OrthoPediatrics Corp. (“OrthoPediatrics” or the

“Company”) (Nasdaq: KIDS), a company focused exclusively on

advancing the field of pediatric orthopedics, today announced its

financial results for the third quarter ended September 30,

2024.

Third Quarter

2024 and Recent Business

Highlights

- Helped a record of more than 33,000

children in the third quarter 2024, an increase of 50% from the

third quarter 2023

- Generated record total revenue of

$54.6 million for the third quarter of 2024, up 37% from $40.0

million in third quarter 2023; domestic revenue increased 45% and

international revenue increased 12% in the quarter

- Grew worldwide Trauma &

Deformity revenue 31%, worldwide Scoliosis revenue 52%; Sports

Medicine/Other revenue increased 50% in the third quarter of 2024

compared to the third quarter of 2023

- Launched Enabling Technologies

Division that will focus on new areas within digital health and

advanced technology intended to differentiate the Company's core

business, generate sustainable revenue, and access new markets and

specialties beyond orthopedics

- Increased full year 2024 revenue

guidance to $202 million to $204 million from $200 million to $203

million, representing growth of 36% to 37% compared to prior

year

David Bailey, President & CEO of

OrthoPediatrics, commented, “The third quarter results represent

yet another strong performance for OrthoPediatrics in which we

continued our positive momentum and executed our strategic

initiatives. With multiple levers driving our growth, we saw

strength across all business segments as Trauma and Deformity,

Scoliosis, and OPSB all contributed to further establishing our

dominant market share position within pediatric orthopedics. As we

look ahead, we are confident in the remainder of 2024 and ending

the year in a position of strength. Even more, we are excited about

our long-term outlook as we expect to continue extending our growth

while we maintain healthy gross margins and generate substantial

EBITDA, all while we surround the children's hospital with

everything needed to optimize pediatric care."

Third Quarter

2024 Financial ResultsTotal

revenue for the third quarter of 2024 was $54.6 million, a 37%

increase compared to $40.0 million for the same period last year.

U.S. revenue for the third quarter of 2024 was $42.7 million, a 45%

increase compared to $29.4 million for the same period last year,

representing 78% of total revenue. The increase in domestic revenue

in the third quarter of 2024 was driven by additional market share

gains across Trauma and Deformity, Scoliosis, and OPSB.

International revenue for the third quarter of 2024 was $11.9

million, a 12% increase compared to $10.6 million for the same

period last year, representing 22% of total revenue. Growth in the

quarter was primarily led by Scoliosis revenue.

Trauma and Deformity revenue for the third

quarter of 2024 was $37.6 million, a 31% increase compared to $28.8

million for the same period last year. This growth was driven

primarily by strong growth across numerous product lines, as well

as the addition of Boston O&P. Scoliosis revenue was $15.6

million, a 52% increase compared to $10.3 million for the third

quarter of 2023. The growth was driven primarily by increased

international scoliosis revenue, new users of spine systems,

RESPONSE 5.5/6.0, as well as 7D. Sports Medicine/Other revenue for

the third quarter of 2024 was $1.3 million, a 50% increase compared

to $0.9 million for the same period last year.

Gross profit for the third quarter of 2024 was

$40.1 million, a 29% increase compared to $31.0 million for the

same period last year. Gross profit margin for the third quarter of

2024 was 73%, compared to 77% for the same period last year. The

change in gross margin was primarily driven by changes in product

mix due to increased 7D unit sales at lower margin, set sales

internationally, as well as less favorable purchase price variance

compared to the third quarter of 2023.

Total operating expenses for the third quarter

of 2024 were $45.6 million, a 29% increase compared to $35.5

million for the same period last year. The increase was mainly

driven by the addition of Boston O&P, as well as increased

commission expense and incremental personnel required to support

the ongoing growth of the Company.

Sales and marketing expenses increased $2.8

million, or 20%, to $16.8 million in the third quarter of 2024. The

increase was driven primarily by increased sales commission

expenses coupled with additional employees to support the OPSB.

Research and development expenses increased

negligibly to $2.6 million in the third quarter of 2024. The slight

increase was driven by timing of external development expenses.

