Mustang Bio Announces Closing of $8 Million Public Offering

February 10 2025 - 7:00AM

Mustang Bio, Inc. (“Mustang” or the “Company”) (Nasdaq: MBIO), a

clinical-stage biopharmaceutical company focused on translating

today’s medical breakthroughs in cell therapies into potential

cures for difficult-to-treat cancers, today announced the closing

of its previously announced public offering, for the issuance and

sale of an aggregate of 2,657,807 shares of its common stock (or

common stock equivalents in lieu thereof), Series C-1 warrants to

purchase up to 2,657,807 shares of common stock and Series C-2

warrants to purchase up to 2,657,807 shares of common stock, at a

combined public offering price of $3.01 per share (or per common

stock equivalent in lieu thereof) and accompanying warrants. The

warrants have an exercise price of $3.01 per share and will be

exercisable beginning on the effective date of stockholder approval

of the issuance of the shares upon exercise of the warrants. The

Series C-1 warrants will expire five years from the date of

stockholder approval and the Series C-2 warrants will expire

twenty-four months from the date of stockholder approval.

H.C. Wainwright & Co. acted as the exclusive

placement agent for the offering.

The gross proceeds from the offering, before

deducting the placement agent's fees and other offering expenses

payable by the Company, were approximately $8 million. Mustang

intends to use the net proceeds from this offering for working

capital and general corporate and other purposes.

The securities described above were offered

pursuant to a registration statement on Form S-1 (File No.

333-284299), which was declared effective by the Securities and

Exchange Commission (the “SEC”) on February 5, 2025. The offering

was made only by means of a prospectus forming part of the

effective registration statement relating to the offering. A final

prospectus relating to the offering was filed with the SEC and is

available on the SEC’s website at http://www.sec.gov. The final

prospectus may also be obtained by contacting H.C. Wainwright &

Co., LLC at 430 Park Avenue, 3rd Floor, New York, NY 10022, by

phone at (212) 856-5711 or e-mail at placements@hcwco.com.

This press release shall not constitute an offer

to sell or a solicitation of an offer to buy any of the securities

described herein, nor shall there be any sale of these securities

in any state or other jurisdiction in which such offer,

solicitation or sale would be unlawful prior to the registration or

qualification under the securities laws of any such state or other

jurisdiction.

About Mustang Bio Mustang Bio,

Inc. is a clinical-stage biopharmaceutical company focused on

translating today’s medical breakthroughs in cell therapies into

potential cures for difficult-to-treat cancers. Mustang aims to

acquire rights to these technologies by licensing or otherwise

acquiring an ownership interest, to fund research and development,

and to outlicense or bring the technologies to market. Mustang has

partnered with top medical institutions to advance the development

of CAR-T therapies. Mustang’s common stock is registered under the

Securities Exchange Act of 1934, as amended, and Mustang files

periodic reports with the SEC. Mustang was founded by Fortress

Biotech, Inc. (Nasdaq: FBIO). For more information, visit

www.mustangbio.com.

Forward-Looking Statements This

press release contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933 and Section

21E of the Securities Exchange Act of 1934, each as amended. Such

statements, which are often indicated by terms such as

“anticipate,” “believe,” “could,” “estimate,” “expect,” “goal,”

“intend,” “look forward to,” “may,” “plan,” “potential,” “predict,”

“project,” “should,” “will,” “would” and similar expressions. The

Company’s forward-looking statements, include, but are not limited

to, the anticipated use of proceeds from the offering and the

receipt of stockholder approval in connection therewith, any

statements relating to the Company’s growth strategy and product

development programs, including the timing of and its ability to

make regulatory filings such as Investigational New Drug

applications and other applications and to obtain regulatory

approvals for its product candidates, statements concerning the

potential of therapies and product candidates and any other

statements that are not historical facts. Actual events or results

may differ materially from those described in this press release

due to a number of risks and uncertainties. Risks and uncertainties

include, among other things, the Company’s need for additional

funds in the immediate future; risks that any actual or potential

clinical trials may not initiate or complete in sufficient

timeframes to advance the Company’s corporate objectives, or at

all, or that any promising early results obtained therefrom may not

be replicable; risks related to the satisfaction of the conditions

necessary to transfer the lease of the Company’s manufacturing

facility to a potential transferee and receive the contingent

payment in connection with the sale of such facility in the

anticipated timeframe or at all; disruption from the sale of the

Company’s manufacturing facility making it more difficult to

maintain business and operational relationships; negative effects

of Company announcements on the market price of the Company’s

common stock; the development stage of the Company’s primary

product candidates; the Company’s ability to obtain, perform under,

and maintain financing and strategic agreements and relationships;

risks relating to the results of research and development

activities; risks relating to the timing of starting and completing

clinical trials; uncertainties relating to preclinical and clinical

testing; the Company’s dependence on third-party suppliers; its

ability to attract, integrate and retain key personnel; the early

stage of products under development; government regulation; patent

and intellectual property matters; competition; as well as other

risks described in the section entitled “Risk Factors,” in the

Company’s registration statement on Form S-1 (File No. 333-284299)

and the periodic filings the Company makes with the SEC. The

Company expressly disclaims any obligation or undertaking to

release publicly any updates or revisions to any forward-looking

statements contained herein to reflect any change in its

expectations or any changes in events, conditions or circumstances

on which any such statement is based, except as required by law,

and the Company claims the protection of the safe harbor for

forward-looking statements contained in the Private Securities

Litigation Reform Act of 1995.

Company Contacts: Jaclyn Jaffe

and Nicole McCloskey Mustang Bio, Inc. (781) 652-4500

ir@mustangbio.com

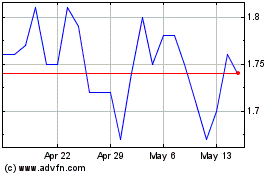

Fortress Biotech (NASDAQ:FBIO)

Historical Stock Chart

From Jan 2025 to Feb 2025

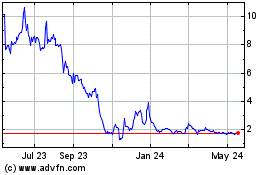

Fortress Biotech (NASDAQ:FBIO)

Historical Stock Chart

From Feb 2024 to Feb 2025