FALSE000100069400010006942023-11-092023-11-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 9, 2023

NOVAVAX, INC.

(Exact name of registrant as specified in charter)

| | | | | | | | | | | | | | |

| Delaware | | 0-26770 | | 22-2816046 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

700 Quince Orchard Road

Gaithersburg, Maryland 20878

(Address of Principal Executive Offices, including Zip Code)

(240) 268-2000

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange on which

registered |

| Common Stock, Par Value $0.01 per share | | NVAX | | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

Third Quarter Financial Results

On November 9, 2023, Novavax, Inc. (the “Company”) issued a press release announcing the Company’s financial results for the quarter ended September 30, 2023. A copy of this press release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | NOVAVAX, INC. |

| | | |

Date: November 9, 2023 | By: | /s/ John A. Herrmann III |

| | Name: | John A. Herrmann III |

| | Title: | Executive Vice President, Chief Legal Officer and Corporate Secretary |

Novavax Reports Third Quarter 2023 Financial Results and Operational Highlights

•Received authorization from the U.S. FDA and approval from the European Commission for the Company’s updated COVID-19 vaccine, and launched the only protein-based non-mRNA vaccine option

•Secured broad access to Novavax’s COVID-19 vaccine in the U.S.

•R21/Matrix-M malaria vaccine received recommendation from WHO, resulting in initial sales of Matrix-M for launch

•Anticipate Phase 3 COVID-19-Influenza Combination vaccine trial to commence in 2024, with potential for accelerated approval and launch in 2026

•Expect to deliver total revenue at low end of guidance range for season, when accounting for some revenue shifting into first quarter 2024

•Prepared to initiate additional cost reduction program, targeting over $300 million in 2024 to align company scope and structure with future COVID-19 market opportunity

•Company to host conference call today at 8:30 a.m. ET

GAITHERSBURG, Md., Nov. 9, 2023 – Novavax, Inc. (Nasdaq: NVAX), a global company advancing protein-based vaccines with its Matrix-M™ adjuvant, today announced its financial results and operational highlights for the third quarter ended September 30, 2023.

“We are proud of the progress we made over the last quarter to deliver the only protein-based non-mRNA vaccine option in the U.S. and have worked to provide broad access across retail pharmacies and healthcare offices,” said John C. Jacobs, President and Chief Executive Officer, Novavax. “With the delayed start of respiratory vaccinations, we believe we have yet to reach the midpoint of the vaccination season and, with early and encouraging signs of demand for our vaccine, we believe there remains opportunity to deliver doses and grow our share. This reinforces our belief that the long-term COVID-19 market represents a sustainable opportunity for Novavax in the years to come.”

“As previously stated, one of our key objectives is to strengthen the financial stability of the company. We are currently exceeding the targeted reductions announced earlier in the year and did so while launching our updated vaccine. To more efficiently scale our business, we are prepared to initiate additional cost reductions to further reduce expenses in 2024 by over $300 million, while continuing to maintain our key capabilities and our ability to bring forward a combination vaccine.”

Third Quarter 2023 and Recent Highlights

During the third quarter, Novavax continued to make progress on its three key priorities for 2023.

Priority #1: Deliver an Updated COVID-19 Vaccine for the Upcoming 2023 Fall Vaccination Season

U.S. Market: Novavax received Emergency Use Authorization (EUA) from the U.S. Food and Drug Administration (FDA) in October for its updated COVID-19 vaccine and is executing its commercial strategy to maximize access for consumers who want a protein-based non-mRNA vaccine option.

•Expect U.S. 2023-2024 season COVID-19 vaccine demand of between 30 and 50 million doses, with potential for significant November and December vaccinations given current trends and later start as compared to 2022

•Secured broad access to the Company’s updated vaccine through major pharmacies, clinics and government programs

oNovavax’s vaccine is available at approximately 14,000 pharmacy locations, including Costco, CVS Pharmacy, Giant, Publix, Rite Aid and Stop & Shop

Global Markets: Received approval in Europe for the Company’s updated COVID-19 vaccine in individuals aged 12 and older

•Advanced regulatory filings against existing APAs for Australia, Canada, New Zealand, Singapore and Taiwan

Priority #2: Reduce Rate of Spend, Manage Cash Flow and Evolve Scale and Structure

Novavax has made significant progress on its commitment to improve its financial position while maintaining the capabilities to support long-term value creation.

