0000912728falsefalsefalsefalsefalsefalse00009127282023-12-112023-12-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________

FORM 8-K

______________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report: December 11, 2023

FORWARD AIR CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | |

| | TN | | | 62-1120025 |

| (State or other jurisdiction of incorporation) | | (I.R.S. Employer Identification No.) |

| 1915 Snapps Ferry Road | Building N | Greeneville | TN | | 37745 |

| (Address of principal executive offices) | | (Zip Code) |

| | |

| 000-22490 |

| (Commission File Number) |

Registrant's telephone number, including area code: (423) 636-7000

| | |

| Not Applicable |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.01 par value | | FWRD | | NASDAQ |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

SECTION 7. REGULATION FD

Item 7.01. Regulation FD Disclosure.

On December 11, 2023, Forward Air Corporation (the “Company” or “Forward”) provided certain prospective lenders with unaudited pro forma condensed combined financial information giving effect to the Company’s acquisition of Omni Newco, LLC (together with its subsidiaries, “Omni”) as contemplated by that certain previously announced agreement and plan of merger (the “Merger Agreement”), dated as of August 10, 2023, by and among the Company, GN Bondco, LLC (the “Escrow Issuer”), Omni and certain other parties, the issuance of $725,000,000 aggregate principal amount of 9.500% senior secured notes due 2031 by the Escrow Issuer, the Company’s establishment of and borrowing under a new seven-year senior secured term loan B facility in an aggregate principal amount of up to $1,125,000,000 and a five-year senior secured revolving credit facility in an aggregate principal amount of up to $400,000,000 and the refinancing of certain debt of the Company and Omni (collectively, the “Transactions”) as of September 30, 2023 and for the nine month periods ended September 30, 2023 and 2022 and the related notes thereto (the “unaudited pro forma condensed combined financial information”). The unaudited pro forma condensed combined financial information is provided for informational purposes only. Such unaudited pro forma condensed combined financial information is not necessarily, and should not be assumed to be, an indication of the results that would have been achieved had the transactions contemplated thereby been completed as of the dates indicated or that may be achieved in the future and should not be taken as representative of future consolidated results of operations or financial condition of the Company. The unaudited pro forma condensed combined financial information is based on a variety of adjustments, assumptions and preliminary estimates which may not prove to be accurate, and other factors may affect the combined company’s results of operations or financial condition following the consummation of the Transactions. The combined company’s potential for future business success and operating profitability must be considered in light of the risks, uncertainties, expenses and difficulties typically encountered by recently combined companies. Furthermore, no effect has been given in the unaudited pro forma condensed combined statement of operations to synergies and potential cost savings, if any, that may be realized through the combination of the two companies or the costs that may be incurred in integrating their operations or in connection with the Transactions. This unaudited pro forma condensed combined financial information is included in Exhibit 99.1 attached to this Form 8-K and incorporated herein by reference.

The information in this Item 7.01, including Exhibit 99.1 attached hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Cautionary Note on Forward-Looking Statements

This Form 8-K includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, which are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, as amended. These statements may reflect Forward’s expectations, beliefs, hopes, intentions or strategies regarding, among other things, the potential transaction between Forward and Omni, the expected timetable for completing the potential transaction, the benefits and expected cost and revenue synergies of the potential transaction (including the timing for realizing any such synergies and the conversion of revenue synergies to adjusted EBITDA) and future opportunities for the combined company, as well as other statements that are other than historical fact, including, without limitation, statements concerning future financial performance, future debt and financing levels (including the achievement of targeted deleveraging within the expected time frames or at all), investment objectives, implications of litigation and regulatory investigations and other management plans for future operations and performance. Words such as “anticipate(s)”, “expect(s)”, “intend(s)”, “plan(s)”, “target(s)”, “project(s)”, “believe(s)”, “will”, “aim”, “would”, “seek(s)”, “estimate(s)” and similar expressions are intended to identify such forward-looking statements.

Forward-looking statements are based on management’s current expectations, projections, estimates, assumptions and beliefs and are subject to a number of known and unknown risks, uncertainties and other factors that could lead to actual results materially different from those described in the forward-looking statements. Forward can give no assurance that its expectations will be attained. Forward’s actual results, liquidity and financial condition may differ from the anticipated results, liquidity and financial condition indicated in these forward-looking statements. We caution readers that any such statements are based on currently available operational, financial and competitive information, and they should not place undue reliance on these forward-looking statements, which reflect management’s opinion only as of the date on which they were made. These forward-looking statements are not a guarantee of future performance and involve risks and uncertainties, and there are certain important factors that could cause Forward’s actual results to differ, possibly materially, from expectations or estimates reflected in such forward-looking statements, including, but without limitation:

•the ability of the parties to consummate the potential transaction in a timely manner or at all;

•the occurrence of any event, change or other circumstance or condition that could give rise to the termination of the Merger Agreement;

•the outcome of any legal proceedings that have or may be instituted against the parties or any of their respective directors or officers related to the potential transaction;

•the satisfaction or waiver of the conditions to the completion of the potential transaction, including the receipt of all required regulatory approvals or clearances in a timely manner and on terms acceptable to Forward;

•the risk that the parties may be unable to achieve the expected strategic, financial and other benefits of the potential transaction, including the realization of expected revenue and cost synergies, the conversion of revenue synergies to adjusted EBITDA and the achievement of deleveraging targets, within the expected time-frames or at all;

•the risk that the committed financing necessary for the consummation of the potential transaction is unavailable at the closing, and that any replacement financing may not be available on similar terms,

or at all;

•the risk that the businesses will not be integrated successfully or that integration may be more difficult, time-consuming or costly than expected;

•the risk that operating costs, customer loss and business disruption (including, without limitation, difficulties in maintaining relationships with employees, customers, clients or suppliers) may be greater than expected following the potential transaction;

