United

States

Securities

and Exchange Commission

Washington,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934

(Amendment

No. )

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

| ☐ |

Preliminary

Proxy Statement |

| |

|

| ☐ |

Confidential,

For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

|

| ☒ |

Definitive

Proxy Statement |

| |

|

| ☐ |

Definitive

Additional Materials |

| |

|

| ☐ |

Soliciting

Materials Pursuant to Rule 14a-12 |

Eastside

Distilling, Inc.

(Name

of Registrant as Specified in Its Charter)

(Name

of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment

of Filing Fee (Check all boxes that apply):

| ☒ |

No

fee required. |

| |

|

| ☐ |

Fee

paid previously with preliminary materials |

| |

|

| ☐ |

Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

EASTSIDE

DISTILLING, INC.

755 Main Street

Monroe, Connecticut 06468

NOTICE

OF SPECIAL MEETING OF STOCKHOLDERS

To

be held on November 25, 2024

To

the Stockholders of Eastside Distilling, Inc.

NOTICE

IS HEREBY GIVEN that a Special Meeting of Stockholders (the “Special Meeting”) of Eastside Distilling, Inc. (the “Company”)

will be held on November 25, 2024, beginning at 11:00 a.m. Eastern Time. The Special Meeting will be held solely

in a virtual meeting format online at www.virtualspecialmeeting.com/EAST2024SM. You will not be able to attend the Special

Meeting at a physical location. At the Special Meeting, stockholders will act on the following matters:

| |

● |

To

adopt and approve an amendment to our Articles of Incorporation to effect a reverse stock split of our issued shares of common stock,

at a specific ratio, ranging from one-for-two (1:2) to one-for-ten (1:10), at any time prior to the one-year anniversary date of

the Special Meeting, with the exact ratio to be determined by the Board of Directors without further approval or authorization of

our stockholders (the “Reverse Split Proposal”); |

| |

|

|

| |

● |

To

adopt and approve an amendment to our Articles of Incorporation to increase the number of authorized shares of the Company’s

common stock, par value $0.0001 per share, from 6,000,000 to 40,000,000, which we refer to as the “Charter Amendment

Proposal”; and |

| |

|

|

| |

● |

To

approve the adjournment of the Special Meeting to a later date or dates, if necessary or appropriate, to permit further solicitation

and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of the Reverse

Split Proposal or the Charter Amendment Proposal (the “Adjournment Proposal”). |

Pursuant

to the Company’s Amended and Restated Bylaws (the “Bylaws”), the Board has fixed the close of business on October

31, 2024 as the record date for determination of the stockholders entitled to vote at the Special Meeting and any adjournments or

postponements thereof.

Your

vote is important. We urge you to submit your proxy (1) over the internet, (2) by telephone, or (3) by mail, whether or not you plan

to attend the meeting in person. For specific instructions, please refer to “About the Meeting” beginning on the first

page of the proxy statement and the instructions on the proxy card relating to the special meeting. We would appreciate receiving your

proxy at your earliest convenience.

By

Order of the Board of Directors

Geoffrey

Gwin

CEO

Monroe, Connecticut

November

4, 2024

Proxy

Statement

For

the Special Meeting of

Stockholders

To Be Held on November 25, 2024

TABLE

OF CONTENTS

EASTSIDE

DISTILLING, INC.

755 Main Street

Monroe, Connecticut 06468

PROXY

STATEMENT

This

proxy statement contains information related to our Special Meeting of Stockholders to be held on November 25, 2024, at 11:00

a.m. Eastern Time, or at such other time and place to which the Special Meeting may be adjourned or postponed (the “Special

Meeting”). The enclosed proxy is solicited by the Board of Directors (the “Board”) of Eastside Distilling, Inc. (the

“Company”). The proxy materials relating to the Special Meeting are being mailed to stockholders entitled to vote at the

meeting on or about November 4, 2024. A list of record holders of the Company’s common stock entitled to vote at the Special

Meeting will be available for examination by any stockholder, for any purpose germane to the Special Meeting, at our principal offices

at 755 Main Street, Monroe, Connecticut, during normal business hours for ten days prior to the Special Meeting and available

during the Special Meeting.

ABOUT

THE MEETING

When

and where will the Special Meeting be held?

The

Special Meeting will be held on November 25, 2024, at 11:00 a.m. Eastern Time, in a virtual meeting format online

at www.virtualshareholdermeeting.com/EAST2024SM, and at any adjournment or postponement thereof. You will not be able to

attend the Special Meeting at a physical location.

What

is the purpose of the Special Meeting?

We

are calling the Special Meeting to seek the approval of our stockholders:

| |

● |

To

adopt and approve an amendment to our Articles of Incorporation (the “Charter”) to effect a reverse stock split of our

issued shares of common stock, at a specific ratio, ranging from one-for-two (1:2) to one-for-ten (1:10), at any time prior to the

one-year anniversary date of the Special Meeting, with the exact ratio to be determined by the Board without further approval or

authorization of our stockholders (the “Reverse Split Proposal”); |

| |

|

|

| |

● |

To

adopt and approve an amendment to our Articles of Incorporation to increase the number of authorized shares of the Company’s

common stock, par value $0.0001 per share, from 6,000,000 to 40,000,000, which we refer to as the “Charter Amendment

Proposal”; and |

| |

|

|

| |

● |

To

approve the adjournment of the Special Meeting to a later date or dates, if necessary or appropriate, to permit further solicitation

and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of the Reverse

Split Proposal or the Charter Amendment Proposal (the “Adjournment Proposal”). |

What

are the Board’s recommendations?

The

Board recommends you vote:

| |

● |

FOR

the Reverse Split Proposal; |

| |

|

|

| |

● |

FOR

the Charter Amendment Proposal; and |

| |

|

|

| |

● |

FOR

the Adjournment Proposal. |

If

you are a stockholder of record and you return a properly executed proxy card or submit a proxy to vote over the Internet but do not

mark the boxes showing how you wish to vote, your shares will be voted in accordance with the recommendations of the Board, as set forth

above.

No

other matters may be brought before the Special Meeting.

