OrthoPediatrics Corp. (“OrthoPediatrics” or the

“Company”) (Nasdaq: KIDS), a company focused exclusively on

advancing the field of pediatric orthopedics, today announced its

financial results for the second quarter ended June 30, 2024.

Second Quarter

2024 and Recent Business

Highlights

- Helped a record 32,000 children in

the second quarter of 2024, an increase of 52% from the second

quarter 2023

- Generated record total revenue of

$52.8 million for the second quarter of 2024, up 33% from $39.6

million in second quarter 2023; domestic revenue increased 39% and

international revenue increased 16% in the quarter

- Grew worldwide Trauma &

Deformity revenue 37%, worldwide Scoliosis revenue 26%; Sports

Medicine/Other revenue increased 17% in the second quarter of 2024

compared to the second quarter of 2023

- Received Breakthrough Device

Designation from FDA for eLLiTM Growing Rod System, an implant

designed to address severe pathology associated with Early Onset

Scoliosis (EOS)

- Continued top tier sponsorship

support of the combined 2024 Pediatric Orthopaedic Society of North

America ("POSNA") and European Paediatric Orthopaedic Society

("EPOS") with Emerald sponsorship at annual meeting

- Announced financing providing up to

$100 million of capital, strengthening balance sheet through a term

loan and private placement of convertible notes from Braidwell,

LP

- Reaffirmed full year 2024 revenue

guidance of $200.0 million to $203.0 million, representing growth

of 34% to 36% compared to prior year

David Bailey, President & CEO of

OrthoPediatrics, commented, “I am excited about our productive

start to the year. We are executing across the business in a

normalized Children's hospital environment to deliver healthy

revenue growth and increased operating leverage. Our clinically

differentiated product portfolio is driving continued market share

gains. We are capitalized to achieve cash flow breakeven and

uniquely positioned to continue investing in transformative product

development and in our OPSB expansion strategy, while we generate

operating cash flow that we expect will support next year's planned

set builds."

Second Quarter

2024 Financial ResultsTotal

revenue for the second quarter of 2024 was $52.8 million, a 33%

increase compared to $39.6 million for the same period last year.

U.S. revenue for the second quarter of 2024 was $41.2 million, a

39% increase compared to $29.6 million for the same period last

year, representing 78% of total revenue. The increase in revenue in

the second quarter of 2024 was driven primarily by organic growth

in Trauma and Deformity and Scoliosis products as well as the

addition of Boston O&P. International revenue for the second

quarter of 2024 was $11.6 million, a 16% increase compared to $10.0

million for the same period last year, representing 22% of total

revenue. Growth in the quarter was primarily driven by Trauma and

Deformity, domestic Scoliosis, partially offset by negative

international Scoliosis.

Trauma and Deformity revenue for the second

quarter of 2024 was $37.8 million, a 37% increase compared to $27.5

million for the same period last year. This growth was driven

primarily by growth across numerous product lines, specifically

Pega systems, PNP Tibia, ExFix, and OPSB, coupled with the addition

of Boston O&P. Scoliosis revenue was $13.7 million, a 26%

increase compared to $10.9 million for the second quarter of 2023.

The growth was driven by increased number of users of our spine

systems, and RESPONSE, as well as the addition of Boston O&P,

partially offset by negative growth in international Scoliosis.

Sports Medicine/Other revenue for the second quarter of 2024 was

$1.3 million, a 17% increase compared to $1.2 million for the same

period last year.

Gross profit for the second quarter of 2024 was

$40.8 million, a 36% increase compared to $30.0 million for the

same period last year. Gross profit margin for the second quarter

of 2024 was 77%, compared to 76% for the same period last year. The

change in gross margin was primarily driven by higher domestic

growth combined with lower international set sales as well as

favorable purchase price variance release.

Total operating expenses for the second quarter

of 2024 were $46.5 million, a 30% increase compared to $35.6

million for the same period last year. The increase was mainly

driven by the addition of Boston O&P, as well as increased

commission expense and incremental personnel required to support

the ongoing growth of the Company.

