Added 44,000 net organic internet and postpaid mobile

subscribers

Delivered operating income of $163 million, up 7% YoY

Expanded Adjusted OIBDA to $428 million, rebased growth of

10%

Repurchased $112 million in equity and convertible notes

Announced acquisition of spectrum and subscriber assets in PR

& USVI for $256 million

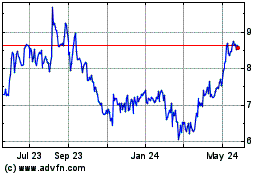

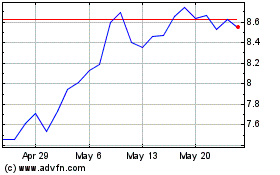

Liberty Latin America Ltd. (“Liberty Latin America” or “LLA”)

(NASDAQ: LILA and LILAK, OTC Link: LILAB) today announced its

financial and operating results for the three months (“Q3”) and

nine months (“YTD”) ended September 30, 2023.

CEO Balan Nair commented, “We drove subscriber growth in the

third quarter as we continued to execute our commercial strategies.

All of our reporting segments delivered higher broadband

subscribers, and we added or upgraded over 100,000 homes passed in

Q3. Postpaid mobile adds were again driven by our market leading

operation in Costa Rica, as well as continued growth across C&W

Caribbean markets.”

“LLA reported $1.1 billion in revenue, $163 million of operating

income, and $428 million in Adjusted OIBDA in the third quarter.

Together with modest top-line growth and the benefits of synergy

realization and efficiency initiatives, four of our five operating

segments delivered double-digit rebased Adjusted OIBDA growth in

the quarter, which propelled us to achieve accelerated 10% rebased

Adjusted OIBDA growth. This is LLA’s best quarterly result in 2

years.”

“Importantly, we continue to make progress on our integration

and with the migration of mobile subscribers in Puerto Rico and the

USVI. To date, we have migrated approximately 225,000 subscribers

and just launched sales efforts for prepaid products on our new

platform. Our latest postpaid offerings are also gaining traction

with iPhone 15 sales and shipments exceeding the iPhone 14 launch

by more than 50%. And our fixed services year-to-date revenue

growth is at 5%, which bodes well for when we are able to sell a

bundled offering in 2024.”

“We are also partnering with AT&T to extend our migration

window by four months through the end of April 2024. By extending

the window, we expect to enhance the migration of incompatible

handsets, integrate all iPhone and Samsung software upgrades,

complete all B2B account migrations and importantly, minimize

changes and disruptions during the holiday season.”

“Our commitment to Puerto Rico and the USVI is bolstered by our

announcement to acquire a combination of over 100 MHz of spectrum

and approximately 120,000 Boost subscribers from DISH Network. Upon

completion, this transaction provides us with valuable spectrum

that will allow us to add more capacity, increase speeds, and

further strengthen our leading 5G mobile network, as well as

increase our scale in the prepaid market.”

“During Q3 we purchased $112 million of our equity and

convertible notes, bringing our year-to-date spend to nearly $300

million. Overall, we continued to drive operational and financial

progress in the quarter and have taken important steps to create

value through our inorganic strategy. We are on-track to build on

this outstanding growth for a robust fourth quarter performance and

continued growth in future years.”

Q3 Business Highlights

- C&W Caribbean: sustained subscriber momentum and

double-digit Adj. OIBDA growth

- 20,000 internet and mobile postpaid organic adds

- Reported and rebased Adj. OIBDA growth of 13% and 14%,

respectively

- C&W Panama: Claro Panamá acquisition synergies drive strong

growth

- Reported and rebased revenue growth of 10%

- Reported and rebased Adj. OIBDA growth of 25%

- Liberty Networks: strong financial performance

- Reported and rebased revenue growth of 9% and 10%,

respectively

- Reported and rebased Adj. OIBDA growth of 9% and 11%,

respectively

- Liberty Puerto Rico: focus on integration

- Robust internet subscriber growth, 29,000 net adds over last

twelve months

- ~225,000 customers migrated to LPR IT platform

- Liberty Costa Rica: postpaid momentum and strong currency drive

Adj. OIBDA growth

- Strongest postpaid quarter of the year, adds over 40% higher

sequentially

- Adj. OIBDA up 52% and 21% on a reported and rebased basis,

respectively

Announced transaction

Acquisition of spectrum and subscriber

assets in Puerto Rico & USVI from DISH Network

- >100MHz of low, mid and high band spectrum and ~120,000

prepaid subscribers

- Aggregate asset purchase price of $256 million to be paid in

four annual installments

- Funding through local liquidity sources, including cash on

hand, cash generated from operations, cash generated from asset

sales, and/or revolving credit facilities

FY 2023 LLA Financial Guidance

- Adjusted OIBDA mid-to-high single digit rebased

growth

- P&E additions as a percentage of revenue at

~16%

- Adjusted FCF of ~$300 million, before distributions to

noncontrolling interests

- Our target remains as previously provided, however several

factors have materialized recently which add variability this year

including the Puerto Rico migration and dependency on large

payments (particularly in Panama) due from B2G and B2B customers

that could fall into next year. The delay in finalizing the Puerto

Rico migration until next year will result in additional costs and

adverse impacts on our working capital in 2023, in large part due

to the need to carry significantly higher mobile handset inventory

in order to drive sales across both the AT&T systems and our

new systems.

Financial and Operating Highlights

Financial Highlights

Q3 2023

Q3 2022

YoY Growth / (Decline)

YoY Rebased

Growth1

YTD 2023

YTD 2022

YoY Growth / (Decline)

YoY Rebased

Growth1

(USD in millions)

Revenue

$

1,126

$

1,221

(8

%)

1

%

$

3,348

$

3,649

(8

%)

1

%

Revenue (excluding VTR)2

$

1,126

$

1,091

3

%

1

%

$

3,348

$

3,199

5

%

1

%

Operating income (loss)

$

163

$

152

7

%

$

405

$

(20

)

N.M.

Adjusted OIBDA3

$

428

$

414

4

%

10

%

$

1,270

$

1,307

(3

%)

5

%

Adjusted OIBDA3 (excluding VTR)2

$

428

$

383

12

%

10

%

$

1,270

$

1,192

7

%

5

%

Property & equipment additions

$

187

$

224

(16

%)

$

524

$

591

(11

%)

As a percentage of revenue

17

%

18

%

16

%

16

%

Adjusted FCF before distributions to

noncontrolling interest owners

$

33

$

(38

)

$

55

$

(19

)

Distributions to noncontrolling interest

owners

$

—

$

—

$

(41

)

$

(2

)

Adjusted FCF4

$

33

$

(38

)

$

14

$

(21

)

Cash provided by operating activities

$

219

$

145

$

507

$

492

Cash used by investing activities

$

(161

)

$

(402

)

$

(453

)

$

(745

)

Cash provided (used) by financing

activities

$

(122

)

$

(9

)

$

(255

)

$

22

N.M. – Not Meaningful.

Operating Highlights5

Q3 2023

Q2 2023

Total customers

1,942,300

1,938,600

Organic customer additions

3,700

12,700

Fixed RGUs

3,898,000

3,874,200

Organic RGU additions

23,800

34,900

Organic internet additions

15,300

18,700

Mobile subscribers

8,033,000

8,011,500

Organic mobile additions

(losses)

31,700

(8,000

)

Organic postpaid additions

28,900

32,800

Revenue Highlights

The following table presents (i) revenue of each of our segments

and corporate operations for the periods indicated and (ii) the

percentage change from period-to-period on both a reported and

rebased basis:

Three months ended

Increase/(decrease)

Nine months ended

Increase/(decrease)

September 30,

September 30,

2023

2022

%

Rebased %

2023

2022

%

Rebased %

in millions, except %

amounts

C&W Caribbean

$

360.5

$

359.1

—

1

$

1,070.6

$

1,069.5

—

—

C&W Panama

190.4

172.5

10

10

536.5

441.3

22

6

Liberty Networks

112.5

102.8

9

10

339.8

326.8

4

7

Liberty Puerto Rico

351.2

365.7

(4

)

(4

)

1,064.2

1,091.4

(2

)

(2

)

Liberty Costa Rica

134.6

109.2

23

—

399.0

324.6

23

1

VTR

—

129.8

N.M.

