As filed with the U.S. Securities and Exchange

Commission on July 26, 2024

Registration No. 333-279133

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 3

to

FORM S-1

REGISTRATION STATEMENT

UNDER THE

SECURITIES ACT OF 1933

LogicMark, Inc.

(Exact name of registrant as specified in its charter)

| Nevada |

|

7381 |

|

46-0678374 |

(State or other jurisdiction of

incorporation or organization) |

|

(Primary Standard Industrial

Classification Code Number) |

|

(I.R.S. Employer

Identification Number) |

LogicMark, Inc.

2801 Diode Lane

Louisville, KY 40299

(502) 442-7911

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Chia-Lin Simmons

Chief Executive Officer

LogicMark, Inc.

2801 Diode Lane

Louisville, KY 40299

(502) 442-7911

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

|

David E. Danovitch, Esq.

Michael DeDonato, Esq.

Sullivan & Worcester LLP

1633 Broadway

New York, NY 10019

(212) 660-3060 |

|

M. Ali Panjwani, Esq.

Pryor Cashman LLP

7 Times Square

New York, New York 10036

(212) 421-4100 |

Approximate date of commencement of proposed

sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this

Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box:

☒

If this Form is filed to register additional securities

for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed

pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed

pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

☐ |

Accelerated filer |

☐ |

| Non-accelerated filer |

☒ |

Smaller reporting company |

☒ |

| |

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration

statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that

specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities

Act or until this registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a),

may determine.

The

information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is soliciting

an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY

PROSPECTUS |

SUBJECT

TO COMPLETION |

DATED

JULY 26, 2024 |

UP

TO 12,306,610 UNITS

EACH UNIT CONSISTING OF

ONE SHARE OF COMMON STOCK,

ONE SERIES A WARRANT TO PURCHASE ONE

SHARE OF COMMON STOCK AND ONE SERIES B

WARRANT TO PURCHASE ONE SHARE OF COMMON STOCK

UP TO 12,306,610 PRE-FUNDED UNITS

EACH UNIT CONSISTING OF

ONE PRE-FUNDED WARRANT TO PURCHASE ONE SHARE

OF COMMON STOCK

ONE SERIES A WARRANT TO PURCHASE ONE SHARE OF

COMMON STOCK

AND ONE SERIES B WARRANT TO PURCHASE ONE SHARE

OF COMMON STOCK

UP TO 36,919,830 SHARES OF COMMON STOCK

UNDERLYING THE SERIES A WARRANTS, THE

SERIES B WARRANTS AND THE PRE-FUNDED WARRANTS

LogicMark, Inc.

LogicMark, Inc. (the “Company”,

“LogicMark”, “we”, “us” or “our”) is offering, pursuant to this prospectus and on a best-efforts

basis, up to 12,306,610 units (the “Units”) at an assumed offering price of $0.5688 per Unit, which is equal to the closing

price of our Common Stock on the Nasdaq Capital Market (“Nasdaq”) on July 18, 2024, with each Unit consisting of: (i) one

share of common stock, par value $0.0001 per share (the “Common Stock”); (ii) one Series A warrant to purchase Common Stock

exercisable for one share of Common Stock (the “Series A Warrants”); and (iii) one Series B warrant to purchase Common Stock

exercisable for one share of Common Stock ( the “Series B Warrants” and, together with the Series A Warrants, the “Warrants”).

Each Warrant, upon exercise at a price of $0.5688 per share (100% of the assumed public offering price of the Unit), will result in the

issuance of one share of Common Stock to the holder of such Warrant. This prospectus also relates to the shares of Common Stock that

are issuable from time to time upon exercise of each of the Warrants (the “Warrant Shares”). Each of the Warrants will be

exercisable only on or after the date on which stockholder approval is obtained to approve the issuance of the Warrant Shares upon exercise

of the Warrants (“Stockholder Approval”), solely to the extent such approval is required by Rule 5635(d) of The Nasdaq Stock

Market LLC (“Rule 5635(d)”) (See “Risk Factors – Risks Related to this Offering and Ownership of Our Securities”

and “Description of Securities That We Are Offering – Series A Warrants, Series B Warrants and Pre-Funded Warrants –

Stockholder Approval – Series A Warrants and Series B Warrants” for additional information regarding Stockholder Approval

and Rule 5635(d)). The Series A Warrants will expire five (5) years after the date of their issuance and the Series B Warrants will expire

two and a half (2.5) years after the date of their issuance.

We are also offering to those purchasers, if any,

whose purchase of Units in this offering would otherwise result in the purchaser, together with its affiliates and related parties, beneficially

owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding Common Stock immediately following the consummation

of this offering, the opportunity to purchase, if they so choose, pre-funded units (“Pre-Funded Units”) in lieu of the Units

that would otherwise result in ownership in excess of 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding Common Stock,

with each Pre-Funded Unit consisting of one pre-funded warrant to purchase one share of our Common Stock (each, a “Pre-Funded Warrant”);

(ii) one Series A Warrant; and (iii) one Series B Warrant. The purchase price of each Pre-Funded Unit will equal the price per Unit, minus

$0.001, and the exercise price of each Pre-Funded Warrant included in the Pre-Funded Unit will be $0.001 per share. There can be no assurance

that we will sell any of the Pre-Funded Units being offered. The Pre-Funded Warrants offered hereby will be immediately exercisable and

may be exercised at any time until exercised in full. For each Pre-Funded Unit we sell, the number of Units we are offering will be decreased

on a one-for-one basis. Because we will issue two Warrants as part of each Unit or Pre-Funded Unit, the number of Warrants sold in this

offering will not change as a result of a change in the mix of the Units and Pre-Funded Units sold.

We are also registering the Common Stock issuable

from time to time upon exercise of each of the Warrants and Pre-Funded Warrants included in the Units and Pre-Funded Units offered hereby.

See “Description of Securities That We Are Offering” in this prospectus for more information. We refer to the shares of our

Common Stock, the Warrants, the Pre-Funded Warrants, and the shares of our Common Stock issued or issuable upon exercise of the Warrants

and Pre-Funded Warrants, collectively, as the “Securities”.

Neither the Units nor the Pre-Funded Units have

stand-alone rights nor will they be certificated or issued as stand-alone securities. The shares of Common Stock, the Series A Warrants

and the Series B Warrants included in the Units are immediately separable, and will be issued separately in this offering, and the Pre-Funded

Warrants, the Series A Warrants and the Series B Warrants included in the Pre-Funded Units are immediately separable, and will be issued

separately in this offering.

Our Common Stock is listed on Nasdaq under

the symbol “LGMK”. The last reported closing price for our Common Stock on Nasdaq on July 18, 2024 was $0.5688 per share.

There is no established trading market for the

Units, Pre-Funded Units, Series A Warrants, Series B Warrants or Pre-Funded Warrants, and we do not expect a market to develop. In addition,

we do not intend to apply for the listing of the Series A Warrants, Series B Warrants or the Pre-Funded Warrants on any national securities

exchange or other trading market. Without an active trading market, the liquidity of such securities will be limited.

