LogicMark, Inc. (Nasdaq: LGMK), a provider of personal safety,

personal emergency response systems (PERS), health communications

devices, and technology for the growing care and safety economy,

today announced financial results for the quarter ended June

30, 2024.

Summary:

- Revenues

were $2.3 million, up slightly compared with the prior year

period.

- Gross margin in

the second quarter of 2024 was 67%, compared with 69% for the

second quarter of 2023.

- Overall

operating expenses were $3.6 million, compared with $3.9 million

for the prior year period.

- The cash balance

on June 30, 2024 was $3.0 million.

- The Company’s

intellectual property portfolio is expanding, with 14 patents filed

since June 2021. This includes five provisional patents, three

awarded patents, and the remaining patents, which have been

finalized.

- The Company’s

product line now includes five hardware products, with new devices

that include fall detection, geo-fencing, and proprietary

leading-edge technology which includes cloud and mobile caretaker

support app technology and a new personal safety app with a

Bluetooth emergency button.

Chia-Lin

Simmons, Chief Executive Officer

of LogicMark, commented, “Our second quarter results

reflect our expanded sales and marketing efforts to promote our

products across various verticals, targeting higher revenue

streams. We now offer five PERS solutions that include features

such as advanced fall detection, geo-fencing for memory care,

connected cloud and caretaker app support, a personal safety

solution with the Aster safety app, and a robust and growing

intellectual property portfolio which includes artificial

intelligence and machine learning.

“The demand for solutions that enhance personal

safety and independence remains strong. Our data indicates that the

elderly population is living longer and prefers to age in place.

With approximately 10,000 baby boomers turning 65 daily, the demand

for healthcare and home industry workers surpasses supply. Concerns

about personal safety are at an all-time high, and our solutions

are designed to provide much-needed peace of mind.

“Our understanding of these evolving industry

trends is clear, leading us to design solutions that are both

reactive and predictive. As the personal safety and elder care

markets continue to grow, our Care Village ecosystem of software

and hardware is helping meet the changing needs of society and its

families across the USA.”

Second Quarter 2024

Results Revenue for the second quarter

ended June 30, 2024 was $2.3 million, up slightly

compared with the same period last year. A higher average selling

price more than offset softness in unit sales.

The gross margin was a more normalized 67% for

the three months ended June 30, 2024, down from 69% for the three

months ended June 30, 2023. Gross profit in the second quarter of

this year was relatively unchanged at $1.6

million, compared with $1.6 million in the same period

last year.

Total operating expenses in the second quarter

of 2024 were $3.6 million versus $3.9 million in the second

quarter of 2023, a decrease of 6%. Reduced operating expenses were

driven by lower spending in product development and technical

engineering, partially offset by higher spending in sales,

marketing, and advertising as the Company pivots from developing

new products to putting those products in the hands of our

customers. General and administrative costs also fell due to lower

recruiting, professional, and legal fees.

Net loss attributable to common shareholders for

the second quarter was $2.1 million compared with a net

loss to common shareholders of $2.3 million in the same

period last year. On a fully diluted basis, the net loss per

share was $0.96, compared with a net loss of $1.83 per

share in the same period last year. This $0.87 per share

improvement in the net loss per share includes $0.68 per share

attributable to the higher weighted average number of common shares

outstanding.

As of June 30, 2024, the cash balance

was $3.0 million.

Subsequent EventsOn August 5,

2025, the Company closed a public offering of units and pre-funded

units consisting of shares of common stock, warrants and pre-funded

warrants. Before deducting placement agent discounts and

commissions and estimated offering expenses, gross proceeds were

approximately $4.5 million. The Company intends to use the net

proceeds from the offering for continued new product development,

working capital and other general corporate purposes.

Investor Call and SEC

Filings Chia-Lin Simmons, CEO,

and Mark Archer, CFO, will host a live investor call and webcast

on August 13, 2024, at 1:30 PM (PDT) / 4:30 PM

(EDT) to review the Company’s second quarter of 2024 financial

results.

Investors wishing to participate in the conference call must

register to obtain their dial-in and pin number here:

https://register.vevent.com/register/BI84b6f480bffa411bb180ee9109eecda5.

To listen to the live webcast, please visit the LogicMark

Investor Relations website here or use the following link:

https://edge.media-server.com/mmc/p/76eaj2t5.

The associated press release, SEC filings, and webcast replay

will also be accessible on the investor relations

website.

About Us LogicMark,

Inc. (Nasdaq: LGMK) is on a mission to let people of all ages

lead a life with dignity, independence, and the joy of

possibility. The Company provides personal safety, personal

emergency response systems (PERS), software apps, health

communications devices, services, and technologies to create a

Connected Care Platform. Made up of a team of leading technologists

with a deep understanding of IoT, AI, and machine learning and a

passionate focus on understanding consumer

needs, LogicMark is dedicated to building a ‘Care

Village’ with proprietary technology and creating innovative

solutions for the care economy. The Company’s PERS technologies are

sold through the United States Veterans Health Administration,

dealers, distributors, and direct to

consumer. LogicMark has been awarded a contract by

the U.S. General Services Administration that enables the

Company to distribute its products to federal, state, and local

governments. For more information visit LogicMark.com.

