Olaplex Holdings, Inc. (NASDAQ: OLPX) ("OLAPLEX" or the "Company")

today announced financial results for the fourth quarter and full

year ended December 31, 2022.

For fiscal year 2022 compared to fiscal year

2021:

- Net sales increased 17.7% to $704.3 million;

- Net sales increased 15.4% in the United States and increased

20.9% internationally

- By channel:

- Professional increased 16.0% to $300.5 million;

- Specialty Retail increased 33.9% to $235.3 million;

- Direct-To-Consumer increased 3.0% to $168.5 million;

- Net income increased 10.5% and adjusted

net income increased 13.1%;

- Diluted EPS was $0.35 for 2022, as compared to $0.32 for

2021;

- Adjusted Diluted EPS was $0.45 for 2022, as compared to $0.40

for 2021

For the fourth quarter

of 2022 compared to the fourth

quarter 2021:

- Net sales declined 21.5% to $130.7 million;

- Net sales decreased 28.0% in the United States and decreased

13.4% internationally

- By channel:

- Professional declined 3.9% to $54.9 million;

- Direct-To-Consumer declined 13.2% to $43.2 million;

- Specialty Retail declined 45.3% to $32.6 million;

- Net income decreased 51.5% and adjusted

net income decreased 32.3%;

- Diluted EPS was $0.05 for the fourth quarter 2022, as compared

to $0.10 for the fourth quarter 2021;

- Adjusted Diluted EPS was $0.07 for the fourth quarter 2022, as

compared to $0.10 for the fourth quarter 2021

JuE Wong, OLAPLEX’s President and Chief

Executive Officer, commented: "As expected, the fourth quarter

represented a challenging end to fiscal 2022 reflecting the rapidly

changing market dynamic that began mid-year. Our priorities in 2023

are to reset our base and invest in our core to provide a more

powerful platform for growth. We are focused on increasing

investments in sales, marketing and education, while continuing to

bring to market efficacious products that professionals and

consumers love and trust. We believe the actions we are taking

along with our strength in product technology, R&D and

community, combined with our strong cash flow generation, will

enable us to increase our leadership position in prestige haircare

and return the business to growth in the future."

