MVB Financial Corp. (NASDAQ: MVBF) (“MVB Financial,” “MVB” or

the “Company”), the holding company for MVB Bank, Inc. (“MVB

Bank”), today announced financial results for the third quarter of

2024, with reported net income of $2.1 million, or $0.16 basic and

diluted earnings per share.

Third Quarter 2024

Highlights

Previously disclosed digital asset program

exit reduced EPS by $0.29 in third quarter and $0.37

year-to-date.

Noninterest bearing deposits represent 33.0%

of total deposits.

On balance sheet payments-related deposits

increased by 60.8% due to growth in existing relationships.

Tangible book value per share of $23.20, up

2.2% from the prior quarter.

Capital strength further enhanced.

From Larry F. Mazza, Chief Executive Officer, MVB

Financial:

“MVB continues to be proactive, and we have adapted our growth

strategy related to changing market conditions. To this end, we

have simplified our number of strategic initiatives to five as we

move into fourth quarter. This laser focus by Team MVB will enhance

our ability to effectively execute on our revised strategy.

“One example of this laser focus is our payments strategy.

Growth in existing account relationships, along with new leadership

and initiatives, drove a 60.8% quarter over quarter increase in

payments-related deposit balances. Excluding the impact of the

digital asset program wind-down and termination costs related to

the decision to call two brokered certificates of deposit, net

interest income and net interest margin are approaching a positive

inflection point. Finally, while loan balances declined partly due

to elevated payoff activity, our loan pipeline has improved from

earlier this year.

“As previously disclosed, we began winding down MVB’s digital

asset program account relationships during the second quarter due

to changing market conditions and profitability challenges. While

this process is now mostly complete, our third-quarter results

reflected both the full quarter impact of this decision and

lingering costs associated with the wind-down, without any

associated revenue benefit. Alongside a higher cost base, these

factors negatively affected earnings in the third quarter,

overshadowing some of the positive trends we’ve seen.

“Through it all, MVB’s foundational strength remains intact,

evidenced by stable asset quality, an enhanced capital base and

growth in tangible book value per share. While our strategic shift

has weighed on earnings in the short-term, we are increasingly

well-positioned for future growth and improved profitability.”

THIRD QUARTER 2024 HIGHLIGHTS

- Growth in payments and gaming deposits drive increased total

deposits.

- Total deposits increased 4.1%, or $118.8 million, to $3.00

billion compared to the prior quarter-end. Deposit growth was led

by payments-related deposits, which increased by 60.8%, primarily

due to the expansion of existing relationships. Deposit growth also

reflected increased gaming deposits, partially offset by the

movement of $70.2 million of banking-as-a-service deposits off

balance sheet.

- Noninterest bearing (“NIB”) deposits increased 0.5%, or $5.3

million, to $989.1 million. NIB deposits represent 33.0% of total

deposits as of September 30, 2024.

- The loan-to-deposit ratio was 72.3% as of September 30, 2024,

compared to 76.5% as of June 30, 2024, and 74.7% as of September

30, 2023.

- Net interest income and net interest margin lower on digital

asset program wind-down and certificate of deposit termination

costs.

- Net interest income on a fully tax-equivalent basis, a non-U.S.

GAAP financial measure, declined 3.4%, or $0.9 million, to $26.8

million relative to the prior quarter, reflecting net interest

margin contraction and lower earning assets balances.

- Net interest margin on a fully tax-equivalent basis, a non-U.S.

GAAP financial measure, was 3.61%, down 14 basis points from the

prior quarter. Approximately 11 basis points of the decline in net

interest margin is attributable to the wind down of the digital

asset program. Also, approximately five basis points of net

interest margin compression reflected termination costs of $0.3

million related to the Company’s decision to call two brokered

certificates of deposit (“CDs”) with a value of $49.5 million

during the third quarter. Total cost of funds was 2.77%, up 23

basis points compared to the prior quarter, primarily reflecting

the full quarter impact of the shift in deposit mix from the

wind-down of the digital asset program and the brokered CD

termination costs.

- Average earning assets balance declined 0.9%, or $26.1 million,

from the prior quarter to $2.95 billion, reflecting lower average

loan balances, partially offset by higher interest-bearing balances

with banks. Average total loan balances declined 2.4%, or $53.3

million, from the prior quarter to $2.18 billion, reflecting

elevated loan payoff activity and muted market demand.

- Noninterest income lower on digital asset program exit,

masking progress on Fintech fee income and continued mortgage

rebound.

- Total noninterest income declined 6.8%, or $0.5 million,

relative to the prior quarter, to $6.7 million. The decline is

attributable to lower other operating income, primarily a $0.8

million decrease in wire transfer fees reflecting the full quarter

impact of the digital asset program wind-down. Excluding other

operating income, noninterest income increased 12.8%, reflecting a

continued rebound in equity method investment income from our

mortgage segment, as well as higher payment card and service charge

income, consulting and compliance income and holding gains on

equity securities.

- Relative to the prior year period, total noninterest income

increased by 15.0%, or $0.9 million, inclusive of the impact of the

digital asset program wind-down, to $6.7 million, primarily

reflecting higher payment card and service income, which increased

by 35.1% year-over-year.

- Foundational strength intact, led by enhanced capital

position, growth in tangible book value per share and stable asset

quality.

- The Community Bank Leverage Ratio, Tier 1 Risk-Based Capital

Ratio and MVB Bank’s Total Risk-Based Capital Ratio were 10.9%,

14.9% and 15.7%, respectively, compared to 10.7%, 14.6% and 15.4%,

respectively, at the prior quarter end.

- The tangible common equity ratio, a non-U.S. GAAP financial

measure, was 8.8% as of September 30, 2024, down from 8.9% as of

June 30, 2024 and up from 7.8% as of September 30, 2023. As of

September 30, 2024, accumulated other comprehensive loss declined

$5.9 million, or 20.9%, and $17.8 million, or 44.2%, to $22.5

million as compared to $28.4 million at June 30, 2024 and $40.3

million at September 30, 2023, respectively. Adjusted for

accumulated other comprehensive loss, the tangible common equity

ratio was 9.4% as of September 30, 2024.