General and administrative expenses increased

$8.3 million, or 46%, to $26.3 million in the third quarter of

2024. The increase was driven primarily by the addition of Boston

O&P, increased depreciation and amortization as well as

personnel and resources to support the continued expansion of the

business.

Total other expense was $3.6 million for the

third quarter of 2024, compared to $0.8 million of other income for

the same period last year. The increase was driven by a one-time

refinancing expense of $3.2 million.

Net loss for the third quarter of 2024 was $7.9

million, compared to $4.6 million for the same period last year.

Net loss per share for the period was $0.34 per basic and diluted

share, compared to $0.20 per basic and diluted share for the same

period last year.

Adjusted EBITDA for the third quarter of 2024

was $4.0 million as compared to $3.6 million for the third quarter

of 2023.

Weighted average basic and diluted shares

outstanding for the three months ended September 30, 2024, was

23,171,249 shares.

As of September 30, 2024, cash, cash

equivalents, short-term investments and restricted cash were $78.1

million compared to $82.3 million as of December 31, 2023.

Full Year 2024

Financial GuidanceFor the full year of 2024, the

Company increased its revenue guidance from $200 million to $203

million to $202 million to $204 million , representing growth of

36% to 37% over 2023 revenue. The Company reiterated annual set

deployment to be less than $20 million and reiterated $8 million to

$9 million of Adjusted EBITDA for the full year of 2024.

Conference CallOrthoPediatrics

will host a conference call on Thursday, November 7, 2024, at 8:00

a.m. ET to discuss the results. Investors interested in listening

to the conference call may do so by accessing a live and archived

webcast of the event at www.orthopediatrics.com, on the Investors

page in the Events & Presentations section. The webcast will be

available for replay for at least 90 days after the event.

Forward-Looking StatementsThis

press release includes "forward-looking statements" within the

meaning of U.S. federal securities laws. You can identify

forward-looking statements by the use of words such as "may,"

"might," "will," "should," "expect," "plan," "anticipate," "could,"

"believe," "estimate," "project," "target," "predict," "intend,"

"future," "goals," "potential,” "objective," "would" and other

similar expressions. Forward-looking statements involve known and

unknown risks, uncertainties and other factors, such as the impact

of widespread health emergencies, such as COVID-19 and respiratory

syncytial virus, and the other risks, uncertainties and factors set

forth under "Risk Factors" in OrthoPediatrics’ Annual Report on

Form 10-K filed with the SEC on March 8, 2024, as updated and

supplemented by our other SEC reports filed from time to time, that

may cause our results, activity levels, performance or achievements

to be materially different from the information expressed or

implied by the forward-looking statements;. Forward-looking

statements speak only as of the date they are made. OrthoPediatrics

assumes no obligation to update forward-looking statements to

reflect actual results, subsequent events, or circumstances or

other changes affecting such statements except to the extent

required by applicable securities laws.

