Registration No. 333-279123

As filed with the Securities and Exchange Commission on May 21, 2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1 TO

FORM S-3

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

________________________________

Predictive Oncology Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

33-1007393 |

| (State or jurisdiction |

(I.R.S. Employer |

| of incorporation or organization) |

Identification No.) |

91 43rd Street, Suite 110

Pittsburgh, Pennsylvania 15201

(412) 432-1500

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

|

Josh Blacher

Interim Chief Financial Officer

Predictive Oncology Inc.

91 43rd Street, Suite 110

Pittsburgh, Pennsylvania 15201

(412) 432-1500

(Name, address and telephone number of agent for service) |

Copy to:

Alan Seem

DLA Piper LLP (US)

3203 Hanover Street, Suite 100

Palo Alto, California 94304

(650) 833-2000 |

Approximate date of commencement of proposed sale to the public: From time

to time on or after the effective date of this Registration Statement, as determined by market conditions and other factors.

If the only securities being registered on this Form are being offered

pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous

basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest

reinvestment plans, check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b)

under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective

registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities

Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement

for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective

amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check

the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General

Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities

Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer,

a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated

filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule

12b-2 of the Exchange Act. (Check one)

| Large accelerated filer ☐ |

Accelerated filer ☐ |

| Non-accelerated filer ☒ |

Smaller reporting company ☒ |

| Emerging growth company ☐ |

|

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 7(a)(2)(B) of Securities Act. ☐

The Registrant hereby amends this Registration

Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which

specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities

Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section

8(a), may determine.

EXPLANATORY NOTE

This Amendment No. 1 to the Registration Statement on Form S-3 of

Predictive Oncology Inc. (File No. 333-279123) (the “Registration Statement”) is being submitted to refile Exhibit 107.

Predictive Oncology Inc. (the “Company”) initially filed the Registration Statement to register the offer and sale of up

to $200 million of securities and intended to carry over the unsold securities under the Company’s prior registration

statement on Form S-3 (File No. 333-255582) (the “Prior Registration Statement”) pursuant to Rule 415(a)(5)(ii) of the

Securities Act of 1933, as amended (the “Securities Act”). The Registration Statement was transmitted to the Securities

Exchange Commission (the “SEC”) via EDGAR on May 3, 2024 but accepted by the SEC with a filing date of May 6, 2024, and

therefore was not filed within the time frame required under Rule 415 of the Securities Act. Accordingly, this Amendment No. 1 is

being filed to amend the filing fee table contained in Exhibit 107 and update Item 14 of Part II of the Registration Statement to

provide that the unsold securities and associated filing fees are not being carried over from the Prior Registration Statement

pursuant to Rule 415, and instead, the filing fees paid under the Prior Registration Statement are being used to offset the filing

fees due under the Registration Statement.

This Amendment No. 1 is also being filed to supplement and revise the

“Incorporation of Certain Documents by Reference” sections of the prospectuses included in the Registration Statement to include

additional Current Reports on Form 8-K and a Quarterly Report on Form 10-Q. The remainder of the prospectuses are unchanged except for

updating certain share price information.

This registration statement contains two prospectuses:

| |

● |

a base prospectus, which covers the offering, issuance and sale by us of up to $200,000,000 of our common stock, preferred stock, debt securities, warrants to purchase our common stock, preferred stock or debt securities, subscription rights to purchase our common stock, preferred stock or debt securities and/or units consisting of some or all of these securities; and |

| |

● |

a sales agreement prospectus covering the offering, issuance and sale by us of up to a maximum aggregate offering price of $3,696,000 of our common stock that may be issued and sold under a sales agreement with H.C. Wainwright & Co., LLC (“Wainwright”). |

The securities being registered hereby may be convertible into or exchangeable or exercisable

for other securities of any identified class. In addition to the securities that may be issued directly under this registration statement,

there is being registered hereunder such indeterminate aggregate number or amount, as the case may be, of the securities of each identified

class as may from time to time be issued upon the conversion, exchange, settlement or exercise of other securities offered hereby. Separate

consideration may or may not be received for securities that are issued upon the conversion or exercise of, or in exchange for, other

securities or that are issued in units.

The base prospectus immediately follows this explanatory note. The specific terms of any securities

to be offered pursuant to the base prospectus will be specified in a prospectus supplement to the base prospectus. The sales agreement

prospectus immediately follows the base prospectus. The $3,696,000 of common stock that may be offered, issued and sold under the sales

agreement prospectus is included in the $200,000,000 of securities that may be offered, issued and sold by us under the base prospectus.

Upon termination of the sales agreement with Wainwright, any portion of the $3,696,000 included in the sales agreement prospectus that

is not sold pursuant to the sales agreement will be available for sale in other offerings pursuant to the base prospectus and a corresponding

prospectus supplement, and if no shares are sold under the Sales Agreement, the full $200,000,000 of securities may be sold in other offerings

by us pursuant to the base prospectus and a corresponding prospectus supplement.

The information in this prospectus is not complete and may

be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective.

This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where

the offer or sale is not permitted.

PRELIMINARY PROSPECTUS, SUBJECT TO COMPLETION - DATED May

21, 2024

PREDICTIVE ONCOLOGY INC.

$200,000,000

Debt Securities

Common Stock

Preferred Stock

Warrants to Purchase Common Stock or Preferred Stock

Units

By this prospectus and an accompanying prospectus supplement, we may from

time to time offer and sell, in one or more offerings, up to $200,000,000 in any combination of debt securities, common stock, preferred

stock, warrants, units, or subscription rights.

We will provide you with more specific terms of the securities offered

by us in one or more supplements to this prospectus. You should read this prospectus and the applicable prospectus supplement carefully

before you invest.

We may offer these securities from time to time in amounts, at prices and

on other terms to be determined at the time of offering. We may offer and sell these securities to or through underwriters, dealers or

agents, or directly to investors, on a continuous or delayed basis.

The supplements to this prospectus will provide the specific terms of the

plan of distribution. The price to the public of the securities we offer and the net proceeds we expect to receive from such sale will

also be set forth in a prospectus supplement.

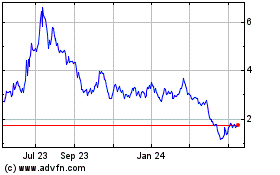

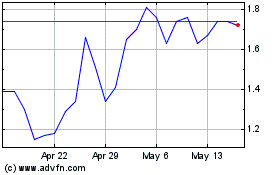

Our common stock is listed on the Nasdaq Capital Market under the symbol

“POAI”. On May 20, 2024, the closing price of our common stock as reported by the Nasdaq Capital Market was $1.69 per share.

The aggregate market value of shares of our common stock held by non-affiliates,

as of the date hereof pursuant to General Instruction of I.B.6 of Form S-3 is $11,088,966, which was calculated based on 3,988,837 shares

of our common stock outstanding held by non-affiliates and at a price of $2.78 per share, the closing price of our common stock on March

27, 2024. During the 12-calendar month period that ends on, and includes, the date of this prospectus, we have not offered or sold any

securities pursuant to General Instruction I.B.6. of Form S-3.

