0001401395false00014013952023-07-172023-07-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): July 17, 2023 |

NEPTUNE WELLNESS SOLUTIONS INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Quebec |

001-33526 |

00-0000000 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

545 Promenade du Centropolis Suite 100 |

|

Laval, Quebec, Canada |

|

H7T 0A3 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 450 687-2262 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Shares, no par value per share |

|

NEPT |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operation and Financial Condition.

On July 17, 2023, Neptune Wellness Solutions Inc. (the “Company”) issued a press release announcing its financial results for the fiscal year ended March 31, 2023. A copy of the press release is furnished hereto as Exhibit 99.1.

The information provided in this Item 2.02 of this Form 8-K, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section. Such information shall not be deemed incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof, regardless of any general incorporation language in such filing, except as otherwise expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

Neptune Wellness Solutions Inc. |

|

|

|

|

Date: |

July 17, 2023 |

By: |

/s/ Raymond Silcock |

|

|

|

Raymond Silcock

Chief Financial Officer |

Exhibit 99.1

EARNINGS RELEASE

SOURCE: Neptune Wellness Solutions Inc.

Neptune Reports Fiscal Fourth Quarter and Full Year 2023 Financial Results

Consolidated revenues for fiscal 2023 totaled $52.6 million, an increase of $3.8 million or 7.8% as compared to $48.8 million for fiscal 2022

Q4 net sales $12.1 million, up 5% from last year’s $11.5 million

Sprout maintained a top 3 brand position on Amazon in fiscal 2023 and strong sales levels in all periods nationally

Sprout was available in 90% of footprint the Organic Baby Food market across all 50 U.S. states and Canada

Company to host a conference call at 5:00 p.m. (Eastern Time) on Tuesday, July 18, 2023

LAVAL, QUÉBEC, CANADA – July 17, 2023 – Neptune Wellness Solutions Inc. ("Neptune" or the "Company") (NASDAQ: NEPT), a consumer-packaged goods company focused on plant-based, sustainable and purpose-driven lifestyle brands, today announced its financial and operating results for the three-month and twelve-month periods ending March 31, 2023.

“Neptune Wellness Solutions has made significant strides in fiscal 2023, demonstrating our unwavering commitment to growth and innovation in the consumer-packaged goods space. Our brands, Sprout and Biodroga, have been instrumental in propelling our platform this year," said Michael Cammarata, CEO and President of Neptune Wellness Solutions. "With Sprout's expansion into the Organic Baby Food market across all 50 U.S. states and Canada, we are strategically focused on delivering high-quality, sustainable products to our customers. We're excited about the cost savings and efficiencies we've achieved, but we acknowledge there's more work to be done. As we transition into fiscal 2024, we remain dedicated to further optimizing our operations and improving our financial position. We recognize there are risks ahead, but we are confident that the platform we are building is the right move for our future.”

Raymond P. Silcock, Chief Financial Officer of Neptune added, “As well as growing our key focus business areas of Sprout and Biodroga, Neptune is focused on further reducing corporate costs, managing expenses and improving its liquidity position into fiscal 2024. We are focused on further optimizing the supply chain for Sprout, and we have restructured production planning with $2.6 million in cost savings for the remainder of fiscal 2023 expected.”

Fourth Quarter and Full Year Financial Highlights:

●Fiscal fourth quarter revenue totaled $12.1 million, as compared to $11.5 million for the same period last year.

●Fiscal year 2023 revenue totaled $52.6 million, an increase of $3.8 million or 7.8% as compared to $48.8 million for fiscal 2022.

●Reported gross profit (loss) of $(2.5) million for fiscal 2023, compared to $(7.5) million for fiscal 2022, an improvement of $5.0 million or 67%.

●Reported gross profit (loss) for the fourth fiscal quarter of $(2.6) million compared to $(5.7) million for the prior corresponding period, an improvement of $3.1 million or 55%.

●Reported fourth quarter net profit (loss) of $(44.5) million compared to a reported net profit (loss) of $(36.7) million in the comparable period in fiscal 2022 and reported fiscal year 2023 net profit (loss) of $(88.8) million compared to a net profit (loss) of $(84.4) million for the fiscal year 2022.

