HighPeak Energy, Inc. (“HighPeak” or the “Company”) (NASDAQ: HPK)

today provided the following financing update.

Financing Update

The Company is currently evaluating multiple

prospective financing arrangements to refinance its February 2024

Senior Notes (“February Notes”) and November 2024 Senior Notes

(together with the February Notes, the “Existing Notes”) and

enhance liquidity. Although the Company continues to progress its

refinancing efforts, it no longer anticipates consummating the

conditional redemption of its Existing Notes on June 30, 2023 as

contemplated by the conditional notice of redemption therefor

previously delivered to the holders of such Existing Notes.

As a result of the Company’s ongoing refinancing

process, the Administrative Agent under the Company’s Credit

Facility has agreed to a postponement of the date on which the

Company was previously obligated thereunder to either extend the

maturity of its February Notes, refinance its February Notes or

allocate a portion of its cash flow to retire the February Notes,

until July 31, 2023. In addition, the Company is in discussions

with the lenders under its Credit Facility regarding an anticipated

increase of the Company’s elected commitments under such Credit

Facility and continues to discuss with such lenders an anticipated

accommodation of additional covenant waivers and extensions.

This press release does not constitute an offer

to sell, a solicitation to buy or an offer to purchase or sell any

securities, nor shall there be any sale of these securities in any

state or jurisdiction in which such offer, solicitation or sale

would be unlawful prior to registration or qualification under the

securities laws of any such state or jurisdiction.

About HighPeak Energy, Inc.

HighPeak Energy, Inc. is a publicly traded

independent crude oil and natural gas company, headquartered in

Fort Worth, Texas, focused on the acquisition, development,

exploration and exploitation of unconventional crude oil and

natural gas reserves in the Midland Basin in West Texas.

Cautionary Note Regarding

Forward-Looking Statements

The information in this press release contains forward-looking

statements that involve risks and uncertainties. When used in this

document, the words “believes,” “plans,” “expects,” “anticipates,”

“forecasts,” “intends,” “continue,” “may,” “will,” “could,”

“should,” “future,” “potential,” “estimate” or the negative of such

terms and similar expressions as they relate to HighPeak Energy,

Inc. (“HighPeak Energy,” the “Company” or the “Successor”) are

intended to identify forward-looking statements, which are

generally not historical in nature. The forward-looking statements

are based on the Company's current expectations, assumptions,

estimates and projections about the Company and the industry in

which the Company operates. Although the Company believes that the

expectations and assumptions reflected in the forward-looking

statements are reasonable as and when made, they involve risks and

uncertainties that are difficult to predict and, in many cases,

beyond the Company's control. For example, the Company’s review of

strategic alternatives may not result in a sale of the Company, a

recommendation that a transaction occur or result in a completed

transaction, and any transaction that occurs may not increase

shareholder value, in each case as a result of such risks and

uncertainties.

These risks and uncertainties include, among other things, the

results of the Company’s ongoing discussions with existing lenders

and ability to refinance the Existing Notes, the ability of the

Company to have adequate liquidity and comply with the terms of its

indebtedness, results of the strategic reviews being undertaken by

the Company’s Board and the interest of prospective counterparties,

the Company’s ability to realize the results contemplated by its

current business plan, volatility of commodity prices, product

supply and demand, the impact of a widespread outbreak of an

illness, such as the coronavirus disease pandemic, on global and

U.S. economic activity, competition, the ability to obtain

environmental and other permits and the timing thereof, other

government regulation or action, the ability to obtain approvals

from third parties and negotiate agreements with third parties on

mutually acceptable terms, litigation, the costs and results of

drilling and operations, availability of equipment, services,

resources and personnel required to perform the Company's drilling

and operating activities, access to and availability of

transportation, processing, fractionation, refining and storage

facilities, HighPeak Energy's ability to replace reserves,

implement its business plans or complete its development activities

as scheduled, access to and cost of capital, the financial strength

of counterparties to any credit facility and derivative contracts

entered into by HighPeak Energy, if any, and purchasers of HighPeak

Energy's oil, natural gas liquids and natural gas production,

uncertainties about estimates of reserves, identification of

drilling locations and the ability to add proved reserves in the

future, the assumptions underlying forecasts, including forecasts

of production, expenses, cash flow from sales of oil and gas and

tax rates, quality of technical data, environmental and weather

risks, including the possible impacts of climate change,

cybersecurity risks and acts of war or terrorism. Specifically,

failure to redeem or refinance the Existing Notes on or before

September 1, 2023, allocate a portion of our cash flow that will

retire such Existing Notes on or before November 30, 2023 or amend

the terms of such Existing Notes to extend the scheduled repayment

thereof to no earlier than February 15, 2025 by September 1, 2023

will result in an event of default under our Credit Agreement and

an acceleration of the repayment of all amounts outstanding

thereunder. These and other risks are described in the Company's

Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and

Current Reports on Form 8-K and other filings with the SEC. The

Company undertakes no duty to publicly update these statements

except as required by law.

Investor Contact:

Ryan HightowerVice President, Business

Development817.850.9204rhightower@highpeakenergy.com

Source: HighPeak Energy, Inc.

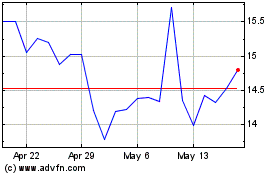

HighPeak Energy (NASDAQ:HPK)

Historical Stock Chart

From Nov 2024 to Dec 2024

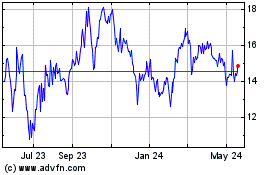

HighPeak Energy (NASDAQ:HPK)

Historical Stock Chart

From Dec 2023 to Dec 2024