•Reduced current liabilities by $128 million during the third quarter of 2023 and by approximately $1 billion as of September 30, 2023

•Reduced year-to-date operating expenses through the third quarter of 2023 by $950 million or 47%, as compared to 2022

•On track to exceed the previously announced global restructuring and cost reduction plan for 2023 by over $100 million for combined Research and Development (R&D) and Selling, General, and Administrative (SG&A) expenses

•Prepared to initiate additional cost reductions to further reshape the size and scope of global operations beyond previously stated cost reduction targets by over $300 million

Priority #3: Leverage Technology Platform, Capabilities, and Portfolio of Assets to Drive Additional Value Beyond Nuvaxovid™

Novavax remains focused on leveraging its technology platform to drive long-term growth and protect global health.

•Expect to initiate a pivotal Phase 3 trial for COVID-19-Influenza Combination (CIC) vaccine candidate in the second half of 2024, with potential for accelerated approval and launch as early as 2026

•Advanced partnerships with Matrix-M adjuvant technology

oR21/Matrix-M vaccine received recommendation from the World Health Organization; launch expected in 2024

Third Quarter 2023 Financial Results

•Total revenue for the third quarter of 2023 was $187 million, compared to $735 million in the same period in 2022. Third quarter 2023 grant revenue of $165 million benefited from milestone achievements related to U.S. market preparedness and progress on clinical projects. Third quarter 2023 royalty and other revenue includes $12 million in Matrix-M sales to our collaboration partner in support of launch preparations for the R21/Matrix-M malaria vaccine.

•Cost of sales for the third quarter of 2023 were $99 million, compared to $435 million in the same period in 2022. Third quarter 2023 cost of sales includes $82 million related to excess, obsolete or expired inventory and losses on firm purchase commitments as compared to $249 million in the same period in 2022. Third quarter 2023 cost of sales also includes a $22 million benefit related to certain negotiated reductions to previously recognized firm purchase commitments.

•R&D expenses for the third quarter of 2023 were $106 million, compared to $304 million in the same period in 2022. The decrease was primarily due to reduction in clinical and manufacturing spend and a $58 million benefit associated with the negotiated settlement of manufacturing liabilities recorded in the third quarter of 2023.

•SG&A expenses for the third quarter of 2023 were $107 million, compared to $123 million for the same period in 2022. The decrease was primarily due to certain cost containment measures to reduce operating spend

•Net loss for the third quarter 2023 was $131 million, compared to a net loss of $169 million in the same period in 2022.

•Cash, cash equivalents and restricted cash were $666 million as of September 30, 2023, compared to $518 million as of June 30, 2023, and $1.3 billion as of December 31, 2022. Through sales of Novavax common stock pursuant to at-the-market offerings during the third quarter of 2023, Novavax raised net proceeds of $143 million.

Financial Framework

Novavax is updating its Full Year 2023 guidance and providing First Quarter 2024 total revenue guidance:

For updated total revenue guidance, we have included combined FY 2023 and Q1 2024 total revenue to reflect the full delivery timing and revenue recognition of sales associated with the 2023-2024 vaccination season. Consistent with 2023, we originally expected no product sales revenue in the first quarter of 2024. Due to the delayed start to and expectation for a longer season in the U.S., we expect some portion of revenue recognition will extend into the first quarter of 2024. In addition, outside of the U.S., some portion of APA dose deliveries may extend into the first quarter of 2024.

| | | | | | | | | | | | | | |

$ in millions | Prior (as of August 8, 2023) | Updated (as of November 9, 2023) |

| | |

|

FY 2023 | Combined FY 2023 & Q1 2024 |

FY 2023 |

Q1 20243 |

Total Revenue1 | $1,300 - $1,500 | $1,300 | $900 - $1,100 | $300 |

Product Sales1 | $960 - $1,140 | $850 | $475 - $625 | $300 |

| Grants, royalties & other | $340 - $360 | $450 | $425 - $475 | |

| | | | |

Combined R&D and SG&A2 | $1,300 - $1,400 | | $1,150 - $1,250 | |

1.Full year 2023 and first quarter 2024 guidance reflects APAs based on committed dose delivery schedules of over $700 million, secured new orders and U.S. market sales of $50 million to $150 million, subject to updated variant manufacturing and regulatory approvals.

2.Full year 2023 adjusted combined R&D and SG&A expenses include one-time restructuring costs for which $15 million was recorded in the second quarter 2023.

3.The first quarter 2024 total revenue guidance reflects the balancing amount to achieve our expected combined full year 2023 and first quarter 2024 product sales and total revenue. We previously expected no product sales in the first quarter of 2024.