Cautionary Statement Regarding

Forward-Looking StatementsThis press release contains

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements reflect management’s current expectations, as of the

date of this press release, and involve certain risks and

uncertainties. Forward-looking statements include statements herein

with respect to the successful execution of the Company’s business

strategy and the Company’s planned use of the proceeds received in

connection with the public offering described above. The Company’s

actual results could differ materially from those anticipated in

these forward-looking statements as a result of various factors.

Such risks and uncertainties include, among other things, our

ability to establish and maintain the proprietary nature of our

technology through the patent process, as well as our ability to

possibly license from others patents and patent applications

necessary to develop products; the availability of financing; the

Company’s ability to implement its long-range business plan for

various applications of its technology; the Company’s ability to

enter into agreements with any necessary marketing and/or

distribution partners; the impact of competition, the obtaining and

maintenance of any necessary regulatory clearances applicable to

applications of the Company’s technology; the Company’s ability to

maintain its Nasdaq listing for its common stock; and management of

growth and other risks and uncertainties that may be detailed from

time to time in the Company’s reports filed with the SEC.

Investor Relations

Contact investors@logicmark.com

| |

|

|

|

|

|

| |

LogicMark, Inc. |

|

| |

CONDENSED BALANCE SHEETS |

|

| |

(Unaudited) |

|

| |

|

June 30, |

|

December 31, |

|

|

|

|

|

2024 |

|

|

|

2023 |

|

|

| |

Assets |

|

|

|

|

| |

Current Assets |

|

|

|

|

| |

Cash and cash equivalents |

$ |

2,959,815 |

|

|

$ |

6,398,164 |

|

|

| |

Accounts receivable, net |

|

11,918 |

|

|

|

13,647 |

|

|

|

|

Inventory |

|

678,537 |

|

|

|

1,177,456 |

|

|

| |

Prepaid expenses and other current assets |

|

773,894 |

|

|

|

460,177 |

|

|

| |

Total Current Assets |

|

4,424,164 |

|

|

|

8,049,444 |

|

|

| |

|

|

|

|

|

| |

Property and equipment, net |

|

161,501 |

|

|

|

203,333 |

|

|

| |

Right-of-use assets, net |

|

82,298 |

|

|

|

113,761 |

|

|

| |

Product development costs, net of amortization of $216,151 and

$68,801, respectively |

|

1,368,120 |

|

|

|

1,269,021 |

|

|

| |

Software development costs, net of amortization of $161,775 and

$23,354, respectively |

|

1,637,875 |

|

|

|

1,299,901 |

|

|

| |

Goodwill |

|

3,143,662 |

|

|

|

3,143,662 |

|

|

| |

Other intangible assets, net of amortization of $6,047,407 and

$5,666,509, respectively |

|

2,557,160 |

|

|

|

2,938,058 |

|

|

| |

|

|

|

|

|

| |

Total Assets |

$ |

13,374,780 |

|

|

$ |

17,017,180 |

|

|

| |

|

|

|

|

|

| |

Liabilities, Series C Redeemable Preferred Stock and

Stockholders’ Equity |

|

|

|

|

| |

|

|

|

|

|

| |

Current Liabilities |

|

|

|

|

| |

Accounts payable |

$ |

796,815 |

|

|

$ |

901,624 |

|

|

| |

Accrued expenses |

|

767,717 |

|

|

|

1,151,198 |

|

|

| |

Deferred Revenue |

|

25,069 |

|

|

|

- |

|

|

| |

Total Current Liabilities |

|

1,589,601 |

|

|

|

2,052,822 |

|

|

| |

Other long-term liabilities |

|

13,382 |

|

|

|

51,842 |

|

|

| |

Total Liabilities |

|

1,602,983 |

|

|

|

2,104,664 |

|

|

| |

|

|

|

|

|

| |

Commitments and Contingencies (Note 8) |

|

|

|

|

| |

|

|

|

|

|

| |

Series C Redeemable Preferred Stock |

|

|

|

|

| |

Series C redeemable preferred stock, par value $0.0001 per share:

2,000 shares designated; 10 shares issued and outstanding as of

June 30, 2024 and December 31, 2023, respectively |

|

1,807,300 |

|

|

|

1,807,300 |

|

|

| |

|

|

|

|

|

| |

Stockholders’ Equity |

|

|

|

|

| |

Preferred stock, par value $0.0001 per share: 10,000,000 shares

authorized |

|

|

|

|

| |

Series F preferred stock, par value $0.0001 per share: 1,333,333

shares designated; 106,333 shares issued and outstanding as of June

30, 2024 and as of December 31, 2023, respectively, aggregate

liquidation preference of $319,000 as of June 30, 2024 and as of

December 31, 2023, respectively |

|

319,000 |

|

|

|

319,000 |

|

|

| |

Common stock, par value $0.0001 per share: 100,000,000 shares

authorized; 2,193,587 and 2,150,412 issued and outstanding as of

June 30, 2024 and December 31, 2023, respectively |

|

220 |

|

|

|

216 |

|

|

| |

Additional paid-in capital |

|

113,589,568 |

|

|

|

112,946,891 |

|

|

| |

Accumulated deficit |

|

(103,944,291 |

) |

|

|

(100,160,891 |

) |

|

| |

|

|

|

|

|

| |

Total Stockholders’ Equity |

|

9,964,497 |

|

|

|

13,105,216 |

|

|

| |

|

|

|

|

|

| |

Total Liabilities, Series C Redeemable Preferred Stock and

Stockholders’ Equity |

$ |

13,374,780 |

|

|

$ |

17,017,180 |

|

|

| |

|

|

|

|

|

|

LogicMark, Inc. |

|

|

CONDENSED STATEMENT OF OPERATIONS |

|

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

| |

For the Three Months Ended June 30, |

|

For the Six Months Ended June 30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

Revenues |

$ |

2,336,268 |

|

|

$ |

2,326,995 |

|

|

$ |

4,947,351 |

|

|

$ |

5,136,713 |

|

|

|

Costs of goods sold |

|

781,318 |

|

|

|

727,276 |

|

|

|

1,625,183 |

|

|

|

1,674,445 |

|

|

|

Gross Profit |

|

1,554,950 |

|

|

|

1,599,719 |

|

|

|

3,322,168 |

|

|

|

3,462,268 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Expenses |

|

|

|

|

|

|

|

|

|

Direct operating cost |

|

320,660 |

|

|

|

312,426 |

|

|

|

651,580 |

|

|

|

575,228 |

|

|

|

Advertising costs |

|

135,220 |

|

|

|

85,277 |

|

|

|

287,433 |

|

|

|

133,393 |

|

|

|

Selling and marketing |

|

605,493 |

|

|

|

517,931 |

|

|

|

1,193,031 |

|

|

|

983,466 |

|

|

|

Research and development |

|

133,556 |

|

|

|

250,266 |

|

|

|

307,458 |

|

|

|

564,154 |

|

|

|

General and administrative |

|

1,982,997 |

|

|

|

2,443,860 |

|

|

|

3,881,960 |

|

|

|

4,857,619 |

|

|

|

Other expense |

|

69,932 |

|

|

|

50,646 |

|

|

|

153,758 |

|

|

|

78,964 |

|

|

|

Depreciation and amortization |

|

377,974 |

|

|

|

215,703 |

|

|

|

723,525 |

|

|

|

431,701 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Operating Expenses |

|

3,625,832 |

|

|

|

3,876,109 |

|

|

|

7,198,745 |

|

|

|

7,624,525 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Loss |

|

(2,070,882 |

) |

|

|

(2,276,390 |

) |

|

|

(3,876,577 |

) |

|

|

(4,162,257 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Other Income |

|

|

|

|

|

|

|

|

|

Interest income |

|

32,025 |

|

|

|

8,510 |

|

|

|

93,177 |

|

|

|

60,938 |

|

|

|

Total Other Income |

|

32,025 |

|

|

|

8,510 |

|

|

|

93,177 |

|

|

|

60,938 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss before Income Taxes |

|

(2,038,857 |

) |

|

|

(2,267,880 |

) |

|

|

(3,783,400 |

) |

|

|

(4,101,319 |

) |

|

|

Income tax expense |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

Net Loss |

|

(2,038,857 |

) |

|

|

(2,267,880 |

) |

|

|

(3,783,400 |

) |

|

|

(4,101,319 |

) |

|

|

Preferred stock dividends |

|

(75,000 |

) |

|

|

(75,000 |

) |

|

|

(150,000 |

) |

|

|

(150,000 |

) |

|

|

Net Loss Attributable to Common Stockholders |

$ |

(2,113,857 |

) |

|

$ |

(2,342,880 |

) |

|

$ |

(3,933,400 |

) |

|

$ |

(4,251,319 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Net Loss Attributable to Common Stockholders Per Share - Basic and

Diluted |

$ |

(0.96 |

) |

|

$ |

(1.83 |

) |

|

$ |

(1.81 |

) |

|

$ |

(3.73 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average Number of Common Shares Outstanding - Basic and

Diluted |

|

2,190,716 |

|

|

|

1,282,794 |

|

|

|

2,170,564 |

|

|

|

1,139,437 |

|

|

| |

|

|

|

|

|

|

|

|

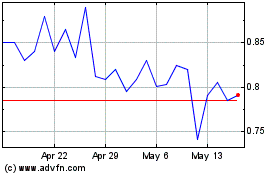

LogicMark (NASDAQ:LGMK)

Historical Stock Chart

From Oct 2024 to Nov 2024

LogicMark (NASDAQ:LGMK)

Historical Stock Chart

From Nov 2023 to Nov 2024