Editas Medicine Announces Fourth Quarter and Full Year 2024 Results and Business Updates

March 05 2025 - 3:05PM

Editas Medicine, Inc. (Nasdaq: EDIT), a pioneering gene editing

company focused on developing transformative medicines for serious

diseases, today reported financial results for the fourth quarter

and full year 2024 and provided business updates.

“Our objective and strategy to become a leader in

in vivo gene editing accelerated in the fourth quarter after we

achieved in vivo preclinical proof of concept ahead of schedule and

shared positive preclinical in vivo data demonstrating the

potential of our platform technology to achieve gene upregulation,

or amplifying the expression of an existing protein to achieve

clinically relevant levels that could potentially drive cures

across tissues with a single dose,” said Gilmore O’Neill, M.B.,

M.M.Sc., President and Chief Executive Officer, Editas Medicine.

“We believe the ability to provide in vivo gene editing via gene

upregulation holds the potential to significantly expand the

addressable therapeutic possibilities for CRISPR-based gene

editing, and we are poised to make meaningful progress towards the

clinic in 2025.”

“The data we have shared over the last several

months demonstrate our ability to attain in vivo gene editing via

gene upregulation to increase the level of a functioning protein to

address diseases caused by loss of function or deleterious

mutations. Notably, our progress highlights the potential of our

gene upregulation strategy across multiple tissues with our ‘plug

‘n play’ program,” said Linda C. Burkly, Ph.D., Chief Scientific

Officer, Editas Medicine. “I am proud of our team’s progress,

underscoring the therapeutic promise of our scientific work as a

significant step towards the clinic as we develop our pipeline of

potentially transformative in vivo gene editing medicines.”

Recent Achievements and

Outlook

In Vivo

Medicines

- Demonstrated preclinical proof of concept in non-human primates

and humanized mice, highlighting the potential of Editas’ gene

upregulation strategy across tissues, presented in December 2024

and January 2025.

Hematopoietic Stem Cells

- Achieved effective delivery and meaningful levels of in vivo

editing of the HBG 1/2 promoter, our therapeutic target, in HSCs

with Editas’ proprietary targeted lipid nanoparticles (tLNPs) after

a single dose of tLNP in non-human primates.

- Ongoing evaluation of further optimized LNP formulations

expected to achieve even higher therapeutic editing levels.

- The Company remains on track to declare an in vivo HSC

development candidate in mid-2025 and to present additional

preclinical in vivo HSC data by year-end.

Liver Cells

- Achieved proof of concept in non-human primates, validating

high efficiency in vivo gene editing in the liver with first use of

AsCas12a delivery by LNP.

- Demonstrated proof of upregulation strategy in mice by

increasing clinically relevant target protein resulting in

significant disease biomarker reduction for an undisclosed liver

target.

- The Company remains on track to declare an in vivo liver

development candidate in mid-2025 and to present additional

preclinical in vivo liver data by year-end.

Other Cells/Tissues

- Demonstrated in vivo proof of concept for “plug ‘n play”

delivery to extrahepatic cell types using the Company’s proprietary

LNP targeting platform at high efficiency in humanized mice.

- The Company remains on track to establish and disclose one

additional target cell type/tissue beyond HSCs and liver by

year-end.

Ex Vivo

Hemoglobinopathies

- Reni-cel (renizgamglogene autogedtemcel, previously EDIT-301)

for severe sickle cell disease and transfusion-dependent beta

thalassemia.

- In December 2024, the Company announced that it ended

development of reni-cel after an extensive search failed to yield a

commercial partner.

- As a result of the decision to end development of reni-cel, the

Company initiated cost savings measures, including an approximately

65% reduction in headcount to align workforce and resources to an

in vivo pipeline.

Fourth Quarter and Full Year 2024 Financial

ResultsCash, cash equivalents, and marketable securities

as of December 31, 2024, were $269.9 million compared to

$265.1 million as of September 30, 2024. The Company expects

the existing cash, cash equivalents, and marketable securities,

together with the retained portions of the payments payable under

its license agreement with Vertex Pharmaceuticals, to fund

operating expenses and capital expenditures into the second quarter

of 2027. The Company’s cash runway includes total estimated

expenses of approximately $45.0 million to $55.0 million related to

ending development of reni-cel and related employee exit costs.

Fourth Quarter 2024

- For the three months ended December 31, 2024, net loss

attributable to common stockholders was $45.4 million, or $0.55 per

share, compared to a net loss of $18.9 million, or $0.23 per share,

for the same period in 2023.