Novavax is prepared to initiate an additional cost reduction program to reduce 2024 expenses by over $300 million:

Intend to further reshape the size and scope of global business operations beyond previously announced 2024 targets to align with the COVID-19 market opportunity.

oAnticipate reducing 2024 R&D and SG&A expenses by over $200 million compared to prior targets to reflect $750 million or lower spend for 2024, representing a greater than 50% reduction compared to 2022.

oIn addition, anticipate reducing supply network costs by over $100 million as we continue to rationalize our manufacturing footprint.

Conference Call

Novavax will host its quarterly conference call today at 8:30 a.m. ET. The dial-in numbers for the conference call are (877) 550-1858 (Domestic) or (848) 488-9160 (International). Participants will be prompted to request to join the Novavax, Inc. call. The passcode entry number is 1754341. A replay of the conference call will be available starting at 11:30 a.m. ET on November 9, 2023, until 11:59 p.m. ET on November 16, 2023. To access the replay by telephone, dial (800) 645-7964 (Domestic) or (757) 849-6722 (International) and use passcode 5567#.

A webcast of the conference call can also be accessed on the Novavax website at novavax.com/events. A replay of the webcast will be available on the Novavax website until February 7, 2023.

Trade Name in the U.S.

The trade name Nuvaxovid has not been approved by the U.S. FDA.

About Novavax

Novavax, Inc. (Nasdaq: NVAX) promotes improved health by discovering, developing and commercializing innovative vaccines to help protect against serious infectious diseases. Novavax, a global company based in Gaithersburg, Md., U.S., offers a differentiated vaccine platform that combines a recombinant protein approach, innovative nanoparticle technology and Novavax's patented Matrix-M adjuvant to enhance the immune response. Focused on the world’s most urgent health challenges, Novavax is currently evaluating vaccines for COVID-19, influenza and COVID-19 and influenza combined. Please visit novavax.com and LinkedIn for more information.

Forward-Looking Statements

Statements herein relating to the future of Novavax, its near-term priorities including delivering an updated COVID-19 vaccine for the 2023-2024 vaccination season, reducing rate of spend, managing cash flow and evolving its scale and structure, the amount and impact of Novavax’s previously announced global restructuring and cost reduction plan and new cost reduction plan, its operating plans, objectives and prospects, full year 2023 and first quarter 2024 financial guidance, its future financial or business performance, conditions or strategies, its partnerships, including with respect to the launch of R21/Matrix-M Malaria vaccine, the ongoing development of its updated COVID-19 vaccine, its CIC vaccine candidate and stand-alone influenza vaccine candidate, the scope, timing and outcome of future and pending regulatory filings and actions, including Novavax’s expected U.S. Biologics License Application submission for Novavax’s prototype COVID-19 vaccine and submissions for its updated COVID-19 vaccine in Europe, the availability of its updated COVID-19 vaccine, the fall 2023 and future COVID-19 market, and the timing of delivery and distribution of its vaccine are forward-looking statements. Novavax cautions that these forward-looking statements are subject to numerous risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. These risks and uncertainties include, without limitation, Novavax’s ability to successfully manufacture, distribute, or market its updated COVID-19 vaccine for the 2023-2024 vaccination season; challenges satisfying, alone or together with partners, various safety, efficacy, and product characterization requirements, including those related to process qualification, assay validation and stability testing, necessary to satisfy applicable regulatory authorities; challenges or delays in conducting clinical trials; challenges or delays in obtaining regulatory authorization for its product candidates, including its updated COVID-19 vaccine in time for the 2023-2024 vaccination season or for future COVID-19 variant strain changes; manufacturing, distribution or export delays or challenges; Novavax's exclusive dependence on Serum Institute of India Pvt. Ltd. and Serum Life Sciences Limited for co-formulation and filling and PCI Pharma Services for finishing Novavax’s COVID-19 vaccines and the impact of any delays or disruptions in their operations on the delivery of customer orders; difficulty obtaining scarce raw materials and supplies; resource constraints, including human capital and manufacturing capacity, and constraints on Novavax’s ability to pursue planned regulatory pathways, alone or with partners, in multiple jurisdictions simultaneously, leading to staggered regulatory filings, and potential regulatory actions; the loss of future funding from the U.S. government; the potential for an unfavorable outcome in disputes, including the pending arbitration with Gavi; challenges in implementing its global restructuring and cost reduction plan; Novavax’s ability to timely deliver doses; challenges in obtaining commercial adoption and market acceptance of its updated COVID-19 vaccine, NVX-CoV2373 or any COVID-19 variant strain-containing formulation; challenges meeting contractual requirements under agreements with multiple commercial, governmental, and other entities, including requirements to deliver doses that may require Novavax to refund portions of upfront and other payments previously received or result in reduced future payments pursuant to such agreements; challenges related to the seasonality of vaccinations against COVID-19; and those other risk factors identified in the "Risk Factors" and "Management's