The Securities will be offered at a fixed price

and are expected to be issued in a single closing. Investors purchasing the Securities offered hereby will execute a securities purchase

agreement with us. When we price the Securities, we will simultaneously enter into securities purchase agreements relating to the offering

with those investors who choose to participate in the offering. We expect this offering to be completed not later than one (1) business

day following the commencement of this offering and we will deliver all of the Securities to be issued in connection with this offering

delivery versus payment/receipt versus payment upon receipt of investor funds received by us. Accordingly, neither we nor the placement

agent have made any arrangements to place investor funds in an escrow account or trust account since the placement agent will not receive

investor funds in connection with the sale of the Securities offered hereunder.

We are a “smaller reporting company”

as defined under the federal securities laws and, under applicable U.S. Securities and Exchange Commission (“SEC”) rules,

we have elected to comply with certain reduced public company reporting and disclosure requirements.

We have engaged Roth Capital Partners, LLC as

our exclusive placement agent (the “placement agent”) to use its reasonable best efforts to solicit offers to purchase the

Securities in this offering. The placement agent has no obligation to purchase any of the Securities from us or to arrange for the purchase

or sale of any specific number or dollar amount of the Securities. Because there is no minimum offering amount required as a condition

to closing in this offering, the actual public offering amount, placement agent’s fee, and proceeds to us, if any, are not presently

determinable and may be substantially less than the total maximum offering amounts set forth above and throughout this prospectus. We

have agreed to pay the placement agent the placement agent fees set forth in the table below. See “Plan of Distribution” in

this prospectus for more information.

| | |

Per Unit | | |

Per Pre-

Funded

Unit | | |

Total | |

| Public offering price | |

$ | | | |

$ | | | |

$ | | |

| Placement agent fees (1) | |

$ | | | |

$ | | | |

$ | | |

| Proceeds, before expenses, to us (2) | |

$ | | | |

$ | | | |

$ | | |

| (1) |

Represents a cash fee equal to 7.0% of the aggregate purchase price paid by investors in this offering. We have also agreed to reimburse the placement agent for certain of its offering-related expenses. See “Plan of Distribution” beginning on page 35 of this prospectus for a description of the compensation to be received by the placement agent. |

| (2) |

Does not include proceeds from the exercise of the Warrants and Pre-Funded Warrants in cash, if any. |

Pursuant to the placement agency agreement

that we will enter into with the placement agent in connection with this offering, in the event that the aggregate value of Securities

sold in connection with this offering equals or exceeds $5 million, we will issue to the placement agent warrants exercisable for up

to a number of shares of Common Stock equal to three percent (3%) of the Securities issued in this offering, and such placement agent

warrants shall have a term of five years. The registration statement of which this prospectus is a part also registers for sale such

placement agent warrants and the shares of Common Stock issuable upon exercise of such placement agent warrants.

Investing in our securities involves a high

degree of risk. See “Risk Factors” beginning on page 5 of this prospectus and in the documents which are incorporated by reference

herein to read about factors you should consider before investing in our securities.

We will deliver the shares of Common Stock being

issued to the purchasers electronically and will electronically deliver to such investors electronic warrant certificates for each of

the Pre-Funded Warrants, the Series A Warrants and the Series B Warrants sold in this offering, upon closing and receipt of investor funds

for the purchase of the Securities offered pursuant to this prospectus. We anticipate that delivery of the shares of Common Stock, Pre-Funded

Warrants, the Series A Warrants and Series B Warrants against payment therefor will be made on or before ,

2024.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete.

Any representation to the contrary is a criminal offense.

Sole Placement Agent

Roth

Capital Partners

The date of this prospectus is ,

2024

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

The registration statement on Form S-1 of which

this prospectus forms a part and that we have filed with the SEC, includes exhibits that provide more detail of the matters discussed

in this prospectus. You should read this prospectus and the related exhibits filed with the SEC, together with the additional information

described under the heading “Where You Can Find More Information.”

You should rely only on the information contained

in this prospectus and the related exhibits, any prospectus supplement or amendment thereto and the documents incorporated by reference,

or to which we have referred you, before making your investment decision. Neither we nor any placement agent engaged by us in connection

with this offering, have authorized anyone to provide you with additional information or information different from that contained in

this prospectus. Neither we nor any placement agents engaged by us take any responsibility for, and can provide no assurance as to the

reliability of, any other information that others may give you. Neither the delivery of this prospectus nor the sale of the Securities

means that the information contained in this prospectus is correct after the date of this prospectus.

You should not assume that the information contained

in this prospectus, any prospectus supplement or amendments thereto, as well as information we have previously filed with the SEC, is

accurate as of any date other than the date on the front cover of the applicable document. Our business, financial condition, results

of operations and prospects may have changed since those dates. This prospectus, any prospectus supplement or amendments thereto do not

constitute an offer to sell, or a solicitation of an offer to purchase, the Securities offered by this prospectus, any prospectus supplement

or amendments thereto in any jurisdiction to or from any person to whom or from whom it is unlawful to make such offer or solicitation

of an offer in such jurisdiction.

For investors outside the United States: Neither

we nor any placement agent engaged by us in connection with this offering, have taken any action that would permit this offering or possession

or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons

outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating

to, the offering of the Securities covered hereby and the distribution of this prospectus outside of the United States.

No person is authorized in connection with this

prospectus to give any information or to make any representations about us, the Securities offered hereby or any matter discussed in this

prospectus, other than the information and representations contained in this prospectus. If any other information or representation is

given or made, such information or representation may not be relied upon as having been authorized by us. To the extent there is a conflict

between the information contained in this prospectus and any prospectus supplement, you should rely on the information in such prospectus

supplement, provided that if any statement in one of these documents is inconsistent with a statement in another document having a later

date — for example, a document incorporated by reference in this prospectus or any prospectus supplement — the statement in

the document having the later date modifies or supersedes the earlier statement.

Neither we nor the placement agent have done anything

that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is

required, other than the United States. You are required to inform yourself about, and to observe any restrictions relating to, this offering

and the distribution of this prospectus.

We own or have rights to certain trademarks that

we use in conjunction with the operations of our business. Each trademark, trade name, service mark or copyright of any other company

appearing or incorporated by reference in this prospectus belongs to its holder. Solely for convenience, trademarks, trade names, service

marks and copyrights referred to in this prospectus may appear with or without the “©”, “®” or “™”

symbols, but the inclusion, or not, of such references are not intended to indicate, in any way, that we, or the applicable owner, will

not assert, to the fullest extent possible under applicable law, our or their, as applicable, rights to these trademarks, trade names

service marks or copyrights. We do not intend our use or display of other companies’ trademarks, trade names, service marks or copyrights

to imply a relationship with, or endorsement or sponsorship of us by, such other companies.

PROSPECTUS SUMMARY

This summary highlights selected information

contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider before investing

in our securities. You should carefully read this entire prospectus, and our other filings with the SEC, including the following sections,

which are either included herein and/or incorporated by reference herein, “Risk Factors,” “Special Note Regarding Forward-Looking

Statements,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated

financial statements incorporated by reference herein, before making a decision about whether to invest in our securities. When used herein,

unless the context requires otherwise, references to the “LogicMark,” “Company,” “we,” “our”

and “us” refer to LogicMark, Inc., a Nevada corporation.