- Book value per share and tangible book value per share, a

non-U.S. GAAP measure, were $23.44 and $23.20, respectively, which

represent increases of 2.2% and 2.2% relative to the prior

quarter-end and 9.9% and 10.1% from the year-ago period.

- Nonperforming loans increased $5.5 million, or 23.6%, to $28.6

million, or 1.3% of total loans, from $23.1 million, or 1.0% of

total loans, at the prior quarter end. Approximately 47.2% of the

balance of nonperforming loans is a single commercial multifamily

loan, which had a balance of $13.5 million as of September 30,

2024, down $1.1 million from the prior quarter. The loan is current

as of September 30, 2024 and the Company believes the loan is

properly collateralized with a loan to value of less than 70%.

Criticized loans as a percentage of total loans were 5.7%,

consistent with the prior quarter end.

- Net charge-offs were $0.7 million, or 0.1% of loans, for the

third quarter of 2024, compared to $0.9 million, or 0.2% of loans,

for the prior quarter.

- Provision for credit losses totaled $1.0 million, compared to

$0.3 million for the prior quarter and included a credit impairment

of an available-for-sale debt security of $0.5 million during the

third quarter.

- Allowance for credit losses was 0.99% of total loans, as

compared to 1.00% at the prior quarter end.

INCOME STATEMENT

Net interest income on a tax-equivalent basis totaled $26.8

million for the third quarter of 2024, a decline of $0.9 million,

or 3.4%, from the second quarter of 2024 and $3.3 million, or

11.0%, from the third quarter of 2023. The decline from both prior

periods reflects net interest margin contraction and lower average

earning asset balances.

Interest income increased $0.5 million, or 1.1%, from the second

quarter of 2024 and declined $1.7 million, or 3.5%, from the third

quarter of 2023. The increase in interest income relative to the

prior quarter reflects an increase in cash balances due to growth

of payment deposits and seasonal considerations. The decline in

interest income relative to the year-ago period reflects a decline

in cash balances, driven by the exit of digital asset program

accounts, and a decline in loan balances, partially offset by a

higher tax-equivalent yield on loans and cash balances.

Interest expense increased $1.5 million, or 8.0%, from the

second quarter of 2024 and $1.6 million, or 8.6%, from the third

quarter of 2024. The cost of funds increased to 2.77% for the third

quarter of 2024, as compared to 2.54% for the second quarter of

2024 and 2.43% for the third quarter of 2023. The higher cost of

funds compared to the prior quarter was primarily attributable to

the full quarter impact of the exit of the digital asset program

account relationships and $0.3 million of termination costs related

to the Company’s decision to call two brokered CDs during the third

quarter. The process of winding down the digital asset program

account relationships was initiated during the second quarter of

2024, and the deposits were replaced with higher cost funding

throughout the third quarter of 2024. Relative to the year-ago

period, the increase reflects the impact of higher interest rates

on our deposits, a shift in the mix of average deposits, the exit

of the digital asset program account relationships and the

termination costs associated with the two brokered CDs that were

called.

On a tax-equivalent basis, net interest margin for the third

quarter of 2024 was 3.61%, a decline of 14 basis points versus the

second quarter of 2024 and 29 basis points versus the third quarter

of 2023. See the table below for a reconciliation between net

interest margin and net interest margin on a fully tax-equivalent

basis, a non-U.S. GAAP measure.

Noninterest income totaled $6.7 million for the third quarter of

2024, a decline of $0.5 million from the second quarter of 2024 and

an increase of $0.9 million from the third quarter of 2023. The

decline compared to the prior quarter is primarily driven by a

decline of $1.2 million in other operating income, partially offset

by increases of $0.5 million in holding gains on equity securities

and $0.3 million in equity method investments income from our

mortgage segment. The $0.9 million increase in noninterest income

from the third quarter of 2023 was primarily driven by increases of

$1.5 million in equity method investments income from our mortgage

segment and $1.0 million in payment card and service charge income,

partially offset by a decline of $1.6 million in other operating

income.

Noninterest expense totaled $29.5 million for the third quarter

of 2024, an increase of $0.6 million from the second quarter of

2024 and a decline of $1.2 million from the third quarter of 2023.

The increase from the second quarter of 2024 primarily reflects

increases of $0.8 million in salaries and employee benefits and

$0.3 million in travel, entertainment, dues and subscriptions,

partially offset by a $0.5 million decline in professional fees.

The decline from the third quarter of 2023 primarily reflects

declines of $1.0 million in professional fees and $0.9 million in

other operating expense, partially offset by an increase of $0.7

million in salaries and employee benefit expense.

BALANCE SHEET

Loans totaled $2.17 billion as of September 30, 2024, a decline

of $35.5 million, or 1.6%, from June 30, 2024, and $99.2 million,

or 4.4%, from September 30, 2023. The decline in loan balances

relative to the prior quarters primarily reflects slower loan

growth based on overall market conditions and the impact of loan

amortization and payoffs.

Deposits totaled $3.00 billion as of September 30, 2024, an

increase of $118.8 million, or 4.1%, from June 30, 2024, and a

decline of $37.2 million, or 1.2%, from September 30, 2023. The

increase in deposits relative to the prior quarter reflects an

increase in payment deposits of $190.9 million and higher CD

balances. The increase in CD balances of $77.0 million, or 10.0%,

to $846.8 million was primarily driven by a $25.1 million, or 5.0%,

increase in brokered CDs and a $52.2 million, or 19.9%, increase in

core CDs. Relative to the year-ago period, the decline in total

deposits reflects a decline in NIB deposits and increased

utilization of off-balance sheet deposit networks to generate fee

income, enhance capital efficiency and manage liquidity and

concentration risk.