N.M.

—

450.6

N.M.

N.M.

Corporate

6.5

5.4

20

20

18.5

16.5

12

12

Eliminations

(29.9

)

(23.7

)

N.M.

N.M.

(81.1

)

(71.3

)

N.M.

N.M.

Total

1,125.8

1,220.8

(8

)

1

3,347.5

$

3,649.4

(8

)

1

Less: VTR

—

129.8

—

450.6

Total excluding VTR2

$

1,125.8

$

1,091.0

3

1

$

3,347.5

$

3,198.8

5

1

N.M. – Not Meaningful.

- Reported revenue declined by 8% for each of the three and nine

months ended September 30, 2023.

- Reported revenue declined in Q3 as (1) net organic growth

driven by C&W Panama and Liberty Networks and (2) net foreign

exchange benefits of $24 million, were more than offset by the

negative year-over-year impact of $130 million related to VTR's

deconsolidation following the formation of the Chile JV in October

2022 and organic decline in Liberty Puerto Rico.

- Reported revenue declined in YTD 2023 as (1) the addition of

$70 million from the acquisition of América Móvil's Panama

operations (Claro Panamá) on July 1, 2022, (2) net foreign exchange

benefits of $63 million and (3) net organic growth driven by

C&W Panama and Liberty Networks, were more than offset by the

negative year-over-year impact of $451 million related to VTR's

deconsolidation and organic decline in Liberty Puerto

Rico.

Q3 2023 Revenue Growth – Segment

Highlights

- C&W Caribbean: revenue was flat on a reported basis and

grew by 1% on a rebased basis, year-over-year.

- Fixed residential revenue decreased by 1% on a reported basis

and was flat on a rebased basis. Subscription revenue grew

year-over-year, driven by higher internet broadband subscribers,

primarily in Jamaica where we added 21,000 RGUs over the last

twelve months. This was partly offset by lower ARPU from telephony

services due to fixed-mobile convergence incentives.

- Mobile revenue was up 6% on a reported basis and 7% higher on a

rebased basis. The increase followed our focus on fixed-mobile

convergence propositions which drove 75,000 postpaid mobile

additions in the last twelve months, and higher prepaid ARPU

resulting from price increases during Q1 2023. We have also

continued to see an increase in inbound roaming revenue as tourism

has recovered in the region.

- B2B revenue was 3% lower on both a reported and rebased basis.

The discontinuation of a non-core transit services agreement at the

beginning of 2023 at C&W Jamaica had a $10 million negative

impact on revenue as compared to the prior year quarter. This

translates to a 270 basis point and 740 basis point impact on

C&W Caribbean's total revenue and B2B revenue growth rates,

respectively and more than offset underlying B2B growth in the

period.

- C&W Panama: revenue grew by 10% on a reported and rebased

basis.

- Fixed residential revenue was up 7% on a reported and rebased

basis. Growth was driven by RGU additions of 59,000 over the past

twelve months, following investments in our networks, products and

commercial activities.

- Mobile revenue was 1% lower on a reported and rebased basis.

Subscription revenue was stable, however a reduction in handset

equipment revenue drove the year-over-year rebased decline.

- B2B revenue grew by 26% on a reported and rebased basis. The

year-over-year performance was driven by increased revenue from

government related projects and data services.

- Liberty Networks: revenue grew by 9% and 10% on a reported and

rebased basis, respectively. Growth on a rebased basis was driven

by higher wholesale network revenue primarily associated with a

significant customer that is recognized on a cash basis, and higher

affiliate revenue due to increased capacity usage. Enterprise

revenue was also higher year-over-year due to continued growth in

B2B connectivity and managed services.

- Liberty Puerto Rico: revenue was 4% lower on a reported and

rebased basis.

- Residential fixed revenue growth of 10% was due to higher ARPU

following rate increases and the negative prior-year impact of

credits issued to customers as a result of power outages related to

Hurricane Fiona. The increase was also driven by net broadband

subscriber additions totaling 29,000 over the past twelve

months.

- Residential mobile revenue was 10% lower compared to the

prior-year period. This was driven by: (1) lower ARPU from mobile

services, due to a higher number of low cost and discounted plans

and the impact of higher contract asset amortization, (2) lower

roaming revenue, and (3) a decline in the average number of prepaid

mobile subscribers.

- Sequentially, revenue grew by 2% primarily due to increased

handset sales following new product initiatives.

- Other revenue declined by $13 million as compared to the

prior-year quarter due to a reduction in revenue recognized on

funds received from the FCC, primarily due to increased recognition

in Q3 2022 related to broadband expansion phasing.

- Liberty Costa Rica: revenue grew by 23% on a reported basis and

was flat on a rebased basis. Reported performance benefited from a

$24 million positive foreign exchange impact year-over-year, as the

Costa Rican colon appreciated against the U.S. dollar. The overall

year-over-year rebased performance was a result of mobile postpaid

subscriber growth offset by lower video RGUs and ARPU due to

increased retention discounts and declines in higher ARPU

plans.

Operating Income (Loss)

- Operating income (loss) was $163 million and $152 million for

the three months ended September 30, 2023 and 2022, respectively,

and $405 million and ($20 million) for the nine months ended

September 30, 2023 and 2022, respectively.

- The increase for the three-month comparison is primarily due to

higher Adjusted OIBDA. The improvement from operating loss to

operating income for the nine-month comparison is primarily due to

the net impact of (i) lower impairment, restructuring and other

operating items, net, mostly due to goodwill impairments recorded

during the second quarter of 2022, (ii) higher depreciation and

amortization and (iii) lower Adjusted OIBDA.

Adjusted OIBDA Highlights

The following table presents (i) Adjusted OIBDA of each of our

reportable segments and our corporate category for the periods

indicated and (ii) the percentage change from period-to-period on

both a reported and rebased basis:

Three months ended

Increase (decrease)

Nine months ended

Increase (decrease)

September 30,

September 30,

2023

2022

%

Rebased %

2023

2022

%

Rebased %

in millions, except %

amounts

C&W Caribbean

$

150.4

$

132.7

13

14

$

436.9

$

397.1

10

10

C&W Panama

58.5

46.7

25

25

161.0

131.6

22

28

Liberty Networks

64.2

58.9

9

11

200.0

196.6

2

4

Liberty Puerto Rico

116.4

130.3

(11

)

(11

)

381.6

413.2

(8

)

(8

)

Liberty Costa Rica

49.9

32.8

52

21

145.2

98.6

47

19

VTR

—

31.2

N.M.

N.M.

—

115.6

N.M.

N.M.

Corporate

(11.0

)

(18.8

)

41

43

(55.0

)

(45.4

)

(21

)

(18

)

Total

$

428.4

$

413.8

4

10

$

1,269.7

$

1,307.3

(3

)

5

Less: VTR

—

31.2

—

115.6

Total excluding VTR2

$

428.4

$

382.6

12

10

$

1,269.7

$

1,191.7

7

5

Operating income (loss) margin

14.5

%

12.4

%

12.1

%

(0.6

)%

Adjusted OIBDA margin

38.1

%

33.9

%

37.9

%

35.8

%

Adjusted OIBDA margin excl. VTR2

38.1

%

35.1

%

37.9

%

37.3

%

N.M. – Not Meaningful.