Company Overview

LogicMark, Inc. provides personal emergency response

systems (“PERS”), health communications devices, and Internet of Things (“IoT”) technology that creates a connected

care platform. The Company’s devices provide people with the ability to receive care at home and age independently. The Company’s

PERS devices incorporate two-way voice communication technology directly in the medical alert pendant and provide life-saving technology

at a customer-friendly price point aimed at everyday consumers. These PERS technologies as well as other personal safety devices are sold

direct-to-consumer through the Company’s eCommerce website and Amazon.com, through dealers and distributors, as well as directly

to the United States Veterans Health Administration (the “VHA”). The Company was awarded a contract by the U.S. General Services

Administration (the “GSA”) that enables the Company to distribute its products to federal, state, and local governments (the

“GSA Agreement”).

Healthcare

LogicMark builds technology to remotely check,

manage and monitor a loved one’s health and safety. The Company is focused on modernizing remote monitoring to help people stay

safe and live independently longer. We believe there are five trends driving the demand for better remote monitoring systems:

| |

1. |

The “Silver Tsunami”. With 11,000 Baby Boomers turning 65 in the U.S. every day, there will be more older adults than children under 18 for the first time in the near future. With 72 million “Baby Boomers” in the United States, they are not only one of the largest generations, but the wealthiest. Unlike generations before them, Baby Boomers are reliant and comfortable with technology. Most of them expect to live independently in their current home or downsize to a smaller home as they get older. |

| |

2. |

Shift to At-Home Care. As it stands, the current healthcare system is unprepared for the resource strain and is shifting much of the care elderly patients used to receive at a hospital or medical facility to the patient’s home. The rise of digital communication to support remote care exploded during the COVID-19 pandemic. The need for connected and remote monitoring devices is more necessary and in-demand than ever before. |

| |

3. |

Rise of Data and IoT. Doctors and clinicians are asking patients to track more and more vital signs. Whether it’s how they’re reacting to medication or tracking blood sugar, patients and their caregivers are participating in their healthcare in unprecedented ways. Consumers are using data collected from connected devices like never before. This data can be used to prevent health emergencies as technology companies use machine learning (ML) / artificial intelligence (“AI”) to learn patient patterns and alert the patient and their care team of potential emergencies, leading to a switch from predicting potential problems to reacting to current problems after they occur. |

| |

4. |

Lack of Healthcare Workers. It’s estimated that 20% of healthcare workers quit during the COVID-19 pandemic. Many healthcare workers who were working during the COVID-19 pandemic suffered from burnout, exhaustion and demoralization due to the COVID-19 pandemic. There were not enough healthcare workers to support our entire population throughout the pandemic, let alone enough to support our elderly population. The responsibility of taking care of elderly family members is increasingly falling on the family, and they need help. |

| |

5. |

Rise of the Care Economy. The term “Care Economy” refers to the money people contribute to care for people until the end of their lives; the Care Economy offsets the deficiencies within the healthcare system and the desire to age in place. There has been little innovation in the industry because the majority of PERS are operated by home security companies. It is not their main line of business, and they have little expertise in developing or launching machine-learning algorithms or artificial intelligence. |

Together, we believe these trends have produced

a large and growing market opportunity for LogicMark. The Company enjoys a strong base of business with the VHA and plans to expand to

other government agencies after being awarded the five-year GSA Agreement in July 2021, which is renewable for up to 25 years.

The PERS Opportunity

PERS, also known as a medical alert or medical

alarm system, is designed to detect a threat that requires attention and then immediately contacts a trusted family member and/or the

emergency medical workforce. Unlike conventional alarm systems which consist of a transmitter and are activated in the case of an emergency,

PERS transmits signals to an alarm monitoring medical team, which then departs for the location where the alarm was activated. These types

of medical alarms are traditionally utilized by the disabled, elderly or those living alone.

The PERS market is generally divided into direct-to-consumer

and healthcare customer channels. With the advent of new technologies, demographic changes, and our five previously stated trends in healthcare,

an expanded opportunity exists for LogicMark to provide at-home and on-the-go health and safety solutions to both customer channels.

For LogicMark, growing the healthcare opportunity

relies on partnering with organizations such as government, Medicaid, hospitals, insurance companies, managed care organizations, affiliates

and dealers. Partners can provide leads at no cost for new and replacement customers, have significant buying power and can provide collaboration

on product research and development.

Our longstanding partnership with the VHA is a

good example. LogicMark has sold over 850,000 PERS devices since 2012, of which over 500,000 devices have been sold to the U.S. government.

The signing of the GSA Agreement in 2021 further strengthened our partnership with the government and expanded our ability to capture

new sales. We envision a continued focus on growing the healthcare channel during 2023 given lower acquisition costs and higher customer

unit economics.

In addition to the healthcare channel, LogicMark

also expects to continue growth in sales volume through its direct-to-consumer channel. It is estimated that approximately 70% of PERS

customers fall into the direct-to-consumer category. Family members regularly conduct research and purchase PERS devices for their loved

ones through online websites. The Company expects traditionally higher customer acquisition costs to be balanced by higher sales growth

and lower sales cycles with an online DTC channel.

With the growth in IoT devices, data driven solutions

using AI and ML are helping guide the growth of the PERS industry. In both the healthcare and direct-to-consumer channels, product offerings

can include 24/7 emergency response, fall detection, location tracking and geo-fencing, activity monitoring, medication management, caregiver

and patient portals, concierge services, telehealth, vitals monitoring, and customer dashboards. These product offerings are primarily

delivered via mobile and home-base equipment. LogicMark will also continue to pursue research and development partnerships to grow our

product offering.

Implications of Being A Smaller Reporting Company

To the extent that we continue to qualify as a

“smaller reporting company,” as such term is defined in Rule 12b-2 under the Exchange Act, we will continue to be permitted

to make certain reduced disclosures in our periodic reports and other documents that we file with the SEC.

Corporate Information

We were originally incorporated in the State of

Delaware on February 8, 2012. In July 2016, we acquired LogicMark, LLC, which operated as a wholly-owned subsidiary of the Company until

December 30, 2021, when it was merged into the Company (formerly known as Nxt-ID, Inc.) along with the Company’s other subsidiary,

3D-ID, LLC. Effective February 28, 2022, the Company changed its name from Nxt-ID, Inc. to LogicMark, Inc. The Company has realigned its

business strategy with that of its former LogicMark, LLC operating division, managing contract manufacturing and distribution of non-monitored

and monitored PERS sold through the VHA, direct-to-consumers, healthcare durable medical equipment dealers and distributors and monitored

security dealers and distributors.

On June 1, 2023, the Company was incorporated

in the State of Nevada by merging its predecessor entity with and into its wholly-owned subsidiary, LogicMark, Inc., a Nevada corporation,

pursuant to an agreement and plan of merger, dated as of June 1, 2023. Such Nevada entity survived and succeeded to the assets, continued

the business and assumed the rights and obligations of LogicMark, Inc., the Delaware corporation that existed immediately prior to the

effective date of such agreement.

Our principal executive office is located at 2801

Diode Lane, Louisville, KY 40299, and our telephone number is (502) 519-2419. Our website address is www.logicmark.com. The information

contained therein or connected thereto shall not be deemed to be incorporated into this prospectus.