Sales and marketing expenses increased $3.1

million, or 23%, to $16.6 million in the second quarter of 2024.

The increase was driven primarily by increased sales commission

expenses coupled with additional employees to support the OPSB.

Research and development expenses decreased

$0.4 million, or 14%, to $2.5 million in the second quarter of

2024. The decrease was driven by timing of external development

expenses.

General and administrative expenses increased

$8.2 million, or 43%, to $27.3 million in the second quarter of

2024. The increase was driven primarily by the addition of Boston

O&P, increased depreciation and amortization as well as

personnel and resources to support the continued expansion of the

business.

Total other expense was $0.4 million for the

second quarter of 2024, compared to $2.3 million of other income

for the same period last year. The change was due primarily to the

favorable fair value adjustment of contingent consideration in the

second quarter of 2023, which did not repeat in 2024 as well as

additional interest expense related to the term loan with

MidCap.

Net loss for the second quarter of 2024 was $6.0

million, compared to $2.9 million for the same period last year.

Net loss per share for the period was $0.26 per basic and diluted

share, compared to $0.13 per basic and diluted share for the same

period last year.

Adjusted EBITDA for the second quarter of 2024

was $2.6 million as compared to $2.3 million for the second quarter

of 2023.

Weighted average basic and diluted shares

outstanding for the three months ended June 30, 2024, was

23,145,064 shares.

As of June 30, 2024, cash, cash

equivalents, short-term investments and restricted cash were $30.9

million compared to $82.3 million as of December 31, 2023.

Cash usage in the second quarter 2024 includes $5.5 million paid

for one time events. Additionally, the Company has signed a private

financing arrangement with Braidwell, LP, consisting of a term loan

and private placement of convertible notes that will provide up to

$100 million of capital. Terms of the financing include a $50

million term loan and $50 million of convertible notes. The term

loan consists of an initial term loan of $25 million and access to

a delayed draw term loan facility for an additional $25 million.

The financing is expected to fund on or around August 12, 2024. In

connection with the financing, the Company has approved a stock

repurchase program of up to $5 million in value of outstanding

common stock. The proceeds from the financing will be used to repay

outstanding debt of approximately $10 million, transaction fees

incurred in connection with the financing, potential stock

repurchases, and general corporate purposes and working capital

needs.

Full Year 2024

Financial GuidanceFor the full year of 2024, the

Company reiterated its revenue guidance of $200.0 million to $203.0

million, representing growth of 34% to 36% over 2023 revenue. The

Company reiterated annual set deployment to be less than $20.0

million and reiterated $8.0 million to $9.0 million of Adjusted

EBITDA for the full year of 2024.

Conference CallOrthoPediatrics

will host a conference call on Tuesday, August 6, 2024, at 8:00

a.m. ET to discuss the results. Investors interested in listening

to the conference call may do so by accessing a live and archived

webcast of the event at www.orthopediatrics.com, on the Investors

page in the Events & Presentations section. The webcast will be

available for replay for at least 90 days after the event.

Forward-Looking StatementsThis

press release includes "forward-looking statements" within the

meaning of U.S. federal securities laws. You can identify

forward-looking statements by the use of words such as "may,"

"might," "will," "should," "expect," "plan," "anticipate," "could,"

"believe," "estimate," "project," "target," "predict," "intend,"

"future," "goals," "potential,” "objective," "would" and other

similar expressions. Forward-looking statements involve known and

unknown risks, uncertainties and other factors, such as the impact

of widespread health emergencies, such as COVID-19 and respiratory

syncytial virus, and the other risks, uncertainties and factors set

forth under "Risk Factors" in OrthoPediatrics’ Annual Report on

Form 10-K filed with the SEC on March 8, 2024, as updated and

supplemented by our other SEC reports filed from time to time, that

may cause our results, activity levels, performance or achievements

to be materially different from the information expressed or

implied by the forward-looking statements;. Forward-looking

statements speak only as of the date they are made. OrthoPediatrics

assumes no obligation to update forward-looking statements to

reflect actual results, subsequent events, or circumstances or

other changes affecting such statements except to the extent

required by applicable securities laws.

