UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported): November

9, 2021 (November 8, 2021)

METROMILE,

INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-39484

|

|

84-4916134

|

|

(State or Other Jurisdiction

|

|

(Commission File Number)

|

|

(I.R.S. Employer

|

|

of Incorporation)

|

|

|

|

Identification No.)

|

|

425 Market Street #700

|

|

|

|

San Francisco, CA

|

|

94105

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(888) 242-5204

(Registrant’s telephone number,

including area code)

N/A

(Former name or former address, if changed since last

report.)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

|

|

☒

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240-13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading symbol(s)

|

|

Name of each exchange on which

registered

|

|

Common Stock, $0.0001 par value per share

|

|

MILE

|

|

The Nasdaq Capital Market

|

|

|

|

|

|

|

|

Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 per share

|

|

MILEW

|

|

The Nasdaq Capital Market

|

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b–2 of the

Securities Exchange Act of 1934 (§240.12b–2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01. Entry into a Material Definitive Agreement.

On November 8, 2021, Metromile,

Inc., a Delaware corporation (“Metromile”), entered into an Agreement and Plan of Merger (the “Merger Agreement”),

by and among Metromile, Lemonade, Inc., a Delaware corporation (“Lemonade”), Citrus Merger Sub A, Inc., a Delaware

corporation and a wholly owned subsidiary of Lemonade (“Acquisition Sub I”), and Citrus Merger Sub B, LLC, a Delaware

limited liability company and a wholly owned subsidiary of Lemonade (“Acquisition Sub II”). The board of directors

of Metromile (the “Metromile Board”) and the board of directors of Lemonade have each unanimously approved the Merger

Agreement.

Pursuant to and on the terms and

conditions set forth in the Merger Agreement, (i) Acquisition Sub I will merge with and into Metromile (the “First Merger,”

and the effective time of the First Merger, the “First Effective Time”), with Metromile continuing as the surviving

entity (the “Initial Surviving Corporation”) in the First Merger, and (ii) the Initial Surviving Corporation will merge

with and into Acquisition Sub II (the “Second Merger,” and together with the First Merger, the “Mergers”),

with Acquisition Sub II as the surviving entity and as a wholly owned subsidiary of Lemonade.

At the First Effective Time, each

share of common stock of Metromile, par value $0.0001 per share (“Metromile Common Stock”), issued and outstanding

immediately prior to the First Effective Time, will be converted into the right to receive 0.05263 (the “Exchange Ratio”)

validly issued, fully paid and non-assessable shares of common stock of Lemonade, par value $0.00001 per share (“Lemonade Common

Stock”).

At the First Effective Time, (i) each

Metromile stock option that is held by an individual who, as of November 8, 2021, was not employed or providing services to Metromile

or its subsidiaries shall be cancelled and converted into the right to receive an amount in cash, without interest, equal to (A) (1) the

Lemonade stock price multiplied by the Exchange Ratio (the “Per Metromile Share Price”) less (2) the per share

exercise price thereof, multiplied by (B) the total number of shares of Metromile Common Stock subject to such option; (ii) each

other Metromile stock option shall be assumed by Lemonade and converted into a corresponding option with respect to Lemonade Common Stock

(with the number of shares and exercise price thereof equitably adjusted based on the Exchange Ratio); (iii) each award of Metromile

restricted stock units that (A) is held by any non-employee director of Metromile or (B) subject to performance vesting conditions

shall be cancelled and converted into the right to receive an amount in cash, without interest, equal to (1) the Per Metromile Share

Price multiplied by (2) the number of shares of Metromile Common Stock subject to such award (in the case of any award subject to

performance vesting conditions, based on actual performance as determined by the Compensation Committee of the Board of Directors of Metromile

prior to the First Effective Time); (iv) each other award of Metromile restricted stock units shall be assumed by Lemonade and converted

into a corresponding award with respect to Lemonade Common Stock (with the number of shares subject to such award equitably adjusted based

on the Exchange Ratio); and (v) each Metromile warrant exercisable for Metromile Common Stock shall be assumed by Lemonade and converted

into a corresponding warrant denominated in shares of Lemonade Common Stock (with the number of warrants and exercise price being adjusted

based on the Exchange Ratio). Except as otherwise set forth above, each Metromile stock option, restricted stock unit award, and warrant

assumed by Lemonade shall continue to have the same terms and conditions as applied immediately prior to the First Effective Time.