●Adjusted EBITDA (non-GAAP)1 profit (loss) for fiscal year 2023 was $(39.7) million compared to an Adjusted EBITDA (non-GAAP)1 profit (loss) of $(53.3) million for the fiscal year 2022, an improvement of 26%.

●Cash and cash equivalents were $2.0 million, as of March 31, 2023.

Fourth Quarter & Recent Business Highlights:

●Expanded Sprout Organics CoComelon co-branded organic baby food into Target stores.

●Sprout extended distribution so its products are now available in 90% of Organic Baby Food footprint in the market, all 50 U.S. states and Canada, with recent launch into Loblaws, the largest grocer in Canada and shipping direct-to-consumers through the Sprout website.

●Sprout continued to optimize its supply chain and expects to achieve $2.6 million in cost savings for the remainder of calendar 2023 due to restructured production planning.

●Sprout’s sales are maintaining a top 3 brand position on Amazon in fiscal 2023 and strong sales levels in all periods nationally, according to Nielsen data.

●On a fiscal year to date basis, Sprout’s fill rate has improved to 90%, compared to 73% for the same period last year.

●At +12%, Sprout’s sales growth outperformed the Total Shelf Stable Baby Food category.

●Biodroga reported gross margins of 28%, up from 25% the same period year prior. Revenue for fiscal 2023 totaled $14.9 million, an increase of 18% as compared to fiscal 2022.

Fourth Quarter & Recent Corporate Highlights:

●Announced closing of debt financing for $4 million, improving the Company’s capital position.

●Announced an accounts receivable factoring facility of up to $7.5 million for its Sprout Organics baby food brand.

●Extended the maturity of its existing $13 million secured promissory note for Sprout with Morgan Stanley Expansion Capital.

Conference Call Details:

The Company will host a conference call at 5:00 p.m. (Eastern Time) on Tuesday, July 18, 2023, to discuss these results. The conference call will be webcast live and can be accessed by registering on the Events and Presentations portion of Neptune's Investor Relations website at www.investors.neptunewellness.com. The webcast will be archived for approximately 90 days.

ADJUSTED EBITDA

Although the concept of Adjusted EBITDA is not a financial or accounting measure defined under US GAAP and it may not be comparable to other issuers, it is widely used by companies. Neptune obtains its Adjusted EBITDA measurement by adding to net loss, net finance costs (income) and depreciation and amortization, and income tax expense (recovery). Other items such as stock-based compensation, non-employee compensation related to warrants, litigation provisions, business acquisition and integration costs, signing bonuses, severances and related costs, impairment losses on non-financial assets, write-downs of non-financial assets, revaluations of derivatives, system migration, conversion and implementation, and other changes in fair values are also added back. The exclusion of net finance costs (income) eliminates the impact on earnings derived from non-operational activities. The exclusion of depreciation and amortization, stock-based compensation, non-employee compensation related to warrants, litigation provisions, impairment losses, write-downs revaluations of derivatives and other changes in fair values eliminates the non-cash impact, and the exclusion of acquisition costs, integration costs, signing bonuses, severance and related costs, costs. From time to time, the Company may exclude additional items if it believes doing so would result in a more effective analysis of underlying operating performance. Adjusting for these items does not imply they are non-recurring.

About Neptune Wellness Solutions Inc.

Neptune is a consumer-packaged goods company that aims to innovate health and wellness products. Founded in 1998 and headquartered in Laval, Quebec, the Company focuses on developing a portfolio of high-quality, affordable consumer products that align with the latest market trends for natural, sustainable, plant-based and purpose-driven lifestyle brands. The Company's products are available in more than 27,000 retail locations and include well-known organic food and beverage brands such as Sprout Organics, Nosh, and Nurturme, as well as nutraceuticals brands like Biodroga and Forest Remedies. With its efficient and adaptable manufacturing and supply chain infrastructure, the Company can quickly respond to consumer demand, and introduce new products through retail partners and e-commerce channels. Please visit neptunewellness.com for more details.