Who

is entitled to vote at the Special Meeting?

The

Board of Directors has set October 31, 2024 as the record date for the special meeting. If you were a stockholder of record at

the close of business on the record date, October 31, 2024, you are entitled to receive notice of the meeting and to vote your

shares at the meeting and at any postponement or adjournment thereof. Holders of the Company’s common stock are entitled to one

vote per share. Holders of the Company’s Series B Preferred Stock are entitled to 0.016129 votes per share of Series B Preferred

Stock. Holders of the Company’s Series F-1 Preferred Stock are entitled to one vote per share.

What

constitutes a quorum?

The

presence at the Special Meeting, in person or by proxy, of the holders of one-third of our common stock outstanding on the record

date will constitute a quorum for the Special Meeting. Pursuant to the corporation law of the State of Nevada, abstentions will be counted

for the purpose of determining whether a quorum is present. If brokers have, and exercise, discretionary authority on at least one item

on the agenda for the Special Meeting, uninstructed shares for which broker non-votes occur will constitute voting power present for

the discretionary matter and will therefore count towards the quorum.

Do

I need to attend the Special Meeting?

No.

It is not necessary for you to attend the virtual Special Meeting in order to vote your shares. You may vote by telephone, through the

Internet or by mail, as described in more detail below.

How

do I vote my shares without attending the Special Meeting?

Stockholder

of record: shares registered in your name. If you are a stockholder of record, you may authorize a proxy to vote on your behalf

at the Special Meeting in any of the following ways:

By

Telephone or via the Internet. You can submit a proxy to vote your shares by telephone or via the Internet by following the instructions

on the enclosed proxy card. Proxies submitted by telephone or via the Internet must be received by 11:59 p.m. Eastern Time, on

the day before the Special Meeting. Have your proxy card in hand as you will be prompted to enter your control number.

By

Mail. You can submit a proxy to vote your shares by mail if you received a printed proxy card by completing, signing, dating and

promptly returning your proxy card in the postage-prepaid envelope provided with the materials. Proxies submitted by mail must be received

by the close of business on the day before the Special Meeting in order to ensure that your vote is counted.

To

facilitate timely receipt of your proxy, we encourage you to promptly vote via the Internet or telephone following the instructions on

the enclosed proxy card. If you are submitting your proxy by telephone or through the Internet, your voting instructions must be received

by 11:59 p.m., Eastern Time on the day before the Special Meeting.

Submitting

your proxy by mail, by telephone or through the Internet will not prevent you from casting your vote at the Special Meeting. You are

encouraged to submit a proxy by mail, by telephone or through the Internet even if you plan to attend the Special Meeting via the virtual

meeting website to ensure that your shares are represented at the Special Meeting.

Beneficial

owner: shares registered in the name of bank, broker or other nominee. If you are a beneficial owner of shares registered

in the name of your bank, broker or other nominee, you should have received voting instructions from that organization rather than from

us. Simply complete and mail the voting instruction form to ensure that your vote is counted. Alternatively, you may vote by telephone

or over the Internet as instructed by your bank, broker or other nominee. Follow the instructions from your broker, bank or other nominee

included with this proxy statement, or contact your bank, broker or other nominee to request a proxy form.

Even

if you plan to attend the Special Meeting live via the Internet, we encourage you to vote in advance by Internet, telephone, or mail

so that your vote will be counted if you later decide not to attend the Special Meeting live via the Internet.

May

I change my vote after I have mailed my proxy card or after I have submitted my proxy by telephone or through the Internet?

Yes.

You may revoke your proxy or change your vote at any time before the proxy is exercised at the Special Meeting. You may revoke your proxy

by delivering a signed written notice of revocation stating that the proxy is revoked and bearing a date later than the date of the proxy

to the Company’s Secretary, Stephanie Kilkenny, at Eastside Distilling, Inc., 755 Main Street, Monroe, Connecticut 06468.

You may also revoke your proxy or change your vote by submitting another proxy by telephone or through the Internet in accordance with

the instructions on the enclosed proxy card. You may also submit a later-dated proxy card relating to the same shares. If you voted by

completing, signing, dating and returning the enclosed proxy card, you should retain a copy of the voter control number found on the

proxy card in the event that you later decide to revoke your proxy or change your vote by telephone or through the Internet. Alternatively,

your proxy may be revoked or changed by attending the Special Meeting via the virtual meeting website and voting at the meeting by following

the internet voting instructions on your proxy card. However, simply attending the Special Meeting without voting will not revoke or

change your proxy. “Street name” holders of shares of our common stock should contact their bank, broker, trust or other

nominee to obtain instructions as to how to revoke or change their proxies.

What

is the difference between holding shares as a stockholder of record and as a beneficial owner?

Many

of our stockholders hold their shares through a broker, bank or other nominee rather than directly in their own name. As summarized below,

there are some distinctions between shares held of record and those owned beneficially.

Stockholder

of Record

If

your shares are registered directly in your name with our transfer agent, Transfer Online, you are considered, with respect to those

shares, the stockholder of record. As the stockholder of record, you have the right to directly grant your voting proxy or to vote in

person at the Special Meeting.

Beneficial

Owner

If

your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held

in street name, and these proxy materials are being forwarded to you by your broker, bank or nominee which is considered, with respect

to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker as to how to vote and are

also invited to attend the Special Meeting. However, because you are not the stockholder of record, you may not vote these shares in

person at the Special Meeting unless you obtain a signed proxy from the record holder giving you the right to vote the shares. If you

do not provide the stockholder of record with voting instructions or otherwise obtain a signed proxy from the record holder giving you

the right to vote the shares, broker non-votes may occur for the shares that you beneficially own. The effect of broker non-votes is

more specifically described in “What vote is required to approve each proposal?” below.

What

vote is required to approve each proposal?