•the risk that, if Forward does not obtain the necessary shareholder approval for the conversion of the perpetual non-voting convertible preferred stock, Forward will be required to pay an annual dividend on such outstanding preferred stock;

•the risks associated with being a holding company with the only material assets after completion of the potential transaction being the interest in the combined business and, accordingly, dependency upon distributions from the combined business to pay taxes and other expenses;

•the requirement for Forward to pay to certain shareholders of Omni certain tax benefits that it may claim in the future, and the expected materiality of these amounts;

•risks associated with organizational structure, including payment obligations under the tax receivable agreement, which may be significant, and any accelerations or significant increases thereto;

•the inability to realize all or a portion of the tax benefits that are currently expected to result from the acquisition of certain corporate owners of Omni, certain pre-existing tax attributes of Omni owners and tax attributes that may arise on the distribution of cash to other Omni owners in connection with the potential transaction, as well as the future exchanges of units of Forward’s operating subsidiary and payments made under the tax receivables agreement;

•increases in interest rates;

•changes in Forward’s credit ratings and outlook;

•risks relating to the indebtedness Forward expects to incur in connection with the potential transaction and the need to generate sufficient cash flows to service and repay such debt;

•the ability to generate the significant amount of cash needed to service the indebtedness;

•the limitations and restrictions in surviving agreements governing indebtedness;

•risks associated with the need to obtain additional financing which may not be available on favorable terms or at all; and

•general economic and market conditions.

These and other risks and uncertainties are more fully discussed in the risk factors identified in “Item 1A. Risk Factors” in Part I of Forward’s most recently filed Annual Report on Form 10-K (as supplemented hereby), and as may be identified in Forward’s Quarterly Reports on Form 10-Q and current reports on Form 8-K. Except to the extent required by law, Forward expressly disclaims any obligation to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in Forward’s expectations with regard thereto or change in events, conditions or circumstances on which any statement is based.

SECTION 9. FINANCIAL STATEMENTS AND EXHIBITS

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits. The following exhibits are being furnished as part of this Report.

| | | | | | | | |

| No. | | Exhibit |

| | |

| 104 | | Cover Page Interactive File (the cover page tags are embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | | FORWARD AIR CORPORATION |

| Date: December 11, 2023 | | By: | /s/ Thomas Schmitt |

| | | | Thomas Schmitt

President and Chief Executive Officer |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| UNAUDITED PRO FORMA CONDENSED COMBINED BALANCE SHEET | |

| AS OF SEPTEMBER 30, 2023 | |

| |

| ($ in thousands) | |

| | | | | | | | | | |

| Historical | | Pro Forma Adjustments | | |

| | Forward | | Omni | | Acquisition Accounting Adjustments | | Financing Adjustments | | Pro Forma Combined | |

| Assets | | | | | | | | | | |

| Current assets: | | | | | | | | | | |

| Cash and cash equivalents | $ | 18,843 | | | $ | 52,407 | | | $ | (150,000) | | 2a. | $ | 151,792 | | 3a. | $ | 73,042 | | |

| Accounts receivable, net | 191,758 | | | 186,747 | | | (5,782) | | 2f. | — | | | 372,723 | | |

| | | | | | | | | | |

| Other current assets | 27,129 | | | 31,740 | | | — | | | — | | | 58,869 | | |

| | | | | | | | | | |

| Total current assets | 237,730 | | | 270,894 | | | (155,782) | | | 151,792 | | | 504,634 | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Property and equipment, net of accumulated depreciation and amortization | 258,248 | | | 76,745 | | | — | | | — | | | 334,993 | | |

| Operating lease right-of-use assets | 134,726 | | | 198,627 | | | (35,452) | | 2b. | — | | | 297,901 | | |

| Goodwill | 356,763 | | | 530,479 | | | 770,937 | | 2c. | — | | | 1,658,179 | | |

| Other acquired intangibles, net of accumulated amortization | 146,710 | | | 757,714 | | | 607,848 | | 2c. | — | | | 1,512,272 | | |

| Other assets | 56,404 | | | 12,092 | | | — | | | — | | | 68,496 | | |

| | | | | | | | | | |

| Total assets | $ | 1,190,581 | | | $ | 1,846,551 | | | $ | 1,187,551 | | | $ | 151,792 | | | $ | 4,376,475 | | |

| | | | | | | | | | |

| Liabilities | | | | | | | | | | |

| Current liabilities: | | | | | | | | | | |

| Accounts payable | $ | 45,702 | | | $ | 33,205 | | | $ | (5,782) | | 2f. | $ | — | | | $ | 73,125 | | |

| Accrued expenses | 56,552 | | | 66,754 | | | 94,663 | | 2e. | (69,450) | | 3a. | 148,519 | | |

| Other current liabilities | 21,619 | | | 8,618 | | | — | | | — | | | 30,237 | | |

| Current portion of debt and finance lease obligations | 15,053 | | | 16,718 | | | (363) | | 2b. | (15,290) | | 3b. | 16,118 | | |

| Current portion of operating lease liabilities | 51,515 | | | 46,084 | | | (10,827) | | 2b. | — | | | 86,772 | | |

| Current portion of contingent consideration | — | | | 53,588 | | | — | | | — | | | 53,588 | | |

| | | | | | | | | | |

| Total current liabilities | 190,441 | | | 224,967 | | | 77,691 | | | (84,740) | | | 408,359 | | |

| | | | | | | | | | |

| Finance lease obligations, less current portion | 23,387 | | | 8,466 | | | (736) | | 2b. | — | | | 31,117 | | |

| Long-term debt, less current portion and debt issuance costs | 118,857 | | | 1,415,855 | | | 24,176 | | 3b. | 236,862 | | 3b. | 1,795,750 | | |

| Operating lease liabilities, less current portion | 87,938 | | | 177,917 | | | (49,999) | | 2b. | — | | | 215,856 | | |