Disclaimer – Safe Harbor Forward–Looking Statements

This news release contains "forward-looking information" and "forward-looking statements" (collectively, "forward-looking statements") within the meaning of applicable securities laws. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates, and projections as at the date of this news release. Any statement that involves discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements. In this news release, forward-looking statements include, among other things, statements with respect to the ability to achieve cost savings and efficiencies and optimizing supply chains.

Media Contacts:

media@neptunecorp.com

Investor Contacts:

Valter Pinto, Managing Director

KCSA Strategic Communications

neptune@kcsa.com

212.896.1254

Consolidated Balance Sheets

(In U.S. dollars)

|

|

|

|

|

|

|

As at |

|

As at |

|

|

March 31,

2023 |

|

March 31,

2022 |

Assets |

|

|

|

|

Current assets: |

|

|

|

|

Cash and cash equivalents |

|

$1,993,257 |

|

$8,726,341 |

Short-term investment |

|

17,540 |

|

19,255 |

Trade and other receivables |

|

7,507,333 |

|

7,599,584 |

Prepaid expenses |

|

1,025,969 |

|

3,983,427 |

Inventories |

|

13,006,074 |

|

17,059,406 |

Total current assets |

|

23,550,173 |

|

37,388,013 |

|

|

|

|

|

Property, plant and equipment |

|

1,403,264 |

|

21,448,123 |

Operating lease right-of-use assets |

|

1,941,347 |

|

2,295,263 |

Intangible assets |

|

1,607,089 |

|

21,655,035 |

Goodwill |

|

2,426,385 |

|

22,168,288 |

Total assets |

|

$30,928,258 |

|

$104,954,722 |

|

|

|

|

|

Liabilities and Equity |

|

|

|

|

Current liabilities: |

|

|

|

|

Trade and other payables |

|

$27,051,561 |

|

$22,700,849 |

Current portion of operating lease liabilities |

|

339,620 |

|

641,698 |

Loans and borrowings |

|

7,538,369 |

|

— |

Deferred revenues |

|

— |

|

285,004 |

Provisions |

|

2,948,340 |

|

1,118,613 |

Liability related to warrants |

|

3,156,254 |

|

5,570,530 |

Total current liabilities |

|

41,034,144 |

|

30,316,694 |

|

|

|

|

|

Operating lease liabilities |

|

2,017,888 |

|

2,063,421 |

Loans and borrowings |

|

15,412,895 |

|

11,648,320 |

Other liability |

|

24,000 |

|

88,688 |

Total liabilities |

|

58,488,927 |

|

44,117,123 |

|

|

|

|

|

Shareholders' Equity (Deficiency): |

|

|

|

|

Share capital - without par value (11,996,387 shares issued and outstanding as of

March 31, 2023; 5,560,829 shares issued and outstanding as of March 31, 2022) |

|

321,946,102 |

|

317,051,125 |

Warrants |

|

6,155,323 |

|

6,079,890 |

Additional paid-in capital |

|

58,138,914 |

|

55,980,367 |

Accumulated other comprehensive loss |

|

(14,538,830) |

|

(7,814,163) |

Deficit |

|

(383,641,363) |

|

(323,181,697) |

Total equity (deficiency) attributable to equity holders of the Company |

|

(11,939,854) |

|

48,115,522 |

|

|

|

|

|

Non-controlling interest |

|

(15,620,815) |

|

12,722,077 |

Total shareholders' equity (deficiency) |

|

(27,560,669) |

|

60,837,599 |

|

|

|

|

|

Commitments and contingencies |

|

|

|

|

Subsequent events |

|

|

|

|

Total liabilities and shareholders' equity (deficiency) |

|

$30,928,258 |

|

$104,954,722 |

See accompanying notes to the consolidated financial statements.