- Our reported Adjusted OIBDA for the three and nine months ended

September 30, 2023 increased by 4% and declined by 3%,

respectively, as compared to the corresponding prior-year periods.

- Reported Adjusted OIBDA was higher in Q3 as (1) organic growth

in C&W Caribbean, C&W Panama, and Liberty Costa Rica, and

(2) the appreciation of the Costa Rican colon, were partly offset

by the deconsolidation of VTR and organic decline in Liberty Puerto

Rico.

- Reported Adjusted OIBDA was lower YTD as (1) organic growth in

C&W Caribbean, C&W Panama, and Liberty Costa Rica, and (2)

the appreciation of the Costa Rican colon, were more than offset by

the deconsolidation of VTR and organic decline in Liberty Puerto

Rico.

Q3 2023 Adjusted OIBDA Growth – Segment

Highlights

- C&W Caribbean: Adjusted OIBDA increased by 13% and 14% on a

reported and rebased basis, respectively. Performance was driven by

the aforementioned mobile revenue growth and lower direct costs,

including declines in programming expenses. Our Adjusted OIBDA

margin improved by over 400 basis points year-over-year to

42%.

- C&W Panama: Adjusted OIBDA increased by 25% on a reported

and rebased basis. The performance was driven by value capture

activities related to the Claro Panamá acquisition.

- Liberty Networks: Adjusted OIBDA increased by 9% and 11% on a

reported and rebased basis, respectively. Our rebased performance

was driven by the aforementioned revenue growth in the

quarter.

- Liberty Puerto Rico: Adjusted OIBDA declined by 11% on a

reported and rebased basis. The performance was driven by the net

impact of our aforementioned revenue decline, lower direct costs,

primarily due to lower gross sales, and higher other operating

costs year-over-year.

- Liberty Costa Rica: Adjusted OIBDA grew by 52% and 21% on a

reported and rebased basis, respectively. Rebased performance was

driven by favorable foreign exchange movements on non-CRC

denominated costs and execution of our integration plan.

- Corporate: Adjusted OIBDA was 41% and 43% higher on a reported

and rebased basis, respectively. Growth as compared to the

prior-year period was driven by lower bonus costs and the timing of

professional services.

Net Earnings (Loss) Attributable to Shareholders

- Net earnings (loss) attributable to shareholders was $60

million and $76 million for the three months ended September 30,

2023 and 2022, respectively, and $29 million and ($309 million) for

the nine months ended September 30, 2023 and 2022,

respectively.

Property & Equipment Additions and Capital

Expenditures

The table below highlights the categories of the property and

equipment additions (P&E Additions) for the indicated periods

and reconciles to cash paid for capital expenditures, net.

Three months ended

Nine months ended

September 30,

September 30,

2023

2022

2023

2022

USD in millions

Customer Premises Equipment

$

45.8

$

64.1

$

137.3

$

205.4

New Build & Upgrade

39.9

42.8

102.5

111.8

Capacity

24.5

32.0

70.1

85.9

Baseline

58.2

63.9

166.9

139.2

Product & Enablers

18.8

21.2

47.5

48.8

Property & equipment additions

187.2

224.0

524.3

591.1

Assets acquired under capital-related

vendor financing arrangements

(45.8

)

(46.7

)

(117.7

)

(114.2

)

Changes in current liabilities related to

capital expenditures and other

8.4

(2.3

)

16.3

17.2

Capital expenditures, net

$

149.8

$

175.0

$

422.9

$

494.1

Property & equipment additions as % of

revenue

16.6

%

18.3

%

15.7

%

16.2

%

Property & Equipment Additions:

C&W Caribbean

$

55.6

$

58.5

$

173.8

$

151.4

C&W Panama

37.3

30.2

82.8

71.6

Liberty Networks

13.2

11.7

37.1

32.0

Liberty Puerto Rico

56.7

63.8

158.4

154.8

Liberty Costa Rica

15.9

20.5

46.2

45.7

VTR

—

27.6

—

107.3

Corporate

8.5

11.7

26.0

28.3

Property & equipment additions

$

187.2

$

224.0

$

524.3

$

591.1

Property & Equipment Additions as a

Percentage of Revenue by Reportable Segment:

C&W Caribbean

15.4

%

16.3

%

16.2

%

14.2

%

C&W Panama

19.6

%

17.5

%

15.4

%

16.2

%

Liberty Networks

11.7

%

11.4

%

10.9

%

9.8

%

Liberty Puerto Rico

16.1

%

17.4

%

14.9

%

14.2

%

Liberty Costa Rica

11.8

%

18.8

%

11.6

%

14.1

%

VTR

N/A

21.3

%

N/A

23.8

%

New Build and Homes Upgraded by Reportable

Segment1:

C&W Caribbean

32,900

22,700

116,300

90,900

C&W Panama

41,200

39,000

94,000

129,300

Liberty Puerto Rico

16,900

10,400

41,400

24,900

Liberty Costa Rica

10,200

14,600

33,200

39,300

VTR

—

20,800

—

137,400

Total

101,200

107,500

284,900

421,800

- Table excludes Liberty Networks as that segment only provides

B2B-related services.

Summary of Debt, Finance Lease Obligations and Cash and Cash

Equivalents

The following table details the U.S. dollar equivalent balances

of the outstanding principal amounts of our debt and finance lease

obligations, and cash and cash equivalents at September 30,

2023:

Debt

Finance lease

obligations

Debt and

finance lease

obligations

Cash, cash equivalents and

restricted cash related to debt

in millions

Liberty Latin America1

$

221.0

$

—

$

221.0

$

118.7

C&W2

4,659.7

—

4,659.7

384.1

Liberty Puerto Rico3

2,642.6

5.5

2,648.1

52.2

Liberty Costa Rica

456.5

2.5

459.0

24.6

Total

$

7,979.8

$

8.0

$

7,987.8

$

579.6

Consolidated Leverage and Liquidity

Information:

September 30,

2023

June 30, 2023

Consolidated debt and finance lease

obligations to operating income ratio

13.4x

16.6x

Consolidated net debt and finance lease

obligations to operating income ratio

12.4x

15.3x

Consolidated gross leverage ratio4

4.6x

4.8x

Consolidated net leverage ratio4

4.3x

4.4x

Weighted average debt tenor5

4.6 years

4.8 years

Fully-swapped borrowing costs

6.0%

5.9%

Unused borrowing capacity (in

millions)6

$887.0

$956.9

- Represents the amount held by Liberty Latin America on a

standalone basis plus the aggregate amount held by subsidiaries of

Liberty Latin America that are outside our borrowing groups.

- Represents the C&W borrowing group, including the C&W

Caribbean, Liberty Networks and C&W Panama reportable

segments.

- Cash amount includes restricted cash that serves as collateral

against certain lines of credit associated with the funding

received from the FCC to continue to expand and improve our fixed

network in Puerto Rico.

- Consolidated leverage ratios are non-GAAP measures. For

additional information, including definitions of our consolidated

leverage ratios and required reconciliations, see Non-GAAP

Reconciliations below.

- For purposes of calculating our weighted average tenor, total

debt excludes vendor financing and finance lease obligations.

- At September 30, 2023, the full amount of unused borrowing

capacity under our subsidiaries' revolving credit facilities was

available to be borrowed, both before and after completion of the

September 30, 2023 compliance reporting requirements.

