Current Report Filing (8-k)

November 04 2022 - 3:33PM

Edgar (US Regulatory)

0001602409

false

0001602409

2022-11-04

2022-11-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

November

4, 2022

Date of Report (Date of earliest event reported)

FINGERMOTION, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-41187 |

|

20-0077155 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

1460 Broadway

New York, New York |

|

10036 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(347)

349-5339

Registrant’s telephone number, including area code

Not

applicable.

(Former name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of

the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol (s) |

Name

of each exchange on which registered |

| Common

Stock |

FNGR |

The Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933

(Section 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (Section 240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

SECTION 3 – SECURITIES

AND TRADING MARKETS

| Item 3.02 | Unregistered Sales of Equity Securities |

On November 4, 2022, FingerMotion, Inc. (the “Company”)

issued an aggregate of 1,887,500 shares of common stock at a price of $4.00 per share to eleven individuals due to the closing of our

private placement at $4.00 per share for aggregate gross proceeds of $7,550,000. We relied upon the exemption from registration under

the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), provided by Rule 903 of Regulation S promulgated

under the U.S. Securities Act for the issuance of the shares to the eleven individuals who were non-U.S. persons as the securities were

issued to the individuals through offshore transactions which were negotiated and consummated outside the United States.

In connection with the closing of the private placement

we issued 91,875 shares of common stock at a price of $4.00 per share for a total value of $367,500 to one individual as finder’s

fees. We relied upon the exemption from registration under the U.S. Securities Act provided by Rule 903 of Regulation S promulgated under

the U.S. Securities Act for the issuance of the shares to the individual who is a non-U.S. person. In addition, we paid a cash finder’s

fee of $10,000 to another individual as finder’s fees. Furthermore, pursuant to an existing financial advisory agreement with Benchmark

Company, LLC (“Benchmark”) and in connection with the closing of the private placement, we are required to pay Benchmark $151,000

in cash and issue to Benchmark 28,312 warrants, which will entitle it to acquire 28,312 shares of our common stock at a price of $8.22

per share until November 4, 2025. We will rely upon the exemption from registration under the U.S. Securities Act provided by Rule 506(b)

of Regulation D and/or Section 4(a)(2) of the U.S. Securities Act for the issuance of the warrants to Benchmark.

SECTION 7 – REGULATION FD

| Item 7.01 | Regulation FD Disclosure |

On November 4, 2022, we issued an aggregate of 1,887,500

shares of common stock at a price of $4.00 per share to eleven individuals due to the closing of our private placement at $4.00 per share

for aggregate gross proceeds of $7,550,000.

In connection with the closing of our private placement,

we issued 91,875 shares of common stock for a total value of $367,500 to one individual as finder’s fees and $10,000 in cash to

another individual as finder’s fees. In addition, we will be paying our financial advisor $151,000 in cash and issuing our financial

advisor 28,312 warrants having an exercise price of $8.22 per share and having an expiry date of November 4, 2025.

We plan to use the proceeds from the private placement

for working capital and general corporate purposes.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

FINGERMOTION,

INC. |

| |

|

|

| DATE:

November 4, 2022 |

By: |

/s/ Martin J. Shen |

| |

|

Martin

J. Shen |

| |

|

CEO |

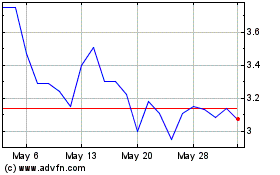

FingerMotion (NASDAQ:FNGR)

Historical Stock Chart

From Jan 2025 to Feb 2025

FingerMotion (NASDAQ:FNGR)

Historical Stock Chart

From Feb 2024 to Feb 2025