Consolidated Statements of Loss and Comprehensive Loss

(In U.S. dollars)

|

|

|

|

|

|

|

|

|

|

|

|

|

Years ended |

|

|

|

March 31,

2023 |

|

March 31,

2022 |

|

|

|

|

|

|

Revenue from sales, net of excise taxes

of $643,476 (2022 - $1,877,543) |

|

$51,744,817 |

|

$47,695,828 |

Royalty revenues |

|

818,584 |

|

1,019,861 |

Other revenues |

|

51,937 |

|

81,435 |

Total revenues |

|

52,615,338 |

|

48,797,124 |

|

|

|

|

|

|

Cost of sales other than impairment loss on inventories,

net of subsidies of nil (2022 - $924,644) |

|

(49,591,156) |

|

(52,561,404) |

Impairment loss on inventories |

|

(5,498,347) |

|

(3,772,066) |

Total Cost of sales |

|

(55,089,503) |

|

(56,333,470) |

Gross profit (loss) |

|

(2,474,165) |

|

(7,536,346) |

|

|

|

|

|

|

Research and development expenses |

|

(484,224) |

|

(880,151) |

Selling, general and administrative expenses, net of subsidies

of nil (2022 - $99,840 ) |

|

(46,424,295) |

|

(60,538,424) |

Impairment loss related to intangible assets |

|

(17,979,060) |

|

(1,527,000) |

Impairment loss related to property, plant and equipment |

|

— |

|

(14,765,582) |

Impairment loss on assets held for sale |

|

(15,346,119) |

|

— |

Impairment loss on right of use assets |

|

(424,454) |

|

— |

Impairment loss related to goodwill |

|

(19,542,436) |

|

(3,288,847) |

Net gain (loss) on sale of property, plant and equipment |

|

(172,945) |

|

6,469 |

Loss from operating activities |

|

(102,847,698) |

|

(88,529,881) |

|

|

|

|

|

|

Finance income |

|

1,445 |

|

7,123 |

Finance costs |

|

(3,824,030) |

|

(2,143,978) |

Loss on issuance of derivatives |

|

(3,156,569) |

|

— |

Foreign exchange gain (loss) |

|

6,434,510 |

|

(685,708) |

Change in revaluation of marketable securities |

|

— |

|

(107,203) |

Gain on revaluation of derivatives |

|

14,709,805 |

|

7,035,118 |

Loss on settlement of liability |

|

(120,021) |

|

— |

|

|

|

14,045,140 |

|

4,105,352 |

Loss before income taxes |

|

(88,802,558) |

|

(84,424,529) |

|

|

|

|

|

|

Income tax recovery |

|

— |

|

— |

Net loss |

|

(88,802,558) |

|

(84,424,529) |

|

|

|

|

|

|

Other comprehensive income (loss) |

|

|

|

|

Net change in unrealized foreign currency gains (losses)

on translation of net investments in foreign operations

(tax effect of nil for all periods) |

|

(6,724,667) |

|

750,248 |

Total other comprehensive income (loss) |

|

(6,724,667) |

|

750,248 |

|

|

|

|

|

|

Total comprehensive loss |

|

$(95,527,225) |

|

$(83,674,281) |

|

|

|

|

|

|

Net loss attributable to: |

|

|

|

|

Equity holders of the Company |

|

$(60,459,666) |

|

$(74,971,745) |

Non-controlling interest |

|

(28,342,892) |

|

(9,452,784) |

Net loss |

|

$(88,802,558) |

|

$(84,424,529) |

|

|

|

|

|

|

Total comprehensive loss attributable to: |

|

|

|

|

Equity holders of the Company |

|

$(67,184,333) |

|

$(74,218,802) |

Non-controlling interest |

|

(28,342,892) |

|

(9,455,479) |

Total comprehensive loss |

|

$(95,527,225) |

|

$(83,674,281) |

|

|

|

|

|

|

Basic loss per share attributable to: |

|

|

|

|

Common Shareholders of the Company |

|

$(5.12) |

|

$(15.54) |

|

|

|

|

|

|

Diluted loss per share attributable to: |

|

|

|

|

Common Shareholders of the Company |

|

$(5.12) |

|

$(15.54) |

|

|

|

|

|

|

Basic and diluted weighted average number of common shares |

|

11,812,337 |

|

4,824,336 |

SELECTED CONSOLIDATED FINANCIAL INFORMATION

The following table sets out selected consolidated financial information and are prepared in accordance with US GAAP.

