ESGEN Acquisition Corporation Announces Closing of Upsized $276 Million Initial Public Offering

October 22 2021 - 1:56PM

Business Wire

ESGEN Acquisition Corporation (“ESGEN” or the “Company”)

announced today the closing of its initial public offering of

27,600,000 units, which includes the full exercise of the

underwriters’ option to purchase 3,600,000 additional units, at a

price of $10.00 per unit. Total gross proceeds from the offering

were $276 million before deducting underwriting discounts and

commissions and other offering expenses payable by the Company.

The units began trading on The Nasdaq Global Market (the

“Nasdaq”) under the ticker symbol “ESACU” on October 20, 2021. Each

unit consists of one Class A ordinary share and one-half of one

redeemable warrant. Each whole warrant entitles the holder thereof

to purchase one Class A ordinary share at a price of $11.50 per

share. Once the securities comprising the units begin separate

trading, the Class A ordinary shares and warrants are expected to

be listed on the Nasdaq under the symbols “ESAC” and “ESACW,”

respectively.

ESGEN is led by Chief Executive Officer Andrejka Bernatova and

Chief Financial Officer Nader Daylami, and is affiliated with

Energy Spectrum Capital, a Dallas-based venture capital firm with

long-standing experience building companies across the energy and

infrastructure landscapes over multiple decades. The Company

intends to concentrate on identifying opportunities in the North

American energy and infrastructure value chain and contiguous

industries that it believes will fundamentally change the current

energy landscape by accelerating a shift to a low-carbon

future.

Citigroup and Barclays Capital Inc. served as the book-running

managers for the offering and Ladenburg Thalman & Co. Inc.

acted as co-manager. The Company granted the underwriters a 45-day

option to purchase up to an additional 3,600,000 units at the

initial public offering price to cover over-allotments, which the

underwriters exercised in full.

A final prospectus relating to, and describing the terms of, the

offering has been filed with the SEC and is available on the SEC’s

web site at www.sec.gov.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy, nor shall there be any sale of

these securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction.

Cautionary Note Concerning Forward-Looking Statements

This press release contains statements that constitute

"forward-looking statements," including with respect to the

anticipated use of the net proceeds. No assurance can be given that

the offering discussed above will be completed on the terms

described, or at all, or that the net proceeds of the offering will

be used as indicated. Forward-looking statements are subject to

numerous conditions, many of which are beyond the control of the

Company, including those set forth in the Risk Factors section of

the Company’s registration statement and preliminary prospectus for

the Company’s offering filed with the Securities and Exchange

Commission (“SEC”). Copies are available on the SEC’s website,

www.sec.gov. The Company undertakes no obligation to update these

statements for revisions or changes after the date of this release,

except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20211022005486/en/

Media:

David Wells or Nick Rust Prosek Partners 212-279-3115

dwells@prosek.com / nrust@prosek.com

ESGEN Acquisition (NASDAQ:ESACU)

Historical Stock Chart

From Oct 2024 to Nov 2024

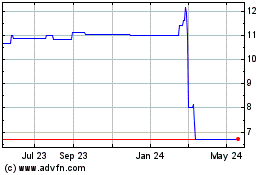

ESGEN Acquisition (NASDAQ:ESACU)

Historical Stock Chart

From Nov 2023 to Nov 2024