Use of Non-GAAP Financial

MeasuresThis press release includes certain non-GAAP

financial measures such as organic revenue, adjusted loss per share

and Adjusted EBITDA, which differ from financial measures

calculated in accordance with U.S. generally accepted accounting

principles (“GAAP”). Sales on an organic basis excludes from our

reported net revenue growth the impacts of revenue from any

acquired business that have been owned for less than one year. We

believe that providing the non-GAAP organic revenue is useful as a

way to measure and evaluate our underlying performance consistently

across the periods presented. Adjusted loss per share in this press

release represents diluted loss per share on a GAAP basis, plus the

accreted interest attributable to acquisition installment payables,

the fair value adjustment of contingent consideration, acquisition

related costs, loss on early extinguishment of debt, nonrecurring

Pega conversion fees, and minimum purchase commitment costs. The

fair value adjustment of contingent consideration is associated

with our estimates of the value of earn-outs in connection with

certain acquisitions. We believe that providing the non-GAAP

diluted loss per share excluding these expenses, as well as the

GAAP measures, assists our investors because such expenses are not

reflective of our ongoing operating results. Adjusted EBITDA in

this release represents net loss, plus interest expense, net plus

other expense, provision for income taxes (benefit), depreciation

and amortization, tradename impairment, stock-based compensation

expense, fair value adjustment of contingent consideration,

acquisition related costs, nonrecurring PEGA conversion fees,

Midcap financing termination loss, and the cost of minimum purchase

commitments. The Company believes the non-GAAP measures provided in

this earnings release enable it to further and more consistently

analyze the period-to-period financial performance of its core

business operating performance. Management uses these metrics as a

measure of the Company’s operating performance and for planning

purposes, including financial projections. The Company believes

these measures are useful to investors as supplemental information

because they are frequently used by analysts, investors and other

interested parties to evaluate companies in its industry. Adjusted

EBITDA is a non-GAAP financial measure and should not be considered

as an alternative to, or superior to, net income or loss as a

measure of financial performance or cash flows from operations as a

measure of liquidity, or any other performance measure derived in

accordance with GAAP, and it should not be construed to imply that

the Company’s future results will be unaffected by unusual or

non-recurring items. In addition, the measure is not intended to be

a measure of free cash flow for management’s discretionary use, as

it does not reflect certain cash requirements such as debt service

requirements, capital expenditures and other cash costs that may

recur in the future. Adjusted EBITDA contains certain other

limitations, including the failure to reflect our cash

expenditures, cash requirements for working capital needs and other

potential cash requirements. In evaluating these non-GAAP measures,

you should be aware that in the future the Company may incur

expenses that are the same or similar to some of the adjustments in

this presentation. The Company’s presentation of non-GAAP diluted

loss per share or Adjusted EBITDA should not be construed to imply

that its future results will be unaffected by any such adjustments.

Management compensates for these limitations by primarily relying

on the Company’s GAAP results in addition to using these adjusted

measures on a supplemental basis. The Company’s definition of these

measures is not necessarily comparable to other similarly titled

captions of other companies due to different methods of

calculation. The schedules below contain reconciliations of

reported GAAP net revenue to non-GAAP organic revenue, GAAP diluted

loss per share to non-GAAP diluted loss and net loss to non-GAAP

Adjusted EBITDA.

About OrthoPediatrics

Corp.Founded in 2006, OrthoPediatrics is an orthopedic

company focused exclusively on advancing the field of pediatric

orthopedics. As such it has developed the most comprehensive

product offering to the pediatric orthopedic market to improve the

lives of children with orthopedic conditions. OrthoPediatrics

currently markets over 70 systems that serve three of the largest

categories within the pediatric orthopedic market. This product

offering spans trauma and deformity, scoliosis, and sports

medicine/other procedures. OrthoPediatrics’ global sales

organization is focused exclusively on pediatric orthopedics and

distributes its products in the United States and over 70 countries

outside the United States. For more information, please visit

www.orthopediatrics.com.