An investment in our securities may be considered speculative and

involves a high degree of risk, including the risk of a substantial loss of your investment. See “Risk Factors” on page 10

for more information on the risks you should consider before buying our securities. An investment in our securities is not suitable for

all investors.

Neither the Securities and Exchange Commission nor any state securities

commission has approved or disapproved of these securities, or passed upon the adequacy or accuracy of this prospectus. Any representation

to the contrary is a criminal offense.

The date of this prospectus is , 2024

Table of Contents

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement filed with

the Securities and Exchange Commission (the “SEC”) using a “shelf” registration process. Under this shelf process,

we may sell the securities described in this prospectus in one or more offerings. This prospectus provides you with a general description

of the securities that may be offered. Each time we offer securities for sale, we will provide a prospectus supplement that contains specific

information about the terms of that offering. Any prospectus supplement may also add or update information contained in this prospectus.

You should read both this prospectus and any prospectus supplement together with additional information described below under “Where

You Can Find More Information” and “Information Incorporated by Reference.”

The registration statement that contains this prospectus (including

the exhibits thereto) contains additional important information about us and the securities we may offer under this prospectus. Specifically,

we have filed certain documents that establish the terms of the securities offered by this prospectus as exhibits to the registration

statement. We will file certain other documents that establish the terms of the securities offered by this prospectus as exhibits to reports

we file with the SEC. You may obtain copies of the registration statement and the other reports and documents referenced herein as described

below under the heading “Where You Can Find More Information.”

You should rely only on the information contained or incorporated

by reference in this prospectus and in any prospectus supplement. We have not authorized any other person to provide you with different

information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making offers to

sell or solicitations to buy the securities in any jurisdiction in which an offer or solicitation is not authorized or in which the person

making that offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make an offer or solicitation. You

should not assume that the information in this prospectus or any prospectus supplement, as well as the information we file or previously

filed with the SEC that we incorporate by reference in this prospectus or any prospectus supplement, is accurate as of any date other

than the date of such document. Our business, financial condition, results of operations and prospects may have changed since those dates.

In this prospectus, unless the context otherwise requires,

references to “Predictive Oncology,” “we,” “us,” “our” or the “Company” refer

to Predictive Oncology Inc.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements made in this prospectus are “forward-looking

statements” that indicate certain risks and uncertainties related to the Company, many of which are beyond the Company’s control.

The Company’s actual results could differ materially and adversely from those anticipated in such forward-looking statements as

a result of certain factors, including those set forth below and elsewhere in this report. Important factors that may cause actual results

to differ from projections include:

| · |

We may not be able to continue operating without additional financing; |

| · |

Continued negative operating cash flows; |

| · |

Our capital needs to accomplish our goals, including any further financing, which may be highly dilutive and may include onerous terms; |

| · |

Risks related to recent and future acquisitions, including risks related to the benefits and costs of acquisition; |

| · |

Risks related to our partnerships with other companies, including the need to negotiate the definitive agreements; possible failure to realize anticipated benefits of these partnerships; and costs of providing funding to our partner companies, which may never be repaid or provide anticipated returns; |

| · |

Risks related to the initiation, formation, or success of our collaboration arrangements, commercialization activities and product sales levels by our collaboration partners and future payments that may come due to us under these arrangements; |

| · |

Risk that we will be unable to protect our intellectual property or claims that we are infringing on others’ intellectual property; |

| · |

The impact of competition; |

| · |

Acquisition and maintenance of any necessary regulatory clearances applicable to applications of our technology; |

| · |

Inability to attract or retain qualified senior management personnel, including sales and marketing personnel; |

| · |

Risk that we never become profitable if our products and services are not accepted by potential customers; |

| · |

Possible impact of government regulation and scrutiny; |

| · |

Unexpected costs and operating deficits, and lower than expected sales and revenues, if any; |

| · |

Adverse results of any legal proceedings; |

| · |

The volatility of our operating results and financial condition, |

| · |

Risk that our business and operations could be materially and adversely affected by disruptions caused by economic and geopolitical uncertainties as well as epidemics or pandemics; and |

| · |

Other specific risks that may be alluded to in this report. |

In some cases, you can identify forward-looking statements by terms such

as “may”, “will”, “should”, “could”, “would”, “expects”, “plans”,

“anticipates”, “believes”, “estimates”, “projects”, “predicts”, “potential”

and similar expressions intended to identify forward-looking statements. These statements reflect our current views with respect to future

events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance

on these forward-looking statements. Also, these forward-looking statements represent our estimates and assumptions only as of the date

of the document containing the applicable statement.

You should read this prospectus, the documents we have filed with the SEC

that are incorporated by reference and any free writing prospectus that we have authorized for use in connection with this offering completely

and with the understanding that our actual future results may be materially different from what we expect. We qualify all of the forward-looking

statements in the foregoing documents by these cautionary statements.

THE COMPANY

This summary contains basic information about us. You should read

the entire prospectus carefully, especially the risks of investing in our securities discussed under “Risk Factors.” Some

of the statements contained in this prospectus supplement, including statements under this summary and “Risk Factors” are

forward-looking statements and may involve a number of risks and uncertainties. We note that our actual results and future events may

differ significantly based upon a number of factors. You should not put undue reliance on the forward-looking statements in this document,

which speak only as of the date on the cover of this prospectus. References to “we,” “our,” “us,”

the “Company,” or “Predictive Oncology” refer to Predictive Oncology Inc., a Delaware corporation.

About Predictive Oncology

We are a knowledge and science-driven company

that applies artificial intelligence (“AI”) to support the discovery and development of optimal cancer therapies, which can

ultimately lead to more effective treatments and improved patient outcomes. We use AI and a proprietary biobank of 150,000+ tumor samples,

categorized by tumor type, to provide actionable insights about drug compounds to improve the drug discovery process and increase the

probability of drug compound success. We offer a suite of solutions for oncology drug development from early discovery to clinical trials.

Our mission is to change the landscape of oncology

drug discovery and enable the development of more effective therapies for the treatment of cancer. By harnessing the power of machine

learning and scientific rigor, we believe that we can improve the probability of success of advancing pharmaceutical and biological drug

candidates with a higher degree of confidence.

We operate in three business areas. In our first

area, we provide optimized, high-confidence drug-response predictions through the application of AI using our proprietary biobank of tumor

samples to enable a more informed selection of drug/tumor combinations and increase the probability of success during development. We

also create and develop tumor-specific 3D cell culture models mimicking the physiological environment of human tissue enabling better-informed

decision-making during development. In our second business area, we provide services and research using a proprietary self-contained and

automated system that conducts high-throughput, self-interaction chromatography screens using additives and excipients commonly included

in protein formulations resulting in soluble and physically stable formulations of biologics. Our third business area produces the United

States Food and Drug Administration (“FDA”)-cleared STREAMWAY® System and associated products for automated medical fluid

waste management and patient-to-drain medical fluid disposal. As of January 1, 2023, we changed our reportable segments to align with

these business areas.

