Net Income of $9.0 Million, or $0.33 per

Diluted Share

HomeStreet, Inc. (NASDAQ:HMST) (including its consolidated

subsidiaries, the “Company” or “HomeStreet”), the parent company of

HomeStreet Bank, today announced net income of $9.0 million, or

$0.33 per diluted share for the quarter ended March 31, 2017,

compared with net income of $2.3 million, or $0.09 per diluted

share for the quarter ended December 31, 2016 and $6.4 million, or

$0.27 per diluted share for the quarter ended March 31, 2016. Core

net income(1) for the quarter ended March 31, 2017 was $9.0

million, or $0.33 per diluted share, compared with core net

income(1) of $2.6 million, or $0.10 per diluted share, for the

quarter ended December 31, 2016 and $9.8 million, or $0.41 per

diluted share, for the quarter ended March 31, 2016.

Key highlights of Q1 2017:

- Net income for the first quarter of

2017 was $9.0 million, an increase of $2.6 million, or 40% compared

to $6.4 million of net income in the first quarter of 2016

- Total assets of $6.40 billion grew

$157.4 million, or 3%, from $6.24 billion at December 31, 2016

- Loans held for investment of $3.99

billion, grew by $136.7 million, or 4%, from $3.85 billion at

December 31, 2016

- Deposits of $4.60 billion grew $166.1

million, or 4%, from $4.43 billion at December 31, 2016, including

5% deposit growth in our California branches

“We are pleased with our results for the first quarter,” said

Mark K. Mason, Chairman, President, and Chief Executive Officer.

“The Mortgage Banking segment recovered from the sharp rise in

interest rates and market dislocation experienced in the fourth

quarter of 2016 and the Commercial & Consumer Banking segment

made significant progress toward our strategic growth goals. In our

Commercial & Consumer Banking segment, loans held for

investment increased 4% from the fourth quarter of 2016 despite the

first quarter generally being seasonally the slowest for commercial

loan originations. Additionally, total deposits increased by 4% and

business deposit balances increased by over 5% during the quarter.

Asset quality also remained a bright spot with nonperforming assets

declining to 0.38% of total assets. In the first quarter we opened

our first Northern California commercial banking office in San

Jose, with plans to open a full service retail deposit branch later

in the year. Our San Jose lending team is already making great

progress in originating new commercial loans and deposits.”

“We are also pleased with the results in our Mortgage Banking

segment. While the first quarter is typically a seasonally slow

origination quarter, our origination business was also negatively

impacted by the multi-year low levels of housing inventory in our

markets. Mitigating this challenge we have improved our execution

on loans sold resulting in a higher composite profit margin.

Additionally, the disruption in the derivatives markets that we

experienced in the fourth quarter normalized in the first quarter,

contributing to positive results in our mortgage servicing

business.”

For details and the complete earnings release, please refer to

the Company’s investor relations website at

http://ir.homestreet.com as well as the Company’s Form 8-K filing

at www.sec.gov.

(1) For notes on non-GAAP financial measures, see pages 10 and 31

of the full earnings release.

Conference Call

HomeStreet, Inc., the parent company of HomeStreet Bank, will

conduct a quarterly earnings conference call on Tuesday, April 25,

2017 at 1:00 p.m. EDT. Mark K. Mason, President and CEO, and Mark

R. Ruh, Senior Vice President and Interim CFO, will discuss first

quarter 2017 results and provide an update on recent activities. A

question and answer session will follow the presentation.

Shareholders, analysts and other interested parties may register in

advance at http://dpregister.com/10103687 or may join the

call by dialing 1-877-508-9589 (1-855-669-9657 in Canada) shortly

before 1:00 p.m. EST.

A rebroadcast will be available approximately one hour after the

conference call by dialing 1-877-344-7529 and entering passcode

10103687.

The information to be discussed in the conference call will be

available on the Company's web site after the market closes on

Monday, April 24, 2017.

About HomeStreet

Now in its 97th year HomeStreet, Inc. (Nasdaq:HMST) is a

diversified financial services company headquartered in Seattle,

Washington and is the holding company for HomeStreet Bank, a

state-chartered, FDIC-insured commercial bank. HomeStreet offers

consumer, commercial and private banking services, investment and

insurance products and originates residential and commercial

mortgages and construction loans for borrowers located in the

Western United States and Hawaii. The bank has consistently

received an “outstanding” rating under the federal Community

Reinvestment Act (CRA). Certain information about our business can

be found on our investor relations web site, located at

http://ir.homestreet.com.

Forward-Looking Statements

This press release contains forward-looking statements

concerning HomeStreet, Inc. and HomeStreet Bank and their

operations, performance, financial conditions and likelihood of

success, as well as plans and expectations for future actions and

events. All statements other than statements of historical fact are

forward-looking statements. Forward-looking statements are based on

many beliefs, assumptions, estimates and expectations of our future

performance, taking into account information currently available to

us, and include statements about the competitiveness of the banking

industry. When used in this press release, the words “anticipate,”

“believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,”

“potential,” “should,” “will” and “would” and similar expressions

(including the negative of these terms) may help identify

forward-looking statements. Such statements involve inherent risks

and uncertainties, many of which are difficult to predict and are

generally beyond management's control. Forward-looking statements

speak only as of the date made, and we do not undertake to update

them to reflect changes or events that occur after that date.