Quarterly Subscriber Variance

Fixed and Mobile Subscriber

Variance Table — September 30, 2023 vs June 30, 2023

Homes Passed

Two-way Homes

Passed

Fixed-line Customer

Relationships

Video RGUs

Internet RGUs

Telephony RGUs

Total

RGUs

Prepaid

Postpaid

Total Mobile

Subscribers

C&W Caribbean:

Jamaica

4,800

4,800

1,800

(700

)

3,600

4,600

7,500

3,800

8,000

11,800

The Bahamas

—

—

1,100

400

1,000

400

1,800

(4,900

)

600

(4,300

)

Trinidad and Tobago

—

—

(1,200

)

(2,300

)

(2,700

)

(2,100

)

(7,100

)

—

—

—

Barbados

—

—

100

100

500

(300

)

300

400

2,300

2,700

Other

(300

)

(200

)

(200

)

(800

)

600

(1,300

)

(1,500

)

(3,000

)

5,900

2,900

Total C&W Caribbean

4,500

4,600

1,600

(3,300

)

3,000

1,300

1,000

(3,700

)

16,800

13,100

C&W Panama

12,900

12,900

(1,000

)

1,900

5,200

5,200

12,300

6,100

(8,100

)

(2,000

)

Total C&W

17,400

17,500

600

(1,400

)

8,200

6,500

13,300

2,400

8,700

11,100

Liberty Puerto Rico

1,600

1,600

4,300

(2,500

)

5,600

900

4,000

(17,700

)

(6,800

)

(24,500

)

Liberty Costa Rica

8,300

8,300

(1,200

)

(1,300

)

1,500

6,300

6,500

18,100

27,000

45,100

Total Organic Change

27,300

27,400

3,700

(5,200

)

15,300

13,700

23,800

2,800

28,900

31,700

Q3 2023 Adjustments:

C&W Caribbean - Jamaica

—

—

—

—

—

—

—

(10,200

)

—

(10,200

)

C&W Caribbean - Other

7,800

7,800

—

—

—

—

—

—

—

—

C&W Panama1

82,100

82,100

—

—

—

—

—

—

—

—

Total Q3 2023 Adjustments:

89,900

89,900

—

—

—

—

—

(10,200

)

—

(10,200

)

Net Adds (Losses)

117,200

117,300

3,700

(5,200

)

15,300

13,700

23,800

(7,400

)

28,900

21,500

- Relates to homes passed adjustments through the network upgrade

process.

ARPU per Customer Relationship

The following table provides ARPU per customer relationship for

the indicated periods:

Three months ended

FX-Neutral1

September 30, 2023

June 30, 2023

% Change

% Change

Reportable Segment:

C&W Caribbean

$

49.29

$

48.99

1

%

1

%

C&W Panama

$

38.39

$

37.64

2

%

2

%

Liberty Puerto Rico

$

74.05

$

74.96

(1

%)

(1

%)

Liberty Costa Rica2

$

45.84

$

47.09

(3

%)

(3

%)

Cable & Wireless Borrowing

Group

$

46.71

$

46.32

1

%

1

%

Mobile ARPU

The following table provides ARPU per mobile subscriber for the

indicated periods:

Three months ended

FX-Neutral1

September 30, 2023

June 30, 2023

% Change

% Change

Reportable Segment:

C&W Caribbean

$

14.46

$

14.09

3

%

3

%

C&W Panama

$

11.17

$

11.07

1

%

1

%

Liberty Puerto Rico

$

38.81

$

38.50

1

%

1

%

Liberty Costa Rica3

$

6.56

$

6.62

(1

%)

(1

%)

Cable & Wireless Borrowing

Group

$

12.80

$

12.56

2

%

2

%

- The FX-Neutral change represents the percentage change on a

sequential basis adjusted for FX impacts and is calculated by

adjusting the current-period figures to reflect translation at the

foreign currency rates used to translate the prior quarter

amounts.

- The ARPU per customer relationship amounts in Costa Rican

colones for the three months ended September 30, 2023 and June 30,

2023 were CRC 24,760 and CRC 25,451, respectively.

- The mobile ARPU amount in Costa Rican colones for the three

months ended September 30, 2023 and June 30, 2023 were CRC 3,544

and CRC 3,579, respectively.

Forward-Looking Statements and Disclaimer

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995, including statements regarding our strategies, priorities and

objectives, performance, guidance and growth expectations for 2023;

our digital strategy, product innovation and commercial plans and

projects; subscriber growth; expectations on demand for

connectivity in the region; our anticipated integration plans,

including timing for completion, synergies, opportunities and

integration costs in Puerto Rico following the AT&T

Acquisition, in Costa Rica following the acquisition of

Telefónica's Costa Rica business and in Panama following the

acquisition of América Móvil’s Panama operations; statements

regarding the benefits and expected impact of the transaction with

DISH Networks; the strength of our balance sheet and tenor of our

debt; our share repurchase program; and other information and

statements that are not historical fact. These forward-looking

statements involve certain risks and uncertainties that could cause

actual results to differ materially from those expressed or implied

by these statements. These risks and uncertainties include events

that are outside of our control, such as hurricanes and other

natural disasters, political or social events, and pandemics, such

as COVID-19, the uncertainties surrounding such events, the ability

and cost to restore networks in the markets impacted by hurricanes

or generally to respond to any such events; the continued use by

subscribers and potential subscribers of our services and their

willingness to upgrade to our more advanced offerings; our ability

to meet challenges from competition, to manage rapid technological

change or to maintain or increase rates to our subscribers or to

pass through increased costs to our subscribers; the effects of

changes in laws or regulation; general economic factors; our

ability to successfully acquire and integrate new businesses and

realize anticipated efficiencies from acquired businesses; the

ability to obtain regulatory approvals for the transaction with

DISH Networks and satisfy the other conditions to closing; the

availability of attractive programming for our video services and

the costs associated with such programming; our ability to achieve

forecasted financial and operating targets; the outcome of any

pending or threatened litigation; the ability of our operating

companies to access cash of their respective subsidiaries; the

impact of our operating companies' future financial performance, or

market conditions generally, on the availability, terms and

deployment of capital; fluctuations in currency exchange and

interest rates; the ability of suppliers and vendors to timely

deliver quality products, equipment, software, services and access;

our ability to adequately forecast and plan future network

requirements including the costs and benefits associated with

network expansions; and other factors detailed from time to time in

our filings with the Securities and Exchange Commission, including

our most recently filed Form 10-K and Form 10-Q. These

forward-looking statements speak only as of the date of this press

release. We expressly disclaim any obligation or undertaking to

disseminate any updates or revisions to any forward-looking

statement contained herein to reflect any change in our

expectations with regard thereto or any change in events,

conditions or circumstances on which any such statement is

based.

About Liberty Latin America

Liberty Latin America is a leading communications company

operating in over 20 countries across Latin America and the

Caribbean under the consumer brands BTC, Flow, Liberty and Más

Móvil, and through ClaroVTR, our joint venture in Chile. The

communications and entertainment services that we offer to our

residential and business customers in the region include digital

video, broadband internet, telephony and mobile services. Our

business products and services include enterprise-grade

connectivity, data center, hosting and managed solutions, as well

as information technology solutions with customers ranging from

small and medium enterprises to international companies and

governmental agencies. In addition, Liberty Latin America operates

a subsea and terrestrial fiber optic cable network that connects

approximately 40 markets in the region.

Liberty Latin America has three separate classes of common

shares, which are traded on the NASDAQ Global Select Market under

the symbols “LILA” (Class A) and “LILAK” (Class C), and on the OTC

link under the symbol “LILAB” (Class B).

For more information, please visit www.lla.com.

Footnotes

- Rebased growth rates are a non-GAAP measure. The indicated

growth rates are rebased for the estimated impacts of (i) for the

nine-month comparison, an acquisition, (ii) a disposition, (iii)

the acquisition by our Liberty Costa Rica segment of the B2B Costa

Rican operations within our Liberty Networks segment and (iv) FX.

See Non-GAAP Reconciliations below.