Use of Non-GAAP Financial

MeasuresThis press release includes certain non-GAAP

financial measures such as organic revenue, adjusted loss per share

and Adjusted EBITDA, which differ from financial measures

calculated in accordance with U.S. generally accepted accounting

principles (“GAAP”). Sales on an organic basis excludes from our

reported net revenue growth the impacts of revenue from any

acquired business that have been owned for less than one year. We

believe that providing the non-GAAP organic revenue is useful as a

way to measure and evaluate our underlying performance consistently

across the periods presented. Adjusted loss per share in this press

release represents diluted loss per share on a GAAP basis, plus the

accreted interest attributable to acquisition installment payables,

the fair value adjustment of contingent consideration, acquisition

related costs, and minimum purchase commitment costs. The fair

value adjustment of contingent consideration is associated with our

estimates of the value of earn-outs in connection with certain

acquisitions. We believe that providing the non-GAAP diluted loss

per share excluding these expenses, as well as the GAAP measures,

assists our investors because such expenses are not reflective of

our ongoing operating results. Adjusted EBITDA in this release

represents net loss, plus interest expense, net plus other expense,

provision for income taxes (benefit), depreciation and

amortization, stock-based compensation expense, fair value

adjustment of contingent consideration, acquisition related costs,

and the cost of minimum purchase commitments. The Company believes

the non-GAAP measures provided in this earnings release enable it

to further and more consistently analyze the period-to-period

financial performance of its core business operating performance.

Management uses these metrics as a measure of the Company’s

operating performance and for planning purposes, including

financial projections. The Company believes these measures are

useful to investors as supplemental information because they are

frequently used by analysts, investors and other interested parties

to evaluate companies in its industry. Adjusted EBITDA is a

non-GAAP financial measure and should not be considered as an

alternative to, or superior to, net income or loss as a measure of

financial performance or cash flows from operations as a measure of

liquidity, or any other performance measure derived in accordance

with GAAP, and it should not be construed to imply that the

Company’s future results will be unaffected by unusual or

non-recurring items. In addition, the measure is not intended to be

a measure of free cash flow for management’s discretionary use, as

it does not reflect certain cash requirements such as debt service

requirements, capital expenditures and other cash costs that may

recur in the future. Adjusted EBITDA contains certain other

limitations, including the failure to reflect our cash

expenditures, cash requirements for working capital needs and other

potential cash requirements. In evaluating these non-GAAP measures,

you should be aware that in the future the Company may incur

expenses that are the same or similar to some of the adjustments in

this presentation. The Company’s presentation of non-GAAP diluted

loss per share or Adjusted EBITDA should not be construed to imply

that its future results will be unaffected by any such adjustments.

Management compensates for these limitations by primarily relying

on the Company’s GAAP results in addition to using these adjusted

measures on a supplemental basis. The Company’s definition of these

measures is not necessarily comparable to other similarly titled

captions of other companies due to different methods of

calculation. The schedules below contain reconciliations of

reported GAAP net revenue to non-GAAP organic revenue, GAAP diluted

loss per share to non-GAAP diluted loss and net loss to non-GAAP

Adjusted EBITDA.

About OrthoPediatrics

Corp.Founded in 2006, OrthoPediatrics is an orthopedic

company focused exclusively on advancing the field of pediatric

orthopedics. As such it has developed the most comprehensive

product offering to the pediatric orthopedic market to improve the

lives of children with orthopedic conditions. OrthoPediatrics

currently markets 71 systems that serve three of the largest

categories within the pediatric orthopedic market. This product

offering spans trauma and deformity, scoliosis, and sports

medicine/other procedures. OrthoPediatrics’ global sales

organization is focused exclusively on pediatric orthopedics and

distributes its products in the United States and over 70 countries

outside the United States. For more information, please visit

www.orthopediatrics.com.