We caution readers that a number of factors could cause actual

results to differ materially from those expressed in, implied or

projected by, such forward-looking statements. Among other things,

we face limitations and risks associated with our ability to expand

our banking operations geographically and across market sectors,

integrate our recent acquisitions, grow our franchise and

capitalize on market opportunities, meet our growth targets,

maintain our position in the industry and generate positive net

income and cash flow. These limitations and risks include without

limitation changes in general political and economic conditions

that impact our markets and our business, actions by the Federal

Reserve Board and financial market conditions that affect monetary

and fiscal policy, regulatory and legislative actions that may

increase capital requirements or otherwise constrain our ability to

do business, including restrictions that could be imposed by our

regulators on certain aspects of our operations or on our growth

initiatives and acquisition activities, our ability to maintain

electronic and physical security of our customer data and our

information systems, our ability to maintain compliance with

current and evolving laws and regulations, our ability to attract

and retain key personnel, our ability to make accurate estimates of

the value of our non-cash assets and liabilities, increases in the

competition in our industry and across our markets and the extent

of our success in problem asset resolution efforts. The results of

our recent acquisitions may fall short of our financial and

operational expectations. We may not realize the benefits expected

from completed bank and branch acquisitions in the anticipated time

frame (or at all), and integrating acquired operations may take

longer or prove more expensive than anticipated. In addition, we

may not recognize all or a substantial portion of the value of our

rate-lock loan activity due to challenges our customers may face in

meeting current underwriting standards, a decrease in interest

rates, an increase in competition for such loans, unfavorable

changes in general economic conditions, including housing prices,

the job market, consumer confidence and spending habits either

nationally or in the regional and local market areas in which the

Company does business, and recent and future legislative or

regulatory actions or reform that affect our Company directly, our

business or the banking or mortgage industries more generally. A

discussion of the factors that we recognize to pose risk to the

achievement of our business goals and our operational and financial

objectives is contained in our Annual Report on Form 10-K for the

fiscal year ended December 31, 2016 and updated from time to time

in our filings with the Securities and Exchange Commission. We

strongly recommend readers review those disclosures in conjunction

with the discussions herein.

The information contained herein is unaudited, although certain

information related to the year ended December 31, 2016 has been

derived from our audited financial statements for the year then

ended as included in our 2016 Form 10-K. All financial data should

be read in conjunction with the notes to the consolidated financial

statements of HomeStreet, Inc., and subsidiaries as of and for the

fiscal year ended December 31, 2016, as contained in the Company's

Annual Report on Form 10-K for such fiscal year.

About Non-GAAP Financial Measures

To supplement our consolidated financial statements, which are

prepared and presented in accordance with GAAP, we have disclosed

“core net income” to provide comparisons of quarter-to-date fiscal

2017 net income to the corresponding periods of fiscal 2016. We

believe this information is useful to investors who are seeking to

exclude the after-tax impact of acquisition-related expenses and a

bargain purchase gain, both of which we recorded in connection with

our merger with OCBB on February 1, 2016, with our acquisition of

two retail deposit branches in Lake Oswego, Oregon on August 12,

2016 and two retail deposit branches in Southern California on

November 11, 2016. We also have presented adjusted expenses, which

eliminate costs incurred in connection with these acquisitions.

Similarly, we have provided information about our balance sheet

items, including total loans, total deposits and total assets,

adjusted in each case to eliminate acquisition-related impacts. The

presentation of this financial information is not intended to be

considered in isolation or as a substitute for, or superior to, the

financial information prepared and presented in accordance with

GAAP.

We also have disclosed tangible equity ratios, return on average

tangible shareholders’ equity and tangible book value per share of

common stock which are non-GAAP financial measures. Tangible common

shareholders' equity is calculated by deducting goodwill and

intangible assets (excluding mortgage servicing rights) from

shareholders' equity. Tangible book value is calculated by dividing

tangible common shareholders' equity by the number of common shares

outstanding. The return on average tangible common shareholders'

equity is calculated by dividing net earnings available to common

shareholders (annualized) by average tangible common shareholders'

equity.

Our management believes that these non-GAAP financial measures

provide meaningful supplemental information regarding our results

of core operations by excluding certain acquisition-related

revenues and expenses that may not be indicative of our expected

recurring results of operations. We believe that both management

and investors benefit from referring to these non-GAAP financial

measures in assessing our performance and when planning,

forecasting, and analyzing future periods. These non-GAAP financial

measures also facilitate management's internal comparisons to our

historical performance, as well as comparisons to our competitors'

operating results. We believe these non-GAAP financial measures are

useful to investors both because (1) they allow for greater

transparency with respect to key metrics used by management in its

financial and operational decision-making and (2) they are

available to institutional investors and analysts to help them

assess the strength of our business on a normalized basis.

For more information on these non-GAAP financial measures, see

the tables captioned "Reconciliations of non-GAAP results of

operations to the nearest comparable GAAP measures," included at

the end of the full release.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170424006539/en/

Investor Relations:HomeStreet, Inc.Gerhard Erdelji,

206-515-4039Gerhard.Erdelji@HomeStreet.comhttp://ir.homestreet.com

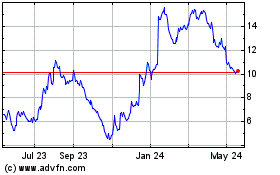

HomeStreet (NASDAQ:HMST)

Historical Stock Chart

From Mar 2024 to Apr 2024

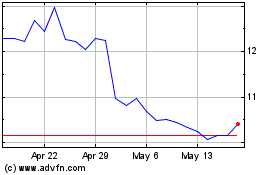

HomeStreet (NASDAQ:HMST)

Historical Stock Chart

From Apr 2023 to Apr 2024