- We provide rebased revenue and Adjusted OIBDA growth rates,

each a non-GAAP measure, for Liberty Latin America excluding VTR in

light of the October 2022 deconsolidation of VTR that occurred in

connection with the closing of our joint venture in Chile with

América Móvil. See the tables below for the required non-GAAP

reconciliations.

- Consolidated Adjusted OIBDA is a non-GAAP measure. For the

definition of Adjusted OIBDA and required reconciliations, see

Non-GAAP Reconciliations below.

- Adjusted Free Cash Flow (“Adjusted FCF”) is a non-GAAP measure.

For the definition of Adjusted FCF and required reconciliations,

see Non-GAAP Reconciliations below.

- See Glossary for the definition of RGUs and mobile subscribers.

Organic figures exclude RGUs and mobile subscribers of acquired

entities at the date of acquisition and other non-organic

adjustments, but include the impact of changes in RGUs and mobile

subscribers from the date of acquisition. All subscriber / RGU

additions or losses refer to net organic changes, unless otherwise

noted.

Additional Information | Cable & Wireless Borrowing

Group

The following tables reflect preliminary unaudited selected

financial results, on a consolidated C&W basis, for the periods

indicated, in accordance with U.S. GAAP.

Three months ended

September 30,

Change

Rebased change1

2023

2022

in millions, except %

amounts

Revenue

$

640.9

$

615.1

4

%

4

%

Operating income

$

90.2

$

59.6

51

%

Adjusted OIBDA

$

273.4

$

238.0

15

%

16

%

Property & equipment additions

$

106.0

$

100.4

6

%

Operating income as a percentage of

revenue

14.1

%

9.7

%

Adjusted OIBDA as a percentage of

revenue

42.7

%

38.7

%

Proportionate Adjusted OIBDA

$

230.7

$

201.5

Nine months ended

September 30,

Change

Rebased change1

2023

2022

in millions, except %

amounts

Revenue

$

1,882.6

$

1,779.3

6

%

3

%

Operating income (loss)

$

205.0

$

(329.2

)

(162

%)

Adjusted OIBDA

$

798.1

$

725.0

10

%

12

%

Property & equipment additions

$

293.6

$

255.0

15

%

Operating income (loss) as a percentage of

revenue

10.9

%

(18.5

)%

Adjusted OIBDA as a percentage of

revenue

42.4

%

40.7

%

Proportionate Adjusted OIBDA

$

677.5

$

620.7

- Indicated growth rates are rebased for the estimated impacts of

an acquisition for the nine-month comparison, FX and the

acquisition by the Liberty Costa Rica borrowing group of the B2B

Costa Rican operations within our C&W borrowing group.

The following table details the U.S. dollar equivalent of the

nominal amount outstanding of C&W's third-party debt and cash

and cash equivalents:

September 30,

June 30,

Facility Amount

2023

2023

in millions

Credit Facilities:

Revolving Credit Facility due 2027

(Adjusted Term SOFR1 + 3.25%)

$

580.0

$

20.0

$

—

Term Loan Facility B-5 due 2028 (Adjusted

Term SOFR1 + 2.25%)

$

1,510.0

1,510.0

1,510.0

Term Loan Facility B-6 due 2029 (Adjusted

Term SOFR1 + 3.00%)

$

590.0

590.0

590.0

Total Senior Secured Credit Facilities

2,120.0

2,100.0

4.25% CWP Term Loan due 2028

$

435.0

435.0

435.0

Regional and other debt2

129.3

129.6

Total Credit Facilities

2,684.3

2,664.6

Notes:

5.75% USD Senior Secured Notes due

2027

$

495.0

495.0

495.0

6.875% USD Senior Notes due 2027

$

1,220.0

1,220.0

1,220.0

Total Notes

1,715.0

1,715.0

Vendor financing

260.4

260.7

Total third-party debt

4,659.7

4,640.3

Less: premiums, discounts and deferred

financing costs, net

(27.4

)

(29.0

)

Total carrying amount of third-party

debt

4,632.3

4,611.3

Less: cash and cash equivalents

(384.1

)

(474.6

)

Net carrying amount of third-party

debt

$

4,248.2

$

4,136.7

- During May 2023, the terms of the agreements underlying the

C&W Credit Facilities were amended, which resulted in (i) the

replacement of LIBOR-based benchmark rates with Adjusted Term SOFR

for the C&W Term Loan B-5 Facility, the C&W Term Loan B-6

Facility and the C&W Revolving Credit Facility for interest

periods commencing after June 30, 2023, (ii) the modification of

the provisions for determining an alternative rate of interest upon

the occurrence of certain events relating to the availability of

interest rate benchmarks and (iii) certain conforming changes.

- Amounts include $69 million of amortizing loans which are due

in three annual installments beginning in May 2024.

- At September 30, 2023, our third-party total and proportionate

net debt was $4.2 billion and $4.0 billion, respectively, our

Fully-swapped Borrowing Cost was 5.4%, and the average tenor of our

debt obligations (excluding vendor financing) was approximately 4.4

years.

- Our portion of Adjusted OIBDA, after deducting the

noncontrolling interests' share, (“Proportionate Adjusted OIBDA”)

was $231 million for Q3 2023.

- C&W's Covenant Proportionate Net Leverage Ratio was 4.1x,

which is calculated by annualizing the last two quarters of

Covenant EBITDA in accordance with C&W's Credit Agreement.

- At September 30, 2023, we had maximum undrawn commitments of

$655 million, including $95 million under our regional facilities.

At September 30, 2023, the full amount of unused borrowing capacity

under our credit facilities (including regional facilities) was

available to be borrowed, both before and after completion of the

September 30, 2023 compliance reporting requirements.

Liberty Puerto Rico (LPR) Borrowing Group

The following tables reflect preliminary unaudited selected

financial results, on a consolidated Liberty Puerto Rico basis, for

the periods indicated, in accordance with U.S. GAAP:

Three months ended

September 30,

Change

2023

2022

in millions, except %

amounts

Revenue

$

351.2

$

365.7

(4

)%

Operating income

$

48.4

$

57.8

(16

)%

Adjusted OIBDA

$

116.4

$

130.3

(11

)%

Property & equipment additions

$

56.7

$

63.8

(11

)%

Operating income as a percentage of

revenue

13.8

%

15.8

%

Adjusted OIBDA as a percentage of

revenue

33.1

%

35.6

%

Nine months ended

September 30,

Change

2023

2022

in millions, except %

amounts

Revenue

$

1,064.2

$

1,091.4

(2

)%

Operating income

$

165.5

$

190.0

(13

)%

Adjusted OIBDA

$

381.6

$

413.2

(8

)%

Property & equipment additions

$

158.4

$

154.8

2

%

Operating income as a percentage of

revenue

15.6

%

17.4

%

Adjusted OIBDA as a percentage of

revenue

35.9

%

37.9

%

The following table details the nominal amount outstanding of

Liberty Puerto Rico's third-party debt, finance lease obligations

and cash and cash equivalents:

September 30,

June 30,

Facility amount

2023

2023

in millions

Credit Facilities:

Revolving Credit Facility due 2027

(Adjusted Term SOFR1 + 3.50%)

$

172.5

$

—

$

—

Term Loan Facility due 2028 (Adjusted Term

SOFR1 + 3.75%)

$

620.0

620.0

620.0

Total Senior Secured Credit Facilities

620.0

620.0

Notes:

6.75% Senior Secured Notes due 2027

$

1,161.0

1,161.0

1,161.0

5.125% Senior Secured Notes due 2029

$

820.0

820.0

820.0

Total Notes

1,981.0

1,981.0

Vendor financing

41.6

32.4

Finance lease obligations

5.5

5.5

Total debt and finance lease

obligations

2,648.1

2,638.9

Less: premiums and deferred financing

costs, net

(23.5

)

(25.0

)

Total carrying amount of debt

2,624.6

2,613.9

Less: cash, cash equivalents and

restricted cash related to debt2

(52.2

)

(21.5

)

Net carrying amount of debt

$

2,572.4

$

2,592.4

- During May 2023, the terms of the agreements underlying the LPR

Credit Facilities were amended, which resulted in (i) the

replacement of LIBOR-based benchmark rates with Adjusted Term SOFR

for the 2028 LPR Term Loan and the LPR Revolving Credit Facility

for interest periods commencing after June 30, 2023, (ii) the

modification of the provisions for determining an alternative rate

of interest upon the occurrence of certain events relating to the

availability of interest rate benchmarks and (iii) certain

conforming changes.