Assuming

that a quorum is present, the following votes will be required:

| |

● |

With

respect to the Reverse Split Proposal, the affirmative vote of the holders of a majority of the voting power in the Company is

required to approve this proposal. For purposes of counting votes on this matter, abstentions and broker non-votes will have

the effect of voting against the matter. |

| |

|

|

| |

● |

With

respect to the Charter Amendment Proposal, the affirmative vote of the holders of a majority of the voting power in the Company is

required to approve this proposal. For purposes of counting votes on this matter, abstentions and broker non-votes will have

the effect of voting against the matter. |

| |

|

|

| |

● |

With

respect to the Adjournment Proposal, the affirmative vote of a majority of the votes cast by all stockholders present in person or

represented by proxy at the Special Meeting and entitled to vote on the proposal is required to approve this proposal. For purposes

of counting votes on this matter, abstentions will have the effect of voting against the matter and broker non-votes will have no

effect on the vote. |

Where

can I find the voting results of the Special Meeting?

The

preliminary voting results will be announced at the Special Meeting, and we will publish final results in a Current Report on Form 8-K

filed with the SEC within four business days of the Special Meeting.

How

are we soliciting this proxy?

We

are soliciting this proxy on behalf of our Board and will pay all expenses associated therewith. Some of our officers, directors and

other employees also may, but without compensation other than their regular compensation, solicit proxies by further mailing or personal

conversations, or by telephone or other electronic means.

We

will also, upon request, reimburse brokers and other persons holding stock in their names, or in the names of nominees, for their reasonable

out-of-pocket expenses for forwarding proxy materials to the beneficial owners of the capital stock and to obtain proxies.

PROPOSAL

NO. 1

THE

REVERSE SPLIT PROPOSAL

Overview

Our

Board has determined that it is advisable and in the best interests of the Company and its stockholders to authorize our Board to amend

our Charter to effect a reverse stock split of our issued shares of common stock at a specific

ratio, ranging from one-for-two (1:2) to one-for-ten (1:10) (the “Approved Split Ratios”), to be determined by the Board

without further approval or authorization of our stockholders (the “Reverse Split”).

Accordingly,

stockholders are asked to adopt and approve the filing of a Certificate of Change to effect the Reverse Split, subject to the

Board’s determination, in its sole discretion, whether or not to implement the Reverse Split, as well as the specific ratio within

the range of the Approved Split Ratios, and provided that the Reverse Split must be effected on or prior to the one-year anniversary

date of the Special Meeting.

If

adopted and approved by our stockholders, the Reverse Split would be effected at an Approved Split Ratio approved by the Board prior

to the one-year anniversary date of the Special Meeting, if at all. To effect the Reverse Stock Split, a Certificate of Change setting

forth the Approved Split Ratio approved by the Board would be filed with the Secretary of State of the State of Nevada and any amendment

to effect the Reverse Split at the other Approved Split Ratios would be abandoned. The Board reserves the right to elect to abandon the Reverse Split at any of the Approved Split Ratios if it determines, in its sole discretion, that the Reverse

Split is no longer in the best interests of the Company and its stockholders.

Purpose

and Rationale for the Reverse Split

Avoid

Delisting from Nasdaq. Nasdaq Listing Rule 5550(a)(2) requires that, for continued listing on Nasdaq, the common stock of the Company

must sustain a $1.00 minimum bid price (the “Minimum Bid Price Requirement”). On August 29, 2024, the Company received a deficiency letter from the Listing Qualifications Department (the “Staff”)

of the Nasdaq Stock Market (“Nasdaq”) notifying Eastside Distilling that, for the preceding 32 consecutive business days,

the closing bid price for Eastside Distilling’s Common Stock was below the minimum $1.00 per share requirement for continued inclusion

on the Nasdaq Capital Market pursuant to Nasdaq Listing Rule 5550(a)(2) (the “Bid Price Requirement”). In accordance with

Nasdaq rules, the Company has been provided a period of 180 calendar days, or until February 25, 2025 (the “Compliance Date”),

to regain compliance with the Bid Price Requirement. If, at any time before the Compliance Date, the closing bid price for the Common

Stock is at least $1.00 for a minimum of 10 consecutive business days, the Staff will provide the Company written confirmation of compliance

with the Bid Price Requirement. If Eastside Distilling does not regain compliance by the Compliance Date, the Company may be eligible

for an additional grace period if, as of the Compliance Date, the Company meets the continued listing requirement for market value of

publicly held shares and all other initial listing standards for the Nasdaq Capital Market, with the exception of the minimum bid price

requirement.

If Eastside Distilling does not regain compliance with the Bid Price Requirement by the Compliance Date and is not

eligible for an additional compliance period at that time, the Staff will provide written notification to Eastside Distilling that the

Common Stock will be subject to delisting. Our shares may then trade on the OTCQB or other small trading markets, such as the OTC Pink

market. In that event, our common stock could trade thinly as a microcap or penny stock, adversely decrease to nominal levels of trading

and may be avoided by retail and institutional investors, resulting in the impaired liquidity of our common stock.

Other

Effects. The Board also believes that the increased market price of our common stock expected as a result of implementing the Reverse

Split could improve the marketability and liquidity of our common stock and will encourage interest and trading in our common stock.

The Reverse Split, if effected, could allow a broader range of institutions to invest in our common stock (namely, funds that are prohibited

from buying stock whose price is below a certain threshold), potentially increasing the trading volume and liquidity of our common stock.

The Reverse Split could help increase analyst and broker’s interest in common stock, as their policies can discourage them from

following or recommending companies with low stock prices. Because of the trading volatility often associated with low-priced stocks,

many brokerage houses and institutional investors have internal policies and practices that either prohibit them from investing in low-priced

stocks or tend to discourage individual brokers from recommending low-priced stocks to their customers. Some of those policies and practices

may make the processing of trades in low-priced stocks economically unattractive to brokers. Additionally, because brokers’ commissions

on low-priced stocks generally represent a higher percentage of the stock price than commissions on higher-priced stocks, a low average

price per share of our common stock can result in individual stockholders paying transaction costs representing a higher percentage of

their total share value than would be the case if the share price were higher.

Our

Board does not intend for this transaction to be the first step in a series of plans or proposals to effect a “going private transaction”

within the meaning of Rule 13e-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Risks

of the Proposed Reverse Split

We

cannot assure you that the proposed Reverse Split will increase the price of our common stock and have the desired effect of regaining

and maintaining compliance with Nasdaq listing rules.