THE OFFERING

| Units offered by us |

Up

to 12,306,610 Units, based on an assumed public offering price of $0.5688 per Unit, each consisting of one share of: (i) one share

of Common Stock; (ii) one Series A Warrant; and (iii) one Series B Warrant. Each Series A Warrant and each Series B Warrant is exercisable

to purchase one share of Common Stock. The Units have no stand-alone rights and will not be certificated or issued as stand-alone

securities. The Common Stock and each of the Warrants are immediately separable and will be issued separately in this offering. |

| |

|

| Pre-Funded Units offered by us |

We are also offering to those purchasers, if any, whose purchase of Units in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding Common Stock immediately following the consummation of this offering, Pre-Funded Units, each consisting of: (i) one Pre-Funded Warrant to purchase one share of our Common Stock; (ii) one Series A Warrant; and (iii) one Series B Warrant. The Pre-Funded Units have no stand-alone rights and will not be certificated or issued as stand-alone securities. The Pre-Funded Warrants and each of the Warrants are immediately separable and will be issued separately in this offering. For each Pre-Funded Unit we sell, the number of Units we are offering will be decreased on a one-for-one basis. The purchase price of each Pre-Funded Unit is equal to the price per Unit being sold to the public in this offering, minus $0.001, and the exercise price of each Pre-Funded Warrant included in the Pre-Funded Unit is $0.001 per share. Because we will issue two Warrants as part of each Unit or Pre-Funded Unit, the number of Warrants sold in this offering will not change as a result of a change in the mix of the Units and Pre-Funded Units sold. |

| |

|

| Series A Warrants and Series B Warrants |

Each of

the Warrants will have an exercise price of $0.5688 (equal to 100% of the assumed public offering

price of each Unit sold in this offering) and will be exercisable on or after the date on which Stockholder

Approval is obtained, solely to the extent required under Rule 5635(d) (See “Risk Factors –

Risks Related to this Offering and Ownership of Our Securities” and “Description of Securities

That We Are Offering – Series A Warrants, Series B Warrants and Pre-Funded Warrants –

Stockholder Approval – Series A Warrants and Series B Warrants” for additional information

regarding Stockholder Approval and Rule 5635(d)). Each of the Warrants will be immediately exercisable

upon Stockholder Approval by paying the aggregate exercise price for such Warrants being exercised

and, in the event of any exercise thereof, there is, at any time, no effective registration statement

registering the Warrant Shares issuable upon such Warrants, or the prospectus contained therein is

not available for the issuance of such Warrant Shares, then such Warrants may also be exercised on

a cashless basis for a net number of shares, as provided in the formula in each of the Warrants.

The Series A Warrants will expire on the fifth anniversary of their

issuance and the Series B Warrants will expire two and one-half years after their issuance. The Warrants include certain mechanisms,

including (i) an alternative cashless exercise provision in the Series B Warrants and (ii) certain anti-dilution provisions and reverse

stock split provisions. To better understand the terms of each of the Warrants, you should carefully read the “Description of Securities

That We Are Offering” section of this prospectus. You should also read the forms of each of the Warrants, which are filed as exhibits

to the registration statement of which this prospectus forms a part. This offering also relates to the shares of Common Stock issuable

upon exercise of each of the Warrants.

|

| |

|

| Pre-Funded Warrants |

Each Pre-Funded Warrant will be immediately exercisable at an exercise price of $0.001 per share of our Common Stock and may be exercised at any time until exercised in full, and the Pre-Funded Warrants may also be exercised on a cashless basis for a net number of shares, as provided in the formula in the Pre-Funded Warrants. To better understand the terms of the Pre-Funded Warrants, you should carefully read the “Description of Securities That We Are Offering” section of this prospectus. You should also read the form of Pre-Funded Warrant, which is filed as an exhibit to the registration statement of which this prospectus forms a part. This offering also relates to the shares of Common Stock issuable upon exercise of the Pre-Funded Warrants. |

| |

|

| Placement

Agent Warrants |

The registration

statement of which this prospectus is a part also registers for sale warrants to purchase

up to 369,198 shares of our Common Stock issuable to the placement agent, as a portion of

the compensation payable to the placement agent in connection with this offering. In accordance

with the terms of the placement agency agreement, such warrants issued to the placement agent

(the “PA Warrants”) will only be issued to the placement agent in the event that

$5 million or more of the Securities are sold in this offering. The PA Warrants will be exercisable

on or after the date of Stockholder Approval and for a five-year period commencing 180 days

following the date of commencement of sales of the Securities, at an exercise price of $0.5688

per share, which is equal to the assumed public offering price of the Units offered hereby.

Please see “Plan of Distribution — Placement Agent Warrants” for a description

of the PA Warrants. |

| Assumed

public offering price per Unit and per Pre-Funded Unit |

$0.5688

per Unit and $0.5678 per Pre-Funded Unit, based on the last reported closing price for our Common Stock on Nasdaq on July 18, 2024. |

| |

|

| Common

Stock outstanding immediately after this offering (1) |

14,500,197

shares of Common Stock (assuming the sale of all of the Securities offered hereby, and assuming no sale of any Pre-Funded Units and

no exercise of the Series A Warrants, Series B Warrants or PA Warrants issued in this offering, if any). |

| |

|

| Use

of proceeds |

We estimate that the net proceeds to us

from the offering will be approximately $6.12 million (based on an assumed public offering price of $0.5688 per Unit), after deducting

the placement agent fees and estimated offering expenses payable by us, and assuming the sale of all Units offered hereby, no sale

of any Pre-Funded Units and no exercise of the Warrants or PA Warrants (if any) issued in this offering. However, this is a best-efforts

offering with no minimum number of Securities or amount of proceeds as a condition to closing, and we may not sell all or any of

the Securities offered pursuant to this prospectus; as a result, we may receive significantly less in net proceeds.

We intend to use the net proceeds of this offering

for continued new product development, working capital and other general corporate purposes. See “Use of Proceeds” for a more

complete description of the intended use of proceeds from this offering. |

| |

|

| Purchases

by directors and officers |

Our

directors and officers intend to purchase an aggregate of approximately 105,480 Units

in this offering and have represented to us that such purchases will be solely for investment intent. |

| |

|

| Risk factors |

An investment in our securities is highly speculative and involves substantial risk. Please carefully consider the “Risk Factors” section on page 5 and other information in this prospectus for a discussion of factors to consider before deciding to invest in the Securities offered hereby. Additional risks and uncertainties not presently known to us or that we currently deem to be immaterial may also impair our business and operations. |

| |

|

| Lock-up agreements |

Our directors and officers have agreed with the

placement agent, subject to certain exceptions, not to offer for sale, issue, sell, contract to sell, pledge or otherwise dispose of any

of our Common Stock or securities convertible into common stock for a period of 60 days from the date of this prospectus without the prior

written consent of the placement agent. See “Plan of Distribution.”

