Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

January 27 2025 - 9:35AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16

UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For

the month of January 2025

Commission

File Number: 001-41467

Magic

Empire Global Limited

3/F,

8 Wyndham Street

Central,

Hong Kong

(Address

of Principal Executive Offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

As

previously disclosed, on November 29, 2024, Magic Empire Global Limited (the “Company”) held its 2024 general meeting (the

“Meeting”). At the Meeting, among other resolutions approved, the shareholders of the Company adopted the following resolutions:

The

maximum number of shares the company was authorized to issue change from 600,000,000 shares of a par value of US$0.0001 each divided

into 300,000,000 ordinary shares of a par value of US$0.0001 each (the “ordinary shares”) and 300,000,000 non-voting ordinary

shares of a par value of US$0.0001 each, to become: 600,000,000 shares with no par value each divided into 280,000,000 class A ordinary

shares with no par value each (the “Class A Ordinary Shares”); 20,000,000 Class B ordinary shares with no par value each

(the “Class B Ordinary Shares”) and 300,000,000 non-voting ordinary shares with no par value each (the “Non-voting

Ordinary Shares”) by re-designating and re-classifying:

(i)

the authorized and issued and outstanding Ordinary Shares in the share capital of the Company held by existing shareholders of the Company

as of the date hereof (except the 2,400,000 and 1,600,000 Ordinary Shares held by Wai Ho Chan and Sze Hon Johnson Chen, respectively),

into Class A Ordinary Shares , each conferring the holder thereof one (1) vote per Class A Ordinary Share at a meeting of members of

the Company or on any resolution of members and the other rights attached to it as set out in the Third Amended and Restated Memorandum

and Articles of Association on a one for one basis;

(ii)

the 2,400,000 and 1,600,000 authorized and issued and outstanding Ordinary Shares held by Wai Ho Chan and Sze Hon Johnson Chen, respectively,

into 2,400,000 and 1,600,000 Class B Ordinary Shares, each conferring the holder thereof twenty (20) votes per Class B Ordinary Share

at a meeting of members of the Company or on any resolution of members and the other rights attached to it as set out in the Third Amended

and Restated Memorandum and Articles of Association on a one for one basis; and

(iii)

the remaining authorized but unissued Ordinary Shares into Class A Ordinary Shares on a one for one basis.

On

December 5, 2024, the Company filed the Third Amended and Restated Memorandum of Association with the Registrar of the British Virgin

Islands.

The

change from Ordinary Shares to Class A Ordinary Shares will be reflected with the Nasdaq Capital Market and in the marketplace at the

open of business on January 28, 2025, whereupon the Class A Ordinary Shares will begin trading. The Company’s Class A Ordinary

Shares will continue to trade on the Nasdaq Capital Market under the symbol “MEGL” and under the CUSIP Number of G5865E113.

Exhibit

Index

SIGNATURES

Pursuant

to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

| |

Magic

Empire Global Limited |

| |

|

|

| Date:

January 27, 2025 |

By: |

/s/

Sze Hon, Johnson Chen |

| |

|

Sze

Hon, Johnson Chen |

| |

|

Chief

Executive Officer |

Exhibit

99.1

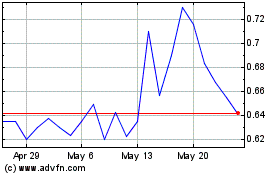

Magic Empire Global (NASDAQ:MEGL)

Historical Stock Chart

From Jan 2025 to Feb 2025

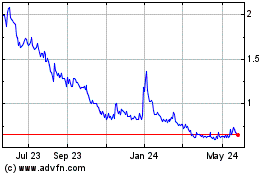

Magic Empire Global (NASDAQ:MEGL)

Historical Stock Chart

From Feb 2024 to Feb 2025