NIB deposits totaled $989.1 million as of September 30, 2024, an

increase of $5.3 million, or 0.5%, from June 30, 2024 and a decline

of $104.8 million, or 9.6%, from September 30, 2023. Relative to

the prior year period, the decline in NIB deposits reflected the

exit of digital asset program accounts. Digital asset program

account balances declined $6.7 million and $180.1 million to $21.4

million as compared to June 30, 2024 and September 30, 2023,

respectively. NIB deposits represented 33.0% of total deposits as

of September 30, 2024, compared to 34.1% of total deposits at the

prior quarter-end and 36.0% for the year-ago period.

Off-balance sheet deposits totaled $1.44 billion as of September

30, 2024, an increase of $85.2 million, or 6.3%, compared to $1.36

billion at June 30, 2024, and $329.0 million, or 30%, from $1.11

billion at September 30, 2023. Management proactively moved $70.2

million of banking-as-a-service deposits off balance sheet due to

uncertainty of the existing regulatory framework for brokered

deposits and potential reclassification of certain

banking-as-a-service deposits as brokered deposits. Off-balance

sheet deposit networks are utilized to generate fee income, enhance

capital efficiency and manage liquidity and concentration risk.

CAPITAL

The Community Bank Leverage Ratio was 10.9% as of September 30,

2024, compared to 10.7% as of June 30, 2024, and 10.4% as of

September 30, 2023. MVB’s Tier 1 Risk-Based Capital Ratio was 14.9%

as of September 30, 2024, compared to 14.6% as of June 30, 2024 and

14.0% as of September 30, 2023. The Bank’s Total Risk-Based Capital

Ratio was 15.7% as of September 30, 2024, compared to 15.4% as of

June 30, 2024 and 14.8% as of September 30, 2023.

The tangible common equity ratio, a non-U.S. GAAP financial

measure, was 8.8% as of September 30, 2024, consistent with June

30, 2024, and up from 7.8% as of September 30, 2023. See the

reconciliation of the tangible common equity ratio to its most

directly comparable U.S. GAAP financial measure later in this

release.

The Company issued a quarterly cash dividend of $0.17 per share

for the third quarter of 2024, consistent with the second quarter

of 2024 and the third quarter of 2023.

ASSET QUALITY

Nonperforming loans totaled $28.6 million, or 1.3% of total

loans, as of September 30, 2024, as compared to $23.1 million, or

1.0% of total loans, as of June 30, 2024, and $10.6 million, or

0.5% of total loans, as of September 30, 2023. Criticized loans as

a percentage of total loans were 5.7% as of September 30, 2024 and

June 30, 2024, compared to 6.1% as of September 30, 2023.

Net charge-offs were $0.7 million, or 0.1% of average total

loans, for the third quarter of 2024, compared to $0.9 million, or

0.2% of average total loans, for the second quarter of 2024 and

$5.9 million, or 1.0% of average total loans, for the third quarter

of 2023.

The provision for credit losses totaled $1.0 million, compared

to $0.3 million for the prior quarter ended June 30, 2024, and a

release of allowance of $0.2 million for the quarter ended

September 30, 2023. The allowance for credit losses for loans was

0.99% of total loans at September 30, 2024, compared to 1.00% at

June 30, 2024, and 1.1% at September 30, 2023.

About MVB Financial Corp.

MVB Financial, the holding company of MVB Bank, is publicly

traded on The Nasdaq Capital Market® (“Nasdaq”) under the ticker

“MVBF.”

MVB Financial is a financial holding company headquartered in

Fairmont, West Virginia. Through its subsidiary, MVB Bank, and MVB

Bank’s subsidiaries, MVB Financial provides financial services to

individuals and corporate clients in the Mid-Atlantic region and

beyond.

Nasdaq is a leading global provider of trading, clearing,

exchange technology, listing, information and public company

services.

For more information about MVB Financial, please visit

ir.mvbbanking.com.

Forward-looking Statements

MVB Financial has made forward-looking statements, within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended,

in this press release that are intended to be covered by the

protections provided under the Private Securities Litigation Reform

Act of 1995. These forward-looking statements are based on current

expectations about the future and are subject to risks and

uncertainties. Forward-looking statements include, without

limitation, information concerning possible or assumed future

results of operations of the Company and its subsidiaries.

Forward-looking statements can be identified by the use of words

such as “may,” “could,” “should,” “would,” “will,” “plans,”

“believes,” “estimates,” “expects,” “anticipates,” “intends,”

“continues” or the negative of those terms or similar expressions.

Note that many factors could affect the future financial results of

the Company and its subsidiaries, both individually and

collectively, and could cause those results to differ materially

from those expressed in forward-looking statements. Therefore,

undue reliance should not be placed upon any forward-looking

statements. Those factors include but are not limited to: market,

economic, operational, liquidity and credit risk; changes in market

interest rates; impacts related to or resulting from recent turmoil

in the banking industry; inability to successfully execute business

plans, including strategies related to investments in Fintech

companies; risks, uncertainties and losses involved with the

developing digital assets industry, including the evolving

regulatory framework; competition; unforeseen events, such as

pandemics or natural disasters, and any governmental or societal

responses thereto; changes in economic, business and political

conditions; changes in demand for loan products and deposit flow;

changes in deposit classifications; operational risks and risk

management failures; and government regulation and supervision.

Additional factors that may cause actual results to differ

materially from those described in the forward-looking statements

can be found in the Company’s Annual Report on Form 10-K for the

year ended December 31, 2023, as well as its other filings with the

Securities and Exchange Commission (“SEC”), which are available on

the SEC’s website at www.sec.gov. Except as required by law, the

Company disclaims any obligation to update, revise or correct any

forward-looking statements.

Accounting standards require the consideration of subsequent

events occurring after the balance sheet date for matters that

require adjustment to, or disclosure in, the consolidated financial

statements. The review period for subsequent events extends up to

and including the filing date of a public company’s financial

statements when filed with the SEC. Accordingly, the consolidated

financial information in this announcement is subject to

change.