Full Year 2022 Highlights

|

(Dollars in $000’s, except per share data) |

|

|

|

|

|

|

|

Full Year |

|

|

2022 |

|

|

|

2021 |

|

|

% Change |

|

Net Sales |

|

$ |

704,274 |

|

|

$ |

598,365 |

|

|

17.7% |

|

Gross Profit |

|

$ |

519,553 |

|

|

$ |

473,822 |

|

|

9.7% |

|

Gross Profit Margin |

|

|

73.8 |

% |

|

|

79.2 |

% |

|

|

|

Adjusted Gross Profit |

|

$ |

533,247 |

|

|

$ |

481,811 |

|

|

10.7% |

|

Adjusted Gross Profit Margin |

|

|

75.7 |

% |

|

|

80.5 |

% |

|

|

|

SG&A |

|

$ |

113,877 |

|

|

$ |

98,878 |

|

|

15.2% |

|

Adjusted SG&A |

|

$ |

102,235 |

|

|

$ |

72,177 |

|

|

41.6% |

|

Net Income |

|

$ |

244,072 |

|

|

$ |

220,784 |

|

|

10.5% |

|

Adjusted Net Income |

|

$ |

311,776 |

|

|

$ |

275,650 |

|

|

13.1% |

|

Adjusted EBITDA |

|

$ |

429,120 |

|

|

$ |

408,784 |

|

|

5.0% |

|

Adjusted EBITDA Margin |

|

|

60.9 |

% |

|

|

68.3 |

% |

|

|

|

Diluted EPS |

|

$ |

0.35 |

|

|

$ |

0.32 |

|

|

9.4% |

|

Adjusted Diluted EPS |

|

$ |

0.45 |

|

|

$ |

0.40 |

|

|

12.5% |

|

Weighted Average Diluted Shares Outstanding |

|

|

691,005,846 |

|

|

|

689,923,792 |

|

|

|

Fourth Quarter 2022

Highlights

|

(Dollars in $000’s, except per share data) |

|

|

|

|

|

|

|

|

|

Q4 2022 |

|

Q4 2021 |

|

% Change |

|

Net Sales |

|

$ |

130,721 |

|

|

$ |

166,498 |

|

|

(21.5)% |

|

Gross Profit |

|

$ |

92,090 |

|

|

$ |

132,213 |

|

|

(30.3)% |

|

Gross Profit Margin |

|

|

70.4 |

% |

|

|

79.4 |

% |

|

|

|

Adjusted Gross Profit |

|

$ |

94,735 |

|

|

$ |

133,803 |

|

|

(29.2)% |

|

Adjusted Gross Profit Margin |

|

|

72.5 |

% |

|

|

80.4 |

% |

|

|

|

SG&A |

|

$ |

34,645 |

|

|

$ |

23,555 |

|

|

47.1% |

|

Adjusted SG&A |

|

$ |

28,836 |

|

|

$ |

22,605 |

|

|

27.6% |

|

Net Income |

|

$ |

33,633 |

|

|

$ |

69,311 |

|

|

(51.5)% |

|

Adjusted Net Income |

|

$ |

48,325 |

|

|

$ |

71,393 |

|

|

(32.3)% |

|

Adjusted EBITDA |

|

$ |

67,626 |

|

|

$ |

110,678 |

|

|

(38.9)% |

|

Adjusted EBITDA Margin |

|

|

51.7 |

% |

|

|

66.5 |

% |

|

|

|

Diluted EPS |

|

$ |

0.05 |

|

|

$ |

0.10 |

|

|

(50.0)% |

|

Adjusted Diluted EPS |

|

$ |

0.07 |

|

|

$ |

0.10 |

|

|

(30.0)% |

|

Weighted Average Diluted Shares Outstanding |

|

|

686,036,091 |

|

|

|

692,863,933 |

|

|

|

Adjusted gross profit, adjusted gross profit

margin, adjusted SG&A, adjusted net income, adjusted EBITDA,

adjusted EBITDA margin and adjusted diluted EPS are measures that

are not calculated or presented in accordance with generally

accepted accounting principles in the United States ("GAAP"). For

more information about how we use these non-GAAP financial measures

in our business, the limitations of these measures, and a

reconciliation of these measures to the most directly comparable

GAAP measures, please see "Disclosure Regarding Non-GAAP Financial

Measures" and the reconciliation tables that accompany this

release.

Balance Sheet

As of December 31, 2022, the Company had

$322.8 million of cash and cash equivalents, compared to

$186.4 million as of December 31, 2021. Inventory at the end

of the fourth quarter of 2022 was $144.4 million, compared to $98.4

million at December 31, 2021. Long-term debt, net of current

portion was $654.3 million as of December 31, 2022, compared

to $738.1 million as of December 31, 2021.

Fiscal Year 2023 Guidance

The Company expects 2023 to be a reset year in

which it increases investments to support future growth. The

Company's fiscal 2023 guidance outlined below incorporates

management's expectations regarding current consumer demand,

uncertainty related to the macroeconomic environment and trends

improving sequentially throughout the year, leading to growth in

the three months ending December 31, 2023 as compared to the three

months ended December 31, 2022.

|

For Fiscal 2023: |

|

|

|

|

(Dollars in millions) |

2023 |

2022 Actual |

% change(based on mid-point) |

|

Net Sales |

$563-$634 |

$704 |

(15)% |

|

Adjusted Net Income* |

$176-$224 |

$312 |

(36)% |

|

Adjusted EBITDA* |

$261-$322 |

$429 |

(32)% |

*Adjusted net income and Adjusted EBITDA are

non-GAAP measures. See “Disclosure Regarding Non-GAAP Financial

Measures” for additional information.

In addition to providing full year guidance for

fiscal 2023, the Company has decided to also provide quarterly

guidance for the first quarter of 2023. However, the Company does

not undertake to provide quarterly guidance in the future. Assuming

fiscal 2023 net sales at the midpoint of the range reflected in the

fiscal 2023 net sales guidance above, the Company expects net sales

to decline in the three months ending March 31, 2023 (“first

quarter”), as compared to the first quarter of 2022, as

follows:

|

(Expected decreases are approximate) |

|

Q1 2023 |

|

Q1 2022 |

|

Change in Net Sales |

|

(41)% |

|

57.6% |

|

Change in Sales by Channel |

|

|

|

|

|

Professional |

|

(43)% |

|

62.6% |

|

Specialty Retail |

|

(47)% |

|

102.5% |

|

DTC |

|

(28)% |

|

15.1% |

The fiscal 2023 net sales, Adjusted net income

and Adjusted EBITDA guidance set forth above are approximations and

are based on the Company’s plans and assumptions for the relevant

period, including, but not limited to, the following:

- First Quarter 2023 Net Sales:

- The Company expects

continued negative impact from inventory rebalancing at certain

professional and specialty retail customers, which is expected to

lower year over year net sales for the first quarter of 2023 by

approximately $25 million (based on the midpoint of the range

reflected in the fiscal 2023 net sales guidance above) as compared

to the prior year.

- The first quarter

of 2022 also included approximately $10 million in net sales

attributable to inventory pipeline sold to a key specialty retailer

during the first quarter of 2022, and similar inventory pipeline

sales did not occur in the first quarter of 2023.

- Second Quarter 2023

Net Sales:

- The Company expects

net sales in the second quarter of 2023 to sequentially improve

from the first quarter of 2023, but remain down significantly

compared to a year ago. The Company expects that this anticipated

decline will primarily be attributable to reduced customer demand,

as well as a result of net sales in the prior period of

approximately $22 million related to the Company’s introduction of

1-Liter size offerings of certain of its products and net sales of

approximately $10 million made to customers during the second

quarter of 2022 in advance of the Company’s price increases

effective as of July 1, 2022.