- Collaboration and other research and development revenues

decreased to $30.6 million for the three months ended

December 31, 2024, compared to $60.0 million for the same

period in 2023. This decrease was primarily attributable to revenue

recognized from the upfront payment under the Company’s license

agreement with Vertex executed in December 2023.

- Research and development expenses decreased by $21.0 million to

$48.6 million for the three months ended December 31, 2024,

compared to $69.6 million for the same period in 2023. The decrease

was primarily attributable to sublicense payments made in

connection with the Vertex license agreement in December 2023.

- General and administrative expenses increased by $1.9 million

to $16.4 million for the three months ended December 31, 2024,

compared to $14.5 million for the same period in 2023. The increase

was primarily driven by increased professional service expenses for

strategic business initiatives.

- Restructuring charges were $12.2 million for the three months

ended December 31, 2024, compared to no restructuring charges

for the same period in 2023. The restructuring charges were related

to the discontinuation of the clinical development of the reni-cel

program, initiated in December 2024, and the related workforce

reduction.

Full Year 2024

- For the full year 2024, net loss attributable to common

stockholders was $237.1 million, or $2.88 per share, compared to

net loss of $153.2 million, or $2.02 per share, for the same period

in 2023.

- Collaboration and other research and development revenues

decreased to $32.3 million for 2024, compared to $78.1 million for

the same period in 2023. The decrease was primarily attributable to

revenue recognized from the upfront payment under the Company’s

license agreement with Vertex executed in December 2023.

- Research and development expenses increased by $21.5 million to

$199.2 million for 2024, compared to $177.7 million for the same

period in 2023. The increase was primarily related to clinical and

manufacturing costs related to the progression of the Company’s

former reni-cel program as well as costs attributable to in vivo

research and discovery.

- General and administrative expenses increased by $2.3 million

to $72.0 million for 2024, compared to $69.7 million for the same

period in 2023. The increase was primarily attributable to

increased employee-related expenses related to increased headcount

to support business operations.

- Restructuring charges were $12.2 million for 2024, compared to

no restructuring charges for the same period in 2023. The

restructuring charges were related to the discontinuation of the

clinical development of our reni-cel program, initiated in December

2024, and the related workforce reduction.

Upcoming Events Editas Medicine

plans to participate in the following investor events:

- Leerink Partners Global Biopharma ConferenceMarch 10, 2024Miami

Beach, FL

- Barclays 27th Annual Global Healthcare ConferenceMarch 11,

2024Miami Beach, FL

No Conference Call The Company is

no longer hosting quarterly earnings conference calls.

About Editas MedicineAs a

pioneering gene editing company, Editas Medicine is focused on

translating the power and potential of the CRISPR/Cas12a and

CRISPR/Cas9 genome editing systems into a robust pipeline of

transformative in vivo medicines for people living with serious

diseases around the world. Editas Medicine aims to discover,

develop, manufacture, and commercialize durable, precision in vivo

gene editing medicines for a broad class of diseases. Editas

Medicine is the exclusive licensee of Broad Institute’s Cas12a

patent estate and Broad Institute and Harvard University’s Cas9

patent estates for human medicines. For the latest information and

scientific presentations, please visit www.editasmedicine.com.

Forward-Looking StatementsThis

press release contains forward-looking statements and information

within the meaning of The Private Securities Litigation Reform Act

of 1995. The words ‘‘anticipate,’’ ‘‘believe,’’ ‘‘continue,’’

‘‘could,’’ ‘‘estimate,’’ ‘‘expect,’’ ‘‘intend,’’ ‘‘may,’’ ‘‘plan,’’

‘‘potential,’’ ‘‘predict,’’ ‘‘project,’’ ‘‘target,’’ ‘‘should,’’