Investor ContactPhilip Trip TaylorGilmartin

Groupphilip@gilmartinir.com415-937-5406

|

ORTHOPEDIATRICS CORP.CONDENSED

CONSOLIDATED BALANCE SHEETS(Unaudited) (In

Thousands, Except Share Data) |

| |

| |

June 30, 2024 |

|

December 31, 2023 |

| |

|

|

|

|

ASSETS |

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

28,927 |

|

|

$ |

31,055 |

|

|

Restricted cash |

|

1,963 |

|

|

|

1,972 |

|

|

Short-term investments |

|

— |

|

|

|

49,251 |

|

|

Accounts receivable - trade, net of allowances of $1,026 and

$1,373, respectively |

|

42,028 |

|

|

|

34,617 |

|

|

Inventories, net |

|

116,366 |

|

|

|

105,851 |

|

|

Prepaid expenses and other current assets |

|

4,499 |

|

|

|

3,750 |

|

|

Total current assets |

|

193,783 |

|

|

|

226,496 |

|

| |

|

|

|

| Property and equipment,

net |

|

53,482 |

|

|

|

41,048 |

|

| |

|

|

|

| Other assets: |

|

|

|

|

Amortizable intangible assets, net |

|

67,848 |

|

|

|

69,275 |

|

|

Goodwill |

|

90,512 |

|

|

|

83,699 |

|

|

Other intangible assets |

|

18,669 |

|

|

|

15,287 |

|

|

Other non-current assets |

|

6,467 |

|

|

|

2,940 |

|

|

Total other assets |

|

183,496 |

|

|

|

171,201 |

|

| |

|

|

|

| Total assets |

$ |

430,761 |

|

|

$ |

438,745 |

|

| |

|

|

|

| |

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

| Current liabilities: |

|

|

|

|

Accounts payable - trade |

|

17,002 |

|

|

|

12,649 |

|

|

Accrued compensation and benefits |

|

12,616 |

|

|

|

11,325 |

|

|

Current portion of long-term debt with affiliate |

|

156 |

|

|

|

152 |

|

|

Current portion of acquisition installment payable |

|

1,304 |

|

|

|

10,149 |

|

|

Other current liabilities |

|

8,491 |

|

|

|

7,391 |

|

|

Total current liabilities |

|

39,569 |

|

|

|

41,666 |

|

| |

|

|

|

| Long-term liabilities: |

|

|

|

|

Long-term debt, net of current portion |

|

9,250 |

|

|

|

9,297 |

|

|

Long-term debt with affiliate, net of current portion |

|

532 |

|

|

|

611 |

|

|

Acquisition installment payment, net of current portion |

|

2,371 |

|

|

|

3,551 |

|

|

Deferred income taxes |

|

4,739 |

|

|

|

5,483 |

|

|

Other long-term liabilities |

|

3,007 |

|

|

|

1,112 |

|

|

Total long-term liabilities |

|

19,899 |

|

|

|

20,054 |

|

| |

|

|

|

| Total liabilities |

|

59,468 |

|

|

|

61,720 |

|

| |

|

|

|

|

Stockholders' equity: |

|

|

|

|

Common stock, $0.00025 par value; 50,000,000 shares authorized;