Questions or comments concerning this earnings release should be

directed to:

Non-U.S. GAAP Financial Measures

This document contains supplemental financial information

determined by methods other than in accordance with accounting

principles generally accepted in the United States of America

(“U.S. GAAP”). Management uses these non-U.S. GAAP measures in its

analysis of the Company’s performance. These measures should not be

considered a substitute for U.S. GAAP basis measures nor should

they be viewed as a substitute for operating results determined in

accordance with U.S. GAAP. Management believes the presentation of

non-U.S. GAAP financial measures that exclude the impact of

specified items provide useful supplemental information that is

essential to a proper understanding of the Company’s financial

condition and results. Non-U.S. GAAP measures are not formally

defined under U.S. GAAP, and other entities may use calculation

methods that differ from those used by us. As a complement to U.S.

GAAP financial measures, our management believes these non-U.S.

GAAP financial measures assist investors in comparing the financial

condition and results of operations of financial institutions due

to the industry prevalence of such non-U.S. GAAP measures. See the

tables below for a reconciliation of these non-U.S. GAAP measures

to the most directly comparable U.S. GAAP financial measures.

MVB Financial Corp.

Financial Highlights

Consolidated Statements of

Income

(Unaudited) (Dollars in

thousands, except per share data)

Quarterly

Year-to-Date

2024

2024

2023

2024

2023

Third Quarter

Second

Quarter

Third Quarter

Interest income

$

46,627

$

46,127

$

48,325

$

142,784

$

140,119

Interest expense

20,042

18,557

18,460

58,490

47,943

Net interest income

26,585

27,570

29,865

84,294

92,176

Provision (release of allowance) for

credit losses

959

254

(159

)

3,210

182

Net interest income after provision

(release of allowance) for credit losses

25,626

27,316

30,024

81,084

91,994

Total noninterest income

6,657

7,142

5,791

21,633

15,277

Noninterest expense:

Salaries and employee benefits

16,722

15,949

16,016

49,160

48,508

Other expense

12,763

12,981

14,709

39,446

40,816

Total noninterest expenses

29,485

28,930

30,725

88,606

89,324

Income before income taxes

2,798

5,528

5,090

14,111

17,947

Income taxes

642

1,379

1,218

3,304

3,639

Net income from continuing operations,

before noncontrolling interest

2,156

4,149

3,872

10,807

14,308

Income from discontinued operations,

before income taxes

—

—

—

—

11,831

Income taxes - discontinued operations

—

—

—

—

3,049

Net income from discontinued

operations

—

—

—

—

8,782

Net Income, before noncontrolling

interest

2,156

4,149

3,872

10,807

23,090

Net (income) loss attributable to

noncontrolling interest

(76

)

(60

)

(5

)

(156

)

231

Net income available to common

shareholders

$

2,080

$

4,089

$

3,867

$

10,651

$

23,321

Earnings per share from continuing

operations - basic

$

0.16

$

0.32

$

0.30

$

0.83

$

1.15

Earnings per share from discontinued

operations - basic

$

—

$

—

$

—

$

—

$

0.69

Earnings per share - basic

$

0.16

$

0.32

$

0.30

$

0.83

$

1.84

Earnings per share from continuing

operations - diluted

$

0.16

$

0.31

$

0.29

$

0.81

$

1.12

Earnings per share from discontinued

operations - diluted

$

—

$

—

$

—

$

—

$

0.67

Earnings per share - diluted

$

0.16

$

0.31

$

0.29

$

0.81

$

1.79

Noninterest Income

(Unaudited) (Dollars in

thousands)

Quarterly

Year-to-Date

2024

2024

2023

2024

2023

Third Quarter

Second

Quarter

Third Quarter

Card acquiring income

$

336

$

337

$

845

$

924

$

2,255

Service charges on deposits

1,088

1,103

490

3,714

2,676

Interchange income

2,428

2,377

1,517

7,844

5,034

Total payment card and service charge

income

3,852

3,817

2,852

12,482

9,965

Equity method investments gain (loss)

746

484

(750

)

102

(70

)

Compliance and consulting income

1,291

1,274

1,314

3,565

3,326

Gain (loss) on sale of loans

26

—

330

26

(1,015

)

Investment portfolio gains (losses)

498

117

244

1,224

(1,734

)

Loss on acquisition and divestiture

activity

—

—

—

—

(986

)

Other noninterest income

244

1,450

1,801

4,234

5,791

Total noninterest income

$

6,657

$

7,142

$

5,791

$

21,633

$

15,277

Condensed Consolidated Balance

Sheets

(Unaudited) (Dollars in

thousands)

September 30, 2024

June 30, 2024

September 30, 2023

Cash and cash equivalents

$

610,911

$

455,517

$

587,100

Investment securities

available-for-sale

374,828

361,254

311,537

Equity securities

41,760

41,261

40,835

Loans held-for-sale

—

—

7,603

Loans receivable

2,171,272

2,206,793

2,270,433

Less: Allowance for credit losses

(21,499

)

(22,084

)

(24,276

)

Loans receivable, net

2,149,773

2,184,709

2,246,157

Premises and equipment, net

18,838

19,540

21,468

Other assets

222,646

225,723

—

222,883

Total assets

$

3,418,756

$

3,288,004

$

3,437,583

Noninterest-bearing deposits

$

989,144

$

983,809

$

1,093,903

Interest-bearing deposits

2,012,504

1,899,043

1,944,986

Senior term loan

—

—

8,473

Subordinated debt

73,725

73,663

73,478

Other liabilities

40,183

34,826

—

45,374

Stockholders’ equity

303,200

296,663

271,369

Total liabilities and stockholders’

equity

$

3,418,756

$

3,288,004

$

3,437,583

Reportable Segments

(Unaudited)