|

|

|

|

|

|

|

|

|

|

|

Three-month periods ended |

Twelve-month periods ended |

|

|

March 31,

2023 |

|

March 31,

2022 |

|

March 31,

2023 |

|

March 31,

2022 |

|

|

|

|

Recasted |

|

|

|

Recasted |

|

|

$ |

|

$ |

|

$ |

|

$ |

Total revenues |

|

12.147 |

|

11.532 |

|

52.615 |

|

48.797 |

Adjusted EBITDA1 |

|

(12.963) |

|

(12.762) |

|

(39.660) |

|

(53.258) |

Net loss |

|

(44.513) |

|

(36.662) |

|

(88.803) |

|

(84.425) |

Net loss attributable to equity holders of the

Company |

|

(26.566) |

|

(31.942) |

|

(60.460) |

|

(74.972) |

Net loss attributable to non-controlling interest |

|

(17.947) |

|

(4.720) |

|

(28.343) |

|

(9.453) |

Basic and diluted loss per share |

|

(3.74) |

|

(7.47) |

|

(7.52) |

|

(17.50) |

Basic and diluted loss attributable

to common shareholders of the Company |

|

(2.23) |

|

(6.51) |

|

(5.12) |

|

(15.54) |

|

|

|

|

|

|

|

|

|

As at

March 31, 2023 |

|

As at

March 31, 2022 |

|

As at

March 31, 2021 |

|

|

$ |

|

$ |

|

$ |

Total assets |

|

30.928 |

|

104.955 |

|

186.948 |

Working capital2 |

|

(17.484) |

|

7.071 |

|

54.718 |

Non-current financial liabilities |

|

17.455 |

|

13.800 |

|

14.593 |

(Deficiency) equity attributable to equity holders of the Company |

|

(11.940) |

|

48.116 |

|

115.368 |

(Deficiency) equity attributable to non-controlling interest |

|

(15.621) |

|

12.722 |

|

22.178 |

1 The Adjusted EBITDA is a non-GAAP measure. It is not a standard measure endorsed by US GAAP requirements. A reconciliation to the Company’s net loss is presented below. In the quarter ended September 30, 2022, the Company recasted comparative Adjusted EBITDA to conform to its current definition. As a result, the following adjustments were removed in the current and comparative quarters: litigation provisions, business acquisition and integration costs, signing bonus, severance and related costs, and write-down of inventories and deposits.

2 Working capital is calculated by subtracting current liabilities from current assets. Because there is no standard method endorsed by US GAAP, the results may not be comparable to similar measurements presented by other public companies. Current assets as at March 31, 2023, 2022 and 2021 were $23.550, $37.388 and $89.528 respectively, and current liabilities as at March 31, 2023, 2022 and 2021 were $41.034, $30.317 and $34.809 respectively.

NON-GAAP FINANCIAL PERFORMANCE MEASURES

The Company uses one adjusted financial measure, Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (“Adjusted EBITDA”) to assess its operating performance. This non-GAAP financial measure is presented in a consistent manner, unless otherwise disclosed. The Company uses this measure for the purposes of evaluating its historical and prospective financial performance, as well as its performance relative to competitors. The measure also helps the Company to plan and forecast for future periods as well as to make operational and strategic decisions. The Company believes that providing this information to investors, in addition to its GAAP financial statements, allows them to see the Company’s results through the eyes of Management, and to better understand its historical and future financial performance. Neptune’s method for calculating Adjusted EBITDA may differ from that used by other corporations.

A reconciliation of net loss to Adjusted EBITDA is presented below.

ADJUSTED EBITDA

Although the concept of Adjusted EBITDA is not a financial or accounting measure defined under US GAAP and it may not be comparable to other issuers, it is widely used by companies. Neptune obtains its Adjusted EBITDA measurement by excluding from its net loss the following items: net finance costs (income), depreciation and amortization, and income tax expense (recovery). Other items such as equity classified stock-based compensation, non-employee compensation related to warrants, impairment losses on non-financial assets, revaluations of derivatives, costs related to conversion from IFRS to US GAAP and other changes in fair values are also added back to Neptune's net loss. The exclusion of net finance costs (income) eliminates the impact on earnings derived from non-operational activities. The exclusion of depreciation and amortization, stock-based compensation, non-employee compensation related to warrants, impairment losses, revaluations of derivatives and other changes in fair values eliminates the non-cash impact of such items, and the exclusion of costs related to conversion from IFRS to US GAAP, together with the other exclusions discussed above, present the results of the on-going business. From time to time, the Company may exclude additional items if it believes doing so would result in a more effective analysis of underlying operating performance. Adjusting for these items does not imply they are non-recurring. For purposes of this analysis, the Net finance costs (income) caption in the reconciliation below includes the impact of the revaluation of foreign exchange rates.