| Contingent consideration liability, less current portion | — | | | 1,284 | | | 12,670 | | 2a. | — | | | 13,954 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Other long-term liabilities | 50,966 | | | 2,906 | | | — | | | — | | | 53,872 | | |

| Deferred income taxes | 53,292 | | | 25,395 | | | 125,489 | | 2b. | — | | | 204,176 | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Shareholders’ equity: | | | | | | | | | | |

| Preferred stock, $0.01 | — | | | — | | | — | | | — | | | — | | |

| Series B Preferred units, $10.00 par value | — | | | — | | | 44 | | 2b. | — | | | 44 | | |

| Series C Preferred units, $10.00 par value | — | | | — | | | 16 | | 2b. | — | | | 16 | | |

| Common stock, $0.01 par value | 257 | | | — | | | 7 | | 2b. | — | | | 264 | | |

| Additional paid-in capital | 280,640 | | | — | | | 520,675 | | 2b. | — | | | 801,315 | | |

| Members' equity | — | | | 153,365 | | | (153,365) | | 2b. | — | | | — | | |

| Accumulated other comprehensive loss | — | | | (5,792) | | | 5,792 | | 2b. | — | | | — | | |

| Retained earnings | 384,803 | | | (157,812) | | | 63,149 | | 2b. | (330) | | 3b. | 289,810 | | |

| Total shareholders’ equity attributable to Forward Air Corporation | 665,700 | | | (10,239) | | | 436,318 | | | (330) | | | 1,091,449 | | |

| Noncontrolling interest | — | | | — | | | 561,942 | | 2d. | | | 561,942 | | |

| Total shareholders’ equity | 665,700 | | | (10,239) | | | 998,260 | | | (330) | | | 1,653,391 | | |

| Total liabilities and shareholders’ equity | $ | 1,190,581 | | | $ | 1,846,551 | | | $ | 1,187,551 | | | $ | 151,792 | | | $ | 4,376,475 | | |

See accompanying notes to the Unaudited Pro Forma Condensed Combined Financial Statements.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

| UNAUDITED PRO FORMA CONDENSED COMBINED STATEMENT OF OPERATIONS |

| FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2023 |

|

| (Amounts in thousands, except per share data) |

| | |

| | | | | | | | | |

| | Historical | | Pro Forma Adjustments | |

| Forward | | Omni | | Acquisition Accounting Adjustments | | Financing Adjustments | | Pro Forma Combined |

| Operating revenues: | $ | 1,242,695 | | | $ | 999,090 | | | $ | (28,034) | | 2f. | $ | — | | | $ | 2,213,751 | |

| | | | | | | | | |

| Operating expenses: | | | | | | | | | |

| Purchased transportation | 557,626 | | | 596,516 | | | (28,034) | | 2f. | — | | | 1,126,108 | |

| Salaries, wages and employee benefits | 254,365 | | | 207,784 | | | — | | | — | | | 462,149 | |

| Operating leases | 76,094 | | | 74,823 | | | — | | | — | | | 150,917 | |

| Depreciation and amortization | 43,654 | | | 45,330 | | | 59,197 | | 2c. | — | | | 148,181 | |

| Insurance and claims | 40,768 | | | — | | | — | | | — | | | 40,768 | |

| Fuel expense | 16,975 | | | — | | | — | | | — | | | 16,975 | |

| Change in fair value of contingent consideration | — | | | 12,320 | | | — | | | — | | | 12,320 | |

| Other operating expenses | 157,000 | | | 111,316 | | | — | | | — | | | 268,316 | |

| | | | | | | | | |

| Total operating expenses | 1,146,482 | | | 1,048,089 | | | 31,163 | | | — | | | 2,225,734 | |

| Income (loss) from operations: | 96,213 | | | (48,999) | | | (59,197) | | | — | | | (11,983) | |

| | | | | | | | | |

| Other expense: | | | | | | | | | |

| Interest expense, net | (7,595) | | | (122,076) | | | — | | | (23,992) | | 3c. | (153,663) | |

| Other income | — | | | 596 | | | — | | | — | | | 596 | |

| Foreign exchange gain (loss) | — | | | (270) | | | — | | | — | | | (270) | |

| Total other expense | (7,595) | | | (121,750) | | | — | | | (23,992) | | | (153,337) | |

| Income (loss) before income taxes | 88,618 | | | (170,749) | | | (59,197) | | | (23,992) | | | (165,320) | |

| Income tax expense (benefit) | 23,011 | | | 426 | | | (51,789) | | 2g. | (4,813) | | 2g. | (33,165) | |

| | | | | | | | | |

| | | | | | | | | |

| Net income (loss) | 65,607 | | | (171,175) | | | (7,408) | | | (19,179) | | | (132,155) | |

| Less: Net income (loss) attributable to noncontrolling interest | — | | | — | | | (42,723) | | 2d. | — | | | (42,723) | |

| Net income (loss) attributable to Forward common shareholders | $ | 65,607 | | | $ | (171,175) | | | $ | 35,315 | | | $ | (19,179) | | | $ | (89,432) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| Net income per share | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Basic | $ | 2.51 | | | | | | | | | $ | (3.35) | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Diluted | $ | 2.50 | | | | | | | | | $ | (3.35) | |

| | | | | | | | | |

| Weighted-average number of common shares outstanding | | | | | | | | | |

| Basic | 25,995 | | | | | | | | 26,765 |

| Diluted | 26,096 | | | | | | | | 26,765 |

| | | | | | | | | |

See accompanying notes to the Unaudited Pro Forma Condensed Combined Financial Statements.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

| UNAUDITED PRO FORMA CONDENSED COMBINED STATEMENT OF OPERATIONS |

| FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2022 |

| | | | | | | | | |

| (Amounts in thousands, except per share data) |

| | |

| | | | | | | | | |

| | Historical | | Pro Forma Adjustments | |

| Forward | | Omni | | Acquisition Accounting Adjustments | | Financing Adjustments | | Pro Forma Combined |