We have three reportable segments that have been

delineated by location and business area:

| · | Pittsburgh segment: provides services that include the

application of AI using its proprietary biobank of 150,000+ tumor samples. Pittsburgh also creates proprietary 3D culture models used

in drug development. |

| · | Birmingham segment: provides contract services and research

focused on solubility improvements, stability studies, and protein production. |

| · | Eagan segment: produces the FDA-cleared STREAMWAY System and associated products for automated

medical fluid waste management and patient-to-drain medical fluid disposal. |

Our Industry

Drug Discovery and Development Solutions

The growing demand for the improvement in the

discovery and development process of novel drug therapies is driving the demand for AI-empowered solutions. Growing partnerships and cooperation

are expected to fuel global market for AI in drug development. The adoption of AI solutions in the drug development process increases

efficiency, reduces cycle time, and increases the productivity and accuracy of the risky and long process. Due to these advantages, the

importance of AI in drug discovery and development is expected to drive the global market. AI-powered drug discovery is an emerging approach

that considers individual variability in multi-omics, including genes, disease and environment to develop effective therapies. This approach

predicts more accurately which treatment, dose, and therapeutic regimen could provide the best possible clinical outcome. Biopharmaceutical

companies, contract research organizations, academia, and other stakeholders began integrating AI-based solutions in their drug development

processes to enhance outcomes and curb costs.

We believe we are uniquely positioned with our

PEDAL platform to provide early insights that clients can use to prioritize drugs for development and identify patient-centric indications.

In addition, the PEDAL platform can be used to re-purpose previously failed drug compounds. We aim to leverage the PEDAL platform for

our biopharma clients and help them prioritize their oncology portfolio. The PEDAL platform supports a biopharma client’s decision

on the drug molecules with a higher likelihood of clinical success. With PEDAL, we look to improve/enhance the way that the biopharma

industry carries out the development of oncology drugs. We believe our platform provides unique financial- and time-saving advantages

for pharmaceutical companies.

We believe the passage of the FDA Modernization

Act 2.0 will increase the use of non-animal methods to study the mechanisms of diseases and to test the effectiveness of new drugs. The

FDA Modernization Act 2.0 allows for alternatives to animal-testing requirements for the development of drugs and allows drug manufacturers

to opt out of animal testing while utilizing other testing methods to develop drugs, such as cell-based assays, organ-on-a-chip technology,

computer models, and other human biology-based test methods. We expect the market to continue to grow due to a shift towards more efficient,

accurate and predictive models.

Infectious and Biohazardous Waste Management

There has long been recognition of the collective

potential for ill effects to healthcare workers from exposure to infectious/biohazardous materials. Federal and state regulatory agencies

have issued mandatory guidelines for the control of such materials, and particularly bloodborne pathogens. OSHA’s Bloodborne Pathogens

Standard (29 CFR 1910.1030) requires employers to adopt engineering and work practice controls that would eliminate or minimize employee

exposure to hazards associated with bloodborne pathogens. In 2001, in response to the Needlestick Safety and Prevention Act, OSHA revised

the Bloodborne Pathogens Standard. The revised standard clarifies and emphasizes the need for employers to select safer needle devices

and to involve employees in identifying and choosing these devices. The revised standard also calls for the use of “automated controls”

as it pertains to the minimization of healthcare exposure to bloodborne pathogens.

Most surgical procedures produce potentially infectious

materials that must be disposed of with the lowest possible risk of cross-contamination to healthcare workers. Current standards of care

allow for these fluids to be retained in canisters and located in the operating room where they can be monitored throughout the surgical

procedure. Once the procedure is complete these canisters and their contents are disposed using a variety of methods, all of which include

manual handling and result in a heightened risk to healthcare workers for exposure to their contents. Canisters are the most prevalent

means of collecting and disposing of infectious fluids in hospitals today. Traditional, non-powered canisters and related suction

and fluid disposable products are exempt and do not require FDA clearance.

We expect

the hospital surgery market to continue to increase due to population growth, the aging of the population, and expansion of surgical procedures

to new areas (for example, use of the endoscope) which requires more medical fluid management and new medical technology.

Corporate Information

Our principal executive offices are located at

91 43rd Street, Suite 110 Pittsburgh, Pennsylvania and our telephone number is (412) 432-1500.

We were originally incorporated in Minnesota on

April 23, 2002, and reincorporated in Delaware in 2013. We changed our name from Skyline Medical Inc. to Precision Therapeutics Inc. on

February 1, 2018 and to Predictive Oncology Inc. on June 13, 2019. Additional information about us is available on our website at predictive-oncology.com. Information

contained on, or that can be accessed through, our website is not incorporated by reference into this prospectus.

For a description of our business, financial condition,

results of operations and other important information regarding us, we refer you to our filings with the SEC incorporated by reference

in this prospectus supplement. For instructions on how to find copies of these documents, see “Where You Can Find More Information.”

RISK FACTORS

An investment in our securities involves a number of risks. Before deciding

to invest in our securities, you should carefully consider the risks discussed under the sections captioned “Risk Factors”

contained in our Annual Report on Form 10-K for the year ended December 31, 2023, which report is incorporated by reference in this prospectus,

the information and documents incorporated by reference herein, and in any prospectus supplement or free writing prospectus that we have

authorized for use in connection with an offering. If any of these risks actually occurs, our business, financial condition, results of

operations or cash flow could be harmed. This could cause the trading price of our common stock to decline, resulting in a loss of all

or part of your investment. The risks described in the documents referenced above are not the only ones that we face. Additional risks

not presently known to us or that we currently deem immaterial may also affect our business.

USE OF PROCEEDS

Unless otherwise indicated in the prospectus supplement, we intend to use

the net proceeds from the sale of securities offered by the prospectus for general corporate purposes and working capital requirements.

We may also use a portion of the net proceeds to:

| |

· |

make capital expenditures, |

| |

· |

license or acquire intellectual property or technologies to incorporate into our products, or |

| |

· |

fund possible investments in and acquisitions of complementary businesses, partnerships and minority investments. |

We have not determined the amounts we plan to spend on the areas listed

above or the timing of these expenditures. As a result, our management will have broad discretion to allocate the net proceeds of the

offerings. We have no current plans, commitments or agreements with respect to any acquisition as of the date of this prospectus.

DILUTION

With the exception of debt securities we may sell with no equity conversion feature and, therefore,

no effect on dilution, we will set forth in a prospectus supplement the following information regarding any material dilution of the equity

interests of investors purchasing securities sold by Predictive Oncology in an offering under this prospectus:

| |

● |

the net tangible book value per share of our equity securities before and after the offering; |

| |

● |

the amount of the increase in such net tangible book value per share attributable to the cash payments made by purchases in the offering; and |

| |

● |

the amount of the immediate dilution from the public offering price which will be absorbed by such purchasers. |

DESCRIPTION OF CAPITAL STOCK

The following description summarizes the material terms of our capital

stock. This summary is, however, subject to the provisions of our certificate of incorporation and bylaws. For greater detail about our

capital stock, please refer to our certificate of incorporation and bylaws.