- Second Half 2023

Net Sales:

- In the second half

of 2023, the Company expects net sales to benefit from the impact

of new product introductions, additional distribution gains, and

improvements in customer demand due to the Company's increased

investments in sales, marketing and education.

- Gross Profit Margin:

- The Company

anticipates an approximate 300 to 400 basis point decline in gross

profit margin in 2023 compared to 2022 as a result of expected

increases in warehousing and distribution costs and anticipated

deleveraging from lower sales volume, which is expected to be more

than offset by the positive impacts of cost savings and price

increases implemented in the second half of 2022.

- Adjusted EBITDA

phasing:

- The Company expects

Adjusted EBITDA margin of approximately 48.7% for fiscal year 2023,

assuming fiscal 2023 net sales and Adjusted EBITDA at the midpoint

of the range reflected in the fiscal 2023 net sales guidance above.

The Company anticipates Adjusted EBITDA margins below this level in

the first half of the year, with the most contraction in the first

quarter of 2023, but higher than this rate in the second half of

2023 driven primarily by an expected improvement in net sales

during that period.

- Interest Expense:

- The Company expects

net interest expense to be approximately $40 million during fiscal

year 2023, which includes net impacts from short-term investments

of the Company's cash and cash equivalents balance.

- Income Tax:

- The Company expects

an effective tax rate of approximately 20.5% for fiscal year

2023.

Webcast and Conference Call Information

The company plans to host an investor conference

call and webcast to review fourth quarter and fiscal 2022 financial

results at 9:00am ET/6:00am PT on the same day. The webcast can be

accessed at https://ir.olaplex.com/. The conference call can

be accessed by calling (201) 689-8521 or (877) 407-8813 for a

toll-free number. A replay of the webcast will remain available on

the website for 90 days.

About OLAPLEX

OLAPLEX is an innovative, science-enabled,

technology-driven beauty company with a mission to improve the hair

health of its consumers. OLAPLEX disrupted and revolutionized the

prestige haircare category by creating the bond-building space in

2014, which is the process of protecting, strengthening and

rebuilding broken bonds in the hair during and after hair services.

The brand’s products have an active, patent-protected ingredient

that works on a molecular level to protect and repair hair from

damage. OLAPLEX’s award-winning products are sold through an

expanding omnichannel model serving the professional, specialty

retail, and direct-to-consumer channels.

Cautionary Note Regarding

Forward-Looking Statements

This press release includes certain

forward-looking statements and information relating to the Company

that are based on the beliefs of management as well as assumptions

made by, and information currently available to, the Company. These

forward-looking statements include, but are not limited to,

statements about: the Company’s financial position and operating

results, including financial guidance for the full fiscal year

2023, the first and second quarters of 2023 and the second half of

2023, including net sales, gross profit margin, adjusted EBITDA

margin, interest expense and effective tax rate; uncertainty

related to the macroeconomic environment; management’s expectation

that trends will improve sequentially throughout fiscal 2023;

customer demand for the Company’s products; inventory rebalancing

across certain of the Company's customers, including the timing

related thereto and the magnitude thereof; the impact of new

product introductions; business plans and objectives, including the

Company's plan to respond to moderating sales growth trends; the

Company’s sales, marketing and education initiatives and related

spending, and the impact thereof on net sales and customer demand;

the Company's investments to support future growth and expansion

opportunities; inventory pipeline sales; distribution gains and the

growth and resiliency of the global prestige haircare industry;

increases in warehousing and distribution costs; net interest

expense, including net impacts from short-term investments of the

Company's cash and cash equivalents balance; the Company's

effective tax rate and other statements contained in this press

release that are not historical or current facts. When used in this

press release, words such as "may," "will," “could," "should,"

"intend," "potential," "continue," "anticipate," "believe,"

"estimate," "expect," "plan," "target," "predict," "project,"

"seek" and similar expressions as they relate to the Company are

intended to identify forward-looking statements.

The forward-looking statements in this press

release reflect the Company’s current expectations and projections

about future events and financial trends that management believes

may affect the Company’s business, financial condition and results

of operation. These statements are predictions based upon

assumptions that may not prove to be accurate, and they are not

guarantees of future performance. As such, you should not place

significant reliance on the Company’s forward-looking statements.

Neither the Company nor any other person assumes responsibility for

the accuracy and completeness of the forward-looking statements,

including any such statements taken from third party industry and

market reports.