| Operating revenues: | $ | 1,492,203 | | | $ | 1,406,784 | | | $ | (28,176) | | 2f. | $ | — | | | $ | 2,870,811 | |

| | | | | | | | | |

| Operating expenses: | | | | | | | | | |

| Purchased transportation | 693,648 | | | 954,296 | | | (28,176) | | 2f. | — | | | 1,619,768 | |

| Salaries, wages and employee benefits | 263,194 | | | 190,667 | | | — | | | — | | | 453,861 | |

| Operating leases | 71,097 | | | 53,274 | | | — | | | — | | | 124,371 | |

| Depreciation and amortization | 34,994 | | | 37,267 | | | 63,477 | | 2c. | — | | | 135,738 | |

| Insurance and claims | 37,257 | | | — | | | — | | | — | | | 37,257 | |

| Fuel expense | 20,951 | | | — | | | — | | | — | | | 20,951 | |

| Change in fair value of contingent consideration | — | | | 11,924 | | | — | | | — | | | 11,924 | |

| Other operating expenses | 166,501 | | | 91,134 | | | 94,663 | | 2e. | — | | | 352,298 | |

| | | | | | | | | |

| Total operating expenses | 1,287,642 | | | 1,338,562 | | | 129,964 | | | — | | | 2,756,168 | |

| Income (loss) from operations: | 204,561 | | | 68,222 | | | (158,140) | | | — | | | 114,643 | |

| | | | | | | | | |

| Other expense: | | | | | | | | | |

| Interest expense, net | (3,521) | | | (66,130) | | | — | | | (83,888) | | 3c. | (153,539) | |

| Other income | — | | | 3,045 | | | — | | | — | | | 3,045 | |

| Foreign exchange gain (loss) | — | | | 5,871 | | | — | | | — | | | 5,871 | |

| Total other expense | (3,521) | | | (57,214) | | | — | | | (83,888) | | | (144,623) | |

| Income (loss) before income taxes | 201,040 | | | 11,008 | | | (158,140) | | | (83,888) | | | (29,980) | |

| Income tax expense (benefit) | 50,791 | | | 2,500 | | | (43,760) | | 2g. | (14,831) | | 2g. | (5,300) | |

| | | | | | | | | |

| | | | | | | | | |

| Net income (loss) | 150,249 | | | 8,508 | | | (114,380) | | | (69,057) | | | (24,680) | |

| Less: Net income (loss) attributable to noncontrolling interest | — | | | — | | | (7,978) | | 2d. | — | | | (7,978) | |

| Net income (loss) attributable to Forward common shareholders | $ | 150,249 | | | $ | 8,508 | | | $ | (106,402) | | | $ | (69,057) | | | $ | (16,702) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| Net income per share: | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Basic | $ | 5.56 | | | | | | | | | $ | (0.61) | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Diluted | $ | 5.53 | | | | | | | | | $ | (0.61) | |

| | | | | | | | | |

| Weighted-average number of common shares outstanding: | | | | | | | | | |

| Basic | 26,864 | | | | | | | | 27,634 |

| Diluted | 26,999 | | | | | | | | 27,634 |

| | | | | | | | | |

See accompanying notes to the Unaudited Pro Forma Condensed Combined Financial Statements.

NOTES TO UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL STATEMENTS

The following unaudited pro forma condensed combined financial statements are based on and derived from the separate historical financial statements of Forward and Omni, after giving effect to the Merger and the other Transactions, including the assumed Pre-Closing Up-C Reorganization, and the assumptions and preliminary pro forma adjustments described below in the notes to the unaudited pro forma condensed combined financial statements. The unaudited pro forma condensed combined balance sheet has been prepared to give effect to the Transactions as if they had occurred on September 30, 2023. The unaudited pro forma condensed combined statements of operations have been prepared to give effect to the Transactions as if they had occurred on January 1, 2022. All amounts presented within this section are presented in thousands, except per share amounts, unless otherwise noted. As a result of displaying amounts in thousands, rounding differences may exist in the tables in this section.

The unaudited pro forma condensed combined financial statements were prepared using the acquisition method of accounting based on the guidance in Accounting Standards Codification Topic 805, Business Combinations, under U.S. generally accepted accounting principals (“GAAP”), with Forward as the acquirer of Omni. Accordingly, consideration given by Forward to complete the Merger was allocated to the assets and liabilities of Omni based upon their estimated fair values as of the date of completion of the Merger. Any excess of consideration over the fair value of assets acquired and liabilities assumed was allocated to goodwill. As of the date of the pro forma condensed combined financial statements, Forward has not completed the detailed valuation studies necessary to arrive at the required estimates of the fair value of all purchase consideration or the Omni assets to be acquired and the liabilities to be assumed and the related allocations of purchase price, nor has it completed all analyses of the accounting conclusions under GAAP related to certain consideration or identified all adjustments necessary to conform Omni’s accounting policies to Forward’s accounting policies. A final determination of the fair value of Omni’s assets and liabilities will be based on the actual net tangible and intangible assets and liabilities of Omni that exist as of the date of completion of the Merger and, therefore, cannot be made prior to the completion of the Merger. Accordingly, the unaudited pro forma purchase price adjustments are preliminary and are subject to further adjustments as additional information becomes available and as additional analyses are performed, and such further adjustments from purchase price or conforming accounting adjustments may be material. The preliminary unaudited pro forma purchase price adjustments have been made solely for the purpose of providing the unaudited pro forma condensed combined financial statements presented below. Forward estimated the fair value of Omni’s assets and liabilities based on discussions with Omni’s management, preliminary valuation studies, due diligence and information presented in Omni’s financial statements.