General

Our authorized capital stock consists of 200,000,000 shares of Common Stock,

and 20,000,000 shares of preferred stock, $0.01 par value per share (“Preferred Stock”). Out of the Preferred Stock, as of

May 20, 2024, 2,300,000 shares have been designated Series B Convertible Preferred Stock, of which 79,246 shares were outstanding.

The outstanding shares of our Common Stock and Preferred Stock are fully

paid and nonassessable.

The Series B Convertible Preferred Stock is convertible into 16 shares

of Common Stock, subject to a 4.99% beneficial ownership blocker.

Our Board of Directors is authorized, subject to any limitations prescribed

by law, to provide for the issuance of the shares of Preferred Stock in series and, by filing a certificate pursuant to the applicable

law of the State of Delaware, to establish from time to time the number of shares to be included in each such series, and to fix the designation,

powers, preferences and rights of the shares of each such series and any qualifications, limitations or restrictions thereon. The number

of authorized shares of Preferred Stock may be increased or decreased (but not below the number of shares thereof then outstanding) by

the affirmative vote of the holders of a majority of the outstanding shares of Common Stock without a vote of the holders of the Preferred

Stock, or of any series thereof, unless a vote of any such holders is required pursuant to the certificate or certificates establishing

the series of Preferred Stock.

Common Stock

As of May 20, 2024, we had 4,102,004 shares of common stock outstanding

held by approximately 156 stockholders of record.

Voting Rights. The holders of our Common Stock are entitled to one

vote for each outstanding share of Common Stock owned by that shareholder on every matter properly submitted to the shareholders for their

vote. Shareholders are not entitled to vote cumulatively for the election of directors.

Dividend Rights. Subject to the dividend rights of the holders of

any outstanding series of preferred stock, holders of our Common Stock are entitled to receive ratably such dividends and other distributions

of cash or any other right or property as may be declared by our Board of Directors out of our assets or funds legally available for such

dividends or distributions.

Liquidation Rights. In the event of any voluntary or involuntary

liquidation, dissolution or winding up of our affairs, holders of our Common Stock would be entitled to share ratably in our assets that

are legally available for distribution to shareholders after payment of liabilities and after the satisfaction of any liquidation preference

owed to the holders of any Preferred Stock.

Conversion, Redemption and Preemptive Rights. Holders of our Common

Stock have no conversion, redemption, preemptive, subscription or similar rights.

Anti-Takeover Provisions

Bylaws. Certain provisions of our Bylaws could have anti-takeover

effects. These provisions are intended to enhance the likelihood of continuity and stability in the composition of our corporate policies

formulated by our Board of Directors. In addition, these provisions also are intended to ensure that our Board of Directors will have

sufficient time to act in what our Board of Directors believes to be in the best interests of our Company and our shareholders. Nevertheless,

these provisions could delay or frustrate the removal of incumbent directors or the assumption of control of us by the holder of a large

block of Common Stock, and could also discourage or make more difficult a merger, tender offer, or proxy contest, even if such event would

be favorable to the interest of our shareholders. These provisions are summarized below.

Advance Notice Provisions for Raising Business or Nominating Directors.

Sections 2.09 and 2.10 of our Bylaws contain advance-notice provisions relating to the ability of shareholders to raise business at a

shareholder meeting and make nominations for directors to serve on our Board of Directors. These advance-notice provisions generally require

shareholders to raise business within a specified period of time prior to a meeting in order for the business to be properly brought before

the meeting.

Number of Directors and Vacancies. Our Bylaws provide that the exact

number of directors shall be determined from time to time solely by resolution adopted by the affirmative vote of a majority of the entire

Board of Directors. The Board of Directors is divided into three classes, as nearly equal in number as possible, designated: Class I,

Class II and Class III (each, a “Class”). In the case of any increase or decrease, from time to time, in the number

of directors, the number of directors in each class shall be apportioned as nearly equal as possible. Except as otherwise provided in

the Certificate of Incorporation, each director serves for a term ending on the date of the third annual meeting of the Company’s

stockholders following the annual meeting at which such director was elected; provided, that the term of each director shall continue

until the election and qualification of a successor and be subject to such director’s earlier death, resignation or removal. Vacancies

on the Board of Directors resulting from death, resignation, removal or otherwise and newly created directorships resulting from any increase

in the number of directors may be filled solely by a majority of the directors then in office (although less than a quorum) or by the

sole remaining director.

Delaware Law. We are subject to Section 203 of the Delaware General

Corporation Law. This provision generally prohibits a Delaware corporation from engaging in any business combination with any interested

stockholder for a period of three years following the date the stockholder became an interested stockholder, unless:

| |

• |

prior to such date, the board of directors approved either the business combination or the transaction that resulted in the stockholder becoming an interested stockholder; |

| |

• |

upon consummation of the transaction that resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced, excluding for purposes of determining the number of shares outstanding those shares owned by persons who are directors and also officers and by employee stock plans in which employee participants do not have the right to determine confidentially whether shares held subject to the plan will be tendered in a tender or exchange offer; or |

| |

• |

on or subsequent to such date, the business combination is approved by the board of directors and authorized at an annual meeting or special meeting of stockholders and not by written consent, by the affirmative vote of at least 66 2/3% of the outstanding voting stock that is not owned by the interested stockholder. |

Section 203 defines a business combination to include:

| |

• |

any merger or consolidation involving the corporation and the interested stockholder; |

| |

• |

any sale, transfer, pledge or other disposition of 10% or more of the assets of the corporation involving the interested stockholder; |

| |

• |

subject to certain exceptions, any transaction that results in the issuance or transfer by the corporation of any stock of the corporation to the interested stockholder; |

| |

• |

any transaction involving the corporation that has the effect of increasing the proportionate share of the stock of any class or series of the corporation beneficially owned by the interested stockholder; or |

| |

• |

the receipt by the interested stockholder of the benefit of any loans, advances, guarantees, pledges or other financial benefits provided by or through the corporation. |

In general, Section 203 defines an “interested stockholder”

as any entity or person beneficially owning 15% or more of the outstanding voting stock of a corporation, or an affiliate or associate

of the corporation and was the owner of 15% or more of the outstanding voting stock of a corporation at any time within three years prior

to the time of determination of interested stockholder status; and any entity or person affiliated with or controlling or controlled by

such entity or person.

These statutory provisions could delay or frustrate the removal of incumbent

directors or a change in control of our company. They could also discourage, impede, or prevent a merger, tender offer, or proxy contest,

even if such event would be favorable to the interests of stockholders. In addition, note that while Delaware law permits companies to

opt out of its business combination statute, our Certificate of Incorporation does not include this opt-out provision.