In addition, pursuant to the securities purchase

agreements that we will enter into with purchasers of Securities in connection with this offering, we will agree, subject to certain exceptions,

not to (i) offer for sale, issue, sell, contract to sell, pledge or otherwise dispose of any of our Common Stock or securities convertible

into Common Stock for a period of 90 days from the closing date of this offering and (ii) effect or enter into an agreement to effect

any issuance by the Company of Common Stock or securities convertible into Common Stock for a period of (or a combination of units thereof)

involving a Variable Rate Transaction (as such term is defined in such securities purchase agreements) for a period of six (6) months

from the closing date of this offering. |

| |

|

| Transfer agent, warrant agent and registrar |

The transfer agent and registrar for our Common Stock and the warrant agent for the Series A Warrants, Series B Warrants and Pre-Funded Warrants will be Nevada Agency and Transfer Company, with its business address at 50 West Liberty Street, Suite 880, Reno NV 89501 and its telephone number is (775) 322-5623. |

| |

|

| Nasdaq symbol and trading |

Our Common Stock is listed on Nasdaq under the symbol “LGMK”. There is no established trading market for the Units, Pre-Funded Units, Series A Warrants, Series B Warrants or Pre-Funded Warrants, and we do not expect a trading market for any such securities to develop. We do not intend to list such securities on any securities exchange or other trading market. Without a trading market, the liquidity of such securities will be extremely limited. |

| (1) | Shares

of our Common Stock that will be outstanding after this offering is based on 2,193,587 shares

of Common Stock outstanding as of July 18, 2024, and excludes the following as of such date:

(i) the exercise of outstanding warrants to purchase up to an aggregate of 9,284,290 shares

of Common Stock at a weighted average exercise price of approximately $33.09 per share, (ii)

the exercise of outstanding options granted to certain directors of the Company to purchase

up to an aggregate of 140,624 shares of Common Stock at a weighted average exercise price

of $5.16 per share, (iii) the conversion of the 106,333 outstanding shares of Series F Preferred

Stock into up to 2,658 shares of Common Stock based on a conversion price equal to $120 per

share, and (iv) the shares of Common Stock issuable upon exercise of each of the Warrants, as

well as the Pre-Funded Warrants and PA Warrants, if any. |

RISK FACTORS

An investment in the Securities offered under

this prospectus involves a high degree of risk. You should carefully consider and evaluate all of the information contained in this prospectus

and in the documents that we incorporate by reference herein before you decide to invest in our securities. In particular, you should

carefully consider and evaluate the risks and uncertainties described under the heading “Risk Factors” in this prospectus

and in the documents incorporated by reference herein. Investors are further advised that the risks described below may not be the only

risks we face. Additional risks that we do not yet know of, or that we currently think are immaterial, may also negatively impact our

business operations or financial results. Any of the risks and uncertainties set forth in this prospectus and in the documents incorporated

by reference herein, as updated by annual, quarterly and other reports and documents that we file with the SEC and incorporate by reference

into this prospectus, could materially and adversely affect our business, results of operations and financial condition, which in turn

could materially and adversely affect the value of our securities.

Risks Related to this Offering and Ownership

of Our Securities

We have been notified by The Nasdaq Stock

Market LLC of our failure to comply with certain continued listing requirements and, if we are unable to regain compliance with all applicable

continued listing requirements and standards of The Nasdaq Stock Market LLC, our Common Stock could be delisted from the Nasdaq Capital

Market.

Our Common Stock is currently listed on Nasdaq.

In order to maintain that listing, we must satisfy minimum financial and other continued listing requirements and standards, including

those regarding director independence and independent committee requirements, minimum stockholders’ equity, minimum share price,

and certain corporate governance requirements.

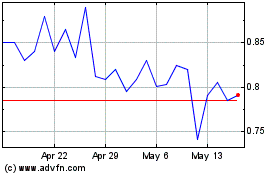

On May 8, 2024, we received a written notification

from the Listing Qualifications Department of The Nasdaq Stock Market LLC notifying us that we were not in compliance with the minimum

bid price requirement for continued listing on Nasdaq, as set forth under Nasdaq Listing Rule 5550(a)(2) (the “Minimum Bid Price

Requirement”), because the closing bid price of our shares of common stock, par value $0.0001 per share (“Common Stock”),

was below $1.00 per share for the previous thirty (30) consecutive business days. We were granted 180 calendar days, or until November

4, 2024, to regain compliance with the Minimum Bid Price Requirement. In the event we do not regain compliance with the Minimum Bid Price

Requirement by November 4, 2024, we may be eligible for an additional 180-calendar day grace period. To qualify, we will be required to

meet the continued listing requirement for market value of publicly held shares and all other listing standards for Nasdaq, with the exception

of the Minimum Bid Price Requirement, and will need to provide written notice to The Nasdaq Stock Market LLC of our intent to regain compliance

with such requirement during such second compliance period. If we do not regain compliance within the allotted compliance period(s), including

any extensions that may be granted, The Nasdaq Stock Market LLC will provide notice that our Common Stock will be subject to delisting

from Nasdaq. At that time, we may appeal The Nasdaq Stock Market LLC’s determination to a hearings panel.

The Company intends to continuously monitor the

closing bid price for its Common Stock, and is in the process of considering various measures to resolve the deficiency and regain compliance

with the Minimum Bid Price Requirement. However, there can be no assurance that we will be able to regain or maintain compliance with

the Minimum Bid Price Requirement or any other Nasdaq listing standards, that Nasdaq will grant the Company any extension of time to regain

compliance with the Minimum Bid Price Requirement or any other Nasdaq listing requirements, or that any such appeal to the Nasdaq hearings

panel will be successful, as applicable. If we are unable to maintain compliance with these Nasdaq requirements, our Common Stock will

be delisted from Nasdaq.

In the event that our Common Stock is delisted

from Nasdaq, as a result of our failure to comply with the Minimum Bid Price Requirement, or due to our failure to continue to comply

with any other requirement for continued listing on Nasdaq, and is not eligible for listing on another exchange, trading in the shares

of our Common Stock could be conducted in the over-the-counter market or on an electronic bulletin board established for unlisted securities

such as the Pink Sheets or the OTC Bulletin Board. In such event, it could become more difficult to dispose of, or obtain accurate price

quotations for, our Common Stock, and it would likely be more difficult to obtain coverage by securities analysts and the news media,

which could cause the price of our Common Stock to decline further. Also, it may be difficult for us to raise additional capital if we

are not listed on a national exchange.

This is a best-efforts

offering, no minimum amount of Securities is required to be sold, and we may not raise the amount of capital that we believe is required

for our business plans.

The placement agent has agreed to use its reasonable

best efforts to solicit offers to purchase the Securities in this offering. The placement agent has no obligation to buy any of the Securities

from us or to arrange for the purchase or sale of any specific number or dollar amount of the Securities. There is no required minimum

number of Securities that must be sold as a condition to completion of this offering. Because there is no minimum offering amount required

as a condition to the closing of this offering, the actual offering amount, placement agent fees and proceeds to us are not presently

determinable and may be substantially less than the maximum amounts set forth herein. We may sell fewer than all of the Securities offered

hereby, which may significantly reduce the amount of proceeds received by us, and investors in this offering will not receive a refund

in the event that we do not sell an amount of Securities sufficient to support our continued operations. Thus, we may not raise the amount

of capital that we believe is required for our operations and may need to raise additional funds. Such additional fundraises may not be

available or available on terms acceptable to us.

The ownership interests of management as

a result of their purchases in this offering and historical beneficial ownership of Common Stock could enable such insiders to prevent

a merger that may provide shareholders a premium for their shares.