Investor ContactPhilip Trip TaylorGilmartin

Groupphilip@gilmartinir.com415-937-5406

|

ORTHOPEDIATRICS CORP.CONDENSED

CONSOLIDATED BALANCE SHEETS(Unaudited) (In

Thousands, Except Share Data) |

| |

| |

September 30, 2024 |

|

December 31, 2023 |

| |

|

|

|

|

ASSETS |

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

51,047 |

|

|

$ |

31,055 |

|

|

Restricted cash |

|

1,998 |

|

|

|

1,972 |

|

|

Short-term investments |

|

25,017 |

|

|

|

49,251 |

|

|

Accounts receivable - trade, net of allowances of $1,025 and

$1,373, respectively |

|

42,827 |

|

|

|

34,617 |

|

|

Inventories, net |

|

120,934 |

|

|

|

105,851 |

|

|

Prepaid expenses and other current assets |

|

6,489 |

|

|

|

3,750 |

|

|

Total current assets |

|

248,312 |

|

|

|

226,496 |

|

| |

|

|

|

| Property and equipment,

net |

|

54,765 |

|

|

|

41,048 |

|

| |

|

|

|

| Other assets: |

|

|

|

|

Amortizable intangible assets, net |

|

65,955 |

|

|

|

69,275 |

|

|

Goodwill |

|

91,262 |

|

|

|

83,699 |

|

|

Other intangible assets |

|

18,744 |

|

|

|

15,287 |

|

|

Other non-current assets |

|

10,256 |

|

|

|

2,940 |

|

|

Total other assets |

|

186,217 |

|

|

|

171,201 |

|

| |

|

|

|

| Total assets |

$ |

489,294 |

|

|

$ |

438,745 |

|

| |

|

|

|

| |

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

| Current liabilities: |

|

|

|

|

Accounts payable - trade |

$ |

11,647 |

|

|

$ |

12,649 |

|

|

Accrued compensation and benefits |

|

13,221 |

|

|

|

11,325 |

|

|

Current portion of long-term debt with affiliate |

|

158 |

|

|

|

152 |

|

|

Current portion of acquisition installment payable |

|

1,325 |

|

|

|

10,149 |

|

|

Other current liabilities |

|

8,274 |

|

|

|

7,391 |

|

|

Total current liabilities |

|

34,625 |

|

|

|

41,666 |

|

| |

|

|

|

| Long-term liabilities: |

|

|

|

|

Long-term loan |

|

23,948 |

|

|

|

9,297 |

|

|

Long-term convertible loan |

|

47,831 |

|

|

|

— |

|

|

Long-term debt with affiliate, net of current portion |

|

491 |

|

|

|

611 |

|

|

Other long-term debt, net of current portion |

|

244 |

|

|

|

— |

|

|

Acquisition installment payable, net of current portion |

|

2,412 |

|

|

|

3,551 |

|

|

Deferred income taxes |

|

4,025 |

|

|

|

5,483 |

|

|

Other long-term liabilities |

|

4,799 |

|

|

|

1,112 |

|

|

Total long-term liabilities |

|

83,750 |

|

|

|

20,054 |

|

| |

|

|

|

| Total liabilities |

|

118,375 |

|

|

|

61,720 |

|

| |

|

|

|

|

Stockholders' equity: |

|

|

|

|

Common stock, $0.00025 par value; 50,000,000 shares authorized;

24,214,046 shares and 23,378,408 shares issued as of

September 30, 2024 and December 31, 2023,

respectively |

|

6 |

|

|

|

6 |

|

|

Additional paid-in capital |

|

597,009 |

|

|

|

580,287 |

|

|

Accumulated deficit |

|

(219,495 |

) |

|

|

(197,742 |

) |

|

Accumulated other comprehensive loss |

|

(6,601 |

) |

|

|

(5,526 |

) |

|

Total stockholders' equity |

|

370,919 |

|

|

|

377,025 |

|

| |

|

|

|

| Total liabilities and

stockholders' equity |

$ |

489,294 |

|

|

$ |

438,745 |

|

| |

|

|

|

|

ORTHOPEDIATRICS CORP.CONDENSED

CONSOLIDATED STATEMENTS OF

OPERATIONS(Unaudited)(In

Thousands, Except Share and Per Share Data) |

| |

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net revenue |

$ |

54,573 |

|

|

$ |

39,972 |

|

|

$ |

152,060 |

|

|

$ |

111,119 |

|

| Cost of revenue |

|

14,513 |

|

|

|

9,019 |

|

|

|

39,027 |

|

|

|

26,580 |

|

| Gross profit |

|

40,060 |

|

|

|

30,953 |

|

|

|

113,033 |

|

|

|

84,539 |

|

| |

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Sales and marketing |

|

16,750 |

|

|

|

13,942 |

|

|

|

47,512 |

|

|

|

40,024 |

|

|

General and administrative |

|

26,299 |

|

|

|

17,973 |

|

|

|

78,358 |

|

|

|

54,242 |

|

|

Tradename impairment |

|

— |

|

|

|

985 |

|

|

|

— |

|

|

|

985 |

|

|

Research and development |

|

2,577 |

|

|

|

2,561 |

|

|

|

8,118 |

|

|

|

7,973 |

|

|

Total operating expenses |

|

45,626 |

|

|

|

35,461 |

|

|

|

133,988 |

|

|

|

103,224 |

|

| |

|

|

|

|

|

|

|

| Operating loss |

|

(5,566 |

) |

|

|

(4,508 |

) |

|

|

(20,955 |

) |

|

|

(18,685 |

) |

| |

|

|

|

|

|

|

|

| Other expense (income): |

|

|

|

|

|

|

|

|

Interest expense, net |

|

404 |

|

|

|

21 |

|

|

|

1,302 |

|

|

|

105 |

|

|

Loss on early extinguishment of debt |

|

3,230 |

|

|

|

— |

|

|

|

3,230 |

|

|

|

— |

|

|

Fair value adjustment of contingent consideration |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(2,974 |