24,216,738 shares and 23,378,408 shares issued as of June 30,

2024 and December 31, 2023, respectively |

|

6 |

|

|

|

6 |

|

|

Additional paid-in capital |

|

593,087 |

|

|

|

580,287 |

|

|

Accumulated deficit |

|

(211,576 |

) |

|

|

(197,742 |

) |

|

Accumulated other comprehensive loss |

|

(10,224 |

) |

|

|

(5,526 |

) |

|

Total stockholders' equity |

|

371,293 |

|

|

|

377,025 |

|

| |

|

|

|

| Total liabilities and

stockholders' equity |

$ |

430,761 |

|

|

$ |

438,745 |

|

|

ORTHOPEDIATRICS CORP.CONDENSED

CONSOLIDATED STATEMENTS OF

OPERATIONS(Unaudited)(In

Thousands, Except Share and Per Share Data) |

| |

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net revenue |

$ |

52,802 |

|

|

$ |

39,559 |

|

|

$ |

97,487 |

|

|

$ |

71,147 |

|

| Cost of revenue |

|

12,003 |

|

|

|

9,534 |

|

|

|

24,514 |

|

|

|

17,561 |

|

| Gross profit |

|

40,799 |

|

|

|

30,025 |

|

|

|

72,973 |

|

|

|

53,586 |

|

| |

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Sales and marketing |

|

16,593 |

|

|

|

13,533 |

|

|

|

30,762 |

|

|

|

26,082 |

|

|

General and administrative |

|

27,329 |

|

|

|

19,112 |

|

|

|

52,059 |

|

|

|

36,269 |

|

|

Research and development |

|

2,543 |

|

|

|

2,966 |

|

|

|

5,541 |

|

|

|

5,412 |

|

|

Total operating expenses |

|

46,465 |

|

|

|

35,611 |

|

|

|

88,362 |

|

|

|

67,763 |

|

| |

|

|

|

|

|

|

|

| Operating loss |

|

(5,666 |

) |

|

|

(5,586 |

) |

|

|

(15,389 |

) |

|

|

(14,177 |

) |

| |

|

|

|

|

|

|

|

| Other expense (income): |

|

|

|

|

|

|

|

|

Interest expense, net |

|

261 |

|

|

|

294 |

|

|

|

898 |

|

|

|

84 |

|

|

Fair value adjustment of contingent consideration |

|

— |

|

|

|

(2,304 |

) |

|

|

— |

|

|

|

(2,974 |

) |

|

Other expense (income), net |

|

120 |

|

|

|

(289 |

) |

|

|

96 |

|

|

|

(620 |

) |

|

Total other expense (income), net |

|

381 |

|

|

|

(2,299 |

) |

|

|

994 |

|

|

|

(3,510 |

) |

| |

|

|

|

|

|

|

|

| Loss before income taxes |

$ |

(6,047 |

) |

|

$ |

(3,287 |

) |

|

|

(16,383 |

) |

|

|

(10,667 |

) |

| Provision for income taxes

(benefit) |

|

(18 |

) |

|

|

(401 |

) |

|

|

(2,549 |

) |

|

|

(975 |

) |

| Net loss |

$ |

(6,029 |

) |

|

$ |

(2,886 |

) |

|

$ |

(13,834 |

) |

|

$ |

(9,692 |

) |

| Weighted average common stock

- basic and diluted |

|

23,145,064 |

|

|

|

22,704,723 |

|

|

|

22,982,921 |

|

|

|

22,587,022 |

|

| Net loss per share – basic and

diluted |

$ |

(0.26 |

) |

|

$ |

(0.13 |

) |

|

$ |

(0.60 |

) |

|

$ |

(0.43 |

) |

|

ORTHOPEDIATRICS CORP.CONDENSED

CONSOLIDATED STATEMENTS OF CASH

FLOWS(Unaudited)(In Thousands) |

| |

| |

Six Months Ended June 30, |

|

|

|

2024 |

|

|

|

2023 |

|

| OPERATING ACTIVITIES |

|

| Net loss |

$ |

(13,834 |

) |

|

$ |

(9,692 |

) |

| Adjustments to reconcile net

loss to net cash used in operating activities: |

|

|

|

|

Depreciation and amortization |

|

9,807 |

|

|

|

7,928 |

|

|

Stock-based compensation |

|

5,738 |

|

|

|

5,415 |

|

|

Fair value adjustment of contingent consideration |

|

— |

|

|

|

(2,974 |

) |

|

Accretion of acquisition installment payable |

|

537 |

|

|

|

812 |

|