- Cash amount at September 30, 2023 includes restricted cash that

serves as collateral against certain lines of credit associated

with the funding received from the FCC to continue to expand and

improve our fixed network in Puerto Rico.

- At September 30, 2023, our Fully-swapped Borrowing Cost was

6.1% and the average tenor of our debt (excluding vendor financing)

was approximately 4.8 years.

- LPR's Covenant Consolidated Net Leverage Ratio was 5.1x, which

is calculated by annualizing the last two quarters of Covenant

EBITDA in accordance with LPR’s Group Credit Agreement.

- At September 30, 2023, we had maximum undrawn commitments of

$173 million. At September 30, 2023, the full amount of unused

borrowing capacity under our revolving credit facility was

available to be borrowed, both before and after completion of the

September 30, 2023 compliance reporting requirements.

Liberty Costa Rica Borrowing Group

The following tables reflect preliminary unaudited selected

financial results, on a consolidated Liberty Costa Rica basis, for

the periods indicated, in accordance with U.S. GAAP:

Three months ended

September 30,

Change

Rebased change1

2023

2022

CRC in billions, except %

amounts

Revenue

72.7

72.1

1

%

—

%

Operating income

16.0

7.6

111

%

Adjusted OIBDA

26.9

21.6

25

%

21

%

Property & equipment additions

8.6

13.6

(37

%)

Operating income as a percentage of

revenue

22.0

%

10.5

%

Adjusted OIBDA as a percentage of

revenue

37.0

%

30.0

%

Nine months ended

September 30,

Change

Rebased change1

2023

2022

CRC in billions, except %

amounts

Revenue

218.4

214.2

2

%

1

%

Operating income

37.4

25.8

45

%

Adjusted OIBDA

79.4

65.1

22

%

19

%

Property & equipment additions

25.2

30.2

(17

%)

Operating income as a percentage of

revenue

17.1

%

12.0

%

Adjusted OIBDA as a percentage of

revenue

36.4

%

30.4

%

- Indicated growth rates are rebased for the acquisition by the

Liberty Costa Rica borrowing group of the B2B Costa Rican

operations within our C&W borrowing group.

The following table details the borrowing currency and Costa

Rican colón equivalent of the nominal amount outstanding of Liberty

Costa Rica's third-party debt, finance lease obligations and cash

and cash equivalents:

September 30,

June 30,

2023

2023

Borrowing currency in

millions

CRC equivalent in

billions

10.875% Term Loan A Facility due 20311

$

50.0

26.8

27.3

10.875% Term Loan B Facility due 20311

$

400.0

214.7

218.6

Revolving Credit Facility due 2028 (Term

SOFR2 + 4.25%)

$

60.0

—

—

Total credit facilities

241.5

245.9

Other

3.5

3.6

Finance lease obligations

1.4

1.4

Total debt and finance lease

obligations

246.4

250.9

Less: deferred financing costs

(7.7

)

(8.4

)

Total carrying amount of debt

238.7

242.5

Less: cash and cash equivalents

(13.2

)

(19.1

)

Net carrying amount of debt

225.5

223.4

Exchange rate (CRC to $)

536.8

546.4

- From July 15, 2028 and thereafter, the interest rate is subject

to increase by 0.125% per annum for each of the two Sustainability

Performance Targets (as defined in the credit agreement) not

achieved by Liberty Costa Rica by no later than December 31,

2027.

- Forward-looking term rate based on SOFR as published by CME

Group Benchmark Administration Limited.

- At September 30, 2023, our Fully-swapped Borrowing Cost was

10.9% and the average tenor of our debt was approximately 7.3

years.

- LCR's Covenant Consolidated Net Leverage Ratio was 2.1x, which

is calculated by annualizing the last two quarters of Covenant

EBITDA in accordance with LCR’s Credit Agreement.

- At September 30, 2023, we had maximum undrawn commitments of

$60 million. At September 30, 2023, the full amount of unused

borrowing capacity under our revolving credit facility was

available to be borrowed, both before and after completion of the

September 30, 2023 compliance reporting requirements.

Subscriber Table

Consolidated Operating Data —

September 30, 2023

Homes Passed

Two-way Homes Passed

Fixed-line Customer

Relationships

Video RGUs

Internet RGUs

Telephony RGUs

Total

RGUs

Prepaid

Postpaid

Total Mobile

Subscribers

C&W Caribbean:

Jamaica

701,000

701,000

343,400

129,700

325,000

320,400

775,100

1,107,700

99,300

1,207,000

The Bahamas

120,900

120,900

35,700

7,800

27,500

34,600

69,900

139,200

24,400

163,600

Trinidad and Tobago

340,900

340,900

149,000

98,400

133,100

92,500

324,000

—

—

—

Barbados

140,400

140,400

84,700

38,500

77,100

69,400

185,000

82,100

47,100

129,200

Other

358,000

338,200

216,500

73,000

191,800

112,400

377,200

319,000

119,900

438,900

Total C&W Caribbean

1,661,200

1,641,400

829,300

347,400

754,500

629,300

1,731,200

1,648,000

290,700

1,938,700

C&W Panama

943,600

943,700

256,300

163,800

225,900

215,800

605,500

1,615,700

352,500

1,968,200

Total C&W

2,604,800

2,585,100

1,085,600

511,200

980,400

845,100

2,336,700

3,263,700

643,200

3,906,900

Liberty Puerto Rico 1,2

1,177,700

1,177,700

577,800

238,900

542,900

263,300

1,045,100

133,300

894,500

1,027,800

Liberty Costa Rica 3

741,900

736,000

278,900

183,600

262,200

70,400

516,200

2,222,200

876,100

3,098,300

Total

4,524,400

4,498,800

1,942,300

933,700

1,785,500

1,178,800

3,898,000

5,619,200

2,413,800

8,033,000

- Prepaid mobile subscribers include 17,100 mobile reseller

subscribers.

- Postpaid mobile subscribers include 209,500 CRUs.

- Our homes passed in Liberty Costa Rica include 54,000 homes on

a third-party network that provides us long-term access.

Glossary

Adjusted OIBDA Margin – Calculated by dividing Adjusted

OIBDA by total revenue for the applicable period.

ARPU – Average revenue per unit refers to the average

monthly subscription revenue (subscription revenue excludes

interconnect, mobile handset sales and late fees) per average

customer relationship or mobile subscriber, as applicable. ARPU per

average customer relationship is calculated by dividing the average

monthly subscription revenue from residential fixed and SOHO fixed

services by the average of the opening and closing balances for

customer relationships for the indicated period. ARPU per average

mobile subscriber is calculated by dividing the average monthly

mobile service revenue by the average of the opening and closing

balances for mobile subscribers for the indicated period. Unless

otherwise indicated, ARPU per customer relationship or mobile

subscriber is not adjusted for currency impacts. ARPU per average

RGU is calculated by dividing the average monthly subscription

revenue from the applicable residential fixed service by the

average of the opening and closing balances of the applicable RGUs

for the indicated period. Unless otherwise noted, ARPU in this

release is considered to be ARPU per average customer relationship

or mobile subscriber, as applicable. Customer relationships, mobile

subscribers and RGUs of entities acquired during the period are

normalized.