Transfer Agent and Registrar

The transfer agent and registrar for our common stock is Pacific Stock Transfer.

Listing

The shares of our common stock are listed on The Nasdaq Capital Market

under the symbol “POAI.” On May 20, 2024, the last reported sale price per share for our common stock as reported by The Nasdaq

Capital Market was $1.69.

Preferred Stock

Our Board of Directors has the authority, without action by our stockholders,

to designate and issue up to 20,000,000 shares of preferred stock in one or more series or classes and to designate the rights, preferences

and privileges of each series or class, which may be greater than the rights of our common stock. The Board’s authority to issue

preferred stock without stockholder approval could make it more difficult for a third party to acquire control of our company, and could

discourage such attempt.

Series B Convertible Preferred Stock Outstanding

In connection with an offering of units that closed on August 31, 2015,

we issued as part of the units 1,895,010 shares of Series B Convertible Preferred Stock pursuant to a Certificate of Designation approved

by our Board.

The Series B Convertible Preferred Stock separated from the other securities

included within the units as of February 29, 2016 and are currently convertible. As of May 20, 2024, 79,246 shares of Series B Convertible

Preferred Stock remain outstanding.

The Series B Convertible Preferred Stock is convertible into sixteen (16)

shares of common stock. The number of shares of common stock issuable upon conversion of the Series B Convertible Preferred Stock is subject

to appropriate adjustment in the event of stock dividends, stock splits, reorganizations or similar events affecting our common stock.

Upon the occurrence of a “Fundamental Transaction”, each share

of Series B Convertible Preferred Stock shall be automatically converted into one share of common stock of the Company, subject to the

beneficial ownership limitation discussed in the next paragraph. A “Fundamental Transaction” means that (i) the Company shall,

directly or indirectly, in one or more related transactions, (1) consolidate or merge with or into (whether or not the Company is the

surviving corporation) any other person unless the shareholders of the Company immediately prior to such consolidation or merger continue

to hold more than 50% of the outstanding shares of voting stock after such consolidation or merger, or (2)sell, lease, license, assign,

transfer, convey or otherwise dispose of all or substantially all of the properties and assets of the Company and its subsidiaries, taken

as a whole, to any other person, or (3) allow any other person to make a purchase, tender or exchange offer that is accepted by the holders

of more than 50% of the outstanding shares of voting stock of the Company (not including any shares of voting stock of the Company held

by the person or persons making or party to, or associated or affiliated with the persons making or party to, such purchase, tender or

exchange offer), or (4) consummate a stock or share purchase agreement or other business combination (including, without limitation, a

reorganization, recapitalization, spin-off or scheme of arrangement) with any other person whereby such other person acquires more than

50% of the outstanding shares of voting stock of the Company (not including any shares of voting stock of the Company held by the other

person or other persons making or party to, or associated or affiliated with the other persons making or party to, such stock or share

purchase agreement or other business combination), or (ii) any “person” or “group” (as these terms are used for

purposes of Sections 13(d) and 14(d) of the Exchange Act and the rules and regulations promulgated thereunder), other than a Permitted

Holder, is or shall become the “beneficial owner” (as defined in Rule 13d-3 under the Exchange Act), directly or indirectly,

of 50% of the aggregate ordinary voting power represented by issued and outstanding voting stock of the Company. The term Permitted Holders

means Josh Kornberg, Atlantic Partners Alliance and SOK Partners, LLC and each of their respective affiliates.

The Series B Convertible Preferred Stock is not convertible by the holder

of such preferred stock to the extent (and only to the extent) that the holder or any of its affiliates would beneficially own in excess

of 4.99% of the common stock of the Company. For purposes of the limitation described in this paragraph, beneficial ownership and all

determinations and calculations are determined in accordance with Section 13(d) of the Exchange Act and the rules and regulations promulgated

thereunder.

The Series B Convertible Preferred Stock has no voting rights, except that

the holders of shares of a majority of the Series B Convertible Preferred Stock will be required to effect or validate any amendment,

alteration or repeal of any of the provisions of the Certificate of Designation that materially adversely affects the powers, preferences

or special rights of the Series B Convertible Preferred Stock, whether by merger or consolidation or otherwise; provided, however, that

(i) in the event of an amendment to terms of the Series B Convertible Preferred Stock, including by merger or consolidation, so long as

the Series B Convertible Preferred Stock remains outstanding with the terms thereof materially unchanged, or the Series B Convertible

Preferred Stock is converted into, preference securities of the surviving entity, or its ultimate parent, with such powers, preferences

or special rights that are, in the good faith determination of the Board of the Company, taken as a whole, not materially less favorable

to the holders of the Series B Convertible Preferred Stock than the powers, preferences or special rights of the Series B Convertible

Preferred Stock in effect prior to such amendment or the occurrence of such event, taken as a whole, then such amendment or the occurrence

of such event will not be deemed to materially and adversely affect such powers, preferences or special rights of the Series B Convertible

Preferred Stock and (ii) the authorization, establishment or issuance by the Corporation of any other series of preferred stock with powers,

preferences or special rights that are senior to or on a parity with the Series B Preferred Stock, including, but not limited to, powers,

preferences or special rights with respect to dividends, distributions or liquidation preferences, shall not be deemed to materially and

adversely affect the power, preferences or special rights of the Series B Preferred Stock, and in the case of either clause (i) or (ii),

the holders shall not have any voting rights with respect thereto, and provided further that, (iii) prior to the date that is the six

month anniversary of the Issuance Date, no amendment, alteration or repeal of any of the provisions of this Certificate of Designation

shall be made that affects the powers, preferences or special rights of the Series B Preferred Stock in any manner, whether by merger

or consolidation or otherwise. An amendment to the terms of the Series B Convertible Preferred Stock only requires the vote of the holders

of Series B Convertible Preferred Stock.

With respect to payment of dividends and distribution of assets upon liquidation

or dissolution or winding up of the Company, the Series B Convertible Preferred Stock shall rank equal to the common stock of the Company.

No sinking fund has been established for the retirement or redemption of the Series B Convertible Preferred Stock. As such, the Series

B Convertible Preferred Stock is not subject to any restriction on the repurchase or redemption of shares by the Company due to an arrearage

in the payment of dividends or sinking fund installments.

The Series B Convertible Preferred Stock also has no liquidation rights

or preemption rights, and there are no special classifications of our Board related to the Series B Convertible Preferred Stock.

The shares of common stock issuable upon conversion of the Series B Convertible

Preferred Stock have been duly authorized, validly issued and fully paid and are non-assessable. We have authorized and reserved at least

that number of shares of common stock equal to the number of shares of common stock issuable upon conversion of all outstanding Series

B Convertible Preferred Stock.

THE HOLDER OF SERIES B CONVERTIBLE PREFERRED STOCK DO NOT POSSESS ANY

RIGHTS AS A STOCKHOLDER UNDER THE SHARES OF SERIES B CONVERTIBLE PREFERRED STOCK UNTIL THE HOLDER CONVERTS THE SHARES OF SERIES B CONVERTIBLE

PREFERRED STOCK.