Forward-looking statements involve known and

unknown risks, inherent uncertainties and other factors that are

difficult to predict which may cause the Company’s actual results,

performance, time frames or achievements to be materially different

from any future results, performance, time frames or achievements

expressed or implied by the forward-looking statements, including,

without limitation: the Company’s ability to anticipate and respond

to market trends and changes in consumer preferences and execute on

its growth strategies and expansion opportunities, including with

respect to new product introductions; the Company’s ability to

develop, manufacture and effectively and profitably market and sell

future products; the Company’s ability to accurately forecast

customer and consumer demand for its products; competition in the

beauty industry; the Company’s ability to effectively maintain and

promote a positive brand image and expand its brand awareness; the

Company’s dependence on a limited number of customers for a large

portion of its net sales; the Company’s ability to attract new

customers and consumers and encourage consumer spending across its

product portfolio; the Company’s ability to successfully implement

new or additional marketing efforts; the Company’s relationships

with and the performance of its suppliers, manufacturers,

distributors and retailers and the Company’s ability to manage its

supply chain; impacts on the Company’s business from political,

regulatory, economic, trade and other risks associated with

operating internationally; the Company’s ability to attract and

retain senior management and other qualified personnel; the

Company’s reliance on its and its third-party service providers’

information technology; the Company’s ability to maintain the

security of confidential information; the Company’s ability to

establish and maintain intellectual property protection for its

products, as well as the Company’s ability to operate its business

without infringing, misappropriating or otherwise violating the

intellectual property rights of others; the outcome of litigation

and regulatory proceedings; the impact of changes in federal, state

and international laws, regulations and administrative policy; the

Company’s existing and any future indebtedness, including the

Company’s ability to comply with affirmative and negative covenants

under its credit agreement; the Company’s ability to service its

existing indebtedness and obtain additional capital to finance

operations and its growth opportunities; volatility of the

Company’s stock price; the Company’s “controlled company” status

and the influence of investment funds affiliated with Advent

International Corporation over the Company; the impact of an

economic downturn and inflationary pressures on the Company’s

business; fluctuations in the Company’s quarterly results of

operations; changes in the Company’s tax rates and the Company’s

exposure to tax liability; and the other factors identified under

the heading “Risk Factors” in Company’s most recent Annual Report

on Form 10-K filed with the Securities and Exchange Commission (the

"SEC") and in the other documents that the Company files with the

SEC from time to time.

Many of these factors are macroeconomic in

nature and are, therefore, beyond the Company’s control. Should one

or more of these risks or uncertainties materialize, or should

underlying assumptions prove incorrect, the Company’s actual

results, performance or achievements may vary materially from those

described in this press release as anticipated, believed,

estimated, expected, intended, planned or projected. The

forward-looking statements in this press release represent

management’s views as of the date hereof. Unless required by law,

the Company neither intends nor assumes any obligation to update

these forward-looking statements for any reason after the date

hereof to conform these statements to actual results or to changes

in the Company’s expectations or otherwise.

Disclosure Regarding Non-GAAP Financial

Measures

In addition to the financial measures presented

in this release in accordance with GAAP, the Company has included

certain non-GAAP financial measures in this press release,

including adjusted EBITDA, adjusted EBITDA margin, adjusted net

income, adjusted gross profit, adjusted gross profit margin,

adjusted SG&A and adjusted diluted EPS. Management believes

these non-GAAP financial measures, when taken together with the

Company’s financial results presented in accordance with GAAP,

provide meaningful supplemental information regarding the Company’s

operating performance and facilitate internal comparisons of its

historical operating performance on a more consistent basis by

excluding certain items that may not be indicative of its business,

results of operations or outlook. In particular, management

believes that the use of these non-GAAP measures may be helpful to

investors as they are measures used by management in assessing the

health of the Company’s business, determining incentive

compensation and evaluating its operating performance, as well as

for internal planning and forecasting purposes.

The Company calculates adjusted EBITDA as net

income, adjusted to exclude: (1) interest expense, net; (2) income

tax provision; (3) depreciation and amortization; (4) share-based

compensation expense; (5) non-ordinary inventory adjustments; (6)

non-ordinary costs and fees; (7) non-ordinary legal costs; (8)

non-capitalizable initial public offering ("IPO") and strategic

transition costs; (9) as applicable, Tax Receivable Agreement

liability adjustments. The Company calculates adjusted EBITDA

margin by dividing adjusted EBITDA by net sales. The Company

calculates adjusted net income as net income, adjusted to exclude:

(1) amortization of intangible assets (excluding software); (2)

non-ordinary costs and fees; (3) non-ordinary legal costs; (4)

non-ordinary inventory adjustments; (5) share-based compensation

expense; (6) non-capitalizable IPO and strategic transition costs;

(7) Tax Receivable Agreement liability adjustment; (8) tax effect

of non-GAAP adjustments. The Company calculates adjusted gross

profit as gross profit, adjusted to exclude: (1) non-ordinary

inventory adjustments and (2) amortization of patented formulations

pertaining to the acquisition of the Olaplex, LLC business in 2020

by certain investment funds affiliated with Advent International

Corporation and other investors (the "Acquisition"). The Company

calculates adjusted gross profit margin by dividing adjusted gross

profit by net sales. The Company calculates adjusted SG&A as

SG&A, adjusted to exclude: (1) share-based compensation

expense; (2) non-ordinary legal costs, (3) non-capitalizable IPO

and strategic transition costs; (4) non-ordinary costs and fees.