‘‘would,’’ and similar expressions are intended to identify

forward-looking statements, although not all forward-looking

statements contain these identifying words. Forward-looking

statements in this press release include statements regarding the

initiation, timing, progress and results of the Company’s

preclinical studies and its research and development programs,

including the Company’s expectation to declare two in vivo

development candidates in mid-2025 and establish an additional in

vivo target cell type/tissue beyond HSCs and the liver by the end

of 2025; the timing for the Company’s receipt and presentation of

data from its preclinical studies, including presenting further in

vivo HSC data and further in vivo data in one liver indication by

the end of 2025; the potential of, and expectations for, the

Company’s in vivo product candidates; the timing or likelihood of

regulatory filings and approvals; the amount of anticipated costs

related to ending development of reni-cel and related employee exit

costs; and the Company’s expectations regarding cash runway into

the second quarter of 2027. The Company may not actually achieve

the plans, intentions, or expectations disclosed in these

forward-looking statements, and you should not place undue reliance

on these forward-looking statements. Actual results or events could

differ materially from the plans, intentions and expectations

disclosed in these forward-looking statements as a result of

various important factors, including: uncertainties inherent in the

initiation and completion of preclinical studies; availability and

timing of results from preclinical studies; expectations for

regulatory approvals to conduct trials; and the availability of

funding sufficient for the Company’s foreseeable and unforeseeable

operating expenses and capital expenditure requirements. These and

other risks are described in greater detail under the caption “Risk

Factors” included in the Company’s most recent Annual Report on

Form 10-K, which is on file with the Securities and Exchange

Commission, as updated by the Company’s subsequent filings with the

Securities and Exchange Commission, and in other filings that the

Company may make with the Securities and Exchange Commission in the

future. Any forward-looking statements contained in this press

release represent the Company’s views only as of the date hereof

and should not be relied upon as representing its views as of any

subsequent date. Except as required by law, the Company explicitly

disclaims any obligation to update any forward-looking

statements.

This press release contains hyperlinks to

information that is not deemed to be incorporated by reference in

this press release.

| |

|

|

|

|

EDITAS MEDICINE, INC.Consolidated

Statement of Operations(amounts in thousands,

except share and per share

data)(Unaudited) |

| |

|

|

|

| |

Three Months EndedDecember

31, |

|

Twelve Months EndedDecember

31, |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Collaboration and other research and development revenues |

|

30,604 |

|

|

|

60,049 |

|

|

|

32,314 |

|

|

|

78,123 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Research and development |

|

48,611 |

|

|

|

69,556 |

|

|

|

199,247 |

|

|

|

177,651 |

|

|

General and administrative |

|

16,354 |

|

|

|

14,455 |

|

|

|

71,987 |

|

|

|

69,653 |

|

|

Restructuring charges |

|

12,232 |

|

|

|

— |

|

|

|

12,232 |

|

|

|

— |

|

|

Total operating expenses |

|

77,197 |

|

|

|

84,011 |

|

|

|

283,466 |

|

|

|

247,304 |

|

| Operating loss |

|

(46,593 |

) |

|

|

(23,962 |

) |

|

|

(251,152 |

) |

|

|

(169,181 |

) |

| Other income, net: |

|

|

|

|

|

|

|

|

Other expense, net |

|

(3 |

) |

|

|

(14 |

) |

|

|

(3 |

) |

|

|

(1,604 |

) |

|

Interest income, net |

|

1,201 |

|

|

|

5,102 |

|

|

|

14,062 |

|

|

|

17,566 |

|

|

Total other income, net |

|

1,198 |

|

|

|

5,088 |

|

|

|

14,059 |

|

|

|

15,962 |

|

| Net loss |

$ |

(45,395 |

) |

|

$ |

(18,874 |

) |

|

$ |

(237,093 |

) |

|

$ |

(153,219 |

) |

| Net loss per share, basic and

diluted |

$ |

(0.55 |

) |

|

$ |

(0.23 |

) |

|

$ |

(2.88 |

) |

|

$ |

(2.02 |

) |

| Weighted-average common shares

outstanding, basic and diluted |

|

82,613,831 |

|

|

|

81,710,470 |

|

|

|

82,338,220 |

|

|

|

75,965,633 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

EDITAS MEDICINE, INC.Selected Consolidated

Balance Sheet Items(amounts in

thousands)(Unaudited) |

| |

|

|

|

| |

December 31, |

|

December 31, |

| |

2024 |

|

2023 |

|

Cash, cash equivalents, and marketable securities |

$ |

269,913 |

|

$ |

427,135 |

| Working capital |

|

212,090 |

|

|

277,612 |

| Total assets |

|

341,589 |

|

|

499,153 |

| Deferred revenue, net of

current portion |

|

54,204 |

|

|

60,667 |

| Total stockholders'

equity |

|

134,274 |

|

|

349,097 |

| |

|

|

|

|

|

Media and Investor Contact:

ir@editasmed.com

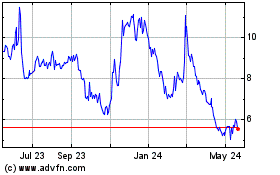

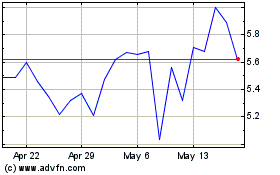

Editas Medicine (NASDAQ:EDIT)

Historical Stock Chart

From Mar 2025 to Apr 2025

Editas Medicine (NASDAQ:EDIT)

Historical Stock Chart

From Apr 2024 to Apr 2025