If

the Reverse Split is implemented, our Board expects that it will increase the market price of our common stock so that we are able to

regain and maintain compliance with the Minimum Bid Price. However, the effect of the Reverse Split upon the market price of our common

stock cannot be predicted with any certainty, and the history of similar stock splits for companies in like circumstances is varied.

It is possible that (i) the per share price of our common stock after the Reverse Split will not rise in proportion to the reduction

in the number of shares of our common stock outstanding resulting from the Reverse Split, (ii) the market price per post-Reverse Split

share may not exceed or remain in excess of the $1.00 minimum bid price for a sustained period of time, or (iii) the Reverse Split may

not result in a per share price that would attract brokers and investors who do not trade in lower priced stocks. Even if the Reverse

Split is implemented, the market price of our common stock may decrease due to factors unrelated to the Reverse Split. In any case, the

market price of our common stock will be based on other factors which may be unrelated to the number of shares outstanding, including

our future performance. If the Reverse Split is consummated and the trading price of our common stock declines, the percentage decline

as an absolute number and as a percentage of our overall market capitalization may be greater than would occur in the absence of the

Reverse Split. Even if the market price per post-Reverse Split share of our common stock remains in excess of $1.00 per share, we may

be delisted due to a failure to meet other continued listing requirements, including the Equity Rule and the Nasdaq requirements related

to the minimum number of shares that must be in the public float and the minimum market value of the public float.

A

decline in the market price of our common stock after the Reverse Split is implemented may result in a greater percentage decline than

would occur in the absence of a reverse stock split.

If

the Reverse Split is implemented and the market price of our common stock declines, the percentage decline may be greater than would

occur in the absence of a reverse stock split. The market price of our common stock will, however, also be based upon our performance

and other factors, which are unrelated to the number of shares of common stock outstanding.

The

proposed Reverse Split may decrease the liquidity of our common stock.

The

liquidity of our common stock may be harmed by the proposed Reverse Split given the reduced number of shares of common stock that would

be outstanding after the Reverse Split, particularly if the stock price does not increase as a result of the Reverse Split.

Determination

of the Ratio for the Reverse Split

If

this Reverse Split Proposal is approved by stockholders and the Board determines that it is in the best interests of the Company and

its stockholders to move forward with the Reverse Split, the Approved Split Ratio will be selected by the Board, in its sole discretion.

However, the Approved Split Ratio will not be less than a ratio of one-for-two (1:2) or exceed a ratio of one-for-ten (1:10). In determining

which Approved Split Ratio to use, the Board will consider numerous factors, including the historical and projected performance of our

common stock, prevailing market conditions and general economic trends, and will place emphasis on the expected closing price of our

common stock in the period following the effectiveness of the Reverse Split. The Board will also consider the impact of the Approved

Split Ratios on investor interest. The purpose of selecting a range is to give the Board the flexibility to meet business needs as they

arise, to take advantage of favorable opportunities and to respond to a changing corporate environment. Based on the number of shares

of common stock issued and outstanding as of October 31, 2024, after completion of the Reverse Split, we will have between 2,400,533 and 480,107 shares of common stock issued and outstanding, depending on the Approved Split Ratio selected by the Board.

Principal

Effects of the Reverse Split

After

the effective date of the proposed Reverse Split, each stockholder will own a reduced number of shares of common stock. Except for adjustments

that may result from the treatment of fractional shares as described below, the proposed Reverse Split will affect all stockholders uniformly.

The proportionate voting rights and other rights and preferences of the holders of our common stock will not be affected by the proposed

Reverse Split except for adjustments that may result from the treatment of fractional shares as described below. For example, a holder

of 2% of the voting power of the outstanding shares of our common stock immediately prior to the Reverse Split would continue to hold

2% of the voting power of the outstanding shares of our common stock immediately after the Reverse Split. The number of stockholders

of record also will not be affected by the proposed Reverse Split.

The

following table contains approximate number of issued and outstanding shares of common stock, and the estimated per share trading price

following a 1:2 to 1:10 Reverse Split as of October 31, 2024, without giving effect to any adjustments for fractional shares of

common stock or the issuance of any derivative securities.

After

Each Reverse Split Ratio

| | |

Current | | |

1:2 Split | | |

1:5 Split | | |

1:10 Split | |

| Common stock authorized(1) | |

| 6,000,000 | | |

| 40,000,000 | | |

| 40,000,000 | | |

| 40,000,000 | |

| Common stock outstanding | |

| 4,801,065 | | |

| 2,400,533 | | |

| 960,213 | | |

| 480,107 | |

| Common stock outstanding – fully diluted(2) | |

| 5,124,833 | | |

| 2,562,417 | | |

| 1,024,967 | | |

| 512,484 | |

| Shares of common stock authorized but unissued and not reserved | |

| 875,167 | | |

| 37,437,583 | | |

| 38,975,033 | | |

| 39,487,516 | |

| Price per share, based on

closing price on October 25, 2024(4) | |

$ | 0.59 | | |

$ | 1.18 | | |

$ | 2.95 | | |

$ | 5.90 | |

| (1) |

This table assumes that the

Charter Amendment Proposal is approved, and that the number of shares of common stock authorized in the Company’s Charter is

increased from 6,000,000 to 40,000,000. |

| (2) |

Includes 40,322 common shares

issuable on conversion of outstanding Series B Preferred Stock and 283,446 shares issuable upon exercise of outstanding warrants and options. |

| (4) |

The price per share indicated

reflects solely the application of the applicable Reverse Split ratio to the closing price of the common stock on October 25,

2024. |

After

the effective date of the Reverse Split, our common stock would have a new committee on uniform securities identification procedures

(CUSIP) number, a number used to identify our common stock.