The Company calculates adjusted basic and diluted EPS as adjusted

net income divided by weighted average basic and diluted shares

outstanding respectively.

Please refer to "Reconciliation of Non-GAAP

Financial Measures to GAAP Equivalents" located in the financial

supplement in this release for a reconciliation of these non-GAAP

metrics to their most directly comparable financial measure stated

in accordance with GAAP.

This release includes forward-looking guidance

for adjusted EBITDA, adjusted EBITDA margin and adjusted net

income. The Company is not able to provide, without unreasonable

effort, a reconciliation of the guidance for adjusted EBITDA,

adjusted EBITDA margin and adjusted net income to the most directly

comparable GAAP measure because the Company does not currently have

sufficient data to accurately estimate the variables and individual

adjustments included in the most directly comparable GAAP measure

that would be necessary for such reconciliations, including (a)

income tax related accruals in respect of certain one-time items,

(b) costs related to potential debt or equity transactions, and (c)

other non-recurring expenses that cannot reasonably be estimated in

advance. These adjustments are inherently variable and uncertain

and depend on various factors that are beyond the Company's

control, and as a result, it is also unable to predict their

probable significance. Therefore, because management cannot

estimate on a forward-looking basis without unreasonable effort the

impact these variables and individual adjustments will have on its

reported results in accordance with GAAP, it is unable to provide a

reconciliation of the non-GAAP measures included in its full fiscal

year 2023 and first quarter 2023 guidance.

CONDENSED CONSOLIDATED BALANCE

SHEETS (in thousands, except shares) (Unaudited)

| |

December 31,2022 |

|

December 31,2021 |

| Assets |

|

|

|

| Current Assets: |

|

|

|

|

Cash and cash equivalents |

$ |

322,808 |

|

|

$ |

186,388 |

|

|

Accounts receivable, net of allowance of $19,198 and $8,231 |

|

46,220 |

|

|

|

40,779 |

|

|

Inventory |

|

144,425 |

|

|

|

98,399 |

|

|

Other current assets |

|

8,771 |

|

|

|

9,621 |

|

| Total current assets |

|

522,224 |

|

|

|

335,187 |

|

| Property and equipment,

net |

|

1,034 |

|

|

|

747 |

|

| Intangible assets, net |

|

995,028 |

|

|

|

1,043,344 |

|

| Goodwill |

|

168,300 |

|

|

|

168,300 |

|

| Deferred tax asset |

|

— |

|

|

|

8,344 |

|

| Other assets |

|

11,089 |

|

|

|

4,500 |

|

| Total assets |

$ |

1,697,675 |

|

|

$ |

1,560,422 |

|

| |

|

|

|

| Liabilities and

stockholders’ equity |

|

|

|

| Current Liabilities: |

|

|

|

|

Accounts payable |

$ |

9,748 |

|

|

$ |

19,167 |

|

|

Sales and income taxes payable |

|

3,415 |

|

|

|

12,144 |

|

|

Accrued expenses and other current liabilities |

|

17,107 |

|

|

|

17,332 |

|

|

Current portion of long-term debt |

|

8,438 |

|

|

|

20,112 |

|

|

Current portion of Related Party payable pursuant to Tax Receivable

Agreement |

|

16,380 |

|

|

|

4,157 |

|

| Total current liabilities |

|

55,088 |

|

|

|

72,912 |

|

| Long-term debt |

|

654,333 |

|

|

|

738,090 |

|

| Deferred tax liabilities |

|

1,622 |

|

|

|

— |

|

| Related Party payable pursuant

to Tax Receivable Agreement |

|

205,675 |

|

|

|

225,122 |

|

| Total liabilities |

|

916,718 |

|

|

|

1,036,124 |

|

| |

|

|

|

| Contingencies |

|

|

|

| |

|

|

|

| Stockholders’ equity |

|

|

|

|

Common stock, $0.001 par value per share; 2,000,000,000 shares

authorized, 650,091,380 and 648,794,041 shares issued and

outstanding as of December 31, 2022 and 2021,

respectively |

|

649 |

|

|

|

648 |

|

|

Preferred stock, $0.001 par value per share; 25,000,000 shares

authorized and no shares issued and outstanding as of

December 31, 2022 and 2021, respectively |

|

— |

|

|

|

— |

|

|

Additional paid-in capital |

|

312,875 |

|

|

|

302,866 |

|

|

Accumulated other comprehensive income |

|

2,577 |

|

|

|

— |

|

|

Retained earnings |

|

464,856 |

|

|

|

220,784 |

|

| Total stockholders’

equity |

|

780,957 |

|

|

|

524,298 |

|

| Total liabilities and

stockholders’ equity |

$ |

1,697,675 |

|

|

$ |

1,560,422 |

|

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE INCOME (amounts in thousands,

except per share and share data) (Unaudited)