) |

|

Other income (expense), net |

|

(63 |

) |

|

|

(787 |

) |

|

|

33 |

|

|

|

(1,407 |

) |

|

Total other expense (income), net |

|

3,571 |

|

|

|

(766 |

) |

|

|

4,565 |

|

|

|

(4,276 |

) |

| |

|

|

|

|

|

|

|

| Loss before income taxes |

$ |

(9,137 |

) |

|

$ |

(3,742 |

) |

|

$ |

(25,520 |

) |

|

$ |

(14,409 |

) |

| Provision for income taxes

(benefit) |

|

(1,218 |

) |

|

|

849 |

|

|

|

(3,767 |

) |

|

|

(126 |

) |

| Net loss |

$ |

(7,919 |

) |

|

$ |

(4,591 |

) |

|

$ |

(21,753 |

) |

|

$ |

(14,283 |

) |

| Weighted average common stock

- basic and diluted |

|

23,171,249 |

|

|

|

22,762,823 |

|

|

|

23,046,155 |

|

|

|

22,646,087 |

|

| Net loss per share – basic and

diluted |

$ |

(0.34 |

) |

|

$ |

(0.20 |

) |

|

$ |

(0.94 |

) |

|

$ |

(0.63 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ORTHOPEDIATRICS CORP.CONDENSED

