)

Gain on insurance

—

(1,188

)

Asset impairment

1,835

178

Cyber incident expenses

36

1,723

CEO transition expenses

1,479

—

Other non-recurring expenses

1,695

—

Tax effect

(1,293

)

(181

)

Adjusted net (loss) income

$

(25,239

)

$

(14,998

)

Thirty-Nine Weeks Ended November 2, 2024

October 28, 2023 Reconciliation of Adjusted EBITDA

Net (loss) income

$

(28,991

)

$

(15,530

)

Interest income

(1,942

)

(2,804

)

Interest expense

238

228

Income tax (benefit) expense

(9,995

)

(5,279

)

Depreciation

14,331

14,138

Gain on insurance

—

(1,188

)

Asset impairment

1,835

178

Cyber incident expenses

36

1,723

CEO transition expenses

1,479

—

Other non-recurring expenses

1,695

—

Adjusted EBITDA

$

(21,314

)

$

(8,534

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241203225687/en/

Tom Filandro ICR, Inc. CitiTrendsIR@icrinc.com

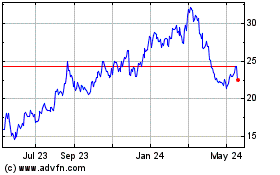

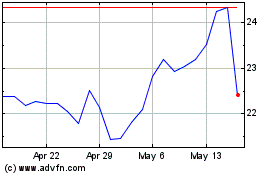

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Dec 2024 to Jan 2025

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Jan 2024 to Jan 2025