Three Months Ended September 30,

2024

CoRe Banking

Mortgage Banking

Financial Holding

Company

Other

Intercompany

Eliminations

Consolidated

(Dollars in thousands)

Interest income

$

46,539

$

103

$

2

$

—

$

(17

)

$

46,627

Interest expense

19,234

—

808

17

(17

)

20,042

Net interest income (expense)

27,305

103

(806

)

(17

)

—

26,585

Provision for credit losses

459

—

500

—

—

959

Net interest income (expense) after

provision for credit losses

26,846

103

(1,306

)

(17

)

—

25,626

Noninterest income

4,574

768

2,956

2,332

(3,973

)

6,657

Noninterest Expenses:

Salaries and employee benefits

10,075

—

4,528

2,119

—

16,722

Other expenses

13,164

4

2,240

1,328

(3,973

)

12,763

Total noninterest expenses

23,239

4

6,768

3,447

(3,973

)

29,485

Income (loss), before income taxes

8,181

867

(5,118

)

(1,132

)

—

2,798

Income taxes

1,774

204

(1,063

)

(273

)

—

642

Net income (loss), before noncontrolling

interest

6,407

663

(4,055

)

(859

)

—

2,156

Net income attributable to noncontrolling

interest

—

—

—

(76

)

—

(76

)

Net income (loss) available to common

shareholders

$

6,407

$

663

$

(4,055

)

$

(935

)

$

—

$

2,080

Three Months Ended June 30,

2024

CoRe Banking

Mortgage Banking

Financial Holding

Company

Other

Intercompany

Eliminations

Consolidated

(Dollars in thousands)

Interest income

$

46,038

$

103

$

3

$

—

$

(17

)

$

46,127

Interest expense

17,635

—

922

17

(17

)

18,557

Net interest income (expense)

28,403

103

(919

)

(17

)

—

27,570

Provision for credit losses

254

—

—

—

—

254

Net interest income (expense) after

provision for credit losses

28,149

103

(919

)

(17

)

—

27,316

Noninterest income

4,898

485

2,769

3,128

(4,138

)

7,142

Noninterest Expenses:

Salaries and employee benefits

9,359

—

4,473

2,117

—

15,949

Other expenses

13,257

—

2,080

1,782

(4,138

)

12,981

Total noninterest expenses

22,616

—

6,553

3,899

(4,138

)

28,930

Income (loss) before income taxes

10,431

588

(4,703

)

(788

)

—

5,528

Income taxes

2,438

145

(1,016

)

(188

)

—

1,379

Net income (loss), before noncontrolling

interest

7,993

443

(3,687

)

(600

)

—

4,149

Net income attributable to noncontrolling

interest

—

—

—

(60

)

—

(60

)

Net income (loss) available to common

shareholders

$

7,993

$

443

$

(3,687

)

$

(660

)

$

—

$

4,089

Three Months Ended September 30,

2023

CoRe Banking

Mortgage Banking

Financial Holding

Company

Other

Intercompany

Eliminations

Consolidated

(Dollars in thousands)

Interest income

$

48,268

$

103

$

2

$

—

$

(48

)

$

48,325

Interest expense

17,454

—

1,000

54

(48

)

18,460

Net interest income (expense)

30,814

103

(998

)

(54

)

—

29,865

Release of allowance for credit losses

(159

)

—

—

—

—

(159

)

Net interest income (expense) after

release of allowance for credit losses

30,973

103

(998

)

(54

)

—

30,024

Noninterest income

4,980

(742

)

2,576

3,099

(4,122

)

5,791

Noninterest Expenses:

Salaries and employee benefits

9,787

—

4,129

2,100

—

16,016

Other expenses

14,701

13

1,992

2,125

(4,122

)

14,709

Total noninterest expenses

24,488

13

6,121

4,225

(4,122

)

30,725

Income (loss), before income taxes

11,465

(652

)

(4,543

)

(1,180

)

—

5,090

Income taxes

2,628

(153

)

(978

)

(279

)

—

1,218

Net income (loss), before noncontrolling

interest

8,837

(499

)

(3,565

)

(901

)

—

3,872

Net income attributable to noncontrolling

interest

—

—

—

(5

)

—

(5

)

Net income (loss) available to common

shareholders

$

8,837

$

(499

)

$

(3,565

)

$

(906

)

$

—

$

3,867

Nine Months Ended September 30,

2024

CoRe Banking

Mortgage Banking

Financial Holding

Company

Other

Intercompany

Eliminations

Consolidated

(Dollars in thousands)

Interest income

$

142,519

$

309

$

7

$

—

$

(51

)

$

142,784

Interest expense

55,796

—

2,689

56

(51

)

58,490

Net interest income (expense)

86,723

309

(2,682

)

(56

)

—

84,294

Provision for credit losses

2,710

—

500

—

—

3,210

Net interest income (expense) after

provision for credit losses

84,013

309

(3,182

)

(56

)

—

81,084

Noninterest income

16,993

124

7,990

8,724

(12,198

)

21,633

Noninterest Expenses:

Salaries and employee benefits

29,257

—

13,679

6,224

—

49,160

Other expenses

40,242

4

6,161

5,237

(12,198

)

39,446

Total noninterest expenses

69,499

4

19,840

11,461

(12,198

)

88,606

Income (loss), before income taxes

31,507

429

(15,032

)

(2,793

)

—

14,111

Income taxes

7,090

120

(3,236

)

(670

)

—

3,304

Net income (loss), before noncontrolling

interest

24,417

309

(11,796

)

(2,123

)

—

10,807

Net income attributable to noncontrolling

interest

—

—

—

(156

)

—

(156

)

Net income (loss) available to common

shareholders

$

24,417

$

309

$

(11,796

)

$

(2,279

)

$

—

$

10,651

Nine Months Ended September 30,

2023

CoRe Banking

Mortgage Banking

Financial Holding

Company

Other

Intercompany

Eliminations

Consolidated

(Dollars in thousands)