CONSOLIDATED STATEMENTS OF CASH

FLOWS(Unaudited)(In Thousands) |

| |

| |

Nine Months Ended September 30, |

|

|

|

2024 |

|

|

|

2023 |

|

| OPERATING ACTIVITIES |

|

| Net loss |

$ |

(21,753 |

) |

|

$ |

(14,283 |

) |

| Adjustments to reconcile net

loss to net cash used in operating activities: |

|

|

|

|

Tradename Impairment |

|

— |

|

|

|

985 |

|

|

Depreciation and amortization |

|

15,087 |

|

|

|

12,198 |

|

|

Stock-based compensation |

|

9,660 |

|

|

|

7,779 |

|

|

Loss on early extinguishment of debt |

|

3,230 |

|

|

|

— |

|

|

Fair value adjustment of contingent consideration |

|

— |

|

|

|

(2,974 |

) |

|

Fair value adjustment of acquisition installment payable |

|

599 |

|

|

|

1,092 |

|

|

Deferred income taxes |

|

(3,907 |

) |

|

|

(899 |

) |

|

Changes in certain current assets and liabilities: |

|

|

|

|

Accounts receivable - trade |

|

(5,178 |

) |

|

|

(12,878 |

) |

|

Inventories, net |

|

(14,154 |

) |

|

|

(22,198 |

) |

|

Prepaid expenses and other current assets |

|

(2,134 |

) |

|

|

(196 |

) |

|

Accounts payable - trade |

|

(1,768 |

) |

|

|

11,492 |

|

|

Accrued expenses and other liabilities |

|

308 |

|

|

|

3,288 |

|

|

Other |

|

(3,051 |

) |

|

|

(2,909 |

) |

| Net cash used in operating

activities |

|

(23,061 |

) |

|

|

(19,503 |

) |

| |

|

|

|

| INVESTING ACTIVITIES |

|

|

|

| Acquisition of Boston O&P,

net of cash acquired |

|

(20,225 |

) |

|

|

— |

|

| Clinic acquisition, net of

cash acquired |

|

(475 |

) |

|

|

— |

|

| Acquisition of MedTech, net of

cash acquired |

|

— |

|

|

|

(3,097 |

) |

| Acquisition of Rhino

assets |

|

— |

|

|

|

(546 |

) |

| Investment in private

companies |

|

(380 |

) |

|

|

— |

|

| Sale of short-term marketable

securities |

|

49,855 |

|

|

|

89,040 |

|

| Purchase of short-term

marketable securities |

|

(25,000 |

) |

|

|

(48,600 |

) |

| Purchases of property and

equipment |

|

(14,525 |

) |

|

|

(13,042 |

) |

| Net cash (used in) provided by

investing activities |

|

(10,750 |

) |

|

|

23,755 |

|

| |

|

|

|

| FINANCING ACTIVITIES |

|

|

|

| Installment payment for

ApiFix |

|

(2,250 |

) |

|

|

(2,000 |

) |

| Installment payment for

MedTech |

|

(1,250 |

) |

|

|

— |

|

| Proceeds from issuance of

debt |

|

73,533 |

|

|

|

— |

|

| Payment on debt |

|

(12,231 |

) |

|

|

— |

|

| Payment of debt issuance

costs |

|

(3,085 |

) |

|

|

— |

|

| Proceeds from exercise of

stock options |

|

— |

|

|

|

21 |

|

| Payments on acquisition

note |

|

(928 |

) |

|

|

— |

|

| Payments on mortgage

notes |

|

(113 |

) |

|

|

(107 |

) |

| Net cash provided by (used in)

financing activities |

|

53,676 |

|

|

|

(2,086 |

) |

| |

|

|

|

| Effect of exchange rate

changes on cash, cash equivalents and restricted cash |

|

153 |

|

|

|

(396 |

) |

| |

|

|

|

| NET INCREASE IN CASH, CASH

EQUIVALENTS AND RESTRICTED CASH |

|

20,018 |

|

|

|

1,770 |

|

| |

|

|

|

| Cash, cash equivalents and

restricted cash, beginning of period |

$ |

33,027 |

|

|

$ |

10,462 |

|

| Cash, cash equivalents and

restricted cash, end of period |

$ |

53,045 |

|

|

$ |

12,232 |

|

| |

|

|

|

| |

|

|

|

| SUPPLEMENTAL DISCLOSURES |

|

|

|

| Cash paid for interest |

$ |

1,381 |

|

|

$ |

32 |

|

| Issuance of common shares to

acquire Rhino |

$ |

— |

|

|

$ |

478 |

|

| Transfer of instruments

between property and equipment and inventory |

$ |

966 |

|

|

$ |

431 |

|

| Issuance of common shares for

ApiFix installment |

$ |

6,929 |

|

|

$ |

6,178 |

|

| Issuance of common shares for

MedTech installment |

$ |

133 |

|

|

$ |

2,274 |

|

| Right-of-use assets obtained

in exchange for lease liabilities |

$ |

3,220 |

|

|

$ |

367 |

|

| Debt issuance costs not yet

paid |

$ |

260 |

|

|

$ |

— |

|

| |

|

|

|

|

|

|

|

|

ORTHOPEDIATRICS CORP.NET REVENUE BY

GEOGRAPHY AND PRODUCT

CATEGORY(Unaudited)(In

Thousands) |

| |

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

Product sales by geographic location: |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

U.S. |

$ |

42,714 |

|

|

$ |

29,360 |

|

|

$ |

118,269 |

|

|

$ |

82,748 |

|

|

International |

|

11,859 |

|

|

|

10,612 |

|

|

|

33,791 |

|

|

|

28,371 |

|

|

Total |

$ |

54,573 |

|

|

$ |

39,972 |

|

|

$ |

152,060 |

|

|

$ |

111,119 |

|

| |

|

|

|

|

|

|

|

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

Product sales by category: |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Trauma and deformity |