The unaudited pro forma condensed combined financial statements are provided for informational purposes only. The unaudited pro forma condensed combined financial information is not necessarily, and should not be assumed to be, an indication of the results that would have been achieved had the Transactions been completed as of the dates indicated or that may be achieved in the future and should not be taken as representative of future combined results of operations or financial condition of Forward. Furthermore, no effect has been given in the unaudited pro forma condensed combined statement of operations to synergies and potential cost savings, if any, that may be realized through the combination of the two companies or the costs that may be incurred to achieve those synergies or to integrate the operations of the two companies.

1.The Transactions

On August 10, 2023, Forward Air Corporation (“Forward”) entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Clue Opco LLC, a Delaware limited liability company and wholly owned subsidiary of Forward (“Opco”), Clue Opco Merger Sub LLC, a Delaware limited liability company and wholly owned subsidiary of Opco (“Opco Merger Sub”), Omni Newco, LLC (“Omni”) and the other parties thereto. The Merger Agreement provides that Opco Merger Sub will merge with and into Omni with Omni surviving the merger as a wholly owned subsidiary of Opco (the “Merger”). The Merger consideration payable by Forward will consist of a combination of (a) $150,000 in cash (the “Cash Consideration”) and (b) (i) common equity consisting 770 shares of Forward’s outstanding common stock, par value $0.01 per share, 4,365 Opco Class B Units and 4,365 Forward Series B Preferred Units representing 5,135 shares of Forward Common Stock on an as-converted and as-exchanged basis (the “Common Equity Consideration”) and (ii) non-voting, convertible perpetual preferred equity consideration consisting of 1,592 Forward Series C Preferred Units and 9,023 Opco Series C-2 Preferred Units and representing, subject to approval by Forward’s common shareholders in a shareholder vote to be held following the consummation of the Merger, an additional 10,615 shares of Forward Common Stock on an as-converted and as-exchanged basis (the “Convertible Preferred Equity Consideration”).

On or prior to the consummation of the Merger, Forward will (a) enter into a new senior secured credit agreement providing for (i) a seven-year senior secured term loan B facility in an aggregate principal amount of up to $1,125,000 (the “New Term Facility”) and (ii) a five-year senior secured revolving credit facility in an aggregate principal amount of $400,000 (the “New Revolving Credit Facility”; and, together with the New Term Facility, the “New Senior Secured Credit Facilities”) and (b) terminate and refinance in full (i) Forward’s existing senior unsecured credit facility, consisting of a $150,000 term loan facility and $300,000 revolving credit facility (the “Existing Forward Credit Facilities”) and (ii) Omni’s senior secured first lien credit facility consisting of a $1,200,000 term loan facility and a $80,000 revolving credit facility (the “Existing Omni First Lien Credit Facilities”) and $245,000 second lien secured subordinated term loan facility (the “Existing Omni Second Lien Credit Facilities”; together with the Existing Omni First Lien Credit Facilities, the “Existing Omni Credit Facilities” and, the Existing Omni Credit Facilities, together with the Existing Forward Credit Facilities, the “Existing Credit Facilities”) using a portion of the net proceeds of the issuance of $725,000 aggregate principal amount of 9.500% Senior Secured Notes due 2031 by GN Bondco, LLC (the “Senior Secured Notes”) and the initial borrowings under the New Term Facility, together with cash on hand. The transactions in the immediately preceding sentence are referred to herein as the “Refinancings.”

For the purposes of these pro forma financial statements, Forward has assumed the use of the proceeds from the issuance of the $725,000 aggregate principal amount of the Senior Secured Notes (issued at 98.0%), borrowings under the New Term Facility in the aggregate principal amount of $1,125,000 (assuming the loans under the New Term Facility are issued at an issue price of 96.0%), and borrowings under the New Revolving Credit Facility in the aggregate principal amount of $59,500, together with cash on hand, will be used to pay the Cash Consideration, to effect the Refinancings and to pay the fees, premiums, expenses and other transaction costs incurred in connection with the Transactions. For the purposes of these pro forma financial statements, Forward has assumed a blended annual effective interest rate on this combined $1,909,500 of New Senior Secured Credit Facilities debt of 9.80% (based on the actual interest rate on the Senior Secured Notes and the estimated initial interest rates applicable to borrowings under the New Senior Secured Credit Facilities) and undrawn fee in respect of the New Revolving Credit Facility of 0.50% per annum.

The transactions described in this Note 1 are referred to as the “Transactions.”

2.Acquisition Accounting Adjustments

a.Estimated Purchase Price

Estimated Merger purchase price consideration of approximately $2,645,080, net of cash acquired of $52,407, consists of $150,000 of cash, the estimated fair value of contingent consideration in respect of the Tax Receivable Agreement (defined below), the estimated fair value of the Common Equity Consideration and the Convertible Preferred Equity Consideration and the extinguishment of the Existing Omni Credit Facilities. The fair value of the Common Equity Consideration and the Convertible Preferred Equity Consideration portions of the purchase price will be measured at the Acquisition Closing at the then current market price per share of Forward’s Common Stock. The value of the estimated purchase price consideration will change based on fluctuations in the share price of Forward’s Common Stock.