The consummation of the Mergers

is subject to the satisfaction or waiver of certain closing conditions, including, among others (i) the effectiveness of the registration

statement on Form S-4 registering the shares of Lemonade Common Stock issuable in the Mergers and absence of any stop order or proceedings

by the U.S. Securities and Exchange Commission (“SEC”) with respect thereto; (ii) the adoption of the Merger Agreement

by holders of a majority of the outstanding shares of Metromile Common Stock; (iii) the expiration or earlier termination of any applicable

waiting period of review under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended; (iv) receipt of other material regulatory

consents and approvals; (v) the approval for listing on the NYSE of the shares of Lemonade Common Stock to be issued pursuant to the Merger

Agreement; (vi) the absence of governmental restraints or prohibitions preventing the consummation of the Mergers; (vii) subject to specified

materiality standards, the truth and accuracy of the representations and warranties made by each party; (viii) the compliance with or

performance by the other party in all material respects of the covenants in the Merger Agreement; and (ix) the absence of a material adverse

effect on each party.

Metromile has agreed, subject

to certain exceptions with respect to unsolicited proposals, not to directly or indirectly solicit competing acquisition proposals or

to enter into discussions concerning, or provide confidential information in connection with, any unsolicited alternative acquisition

proposals. Additionally, the Metromile Board is required to recommend the adoption of the Merger Agreement to its stockholders, subject

to certain exceptions. Prior to the approval of the transaction-related proposals by the Metromile stockholders, the Metromile Board may

change its recommendation in response to an unsolicited proposal for an alternative transaction, if the Metromile Board determines in

good faith after consultation with its outside legal counsel and financial advisor that the proposal constitutes a “Company Superior

Proposal” (as defined in the Merger Agreement), and that failure to take such action would reasonably be expected to be inconsistent

with their fiduciary duties to Metromile and its stockholders under applicable law, subject to complying with certain procedures set forth

in the Merger Agreement. Prior to the approval of the transaction-related proposals by the Metromile stockholders, the Metromile Board

may also change its recommendation if a “Company Intervening Event” (as defined in the Merger Agreement) occurs, and the Metromile

Board determines in good faith after consultation with its outside legal counsel and financial advisor that failing to change its recommendation

would reasonably expected to be inconsistent with its fiduciary duties, subject to complying with certain procedures set forth in the

Merger Agreement.

Metromile and Lemonade have each

made customary representations and warranties in the Merger Agreement for transactions of this nature. The Merger Agreement also contains

customary covenants and agreements, including covenants and agreements relating to (i) the conduct of each of Metromile’s and Lemonade’s

business between the date of the signing of the Merger Agreement and the closing date of the Mergers and (ii) the efforts of the parties

to cause the Mergers to be completed, including actions which may be necessary to obtain the required regulatory consents and approvals

for the transaction.

The Merger Agreement may be terminated

by each of Metromile and Lemonade in certain limited circumstances, including, among others, (i) by mutual written consent; (ii) if the

Mergers have not consummated by August 8, 2022 (subject to a 3-month extension to November 8, 2022 in the event that certain regulatory

closing conditions remain outstanding); (iii) if any restraint having the effect of preventing the consummation of the Mergers has become

final and non-appealable; (iv) if stockholders of Metromile fail to adopt the Merger Agreement; and (v) due to a material breach by the

other party of any its representations, warranties, or covenants in the Merger Agreement (which is not cured within 30 days after written

notice of such breach) which would result in the closing conditions not being satisfied.

In addition, Lemonade may terminate

the Merger Agreement if (i) the Metromile Board withholds, changes or fails to reaffirm its recommendation to approve the Mergers; or

(ii) if Metromile materially breaches its no-solicitation or stockholder meeting covenants in the Merger Agreement.

The Merger Agreement further provides

that, upon termination of the Merger Agreement under specific circumstances, Metromile may be required to pay Lemonade a termination fee

equal to $12,500,000.