Consolidated Debt and Finance Lease Obligations to Operating

Income Ratio – Defined as total principal amount of debt

outstanding (including liabilities related to vendor financing and

and finance lease obligations) to annualized operating income from

the most recent two consecutive fiscal quarters.

Consolidated Net Debt and Finance Lease Obligations to

Operating Income Ratio – Defined as total principal amount of

debt outstanding (including liabilities related to vendor financing

and and finance lease obligations) less cash, cash equivalents and

restricted cash related to debt to annualized operating income from

the most recent two consecutive fiscal quarters.

CRU – Corporate responsible user.

Customer Relationships – The number of customers who

receive at least one of our video, internet or telephony services

that we count as RGUs, without regard to which or to how many

services they subscribe. To the extent that RGU counts include

equivalent billing unit (“EBU”) adjustments, we reflect

corresponding adjustments to our customer relationship counts. For

further information regarding our EBU calculation, see Additional

General Notes below. Customer relationships generally are counted

on a unique premises basis. Accordingly, if an individual receives

our services in two premises (e.g., a primary home and a vacation

home), that individual generally will count as two customer

relationships. We exclude mobile-only customers from customer

relationships.

Fully-swapped Borrowing Cost – Represents the weighted

average interest rate on our debt (excluding finance leases and

including vendor financing obligations), including the effects of

derivative instruments, original issue premiums or discounts, which

includes a discount on the convertible notes issued by Liberty

Latin America associated with a conversion option feature, and

commitment fees, but excluding the impact of financing costs.

Homes Passed – Homes, residential multiple dwelling units

or commercial units that can be connected to our networks without

materially extending the distribution plant. Certain of our homes

passed counts are based on census data that can change based on

either revisions to the data or from new census results.

Internet (Broadband) RGU – A home, residential multiple

dwelling unit or commercial unit that receives internet services

over our network.

Leverage – Our gross and net leverage ratios, each a

non-GAAP measure, are defined as total debt (total principal amount

of debt outstanding, including liabilities related to vendor

financing and and finance lease obligations, net of projected

derivative principal-related cash payments (receipts)) and net debt

to annualized Adjusted OIBDA of the latest two quarters. Net debt

is defined as total debt (including the convertible notes and

liabilities related to vendor financing and finance lease

obligations) less cash, cash equivalents and restricted cash

related to debt. For purposes of these calculations, debt is

measured using swapped foreign currency rates, consistent with the

covenant calculation requirements of our subsidiary debt

agreements.

Mobile Subscribers – Our mobile subscriber count

represents the number of active subscriber identification module

(“SIM”) cards in service rather than services provided. For

example, if a mobile subscriber has both a data and voice plan on a

smartphone this would equate to one mobile subscriber.

Alternatively, a subscriber who has a voice and data plan for a

mobile handset and a data plan for a laptop (via a dongle) would be

counted as two mobile subscribers. Customers who do not pay a

recurring monthly fee are excluded from our mobile telephony

subscriber counts after periods of inactivity ranging from 30 to 90

days, based on industry standards within the respective country. In

a number of countries, our mobile subscribers receive mobile

services pursuant to prepaid contracts. Our Liberty Puerto Rico

segment prepaid subscriber count includes mobile reseller

subscribers, which represent organizations that purchase minutes

and data at wholesale prices and subsequently resell it under the

purchaser's brand name. These reseller subscribers result in a

significantly lower ARPU than the remaining subscribers included in

our prepaid balance. Additionally, our Liberty Puerto Rico segment

postpaid subscriber count includes CRUs, which represent an

individual receiving mobile services through an organization that

has entered into a contract for mobile services with us and where

the organization is responsible for the payment of the CRU’s mobile

services.

NPS – Net promoter score.

Property and Equipment Addition Categories

- Customer Premises Equipment: Includes capitalizable equipment

and labor, materials and other costs directly associated with the

installation of such CPE;

- New Build & Upgrade: Includes capitalizable costs of

network equipment, materials, labor and other costs directly

associated with entering a new service area and upgrading our

existing network;

- Capacity: Includes capitalizable costs for network capacity

required for growth and services expansions from both existing and

new customers. This category covers Core and Access parts of the

network and includes, for example, fiber node splits,

upstream/downstream spectrum upgrades and optical equipment

additions in our international backbone connections;

- Baseline: Includes capitalizable costs of equipment, materials,

labor and other costs directly associated with maintaining and

supporting the business. Relates to areas such as network

improvement, property and facilities, technical sites, information

technology systems and fleet; and

- Product & Enablers: Discretionary capitalizable costs that

include investments (i) required to support, maintain, launch or

innovate in new customer products, and (ii) in infrastructure,

which drive operational efficiency over the long term.

Proportionate Net Leverage Ratio (C&W) – Calculated

in accordance with C&W's Credit Agreement, taking into account

the ratio of outstanding indebtedness (subject to certain

exclusions) less cash and cash equivalents to EBITDA (subject to

certain adjustments) for the last two quarters annualized, with

both indebtedness and EBITDA reduced proportionately to remove any

noncontrolling interests' share of the C&W group.

Revenue Generating Unit (RGU) – RGU is separately a video

RGU, internet RGU or telephony RGU. A home, residential multiple

dwelling unit, or commercial unit may contain one or more RGUs. For

example, if a residential customer in Puerto Rico subscribed to our

video service, fixed-line telephony service and broadband internet

service, the customer would constitute three RGUs. RGUs are

generally counted on a unique premises basis such that a given

premises does not count as more than one RGU for any given service.

On the other hand, if an individual receives one of our services in

two premises (e.g., a primary home and a vacation home), that

individual will count as two RGUs for that service. Each bundled

video, internet or telephony service is counted as a separate RGU

regardless of the nature of any bundling discount or promotion.

Non-paying subscribers are counted as RGUs during their free

promotional service period. Some of these subscribers may choose to

disconnect after their free service period. Services offered

without charge on a long-term basis (e.g., VIP subscribers or free

service to employees) generally are not counted as RGUs. We do not

include subscriptions to mobile services in our externally reported

RGU counts. In this regard, our RGU counts exclude our separately

reported postpaid and prepaid mobile subscribers.

SOHO – Small office/home office customers.

Telephony RGU – A home, residential multiple dwelling

unit or commercial unit that receives voice services over our

network. Telephony RGUs exclude mobile subscribers.

Two-way Homes Passed – Homes passed by those sections of

our networks that are technologically capable of providing two-way

services, including video, internet and telephony services.

U.S. GAAP – Generally accepted accounting principles in

the United States.

Video RGU – A home, residential multiple dwelling unit or

commercial unit that receives our video service over our network,

primarily via a digital video signal while subscribing to any

recurring monthly service that requires the use of

encryption-enabling technology. Video RGUs that are not counted on

an EBU basis are generally counted on a unique premises basis. For

example, a subscriber with one or more set-top boxes that receives

our video service in one premises is generally counted as just one

RGU.

Additional General Notes

Most of our operations provide telephony, broadband internet,

mobile data, video or other B2B services. Certain of our B2B

service revenue is derived from SOHO customers that pay a premium

price to receive enhanced service levels along with video, internet

or telephony services that are the same or similar to the mass

marketed products offered to our residential subscribers. All mass

marketed products provided to SOHO customers, whether or not

accompanied by enhanced service levels and/or premium prices, are

included in the respective RGU and customer counts of our

operations, with only those services provided at premium prices

considered to be “SOHO RGUs” or “SOHO customers.” To the extent our

existing customers upgrade from a residential product offering to a

SOHO product offering, the number of SOHO RGUs and SOHO customers

will increase, but there is no impact to our total RGU or customer

counts. With the exception of our B2B SOHO customers, we generally

do not count customers of B2B services as customers or RGUs for

external reporting purposes.

