EUROPE MARKETS: European Markets Tick Up As Investors Await Trade Talks

January 30 2019 - 4:41AM

Dow Jones News

By Emily Horton

Europe's major markets were largely up Wednesday, as investors

awaited the renewal of U.S./China trade talks and the outcome of

the latest Federal Open Market Committee meeting.

Heavyweight miners were rising.

How did markets perform?

The Stoxx Europe 600 rose slightly on Wednesday, adding 0.1% to

357.47, after finishing up 0.8% on Tuesday.

The FTSE 100 rose 0.8% to reach 6,888.33, helped by a dip in the

pound on Tuesday night.

France's CAC 40 added 0.5% to 4,945.52 Italy's FTSE MIB Italy

index rose by 0.2% to 19,742.97.

Germany's DAX 30 (DAX) lagged behind the rest of Europe's major

indexes, losing 0.2% to 11,201.19.

The euro remained mostly unchanged, fetching $1.143. Meanwhile,

the pound regained some lost ground to $1.3106; it had dropped on

Tuesday night after U.K. parliament voted down a series of Brexit

deal amendments.

What drove the markets?

In the U.S., the latest Federal Open Market Committee meeting

will conclude on Wednesday. Although the Fed is expected to leave

its short-term interest rate unchanged

(http://www.marketwatch.com/story/fed-to-stress-patience-and-that-means-no-interest-rate-move-until-at-least-june-2019-01-22),

the nuances of a press conference by chairman Jerome Powell will be

closely watched.

Trade talks

(http://www.marketwatch.com/story/as-china-us-resume-trade-talks-few-indications-that-a-breakthrough-is-likely-2019-01-28)

are also set to resume between Chinese and U.S. officials in

Washington.

French growth slowed

(http://www.marketwatch.com/story/french-growth-slows-over-anti-government-protests-2019-01-30)in

the fourth quarter as anti-government protests hit business

activity, but German consumer sentiment is set to improve

(http://www.marketwatch.com/story/german-consumer-sentiment-set-to-improve-gfk-2019-01-30)

in February.

British lawmakers on Tuesday rejected proposals from

pro-European MPs to delay Brexit, but narrowly backed a broad

declaration that the government should not leave the EU without a

deal in place. Prime Minister Theresa May now has the green light

to return to Brussels to seek further changes to the Irish border

agreement, a topic the EU has repeatedly said isn't open for

negotiation.

Shares in Apple (AAPL) rose yesterday, despite mixed earnings

(http://www.marketwatch.com/story/apple-revenue-should-continue-to-shrink-so-why-is-the-stock-up-2019-01-29).

What shares were active?

Miners Rio Tinto PLC (RIO.LN)and BHP PLC (BHP.LN) gained almost

2%, while Glencore PLC(GLEN.LN) added just under 3%.

Royal KPN NV lost around 2% on the news the telecommunications

company had swung into a loss

(http://www.marketwatch.com/story/royal-kpn-swings-to-loss-on-revaluation-cost-2019-01-30)

in the fourth quarter.

Siemens AG (SIE.XE) announced a sharp fall in its earnings

(http://www.marketwatch.com/story/siemens-earnings-drop-on-tough-comparisons-2019-01-30)

on Wednesday, dragging shares in the company down by 1%.

Spain's Banco Santander SA (SAN.MC) lost 1%, despite the bank

beating its net profit expectations

(http://www.marketwatch.com/story/santander-profit-beats-expectations-2019-01-30)

for Q4.

(END) Dow Jones Newswires

January 30, 2019 05:26 ET (10:26 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

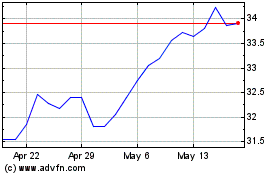

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Nov 2024 to Dec 2024

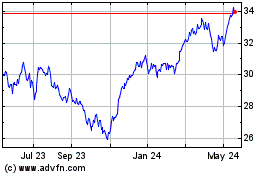

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Dec 2023 to Dec 2024