| |

Three Months Ended December 31, |

|

Year Ended December 31, |

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| Net sales |

$ |

130,721 |

|

|

$ |

166,498 |

|

|

$ |

704,274 |

|

|

$ |

598,365 |

|

| Cost of sales: |

|

|

|

|

|

|

|

|

Cost of product (excluding amortization) |

|

36,222 |

|

|

|

32,695 |

|

|

|

177,221 |

|

|

|

116,554 |

|

|

Amortization of patented formulations |

|

2,409 |

|

|

|

1,590 |

|

|

|

7,500 |

|

|

|

7,989 |

|

| Total cost of sales |

|

38,631 |

|

|

|

34,285 |

|

|

|

184,721 |

|

|

|

124,543 |

|

| Gross profit |

|

92,090 |

|

|

|

132,213 |

|

|

|

519,553 |

|

|

|

473,822 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Selling, general, and administrative |

|

34,645 |

|

|

|

23,555 |

|

|

|

113,877 |

|

|

|

98,878 |

|

|

Amortization of other intangible assets |

|

10,392 |

|

|

|

10,243 |

|

|

|

41,282 |

|

|

|

40,790 |

|

| Total operating expenses |

|

45,037 |

|

|

|

33,798 |

|

|

|

155,159 |

|

|

|

139,668 |

|

| Operating income |

|

47,053 |

|

|

|

98,415 |

|

|

|

364,394 |

|

|

|

334,154 |

|

| Interest expense, net |

|

(10,525 |

) |

|

|

(15,096 |

) |

|

|

(41,178 |

) |

|

|

(61,148 |

) |

| Other income (expense),

net |

|

|

|

|

|

|

|

|

Loss on extinguishment of debt |

|

— |

|

|

|

— |

|

|

|

(18,803 |

) |

|

|

— |

|

|

Tax receivable agreement liability adjustment |

|

3,084 |

|

|

|

3,615 |

|

|

|

3,084 |

|

|

|

3,615 |

|

|

Other expense |

|

1,596 |

|

|

|

(595 |

) |

|

|

(2,256 |

) |

|

|

(1,012 |

) |

| Total other income (expense),

net |

|

4,680 |

|

|

|

3,020 |

|

|

|

(17,975 |

) |

|

|

2,603 |

|

|

Income before provision for income taxes |

|

41,208 |

|

|

|

86,339 |

|

|

|

305,241 |

|

|

|

275,609 |

|

| Income tax provision |

|

7,575 |

|

|

|

17,028 |

|

|

|

61,169 |

|

|

|

54,825 |

|

| Net income |

$ |

33,633 |

|

|

$ |

69,311 |

|

|

$ |

244,072 |

|

|

$ |

220,784 |

|

| |

|

|

|

|

|

|

|

| Net income per share: |

|

|

|

|

|

|

|

|

Basic |

$ |

0.05 |

|

|

$ |

0.11 |

|

|

$ |

0.38 |

|

|

$ |

0.34 |

|

|

Diluted |

$ |

0.05 |

|

|

$ |

0.10 |

|

|

$ |

0.35 |

|

|

$ |

0.32 |

|

| Weighted average common shares

outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

649,476,301 |

|

|

|

648,422,232 |

|

|

|

649,092,846 |

|

|

|

648,166,472 |

|

|

Diluted |

|

686,036,091 |

|

|

|

692,863,933 |

|

|

|

691,005,846 |

|

|

|

689,923,792 |

|

| |

|

|

|

|

|

|

|

| Other comprehensive

income: |

|

|

|

|

|

|

|

|

Unrealized gain on derivatives, net of income tax effect |

$ |

646 |

|

|

$ |

— |

|

|

$ |

2,577 |

|

|

$ |

— |

|

|

Total other comprehensive income |

|

646 |

|

|

|

— |

|

|

|

2,577 |

|

|

|

— |

|

| Comprehensive income |

$ |

34,279 |

|

|

$ |

69,311 |

|

|

$ |

246,649 |

|

|

$ |

220,784 |

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS (amounts in thousands) (Unaudited)

| |

Year Ended December 31, |

|

|

|

2022 |

|

|

|

2021 |

|

| Cash flows from operating

activities |

|

|

|

| Net income |

$ |

244,072 |

|

|

$ |

220,784 |

|

| Adjustments to reconcile net

income to net cash provided by operating activities: |

|

11,252 |

|

|

|

(20,755 |

) |

| Net cash provided by operating

activities |

|

255,324 |

|

|

|

200,029 |

|

| Net cash used in investing

activities |

|

(2,682 |

) |

|

|

(6,265 |

) |

| Net cash used in financing

activities |

|

(116,222 |

) |

|

|

(18,340 |

) |

| Net increase in cash and cash

equivalents |

|

136,420 |

|

|

|

175,424 |

|

| Cash and cash equivalents -

beginning of period |

|

186,388 |

|

|

|

10,964 |

|

| Cash and cash equivalents -

end of period |

$ |

322,808 |

|

|

$ |

186,388 |

|

Reconciliation of Non-GAAP Financial

Measures to GAAP Equivalents

The following tables present a reconciliation of net income,

gross profit and SG&A, as the most directly comparable

financial measure stated in accordance with U.S. GAAP, to adjusted

EBITDA, adjusted EBITDA margin, adjusted gross profit, adjusted

gross profit margin, adjusted SG&A, adjusted net income and

adjusted net income per share for each of the periods

presented.