Our

common stock is currently registered under Section 12(b) of the Exchange Act, and we are subject to the periodic reporting and other

requirements of the Exchange Act. The proposed Reverse Split will not affect the registration of our common stock under the Exchange

Act. Our common stock would continue to be reported on Nasdaq under the symbol “EAST,” assuming that we are able to regain

compliance with Nasdaq Continued Listing Requirements, although it is likely that Nasdaq would add the letter “D” to the

end of the trading symbol for a period of twenty trading days after the effective date of the Reverse Split to indicate that the Reverse

Split had occurred.

Effect

on Outstanding Derivative Securities

The

Reverse Split will require that proportionate adjustments be made to the per share exercise price and the number of shares issuable upon

the exercise of the following outstanding derivative securities issued by us, in accordance with the Approved Split Ratio (all figures

are as of October 31, 2024 and are on a pre-Reverse Split basis), including:

| |

● |

40,322

shares of common stock issuable upon conversion of 2,500,000 outstanding shares of Series B Preferred Stock. |

| |

|

|

| |

● |

130,914

shares of common stock issuable upon conversion of secured convertible promissory notes in the aggregate principal amount of $399,290,

with a conversion price of $3.05 per share; |

| |

|

|

| |

● |

190,833

shares of common stock issuable upon the exercise of outstanding warrants, with a weighted average exercise price of $26.14 per share; |

| |

● |

2,021

of common stock issuable upon exercise of stock options, with a weighted average exercise price of $57.95 per share; and |

| |

|

|

| |

● |

239,254

shares of common stock reserved for future issuance under the Company’s 2016 Equity Incentive Plan (the “2016 Plan”). |

The

adjustments to the above securities, as required by the Reverse Split and in accordance with the Approved Split Ratio, would result in

approximately the same aggregate price being required to be paid under such securities upon exercise, and approximately the same value

of shares of common stock being delivered upon such exercise or conversion, immediately following the Reverse Split as was the case immediately

preceding the Reverse Split.

Effect

on our Equity Incentive Plan

As

of October 31, 2024, we had 2,021 shares of common stock reserved for issuance pursuant to the exercise of outstanding options

issued under our 2016 Plan, as well as 239,254 shares of common stock available for issuance under the 2016 Plan. Pursuant to the terms

of the 2016 Plan, the Board, or a designated committee thereof, as applicable, will adjust the number of shares of common stock underlying

outstanding stock options, the exercise price per share of outstanding stock options and other terms of outstanding awards issued pursuant

to the 2016 Plan to equitably reflect the effects of the Reverse Split. Furthermore, the number of shares available for future grant

under the 2016 Plan will be similarly adjusted.

Effective

Date

The

proposed Reverse Split would become effective on the date of filing of the Charter Amendment with the office of the Secretary of State

of the State of Nevada unless another effective date is set forth in the Charter Amendment. On the effective date, shares of common stock

issued immediately prior thereto will be combined and reclassified, automatically and without any action on the part of our stockholders,

into new shares of common stock in accordance with the Approved Split Ratio set forth in this Reverse Split Proposal. If the proposed

Charter Amendment is not adopted and approved by our stockholders, the Reverse Split will not occur.

Treatment

of Fractional Shares

No

fractional shares of common stock will be issued as a result of the Reverse Split. Instead, record holders of our common stock who otherwise

would be entitled to receive a fractional share because they hold a number of shares not evenly divisible by the Approved Split Ratio

will automatically be entitled to receive an additional fraction of a share of common stock to round up to the next whole share. In any

event, cash will not be paid for fractional shares.

Record

and Beneficial Stockholders

If

the Reverse Split is authorized by our stockholders and our Board elects to implement the Reverse Split, stockholders of record holding

some or all of their shares of common stock electronically in book-entry form under the direct registration system for securities will

receive a transaction statement at their address of record indicating the number of shares of common stock they hold after the Reverse

Split. Non-registered stockholders holding common stock through a bank, broker or other nominee should note that such banks, brokers

or other nominees may have different procedures for processing the consolidation than those that would be put in place by us for registered

stockholders. If you hold your shares with such a bank, broker or other nominee and if you have questions in this regard, you are encouraged

to contact your nominee.

If

the Reverse Split is authorized by the stockholders and our Board elects to implement the Reverse Split, stockholders of record holding

some or all of their shares in certificated form (i.e., shares represented by one or more physical stock certificates) will be requested

to exchange their old stock certificate(s) (“Old Certificate(s)”) for shares held in book-entry form at our transfer agent,

Transfer Online, in their direct registration system representing the appropriate number of whole shares of our common stock resulting

from the Reverse Split. Stockholders of record upon the effective time of the Reverse Split will be furnished the necessary materials

and instructions for the surrender and exchange of their Old Certificate(s) at the appropriate time by our transfer agent. As soon as

practicable after the effective time of the Reverse Split, our transfer agent will send a transmittal letter to each stockholder advising

such holder of the procedure for surrendering Old Certificate(s) in exchange for new shares held in book-entry. Your Old Certificate(s)

representing pre-split shares cannot be used for either transfers or deliveries. Accordingly, you must exchange your Old Certificate(s)

in order to effect transfers or deliveries of your shares. Any stockholder whose Old Certificate(s) have been lost, destroyed or stolen

will be entitled to new shares in book-entry only after complying with the requirements that we and our transfer agent customarily apply

in connection with lost, stolen or destroyed certificates.

STOCKHOLDERS

SHOULD NOT DESTROY ANY PRE-SPLIT STOCK CERTIFICATE AND SHOULD NOT SUBMIT ANY CERTIFICATES UNTIL THEY ARE REQUESTED TO DO SO.

Accounting

Consequences

The

par value per share of our common stock would remain unchanged at $0.0001 per share after the Reverse Split. As a result, on the effective

date of the Reverse Split, the stated capital on our balance sheet attributable to the common stock will be reduced proportionally, based

on the Approved Split Ratio selected by the Board, from its present amount, and the additional paid-in capital account shall be credited

with the amount by which the stated capital is reduced. The per share common stock net income or loss and net book value will be increased

because there will be fewer shares of common stock outstanding. The shares of common stock held in treasury, if any, will also be reduced

proportionately based on the Approved Split Ratio selected by the Board. Retroactive restatement will be given to all share numbers in

our financial statements, and accordingly all amounts including per share amounts will be shown on a post-split basis. We do not anticipate

that any other accounting consequences would arise as a result of the Reverse Split.