Our directors and officers intend to purchase

an aggregate of 105,480 Units in this offering, based on an assumed offering price of $0.5688 per Unit, and after such purchase would

beneficially own approximately 3.0% of our outstanding shares of Common Stock assuming all Units in this offering are sold, upon the

separation of Units into their component shares, Series A Warrants and Series B Warrants upon the consummation of this offering. However,

depending on the total number of Units issued in this offering, this may result in management controlling a significant percentage of

shares of Common Stock. If such individuals were to act together, they could have significant influence over the outcome of any shareholder

vote. This voting power may discourage a potential sale of the Company that its shareholders may desire.

The market price for our Common Stock is

particularly volatile given our status as a relatively unknown company with a small and thinly traded public float, and lack of profits,

which could lead to wide fluctuations in our share price. You may be unable to sell your shares of Common Stock at or above the assumed

public offering price attributed to the Common Stock included in the Units purchased in this offering or to the Common Stock issued upon

exercise of the Warrants or Pre-Funded Warrants included in the Units and/or Pre-Funded Units in this offering, which may result in substantial

losses to you.

The market for our Common Stock is characterized

by significant price volatility when compared to the shares of larger, more established companies that have large public floats, and we

expect that our share price will continue to be more volatile than the shares of such larger, more established companies for the indefinite

future. The volatility in our share price is attributable to a number of factors. First, as noted above, our Common Stock is, compared

to the shares of such larger, more established companies, sporadically and thinly traded. The price for our Common Stock could, for example,

decline precipitously in the event that a large number of our Common Stock is sold on the market without commensurate demand. Secondly,

we are a speculative or “risky” investment due to our lack of profits to date. As a consequence of this enhanced risk, more

risk-adverse investors may, under the fear of losing all or most of their investment in the event of negative news or lack of progress,

be more inclined to sell their shares of Common Stock on the market more quickly and at greater discounts than would be the case with

the stock of a larger, more established company that has a large public float. Many of these factors are beyond our control and may decrease

the market price of our Common Stock regardless of our operating performance.

Because of volatility in the stock market

in general, the market price of our Common Stock will also likely be volatile.

The stock market in general, and the market for

stocks of healthcare technology companies in particular, has been highly volatile. As a result, the market price of our Common Stock is

likely to be volatile, and investors in our Common Stock may experience a decrease, which could be substantial, in the value of their

shares of Common Stock or the loss of their entire investment for a number of reasons, including reasons unrelated to our operating performance

or prospects. The market price of our Common Stock could be subject to wide fluctuations in response to a broad and diverse range of factors,

including those described elsewhere in this “Risk Factors” section and this prospectus and the following:

| |

● |

recent price volatility and any known risks of investing in our Common Stock under these circumstances; |

| |

● |

the market price of our Common Stock prior to the recent price volatility; |

| |

● |

any recent change in financial condition or results of operations, such as in earnings, revenues or other measure of company value that is consistent with the recent change in the prices of our Common Stock; and |

| |

● |

risk factors addressing the recent extreme volatility in stock price, the effects of a potential “short squeeze” due to a sudden increase in demand for our Common Stock as a result of current investor exuberance associated with technology-related stocks, the impact that this offering could have on the price of our Common Stock and on investors where there is a significant number of shares of Common Stock being offered relative to the number of shares of our Common Stock currently outstanding and, to the extent that the Company expects to conduct additional offerings in the future to fund its operations or provide liquidity, the dilutive impact of those offerings on investors that purchase such shares in the offering at a significantly higher price. |

Substantial future issuances and sales

of shares of our Common Stock, including as a result of certain provisions contained in the Series A Warrants and Series B Warrants,

could cause the market price of our Common Stock to decline.

We expect that significant additional capital

will be needed in the near future to continue our planned operations. Sales of a substantial number of shares of our Common Stock in the

public market following the completion of this offering, or the perception that these sales might occur, could depress the market price

of our Common Stock and could impair our ability to raise capital through the sale of additional equity securities. We are unable to predict

the effect that such sales may have on the prevailing market price of our Common Stock.

Additionally, if the Series B Warrants are

exercised using the alternative cashless exercise provision contained therein, assuming receipt of Stockholder Approval, such exercising

holder will receive two (2) shares of Common Stock for each Series B Warrant they exercise, without any cash payment to us. Such issuance

may result in substantial dilution to stockholders. Each of the Series A Warrants and Series B Warrants also contain certain anti-dilutive

provisions whereby (i) the exercise price of the Series A Warrants will be reduced in the event of a subsequent issuance by the Company

of Common Stock (or securities exercisable, convertible or exchangeable into Common Stock) to the price of such shares or securities

in such subsequent issuance and (ii) the exercise price of the Series A Warrants and Series B will be reduced in the event of a subsequent

reverse stock split of Common Stock or similar share combination recapitalization event to the lowest VWAP (as defined in the Warrants)

of the Common Stock within a set period before and after such split or other event, which price reduction in each case is subject to

a floor price. In the event that any such price reduction occurs, the number of shares of Common Stock issuable upon exercise of such

Series A Warrants and/or Series B Warrants upon such applicable event will increase proportionately such that the aggregate exercise

price of such Series A Warrants and/or Series B Warrants remains the same. Assuming Stockholder Approval is obtained, in the event that

such Series A Warrants and Series B Warrants are subsequently exercised, such issuances would result in substantial dilution to stockholders.

See “Description of Securities That We Are Offering” for additional information. Furthermore, if previously issued warrants,

options and shares of our preferred stock are exercised for or converted into Common Stock, you will experience further dilution. See

“Description of Securities That We Are Offering” for additional information.

We may seek to raise additional funds, finance

acquisitions or develop strategic relationships by issuing securities that would dilute the ownership of the Common Stock. Depending on

the terms available to us, if these activities result in significant dilution, it may negatively impact the trading price of our shares

of Common Stock.

We have financed our operations, and we expect

to continue to finance our operations, acquisitions, if any, and the development of strategic relationships by issuing equity and/or convertible

securities, which could significantly reduce the percentage ownership of our existing stockholders. Further, any additional financing

that we secure may require the granting of rights, preferences or privileges senior to, or pari passu with, those of our Common Stock.

Additionally, we may acquire other technologies or finance strategic alliances by issuing our equity or equity-linked securities, which

may result in additional dilution. Any issuances by us of equity securities may be at or below the prevailing market price of our Common

Stock and in any event may have a dilutive impact on your ownership interest, which could cause the market price of our Common Stock to

decline. We may also raise additional funds through the incurrence of debt or the issuance or sale of other securities or instruments

senior to our shares of Common Stock. The holders of any securities or instruments we may issue may have rights superior to the rights

of our common stockholders. If we experience dilution from issuance of additional securities and we grant superior rights to new securities

over such stockholders, it may negatively impact the trading price of our shares of Common Stock.

We could issue “blank check”

preferred stock without stockholder approval with the effect of diluting then current stockholder interests and impairing their voting

rights; and provisions in our charter documents could discourage a takeover that stockholders may consider favorable.