In connection with the Acquisition Closing, a Tax Receivable Agreement (the “Tax Receivable Agreement”) will be entered into by Forward, Opco, existing direct and certain indirect equity holders of Omni (“Omni Holders”) and certain other parties, which sets forth the agreement among holders regarding the sharing of certain tax benefits realized by Forward as a result of the Transactions. Under the Tax Receivable Agreement, Forward will be generally obligated to pay certain Omni Holders 83.5% of (a) the total tax benefit that Forward realizes as a result of increases in tax basis in Opco’s assets resulting from certain actual or deemed distributions and the future exchange of units of Opco for shares of securities of Forward (or cash) pursuant to the amended and restated limited liability company agreement of Opco to be entered into at the Acquisition Closing (the “Opco LLCA”), (b) certain pre-existing tax attributes of certain Omni Holders that are corporate entities for tax purposes, (c) the tax benefits that Forward realizes from certain tax allocations that correspond to items of income or gain required to be recognized by certain Omni Holders, and (d) other tax benefits attributable to payments under the Tax Receivable Agreement. The estimated purchase price assumes that $24,377 of Opco Class B Units and corresponding Forward Series B Preferred Units will be exchanged by Omni Holders for Forward Common Stock. Therefore, an initial tax receivable contingent liability was established. After the Acquisition Closing, the effect of each exchange of Opco Class B Units and corresponding Forward Series B Preferred Units may result in an adjustment to the deferred tax balances and the tax receivable liability. Forward is not able to anticipate the expected timing of, or quantify the dollar amount of, the payments under the Tax Receivable Agreement. The timing and amount of the payments will depend on a variety of factors, including, but not limited to (1) the amount and timing of future exchanges, and the extent to which these exchanges are taxable, (2) the price per share of Forward Common Stock at the time of an exchange, (3) the amount and timing of future income against which to offset the potential tax benefits resulting from the subsequent exchange and (4) the tax laws in effect.

The following table summarizes the components of the estimated purchase price to be paid and issued to the Omni Holders:

| | | | | | | | |

| Cash Consideration | | $ | 150,000 | |

Contingent consideration(1) | | 12,670 | |

| | |

| Forward Common Stock issued | | 770 | |

| Forward Series B Preferred Units issued and Opco Class B Units issued | | 4,365 | |

| Forward Series C Preferred Units issued | | 1,592 | |

| Opco Series C-2 Preferred Units Issued | | 9,023 | |

| | |

| Total shares of Forward Common Stock issued on an as-converted and as-exchanged basis | | 15,750 | |

Forward's share price(2) | | $ | 68.74 | |

| Equity portion of purchase price | | $ | 1,082,684 | |

| Extinguishment of Existing Omni's Credit Facilities | | 1,452,133 | |

| | |

| Less: cash acquired | | (52,407) | |

| | |

| Total estimated purchase price consideration, net of cash acquired | | $ | 2,645,080 | |

| | |

| | |

(1) Represents the estimated fair value of the tax receivable liability. Estimated fair value was calculated using the estimated undiscounted cash flow payments payable by Forward under the Tax Receivable Agreement and a discount rate of 9.25%. |

(2) Represents the share price of Forward Common Stock as of September 30, 2023. The equity portion of the purchase price consideration will depend on the market price of Forward Common Stock on the date of the Acquisition Closing. |

b.Preliminary Purchase Price Allocation

The unaudited pro forma condensed combined balance sheet has been adjusted to reflect the preliminary allocation of the estimated purchase price to identifiable assets acquired and liabilities assumed related to Omni, with the excess recorded as goodwill. The following table summarizes the preliminary allocation of the estimated purchase price:

| | | | | | | | |

| Accounts receivable | | $ | 186,747 | |

| Other current and noncurrent assets | | 43,832 | |

| Property and equipment | | 76,745 | |

Operating lease right-of-use assets(1) | | 163,175 | |

| Identifiable intangible assets | | 1,365,562 | |

| Goodwill | | 1,301,416 | |

| Total assets acquired | | 3,137,477 | |

| Accounts payable and accrued expenses | | 99,959 | |

Finance lease obligations(1) | | 11,524 | |

Operating lease liabilities(1) | | 11,983 | |

Contingent consideration(2) | | 163,175 | |

Deferred income taxes(1) | | 54,872 | |

| Total liabilities assumed | | 150,884 | |

| Net assets acquired | | 492,397 | |

| | $ | 2,645,080 | |

| | |

(1) Reflects an adjustment to the book value based on preliminary estimates of fair value. |

(2) Reflects the contingent consideration in the amount of $54,872 estimated at fair value in Omni’s historical financial statements. |

The preliminary purchase price allocation has been used to prepare the transaction accounting adjustments in the unaudited pro forma condensed combined balance sheet and statements of operations. The final purchase price allocation will be determined when Forward has completed the detailed valuations and necessary calculations. The final amounts allocated to Omni assets and liabilities could differ materially from the preliminary amounts presented in these unaudited pro forma condensed combined financial statements.

The unaudited pro forma condensed combined balance sheet has been adjusted to reflect the preliminary impact on shareholder’s equity of the combined entity. The following table summarizes the pro forma adjustments to shareholders equity:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| As of September 30, 2023 |

| | Eliminate Historical Omni Equity (1) | | Record the Combination Consideration | | Other Equity Adjustments (2) | | Total Pro Forma Adjustment |

| Preferred stock | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| Series B Preferred units | | — | | | 44 | | | — | | | 44 | |

| Series C Preferred units | | — | | | 16 | | | — | | | 16 | |

| Common stock | | — | | | 7 | | | — | | | 7 | |

| Additional paid-in capital | | — | | | 520,675 | | | — | | | 520,675 | |

| Members'equity | | (153,365) | | | — | | | — | | | (153,365) | |

| Accumulated other comprehensive loss | | 5,792 | | | — | | | — | | | 5,792 | |

| (Accumulated deficit) retained earnings | | 157,812 | | | — | | | (94,663) | | | 63,149 | |

| Subtotal-shareholders' (deficit) equity | | $ | 10,239 | | | $ | 520,742 | | | $ | (94,663) | | | $ | 436,318 | |

|

(1) Represents the elimination of historical Omni shareholders’ (deficit) equity. |