Dissenter’s

Rights of Appraisal

Any

stockholders who dissent from the Reverse Split have no right to appraisal under the Nevada Revised Statutes, our Articles of Incorporation,

or our bylaws.

Material

Federal U.S. Income Tax Consequences of the Reverse Split

The

following is a summary of the material U.S. federal income tax consequences of a Reverse Split to our U.S. Holders (as defined below).

The summary is based on the Internal Revenue Code of 1986, as amended (the “Code”), applicable Treasury Regulations promulgated

thereunder, judicial authority and current administrative rulings and practices as in effect on the date of this Proxy Statement. Changes

to the laws could alter the tax consequences described below, possibly with retroactive effect. We have not sought and will not seek

an opinion of counsel or a ruling from the Internal Revenue Service regarding the federal income tax consequences of a Reverse Split.

This discussion only addresses U.S. Holders who hold common stock as capital assets. It does not purport to be complete and does not

address U.S. Holders subject to special tax treatment under the Code, including, without limitation, financial institutions, tax-exempt

organizations, insurance companies, dealers in securities, foreign stockholders, stockholders who hold their pre-reverse stock split

shares as part of a straddle, hedge or conversion transaction, and stockholders who acquired their pre-reverse stock split shares pursuant

to the exercise of employee stock options or otherwise as compensation. If a partnership (or other entity treated as a partnership for

U.S. federal income tax purposes) is the beneficial owner of our common stock, the U.S. federal income tax treatment of a partner in

the partnership will generally depend on the status of the partner and the activities of the partnership. Accordingly, partnerships (and

other entities treated as partnerships for U.S. federal income tax purposes) holding our common stock and the partners in such entities

should consult their own tax advisors regarding the U.S. federal income tax consequences of the proposed Reverse Split to them. In addition,

the following discussion does not address the tax consequences of the Reverse Split under state, local and foreign tax laws. Furthermore,

the following discussion does not address any tax consequences of transactions effectuated before, after or at the same time as the Reverse

Split, whether or not they are in connection with the Reverse Split.

For

purposes of the discussion below, a “U.S. Holder” is a beneficial owner of shares of the Company’s common stock that

for U.S. federal income tax purposes is: (i) an individual citizen or resident of the United States; (ii) a corporation (or other entity

taxable as a corporation for U.S. federal income tax purposes) created or organized in or under the laws of the United States, any state

therein or the District of Columbia; (iii) an estate, the income of which is subject to U.S. federal income taxation regardless of its

source; or (iv) a trust with respect to which a U.S. court is able to exercise primary supervision over its administration and one or

more U.S. persons have the authority to control all of its substantial decisions of the trust, or that has a valid election in effect

to be treated as a U.S. person under applicable U.S. Treasury Regulations.

The

Reverse Split is expected to constitute a “recapitalization” for U.S. federal income tax purposes pursuant to Section 368(a)(1)(E)

of the Code. A U.S. Holder generally will not recognize gain or loss on the deemed exchange of shares pursuant to the Reverse Split,

except potentially with respect to any additional fractions of a share of our common stock received as a result of the rounding up of

any fractional shares that otherwise would be issued, as discussed below. Subject to the following discussion regarding a U.S. Holder’s

receipt of a whole share of the Company’s common stock in lieu of a fractional share, a U.S. Holder’s aggregate tax basis

in the shares of common stock received in the Reverse Split will equal the U.S. Holder’s basis in its old shares of common stock

and such U.S. Holder’s holding period in the shares received will include the holding period in its old shares exchanged. The Treasury

Regulations provide detailed rules for allocating the tax basis and holding period of shares of common stock surrendered in a recapitalization

to shares received in the recapitalization.

As

described above under “Treatment of Fractional Shares,” no fractional shares of the Company’s common stock will be

issued as a result of the Reverse Split. Instead, record holders of our common stock who otherwise would be entitled to receive a fractional

share because they hold a number of shares not evenly divisible by the Approved Split Ratio will automatically be entitled to receive

an additional fraction of a share of common stock to round up to the next whole share. A U.S. Holder who receives one whole share of

the Company’s common stock in lieu of a fractional share may recognize income or gain in an amount not to exceed the excess of

the fair market value of such share over the fair market value of the fractional share to which such U.S. Holder was otherwise entitled.

We

will not recognize any gain or loss as a result of the proposed Reverse Split.

THE

PRECEDING DISCUSSION IS INTENDED ONLY AS A SUMMARY OF CERTAIN FEDERAL U.S. INCOME TAX CONSEQUENCES OF THE REVERSE SPLIT AND DOES NOT

PURPORT TO BE A COMPLETE ANALYSIS OR DISCUSSION OF ALL POTENTIAL TAX EFFECTS RELEVANT THERETO. YOU SHOULD CONSULT YOUR OWN TAX ADVISORS

AS TO THE PARTICULAR FEDERAL, STATE, LOCAL, FOREIGN AND OTHER TAX CONSEQUENCES OF THE REVERSE SPLIT IN LIGHT OF YOUR SPECIFIC CIRCUMSTANCES.

Required

Vote and Recommendation

In

accordance with our Charter and Nevada law, approval and adoption of this Reverse Split Proposal requires the affirmative vote of the

holders of a majority of the voting power held by all stockholders. Abstentions will have the effect of voting against the Reverse Split

Proposal and broker non-votes will have no effect on the vote.

THE

BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE APPROVAL OF THE REVERSE SPLIT PROPOSAL.

PROPOSAL

NO. 2

THE

CHARTER AMENDMENT PROPOSAL

Overview

As

of October 31, 2024, there were: 6,000,000 shares of the Company’s common stock authorized and a total of 4,801,065

shares of common stock issued and outstanding. As a result, the Company currently has only 1,198,935 authorized shares of common

stock that are available for issuance, other than to the holders of outstanding derivative securities.