Our articles of incorporation (“Articles

of Incorporation”) authorize the issuance of up to 10,000,000 shares of “blank check” preferred stock with designations,

rights and preferences as may be determined from time to time by our Board. Our Board is empowered, without stockholder approval, to issue

a series of preferred stock with dividend, liquidation, conversion, voting or other rights which could dilute the interest of, or impair

the voting power of, our common stockholders. The issuance of a series of preferred stock could be used as a method of discouraging, delaying

or preventing a change in control of the Company. For example, it would be possible for our Board to issue preferred stock with voting

or other rights or preferences that could impede the success of any attempt to change control of the Company. The Series C Preferred Stock

currently ranks senior to the Common Stock and our Series F Preferred Stock, and any class or series of capital stock created after the

Series C Preferred Stock and has a special preference upon the liquidation of the Company. The Series F Preferred Stock currently ranks

senior to the Common Stock and any class or series of capital stock created after the Series F Preferred Stock and has a special preference

upon the liquidation of the Company. For further information regarding our shares of (i) Series C Preferred Stock, please refer to the

disclosure contained in our Current Report on Form 8-K filed with the SEC on May 30, 2017 and the Certificate of Designations for our

Series C Preferred Stock filed as an exhibit to our Current Report on Form 8-K filed with the SEC on June 2, 2023 and (ii) Series F Preferred

Stock, please refer to the disclosure contained in our Current Report on Form 8-K filed with the SEC on August 17, 2021 and the Certificate

of Designation for the Series F Preferred Stock filed as an exhibit to our Current Report on Form 8-K filed with the SEC on June 2, 2023.

If and when a larger trading market for

our Common Stock develops, the market price of our Common Stock is still likely to be highly volatile and subject to wide fluctuations,

and you may be unable to resell your shares of Common Stock at or above the assumed public offering price of the shares of Common Stock

included in the Units in this offering or the assumed public offering price of the Common Stock obtained upon exercise of the Warrants

or Pre-Funded Warrants included in the Units and/or Pre-Funded Units in this offering.

The market price of our Common Stock may be highly

volatile and could be subject to wide fluctuations in response to a number of factors that are beyond our control, including, but not

limited to:

| |

● |

variations in our revenues and operating expenses; |

| |

● |

actual or anticipated changes in the estimates of our operating results or changes in stock market analyst recommendations regarding our Common Stock, other comparable companies or our industry generally; |

| |

● |

market conditions in our industry, the industries of our customers and the economy as a whole; |

| |

● |

actual or expected changes in our growth rates or our competitors’ growth rates; |

| |

● |

developments in the financial markets and worldwide or regional economies; |

| |

● |

announcements of innovations or new products or services by us or our competitors; |

| |

● |

announcements by the government relating to regulations that govern our industry; |

| |

● |

sales of our Common Stock or other securities by us or in the open market; |

| |

● |

changes in the market valuations of other comparable companies; and |

| |

● |

other events or factors, many of which are beyond our control, including those resulting from such events, or the prospect of such events, including war, terrorism and other international conflicts, public health issues including health epidemics or pandemics, and natural disasters such as fire, hurricanes, earthquakes, tornados or other adverse weather and climate conditions, whether occurring in the United States or elsewhere, could disrupt our operations, disrupt the operations of our suppliers or result in political or economic instability. |

We may acquire other technologies or finance strategic

alliances by issuing our equity or equity-linked securities, which may result in additional dilution to our stockholders.

If securities or industry analysts do not

publish research or reports about our business, or publish negative reports about our business, our share price and trading volume could

decline.

The trading market for our Common Stock may depend

in part on the research and reports that securities or industry analysts may publish about us or our business, our market and our competitors.

We do not have any control over such analysts. If one or more such analysts downgrade or publish a negative opinion of our Common Stock,

our share price would likely decline. If analysts do not cover our Company or do not regularly publish reports on us, we may not be able

to attain visibility in the financial markets, which could have a negative impact on our share price or trading volume.

We do not anticipate paying dividends on

our Common Stock in the foreseeable future; you should not invest in our Securities if you expect dividends.

The payment of dividends on our Common Stock will

depend on earnings, financial condition and other business and economic factors affecting us at such time as our Board may consider relevant.

If we do not pay dividends, our shares of Common Stock may be less valuable because a return on your investment will only occur if our

stock price appreciates.

Additionally, the holder of our shares of Series

C Preferred Stock are entitled to receive dividends pursuant to the Series C Certificate of Designations. The Series C Certificate of

Designations requires us to pay cash dividends on our Series C Preferred Stock on a quarterly and cumulative basis at a rate of five percent

(5%) per annum commencing on the date of issuance of such shares, which rate increases to fifteen percent (15%) per annum in the event

that the Company’s market capitalization is $50 million or greater for thirty consecutive days. We are currently obligated to declare

and pay $75,000 in quarterly dividends on our shares of Series C Preferred Stock. The Series F Certificate of Designation required us

to pay dividends on our Series F Preferred Stock at a rate of ten percent (10%) per annum commencing on the date of issuance of such shares,

which were payable until the earlier of the date on which such shares were converted or twelve months from such date of issuance, as applicable.

As of the date of this prospectus, we are no longer obligated to declare and pay dividends on outstanding shares of Series F Preferred

Stock, as such shares were issued over twelve months prior to such date, and an aggregate of approximately 37,800 shares of Common Stock

are payable as dividends to the holder of our shares of Series F Preferred Stock.

Subject to the payment of dividends on our shares

of Series C Preferred Stock, we currently intend to retain our future earnings to support operations and to finance expansion and, therefore,

we do not anticipate paying any cash dividends on our capital stock in the foreseeable future.

Financial Industry Regulatory Authority,

Inc. (“FINRA”) sales practice requirements may limit a stockholder’s ability to buy and sell our shares Common Stock.

FINRA has adopted rules that require that in recommending

an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer.

Prior to recommending speculative low-priced securities to their non-institutional customers, broker-dealers must make reasonable efforts

to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations

of these rules, FINRA believes that there is a high probability that speculative low-priced securities will not be suitable for certain

customers. FINRA requirements will likely make it more difficult for broker-dealers to recommend that their customers buy our shares of

Common Stock, which may have the effect of reducing the level of trading activity in our Common Stock. As a result, fewer broker-dealers

may be willing to make a market in our Common Stock, reducing a stockholder’s ability to resell shares of our Common Stock.

Our management

will have broad discretion over the use of the net proceeds from this offering, you may not agree with how we use the proceeds and the

proceeds may not be invested successfully.

Our management will have broad discretion as to

the use of the net proceeds from this offering and could use them for purposes other than those contemplated at the time of commencement

of this offering. Accordingly, you will be relying on the judgment of our management regarding the use of these net proceeds, and you

will not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used appropriately. It is

possible that, pending their use, we may invest the net proceeds in a way that does not yield a favorable, or any, return for us. The

failure of our management to use such funds effectively could have a material adverse effect on our business, financial condition, operating

results and cash flows.

There is no public market for the Units,

Pre-Funded Units, Series A Warrants, Series B Warrants or Pre-Funded Warrants.

There is no established public trading market

for the Units, Pre-Funded Units, Series A Warrants, Series B Warrants or Pre-Funded Warrants offered hereby, and we do not expect a market

to develop. In addition, we do not intend to apply to list such securities on any national securities exchange or other nationally recognized

trading system, including Nasdaq. Without an active market, the liquidity of such securities will be limited.