There is no established public trading market for our Series B Convertible

Preferred Stock, and we do not expect a market to develop. We do not intend to apply to list Series B Convertible Preferred Stock on any

securities exchange. Without an active market, the liquidity of the Series B Convertible Preferred Stock will be limited.

One or More New Series of Preferred Stock

The following description of preferred stock and the description of the

terms of any particular series of preferred stock that we choose to issue hereunder and that will be set forth in the related prospectus

supplement are not complete. These descriptions are qualified in their entirety by reference to the certificate of designation relating

to that series. The rights, preferences, privileges and restrictions of the preferred stock of each series will be fixed by the certificate

of designation relating to that series.

Our board of directors has the authority, without stockholder approval,

subject to limitations prescribed by law, to provide for the issuance of the shares of preferred stock in one or more series, and by filing

a certificate pursuant to the applicable law of the State of Delaware, to establish from time to time the number of shares to be included

in each such series, and to fix the designation, powers, preferences and rights of the shares of each series and the qualifications, limitations

or restrictions, including, but not limited to, the following:

| • | the number of shares constituting that series; |

| • | dividend rights and rates; |

| • | rights and terms of redemption (including sinking fund provisions); and |

| • | rights of the series in the event of liquidation, dissolution or winding up. |

All shares of preferred stock offered hereby will, when issued, be fully

paid and nonassessable and will not have any preemptive or similar rights. Our board of directors could authorize the issuance of shares

of preferred stock with terms and conditions that could have the effect of discouraging a takeover or other transaction that might involve

a premium price for holders of the shares or which holders might believe to be in their best interests.

We will set forth in a prospectus supplement relating to the series of

preferred stock being offered the following items:

| • | the title and stated value of the preferred stock; |

| • | the number of shares of the preferred stock offered, the liquidation preference per share and the offering

price of the preferred stock; |

| • | the dividend rate(s), period(s) and/or payment date(s) or method(s) of calculation applicable to the preferred

stock; |

| • | whether dividends are cumulative or non-cumulative and, if cumulative, the date from which dividends on

the preferred stock will accumulate; |

| • | the procedures for any auction and remarketing, if any, for the preferred stock; |

| • | the provisions for a sinking fund, if any, for the preferred stock; |

| • | the provision for redemption, if applicable, of the preferred stock; |

| • | any listing of the preferred stock on any securities exchange; |

| • | the terms and conditions, if applicable, upon which the preferred stock will be convertible into common

stock, including the conversion price (or manner of calculation) and conversion period; |

| • | voting rights, if any, of the preferred stock; |

| • | a discussion of any material and/or special United States federal income tax considerations applicable

to the preferred stock; |

| • | the relative ranking and preferences of the preferred stock as to dividend rights and rights upon the

liquidation, dissolution or winding up of our affairs; |

| • | any limitations on issuance of any class or series of preferred stock ranking senior to or on a parity

with the class or series of preferred stock as to dividend rights and rights upon liquidation, dissolution or winding up of our affairs;

and |

| • | any other specific terms, preferences, rights, limitations or restrictions of the preferred stock. |

The transfer agent and registrar for any series of preferred stock will

be set forth in the applicable prospectus supplement.

Certificate of Incorporation and Bylaws

Our current Certificate of Incorporation authorizes the issuance of “blank

check” preferred stock that could be issued by our Board of Directors to defend against a takeover attempt. See “Preferred

Stock” above.

DESCRIPTION OF WARRANTS

We may issue warrants for the purchase of our common stock or preferred

stock, or a combination thereof. Warrants may be issued independently or together with our debt securities, preferred stock or common

stock and may be attached to or separate from any offered securities. Each series of warrants will be issued under a separate warrant

agreement to be entered into between us and a bank or trust company, as warrant agent. The warrant agent will act solely as our agent

in connection with the warrants. The warrant agent will not have any obligation or relationship of agency or trust for or with any holders

or beneficial owners of warrants. This description is a summary of the certain provisions of the units, and does not purport to be complete

and is subject to, and qualified in its entirety by reference to, the provisions of the warrant agreement that will be filed with the

SEC in connection with an offering of the warrants. The particular terms of any units offered by us will be described in the applicable

prospectus supplement. To the extent the terms of the warrants described in the prospectus supplement differ from the terms set forth

in this summary, the terms described in the prospectus supplement will supersede the terms described below.

The prospectus supplement relating to a particular series of warrants to

purchase our common stock or preferred stock will describe the terms of the warrants, including the following:

| |

• |

the title of the warrants; |

| |

• |

the offering price for the warrants, if any; |

| |

• |

the aggregate number of warrants; |

| |

• |

the designation and terms of the common stock or preferred stock that may be purchased upon exercise of the warrants; |

| |

• |

if applicable, the designation and terms of the securities with which the warrants are issued and the number of warrants issued with each security; |

| |

• |

if applicable, the date from and after which the warrants and any securities issued with the warrants will be separately transferable; |

| |

• |

the number of shares of common stock or preferred stock that may be purchased upon exercise of a warrant and the exercise price for the warrants; |

| |

• |

the dates on which the right to exercise the warrants shall commence and expire; |

| |

• |

if applicable, the minimum or maximum amount of the warrants that may be exercised at any one time; |

| |

• |

the currency or currency units in which the offering price, if any, and the exercise price are payable; |

| |

• |

if applicable, a discussion of material U.S. federal income tax considerations; |

| |

• |

the antidilution provisions of the warrants, if any; |

| |

• |

the redemption or call provisions, if any, applicable to the warrants; |

| |

• |

any provisions with respect to holder’s right to require us to repurchase the warrants upon a change in control or similar event; and |

| |

• |

any additional terms of the warrants, including procedures, and limitations relating to the exchange, exercise and settlement of the warrants. |

Holders of equity warrants will not be entitled:

| |

• |

to vote, consent or receive dividends; |

| |

• |

receive notice as stockholders with respect to any meeting of stockholders for the election of our directors or any other matter; or |

| |

• |

exercise any rights as stockholders of the Company. |

DESCRIPTION OF DEBT SECURITIES

This description is a summary of the material provisions of the debt securities

and the related indenture. We urge you to read the form of indenture filed as an exhibit to the registration statement of which this prospectus

is a part because the indenture, and not this description, governs your rights as a holder of debt securities. References in this prospectus

to an “indenture” refer to the particular indenture under which we may issue a series of debt securities.