| |

Three Months Ended December 31, |

|

Year Ended December 31, |

|

(in thousands) |

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| Reconciliation of Net

Income to Adjusted EBITDA |

|

|

|

|

|

|

|

| Net income |

$ |

33,633 |

|

|

$ |

69,311 |

|

|

$ |

244,072 |

|

|

$ |

220,784 |

|

| Income tax provision |

|

7,575 |

|

|

|

17,028 |

|

|

|

61,169 |

|

|

|

54,825 |

|

| Depreciation and amortization

of intangible assets |

|

12,932 |

|

|

|

11,908 |

|

|

|

49,146 |

|

|

|

48,941 |

|

| Interest expense |

|

10,525 |

|

|

|

15,096 |

|

|

|

41,178 |

|

|

|

61,148 |

|

| Loss on extinguishment of

debt(1) |

|

— |

|

|

|

— |

|

|

|

18,803 |

|

|

|

— |

|

| Share-based compensation |

|

1,821 |

|

|

|

844 |

|

|

|

7,275 |

|

|

|

3,963 |

|

| Inventory write off and

disposal(2) |

|

249 |

|

|

|

— |

|

|

|

4,573 |

|

|

|

— |

|

| Executive reorganization

costs(7) |

|

3,988 |

|

|

|

— |

|

|

|

3,988 |

|

|

|

— |

|

| Non-recurring litigation

costs(5) |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

14,250 |

|

| Labelling stock write off and

disposal(3) |

|

(13 |

) |

|

|

— |

|

|

|

1,621 |

|

|

|

— |

|

| Distribution start-up

costs(4) |

|

— |

|

|

|

— |

|

|

|

379 |

|

|

|

— |

|

| Non-capitalizable IPO and

strategic transition costs (6) |

|

— |

|

|

|

106 |

|

|

|

— |

|

|

|

8,488 |

|

| Tax receivable agreement

liability adjustment |

|

(3,084 |

) |

|

|

(3,615 |

) |

|

|

(3,084 |

) |

|

|

(3,615 |

) |

|

Adjusted EBITDA |

$ |

67,626 |

|

|

$ |

110,678 |

|

|

$ |

429,120 |

|

|

$ |

408,784 |

|

|

Adjusted EBITDA margin |

|

51.7 |

% |

|

|

66.5 |

% |

|

|

60.9 |

% |

|

|

68.3 |

% |

| |

Three Months Ended December 31, |

|

Year Ended December 31, |

|

(in thousands) |

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| Reconciliation of

Gross Profit to Adjusted Gross Profit |

|

|

|

|

|

|

|

| Gross profit |

$ |

92,090 |

|

|

$ |

132,213 |

|

|

$ |

519,553 |

|

|

$ |

473,822 |

|

| Amortization of patented

formulations |

|

2,409 |

|

|

|

1,590 |

|

|

|

7,500 |

|

|

|

7,989 |

|

| Inventory write off and

disposal(2) |

|

249 |

|

|

|

— |

|

|

|

4,573 |

|

|

|

— |

|

| Labelling stock write off and

disposal(3) |

|

(13 |

) |

|

|

— |

|

|

|

1,621 |

|

|

|

— |

|

|

Adjusted gross profit |

$ |

94,735 |

|

|

$ |

133,803 |

|

|

$ |

533,247 |

|

|

$ |

481,811 |

|

|

Adjusted gross profit margin |

|

72.5 |

% |

|

|

80.4 |

% |

|

|

75.7 |

% |

|

|

80.5 |

% |

| |

|

Three Months Ended December 31, |

|

Year Ended December 31, |

|

(in thousands) |

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| Reconciliation of

SG&A to Adjusted SG&A |

|

|

|

|

|

|

|

|

| SG&A |

|

$ |

34,645 |

|

|

$ |

23,555 |

|

|

$ |

113,877 |

|

|

$ |

98,878 |

|

| Share-based compensation |

|

|

(1,821 |

) |

|

|

(844 |

) |

|

|

(7,275 |

) |

|

|

(3,963 |

) |

| Executive reorganization

costs(7) |

|

|

(3,988 |

) |

|

|

— |

|

|

|

(3,988 |

) |

|

|

— |

|

| Non-recurring litigation

costs(5) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(14,250 |

) |

| Distribution start-up

costs(4) |

|

|

— |

|

|

|

— |

|

|

|

(379 |

) |

|

|

— |

|

| Non-capitalizable IPO and

strategic transition costs (6) |

|

|

— |

|

|

|

(106 |

) |

|

|

— |

|

|

|

(8,488 |

) |

|

Adjusted SG&A |

|

$ |

28,836 |

|

|

$ |

22,605 |

|

|

$ |

102,235 |

|

|

$ |

72,177 |

|

| |

Three Months Ended December 31, |

|

Year Ended December 31, |

|

(in thousands, except per share data) |

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| Reconciliation of Net

Income to Adjusted Net Income |

|

|

|

|

|

|

|

| Net income |

$ |

33,633 |

|

|

$ |

69,311 |

|

|

$ |

244,072 |

|

|

$ |

220,784 |

|