Discussion and Analysis of Financial Condition and Results of Operations" sections of Novavax's Annual Report on Form 10-K for the year ended December 31, 2022 and subsequent Quarterly Reports on Form 10-Q, as filed with the Securities and Exchange Commission (SEC). We caution investors not to place considerable reliance on forward-looking statements contained in this press release. You are encouraged to read our filings with the SEC, available at www.sec.gov and www.novavax.com, for a discussion of these and other risks and uncertainties. The forward-looking statements in this press release speak only as of the date of this document, and we undertake no obligation to update or revise any of the statements. Our business is subject to substantial risks and uncertainties, including those referenced above. Investors, potential investors, and others should give careful consideration to these risks and uncertainties.

| | | | | | | | | | | | | | | | | | | | | | | |

| NOVAVAX, INC. |

| CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS |

| (in thousands, except per share information) |

| | | | | | | |

| | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, | | September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| (unaudited) | | (unaudited) |

| | | | | | | |

| Revenue: | | | | | | | |

| Product sales | $ | 2,231 | | | $ | 626,091 | | | $ | 279,937 | | | $ | 1,267,174 | |

| Grants | 164,922 | | 106,273 | | 389,380 | | 313,348 |

| Royalties and other | 19,833 | | 2,213 | | 23,046 | | 43,951 |

| Total revenue | 186,986 | | 734,577 | | 692,363 | | 1,624,473 |

| Expenses: | | | | | | | |

| Cost of sales | 98,929 | | 434,593 | | 188,792 | | 720,874 |

| Research and development | 106,229 | | 304,297 | | 572,805 | | 977,428 |

| Selling, general, and administrative | 107,460 | | 122,876 | | 313,709 | | 327,028 |

| Total expenses | 312,618 | | 861,766 | | 1,075,306 | | 2,025,330 |

| Loss from operations | (125,632) | | (127,189) | | (382,943) | | (400,857) |

| Interest expense | (2,859) | | (4,169) | | (10,299) | | (15,279) |

| Other income (expense) | (2,982) | | (34,783) | | 26,912 | | (53,002) |

| Loss before income taxes | (131,473) | | (166,141) | | (366,330) | | (469,138) |

Income tax expense (benefit) | (697) | | 2,472 | | 343 | | 6,552 |

| Net loss | $ | (130,776) | | | $ | (168,613) | | | $ | (366,673) | | | $ | (475,690) | |

| | | | | | | |

| Net loss per share | | | | | | | |

| Basic and diluted | $ | (1.26) | | | $ | (2.15) | | | $ | (3.94) | | | $ | (6.13) | |

| Weighted average number of common shares outstanding | | | | | | | |

| Basic and diluted | 103,429 | | 78,274 | | 93,046 | | 77,631 |

| | | | | | | |

SELECTED CONSOLIDATED BALANCE SHEET DATA

(in thousands)

| | | | | | | | | | | | | | |

| | September 30, 2023 | | December 31, 2022 |

| | (unaudited) | | |

| | | | |

Cash and cash equivalents |

| $ | 651,104 | | $ | 1,336,883 |

Total restricted cash | | 15,259 | | 11,962 |

Total current assets | | 1,006,764 | | 1,703,391 |

Working capital | | (461,826) | | (756,553) |

Total assets | | 1,657,157 | | 2,258,679 |

Convertible notes payable* | | 167,621 | | 491,347 |

Total stockholders’ deficit | | (678,350) | | (634,078) |

*Included in non-current liabilities as of September 30, 2023, and current and non-current liabilities as of December 31, 2022.

Contacts:

Investors

Erika Schultz

240-268-2022

ir@novavax.com

Media

Ali Chartan

240-720-7804

media@novavax.com

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

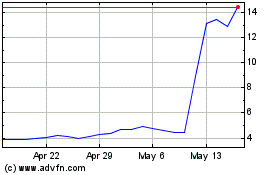

Novavax (NASDAQ:NVAX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Novavax (NASDAQ:NVAX)

Historical Stock Chart

From Apr 2023 to Apr 2024