On October 7, 2024 the Company was party to a forward merger in which Beeline Financial Solutions, Inc. was merged

into a subsidiary of the Company in exchange for 69,482,229 shares of the Company’s Series F Preferred Stock and 517,775 shares

of the Company’s Series F-1 Preferred Stock. The Series F shares have no voting power; the Series F-1 may cast one vote per share.

The Merger Agreement requires the Company to seek the approval of its shareholders to the conversion of the Series F and Series F-1 shares

into shares of common stock of the Company on a one-for-one basis; that special meeting of shareholders will be held early in 2025. In

the event that the shareholders of the Company approve the conversion of the Series F and Series F-1 shares into shares of common stock,

the Company will not be able to comply unless the shareholders approve an increase in the authorized shares accompanied by the reverse

stock split that is the subject of Proposal No. 1.

After

consideration, our Board of Directors determined it would be in the best interest of Eastside and its stockholders to seek stockholder

approval for an amendment to the Articles of Incorporation which would increase the number of authorized shares of Common Stock

for various purposes described below. The amendment would increase Eastside’s total number of authorized shares of common stock

from 6,000,000 shares to 40,000,000 shares. We are not requesting any increase to the authorized number of shares of preferred

stock, which would remain unchanged at 100,000,000 shares.

Rationale

for the Amendment and Factors to Consider

The

amendment is intended to, among other things, allow Eastside to have shares of our common stock available to provide flexibility for

Eastside to use its capital stock for business and financial purposes in the future, without the expense and delay of an additional special

meeting of stockholders, unless such approval is expressly required by applicable law or Nasdaq Rules. In addition to providing a reserve in the event that the shareholders approve the conversion of Series F and Series

F-1 shares into common stock, the additional shares may

be used for various purposes, including for: (i) capital-raising, financing or refinancing transactions involving the issuance of shares

of our common stock, the issuance of convertible securities or the issuance of other equity securities; (ii) future acquisitions and

investment opportunities; (iii) strategic business transactions; (iv) current or future equity compensation plans; (v) stock splits;

(vi) stock dividends; and (vii) other corporate purposes.

In

particular, under Eastside’s current circumstances, a significant reserve of authorized common stock may be useful to Management

in its efforts to improve the Company’s balance sheet and so enable us to finance growth, particularly growth in our new Beeline

subsidiary. Such efforts could entail sales of equity securities to institutional investors. Such efforts could also involve Eastside’s

acquisition of one or more operating businesses that are compatible with our existing business operations and are attracted by the opportunities

for liquidity that participation in a Nasdaq-listed company would provide. Management believes that the availability of a significant

amount of authorized common stock could make opportunities available for investment or expansion transactions that would strengthen Eastside’s

balance sheet and facilitate the expansion of our operations.

At

this time, we have no specific plans, arrangements or understandings to issue any of the shares of common stock that would be authorized

by the Charter Amendment Proposal, as our other outstanding securities will not be convertible into common stock unless the approval

of the stockholders is obtained. However, we believe that it is critical to have the flexibility to issue shares of common stock

beyond the limited amount that approval of the Reverse Stock Proposal and implementation of a Reverse Stock Split would make available.

We believe the failure to approve the Charter Amendment Proposal would likely hinder our ability to pursue stockholder value-enhancing

transactions. We have not proposed the increase in the authorized number of shares of Common stock with the intention of using the additional

shares for anti-takeover purposes, although we could theoretically use the additional shares to make it more difficult or to discourage

an attempt to acquire control of Eastside.

The

issuance of any shares of common stock, or securities convertible into common stock, in connection with any financing or refinancing

or acquisition transaction, may dilute the proportionate ownership and voting power of existing stockholders and depress the market price

of our common stock. Although the future issuance of additional shares of common stock would dilute the relative ownership interests

of existing stockholders, our Board believes that having the flexibility to issue additional shares in appropriate circumstances could

increase the overall value of Eastside to its stockholders.

Effect

of Approval

Approval

of Proposal 2 will constitute approval of the amendment to Section 4.1 of Eastside’s Articles of Incorporation. If Proposal 2 is

approved, the Company intends to file an amendment to the Articles of Incorporation with the Secretary of State of the State

of Nevada, and Proposal 2 will become effective at the time of that filing.

Dissenter’s

Rights of Appraisal

Any

stockholders who dissent from the Charter Amendment have no right to appraisal under the Nevada Revised Statutes, our Articles of Incorporation,

or our bylaws.

Required

Vote and Recommendation

In

accordance with our Articles of Incorporation and Nevada law, approval and adoption of this Charter Amendment Proposal requires the affirmative

vote of a majority of the voting power held by all stockholders. Abstentions will have the effect of voting against the Charter Amendment

Proposal and broker non-votes will have no effect on the vote.

THE

BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE APPROVAL OF THE CHARTER AMENDMENT PROPOSAL.

PROPOSAL

NO. 3

APPROVAL

OF THE ADJOURNMENT OF THE SPECIAL MEETING

IF

THERE ARE INSUFFICIENT PROXIES AT

THE

SPECIAL MEETING TO APPROVE THE PROPOSALS

Adjournment

of the Special Meeting

In

the event that the number of shares of common stock present or represented by proxy at the Special Meeting and voting “FOR”

the adoption of the Reverse Split Proposal and the Charter Amendment Proposal is insufficient to approve such proposals, we may

move to adjourn the Special Meeting in order to enable us to solicit additional proxies in favor of the adoption of any such proposal.

In that event, we may ask stockholders to vote only upon the Adjournment Proposal. If the adjournment is for more than thirty (30) days,

a notice of the adjourned meeting shall be given to each stockholder of record entitled to vote at the meeting.

Required

Vote and Recommendation

In

accordance with our Articles of Incorporation and Nevada law, approval and adoption of this Adjournment Proposal requires the affirmative

vote of a majority of the votes cast by all stockholders present in person or represented by proxy at the Special Meeting and entitled

to vote on the proposal. Abstentions and broker non-votes, if any, with respect to this proposal are not counted as votes cast and will

not affect the outcome of this proposal.