In the event that Rule 5635(d) requires

that our stockholders approve the issuance of the Warrant Shares upon exercise of the Series A Warrants and Series B Warrants, such Series

A Warrants and Series B Warrants will not be exercisable until we are able to receive Stockholder Approval, and if we are unable to obtain

such Stockholder Approval, the Series A Warrants and Series B Warrants will have significantly less value.

Our Common Stock is currently listed on Nasdaq

and, as such, the Company is subject to the listing rules and regulations of The Nasdaq Stock Market LLC. Rule 5635(d) requires prior

stockholder approval for transactions, other than public offerings, involving the issuance of 20% or more of the pre-transaction shares

of Common Stock outstanding at less than the “Minimum Price”, which is defined as a price that is the lower of: (i) the Nasdaq

Official Closing Price (as reflected on Nasdaq.com) immediately preceding the signing of the binding agreement; or (ii) the average Nasdaq

Official Closing Price of the Common Stock (as reflected on Nasdaq.com) for the five trading days immediately preceding the signing of

the binding agreement. Shares of Common Stock issuable upon the exercise of warrants issued in such non-public offerings will be considered

shares issued in such a transaction in determining whether the 20% limit has been reached, except in certain circumstances such as issuing

warrants that are not exercisable for a minimum of six months and have an exercise price that exceeds market value.

In the event that Rule 5635(d) requires our

stockholders to approve the issuance of the Warrant Shares upon exercise of the Series A Warrants and Series B Warrants in excess of

such 20% limitation described above, the Series A Warrants and the Series B Warrants will not be exercisable until, and unless, we obtain

Stockholder Approval. Moreover, certain beneficial provisions to investors in this offering contained in the Series A Warrants and Series

B Warrants, such as the issuance of additional Warrant Shares in excess of such 20% limitation upon the triggering of the alternative

cashless exercise provision in the Series B Warrants and certain anti-dilution provisions in both the Series A Warrants and the Series

B Warrants, will not be effective until, and unless, we obtain Stockholder Approval. While we intend to promptly seek Stockholder Approval

to the extent required under Rule 5635(d), there is no guarantee that Stockholder Approval will ever be obtained. If Stockholder Approval

is required and we are unable to obtain such approval, the Warrants will not become exercisable and will have substantially less value.

In addition, we will incur substantial cost, and management will devote substantial time and attention, in attempting to obtain Stockholder

Approval. For the avoidance of doubt, Stockholder Approval would only be sought to approve the issuance of the Warrant Shares underlying

each of the Series A Warrants and the Series B Warrants in order to comply with such 20% limitation set forth in Rule 5635(d); the issuance

of the Warrant Shares, Series A Warrants and Series B Warrants is not otherwise subject to stockholder approval or any other limitation

on their issuance and registration hereon, and upon receipt of Stockholder Approval, the Warrants will be immediately exercisable for

registered Warrant Shares. See also “Description of Securities That We Are Offering – Series A Warrants, Series B Warrants

and Pre-Funded Warrants – Stockholder Approval – Series A Warrants and Series B Warrants”.

We will likely not receive any additional

funds upon the exercise of the Warrants.

If we are able to obtain Stockholder Approval,

the each of the Warrants may be exercised by way of a cashless exercise provision, and the Series B Warrants may be exercised by way

of an alternative cashless exercise provision, meaning that the holders thereof may not pay a cash purchase price upon exercise, but

instead would receive upon such exercise a number of shares of our Common Stock determined according to the applicable formula set forth

in the applicable Warrants. If the Series B Warrants are exercised pursuant to such alternative cashless exercise provision, such exercising

holder will receive two shares of Common Stock for each Series B Warrant exercised, without any cash payment to us. Accordingly, we will

likely not receive any additional funds upon the exercise of such Warrants. See “Description

of Securities That We Are Offering” for more information.

Each of the Series A Warrants, Series B

Warrants and the Pre-Funded Warrants in this offering are speculative in nature.

Following this offering, the market value

of each of the Series A Warrants, Series B Warrants and the Pre-Funded Warrants, if any, is uncertain and there can be no assurance that

the market value of each of the Series A Warrants, Series B Warrants and the Pre-Funded Warrants will equal or exceed their respective

imputed assumed public offering price. In the event that our Common Stock price does not exceed the respective exercise price of the

Series A Warrants, Series B Warrants or Pre-Funded Warrants during the period when such Series A Warrants, Series B Warrants and Pre-Funded

Warrants are exercisable, such Series A Warrants, Series B Warrants and Pre-Funded Warrants may not have any value. Furthermore, each

Series A Warrant, will expire five years from its date of issuance and each Series B Warrant will expire two and one half years from

its date of issuance.

Holders of each of the Series A Warrants,

Series B Warrants and Pre-Funded Warrants will not have rights of holders of our shares of Common Stock until such Series A Warrants,

Series B Warrants and Pre-Funded Warrants are exercised.

Neither the Series A Warrants, the Series B Warrants

nor the Pre-Funded Warrants in this offering confer any rights of share ownership on their holders, but rather merely represent the right

to acquire shares of Common Stock at a fixed price. Until holders of each of the Series A Warrants, Series B Warrants and Pre-Funded Warrants

acquire shares of Common Stock upon exercise of such Series A Warrants, Series B Warrants and Pre-Funded Warrants, respectively, such

holders will have no rights with respect to our shares of Common Stock underlying such Series A Warrants, Series B Warrants and Pre-Funded

Warrants.

Purchasers who

purchase the Securities in this offering pursuant to a securities purchase agreement may have rights not available to purchasers that

purchase without the benefit of a securities purchase agreement.

In addition to rights and remedies available to

all purchasers in this offering under federal securities and state law, the purchasers that enter into a securities purchase agreement

to purchase the Securities will also be able to bring claims of breach of contract against us. The ability to pursue a claim for breach

of contract provides those investors with the means to enforce the covenants uniquely available to them under such securities purchase

agreement.

Risks Related to Our Business

Our inability to win or renew government

contracts during regulated procurement processes or preferences granted to certain bidders for which we would not qualify could harm our

operations and significantly reduce or eliminate our profits.

U.S. government contracts are awarded through

a regulated procurement process. The U.S. government has increasingly relied upon multi-year contracts with pre-established terms and

conditions, such as indefinite delivery, indefinite quantity (“IDIQ”) contracts, which generally require those contractors

who have previously been awarded contracts to engage in an additional competitive bidding process. The increased competition may require

us to make sustained efforts to reduce costs to realize revenue and profits under government contracts. If we are not successful in reducing

the amount of costs we incur, our profitability on government contracts will be negatively impacted.

The U.S. government has also increased its use

of contracts in which the client qualifies multiple contractors for a specific program and then awards specific task orders or projects

among the qualified contractors, which have the potential to create pricing pressure and to increase our costs by requiring us to submit

multiple bids and proposals. The competitive bidding process entails substantial costs and managerial time to prepare bids and proposals

for contracts that may not be awarded to us or may be split among competitors. Further, the U.S. government has announced specific statutory

goals regarding awarding prime and subcontracts to small businesses, women-owned small businesses, service-disabled veteran-owned businesses