|

Deferred income taxes |

|

(2,955 |

) |

|

|

(975 |

) |

|

Changes in certain current assets and liabilities: |

|

|

|

|

Accounts receivable - trade |

|

(4,583 |

) |

|

|

(8,964 |

) |

|

Inventories, net |

|

(10,420 |

) |

|

|

(11,860 |

) |

|

Prepaid expenses and other current assets |

|

(403 |

) |

|

|

72 |

|

|

Accounts payable - trade |

|

4,150 |

|

|

|

9,724 |

|

|

Accrued expenses and other liabilities |

|

959 |

|

|

|

1,325 |

|

|

Other |

|

(1,778 |

) |

|

|

(1,645 |

) |

| Net cash used in operating

activities |

|

(12,782 |

) |

|

|

(10,834 |

) |

| |

|

|

|

| INVESTING ACTIVITIES |

|

|

|

| Acquisition of Boston O&P,

net of cash acquired |

|

(20,693 |

) |

|

|

— |

|

| Acquisition of MedTech |

|

— |

|

|

|

(3,097 |

) |

| Sale of short-term marketable

securities |

|

49,855 |

|

|

|

72,347 |

|

| Purchase of short-term

marketable securities |

|

— |

|

|

|

(44,600 |

) |

| Purchases of property and

equipment |

|

(13,144 |

) |

|

|

(10,563 |

) |

| Net cash provided by investing

activities |

|

16,018 |

|

|

|

14,087 |

|

| |

|

|

|

| FINANCING ACTIVITIES |

|

|

|

| Installment payment for

ApiFix |

|

(2,250 |

) |

|

|

(2,000 |

) |

| Installment payment for

MedTech |

|

(1,250 |

) |

|

|

— |

|

| Payments on acquisition

note |

|

(928 |

) |

|

|

— |

|

| Payment of debt issuance

costs |

|

(343 |

) |

|

|

— |

|

| Payments on mortgage

notes |

|

(71 |

) |

|

|

(71 |

) |

| Net cash used in financing

activities |

|

(4,842 |

) |

|

|

(2,071 |

) |

| |

|

|

|

| Effect of exchange rate

changes on cash, cash equivalents and restricted cash |

|

(531 |

) |

|

|

(335 |

) |

| |

|

|

|

| NET (DECREASE) INCREASE IN

CASH, CASH EQUIVALENTS AND RESTRICTED CASH |

|

(2,137 |

) |

|

|

847 |

|

| |

|

|

|

| Cash, cash equivalents and

restricted cash, beginning of period |

$ |

33,027 |

|

|

$ |

10,462 |

|

| Cash, cash equivalents and

restricted cash, end of period |

$ |

30,890 |

|

|

$ |

11,309 |

|

| |

|

|

|

| SUPPLEMENTAL DISCLOSURES |

|

|

|

| Cash paid for interest |

$ |

760 |

|

|

$ |

11 |

|

| Transfer of instruments from

property and equipment to inventory |

$ |

281 |

|

|

$ |

367 |

|

| Issuance of common shares for

ApiFix installment |

$ |

6,929 |

|

|

$ |

6,178 |

|

| Issuance of common shares for

MedTech installment |

$ |

133 |

|

|

$ |

2,274 |

|

| Right-of-use assets obtained

in exchange for lease liabilities |

$ |

— |

|

|

$ |

293 |

|

| Debt issuance costs not yet

paid |

$ |

67 |

|

|

$ |

— |

|

|

ORTHOPEDIATRICS CORP.NET REVENUE BY

GEOGRAPHY AND PRODUCT

CATEGORY(Unaudited)(In

Thousands) |

| |

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

Product sales by geographic location: |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

U.S. |

$ |

41,249 |

|

|

$ |

29,587 |

|

|

$ |

75,554 |

|

|

|

53,388 |

|

|

International |

|

11,553 |

|

|

|

9,972 |

|

|

|

21,933 |

|

|

|

17,759 |

|

|

Total |

$ |

52,802 |

|

|

$ |

39,559 |

|

|

$ |

97,487 |

|

|

$ |

71,147 |

|

| |

|

|

|

|

|

|

|

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

Product sales by category: |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Trauma and deformity |