Interest income

$

139,859

$

313

$

38

$

—

$

(91

)

$

140,119

Interest expense

44,934

—

2,992

108

(91

)

47,943

Net interest income (expense)

94,925

313

(2,954

)

(108

)

—

92,176

Provision for credit losses

182

—

—

—

—

182

Net interest income (expense) after

provision for credit losses

94,743

313

(2,954

)

(108

)

—

91,994

Noninterest income

12,111

(56

)

8,102

5,934

(10,814

)

15,277

Noninterest Expenses:

Salaries and employee benefits

27,891

7

13,702

6,908

—

48,508

Other expenses

39,903

65

6,072

5,590

(10,814

)

40,816

Total noninterest expenses

67,794

72

19,774

12,498

(10,814

)

89,324

Income (loss), before income taxes

39,060

185

(14,626

)

(6,672

)

—

17,947

Income taxes

8,380

(14

)

(3,127

)

(1,600

)

—

3,639

Net income (loss) from continuing

operations

30,680

199

(11,499

)

(5,072

)

—

14,308

Income from discontinued operations,

before income taxes

—

—

—

11,831

—

11,831

Income tax expense - discontinued

operations

—

—

—

3,049

—

3,049

Net income from discontinued

operations

—

—

—

8,782

—

8,782

Net income (loss), before noncontrolling

interest

30,680

199

(11,499

)

3,710

—

23,090

Net loss attributable to noncontrolling

interest

—

—

—

231

—

231

Net income (loss) available to common

shareholders

$

30,680

$

199

$

(11,499

)

$

3,941

$

—

$

23,321

Average Balances and Interest

Rates

(Unaudited) (Dollars in

thousands)

Three Months Ended

Three Months Ended

Three Months Ended

September 30, 2024

June 30, 2024

September 30, 2023

Average

Balance

Interest

Income/

Expense

Yield/

Cost

Average

Balance

Interest

Income/

Expense

Yield/

Cost

Average

Balance

Interest

Income/

Expense

Yield/

Cost

Assets

Interest-bearing balances with banks

$

400,330

$

5,218

5.19

%

$

380,278

$

5,065

5.36

%

$

483,158

$

6,404

5.26

%

Investment securities:

Taxable

258,151

1,846

2.84

252,963

1,905

3.03

206,340

1,056

2.03

Tax-exempt 1

104,769

867

3.29

102,785

684

2.68

107,490

1,016

3.75

Loans and loans held-for-sale: 2

Commercial

1,553,666

31,136

7.97

1,597,359

30,824

7.76

1,593,875

31,348

7.80

Tax-exempt 1

3,129

34

4.32

3,261

35

4.32

3,678

40

4.31

Real estate

558,691

6,446

4.59

563,011

6,391

4.57

573,579

6,351

4.39

Consumer

68,337

1,269

7.39

73,531

1,374

7.52

95,032

2,331

9.73

Total loans

2,183,823

38,885

7.08

2,237,162

38,624

6.94

2,266,164

40,070

7.02

Total earning assets

2,947,073

46,816

6.32

2,973,188

46,278

6.26

3,063,152

48,546

6.29

Less: Allowance for credit losses

(22,043

)

(22,596

)

(29,693

)

Cash and due from banks

4,638

4,528

6,686

Other assets

284,640

305,644

281,504

Total assets

$

3,214,308

$

3,260,764

$

3,321,649

Liabilities

Deposits:

NOW

$

534,494

$

4,422

3.29

%

$

465,587

$

4,139

3.58

%

$

674,745

$

4,970

2.92

%

Money market checking

434,174

3,378

3.10

400,205

3,337

3.35

537,592

3,294

2.43

Savings

116,861

883

3.01

112,225

944

3.38

72,206

438

2.41

IRAs

8,164

91

4.43

7,948

81

4.10

6,788

56

3.27

CDs

800,986

10,440

5.19

731,337

9,130

5.02

664,281

8,702

5.20

Repurchase agreements and federal funds

sold

3,589

19

2.11

3,459

4

0.47

4,911

—

—

FHLB and other borrowings

44

—

—

—

—

—

278

—

—

Senior term loan 3

—

—

—

2,736

114

16.76

8,751

191

8.66

Subordinated debt

73,702

809

4.37

73,629

808

4.41

73,446

809

4.37

Total interest-bearing liabilities

1,972,014

20,042

4.04

1,797,126

18,557

4.15

2,042,998

18,460

3.58

Noninterest-bearing demand deposits

910,787

1,139,070

975,164

Other liabilities

37,591

36,101

38,021

Total liabilities

2,920,392

2,972,297

3,056,183

Stockholders’ equity

Common stock

13,776

13,731

13,570

Paid-in capital

163,189

162,518

159,050

Treasury stock

(16,741

)

(16,741

)

(16,741

)

Retained earnings

160,694

161,709

146,504

Accumulated other comprehensive loss

(27,069

)

(32,299

)

(36,865

)

Total stockholders’ equity attributable to

parent

293,849

288,918

265,518

Noncontrolling interest

67

(451

)

(52

)

Total stockholders’ equity

293,916

288,467

265,466

Total liabilities and stockholders’

equity

$

3,214,308

$

3,260,764

$

3,321,649

Net interest spread (tax-equivalent)

2.28

%

2.11

%

2.71

%

Net interest income and margin

(tax-equivalent)1

$

26,774

3.61

%

$

27,721

3.75

%

$

30,086

3.90

%

Less: Tax-equivalent adjustments

$

(189

)

$

(151

)

$

(221

)

Net interest spread

2.25

%

2.09

%

2.68

%

Net interest income and margin

$

26,585

3.59

%

$

27,570

3.73

%

$

29,865

3.87

%

1In order to make pre-tax income and

resultant yields on tax-exempt loans and investment securities

comparable to those on taxable loans and investment securities, a

tax-equivalent adjustment has been computed using a Federal tax

rate of 21% for the periods presented, which is a non-U.S. GAAP

financial measure. See the reconciliation of this non-U.S. GAAP

financial measure to its most directly comparable GAAP financial

measure included in the tables on page 19.