General

The terms of each series of debt securities will be established by or pursuant

to a resolution of our board of directors and set forth or determined in the manner provided in an officers’ certificate or by a

supplemental indenture. Debt securities may be issued in separate series without limitation as to aggregate principal amount. We may specify

a maximum aggregate principal amount for the debt securities of any series. The particular terms of each series of debt securities will

be described in a prospectus supplement relating to such series, including any pricing supplement. The prospectus supplement will set

forth specific terms relating to some or all of the following:

| |

• |

any limit on the aggregate principal amount; |

| |

• |

the person who shall be entitled to receive interest, if other than the record holder on the record date; |

| |

• |

the date the principal will be payable; |

| |

• |

the interest rate, if any, the date interest will accrue, the interest payment dates and the regular record dates; |

| |

• |

the place where payments may be made; |

| |

• |

any mandatory or optional redemption provisions; |

| |

• |

if applicable, the method for determining how the principal, premium, if any, or interest will be calculated by reference to an index or formula; |

| |

• |

if other than U.S. currency, the currency or currency units in which principal, premium, if any, or interest will be payable and whether we or the holder may elect payment to be made in a different currency; |

| |

• |

the portion of the principal amount that will be payable upon acceleration of stated maturity, if other than the entire principal amount; |

| |

• |

any defeasance provisions if different from those described below under “Satisfaction and Discharge; Defeasance”; |

| |

• |

any conversion or exchange provisions; |

| |

• |

any obligation to redeem or purchase the debt securities pursuant to a sinking fund; |

| |

• |

whether the debt securities will be issuable in the form of a global security; |

| |

• |

any subordination provisions, if different from those described below under “Subordination”; |

| |

• |

any deletions of, or changes or additions to, the events of default or covenants; and |

| |

• |

any other specific terms of such debt securities. |

Unless otherwise specified in the prospectus supplement, the debt securities

will be registered debt securities. Debt securities may be sold at a substantial discount below their stated principal amount, bearing

no interest or interest at a rate which at the time of issuance is below market rates.

Exchange and Transfer

Debt securities may be transferred or exchanged at the office of the security

registrar or at the office of any transfer agent designated by us.

We will not impose a service charge for any transfer or exchange, but we

may require holders to pay any tax or other governmental charges associated with any transfer or exchange.

In the event of any potential redemption of debt securities of any series,

we will not be required to:

| |

• |

issue, register the transfer of, or exchange, any debt security of that series during a period beginning at the opening of business 15 days before the day of mailing of a notice of redemption and ending at the close of business on the day of the mailing; or |

| |

• |

register the transfer of or exchange any debt security of that series selected for redemption, in whole or in part, except the unredeemed portion being redeemed in part. |

We may initially appoint the trustee as the security registrar. Any transfer

agent, in addition to the security registrar, initially designated by us will be named in the prospectus supplement. We may designate

additional transfer agents or change transfer agents or change the office of the transfer agent. However, we will be required to maintain

a transfer agent in each place of payment for the debt securities of each series.

Global Securities

The debt securities of any series may be represented, in whole or in part,

by one or more global securities. Each global security will:

| |

• |

be registered in the name of a depositary that we will identify in a prospectus supplement; |

| |

• |

be deposited with the depositary or nominee or custodian; and |

| |

• |

bear any required legends. |

No global security may be exchanged in whole or in part for debt securities

registered in the name of any person other than the depositary or any nominee unless:

| |

• |

the depositary has notified us that it is unwilling or unable to continue as depositary or has ceased to be qualified to act as depositary; |

| |

• |

an event of default is continuing; or |

| |

• |

the Company executes and delivers to the trustee an officers’ certificate stating that the global security is exchangeable. |

As long as the depositary, or its nominee, is the registered owner of a

global security, the depositary or nominee will be considered the sole owner and holder of the debt securities represented by the global

security for all purposes under the indenture. Except in the above limited circumstances, owners of beneficial interests in a global security:

| |

• |

will not be entitled to have the debt securities registered in their names; |

| |

• |

will not be entitled to physical delivery of certificated debt securities; and |

| |

• |

will not be considered to be holders of those debt securities under the indentures. |

Payments on a global security will be made to the depositary or its nominee

as the holder of the global security. Some jurisdictions have laws that require that certain purchasers of securities take physical delivery

of such securities in definitive form. These laws may impair the ability to transfer beneficial interests in a global security.

Institutions that have accounts with the depositary or its nominee are

referred to as “participants.” Ownership of beneficial interests in a global security will be limited to participants and

to persons that may hold beneficial interests through participants. The depositary will credit, on its book-entry registration and transfer

system, the respective principal amounts of debt securities represented by the global security to the accounts of its participants.

Ownership of beneficial interests in a global security will be shown on

and effected through records maintained by the depositary, with respect to participants’ interests, or any participant, with respect

to interests of persons held by participants on their behalf.

Payments, transfers and exchanges relating to beneficial interests in a

global security will be subject to policies and procedures of the depositary.

The depositary policies and procedures may change from time to time. Neither

we nor the trustee will have any responsibility or liability for the depositary’s or any participant’s records with respect

to beneficial interests in a global security.

Payment and Paying Agent

The provisions of this paragraph will apply to the debt securities unless

otherwise indicated in the prospectus supplement. Payment of interest on a debt security on any interest payment date will be made to

the person in whose name the debt security is registered at the close of business on the regular record date. Payment on debt securities

of a particular series will be payable at the office of a paying agent or paying agents designated by us. However, at our option, we may

pay interest by mailing a check to the record holder. The corporate trust office will be designated as our sole paying agent.

We may also name any other paying agents in the prospectus supplement.

We may designate additional paying agents, change paying agents or change the office of any paying agent. However, we will be required

to maintain a paying agent in each place of payment for the debt securities of a particular series.

All moneys paid by us to a paying agent for payment on any debt security

which remain unclaimed at the end of two years after such payment was due will be repaid to us. Thereafter, the holder may look only to

us for such payment.

Consolidation, Merger and Sale of Assets

Except as otherwise set forth in the prospectus supplement, we may not

consolidate with or merge into any other person, in a transaction in which we are not the surviving corporation, or convey, transfer or

lease our properties and assets substantially as an entirety to, any person, unless:

| |

• |

the successor, if any, is a U.S. corporation, limited liability company, partnership, trust or other entity; |

| |

• |

the successor assumes our obligations on the debt securities and under the indenture; |

| |

• |

immediately after giving effect to the transaction, no default or event of default shall have occurred and be continuing; and |

| |

• |

certain other conditions are met. |

Events of Default

Unless we inform you otherwise in the prospectus supplement, the indenture

will define an event of default with respect to any series of debt securities as one or more of the following events:

| |

(1) |

failure to pay principal of or any premium on any debt security of that series when due; |

| |

(2) |

failure to pay any interest on any debt security of that series for 30 days when due; |

| |

(3) |

failure to deposit any sinking fund payment when due; |

| |

(4) |

failure to perform any other covenant in the indenture continued for 90 days after being given the notice required in the indenture; |

| |

(5) |

our bankruptcy, insolvency or reorganization; and |

| |

(6) |

any other event of default specified in the prospectus supplement. |

An event of default of one series of debt securities is not necessarily

an event of default for any other series of debt securities.

If an event of default, other than an event of default described in clause

(5) above, shall occur and be continuing, either the trustee or the holders of at least 25% in aggregate principal amount of the outstanding

securities of that series may declare the principal amount of the debt securities of that series to be due and payable immediately.