In the quarter ended September 30, 2022, the Company recast comparative Adjusted EBITDA to conform to the current definition. As a result, the following adjustments were removed in the current and comparative quarters: litigation provisions, business acquisition and integration costs, signing bonus, severance and related costs, D&O insurance and write-down of inventories and deposits.

Adjusted EBITDA1 reconciliation, in millions of dollars

|

|

|

|

|

|

|

|

|

|

|

Three-month periods ended |

|

Twelve-month periods ended |

|

|

March 31,

2023 |

|

March 31,

2022 |

|

March 31,

2023 |

|

March 31,

2022 |

|

|

0 |

|

Recasted |

|

|

|

Recasted |

|

|

|

|

|

|

|

|

|

Net loss for the year |

|

$(44.513) |

|

$(36.662) |

|

$(88.803) |

|

$(84.425) |

Add (deduct): |

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

0.843 |

|

1.656 |

|

3.234 |

|

6.791 |

Revaluation of derivatives |

|

1.374 |

|

1.672 |

|

(14.710) |

|

(7.035) |

Net finance costs |

|

1.166 |

|

1.266 |

|

3.823 |

|

2.823 |

Equity classified stock-based compensation |

|

0.671 |

|

1.565 |

|

3.504 |

|

7.817 |

Non-employee compensation related to warrants |

|

— |

|

— |

|

— |

|

0.179 |

System migration, conversion, implementation |

|

— |

|

(0.001) |

|

— |

|

0.327 |

Impairment loss on long-lived assets |

|

27.511 |

|

17.177 |

|

53.292 |

|

19.581 |

Costs related to conversion from IFRS to US GAAP |

|

— |

|

0.577 |

|

— |

|

0.577 |

Change in revaluation of marketable securities |

|

— |

|

— |

|

— |

|

0.107 |

Income tax recovery |

|

(0.015) |

|

(0.012) |

|

— |

|

— |

Adjusted EBITDA1 |

|

$(12.963) |

|

$(12.762) |

|

$(39.660) |

|

$(53.258) |

1 The Adjusted EBITDA is not a standard measure endorsed by US GAAP requirements. In the quarter ended September 30, 2022, the Company recasted comparative Adjusted EBITDA to conform to its current definition. As a result, the following adjustments were removed in the current and comparative quarters: litigation provisions, business acquisition and integration costs, signing bonus, severance and related costs, and write-down of inventories and deposits

v3.23.2

Document And Entity Information

|

Jul. 17, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jul. 17, 2023

|

| Entity Registrant Name |

NEPTUNE WELLNESS SOLUTIONS INC.

|

| Entity Central Index Key |

0001401395

|

| Entity Emerging Growth Company |

false

|

| Securities Act File Number |

001-33526

|

| Entity Incorporation, State or Country Code |

A8

|

| Entity Tax Identification Number |

00-0000000

|

| Entity Address, Address Line One |

545 Promenade du Centropolis

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

Laval

|

| Entity Address, State or Province |

QC

|

| Entity Address, Postal Zip Code |

H7T 0A3

|

| City Area Code |

450

|

| Local Phone Number |

687-2262

|

| Entity Information, Former Legal or Registered Name |

N/A

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Shares, no par value per share

|

| Trading Symbol |

NEPT

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

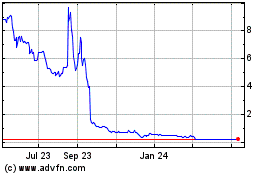

Neptune Wellness Solutions (NASDAQ:NEPT)

Historical Stock Chart

From Apr 2024 to May 2024

Neptune Wellness Solutions (NASDAQ:NEPT)

Historical Stock Chart

From May 2023 to May 2024