$ |

37,771 |

|

|

$ |

27,514 |

|

|

|

71,073 |

|

|

|

50,909 |

|

|

Scoliosis |

|

13,682 |

|

|

|

10,893 |

|

|

|

23,886 |

|

|

|

17,966 |

|

|

Sports medicine/other |

|

1,349 |

|

|

|

1,152 |

|

|

|

2,528 |

|

|

|

2,272 |

|

|

Total |

$ |

52,802 |

|

|

$ |

39,559 |

|

|

$ |

97,487 |

|

|

$ |

71,147 |

|

|

ORTHOPEDIATRICS CORP.RECONCILIATION OF NET

LOSS TO NON-GAAP ADJUSTED

EBITDA(Unaudited)(In

Thousands) |

| |

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net

loss |

$ |

(6,029 |

) |

|

$ |

(2,886 |

) |

|

$ |

(13,834 |

) |

|

$ |

(9,692 |

) |

|

Interest expense (income), net |

|

261 |

|

|

|

294 |

|

|

|

898 |

|

|

|

84 |

|

|

Other income |

|

120 |

|

|

|

(289 |

) |

|

|

96 |

|

|

|

(620 |

) |

|

Provision for income taxes (benefit) |

|

(18 |

) |

|

|

(401 |

) |

|

|

(2,549 |

) |

|

|

(975 |

) |

|

Depreciation and amortization |

|

4,779 |

|

|

|

4,080 |

|

|

|

9,807 |

|

|

|

7,928 |

|

|

Stock-based compensation |

|

2,939 |

|

|

|

3,303 |

|

|

|

5,738 |

|

|

|

5,415 |

|

|

Fair value adjustment of contingent consideration |

|

— |

|

|

|

(2,304 |

) |

|

|

— |

|

|

|

(2,974 |

) |

|

Acquisition related costs |

|

142 |

|

|

|

199 |

|

|

|

387 |

|

|

|

199 |

|

|

Nonrecurring Pega conversion fees |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

277 |

|

|

Minimum purchase commitment cost |

|

433 |

|

|

|

276 |

|

|

|

976 |

|

|

|

576 |

|

|

Adjusted EBITDA |

$ |

2,627 |

|

|

$ |

2,272 |

|

|

$ |

1,519 |

|

|

$ |

218 |

|

|

ORTHOPEDIATRICS CORP.RECONCILIATION OF

DILUTED LOSS PER SHARE TO NON-GAAP ADJUSTED DILUTED LOSS PER

SHARE(Unaudited) |

| |

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Loss per share, diluted

(GAAP) |

$ |

(0.26 |

) |

|

$ |

(0.13 |

) |

|

$ |

(0.60 |

) |

|

$ |

(0.43 |

) |

|

Accretion of interest attributable to acquisition installment

payable |

|

— |

|

|

|

0.02 |

|

|

|

0.01 |

|

|

|

0.04 |

|

|

Fair value adjustment of contingent consideration |

|

— |

|

|

|

(0.10 |

) |

|

|

— |

|

|

|

(0.13 |

) |

|

Acquisition related costs |

|

0.01 |

|

|

|

0.01 |

|

|

|

0.02 |

|

|

|

0.01 |

|

|

Nonrecurring Pega conversion fees |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

0.01 |

|

|

Minimum purchase commitment cost |

|

0.02 |

|

|

|

0.01 |

|

|

|

0.04 |

|

|

|

0.03 |

|

| Loss per share, diluted

(non-GAAP) |

$ |

(0.23 |

) |

|

$ |

(0.19 |

) |

|

$ |

(0.53 |

) |

|

$ |

(0.47 |

) |

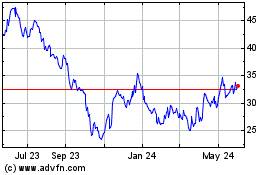

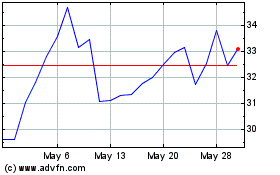

OrthoPediatrics (NASDAQ:KIDS)

Historical Stock Chart

From Dec 2024 to Jan 2025

OrthoPediatrics (NASDAQ:KIDS)

Historical Stock Chart

From Jan 2024 to Jan 2025