If an event of default described in clause (5) above shall occur, the principal

amount of all the debt securities of that series will automatically become immediately due and payable. Any payment by us on subordinated

debt securities following any such acceleration will be subject to the subordination provisions described below under “Subordinated

Debt Securities.”

After acceleration the holders of a majority in aggregate principal amount

of the outstanding securities of that series may, under certain circumstances, rescind and annul such acceleration if all events of default,

other than the non-payment of accelerated principal, or other specified amount, have been cured or waived.

Other than the duty to act with the required care during an event of default,

the trustee will not be obligated to exercise any of its rights or powers at the request of the holders unless the holders shall have

offered to the trustee reasonable indemnity. Generally, the holders of a majority in aggregate principal amount of the outstanding debt

securities of any series will have the right to direct the time, method and place of conducting any proceeding for any remedy available

to the trustee or exercising any trust or power conferred on the trustee.

A holder will not have any right to institute any proceeding under the

indentures, or for the appointment of a receiver or a trustee, or for any other remedy under the indentures, unless:

| |

(1) |

the holder has previously given to the trustee written notice of a continuing event of default with respect to the debt securities of that series; |

| |

(2) |

the holders of at least 25% in aggregate principal amount of the outstanding debt securities of that series have made a written request and have offered reasonable indemnity to the trustee to institute the proceeding; and |

| |

(3) |

the trustee has failed to institute the proceeding and has not received direction inconsistent with the original request from the holders of a majority in aggregate principal amount of the outstanding debt securities of that series within 90 days after the original request. |

Holders may, however, sue to enforce the payment of principal or interest

on any debt security on or after the due date without following the procedures listed in (1) through (3) above.

Modification and Waiver

Except as provided in the next two succeeding paragraphs, the applicable

trustee and we may make modifications and amendments to the indentures (including, without limitation, through consents obtained in connection

with a tender offer or exchange offer for, outstanding securities) and may waive any existing default or event of default (including,

without limitation, through consents obtained in connection with a tender offer or exchange offer for, outstanding securities) with the

consent of the holders of a majority in aggregate principal amount of the outstanding securities of each series affected by the modification

or amendment.

However, neither we nor the trustee may make any amendment or waiver without

the consent of the holder of each outstanding security of that series affected by the amendment or waiver if such amendment or waiver

would, among other things:

| |

• |

change the amount of securities whose holders must consent to an amendment, supplement or waiver; |

| |

• |

change the stated maturity of any debt security; |

| |

• |

reduce the principal on any debt security or reduce the amount of, or postpone the date fixed for, the payment of any sinking fund; |

| |

• |

reduce the principal of an original issue discount security on acceleration of maturity; |

| |

• |

reduce the rate of interest or extend the time for payment of interest on any debt security; |

| |

• |

make a principal or interest payment on any debt security in any currency other than that stated in the debt security; |

| |

• |

impair the right to enforce any payment after the stated maturity or redemption date; |

| |

• |

waive any default or event of default in payment of the principal of, premium or interest on any debt security (except certain rescissions of acceleration); or |

| |

• |

waive a redemption payment or modify any of the redemption provisions of any debt security; |

Notwithstanding the preceding, without the consent of any holder of outstanding

securities, we and the trustee may amend or supplement the indentures:

| |

• |

to provide for the issuance of and establish the form and terms and conditions of debt securities of any series as permitted by the indenture; |

| |

• |

to provide for uncertificated securities in addition to or in place of certificated securities; |

| |

• |

to provide for the assumption of our obligations to holders of any debt security in the case of a merger, consolidation, transfer or sale of all or substantially all of our assets; |

| |

• |

to make any change that does not adversely affect the legal rights under the indenture of any such holder; |

| |

• |

to comply with requirements of the Commission in order to effect or maintain the qualification of an indenture under the Trust Indenture Act; or |

| |

• |

to evidence and provide for the acceptance of appointment by a successor trustee with respect to the debt securities of one or more series and to add to or change any of the provisions of the indenture as shall be necessary to provide for or facilitate the administration of the trusts by more than one Trustee. |

The consent of holders is not necessary under the indentures to approve

the particular form of any proposed amendment. It is sufficient if such consent approves the substance of the proposed amendment.

Satisfaction and Discharge; Defeasance

We may be discharged from our obligations on the debt securities of any

series that have matured or will mature or be redeemed within one year if we deposit with the trustee enough cash to pay all the principal,

interest and any premium due to the stated maturity date or redemption date of the debt securities.

Each indenture contains a provision that permits us

to elect:

| |

• |

to be discharged from all of our obligations, subject to limited exceptions, with respect to any series of debt securities then outstanding; and/or |

| |

• |

to be released from our obligations under the following covenants and from the consequences of an event of default resulting from a breach of certain covenants, including covenants as to payment of taxes and maintenance of corporate existence. |

To make either of the above elections, we must deposit in trust with the

trustee enough money to pay in full the principal and interest on the debt securities. This amount may be made in cash and/or U.S. government

obligations. As a condition to either of the above elections, we must deliver to the trustee an opinion of counsel that the holders of

the debt securities will not recognize income, gain or loss for federal income tax purposes as a result of the action.

If any of the above events occurs, the holders of the debt securities of

the series will not be entitled to the benefits of the indenture, except for the rights of holders to receive payments on debt securities

or the registration of transfer and exchange of debt securities and replacement of lost, stolen or mutilated debt securities.

Notices

Notices to holders will be given by mail to the addresses of the holders

in the security register.

Governing Law

The indenture and the debt securities will be governed by, and construed

under, the law of the State of New York.

Regarding the Trustee

The indenture limits the right of the trustee, should it become a creditor

of us, to obtain payment of claims or secure its claims.

The trustee is permitted to engage in certain other transactions. However,

if the trustee acquires any conflicting interest, and there is a default under the debt securities of any series for which they are trustee,

the trustee must eliminate the conflict or resign.

Subordination

Payment on subordinated debt securities will, to the extent provided in

the indenture, be subordinated in right of payment to the prior payment in full of all of our senior indebtedness (except that holders

of the notes may receive and retain (i) permitted junior securities and (ii) payments made from the trust described under “Satisfaction

and Discharge; Defeasance”). Any subordinated debt securities also are effectively subordinated to all debt and other liabilities,

including lease obligations, if any.

Upon any distribution of our assets upon any dissolution, winding up, liquidation

or reorganization, the payment of the principal of and interest on subordinated debt securities will be subordinated in right of payment

to the prior payment in full in cash or other payment satisfactory to the holders of senior indebtedness. In the event of any acceleration

of subordinated debt securities because of an event of default, the holders of any senior indebtedness would be entitled to payment in

full in cash or other payment satisfactory to such holders of all senior indebtedness obligations before the holders of subordinated debt

securities are entitled to receive any payment or distribution, except for certain payments made by the trust described under “Satisfaction