Certain of our residential and commercial RGUs are counted on an

EBU basis, including residential multiple dwelling units and

commercial establishments, such as bars, hotels, and hospitals, in

Puerto Rico. Our EBUs are generally calculated by dividing the bulk

price charged to accounts in an area by the most prevalent price

charged to non-bulk residential customers in that market for the

comparable tier of service. As such, we may experience variances in

our EBU counts solely as a result of changes in rates.

While we take appropriate steps to ensure that subscriber and

homes passed statistics are presented on a consistent and accurate

basis at any given balance sheet date, the variability from country

to country in (i) the nature and pricing of products and services,

(ii) the distribution platform, (iii) billing systems, (iv) bad

debt collection experience and (v) other factors add complexity to

the subscriber and homes passed counting process. We periodically

review our subscriber and homes passed counting policies and

underlying systems to improve the accuracy and consistency of the

data reported on a prospective basis. Accordingly, we may from time

to time make appropriate adjustments to our subscriber and homes

passed statistics based on those reviews.

Non-GAAP Reconciliations

We include certain financial measures in this press release that

are considered non-GAAP measures, including (i) Adjusted OIBDA and

Adjusted OIBDA Margin, each on a consolidated basis, (ii) Adjusted

Free Cash Flow, (iii) rebased revenue and rebased Adjusted OIBDA

growth rates, and (iv) consolidated leverage ratios. The following

sections set forth reconciliations of the nearest GAAP measure to

our non-GAAP measures, as well as information on how and why

management of the Company believes such information is useful to an

investor.

Adjusted OIBDA

On a consolidated basis, Adjusted OIBDA, a non-GAAP measure, is

the primary measure used by our chief operating decision maker to

evaluate segment operating performance. Adjusted OIBDA is also a

key factor that is used by our internal decision makers to

determine how to allocate resources to segments. As we use the

term, Adjusted OIBDA is defined as operating income or loss before

share-based compensation, depreciation and amortization, provisions

and provision releases related to significant litigation and

impairment, restructuring and other operating items. Other

operating items include (i) gains and losses on the disposition of

long-lived assets, (ii) third-party costs directly associated with

successful and unsuccessful acquisitions and dispositions,

including legal, advisory and due diligence fees, as applicable,

and (iii) other acquisition-related items, such as gains and losses

on the settlement of contingent consideration. Our internal

decision makers believe Adjusted OIBDA is a meaningful measure

because it represents a transparent view of our recurring operating

performance that is unaffected by our capital structure and allows

management to (i) readily view operating trends, (ii) perform

analytical comparisons and benchmarking between segments and (iii)

identify strategies to improve operating performance in the

different countries in which we operate. We believe our Adjusted

OIBDA measure is useful to investors because it is one of the bases

for comparing our performance with the performance of other

companies in the same or similar industries, although our measure

may not be directly comparable to similar measures used by other

public companies. Adjusted OIBDA should be viewed as a measure of

operating performance that is a supplement to, and not a substitute

for, operating income or loss, net earnings or loss and other U.S.

GAAP measures of income. A reconciliation of our operating income

or loss to total Adjusted OIBDA is presented in the following

table:

Three months ended

Nine months ended

September 30,

September 30,

2023

2022

2023

2022

in millions

Operating income (loss)

$

162.7

$

151.7

$

404.7

$

(20.4

)

Share-based compensation expense

24.1

20.8

77.8

82.6

Depreciation and amortization

230.5

234.3

705.6

661.7

Impairment, restructuring and other

operating items, net

11.1

7.0

81.6

583.4

Adjusted OIBDA

$

428.4

$

413.8

$

1,269.7

$

1,307.3

Operating income (loss) margin1

14.5

%

12.4

%

12.1

%

(0.6

)%

Adjusted OIBDA margin2

38.1

%

33.9

%

37.9

%

35.8

%

- Calculated by dividing operating income (loss) by total revenue

for the applicable period.

- Calculated by dividing Adjusted OIBDA by total revenue for the

applicable period.

Adjusted Free Cash Flow Definition and Reconciliation

We define Adjusted Free Cash Flow (Adjusted FCF), a non-GAAP

measure, as net cash provided by our operating activities, plus (i)

cash payments for third-party costs directly associated with

successful and unsuccessful acquisitions and dispositions, (ii)

expenses financed by an intermediary, (iii) insurance recoveries

related to damaged and destroyed property and equipment and (iv)

certain net interest payments or receipts incurred or received,

including associated derivative instrument payments and receipts,

in advance of a significant acquisition, less (a) capital

expenditures, net, (b) principal payments on amounts financed by

vendors and intermediaries, (c) principal payments on finance

leases, and (d) distributions to noncontrolling interest owners. We

believe that our presentation of Adjusted FCF provides useful

information to our investors because this measure can be used to

gauge our ability to service debt and fund new investment

opportunities. Adjusted FCF should not be understood to represent

our ability to fund discretionary amounts, as we have various

mandatory and contractual obligations, including debt repayments,

which are not deducted to arrive at this amount. Investors should

view Adjusted FCF as a supplement to, and not a substitute for,

U.S. GAAP measures of liquidity included in our consolidated

statements of cash flows.

The following table provides the reconciliation of our net cash

provided by operating activities to Adjusted FCF for the indicated

period:

Three months ended

Nine months ended

September 30,

September 30,

2023

2022

2023

2022

in millions

Net cash provided by operating

activities

$

218.5

$

144.7

$

506.5

$

491.8

Cash payments for direct acquisition and

disposition costs

1.5

15.3

5.0

18.4

Expenses financed by an intermediary1

38.4

36.3

132.3

115.7

Capital expenditures, net

(149.8

)

(175.0

)

(422.9

)

(494.1

)

Principal payments on amounts financed by

vendors and intermediaries

(75.5

)

(60.4

)

(164.9

)

(154.1

)

Pre-acquisition interest payments,

net2

—

1.5

—

3.9

Principal payments on finance leases

(0.2

)

(0.7

)

(0.7

)

(0.9

)

Adjusted FCF before distributions to

noncontrolling interest owners

32.9

(38.3

)

55.3

(19.3

)

Distributions to noncontrolling interest

owners

—

—

(41.2

)

(1.9

)

Adjusted FCF

$

32.9

$

(38.3

)

$

14.1

$

(21.2

)

- For purposes of our condensed consolidated statements of cash

flows, expenses, including value-added taxes, financed by an

intermediary are treated as operating cash outflows and financing

cash inflows when the expenses are incurred. When we pay the

financing intermediary, we record financing cash outflows in our

condensed consolidated statements of cash flows. For purposes of

our Adjusted FCF definition, we add back the operating cash

outflows when these financed expenses are incurred and deduct the

financing cash outflows when we pay the financing

intermediary.

- The amounts for the 2022 periods relate to the portion of

interest paid that relates to the pre-acquisition debt for the

Claro Panama Acquisition.

Rebase Information

Rebase growth rates are a non-GAAP measure. For purposes of

calculating rebased growth rates on a comparable basis for all

businesses that we owned during the current year, we have adjusted

our historical revenue and Adjusted OIBDA to include or exclude the

pre-acquisition amounts of acquired, disposed or transferred

businesses, as applicable, to the same extent they are included or

excluded from the current year. The businesses that were acquired,

disposed or transferred impacting the comparative periods are as

follows:

- Claro Panamá, which was acquired on July 1, 2022;

- VTR, which was deconsolidated as of October 6, 2022; and

- the January 2023 acquisition by our Liberty Costa Rica segment

of the B2B Costa Rican operations within our Liberty Networks

segment.