| Amortization of intangible

assets (excluding software) |

|

12,593 |

|

|

|

11,774 |

|

|

|

48,232 |

|

|

|

48,720 |

|

| Loss on extinguishment of

debt(1) |

|

— |

|

|

|

— |

|

|

|

18,803 |

|

|

|

— |

|

| Share-based compensation |

|

1,821 |

|

|

|

844 |

|

|

|

7,275 |

|

|

|

3,963 |

|

| Inventory write off and

disposal(2) |

|

249 |

|

|

|

— |

|

|

|

4,573 |

|

|

|

— |

|

| Executive reorganization

costs(7) |

|

3,988 |

|

|

|

— |

|

|

|

3,988 |

|

|

|

— |

|

| Labelling stock write off and

disposal(3) |

|

(13 |

) |

|

|

— |

|

|

|

1,621 |

|

|

|

— |

|

| Distribution start-up

costs(4) |

|

— |

|

|

|

— |

|

|

|

379 |

|

|

|

— |

|

| Non-recurring litigation

costs(5) |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

14,250 |

|

| Non-capitalizable IPO and

strategic transition costs (6) |

|

— |

|

|

|

106 |

|

|

|

— |

|

|

|

8,488 |

|

| Tax receivable agreement

liability adjustment |

|

(3,084 |

) |

|

|

(3,615 |

) |

|

|

(3,084 |

) |

|

|

(3,615 |

) |

| Tax effect of adjustments |

|

(862 |

) |

|

|

(7,027 |

) |

|

|

(14,083 |

) |

|

|

(16,940 |

) |

|

Adjusted net income |

$ |

48,325 |

|

|

$ |

71,393 |

|

|

$ |

311,776 |

|

|

$ |

275,650 |

|

| Adjusted net income per

share: |

|

|

|

|

|

|

|

|

Basic |

$ |

0.07 |

|

|

$ |

0.11 |

|

|

$ |

0.48 |

|

|

$ |

0.43 |

|

|

Diluted |

$ |

0.07 |

|

|

$ |

0.10 |

|

|

$ |

0.45 |

|

|

$ |

0.40 |

|

(1) On February 23, 2022, the

Company refinanced its existing secured credit facility with a new

credit agreement comprised of a $675 million senior secured term

loan facility and a $150 million senior secured revolving credit

facility. This refinancing resulted in recognition of loss on

extinguishment of debt of $18.8 million which is comprised of $11.0

million in deferred financing fee write off, and $7.8 million of

prepayment fees for the previously existing credit facility. Loss

on extinguishment of debt is included as non-ordinary costs and

fees in the reconciliations above.

(2) The inventory write-off and

disposal costs relate to unused stock of a product that the Company

reformulated in June 2021 as a result of regulation changes in the

E.U. In the interest of having a single formulation for sale

worldwide, the Company reformulated on a global basis and is now

disposing of unused stock.

(3) Labelling stock write-off

and disposal costs relate to disposal of unused product labels that

the Company was required to update as a result of regulation

changes in the E.U that become effective in the first quarter of

2023.

(4) The distribution start-up

costs relate to one-time charges associated with the set-up of a

new third party logistics provider.

(5) Represents costs incurred

during the year ended December 31, 2021 related to the payment to

LIQWD, Inc., a predecessor entity to the Company substantially all

of whose assets and liabilities were purchased as part of the

Acquisition ("LIQWD"), of certain amounts due in connection with

the resolution of certain litigation and contingency matters

involving LIQWD, which amounts were required to be paid pursuant to

the purchase agreement for the Acquisition.

(6) Represents

non-capitalizable professional fees and executive severance

incurred in connection with the Company's initial public offering

and the Company’s public company transition.

(7) Represents one-time costs

associated with the departure of the Company's Chief Operating

Officer during the year ended December 31, 2022.

Contacts:

ICR, Inc.

For Investors:Patrick Flahertypatrick.flaherty@olaplex.com

For Media:Brittany Fraser

Olaplex@icrinc.com203.682.8220

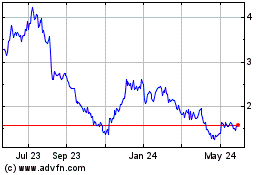

Olaplex (NASDAQ:OLPX)

Historical Stock Chart

From Dec 2024 to Jan 2025

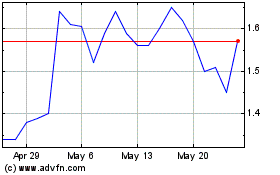

Olaplex (NASDAQ:OLPX)

Historical Stock Chart

From Jan 2024 to Jan 2025