(2) Includes the estimated transaction costs that are not expected to recur beyond twelve months after the Acquisition Closing. |

c.Intangible Assets and Amortization Expense

The unaudited pro forma condensed combined financial statements have been adjusted to reflect the estimated fair value of acquired identifiable intangible assets and to adjust amortization expense accordingly. The following table summarizes the pro forma adjustments for intangible assets and amortization expense:

| | | | | | | | | | | | | | | | | | | | |

| | | | Estimated Amortization Expense |

| | Preliminary Estimated Fair Value | | For the Nine Months Ended September 30, 2023 | | For the Nine Months Ended September 30, 2022 |

Acquired identifiable intangible assets(1) | | $ | 1,365,562 | | | $ | 94,199 | | | $ | 94,199 | |

| Goodwill | | 1,301,416 | | | | | |

| Less: Omni's historical identifiable intangible assets | | (757,714) | | | (35,002) | | | (30,722) | |

| Less: Omni's historical goodwill | | (530,479) | | | | | |

| Pro forma adjustment | | $ | 1,378,785 | | | $ | 59,197 | | | $ | 63,477 | |

|

(1) Adjustment to amortization expense was determined using the straight-line method over an estimated useful life of ranging from five to twelve years. |

The preliminary estimates of fair value and estimated useful lives will likely differ from the final amount Forward will calculate after completing a detailed valuation analysis. As a result, the financial estimates of fair value and estimated useful lives after completing such analysis may be materially different from the preliminary estimates presented herein.

d.Noncontrolling Interest Adjustment

The noncontrolling interest adjustment to the unaudited pro forma condensed combined financial statements represents Omni Holders’ interest of 32.3% in Opco. Opco will be structured as an umbrella partnership C corporation through which Omni Holders will hold a portion of the purchase price equity consideration in the form of units that are ultimately exchangeable for Forward Common Stock. Opco issued 4,365 Opco Class B Units and 9,023 Opco Series C-2 Preferred Units to Omni Holders in connection with the Transactions.

e.Transaction Cost Adjustment

The transaction cost adjustment to the unaudited pro forma condensed combined financial statements represents Omni’s and Forward’s estimated acquisition-related costs of $94,663 that are not expected to recur beyond twelve months after the Acquisition Closing. As of September 30, 2023, Forward’s and Omni’s historical condensed balance sheets reflected a combined accrued expense in the amount of $12,791 for transaction costs.

f.Intercompany Pro Forma Adjustments

The intercompany pro forma adjustments to the unaudited pro forma condensed combined financial statements represent the transactions between Forward and Omni that would be eliminated in combination.

g.Income Tax Adjustments

The income tax adjustments to the unaudited pro forma condensed combined financial statements represent the income tax expense of Forward after the consideration of its interest in Opco. The rate of 20.1% for the nine months ended September 30, 2023, and 17.7% for the nine months ended September 30, 2022 represents the pro forma combined income tax expense for the pro forma combined entity and differs from the statutory rate primarily as a result of no taxes recorded on the portion of the domestic pre-tax income that is allocated to Opco.

h.Reclassifications

Certain reclassifications have been made to amounts in the Omni historical financial information to conform to the Forward financial statement presentation. The table below summarizes the reclassifications:

| | | | | | | | | | | | | | | | | | | | |

| Reclassifications in the unaudited pro forma condensed combined balance sheet |

| | | | | | |

| | As of September 30, 2023 |

| | Before Reclassification | | Reclassification | | After Reclassification |

| Prepaid expenses and other assets | | $ | 28,523 | | | $ | (28,523) | | (i) | $ | — | |

| Other current assets | | — | | | 31,740 | | (i) | 31,740 | |

| Accrued expenses and other | | 72,155 | | | (72,155) | | (ii) | — | |

| Accrued expenses | | — | | | 66,754 | | (ii) | 66,754 | |

| Other current liabilities | | — | | | 8,618 | | (ii) | 8,618 | |

| Long-term debt, less current portion | | 1,424,321 | | | (1,424,321) | | (iii) | — | |

| Finance lease obligations, less current portion | | — | | | 8,466 | | (iii) | 8,466 | |

| Long-term debt, less current portion and debt issuance costs | | — | | | 1,415,855 | | (iii) | 1,415,855 | |

| | | | | | | | | | | | | | | | | | | | |

| Reclassifications in the unaudited pro forma condensed combined statement of operations |

| | | | | | |

| | For the Nine Months Ended September 30, 2023 |

| | Before Reclassification | | Reclassification | | After Reclassification |

| Operating revenues | | $ | 998,858 | | | $ | 232 | | (iv) | $ | 999,090 | |

| Selling, general and administrative | | 390,120 | | | (390,120) | | (iv) | — | |

| Salaries, wages and employee benefits | | — | | | 207,784 | | (iv) | 207,784 | |

| Operating leases | | — | | | 74,823 | | (iv), (v) | 74,823 | |

| Depreciation and amortization | | 48,901 | | | (3,571) | | (v) | 45,330 | |

| Other operating expenses | | — | | | 111,316 | | (iv) | 111,316 | |

| | | | | | | | | | | | | | | | | | | | |

| Reclassifications in the unaudited pro forma condensed combined statement of operations |

| | | | | | |

| | For the Nine Months Ended September 30, 2022 |

| | Before Reclassification | | Reclassification | | After Reclassification |

| Selling, general and administrative | | $ | 332,942 | | | $ | (332,942) | | (vi) | $ | — | |

| Salaries, wages and employee benefits | | — | | | 190,667 | | (vi) | 190,667 | |

| Operating leases | | — | | | 53,274 | | (vi), (vii) | 53,274 | |

| Depreciation and amortization | | 39,400 | | | (2,133) | | (vii) | 37,267 | |

| Other operating expenses | | — | | | 91,134 | | (vi) | 91,134 | |

| | | | | | | | | | | | | | | | | | | | |

(i) Represents the reclassification of Prepaid expenses and other assets as reflected in Omni’s historical balance sheet as of September 30, 2023 to Other current assets to conform to Forward’s historical balance sheet presentation. |