2 Non-accrual loans are included in total

loan balances, lowering the effective yield for the portfolio in

the aggregate.

3 The senior term loan was paid off in May

2024, and the unamortized debt issuance costs were recorded as

interest expense upon the repayment.

Nine Months Ended

Nine Months Ended

September 30, 2024

September 30, 2023

Average

Balance

Interest

Income/

Expense

Yield/

Cost

Average

Balance

Interest

Income/

Expense

Yield/

Cost

Assets

Interest-bearing balances with banks

$

443,475

$

17,624

5.31

%

$

405,012

$

15,099

4.98

%

Investment securities:

Taxable

252,423

5,494

2.91

221,089

4,133

2.50

Tax-exempt 1

104,622

2,436

3.11

122,818

3,471

3.78

Loans and loans held-for-sale: 2

Commercial

1,592,295

94,112

7.89

1,616,510

90,413

7.48

Tax-exempt 1

3,254

106

4.35

3,813

125

4.38

Real estate

565,923

19,450

4.59

596,070

18,343

4.11

Consumer

73,039

4,095

7.49

120,075

9,290

10.34

Total loans

2,234,511

117,763

7.04

2,336,468

118,171

6.76

Total earning assets

3,035,031

143,317

6.31

3,085,387

140,874

6.10

Less: Allowance for credit losses

(22,298

)

(31,656

)

Cash and due from banks

4,856

4,252

Other assets

308,351

303,233

Total assets

$

3,325,940

$

3,361,216

Liabilities

Deposits:

NOW

$

518,595

$

13,490

3.47

%

$

717,527

$

14,448

2.69

%

Money market checking

414,453

10,474

3.38

455,463

6,661

1.96

Savings

130,848

3,468

3.54

79,187

1,430

2.41

IRAs

7,958

246

4.13

6,448

128

2.65

CDs

735,883

28,097

5.10

572,078

21,396

5.00

Repurchase agreements and federal funds

sold

3,334

23

0.92

5,974

—

—

FHLB and other borrowings

29

2

5.99

23,449

888

5.06

Senior term loan 3

3,146

264

11.21

9,285

583

8.39

Subordinated debt

73,634

2,426

4.40

73,383

2,409

4.39

Total interest-bearing liabilities

1,887,880

58,490

4.14

1,942,794

47,943

3.30

Noninterest-bearing demand deposits

1,109,089

1,107,712

Other liabilities

38,566

37,987

Total liabilities

3,035,535

3,088,493

Stockholders’ equity

Common stock

13,722

13,525

Paid-in capital

162,416

157,034

Treasury stock

(16,741

)

(16,741

)

Retained earnings

161,113

153,769

Accumulated other comprehensive income

loss

(29,965

)

(34,980

)

Total stockholders’ equity attributable to

parent

290,545

272,607

Noncontrolling interest

(140

)

116

Total stockholders’ equity

290,405

272,723

Total liabilities and stockholders’

equity

$

3,325,940

$

3,361,216

Net interest spread (tax-equivalent)

2.17

%

2.80

%

Net interest income and margin

(tax-equivalent)1

$

84,827

3.73

%

$

92,931

4.03

%

Less: Tax-equivalent adjustments

$

(533

)

$

(755

)

Net interest spread

2.14

%

2.77

%

Net interest income and margin

$

84,294

3.71

%

$

92,176

3.99

%

1 In order to make pre-tax income and

resultant yields on tax-exempt loans and investment securities

comparable to those on taxable loans and investment securities, a

tax-equivalent adjustment has been computed using a Federal tax

rate of 21% for the periods presented, which is a non-U.S. GAAP

financial measure. See the reconciliation of this non-U.S. GAAP

financial measure to its most directly comparable GAAP financial

measure included in the tables on page 19.

2 Non-accrual loans are included in total

loan balances, lowering the effective yield for the portfolio in

the aggregate.

3 The senior term loan was paid off in May

2024, and the unamortized debt issuance costs were recorded as

interest expense upon the repayment.

Selected Financial

Data

(Unaudited) (Dollars in

thousands, except per share data)

Quarterly

Year-to-Date

2024

2024

2023

2024

2023

Third Quarter

Second Quarter

Third Quarter

Earnings and Per Share Data:

Net income

$

2,080

$

4,089

$

3,867

$

10,651

$

23,321

Earnings per share from continuing

operations - basic

$

0.16

$

0.32

$

0.30

$

0.83

$

1.15

Earnings per share from discontinued

operations - basic

$

—

$

—

$

—

$

—

$

0.69

Earnings per share - basic

$

0.16

$

0.32

$

0.30

$

0.83

$

1.84

Earnings per share from continuing

operations - diluted

$

0.16

$

0.31

$

0.29

$

0.81

$

1.12

Earnings per share from discontinued

operations - diluted

$

—

$

—

$

—

$

—

$

0.67

Earnings per share - diluted

$

0.16

$

0.31

$

0.29

$

0.81

$

1.79

Cash dividends paid per common share

$

0.17

$

0.17

$

0.17

$

0.51

$

0.51

Book value per common share

$

23.44

$

22.94

$

21.33

$

23.44

$

21.33

Tangible book value per common share 1

$

23.20

$

22.70

$

21.08

$

23.20

$

21.08

Weighted-average shares outstanding -

basic

12,927,962

12,883,426

12,722,010

12,874,311

12,678,708

Weighted-average shares outstanding -

diluted

13,169,011

13,045,660

13,116,629

13,121,245

13,012,834

Performance Ratios:

Return on average assets 2

0.3

%

0.5

%

0.5

%

0.4

%

0.9

%

Return on average equity 2

2.8

%

5.7

%

5.8

%

4.9

%

11.4

%

Net interest margin 3 4

3.61

%

3.75

%

3.90

%

3.73

%

4.03

%

Efficiency ratio 5

88.7

%

83.3

%

86.2

%

83.6

%

75.4

%

Overhead ratio 2 6

3.7

%

3.5

%

3.7

%

3.6

%

3.5

%

Equity to assets

8.9

%

9.0

%

7.9

%

8.9

%

7.9

%

Asset Quality Data and Ratios:

Charge-offs

$

1,392

$

1,538

$

8,064

$

5,080

$

16,611

Recoveries

$

681

$

688

$

2,205

$

2,204

$

7,842

Net loan charge-offs to total loans 2

7

0.1

%

0.2

%

1.0

%

0.2

%

0.5

%

Allowance for credit losses

$

21,499

$

22,084

$

24,276

$

21,499

$

24,276

Allowance for credit losses to total loans

8

0.99

%

1.00

%

1.07

%

0.99

%

1.07

%

Nonperforming loans

$

28,556

$

23,099

$

10,593

$

28,556

$

10,593

Nonperforming loans to total loans

1.3

%

1.0

%

0.5

%

1.3

%

0.5

%

Mortgage Company Equity Method

Investees Production Data9:

Mortgage pipeline

$

1,048,865

$

927,875

$

643,578

$

1,048,865

$

643,578

Loans originated

$

1,469,223

$

1,383,405

$

1,131,963

$

3,902,717

$

3,299,253

Loans closed

$

937,333

$

828,849

$

786,885

$

2,419,488

$

2,282,768

Loans sold

$

655,668

$

639,035

$

605,296

$

2,210,818

$

1,827,019

1 Common equity less total goodwill and

intangibles per common share, a non-U.S. GAAP measure. See the

reconciliation of this non-U.S. GAAP financial measure to its most

directly comparable GAAP financial measure included in the tables

on page 19.

2 Annualized for the quarterly periods

presented.

3 Net interest income as a percentage of

average interest-earning assets.

4 Presented on a fully tax-equivalent

basis, a non-U.S. GAAP financial measure.

5 Noninterest expense as a percentage of

net interest income and noninterest income, a non-U.S. GAAP

measure.

6 Noninterest expense as a percentage of

average assets, a non-U.S. GAAP measure.

7 Charge-offs, less recoveries.

8 Excludes loans held-for-sale.

9 Information is related to Intercoastal

Mortgage Company, LLC and Warp Speed Holdings LLC, entities in

which MVB has an ownership interest that are accounted for as

equity method investments.

Non-U.S. GAAP Reconciliation:

Net Interest Margin on a Fully Tax-Equivalent Basis

The following table reconciles, for the

periods shown below, net interest margin on a fully tax-equivalent

basis:

Three Months Ended

Nine Months Ended

(Dollars in thousands)

September 30, 2024

June 30, 2024

September 30, 2023

September 30, 2024

September 30, 2023

Net interest margin - U.S. GAAP

basis

Net interest income

$

26,585

$

27,570

$

29,865

$

84,294

$

92,176

Average interest-earning assets

$

2,947,073

$

2,973,188

$

3,063,152

3,035,031

3,085,387

Net interest margin

3.59

%

3.73

%

3.87

%

3.71

%

3.99

%

Net interest margin - non-U.S. GAAP

basis

Net interest income

$

26,585

$

27,570

$

29,865

$

84,294

$

92,176

Impact of fully tax-equivalent

adjustment

189

151

221

533

755

Net interest income on a fully

tax-equivalent basis

$

26,774

$

27,721

$

30,086

84,827

92,931

Average interest-earning assets

$

2,947,073

$

2,973,188

$

3,063,152

$

3,035,031

$

3,085,387

Net interest margin on a fully

tax-equivalent basis

3.61

%

3.75

%

3.90

%

3.73

%

4.03

%

Non-U.S. GAAP Reconciliation:

Tangible Book Value per Common Share and Tangible Common Equity

Ratio

(Unaudited) (Dollars in

thousands, except per share data)

September 30, 2024

June 30, 2024

September 30, 2023

Tangible Book Value per Common

Share

Goodwill

$

2,838

$

2,838

$

2,838

Intangibles

285

307

375

Total intangibles

$

3,123

3,145

3,213

Total equity attributable to parent

$

303,086

296,625

271,416

Less: Total intangibles

(3,123

)

(3,145

)

(3,213

)

Tangible common equity

$

299,963

$

293,480

$

268,203

Tangible common equity

$

299,963

$

293,480

$

268,203

Common shares outstanding (000s)

12,928

12,928

12,726

Tangible book value per common share

$

23.20

$

22.70

$

21.08

Tangible Common Equity Ratio

Total assets

$

3,418,756

$

3,288,004

$

3,437,583

Less: Total intangibles

(3,123

)

(3,145

)

(3,213

)

Tangible assets

$

3,415,633

$

3,284,859

$

3,434,370

Tangible assets

$

3,415,633

$

3,284,859

$

3,434,370

Tangible common equity

$

299,963

$

293,480

$

268,203

Tangible common equity ratio

8.8

%

8.9

%

7.8

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241030097498/en/

MVB Financial Corp. Donald T. Robinson, President and

Chief Financial Officer (304) 598-3500 drobinson@mvbbanking.com Amy

Baker, VP, Corporate Communications and Marketing (844) 682-2265

abaker@mvbbanking.com

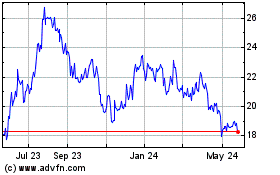

MVB Financial (NASDAQ:MVBF)

Historical Stock Chart

From Oct 2024 to Nov 2024

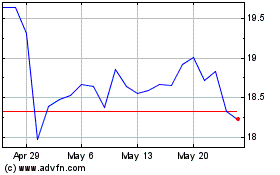

MVB Financial (NASDAQ:MVBF)

Historical Stock Chart

From Nov 2023 to Nov 2024