$ |

37,642 |

|

|

$ |

28,806 |

|

|

$ |

108,715 |

|

|

$ |

79,715 |

|

|

Scoliosis |

|

15,635 |

|

|

|

10,304 |

|

|

|

39,521 |

|

|

|

28,270 |

|

|

Sports medicine/other |

|

1,296 |

|

|

|

862 |

|

|

|

3,824 |

|

|

|

3,134 |

|

|

Total |

$ |

54,573 |

|

|

$ |

39,972 |

|

|

$ |

152,060 |

|

|

$ |

111,119 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ORTHOPEDIATRICS CORP.RECONCILIATION OF NET

LOSS TO NON-GAAP ADJUSTED

EBITDA(Unaudited)(In

Thousands) |

| |

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net

loss |

$ |

(7,919 |

) |

|

$ |

(4,591 |

) |

|

$ |

(21,753 |

) |

|

$ |

(14,283 |

) |

|

Interest expense, net |

|

404 |

|

|

|

21 |

|

|

|

1,302 |

|

|

|

105 |

|

|

Other (income) expense |

|

(63 |

) |

|

|

(787 |

) |

|

|

33 |

|

|

|

(1,407 |

) |

|

Provision for income taxes (benefit) |

|

(1,218 |

) |

|

|

849 |

|

|

|

(3,767 |

) |

|

|

(126 |

) |

|

Depreciation and amortization |

|

5,280 |

|

|

|

4,270 |

|

|

|

15,087 |

|

|

|

12,198 |

|

|

Stock-based compensation |

|

3,922 |

|

|

|

2,364 |

|

|

|

9,660 |

|

|

|

7,779 |

|

|

Tradename impairment loss |

|

— |

|

|

|

985 |

|

|

|

— |

|

|

|

985 |

|

|

Fair value adjustment of contingent consideration |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(2,974 |

) |

|

Acquisition related costs |

|

117 |

|

|

|

10 |

|

|

|

504 |

|

|

|

209 |

|

|

Nonrecurring Pega conversion fees |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

277 |

|

|

Loss on early extinguishment of debt |

|

3,230 |

|

|

|

— |

|

|

|

3,230 |

|

|

|

— |

|

|

Minimum purchase commitment cost |

|

224 |

|

|

|

477 |

|

|

|

1,200 |

|

|

|

1,053 |

|

|

Adjusted EBITDA |

$ |

3,977 |

|

|

$ |

3,598 |

|

|

$ |

5,496 |

|

|

$ |

3,816 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ORTHOPEDIATRICS CORP.RECONCILIATION OF

DILUTED LOSS PER SHARE TO NON-GAAP ADJUSTED DILUTED LOSS PER

SHARE(Unaudited) |

| |

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Loss per share, diluted

(GAAP) |

$ |

(0.34 |

) |

|

$ |

(0.20 |

) |

|

$ |

(0.94 |

) |

|

$ |

(0.63 |

) |

|

Tradename impairment loss |

|

— |

|

|

|

0.04 |

|

|

|

— |

|

|

|

0.04 |

|

|

Accretion of interest attributable to acquisition installment

payable |

|

— |

|

|

|

0.01 |

|

|

|

— |

|

|

|

0.05 |

|

|

Fair value adjustment of contingent consideration |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(0.13 |

) |

|

Acquisition related costs |

|

0.01 |

|

|

|

— |

|

|

|

0.02 |

|

|

|

0.01 |

|

|

Nonrecurring Pega conversion fees |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

0.01 |

|

|

Loss on early extinguishment of debt |

|

0.14 |

|

|

|

— |

|

|

|

0.14 |

|

|

|

— |

|

|

Minimum purchase commitment cost |

|

0.01 |

|

|

|

0.02 |

|

|

|

0.05 |

|

|

|

0.05 |

|

| Loss per share, diluted

(non-GAAP) |

$ |

(0.18 |

) |

|

$ |

(0.13 |

) |

|

$ |

(0.73 |

) |

|

$ |

(0.60 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

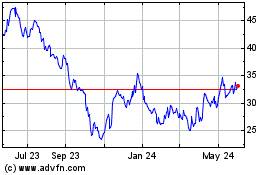

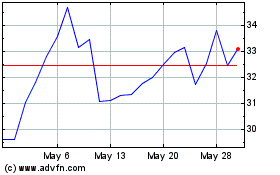

OrthoPediatrics (NASDAQ:KIDS)

Historical Stock Chart

From Oct 2024 to Nov 2024

OrthoPediatrics (NASDAQ:KIDS)

Historical Stock Chart

From Nov 2023 to Nov 2024