THE

BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ADJOURNMENT OF THE SPECIAL MEETING IF THERE ARE INSUFFICIENT PROXIES AT THE

SPECIAL MEETING TO APPROVE THE REVERSE SPLIT PROPOSAL.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Common

Stock

The

following table sets forth information as of the date of the Record Date as to each person or group who is known to us to be the beneficial

owner of more than 5% of our outstanding common stock and as to the security and percentage ownership of each of our executive officers

and directors and of all of our officers and directors as a group. As of the Record Date, the Company had 4,801,065 shares of

common stock outstanding.

Beneficial

ownership is determined under the rules of the SEC and generally includes voting or investment power over securities. Except in cases

where community property laws apply or as indicated in the footnotes to this table, we believe that each stockholder identified in the

table possesses sole voting and investment power over all shares of common stock shown as beneficially owned by the stockholder.

Shares

of common stock subject to options or warrants that are currently exercisable or exercisable within 60 days of the Record Date are considered

outstanding and beneficially owned by the person holding the options for the purpose of computing the percentage ownership of that person

but are not treated as outstanding for the purpose of computing the percentage ownership of any other person.

| Name and Address (1) | |

Number of Common Shares Beneficially

Owned | | |

Percentage Owned | |

| Geoffrey Gwin | |

| 635,751 | | |

| 13,24 | % |

| Eric Finnsson | |

| 19,880 | (2) | |

| 0.41 | % |

| Stephanie Kilkenny | |

| 200,851 | (3) | |

| 3.67 | % |

| Robert Grammen | |

| 124,650 | (4) | |

| 2.60 | % |

| Joseph Freedman | |

| — | | |

| — | |

| Joseph Caltabiano | |

| — | | |

| — | |

| All directors and executive officers as a group (6 persons) | |

| 981,132 | | |

| 19.82 | % |

| |

(1) |

Unless

otherwise noted, the address is c/o Eastside Distilling, Inc., 755 Main Street, Monroe, Connecticut 06468. |

| |

|

|

| |

(2) |

Includes

250 shares underlying presently exercisable stock options. |

| |

|

|

| |

(3) |

Includes

7,292 shares held in Ms. Kilkenny’s capacity as trustee of the Stephanie A. Kilkenny Trust, 145,833 shares issuable upon exercise

of warrants held by TQLA, LLC, which Ms. Kilkenny, together with her spouse, owns and controls; 1,389 warrants held directly by Patrick

J. Kilkenny, Trustee of the Patrick J. Kilkenny Revocable Trust, and 46,337 shares owned by two companies managed by Patrick Kilkenny.

Mr. Kilkenny is the spouse of the Reporting Person. |

| |

|

|

| |

(4) |

Includes

250 shares underlying presently exercisable stock options. |

Series

B Preferred Stock

The

following table sets forth information as of Record Date as to each person or group who is known to us to be the beneficial owner of

more than 5% of our outstanding Series B preferred stock. As of the Record Date, we had 2,500,000 shares of Series B preferred

stock outstanding.

Beneficial

ownership is determined under the rules of the SEC and generally includes voting or investment power over securities. Except in cases

where community property laws apply or as indicated in the footnotes to this table, we believe that each stockholder identified in the

table possesses sole voting and investment power over all shares of capital stock shown as beneficially owned by the stockholder.

Shares

of Series B preferred stock subject to options or warrants that are currently exercisable or exercisable within 60 days of the Record

Date are considered outstanding and beneficially owned by the person holding the options for the purpose of computing the percentage

ownership of that person but are not treated as outstanding for the purpose of computing the percentage ownership of any other person.

| Name And

Address | |

Number

of Series B Preferred Shares Beneficially Owned | | |

Percentage

Owned | |

| 5% Stockholders: | |

| | |

| |

| Crater Lake Pte Ltd | |

| 2,500,000 | | |

| 100.00 | % |

| 111 North Bridge Road #08-19 Peninsula

Plaza, Singapore 179098 | |

| | | |

| | |

HOUSEHOLDING

Proxy

Materials Delivered to a Shared Address

Stockholders

who have the same mailing address and last name may have received a notice that your household will receive only one set of proxy materials.

This practice, commonly referred to as “householding,” is designed to reduce the volume of duplicate information and reduce

printing and postage costs. A single proxy statement will be delivered to multiple stockholders sharing an address unless contrary instructions

have been received from the affected stockholders. Once you have received notice, from us or from your bank, broker or other registered

holder, that it will be householding communications to your address, householding will continue until you are notified otherwise or until

you revoke your consent. A number of banks, brokers and other registered holders with account holders who are our stockholders will be

householding our proxy materials. If you hold your shares in street name, and no longer wish to participate in householding and would

prefer to receive a separate proxy statement in the future, or currently receive multiple copies of the proxy materials and would like

to request householding, please notify your bank, broker or other registered holder. If you are a holder of record, and no longer wish

to participate in householding and would prefer to receive a separate proxy statement in the future, or currently receive multiple copies

of the proxy materials and would like to request householding, please notify us in writing at 755 Main Street, Monroe, CT 06468,

or by telephone at (971) 888-4264. Any stockholder residing at a shared address to which a single copy of the proxy materials was delivered

who wishes to receive a separate copy of our proxy statement may obtain a copy by written request addressed to 755 Main Street, Monroe,

CT 06468, attention: Secretary. We will deliver a separate copy of our proxy statement to any stockholder who so requests in writing

promptly following our receipt of such request.

OTHER

MATTERS

Management

and the Board of the Company know of no matters to be brought before the Special Meeting other than as set forth herein.

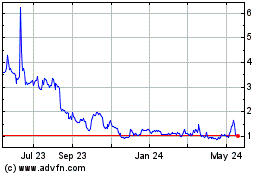

Eastside Distilling (NASDAQ:EAST)

Historical Stock Chart

From Dec 2024 to Jan 2025

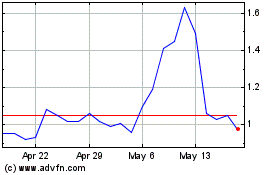

Eastside Distilling (NASDAQ:EAST)

Historical Stock Chart

From Jan 2024 to Jan 2025