(ii) Represents the reclassification of Accrued expenses and other as reflected in Omni's historical balance sheet as of September 30, 2023 to Accrued expenses and Other current liabilities to conform to Forward's historical balance sheet presentation. |

(iii) Represents the reclassification of Prepaid expenses and other assets as reflected in Omni’s historical balance sheet as of September 30, 2023 to Other current assets to conform to Forward’s historical balance sheet presentation. |

(iv) Represents the reclassification of Selling, general and administrative as reflected in Omni's historical statement of operations for the nine months ended September 30, 2023 to Operating revenues, Salaries, wages and employee benefits, Operating leases and Other operating expenses to conform to Forward's historical statement of operations presentation. |

| (v) Represents the reclassification of Amortization expense relating to the right of use assets from Depreciation and amortization as reflected in Omni's historical statement of operations for the nine months ended September 30, 2023 to Operating leases to conform to Forward's historical statement of operations presentation. |

(vi) Represents the reclassification of Selling, general and administrative as reflected in Omni's historical statement of operations for the nine months ended September 30, 2022 to Salaries, wages and employee benefits, Operating leases and Other operating expenses to conform to Forward's historical statement of operations presentation. |

(vii) Represents the reclassification of Amortization expense relating to the right of use assets from Depreciation and amortization as reflected in Omni's historical statement of operations for the nine months ended September 30, 2022 to Operating leases to conform to Forward's historical statement of operations presentation. |

3.Financing Adjustments

The unaudited pro forma condensed combined financial statements reflect the following adjustments related to the financing, the proceeds of which will be used in part to fund the Transactions:

a.Adjustments to Cash

| | | | | | | | |

| | As of September 30, 2023 |

| Repayment of Existing Omni Credit Facilities | | $ | (1,452,133) | |

| Repayment of Existing Forward Credit Facilities | | (122,375) | |

Gross proceeds of Senior Secured Notes(1) | | 710,500 | |

Gross proceeds of borrowings under the New Term Facility(1) | | 1,080,000 | |

| Gross proceeds of borrowings under the New Revolving Credit Facility | | 59,500 | |

| Cash paid for fees related to the Senior Secured Notes, New Term Facility and New Revolving Credit Facility | | (54,250) | |

| Cash paid for transaction costs | | (69,450) | |

| Total adjustment to cash | | $ | 151,792 | |

| | |

(1) Assumes the Senior Secured Notes are issued with an original issue discount of 98.0%. To the extent the borrowings under the New Term Facility are issued with original issue discount, the amount of drawings on the New Revolving Credit Facility and/or the amount of cash on hand utilized to consummate the Transactions will increase by a corresponding amount. |

b.Adjustments to Long-Term Debt

| | | | | | | | |

| | As of September 30, 2023 |

| Current portion of debt: | | |

| Extinguishment of Existing Omni Credit Facilities | | $ | (12,102) | |

| Extinguishment of Existing Forward Credit Facilities | | (3,188) | |

| Total adjustments to current portion of debt | | $ | (15,290) | |

| Long-Term Debt, net of current portion: | | |

| Extinguishment of Existing Omni Credit Facilities | | (1,440,031) | |

| Extinguishment of Existing Forward Credit Facilities | | (119,187) | |

Record noncurrent portion of the Senior Secured Notes(1) | | 725,000 | |

Record noncurrent portion of the New Term Facility(1) | | 1,125,000 | |

Record noncurrent portion of the New Revolving Credit Facility(1) | | 59,500 | |

Less: debt issuance costs and debt discount(2) | | (113,420) | |

| Pro forma adjustment to interest expense | | $ | 236,862 | |

| | |

(1) Debt obligations are classified as noncurrent debt based on the average term of seven years. |

(2) Amount reflects the extinguishment of the debt issuance costs of the Existing Forward Credit Facilities of $330 offset by the aggregate debt issuance costs incurred with the Senior Secured Notes, the New Term Facility and the New Revolving Credit Facility of $54,250 and issuance of discounts on the Senior Secured Notes and the borrowings under the New Term Facility of $14,500 and $45,000, respectively. |

c.Adjustments to Interest Expense

| | | | | | | | | | | | | | |

| | Nine Months Ended |

| | September 30, 2023 | | September 30, 2022 |

Interest expense for the Senior Secured Notes, New Term Facility and New Revolving Credit Facility(1) | | $ | 140,882 | | | $ | 140,882 | |

Amortization of debt issuance costs(2) | | 5,931 | | | 5,931 | |

| Amortization of debt discount | | 6,181 | | | 6,181 | |

| Total interest expense | | 152,994 | | | 152,994 | |

| Less: Omni’s historical interest expense and amortization of debt issuance costs | | (121,974) | | | (65,888) | |

| Less: Forward’s historical interest expense and amortization of debt issuance costs | | (7,028) | | | (3,218) | |

| Pro forma adjustment to interest expense | | $ | 23,992 | | | $ | 83,888 | |

| | | | |

(1) Adjustment is based on a blended annual interest rate of 9.8% (based on the actual interest rate on the Senior Secured Notes and the estimated initial interest rate applicable to borrowings under the New Senior Secured Credit Facilities) and undrawn fee in respect of the New Revolving Credit Facility of 0.50% per annum. Approximately $340,500 of the New Revolving Credit Facility is assumed to be undrawn. |

(2) Debt issuance costs are amortized on a straight-line basis over a weighted-average period of seven years. |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

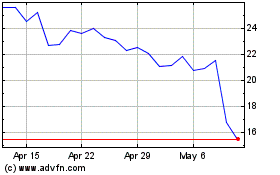

Forward Air (NASDAQ:FWRD)

Historical Stock Chart

From Apr 2024 to May 2024

Forward Air (NASDAQ:FWRD)

Historical Stock Chart

From May 2023 to May 2024