The Merger Agreement contains

representations, warranties and covenants that the respective parties made to each other as of the date of such agreement or other specific

dates. The assertions embodied in those representations, warranties and covenants were made for purposes of the contract among the respective

parties and are subject to important qualifications and limitations agreed to by the parties in connection with negotiating such agreement.

The representations, warranties and covenants in the Merger Agreement are also modified in important part by the underlying disclosure

schedules which are not filed publicly and which are subject to a contractual standard of materiality different from that generally applicable

to stockholders and were used for the purpose of allocating risk among the parties rather than establishing matters as facts. Metromile

does not believe that these schedules contain information that is material to an investment decision. Investors are not third-party beneficiaries

under the Merger Agreement and should not rely on the representations, warranties and covenants or any descriptions thereof as characterizations

of the actual state of facts or condition of the parties thereto or any of their respective subsidiaries or affiliates. This description

of the Merger Agreement does not purport to be complete and is qualified in its entirety by the terms and conditions of the Merger Agreement,

a copy of which is attached hereto as Exhibit 2.1 and is incorporated herein by reference.

Additional Agreements

Voting and Support Agreements

Contemporaneously with the execution

of the Merger Agreement, certain stockholders of Metromile holding approximately 11.3% of the outstanding shares of Metromile Common Stock,

including all members of the Metromile Board and certain officers (the “Stockholders”), entered into voting and support

agreements (the “Voting and Support Agreements”) with Lemonade, pursuant to which the Stockholders agreed to, among

other things, vote all of their shares in Metromile (“Voting Shares”) (i) in favor of the adoption of the Merger Agreement

and approval of the Mergers and other transactions contemplated by the Merger Agreement; (ii) in favor of any adjournment or postponement

recommended by Metromile with respect to any Company stockholders meeting to the extent permitted or required pursuant to the Merger Agreement;

(iii) against any alternative acquisition proposal or transaction; (iv) against any merger, sale of substantial assets or liquidation

of Metromile; and (v) against any proposal, action or agreement that would reasonably be expected to impede, interfere with, delay or

postpone, prevent or otherwise impair the Mergers or the other transactions contemplated by the Merger Agreement.

The Voting and Support Agreements

generally prohibit the Stockholders from transferring, or permitting to exist any liens on, their Voting Shares prior to the consummation

of the Mergers, other than for certain standard permitted transfers, including, among others, for estate planning and pursuant to a Rule

10b5-1 trading plan. The Voting and Support Agreements will terminate upon the earliest to occur of (i) the mutual agreement of Lemonade

and the Stockholder party thereto, (ii) the closing of the Mergers, and (iii) the termination of the Merger Agreement in accordance with

its terms.

The foregoing description of the Voting and Support

Agreements does not purport to be complete and is qualified in its entirety by reference to the full text of the Voting and Support Agreements,

a copy of the form which is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

2.1

|

|

Agreement and Plan of Merger, dated November 8, 2021, by and among Lemonade, Inc., Citrus Merger Sub A, Inc., Citrus Merger Sub B, LLC and Metromile, Inc.

|

|

10.1

|

|

Form of Voting and Support Agreement by and among Lemonade, Inc. and certain stockholders of Metromile, Inc.

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURES

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

|

Dated: November 9, 2021

|

METROMILE, INC.

|

|

|

|

|

|

|

By:

|

/s/ Regi Vengalil

|

|

|

Name:

|

Regi Vengalil

|

|

|

Title:

|

Chief Financial Officer

|

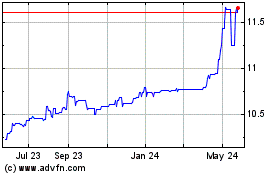

Insight Acquisition (NASDAQ:INAQ)

Historical Stock Chart

From Dec 2024 to Jan 2025

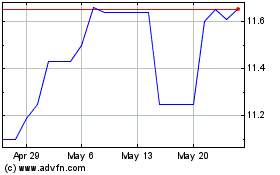

Insight Acquisition (NASDAQ:INAQ)

Historical Stock Chart

From Jan 2024 to Jan 2025